Global Device Anti-Theft Software Market Size, Share Report Analysis By Component (Software, Services), By Device Type (Smartphones, Laptops, Tablets, Desktops, Others), By Deployment Mode (On-Premises, Cloud-Based), By End-User (Individual, Enterprises, Government, Others), By Distribution Channel (Online, Offline) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170350

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Theft, Loss and Usage Trends

- Role of Generative AI

- U.S. Market Size

- Component Analysis

- Device Type Analysis

- Deployment Mode Analysis

- End-User Analysis

- Distribution Channel Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

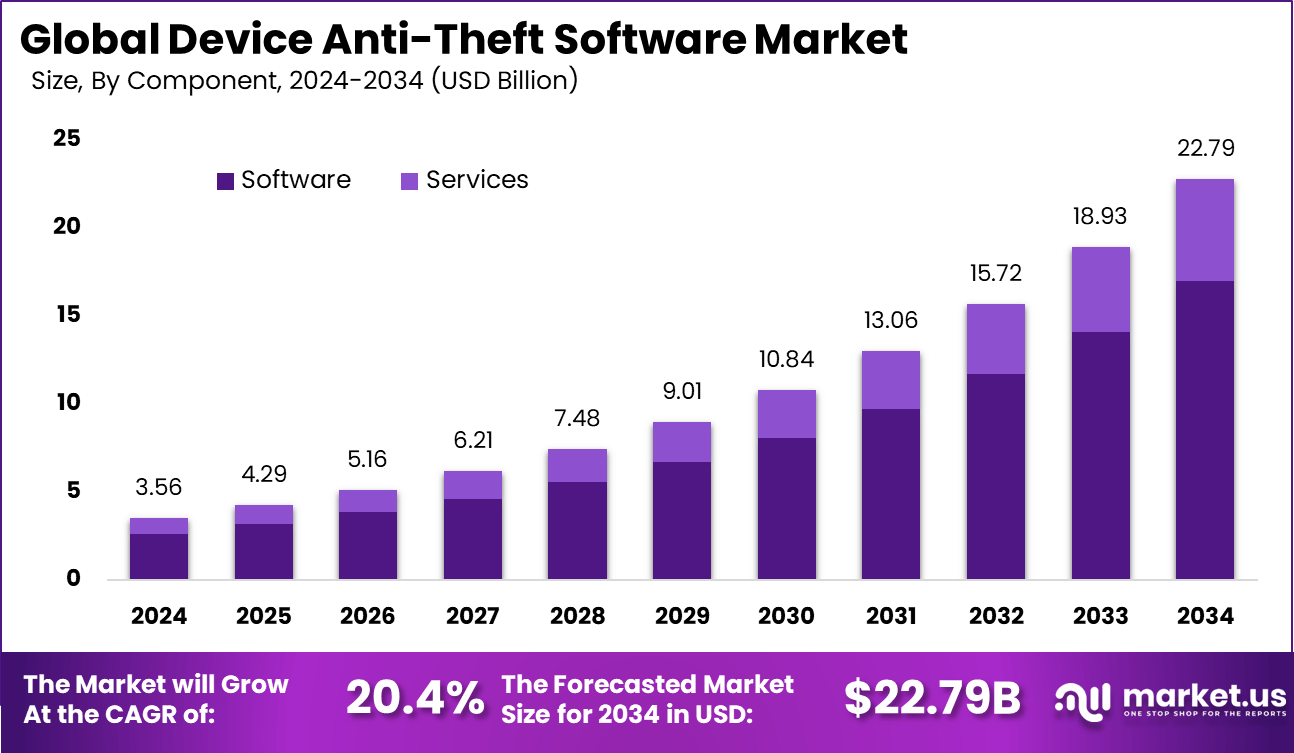

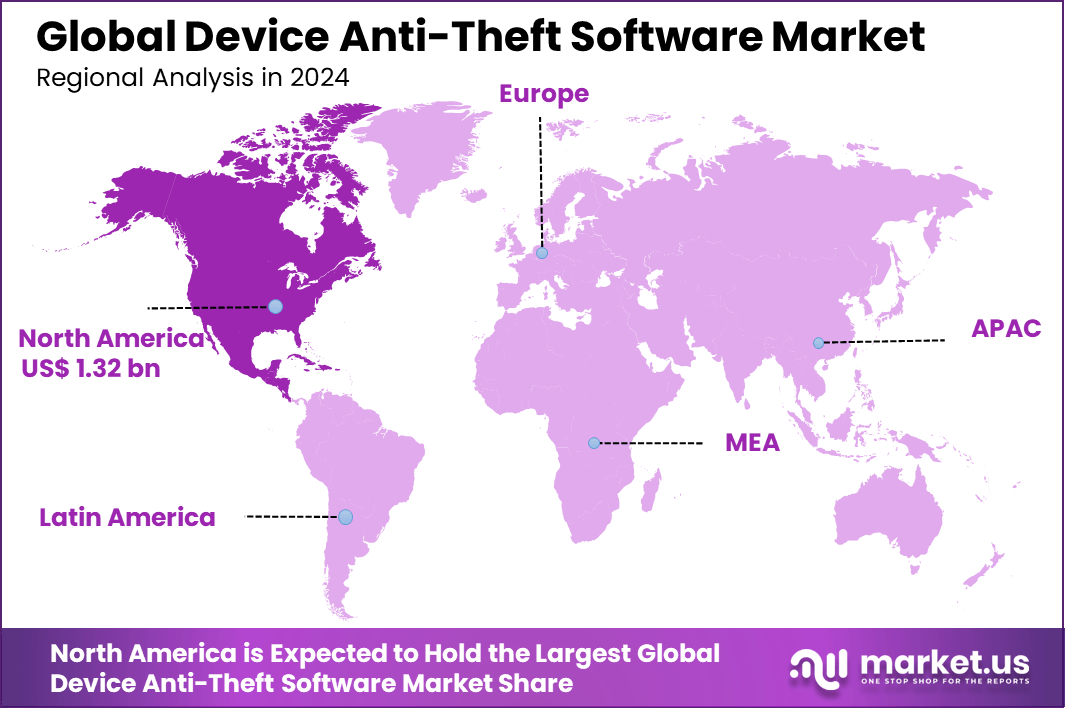

The Global Device Anti-Theft Software Market size is expected to be worth around USD 22.79 billion by 2034, from USD 3.56 billion in 2024, growing at a CAGR of 20.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.2% share, holding USD 1.32 billion in revenue.

The device anti theft software market focuses on solutions designed to protect smartphones, laptops, tablets, and other connected devices from loss and theft. These software tools help users locate devices, lock access, erase sensitive data remotely, and prevent unauthorized usage. The market has gained importance as personal and business data stored on devices continues to increase. Enterprises and individual users are giving higher priority to data protection, especially with the rise in mobile work and remote access.

Growth in this market is driven by the increasing number of mobile and connected devices used for work and personal activities. Rising incidents of device theft and data breaches have increased awareness about digital security. Organizations are adopting bring your own device policies, which has created a strong need for centralized device security solutions. Regulatory pressure related to data privacy and information security has also supported adoption.

For instance, in October 2025, McAfee LLC highlighted device anti-theft in its 2025 cybersecurity predictions, launching AI-driven scam alerts that tie into remote lock and track features for mobile endpoints. With cyberthieves increasingly targeting hardware for data grabs, McAfee’s updates help users wipe sensitive info before it’s too late.

Demand for device anti theft software is expanding steadily across both enterprise and consumer segments. Businesses are investing in these solutions to protect confidential data and reduce financial losses linked to stolen devices. Educational institutions and public sector organizations are also increasing adoption to secure large fleets of devices. On the consumer side, demand is supported by higher smartphone usage and growing concern over personal data safety.

