Global Dental Sterilization Market By Product Type (Instruments (Sterilization Equipment (Low-temperature Sterilizers and High-temperature Sterilizers), Cleaning and Disinfectant Equipment (Ultrasonic Cleaners and Washer Disinfectants), and Packaging Equipment) and Consumables & Accessories (Surface Disinfectants, Sterilization Packaging Accessories, Sterilization Indicators, Lubrication and Cleaning Solutions, and Instrument Disinfectants)), By End-user (Hospitals, Dental Laboratories, and Dental Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154881

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

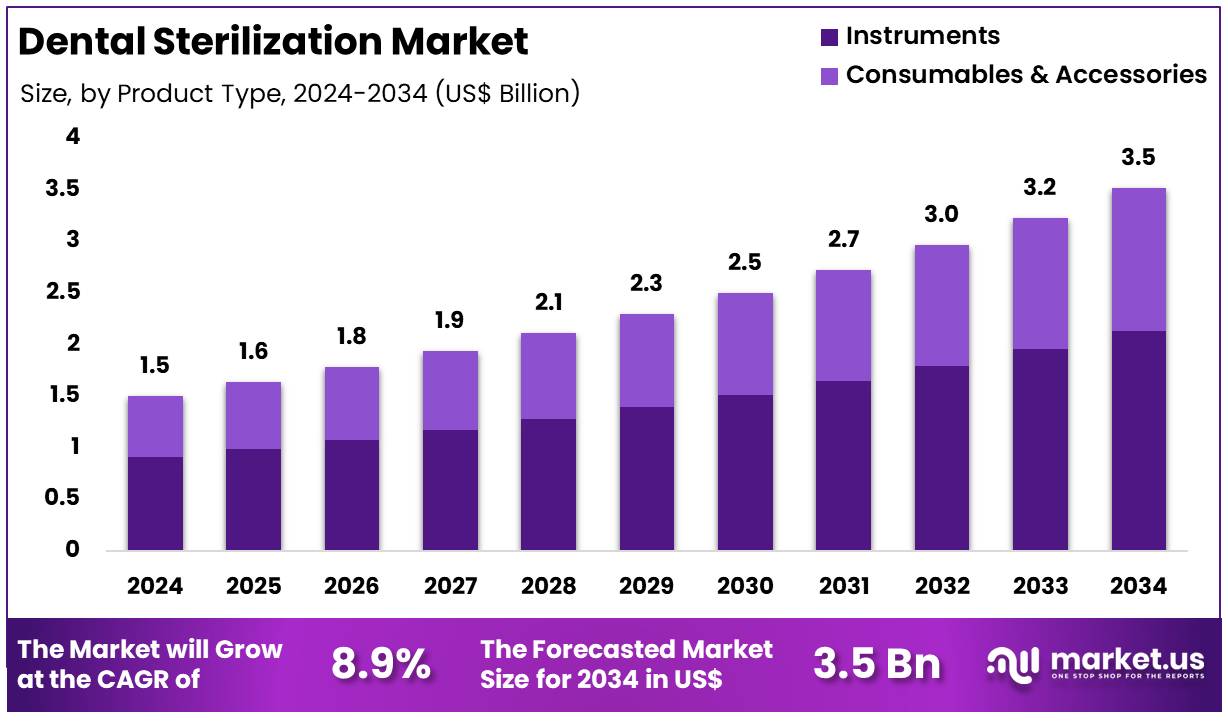

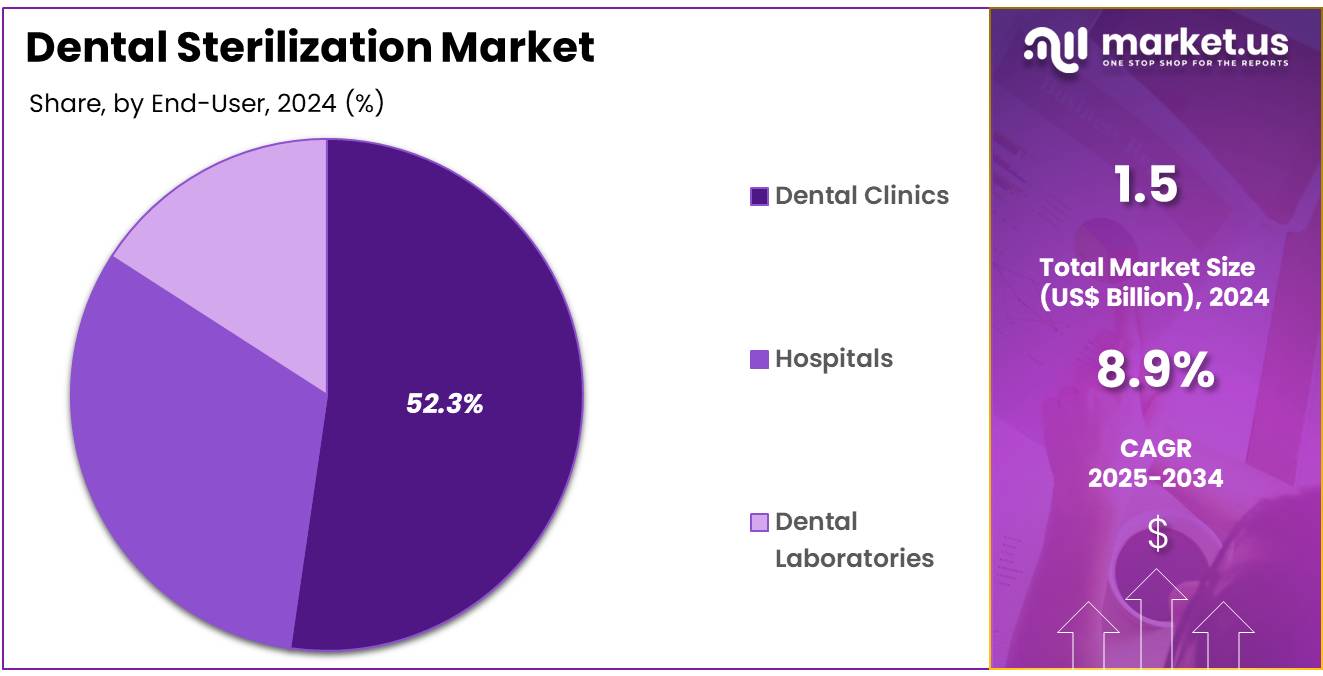

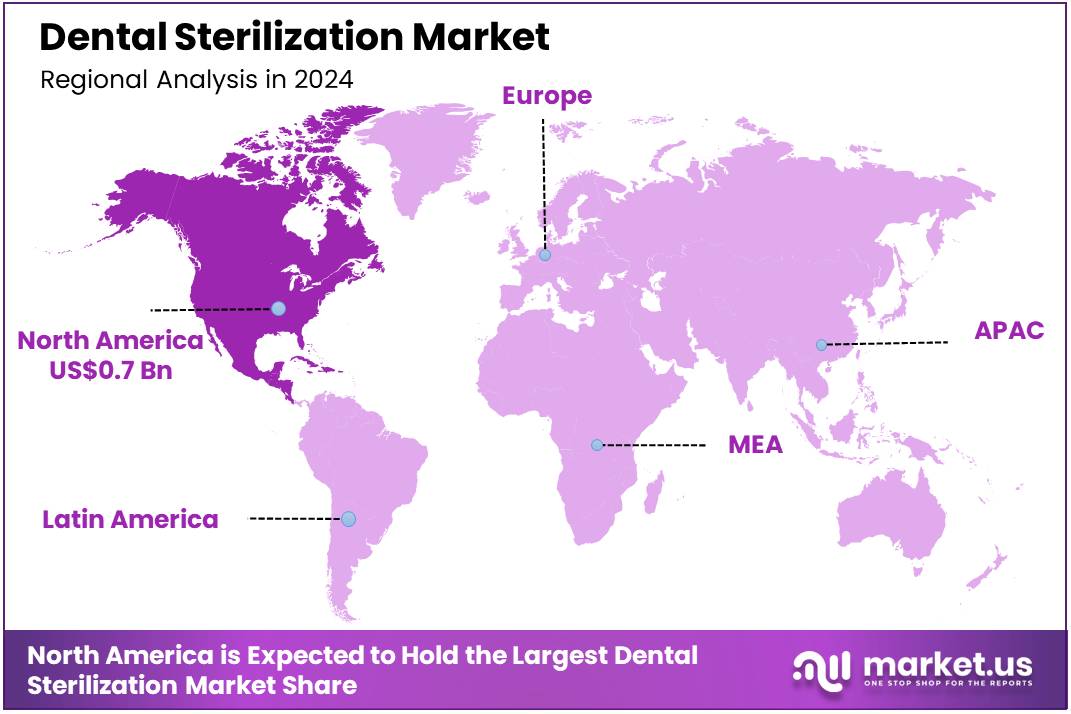

Global Dental Sterilization Market size is expected to be worth around US$ 3.5 Billion by 2034 from US$ 1.5 Billion in 2024, growing at a CAGR of 8.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.4% share with a revenue of US$ 0.7 Billion.

The dental sterilization market is on a robust growth trajectory, driven by a heightened global emphasis on infection control and patient well-being. A key driver for this expansion is the increased awareness among practitioners and patients regarding the dangers of non-sterile instruments. This concern is particularly relevant given the steady rise in dental procedures, from routine check-ups to complex cosmetic work.

