Global Di-Nitrotoluene Market Size, Share Analysis Report By Applications (Chemical, Plastics, Herbicides, Pharmaceuticals, Others), By Distribution Channel (Direct Sales, Indirect Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164123

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

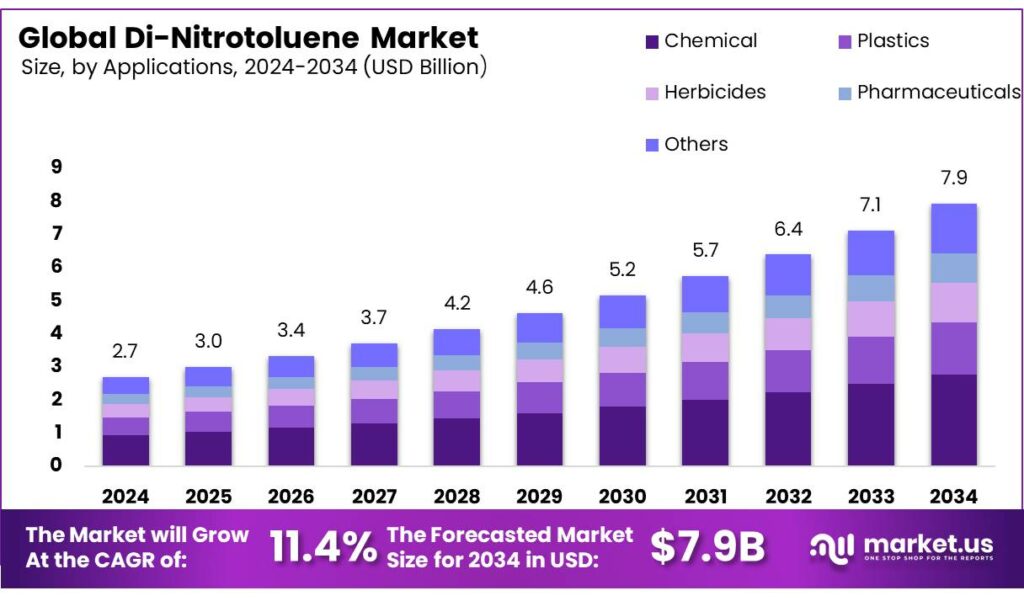

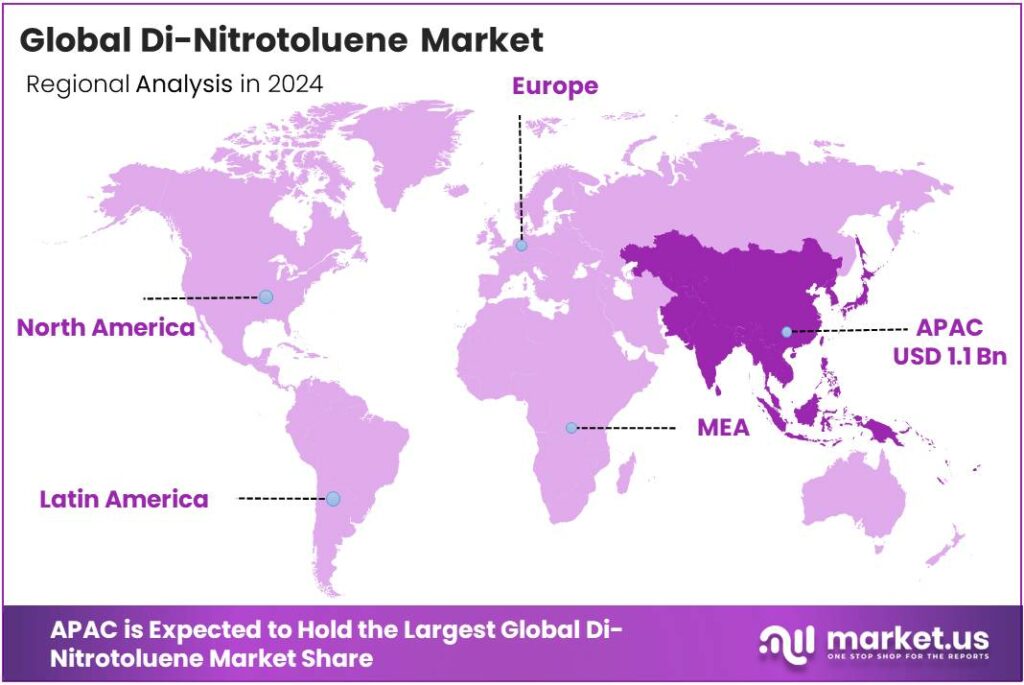

The Global Di-Nitrotoluene Market size is expected to be worth around USD 7.9 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 43.9% share, holding USD 1.1 Billion in revenue.

Di-nitrotoluene (DNT) sits at the heart of the polyurethane chain as the immediate precursor to toluene diisocyanate (TDI), which ultimately goes into flexible foams for furniture, bedding, automotive seating and coatings. Authoritative technical compendia and U.S. EPA materials consistently describe DNT as a nitration product of toluene used mainly to make TDI, with secondary uses in energetic materials and dyes—underscoring its strategic position across civilian and defense supply chains.

On the demand side, downstream pull from diisocyanates remains the primary industrial driver. The Center for the Polyurethanes Industry reports that U.S. TDI demand reached 482.9 million pounds in 2023, a clear indicator of robust consumption in key foam end-markets that depend on steady DNT availability. Operationally, producers manage DNT under strict occupational controls. U.S. NIOSH lists a recommended exposure limit and OSHA PEL of 1.5 mg/m³ for dinitrotoluene, framing plant ventilation, personal protection, and monitoring practices that add compliance cost but also reduce disruption risk from incidents.

Demand drivers sit downstream: TDI consumption in flexible foams for furniture, bedding, automotive interiors, and CASE applications. Energy-efficiency policy further supports polyurethane use. The U.S. Department of Energy’s Weatherization Assistance Program reports average household energy-bill savings of $372 per year and a cumulative 7.2 million households served since 1976, policy signals that indirectly sustain insulation demand where PU systems compete.

Energy and feedstock dynamics are the second major lever on DNT cost curves. Toluene and nitric/sulfuric acids are energy-intensive to make and handle, so fuel and power swings ripple through nitration economics. In 2024, Brent crude oil averaged $80/bbl, easing versus 2023 and narrowing intrayear volatility; this helped stabilize petro-aromatics chains that supply toluene, a core DNT feedstock.

In Europe, industrial gas conditions also improved: the IEA notes EU industrial gas consumption in 2024 was still ~15% below 2019, reflecting ongoing efficiency and demand-side adjustments after the 2022 shock—supportive for nitrogen value-chains via more predictable gas input costs to ammonia and nitric acid.

Regulatory stewardship remains central given DNT’s toxicological profile. NIOSH’s Recommended Exposure Limit (REL) and OSHA’s Permissible Exposure Limit (PEL) are both 1.5 mg/m³ (skin) as an 8-hour TWA, parameters that shape permitting, engineering controls, and monitoring costs at nitration and downstream conversion units.

In parallel, competitive pressures from ethane-based chains affect overall petrochemical cost curves; the U.S. Energy Information Administration (EIA) notes U.S. ethane production averaged ~2.8 million barrels per day in 2024, with ~47% of exports headed to China in 2024—context for global chemical cost competitiveness that can spill over into aromatics and downstream PU markets.

Key Takeaways

- Di-Nitrotoluene Market size is expected to be worth around USD 7.9 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 11.4%.

- Chemical segment held a dominant market position, capturing more than a 34.9% share in the global Di-Nitrotoluene market.