Key Takeaway

- Software-based solutions led the market with a 74.7% share, as organizations prioritize scalable and update-driven security tools.

- Smartphones accounted for 40.6%, reflecting rising theft risks linked to high mobile device penetration and remote work usage.

- On-premises deployment captured 55.4%, driven by enterprises seeking stronger control over sensitive security data.

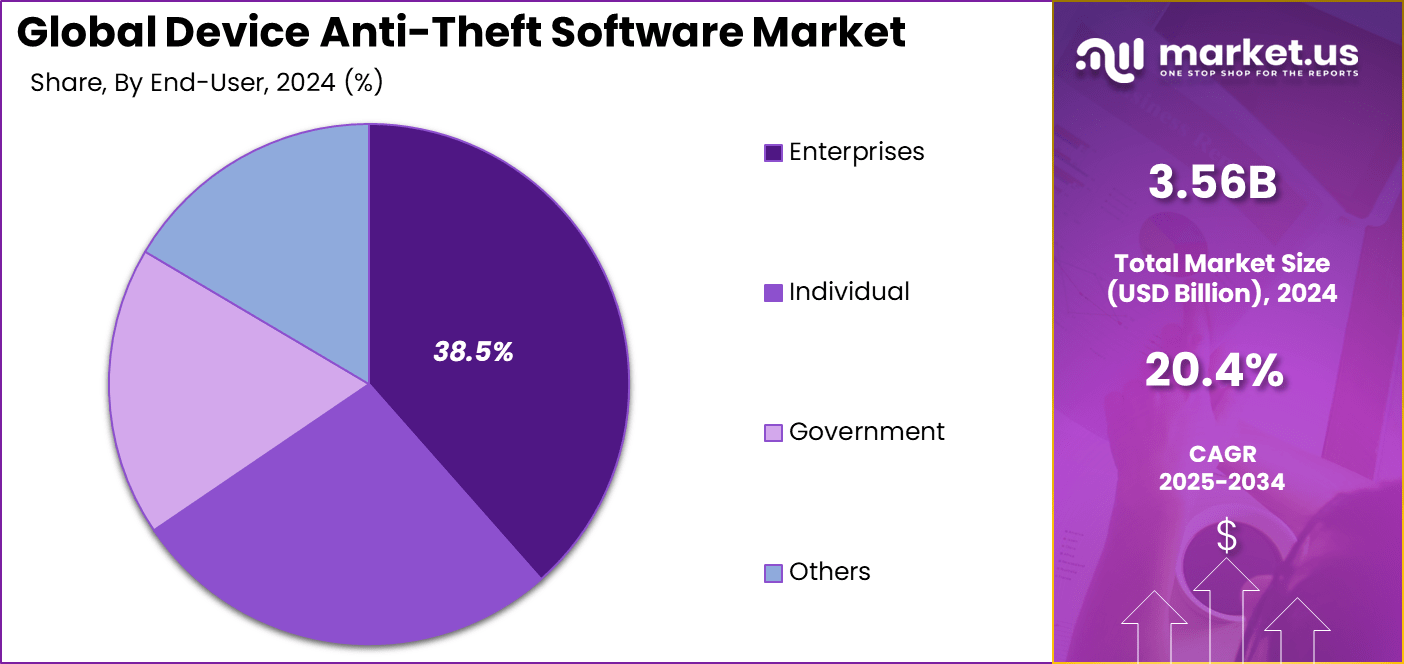

- Enterprises held 38.5%, highlighting higher adoption among large organizations managing fleets of corporate devices.

- Offline anti-theft capabilities dominated with 58.7%, as location tracking and device locking remain critical without active connectivity.

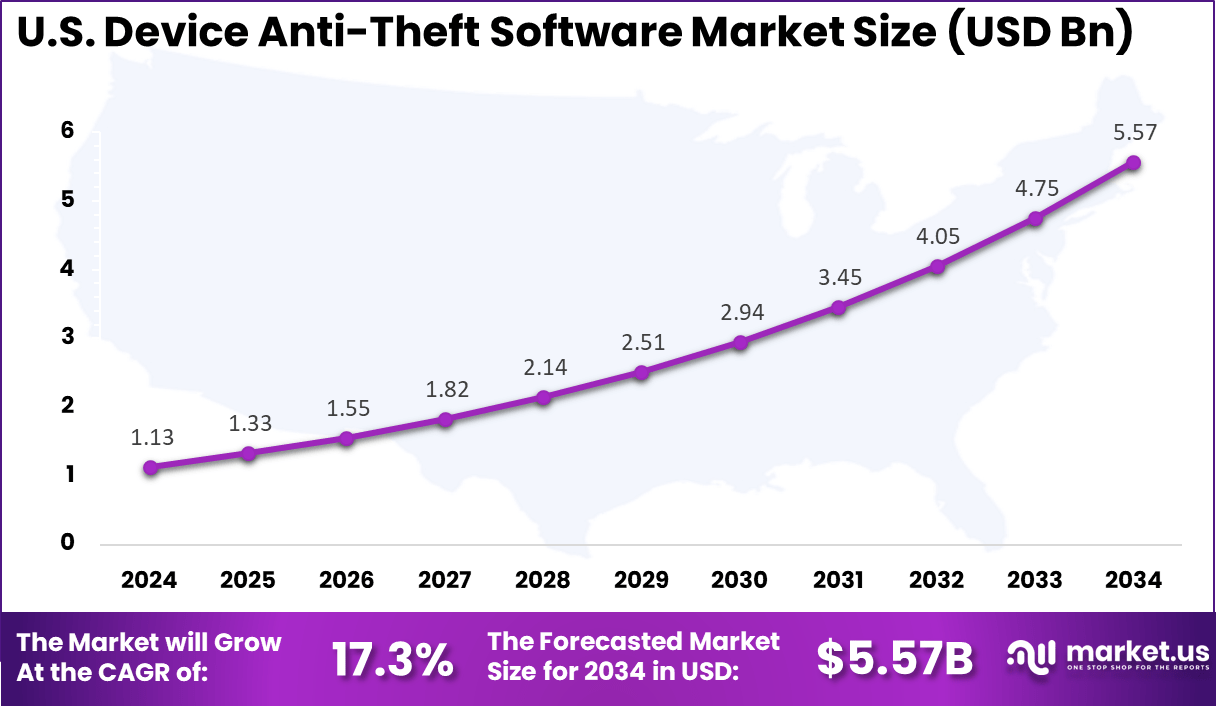

- The U.S. market reached USD 1.13 billion in 2024, expanding at a strong 17.3% CAGR due to increasing device theft and cybersecurity spending.

- North America led globally with over 37.2% share, supported by early technology adoption and strict data protection practices.

Theft, Loss and Usage Trends

- A laptop is stolen every 53 seconds, and around 70 million smartphones are lost each year, with only 7% ever recovered.

- Workplace environments remain high risk, with 52% of device thefts occurring in offices and 24% at conferences.

- Data exposure is the biggest financial risk, as 80% of the total cost of a lost laptop comes from data breaches rather than hardware loss.

- Microsoft Defender leads the market with 23% share, followed by McAfee at 18% and Norton at 13%, reflecting strong trust in established security brands.

- Malwarebytes holds 9%, showing steady adoption among users seeking lightweight protection.

- Built-in operating system tools such as remote locking and theft detection are now widely used, improving baseline device security.

- Rising urbanization and crime rates continue to push demand for stronger anti-theft software across personal and enterprise devices.

- Protecting sensitive corporate and personal data remains the primary driver behind increased adoption of advanced device anti-theft solutions.

Role of Generative AI

Generative AI enhances device anti-theft software by analyzing patterns to detect threats early and improve response times. A recent survey of IT decision-makers found that 76% of organizations faced device theft incidents in the past two years, often leading to data breaches in 46% of cases. This AI learns typical device usage, such as movement speeds or login habits, to flag anomalies like sudden grabs or unauthorized access instantly.