Consequently, the demand for sophisticated sterilization products is a direct response to the need for a sterile environment that prevents the transmission of infections. This necessity is underscored by the World Health Organization’s (WHO) estimate that oral diseases impact nearly 3.5 billion people globally, highlighting the vast volume of dental care that requires meticulous sterilization protocols.

The industry’s expansion is further fueled by the demand for more rigorous infection control standards. As dental providers and their clients prioritize hygiene, the need for advanced equipment to prevent cross-contamination has escalated. This trend is backed by increasingly stringent regulatory frameworks that mandate strict sterilization practices in clinics.

Technological innovation also serves as a major market driver; contemporary systems, such as automated washer-disinfectors and low-temperature sterilizers, offer superior efficiency and user-friendliness. A prime example is the introduction of the Flight Clave45+ Steam Sterilizer, a high-capacity device with a user-friendly LCD interface designed for efficient, high-volume sterilization, which addresses the evolving needs of practitioners and ensures optimal patient safety.

A significant factor propelling the adoption of sterilization solutions is the worldwide expansion of dental clinics, particularly in developing economies. This proliferation is bolstered by government initiatives and private investments aimed at improving oral health awareness. As the number of dental facilities grows, so too does the demand for reliable and cost-effective sterilization systems to meet elevated hygiene standards.

The American Dental Association’s Health Policy Institute reports that dental visits in the US have consistently trended upward, reaching over 50% of the population in recent years. The Centers for Disease Control and Prevention (CDC) further issues specific guidance for dental settings, outlining detailed checklists that drive the procurement of compliant equipment. This focus on adherence is also evident in NHS England data, which recorded a 4.3% rise in treatments in the 2023-2024 period, with total activity units increasing to 73 million, showcasing the immense volume of procedures that depend on proper sterilization.

Key Takeaways

- In 2024, the market for dental sterilization generated a revenue of US$ 1.5 billion, with a CAGR of 8.9%, and is expected to reach US$ 3.5 billion by the year 2034.

- The product type segment is divided into instruments and consumables & accessories, with instruments taking the lead in 2023 with a market share of 60.5%.

- Considering end-user, the market is divided into hospitals, dental laboratories, and dental clinics. Among these, dental clinics held a significant share of 52.3%.

- North America led the market by securing a market share of 44.4% in 2024.

Product Type Analysis

Instruments account for 60.5% of the dental sterilization market. This segment’s growth is expected to continue as dental instruments, including handpieces, scalers, forceps, and mirrors, are essential in nearly all dental procedures. The need for these instruments to be properly sterilized to prevent cross-contamination and maintain hygiene standards drives demand for sterilization equipment. As awareness around infection control rises and the focus on patient safety increases, the importance of reliable and efficient sterilization instruments becomes paramount.

Furthermore, the growth in dental procedures, including routine checkups, surgeries, and cosmetic dental treatments, is anticipated to drive the need for more sterilization systems and instruments. The adoption of advanced sterilization instruments, such as autoclaves with faster and more reliable cycles, is expected to increase as dental clinics and hospitals prioritize efficiency and cost-effectiveness. As dental practices continue to modernize, the demand for cutting-edge sterilization instruments will likely grow, ensuring that this segment maintains its dominant position in the market.

End-User Analysis

Dental clinics represent 52.3% of the end-user segment in the dental sterilization market. This growth is expected to continue as dental clinics are the most common setting for routine dental care, where sterilization practices are critical to maintaining hygiene and patient safety. With increasing awareness of the importance of infection control, dental clinics are expected to invest in more advanced sterilization technologies to ensure compliance with stringent regulations and standards. The growth in cosmetic dentistry, along with an increasing number of people seeking dental treatments, is likely to boost demand for sterilization solutions in dental clinics.

Furthermore, the ongoing shift toward infection prevention and control in all healthcare settings, including dental offices, will drive the market for dental sterilization. As patient expectations for clean, safe, and sterile environments rise, dental clinics are expected to continue to adopt the latest sterilization technologies, ensuring that this segment remains the dominant end-user in the market. Additionally, the growth in the number of private dental clinics and smaller practices offering specialized treatments is projected to further contribute to this trend.

Key Market Segments

By Product Type

- Instruments

- Sterilization Equipment

-

-

- Low- temperature Sterilizers

- High-temperature Sterilizers

-

-

- Cleaning and Disinfectant Equipment

-

-

- Ultrasonic Cleaners

- Washer Disinfectants

-

-

- Packaging Equipment

- Consumables & Accessories

- Surface Disinfectants

- Sterilization Packaging Accessories

- Sterilization Indicators

- Lubrication and Cleaning Solutions

- Instrument Disinfectants

By End-user

- Hospitals

- Dental Laboratories

- Dental Clinics

Drivers

Strict infection control protocols and rising awareness of patient safety are driving the market.

The market for dental sterilization is primarily driven by the increasing emphasis on strict infection control protocols and a heightened awareness of patient safety. Dental practices are mandated by regulatory bodies like the Centers for Disease Control and Prevention (CDC) to adhere to rigorous standards to prevent the transmission of infectious diseases. This includes a comprehensive process of cleaning, disinfecting, and sterilizing all reusable instruments.

A 2024 report by The HIPAA Journal highlighted that the number of healthcare data breaches reported to the HHS Office for Civil Rights (OCR) had increased by 9.3% in the first half of 2024 compared to the same period in 2023, underscoring the constant threat of contamination and the need for stringent protocols.

Furthermore, a 2023 study published in The Journal of the American Dental Association noted a 12.3% increase in total dental procedures performed in the US between 2021 and 2023. This rise in patient volume and procedural complexity directly correlates with a greater need for efficient and reliable sterilization equipment to process more instruments safely and in a timely manner. The combination of regulatory pressure and a larger procedural workload fuels the consistent demand for advanced sterilization equipment and consumables.

Restraints

The high initial cost and a complex compliance environment are restraining the market.

A significant restraint on the market’s growth is the high initial cost of sterilization equipment and the complexities of the compliance environment. While advanced sterilization systems offer enhanced efficiency and safety, their high price point can be a substantial barrier for many dental practices, especially smaller, independent clinics. A 2024 report from the American Dental Association’s Health Policy Institute (ADA HPI) indicated that increasing expenses and overhead costs were a key concern for 45.7% of dentists.

The acquisition of new, high-tech sterilizers, autoclaves, and related consumables represents a major capital expenditure that can be difficult for these practices to absorb. Furthermore, the regulatory landscape is constantly evolving, requiring dental practices to navigate a maze of federal and state guidelines. The Centers for Disease Control and Prevention (CDC) guidelines for infection control are extensive, and ensuring a practice’s sterilization processes are consistently compliant demands significant staff training and ongoing monitoring. This combination of financial burden and procedural complexity can slow the adoption of new technologies and limit the overall expansion of the market.

Opportunities

Technological advancements and automation are creating growth opportunities.

The accelerating pace of technological advancements, particularly in automation and digital integration, presents a major opportunity for the dental sterilization market. New generation sterilizers and autoclaves are being developed with features that automate key steps of the sterilization process, from cleaning and drying to documentation and tracking. This reduces the risk of human error, enhances workflow efficiency, and ensures a higher level of compliance with regulatory standards.

A 2024 study in the Journal of Dental Research highlighted that automated instrument processing systems can save dental practices an average of 45 minutes per day, significantly improving productivity and allowing for more patient procedures. This synergy between advanced hardware and intelligent software creates a compelling value proposition for dental practices.

A 2023 survey by a leading dental publication revealed that over 60% of dental professionals expressed interest in adopting automated sterilization systems to streamline their practice operations. The continuous innovation in this space is a powerful catalyst for growth, driving the transition away from manual processes toward more efficient and reliable automated solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical forces are profoundly shaping the operational environment for manufacturers and suppliers in the dental sterilization market. Global inflationary pressures have driven up the costs of raw materials, energy, and skilled labor, which, in turn, increases the price of both sterilization equipment and consumables. According to a 2025 report on global medical trends, the average medical trend rate is projected to be 10.0%, marking two consecutive years of double-digit increases. This trend can squeeze profit margins and lead to higher costs for dental practices, potentially affecting their budgets for new equipment.

At the same time, geopolitical tensions can disrupt complex global supply chains. A company’s dependence on specific regions for critical materials can be threatened by trade disputes or logistical challenges, compelling a strategic pivot toward more diversified sourcing and localized production. The industry is effectively navigating this complex landscape by focusing on operational efficiency and strategic procurement. Firms with resilient supply chains and the capacity to absorb or offset these cost pressures are better positioned to maintain stability and profitability, demonstrating that an agile and proactive approach can ensure a positive trajectory.

The current tariff structure in the United States is creating a challenging dynamic for the supply chain. New duties on various imported components and finished goods from key trading partners have increased the landed cost of these products. These tariffs, which in 2025 included a 10% baseline tariff on many imported goods and a 25% tariff on specific medical devices, are passed down the supply chain, affecting distributors’ margins and ultimately leading to higher prices for dental practices. This can reduce the financial viability of new solutions and increase the cost to the end consumer, which negatively impacts access to care and slows the adoption of innovative technologies.

For example, AdvaMed, a medical technology trade association, has publicly appealed to the White House to exempt medical devices from these tariffs due to their potential to disrupt the healthcare supply chain. Conversely, these tariffs are providing a competitive advantage to US-based manufacturers who are not subject to these import duties.

As a result, some dental clinics are beginning to shift their purchasing toward domestically produced goods to ensure a more stable supply and predictable pricing. This dynamic is fostering domestic manufacturing and motivating companies to invest in local production capabilities to bypass the tariff burden and strengthen their market position. The industry is responding with adaptive measures, which demonstrates a resilient path forward.

Latest Trends

The increasing focus on sustainable and eco-friendly sterilization is a recent trend.

A notable trend observed in 2024 and 2025 is the growing emphasis on sustainable and eco-friendly sterilization methods. Dental practices and manufacturers are increasingly recognizing the environmental impact of traditional sterilization processes, which often involve high energy consumption, substantial water usage, and the disposal of chemical waste. In response, a shift towards more sustainable solutions is underway. For instance, manufacturers are introducing advanced autoclaves with energy-saving modes and faster cycle times, reducing both electricity and water consumption.

A 2024 report from the United Nations Environment Programme (UNEP) highlighted that the global healthcare sector’s carbon footprint is a major concern, prompting industries to seek out greener alternatives. Furthermore, the development of biodegradable disinfectants and recyclable sterilization packaging is gaining traction.

In 2024, a major dental consumables manufacturer launched a new line of sterilization pouches made from sustainable materials that are 100% recyclable. This focus on environmental responsibility not only appeals to a growing number of eco-conscious consumers and professionals but also allows practices to align with a broader corporate social responsibility mandate, positioning sustainability as a key market differentiator.

Regional Analysis

North America is leading the Dental Sterilization Market

The dental sterilization market in North America held a dominant position in 2024, securing the largest revenue share of 44.4%. This can be attributed to the region’s robust healthcare infrastructure, proactive adoption of advanced technologies, and strict adherence to infection control protocols. The United States, in particular, has a high concentration of dental clinics and a large workforce of dental professionals.

As of 2023, the ADA Health Policy Institute reported 202,304 professionally active dentists in the US, a figure that underpins the consistent demand for sterilization equipment. The market is also bolstered by governmental guidance; for instance, the CDC’s “Summary of Infection Prevention Practices in Dental Settings” outlines the standard of care for sterilization, ensuring a high level of compliance and safety.

The high emphasis on patient safety and compliance with regulatory standards is a primary driver in the United States. Innovations in sterilization technology, such as the W&H Lexa Mini, a Class B rapid sterilizer launched in November 2024, offer dental practices advanced solutions that prioritize efficiency and safety. The widespread adoption of digital technologies, including automated and integrated sterilization systems, further bolsters market growth. This is critical given the high volume of dental procedures; the CDC’s 2024 Oral Health Surveillance Report indicates that nearly 26% of adults aged 20–64 have untreated dental caries, a condition that necessitates frequent use of sterile instruments for treatment.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The dental sterilization market in Asia Pacific is experiencing rapid growth, driven by escalating investments in healthcare infrastructure and rising awareness of oral hygiene. This is particularly evident in emerging economies where urbanization is increasing the accessibility of dental care. The growing dental sector is also supported by a large and expanding population. According to a 2022 report from the FDI World Dental Federation, China had a density of 4.5 dentists per 10,000 population in 2021, and this number is continuously growing, indicating a substantial and expanding professional base to serve patient needs.

Key markets within the Asia Pacific region are seeing strong growth due to country-specific factors. In Japan, the market is driven by an aging population with a high demand for premium dental services and a push toward automated, energy-efficient sterilization systems to improve clinic efficiency. Meanwhile, China’s market is expanding with a booming dental care sector, supported by a rising middle class and governmental efforts to improve rural healthcare access.

The launch of cutting-edge sterilization solutions, such as the JP-STE-18L/23 autoclave by Shanghai JPS Medical Co., Ltd in July 2024, further demonstrates the region’s commitment to advancing dental hygiene standards. These developments, along with a growing focus on infection control, project a strong growth trajectory for the dental sterilization market throughout Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the dental sterilization market are focused on a multi-faceted strategy to drive growth, with a strong emphasis on innovation, adherence to regulations, and market expansion. They are actively developing advanced technologies, such as low-temperature sterilization systems, to meet the changing needs of dental professionals.

To broaden their reach and strengthen their market position, these companies form strategic partnerships with healthcare providers and distributors. They also invest in educational programs to promote proper sterilization techniques and raise awareness about infection control. Mergers and acquisitions are another key tactic, used to diversify their product offerings and enter new regions, particularly in emerging economies. By building strong customer relationships and offering customized solutions, these firms are further cementing their market dominance.

STERIS Corporation is a major force in the dental sterilization market, offering a comprehensive suite of solutions that meet strict industry standards. The company is known for its cutting-edge sterilization technology and continuously innovates to provide products that boost operational efficiency and safety in dental practices. With a robust global presence, STERIS maintains its competitive advantage through strategic acquisitions and collaborations, and is actively working to expand its reach into new markets.

Top Key Players

- W&H Dentalwerk

- Tuttnauer USA. Co., Ltd

- SciCan Ltd

- Nakanishi inc

- