Global Derivatives and Commodities Brokerage Market Size, Share Analysis Report By Type (Commodity Brokerage, Derivative Brokerage), By Brokers (Futures Commission Merchants, Introducing Brokers, National Futures Association, Commodity Pool Operator, Floor Trader, Others), By Derivative Contract (Options, Futures, Forwards, Swaps), By Application (Futures Company, Securities Company), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152582

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

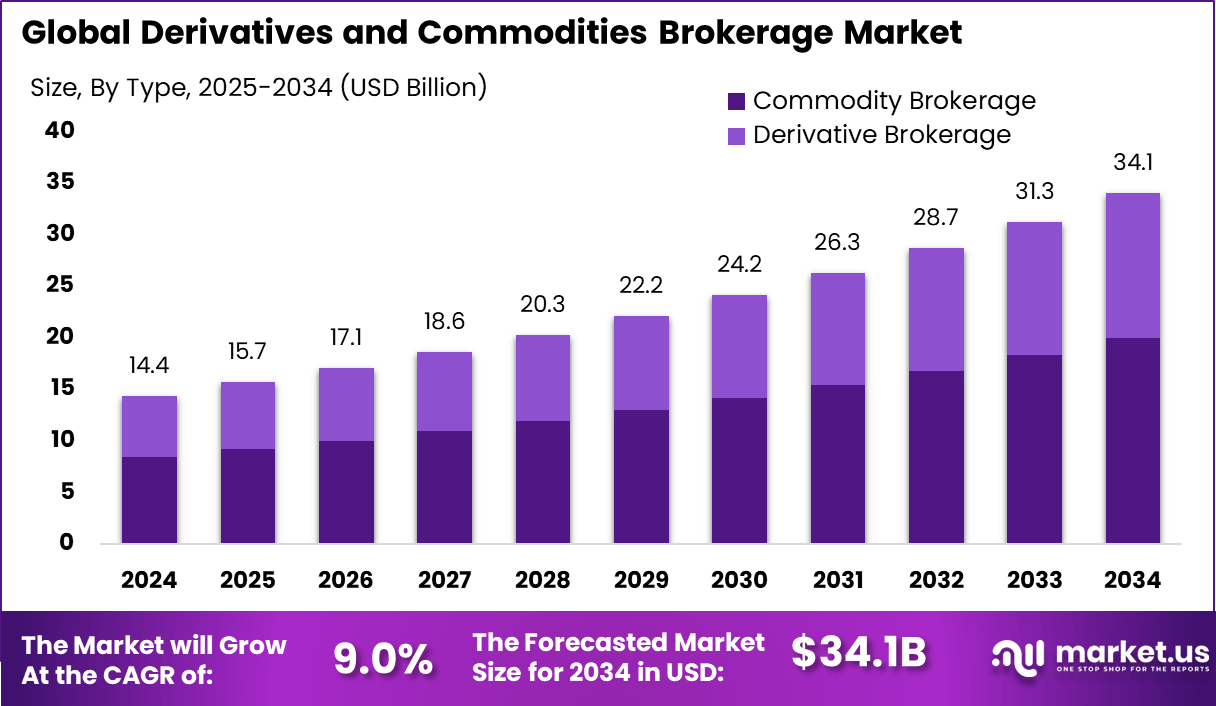

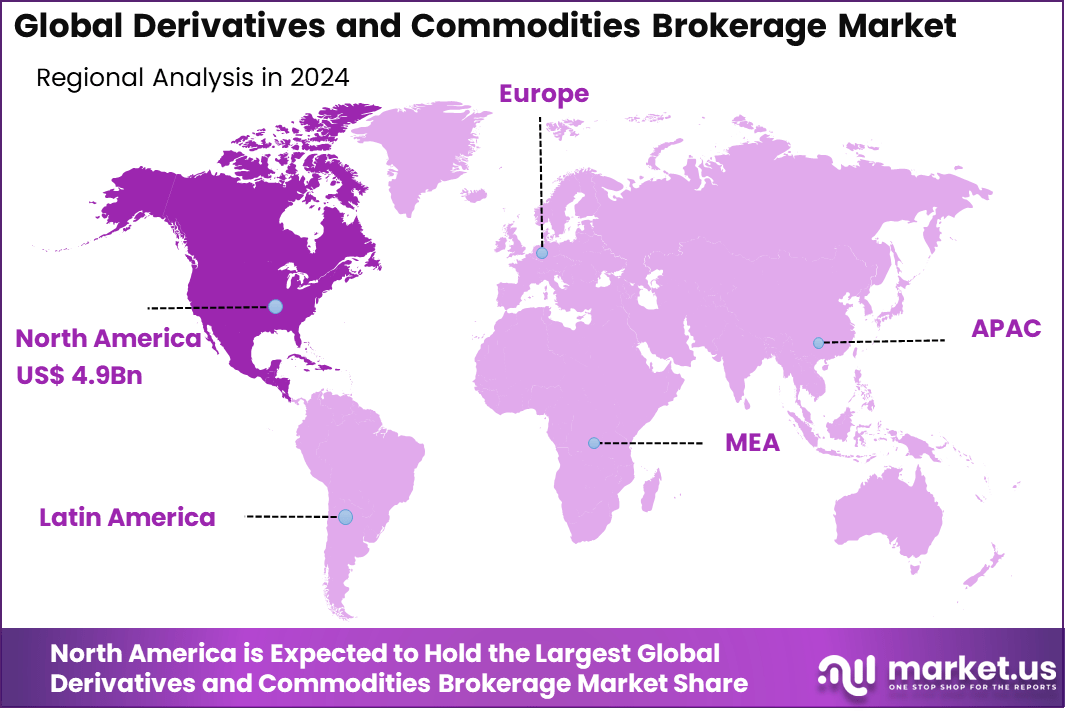

The Global Derivatives and Commodities Brokerage Market size is expected to be worth around USD 34.1 Billion By 2034, from USD 14.4 billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.2% share, holding USD 4.9 Billion revenue.

The derivatives and commodities brokerage market refers to a specialized segment of the financial services industry that facilitates the trading of derivative instruments and commodity contracts between buyers and sellers. This market enables participants to hedge risk, speculate on price movements, or gain exposure to commodities and financial indices. Brokers play a crucial role by providing access to exchanges, offering advisory services, and ensuring compliance with trading norms.

The market is witnessing growing participation from institutional and retail investors, supported by improving financial literacy and digital access to trading platforms. The top driving factors shaping this market include the rising need for effective risk management in volatile commodity and currency environments, and increasing globalization of trade and financial markets. Businesses are actively engaging in derivatives to hedge against fluctuations in commodity prices, interest rates, and foreign exchange rates.