In real-world use, generative AI drives automatic screen locks during theft-like sensor readings and creates synthetic training data to boost model precision without exposing real user info. Stolen devices contribute to 41% of data loss incidents, surpassing ransomware at 32%, which underscores the need for such proactive tools. Developers use it to build systems that adapt to evolving risks across phones, laptops, and tablets.

Generative AI cuts false positives by separating normal actions from threats, like quick zone exits, and predicts issues to guide remote controls. With 30% of firms reporting financial hits from replacements and 32% facing productivity dips after thefts, this technology turns security from basic tracking to forward-looking protection. It fits seamlessly into daily device operations while addressing rising theft pressures.

U.S. Market Size

The U.S. device anti theft software market is valued at USD 1.13 billion and is expanding at a projected CAGR of 17.3%, driven by rising smartphone theft in urban areas and wider use of remote work devices. Strong data privacy regulations, high mobile penetration, and growing demand for real time tracking, geofencing, and remote data wipe features are accelerating adoption across enterprises and consumers.

For instance, In January 2025, McAfee LLC showcased AI powered anti theft and scam protection solutions at CES 2025, including Scam Detector and Deepfake Detector integrated with AMD and Qualcomm hardware. These innovations strengthen real time device security and highlight continued U.S. leadership in advanced device protection technologies.

In 2024, North America led the global device anti theft software market with more than 37.2% share, generating approximately USD 1.32 billion in revenue. High smartphone penetration, frequent urban thefts, and widespread remote work have increased the risk of data loss from misplaced or stolen devices, pushing strong adoption of tracking and remote wipe solutions. Strict privacy regulations and the presence of major technology hubs further support rapid use of AI driven alerts and geofencing tools.

In October 2025, Zimperium Inc. was named Mobile Security Solution of the Year at the 2025 Mobile Breakthrough Awards for its AI based protection against mobile threats and zero day exploits. This recognition highlights North America’s leadership in advanced device security innovation and reinforces the region’s dominance in the device anti theft software market.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 74.7% share of the Global Device Anti-Theft Software Market. These tools manage key functions like real-time location tracking and remote data wipes. They integrate AI updates to stay ahead of evolving threats. Users find them straightforward to deploy across devices without heavy setup. Businesses value the seamless fit into existing security layers. This focus on core protection drives their lead in the space.

The strength comes from the software’s ability to handle geofencing and alert systems effectively. Regular patches keep pace with new theft tactics seen in urban areas. For teams managing fleets of devices, these solutions offer centralized dashboards for quick response. Individuals appreciate the app-based controls that work on the go. Overall, software’s flexibility and power make it the clear choice over hardware options.

For Instance, in October 2025, Absolute Software Corporation earned top recognition in patch management from GigaOm Radar. This honors their software tools that automate updates and block ransomware on endpoints. Their solutions embed deeply to track and secure devices even after OS issues, fitting the software focus perfectly.

Device Type Analysis

In 2024, the Smartphones segment held a dominant market position, capturing a 40.6% share of the Global Device Anti-Theft Software Market. They carry sensitive data like contacts and financial apps, making theft a big risk. Features such as biometric locks and kill switches protect against quick losses. High daily usage in work and personal life boosts demand for tailored security. This segment sees steady growth from rising mobile reliance everywhere.

Theft incidents often target smartphones due to their resale value on black markets. Anti-theft software adds layers like SIM lockouts to block unauthorized use. Remote tracking helps recover devices in crowded cities fast. Users pair these with backups to minimize data loss. As screen sizes grow, so does the need for robust protection on these portable hubs of information.

For instance, in January 2025, McAfee showcased Deepfake Detector at CES for smartphones with AMD and Qualcomm. It runs on mobile processors to spot manipulated videos and scams fast. Such features protect smartphone users from evolving theft and fraud tactics.