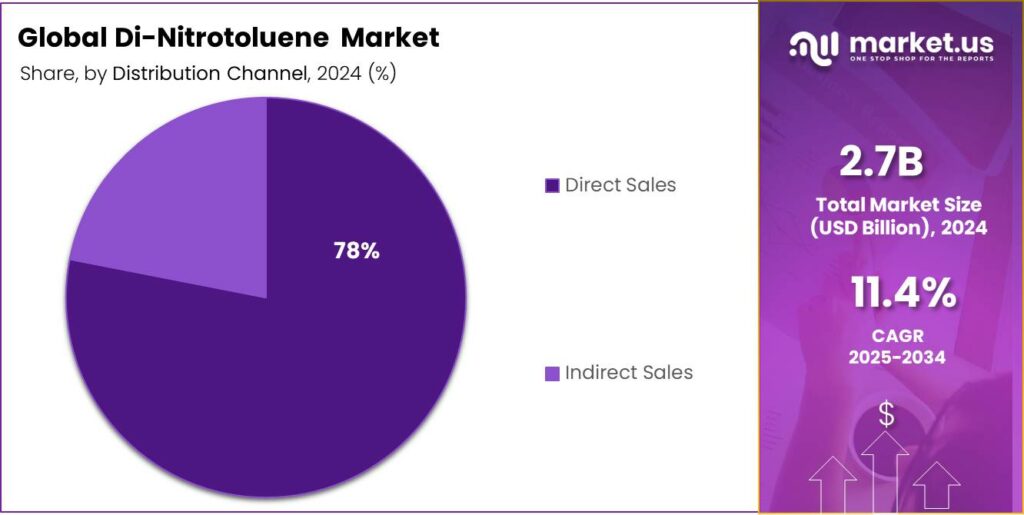

- Direct Sales held a dominant market position, capturing more than a 78.3% share in the global Di-Nitrotoluene market.

- Asia-Pacific (APAC) region emerged as the dominating geography for the Di‑Nitrotoluene (DNT) market, capturing approximately 43.90% of the global market and amounting to an estimated USD 1.1 billion.

By Applications Analysis

Chemical dominates with 34.9% share driven by rising industrial applications

In 2024, the Chemical segment held a dominant market position, capturing more than a 34.9% share in the global Di-Nitrotoluene market. This strong position was supported by the compound’s widespread use as an intermediate in the synthesis of toluene diisocyanate (TDI), dyes, and other aromatic intermediates across chemical manufacturing industries. The sector benefited from the consistent demand for polyurethane production, where Di-Nitrotoluene serves as a key precursor. Increasing utilization of DNT in the synthesis of specialty chemicals and polymer additives further strengthened its industrial importance.

In 2025, the segment is expected to witness steady growth as downstream industries—particularly coatings, adhesives, and construction chemicals—expand in developing economies. Government initiatives promoting local chemical production in countries such as India and China, alongside rising exports of nitro compounds, are expected to sustain demand levels. Additionally, advancements in nitration technologies and improved environmental controls have enhanced process efficiency, enabling large-scale manufacturers to reduce production costs and comply with tightening safety standards.

By Distribution Channel Analysis

Direct Sales dominates with 78.3% share due to strong manufacturer–end user integration

In 2024, Direct Sales held a dominant market position, capturing more than a 78.3% share in the global Di-Nitrotoluene market. This dominance was driven by the preference of major chemical producers to supply directly to large industrial consumers such as polyurethane, explosives, and dye manufacturers. Direct transactions enabled tighter quality control, competitive pricing, and reliable logistics, which are critical in handling hazardous intermediates like Di-Nitrotoluene. Large-scale buyers, including chemical plants and defense suppliers, preferred direct procurement to ensure continuous supply and adherence to safety and environmental standards.

The direct sales channel is projected to maintain its lead as global manufacturers continue to strengthen long-term supply agreements and localized distribution facilities. The growth of chemical hubs in Asia-Pacific and Europe, along with expanding polyurethane and intermediate chemical capacities, has reinforced direct trade relationships between producers and industrial end users. Furthermore, regulatory frameworks encouraging transparent traceability in chemical transactions are expected to further support the direct sales model.

Key Market Segments

By Applications

- Chemical

- Plastics

- Herbicides

- Pharmaceuticals

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Emerging Trends

Efficiency-First Cold Chains Driving DNT-Linked Polyurethane

A clear, current trend shaping di-nitrotoluene (DNT) demand is the food sector’s shift to efficiency-first cold-chain infrastructure. DNT feeds into toluenediamine (TDA) and then toluene diisocyanate (TDI), enabling high-performance polyurethane foams used in refrigerated warehouses, truck bodies, display cases, and processing rooms—places where tighter insulation cuts energy and reduces spoilage.

The food system’s need is unmistakable: the UN Food and Agriculture Organization (FAO) estimates roughly one-third of food produced is lost or wasted—about 1.3 billion tonnes per year—a signal that better storage and temperature control can unlock huge gains and that high-R-value polyurethane will be specified more often across the chain.