According to Market.us, The Global E-brokerage Market is projected to reach approximately USD 32.0 Billion by 2033, up from an estimated USD 13.5 Billion in 2023. This reflects a steady CAGR of 9.0% during the forecast period from 2024 to 2033. The market growth is being driven by increasing digital adoption in financial services, the democratization of stock market access, and rising demand for low-cost, real-time trading platforms.

Scope and Forecast

Report Features Description Market Value (2024) USD 14.4 Bn Forecast Revenue (2034) USD 34.1 Bn CAGR (2025-2034) 9.0% Largest market in 2024 North America [34.2% market share] The increasing adoption of technologies such as advanced trading platforms, algorithmic trading tools, and blockchain-based settlement systems is transforming the brokerage landscape. Automation of trade execution, improved data analytics for risk assessment, and artificial intelligence-driven customer support are becoming standard offerings. These technologies are not only improving operational efficiency but also enabling brokers to serve a wider client base with customized solutions at competitive costs.

Key Insight Summary

- The market is projected to grow from USD 14.4 billion in 2024 to approximately USD 34.1 billion by 2034, registering a steady CAGR of 9.0%, driven by increasing hedging activities, speculative trading, and demand for risk management solutions.

- North America led the global market in 2024, accounting for over 34.2% share and generating around USD 4.9 billion, supported by a mature financial market and high trading volumes in derivatives.

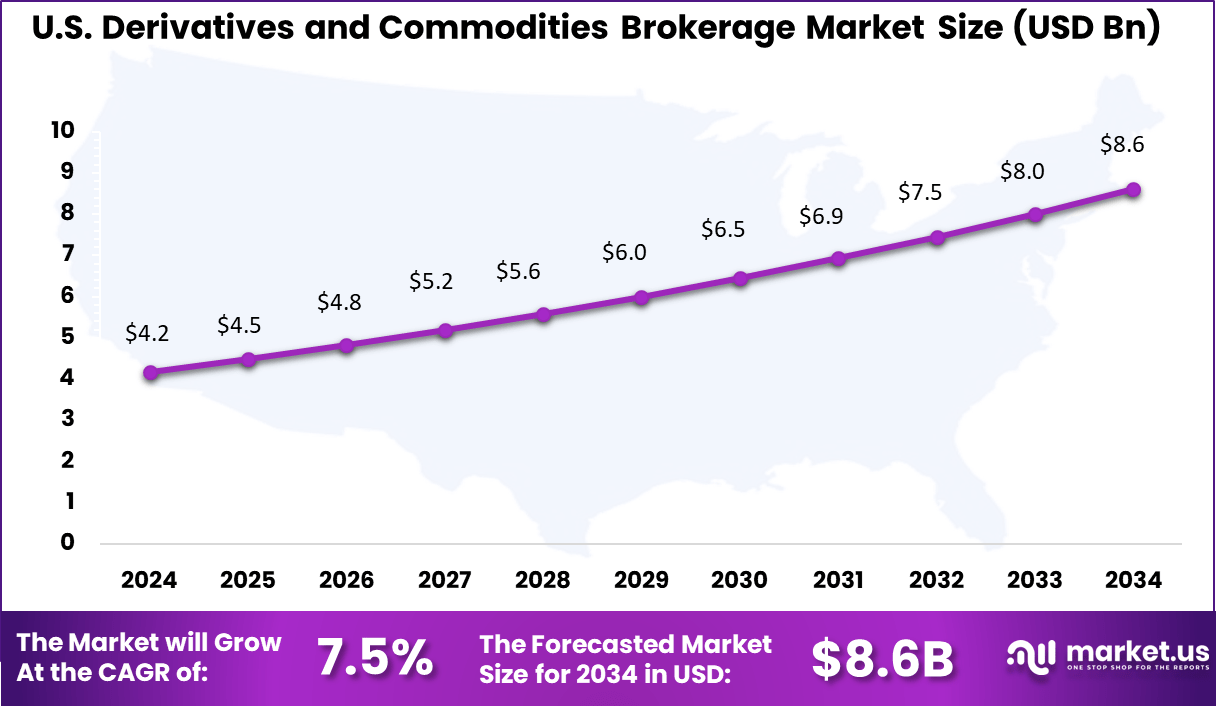

- The U.S. market contributed approximately USD 4.18 billion in 2024, with an expected CAGR of 7.5%, reflecting robust participation in both institutional and retail trading segments.

- By type, Commodity Brokerage dominated with a 58.6% share, underscoring the strong demand for brokerage services in energy, metals, and agricultural commodity markets.

- By broker type, Futures Commission Merchants (FCMs) accounted for 28.9% share, reflecting their critical role in clearing and executing client trades in futures and options markets.

- Among derivative contracts, Options held the largest share at 32.6%, driven by their flexibility in managing price risk and speculation strategies.

