Global Desert Border Surveillance Market Size, Share Report Analysis By Component (Cameras, Sensors, Radars, Unmanned Aerial Vehicles, Command & Control Systems, Others), By Application (Perimeter Security, Intrusion Detection, Illegal Trafficking Prevention, Others), By Technology (Infrared, Thermal Imaging, Motion Detection, AI-based Analytics, Others), By End-User (Military & Defense, Homeland Security, Law Enforcement Agencies, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169709

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

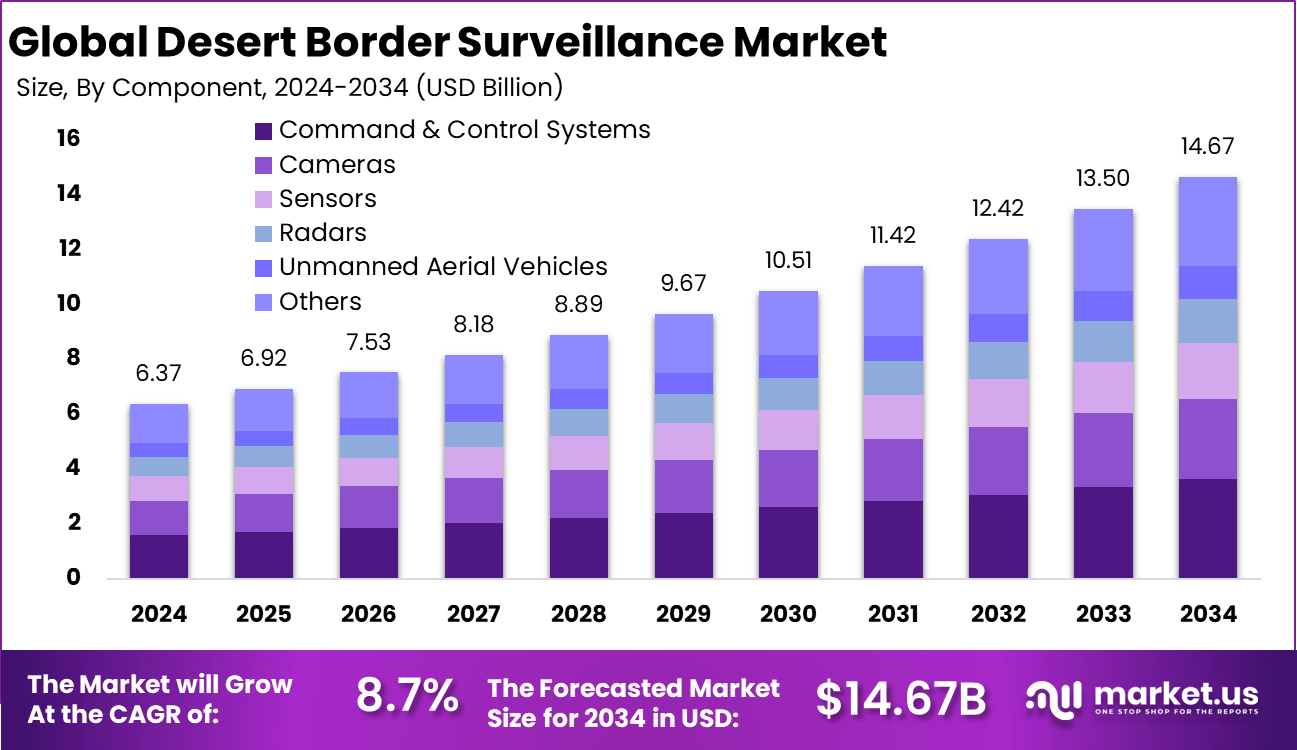

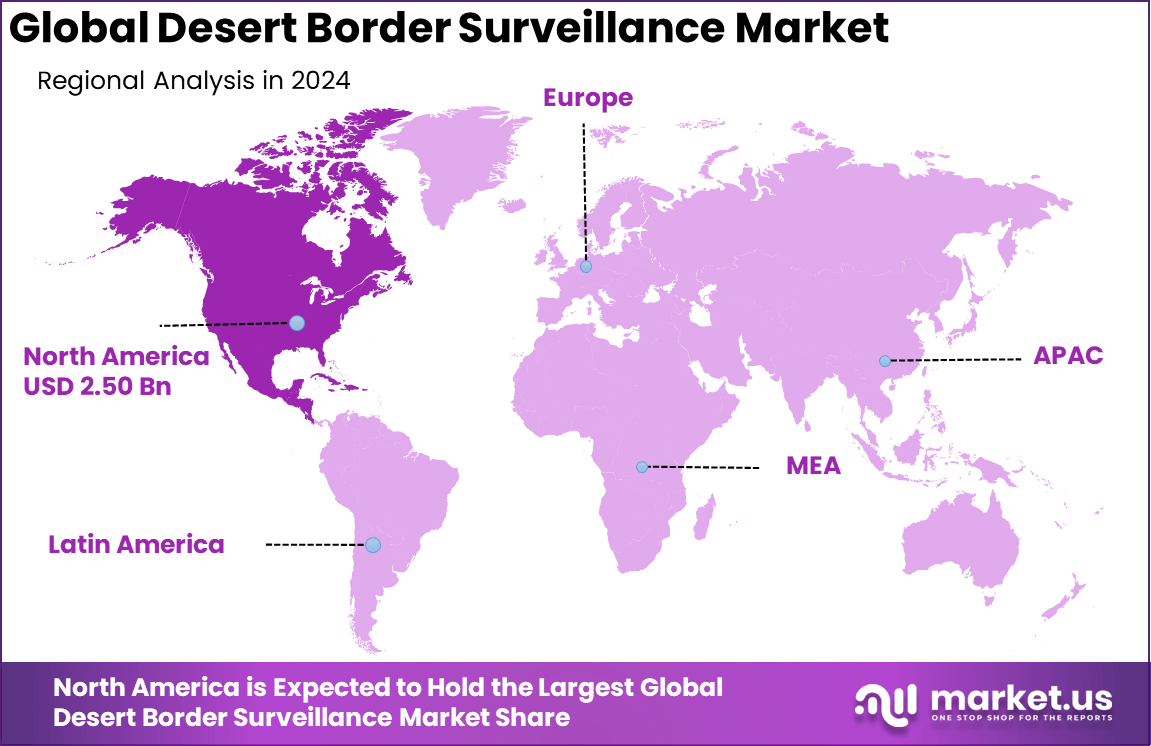

The Global Desert Border Surveillance Market size is expected to be worth around USD 14.67 billion by 2034, from USD 6.37 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.4% share, holding USD 2.50 billion in revenue.

The desert border surveillance market has grown as countries strengthen monitoring across vast and remote desert regions to control illegal crossings and protect national boundaries. Growth is linked to the difficulty of securing long desert borders using physical patrols alone. Governments rely on surveillance systems to maintain continuous visibility across harsh terrain where human presence is limited.

The growth of the market can be attributed to rising border security concerns, increasing illegal movement across desert routes and growing pressure on authorities to prevent smuggling and cross border crime. Desert terrain makes traditional fencing and manual patrols costly and slow. Surveillance systems allow continuous monitoring with lower operational risk to security forces.

Demand comes from vast desert borders that run for thousands of kilometers with no clear signs. Patrols face over 1.5 million encounters each year in hot zones, wearing down teams. Far-off areas get few guards but hold big risks, so instant alert systems rise up. This cuts wait times and fills dark spots on maps. Remote teams get feedback right away to move fast. Fewer blind areas mean stronger holds overall. Needs keep climbing as threats shift patterns.

For instance, in July 2025, Elbit America ramped up deployment of its Integrated Surveillance Towers (ISTs) along the rugged Del Rio sector of the U.S. southern border under a $1.8 billion CBP contract. Each tower uses AI sensors to cover 100 square miles autonomously, easing the load on agents patrolling remote desert stretches.

Key Takeaway

- Command and Control systems held 24.7% in 2024, showing their central role in coordinating real-time border surveillance operations.