Capacity and professionalization data underline this shift. In the United States, official figures show 3.69 billion ft³ of gross refrigerated space in 2023 across 900 warehouses, with 2.51 billion ft³ in public sites and 1.18 billion ft³ in private/semi-private facilities—illustrating a vast installed base where thermal performance directly affects operating cost and uptime. Rising utilization and throughput encourage operators to prefer materials that keep loads cold with thinner walls and lower leakage, which is where polyurethane from the DNT→TDI route excels.

Policy adds momentum. India’s India Cooling Action Plan (ICAP) projects nationwide cooling demand (in Tonnage of Refrigeration) to grow around eight-fold by 2037-38 versus 2017-18, while implementation targets aim to reduce total cooling demand by ~25% through efficiency improvements and better practice—both changes that reward high-performance envelopes in food logistics and processing. These goals sit alongside “thermal comfort for all” and “sustainable cooling,” giving industry a durable policy anchor for efficient insulation choices.

Drivers

Energy Efficiency in Building Construction

One major driving factor for the demand of intermediates like di-nitrotoluene (DNT) arises from the growing emphasis on building-envelope energy efficiency and insulation upgrades. Homes and commercial buildings around the world consume huge amounts of energy for heating and cooling, and industry players are increasingly turning to high-performance insulation materials—such as polyurethane foams derived from DNT → TDI chemistry—to reduce that consumption. For instance, the American Chemistry Council highlights that polyurethane products help reduce heat loss by as much as 30% for a building’s heating and cooling bills when spray foams are used to both insulate and air-seal a structure.

Further emphasizing the scale of this opportunity, the U.S. Department of Energy notes that polyurethane foam insulation is widely used because it incorporates a low-conductivity gas in its cells and in closed-cell form “can insulate 30 % to 40 % better for a given thickness” compared with more traditional board-insulations.

From a policy perspective, governments are recognising the dual benefit of energy savings and emissions reduction. In the UK, for example, research shows that fully refurbishing the non-domestic building stock to certain thermal performance levels could deliver annual energy cost savings of £5.65 billion per year by 2022—and primary energy savings of 24,000 GWh per annum, equating to around 1.25% of the UK’s total primary energy requirements.

In practical terms, the insulation sector’s reliance on strong thermal performance means that feed-stocks must deliver consistent quality, purity and downstream performance. If DNT supply were constrained or if alternatives dominated, that could shift the economics. However, the fact that policy frameworks reward better insulation (for example, programmes to reduce energy use by 30% or more) signals that intermediates tied to premium insulation systems have a favourable margin of safety and attractiveness.

Restraints

Workplace Health A Safety Liabilities

One of the most significant restraining factors for the development and expansion of the industry around Dinitrotoluene (DNT) is the serious health and safety risk it poses to workers and the resulting regulatory burden. According to the National Institute for Occupational Safety and Health (NIOSH), DNT and its isomers are recommended to be regarded as potential human carcinogens in workforce settings, and possible causes of adverse reproductive effects.

From a regulatory perspective, the permissible exposure limits (PELs) and recommended exposure limits (RELs) impose stringent controls on industrial operations. The U.S. Occupational Safety and Health Administration (OSHA) currently lists a PEL of 1.5 mg/m³ (8-hour TWA, skin designation) for DNT mixtures. Meanwhile, the American Conference of Governmental Industrial Hygienists (ACGIH) recommends a much lower Threshold Limit Value (TLV) of 0.2 mg/m³ (8-hour TWA) for the same substances.

On a human level, these constraints mean that the workers handling nitration units, hydrogenation units, or intermediate storage face elevated risk and thus require stronger oversight. For an industrial company, the reputation & liability risk is real: if a worker develops an occupational illness tied to DNT exposure, the firm could suffer regulatory penalties, litigation, reputational damage, and even production shutdowns. Because of the carcinogenic classification (or potential thereof) and associated long latent periods for disease, firms must keep long-term exposure records, medical monitoring data, and often pay for periodic retesting or monitoring programs.

Furthermore, because the hazard is intrinsic to the chemical (rather than just the process), substitution or mitigation is less straightforward. It’s not simply a matter of changing a catalyst or tweaking a process; the entire value chain—from DNT nitration, to TDA (toluenediamine), to TDI (toluene diisocyanate), to polyurethane foam—relies on the substance.