Deployment Mode Analysis

In 2024, The On-Premises segment held a dominant market position, capturing a 55.4% share of the Global Device Anti-Theft Software Market. Organizations choose them for complete control over sensitive data storage. They link well with legacy networks common in large firms. Strict compliance rules favor local servers to avoid cloud risks. Setup allows custom tweaks to match unique workflows. This approach suits sectors handling regulated information daily.

Even with cloud advances, on-premises wins for reliability during outages. IT teams manage updates and access without internet dependency. Data stays within borders, easing privacy concerns in global ops. Costs spread over time make sense for long-term use. Hybrid shifts still lean on these for core functions, keeping their strong position intact.

For Instance, in October 2025, Sophos Ltd. updated its endpoint security for on-premises setups. New EDR licensing simplifies access to protection that runs locally without cloud reliance. This suits firms needing full control over device data in regulated environments.

End-User Analysis

In 2024, The Enterprises segment held a dominant market position, capturing a 38.5% share of the Global Device Anti-Theft Software Market. They embed anti-theft into wide security frameworks for employee devices. Remote work spreads risks, so central monitoring tracks assets across locations. Policies enforce installs to safeguard company info from leaks. This group invests in scalable tools for growing teams. Their focus on prevention sets the pace for market trends.

Large-scale needs drive enterprise preference with features like fleet management. Lost laptops cost firms dearly in data breaches and downtime. Software logs activity to aid audits and quick lockouts. Training integrates these into daily routines smoothly. As threats target business mobility, enterprises lead in pushing advanced protections forward.

For Instance, in October 2025, Sophos Ltd. added AI assistants to XDR and MDR for enterprise threat hunting. These tools help large teams investigate device risks centrally. On-site management fits enterprise needs for hybrid work security.

Distribution Channel Analysis

In 2024, The Offline segment held a dominant market position, capturing a 58.7% share of the Global Device Anti-Theft Software Market. Retail stores offer hands-on demos for buyers to test features live. Staff guide selections based on user needs, like travel or office use. Bundles with devices simplify purchases at checkout. In areas with spotty internet, this route proves reliable. Trust builds through direct interactions and support.

Partners like resellers provide setup help and warranties on-site. Customers try tracking demos before committing. Offline sales suit cautious buyers wanting immediate advice. Local events showcase updates to draw crowds. This personal touch speeds decisions over online browsing alone.

For Instance, in November 2025, Bitdefender highlighted anti-theft in their consumer survey and Computer Security Day push. Features like remote wipe and photo capture sell well through retail demos. Offline channels let buyers test smartphone protection hands-on before purchase.

Emerging trends

Emerging trends in this market reflect broader technology and behavioural patterns. Focus on cloud-based deployment is becoming more prevalent as users prioritise convenience and remote accessibility over traditional on-premises installations. Cloud solutions allow continuous update delivery and remote control of device status, which enhances utility for dispersed device fleets.

Strong interest in advanced tracking methods such as geofencing, biometric authentication, and remote data wiping demonstrates a clear move toward richer feature sets that can address a widening range of theft and loss scenarios. Enhanced integration with operating systems and mobile ecosystems is also notable, indicating that software is increasingly expected to work seamlessly across platforms.

Another trend is the growing emphasis on regulatory compliance and data privacy protection. As laws around data security and user privacy strengthen in many regions, organisations and individuals alike are more inclined to adopt anti-theft software that can align with these legal requirements. Protection of sensitive information in stolen or lost devices is becoming a non-negotiable part of enterprise risk management, reinforcing uptake across sectors such as education, healthcare, and professional services.

Growth Factors

Growth in the market is underpinned by multiple intersecting factors. The sheer increase in device ownership worldwide has created a baseline demand for anti-theft capabilities that extend beyond simple location tracking to include comprehensive security actions such as remote locking and data erasure. This demand is strengthened by heightened concerns about cybercrime and device theft, both of which have been reported with increasing frequency in major urban areas and digital ecosystems.

Another key driver lies in consumer and business awareness of asset value. Devices today often hold a combination of personal, financial, and proprietary data. Loss of such data through theft can have serious consequences, prompting proactive investment in software that can mitigate such risks. In enterprise contexts, the presence of large device fleets amplifies both the exposure to theft risk and the value of solutions that can centrally manage device security.

Technology evolution further supports growth. Improvements in machine learning, artificial intelligence, and network-based communication have made tracking and threat detection more reliable and sophisticated. This allows anti-theft software to offer better accuracy in locating devices, more responsive alerting mechanisms, and deeper integration with supplementary security tools. As these technologies continue to mature, adoption is being encouraged by enhanced capability and confidence in software performance.

Key Market Segments

By Component

- Software

- Services

By Device Type

- Smartphones

- Laptops

- Tablets

- Desktops

- Others

By Deployment Mode

- On-Premises

- Cloud-Based

By End-User

- Individual

- Enterprises

- Government

- Others

By Distribution Channel

- Online

- Offline

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Device Theft

The growing rate of lost and stolen devices like smartphones and laptops is a strong catalyst for demand in anti-theft software solutions. Companies rely increasingly on digital equipment for business operations, making real-time tracking and recovery tools essential. These solutions help organizations safeguard valuable assets while minimizing downtime caused by stolen or misplaced devices.

Remote work further amplifies this need as employees now use company devices in varied, unsecured environments. Businesses are prioritizing software that can remotely lock or wipe sensitive data to prevent data breaches and financial losses. This shift toward proactive protection strengthens the appeal of device security as a core business investment.

For instance, in January 2025, McAfee showed off at CES 2025 with new tracking for lost devices. Their software pairs with hardware to lock ultrabooks from afar. Users get location maps even if the power goes off. This meets the surge in mobile work gear going missing. Theft recovery jumps as firms add it to fleets.

Restraint

Privacy Worries

Privacy concerns remain a significant barrier to widespread adoption of anti-theft software. Many users see constant location tracking and remote access functions as intrusive, fearing misuse or unauthorized surveillance. These apprehensions are particularly strong in regions where personal data control is culturally and legally prioritized.

Regulations like the GDPR require vendors to manage user data responsibly, which complicates product design and compliance. The need to balance protection and privacy often forces companies to adopt conservative data policies or delay implementation, slowing customer adoption in sensitive markets.

For instance, in December 2025, Kaspersky saw detections rise but faced US ban fallout. Auto-swaps to new tools spark privacy distrust. Root access worries slow enterprise picks. Global users hesitate on tracking amid spy claims. Strict laws curb sales in key markets.

Opportunities

AI Advances

Artificial intelligence presents a major opportunity for next-generation anti-theft software. Modern systems use machine learning to analyze user behavior and detect unusual activity patterns that might indicate potential theft. This predictive approach helps companies respond faster and with greater accuracy than traditional tracking tools.

Integration with cloud platforms and mobile ecosystem providers also expands software reach. Partnerships with smartphone manufacturers and telecom carriers allow seamless security solutions to reach users at lower costs, especially in fast-growing mobile markets across Asia and other emerging regions.

For instance, in July 2025, Bitdefender boosted content platform shields against scams. AI blocks phishing on emails and DMs across devices. Remote lock and photo capture aid theft response. Cloud links grow as phones boom in emerging areas. Multi-device tools pull in remote teams.

Challenges

Skilled Worker Shortage

A shortage of cybersecurity and software development experts hinders innovation in anti-theft technologies. Building advanced behavioral detection systems and integrating AI capabilities requires specialized knowledge that many firms struggle to retain or hire. This gap leads to slower feature rollouts and weaker threat response strategies.

High training expenses and compliance demands exacerbate the issue, particularly for smaller vendors lacking technical teams. Many opt for simplified or outsourced solutions, which limit their ability to compete with larger players in developing robust, intelligent protection tools.

For instance, in July 2025, Sophos pushed Secure by Design but delayed audit log tools. Acquisition shifts slowed skilled team building. Ransomware blocks rose, yet data theft tactics outpace. Few experts handle fast threat changes. Training lags hold back full endpoint control.

Key Players Analysis

Absolute Software, Prey, Kaspersky, McAfee, Symantec, Bitdefender, and Avast lead the device anti-theft software market with solutions that enable device tracking, remote locking, data wiping, and recovery support. Their platforms protect laptops, smartphones, and enterprise endpoints against loss and theft. These companies focus on persistent security, cross-platform compatibility, and centralized management. Rising device mobility and remote work adoption continue to reinforce their leadership.

Sophos, Trend Micro, Lookout, F-Secure, ESET, Microsoft, IBM, and Cisco strengthen the market with anti-theft features integrated into broader endpoint security and device management platforms. Their solutions combine threat detection with location tracking and access control. These providers help enterprises protect sensitive data while maintaining device visibility. Growing cybersecurity risks and compliance needs drive wider adoption of integrated anti-theft capabilities.

Check Point, Zimperium, Cerberus Anti-Theft, G Data CyberDefense, BullGuard, and other participants expand the market with specialized mobile-first and consumer-focused anti-theft tools. Their offerings emphasize real-time alerts, SIM change detection, and rapid response features. These companies serve users seeking lightweight and cost-effective protection. Increasing smartphone usage and data privacy concerns continue to drive demand for device anti-theft software worldwide.

Top Key Players in the Market

- Absolute Software Corporation

- Prey Inc.

- Kaspersky Lab

- McAfee LLC

- Symantec Corporation (NortonLifeLock Inc.)

- Bitdefender

- Avast Software s.r.o.

- Sophos Ltd.

- Trend Micro Incorporated

- Lookout Inc.

- F-Secure Corporation

- ESET, spol. s.r.o.

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Zimperium Inc.

- Cerberus Anti-Theft

- G Data CyberDefense AG

- BullGuard Ltd.

- Others

Recent Developments

- In December 2025, Kaspersky Lab reported detecting an average of 500,000 malicious files daily throughout the year, with anti-theft modules in their suites blocking unauthorized access on millions of compromised devices. This data underscores Kaspersky’s role in preventing theft-related data breaches, especially as remote work blurs device boundaries.

- In February 2025, Trend Micro Incorporated expanded its Maximum Security suite with enhanced Folder Shield ransomware protection and device locator tools, earning top marks in independent tests for anti-theft performance. This rollout targets small businesses hit hard by theft, offering cloud-synced recovery without slowing down daily operations.

Report Scope

Report Features Description Market Value (2024) USD 3.56 Bn Forecast Revenue (2034) USD 22.79 Bn CAGR(2025-2034) 20.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Device Type (Smartphones, Laptops, Tablets, Desktops, Others), By Deployment Mode (On-Premises, Cloud-Based), By End-User (Individual, Enterprises, Government, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Absolute Software Corporation, Prey Inc., Kaspersky Lab, McAfee LLC, Symantec Corporation (NortonLifeLock Inc.), Bitdefender, Avast Software s.r.o., Sophos Ltd., Trend Micro Incorporated, Lookout Inc., F-Secure Corporation, ESET, spol. s r.o., Microsoft Corporation, IBM Corporation, Cisco Systems, Inc., Check Point Software Technologies Ltd., Zimperium Inc., Cerberus Anti-Theft, G Data CyberDefense AG, BullGuard Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Device Anti-Theft Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Device Anti-Theft Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Absolute Software Corporation

- Prey Inc.

- Kaspersky Lab

- McAfee LLC

- Symantec Corporation (NortonLifeLock Inc.)

- Bitdefender

- Avast Software s.r.o.

- Sophos Ltd.

- Trend Micro Incorporated

- Lookout Inc.

- F-Secure Corporation

- ESET, spol. s.r.o.

- Microsoft Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Zimperium Inc.

- Cerberus Anti-Theft

- G Data CyberDefense AG

- BullGuard Ltd.

- Others