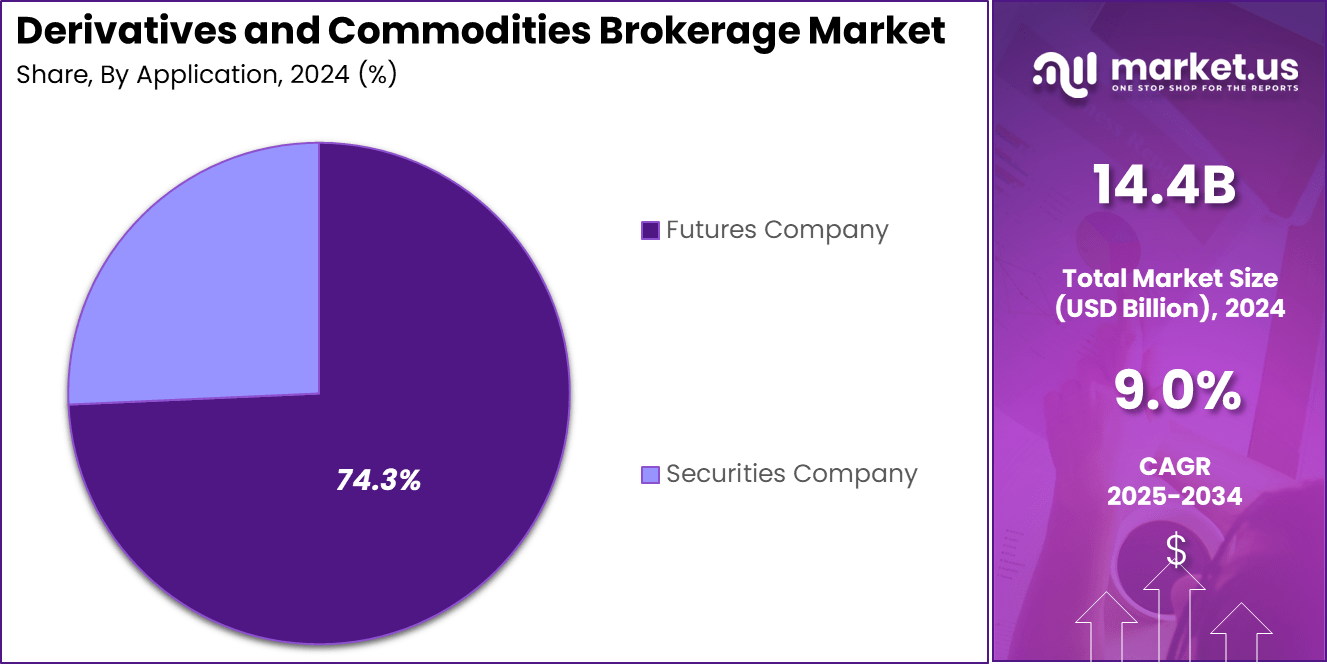

- By application, Futures Companies dominated with a commanding 74.3% share, highlighting their central role as intermediaries in global derivatives and commodities trading.

US Market Size

The U.S. Derivatives and Commodities Brokerage Market was valued at USD 4.2 Billion in 2024 and is anticipated to reach approximately USD 8.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 34.2% share, holding USD 4.9 billion in revenue. This leadership can be attributed to the region’s highly matured financial infrastructure, deep liquidity pools, and strong presence of institutional investors actively engaging in derivatives and commodities trading.

The availability of advanced clearing systems, sophisticated trading algorithms, and integrated risk management tools has made North America an ideal environment for complex financial instruments. Additionally, regulatory clarity from bodies such as the Commodity Futures Trading Commission has reinforced investor confidence, allowing brokerage firms to scale and innovate securely within a well‑monitored ecosystem.

The growing appeal of commodities such as oil, natural gas, and agricultural products has further contributed to brokerage expansion in the United States and Canada. These economies benefit from being both major producers and consumers of key commodities, offering natural exposure to spot and derivatives markets.

By Type Analysis

In 2024, Commodity Brokerage segment held a dominant market position, capturing more than a 58.6% share. This leadership was driven by rising volatility in global commodity prices, which increased the demand for risk management solutions among producers, traders, and institutional buyers.

The commodity brokerage segment benefited from broader participation in energy, metals, and agricultural contracts, particularly across regions where supply chain disruptions and geopolitical tensions influenced pricing. These dynamics pushed market participants to seek broker-assisted access to futures and spot markets for hedging and diversification purposes.

The segment’s growth was further supported by digitalization of trading platforms that made commodity instruments more accessible to retail clients and small enterprises. Increasing emphasis on energy transition and sustainability also played a role, with more clients seeking exposure to green commodities and carbon-linked instruments. Brokers offering tailored research, margin financing, and end-to-end trade support gained strong market traction.

By Brokers Analysis

In 2024, the Futures Commission Merchants (FCMs) segment held a dominant market position, capturing more than 28.9% of total brokerage activity. This leadership was driven by the critical role FCMs play in executing client trades, managing margin accounts, and clearing futures and options transactions efficiently.

Their registration with the National Futures Association and compliance with Commodity Futures Trading Commission rules ensure transparency and segregation of client funds, fostering strong investor confidence. These safeguards have made FCMs the preferred brokers, especially for institutional clients seeking reliability and compliance assurance.

The FCM segment maintained its lead due to enhanced regulatory frameworks and their ability to manage client risk in a volatile environment. Recent regulatory amendments broadened the permissible instruments for client funds while imposing stricter capital and diversification standards. This has strengthened the financial resilience of FCMs and reassured market participants of their stability.

By Derivative Contract Analysis

In 2024, the Options segment held a dominant market position, capturing more than a 32.6 % share. This dominance can be attributed to strong trading volumes across both retail and institutional participants. Global exchange-listed equity options reached record highs, with approximately 10.2 billion contracts traded by November in the U.S. alone, marking the fifth consecutive year of growth.

Retail participation, particularly in short-dated instruments like zero days to expiration (0DTE) options, significantly contributed to this momentum. The combination of high demand and innovation in contract structures has strengthened the Options segment’s leadership in the derivatives brokerage market.

The leading position of the Options segment is also supported by its superior liquidity and structural advantages. Major exchanges have consistently expanded liquid options markets across various asset classes and contract sizes. High liquidity promotes tighter bid-ask spreads and improves execution efficiency, making options an effective tool for hedging and speculative strategies.

Additionally, the asymmetric risk and reward profiles offered by options align well with the risk management needs of institutional investors and the quick-return strategies favored by active retail traders. These factors continue to secure the Options segment’s prominence in the broader market.

By Application Analysis

In 2024, Futures Company segment held a dominant market position, capturing more than a 74.3% share. This dominance reflects the essential role that futures firms play in facilitating large-scale derivatives and commodities transactions. These companies serve as primary gateways for clients seeking direct access to futures markets, enabling efficient execution, clearing, and margin management.

Their specialized infrastructure supports high-volume trading, often involving institutional clients with sophisticated risk management requirements. As a result, futures companies naturally dominate the application segment of the brokerage market. The leading position of futures firms is also supported by their ability to scale operations and absorb market fluctuations.

These companies have built robust systems that integrate real-time pricing, liquidity provisioning, and automated trade capabilities. Additionally, compliance frameworks tailored for futures trading facilitate smoother interactions with regulators and exchanges. By continuously investing in technology and operational resilience, futures companies have reinforced their market leadership.

Key Market Segments

By Type

- Commodity Brokerage

- Derivative Brokerage

By Brokers

- Futures Commission Merchants

- Introducing Brokers

- National Futures Association

- Commodity Pool Operator

- Floor Trader

- Others

By Derivative Contract

- Options

- Futures

- Forwards

- Swaps

By Application

- Futures Company

- Securities Company

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Digital Transformation and Algorithmic Execution

Brokerages are rapidly adopting digital trading platforms and algorithmic execution engines to improve efficiency and speed. Automation in order routing and real‑time analytics is becoming a standard feature, allowing traders to capitalize on millisecond market movements. This digital integration is reshaping the trading experience and enabling firms to process higher volumes with improved precision.

Another key trend is the integration of blockchain and distributed ledger technologies to streamline trade settlement. These innovations enhance transparency, reduce counterparty risk, and simplify post‑trade operations through automated smart contracts. The shift toward DLT signals a move to more secure and efficient infrastructure in brokerage services.

Driver

Volatility and Risk Management Demand

Market volatility is driving both institutional and retail participation in derivatives and commodities, as both groups seek hedging strategies against price swings. Heightened geopolitical tensions, inflation, and trade dynamics raise demand for tools that allow users to lock in prices or offset risk exposure.

Coupled with this, there is greater adoption of digital and mobile platforms that provide low-cost access to complex instruments. These platforms enable brokers to reach a broader audience, while automated analytics support users in identifying optimal hedging tactics or entry points. Accessibility and transparency in risk management have become key drivers.

Restraint

Regulatory Complexity and Margin Requirements

Brokerage firms face growing regulatory burdens that limit flexibility and increase operating costs. Evolving global compliance demands require extensive investment in reporting systems, internal controls, and audit capabilities. These obligations constrain smaller players and may slow innovation.

In addition, margin requirements and collateral rules grow more stringent during volatile periods. These rules aim to protect counterparties but can reduce liquidity and raise capital costs for brokers. Such constraints hinder the ability of brokers to offer competitive leverage and may deter client engagement during high‑risk periods.

Opportunity

Adoption of Sentiment‑Driven Hedging and ESG Products

There is growing opportunity in sentiment‑informed trading driven by large language models and real‑time news analytics. These tools can detect shifts in market mood before major price movements, enabling brokers to offer dynamic hedging strategies. This emerging approach may deliver superior risk‑adjusted returns and differentiate brokers in a competitive landscape.

Another significant opportunity is the expansion of ESG and climate‑linked derivatives. Products such as weather contracts and emissions futures are gaining attention as firms seek to hedge exposures related to environmental change and sustainability mandates. Offering these innovative products can position brokers to serve clients in sectors undergoing energy transition.

Challenge

Liquidity Gaps and Retail Risk Exposure

A major challenge lies in maintaining liquidity when hedge funds or large institutional players withdraw during market stress. For example, recent exits from sectors such as cocoa have reduced depth and widened bid‑ask spreads. This liquidity gap undermines execution quality and can raise costs for end users.

Another challenge stems from the growing participation of uninformed retail traders in complex derivatives. Studies show a large proportion of retail participants experience net losses. This trend raises ethical concerns, compliance issues, and reputational risks for brokers that facilitate speculative trading without adequate education.

Key Player Analysis

Abans Global Limited, Bovill Limited, and Northern Trust Corporation focus on compliance-driven solutions and digital tools to enhance brokerage services. TP ICAP Group Plc and Multi Commodity Exchange of India Ltd. expand their commodity and derivatives portfolios through advanced trading platforms. These players emphasize risk management and product innovation to meet client demands in a dynamic market.

Japan Exchange Group, ICICI Securities Limited, Kotak Securities Ltd., and Sharekhan strengthen market access with digital platforms and transparent execution. The Charles Schwab Corporation and Fidelity Investments invest in cloud-based systems to improve operations and attract diverse clients. Their strategies center on client experience and service differentiation.

Interactive Brokers Group Inc., TradeStation Group Inc., Saxo Bank A/S, and Pepperstone Group Limited advance algorithmic and low-latency trading solutions for professional traders. They focus on innovation, global connectivity, and regional growth. Other players pursue alliances and diversification, fostering efficiency and competitiveness in the brokerage industry.

Top Key Players Covered

- Abans Global Limited

- Bovill Limited

- Northern Trust Corporation

- TP ICAP Group Plc

- Multi Commodity Exchange of India Ltd.

- Japan Exchange Group

- ICICI Securities Limited

- Kotak Securities Ltd.

- Sharekhan

- The Charles Schwab Corporation

- Fidelity Investments

- Interactive Brokers Group Inc.

- TradeStation Group Inc.

- Saxo Bank A/S

- Pepperstone Group Limited

- Others

Recent Developments

- In June 2024: IG, a leading UK online trading company, launched a new UK derivatives trading platform. The platform gives traders access to over 7,000 underlying assets across options and futures, with advanced trading tools and live financial content. This launch is aimed at giving UK traders more sophisticated trading opportunities and actionable insights.

- In May 2024, Shift Markets, a U.S. based Crypto-as-a-Service provider, launched its White Label Crypto Derivatives Platform. This move is significant as it enables brokers to offer crypto derivatives under their own brand, enhancing market reach and product diversity.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Commodity Brokerage, Derivative Brokerage), By Brokers (Futures Commission Merchants, Introducing Brokers, National Futures Association, Commodity Pool Operator, Floor Trader, Others), By Derivative Contract (Options, Futures, Forwards, Swaps), By Application (Futures Company, Securities Company) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abans Global Limited, Bovill Limited, Northern Trust Corporation, TP ICAP Group Plc, Multi Commodity Exchange of India Ltd., Japan Exchange Group, ICICI Securities Limited, Kotak Securities Ltd., Sharekhan, The Charles Schwab Corporation, Fidelity Investments, Interactive Brokers Group Inc., TradeStation Group Inc., Saxo Bank A/S, Pepperstone Group Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Derivatives and Commodities Brokerage MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Derivatives and Commodities Brokerage MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abans Global Limited

- Bovill Limited

- Northern Trust Corporation

- TP ICAP Group Plc

- Multi Commodity Exchange of India Ltd.

- Japan Exchange Group

- ICICI Securities Limited

- Kotak Securities Ltd.

- Sharekhan

- The Charles Schwab Corporation

- Fidelity Investments

- Interactive Brokers Group Inc.

- TradeStation Group Inc.

- Saxo Bank A/S

- Pepperstone Group Limited

- Others