Opportunity

Cold-Chain Expansion And Food Loss Reduction

A powerful growth opportunity for di-nitrotoluene (DNT) sits in the global push to build out efficient cold chains that cut food loss and improve refrigeration performance. DNT feeds into toluenediamine (TDA) and then toluene di-isocyanate (TDI), which enables high-performance polyurethane foams used in refrigerated warehouses, transport boxes, truck bodies, display cases and building envelopes. The food system’s needs are clear: the UN Food and Agriculture Organization estimates that roughly one-third of all food produced for people is lost or wasted—about 1.3 billion tonnes each year—a stark signal that better storage, chilling and transport can deliver real gains.

Capacity data show the cold-storage base is expanding and professionalising, which in turn raises demand for premium insulation systems. In the United States, the Department of Agriculture reports 2.51 billion ft³ of public refrigerated capacity and 1.18 billion ft³ of private/semi-private capacity in 2023—3.69 billion ft³ in total across 900 warehouses—underlining the scale where thermal performance matters every day.

Globally, the industry is also concentrating among specialist operators: the Global Cold Chain Alliance (GCCA) reported a 10% capacity increase for its Top-25 warehouse providers in 2025, reaching 7.3 billion ft³, a directional indicator of sustained investment in large, modern facilities that specify high-R-value polyurethane systems.

Policy momentum strengthens this opportunity, especially where governments link food security with energy-efficient cooling. India’s official India Cooling Action Plan (ICAP) projects nationwide cooling demand will grow ~8× by 2037-38 versus 2017-18, with government-endorsed pathways to manage refrigerants and improve system efficiency—practical tailwinds for insulation demand in food processing, dairy, fisheries and retail cold chains.

Regional Insights

In 2024, the Asia-Pacific (APAC) region emerged as the dominating geography for the Di‑Nitrotoluene (DNT) market, capturing approximately 43.90% of the global market and amounting to an estimated USD 1.1 billion in revenue. This leadership is underpinned by responsive growth in key manufacturing hubs such as China, India and Southeast Asia, where infrastructure expansion, polyurethane production and chemical intermediates supply chains have accelerated. Existing reports indicate that Asia-Pacific holds a leading share exceeding 40% of the DNT market, driven by industrialisation, urbanisation and strong demand in downstream sectors.

In the APAC region, booming automotive and construction industries have led to elevated requirements for foams, insulation materials and speciality chemicals—all of which employ DNT as an intermediate. For example, expanding capacity in polyurethane systems across China and India has increased procurement of nitro-aromatic intermediates.

Moreover, favourable government policies promoting chemical cluster development and foreign direct investment have strengthened regional competitiveness for DNT production and consumption. The strong share in 2024 reflects both high regional consumption and a supportive output base.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE: BASF’s Intermediates division offers more than 600 chemical-intermediate products and operates world-scale plants in Europe, North America and Asia. The company is emphasising sustainable production and, for example, shifted its European amines portfolio to 100 % renewable electricity in 2025, reducing some 188,000 tons CO₂ eq annually versus 2020. Through its integrated value chains and large-scale infrastructure, BASF is well positioned in the DNT supply stream.

LANXESS AG: LANXESS maintains a dedicated Aromatics Network that includes nitrotoluene and related derivatives within its industrial-intermediates portfolio. The company’s investments (e.g., > €20 million over three years) in modernising its nitrotoluene/ardomatics production plants underscore its commitment to production efficiency and safety. LANXESS thus holds a meaningful role in supplying aromatic intermediates relevant to DNT markets.

Covestro AG: Covestro specialises in high-performance polymer raw materials including isocyanates and polyols, supplying to automotive, electronics, construction and other industries. The company is innovating in sustainable chemistry (example: bio-based aniline derived from plant biomass) as part of its circular-economy strategy. Covestro’s integration into downstream polyurethane and advanced materials markets gives it strategic exposure to DNT intermediates used in those value chains.

Top Key Players Outlook

- BASF SE

- Covestro AG

- LANXESS AG

- Huntsman Corporation

- Others

Recent Industry Developments

In fiscal year 2024, Covestro reported group sales of €14.179 billion, down about 1.4 % from the prior year.

In 2024, Huntsman recorded total revenues of US $6,036 million compared with US $6,111 million in 2023, reflecting a 1 % decline.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 7.9 Bn CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Applications (Chemical, Plastics, Herbicides, Pharmaceuticals, Others), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Covestro AG, LANXESS AG, Huntsman Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Covestro AG

- LANXESS AG

- Huntsman Corporation

- Others