- Perimeter security dominated with 33.6%, confirming strong demand for intrusion detection and barrier protection across desert borders.

- AI-based analytics captured 30.2%, reflecting rising use of automated threat detection, tracking, and predictive monitoring.

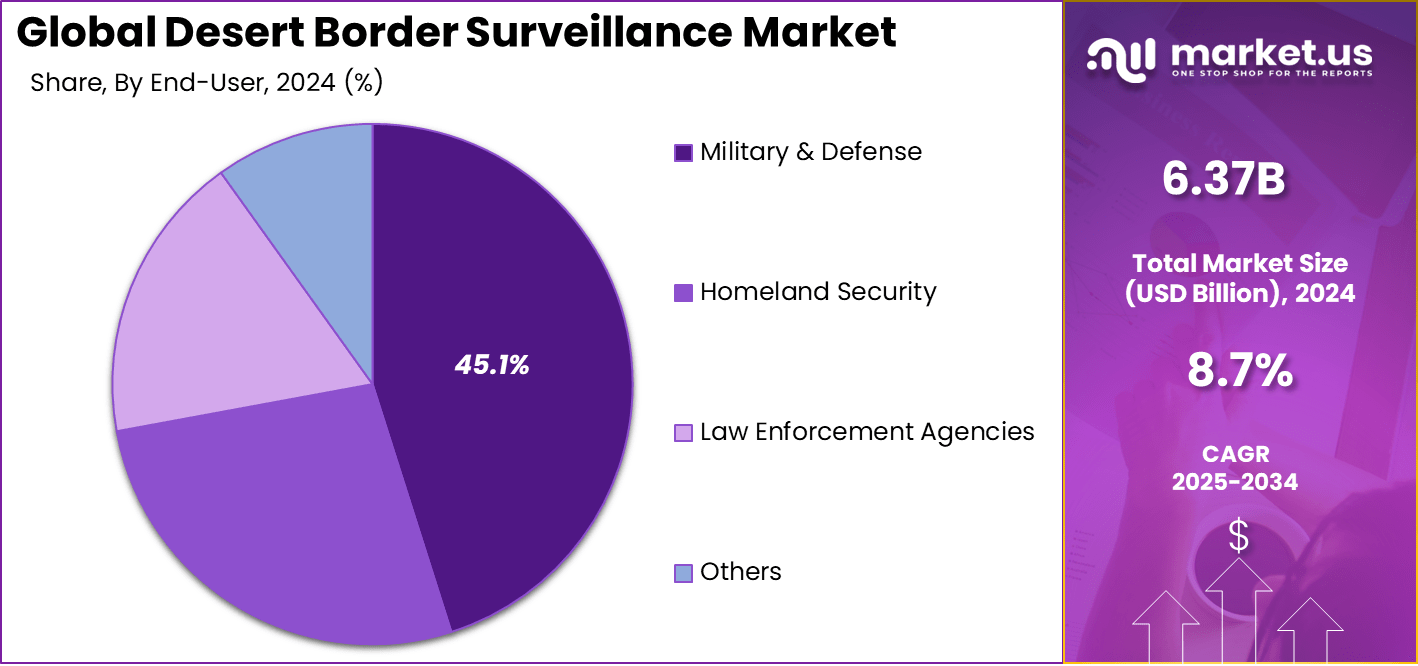

- The military and defense segment accounted for 45.1%, highlighting that national security agencies remain the largest buyers of desert surveillance technologies.

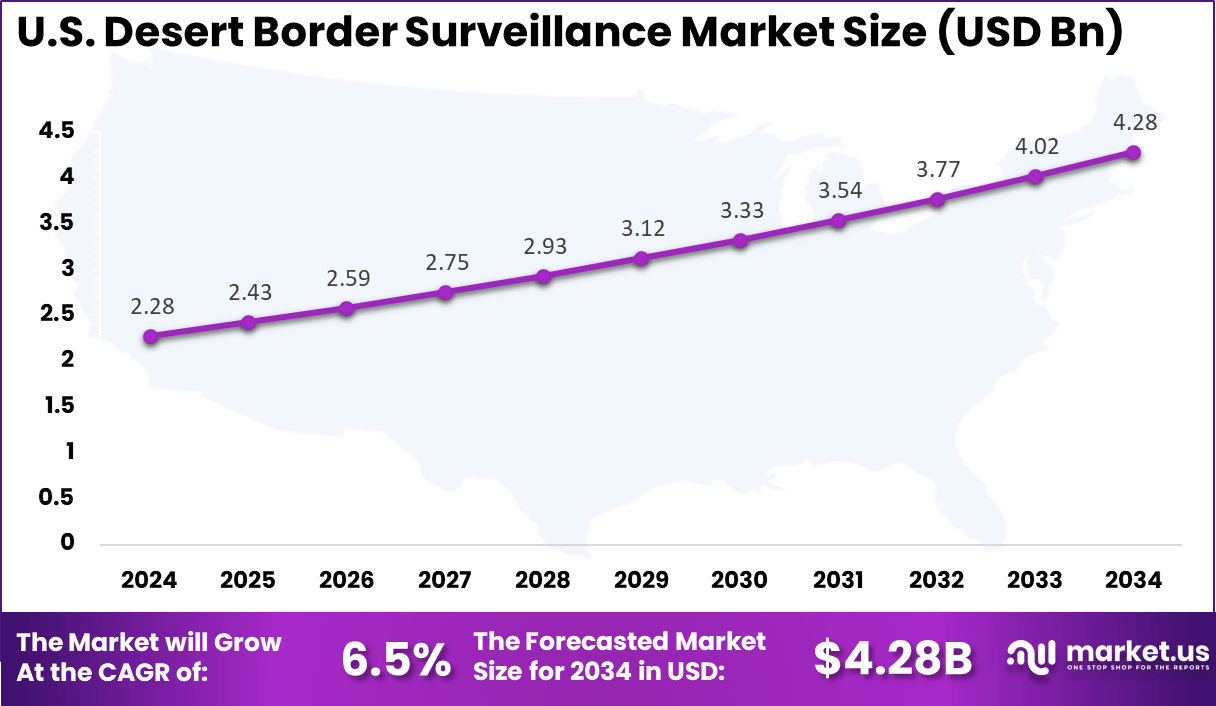

- The U.S. market reached USD 2.28 billion in 2024 and is expanding at a steady 6.5% CAGR, supported by continuous border infrastructure upgrades.

- North America held more than 39.4% share, driven by high defense spending and advanced surveillance deployment across border regions.

U.S. Market Size

The market for Desert Border Surveillance within the U.S. is growing tremendously and is currently valued at USD 2.28 billion, the market has a projected CAGR of 6.5%. The market is growing due to rising illegal crossings along the southern desert borders, pushing demand for advanced sensors and radars.

Harsh terrain and heat drive the need for rugged command systems that link drones and cameras seamlessly. Military focus sharpens with threats like smuggling and drones, while AI analytics cuts false alerts in vast sands. Federal funds back upgrades for tighter perimeter security year-round.

For instance, In October 2025, Raytheon Technologies Corporation began initial production of its SharpSight multi-domain surveillance radar, a high-altitude system built for real-time imaging and wide-area tracking in harsh desert environments. The radar combines advanced technologies to deliver persistent land surveillance in any weather, day or night, strengthening U.S. capabilities in modern border security.

In 2024, North America held a dominant market position in the Global Desert Border Surveillance Market, capturing more than a 39.4% share, holding USD 2.50 billion in revenue. This dominance is due to vast desert frontiers along the southern US border, facing high illegal crossings and smuggling.

Heavy federal investments fund rugged sensors, radars, and command systems built for extreme heat and sand. Military demands drive AI analytics and perimeter tech for quick threat response. Long borders need integrated setups that link air and ground watch effectively. Regional tech hubs speed innovations for reliable coverage.

For instance, In March 2025, Lockheed Martin Corporation integrated its AN/TPQ-53 multi-mission radar with Joint Task Force Southern Border systems at Fort Huachuca, Arizona, improving detection of airborne and ground threats along the U.S. Mexico desert border. This deployment strengthens USNORTHCOM operations by demonstrating the radar’s reliability and open architecture, supporting faster and more accurate threat response.

Component Analysis

Command and Control systems account for 24.7% of total demand in desert border surveillance operations. These systems act as the central platform that connects sensors, cameras, radar units, and communication networks into one unified monitoring structure. They allow operators to receive, analyze, and respond to threats in real time.

The importance of this segment is driven by the need for fast decision making in wide and remote desert areas. C2 systems help reduce response time, improve coordination between ground forces and air units, and support continuous situational awareness across long border stretches.

For Instance, in September 2025, Elbit Systems unveiled Frontier at DSEI 2025, a wide-area surveillance system with strong command features for border defense. It pulls in data from multiple sensors for real-time operator views. The setup handles land and air threats in tough spots. This boosts coordination across desert fronts.

Application Analysis

Perimeter security represents 33.6% of total application demand. This segment focuses on protecting border lines using fences, sensor grids, surveillance towers, motion detectors, and camera systems deployed across desert terrain.

Its strong share reflects the constant need to detect unauthorized crossings, smuggling activities, and vehicle movement in open landscapes. Perimeter systems provide early warning capabilities and help security personnel react before threats move deeper into secured territories.

For instance, in July 2025, Elbit America started deploying Integrated Surveillance Towers along the US southern border under a big CBP contract. These towers secure wide perimeter areas with autonomous sensors. They cut staffing needs while watching 100-square-mile zones. Desert perimeters gain tight, reliable coverage.

Technology Analysis

AI based analytics account for 30.2% of surveillance technology usage in desert borders. These systems analyze video feeds, radar signals, and motion data to automatically detect unusual behavior, moving objects, and intrusion patterns.

The growing role of AI in this market is linked to the large data volumes generated by continuous surveillance. AI improves detection accuracy, reduces false alarms caused by animals or weather, and lowers the workload on human operators.

For Instance, in September 2025, Elbit launched Frontier with AI that learns routines and flags threats on borders in real time. It sorts anomalies from normal patterns across huge areas. Desert surveillance sharpens as AI handles dust and night feeds. Operators focus on real risks with smart alerts.

End-User Analysis

Military and defense agencies hold the largest share at 45.1%. These organizations are responsible for securing national borders against illegal crossings, organized trafficking, and security threats in remote desert zones.

Their high adoption reflects long term investment in advanced surveillance tools for national security operations. Military users require systems with high durability, long range detection, encrypted communications, and full time monitoring capabilities under harsh desert conditions.

For Instance, in March 2025, Lockheed integrated AN/TPQ-53 radar for the US Northern Command’s southern border mission. Military teams track drones and ground moves in desert threats. Quick setup aids defense responses under five minutes. It proves vital for frontline border defense.

Emerging Trends

One emerging trend in the desert border surveillance market is the increased use of autonomous systems. Many desert regions are difficult to patrol due to heat, sand, long distances, and limited visibility. New solutions such as unmanned ground vehicles, remote sensor towers, and long-range drones are becoming more common. These systems help monitor large areas with fewer personnel and provide steady observation even in harsh conditions.

Another trend is the shift toward integrated monitoring platforms. Border agencies are linking radar, thermal cameras, satellite imagery, and communication networks into a single system that delivers real-time awareness. This integration allows faster detection of movement across remote desert zones and reduces blind spots. As technology improves, more countries are adopting unified platforms to manage surveillance across wide and isolated regions.

Growth Factors

A major growth factor is the rising need to strengthen border security in regions where desert terrain creates natural gaps in monitoring. Many countries face challenges related to uncontrolled crossings, smuggling, and movement across remote desert routes. Surveillance systems that work reliably in high-temperature and low-infrastructure environments help address these gaps, which increases demand for advanced monitoring tools.

Another growth factor comes from improvements in long-range sensors and low-power communication systems. New thermal cameras, motion detectors, and radar tools can operate for long periods with minimal maintenance, which is essential in deserts where access is difficult. These advances reduce operational burden and make long-term surveillance more practical.

Key Market Segments

By Component

- Cameras

- Sensors

- Radars

- Unmanned Aerial Vehicles

- Command & Control Systems

- Others

By Application

- Perimeter Security

- Intrusion Detection

- Illegal Trafficking Prevention

- Others

By Technology

- Infrared

- Thermal Imaging

- Motion Detection

- AI-based Analytics

- Others

By End-User

- Military & Defense

- Homeland Security

- Law Enforcement Agencies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

A major driver in the desert border surveillance market is the rising need for stronger monitoring across long, remote, and difficult terrains. Many desert regions have limited visibility, harsh conditions, and large unpopulated areas that make patrol work challenging. Governments and security agencies increasingly rely on surveillance systems such as cameras, sensors, ground radar, and unmanned platforms to monitor movement and reduce risks related to smuggling or unauthorized crossings. This steady demand for reliable monitoring tools supports market growth.

Another driver comes from improvements in imaging and detection technologies. Modern systems can operate in extreme temperatures, low-light conditions, and sand-heavy environments. Thermal cameras and long-range sensors provide clearer information over wide distances, which allows security teams to detect activity earlier. These improvements encourage adoption of new surveillance solutions, especially in regions where manual patrols are less effective.

For instance, in March 2025, Raytheon signed a deal with the UAE’s Tawazun Council to produce Coyote counter-drone systems locally. Cartel drones pose big risks along desert borders like the US-Mexico. The move strengthens supply chains for rapid threat response. It supports allies facing smuggling and surveillance drone threats. Production ramps up mission readiness in hot regions.

Restraint

A key restraint in this market is the high setup and maintenance cost of surveillance systems in desert environments. Equipment must withstand heat, dust, sand, and long operating hours. Frequent repairs or replacements increase financial pressure on agencies with limited budgets. This challenge slows adoption for countries that cannot support continuous spending.

Another restraint comes from difficulties in building supporting infrastructure. Remote desert areas often lack stable power, communications networks, or roads. Installing surveillance towers, sensor networks, or command systems in such regions requires significant planning and investment. These logistical barriers limit deployment in some locations.

For instance, in July 2024, Lockheed’s Desert Hawk UAV project faced delays due to high costs in early tests. The small drone was aimed at base protection in arid areas, but budgets were strained. Desert ops need rugged gear that jacks up prices for sensors and endurance. The program scaled back after funding reviews hit limits. Ongoing expenses slow full rollouts in remote sites.

Opportunities

There is strong opportunity in expanding surveillance coverage across regions where border security remains a priority. Many countries with desert boundaries are investing in new monitoring systems to improve situational awareness. Providers that offer systems designed specifically for harsh climates can meet this growing need.

Another opportunity lies in combining multiple technologies into unified platforms. Integrated systems that connect ground sensors, cameras, radar, and communication links allow faster decision making. Users increasingly prefer solutions that support real-time alerts, long-range visibility, and reliable performance without requiring large on-site teams. This creates room for service providers to offer complete and scalable systems.

For instance, in March 2022, Teledyne FLIR launched the Lightweight Vehicle Surveillance System with counter-drone features. AI cuts false alerts in desert heat for better threat spotting. System suits mobile border patrols over rough terrain. Trials show gains in real-time data for unmanned ops. Opens sales for upgrades in arid security needs.

Challenges

A major challenge is maintaining consistent performance in extreme weather. Sandstorms, heat waves, and shifting terrain can reduce sensor accuracy or damage equipment. Systems must be inspected often to avoid failures, which adds workload and cost for operators.

Another challenge involves the risk of false alarms. Natural movements such as wind-driven sand, animals, or temperature fluctuations can trigger unwanted alerts if detection settings are not calibrated properly. Managing these alerts requires trained personnel and strong operational procedures. Countries with limited technical staff may find it difficult to maintain reliable surveillance without additional support.

For instance, in November 2025, BAE cameras failed in Arizona sandstorms during field use. Dust blocked the lenses after weeks in 50 °C heat. Border Patrol noted 20% downtime rates. Fixes need sealed designs, yet costs climb. Teams seek better seals now.

Key Players Analysis

Elbit Systems, Raytheon Technologies, Lockheed Martin, Leonardo, and Thales lead the desert border surveillance market with integrated solutions that combine ground radars, electro-optical sensors, thermal imaging, and AI-based tracking. Their systems support wide-area monitoring, intrusion detection, and real-time threat classification in harsh desert environments. These companies focus on long-range detection, high system uptime, and secure command-and-control integration.

Teledyne FLIR, Northrop Grumman, Saab, BAE Systems, and L3Harris strengthen the competitive landscape with advanced ISR platforms, unattended ground sensors, and networked surveillance towers. Their solutions enhance situational awareness across vast, low-visibility terrains. These providers support military and homeland security agencies with modular, rapidly deployable systems.

Indra Sistemas, Israel Aerospace Industries, General Dynamics, Rheinmetall, Kongsberg Gruppen, and Airbus Defence and Space expand the market with UAV integration, coastal and land radar systems, and secure communication networks. Their offerings support persistent surveillance and rapid response along remote borders. These companies emphasize interoperability, ruggedized hardware, and real-time data sharing.

Top Key Players in the Market

- Elbit Systems Ltd.

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Leonardo S.p.A.

- Thales Group

- FLIR Systems, Inc. (Teledyne FLIR)

- Northrop Grumman Corporation

- Saab AB

- BAE Systems plc

- Harris Corporation (L3Harris Technologies)

- Indra Sistemas S.A.

- Israel Aerospace Industries (IAI)

- General Dynamics Corporation

- Rheinmetall AG

- Kongsberg Gruppen ASA

- Airbus Defence and Space

- Others

Recent Developments

- In September 2025, Elbit Systems Ltd. launched Frontier, a cutting-edge AI-driven wide-area surveillance system at DSEI 2025, specifically designed to tackle tough border defense challenges in harsh desert environments. This system autonomously detects, classifies threats, and learns from patterns to cut false alarms, perfect for vast arid frontiers where quick decisions matter most.

- In March 2025, Lockheed Martin integrated its AN/TPQ-53 multi-mission radar with Joint Task Force-Southern Border systems, boosting detection of drones and ground threats across America’s desert frontiers. Quick-deploy in under five minutes, it’s proving vital for USNORTHCOM’s real-world border ops.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Bn Forecast Revenue (2034) USD 14.6 Bn CAGR(2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Cameras, Sensors, Radars, Unmanned Aerial Vehicles, Command & Control Systems, Others), By Application (Perimeter Security, Intrusion Detection, Illegal Trafficking Prevention, Others), By Technology (Infrared, Thermal Imaging, Motion Detection, AI-based Analytics, Others), By End-User (Military & Defense, Homeland Security, Law Enforcement Agencies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Elbit Systems Ltd., Raytheon Technologies Corporation, Lockheed Martin Corporation, Leonardo S.p.A., Thales Group, FLIR Systems, Inc. (Teledyne FLIR), Northrop Grumman Corporation, Saab AB, BAE Systems plc, Harris Corporation (L3Harris Technologies), Indra Sistemas S.A., Israel Aerospace Industries (IAI), General Dynamics Corporation, Rheinmetall AG, Kongsberg Gruppen ASA, Airbus Defence and Space, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Desert Border Surveillance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Desert Border Surveillance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Elbit Systems Ltd.

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Leonardo S.p.A.

- Thales Group

- FLIR Systems, Inc. (Teledyne FLIR)

- Northrop Grumman Corporation

- Saab AB

- BAE Systems plc

- Harris Corporation (L3Harris Technologies)

- Indra Sistemas S.A.

- Israel Aerospace Industries (IAI)

- General Dynamics Corporation

- Rheinmetall AG

- Kongsberg Gruppen ASA

- Airbus Defence and Space

- Others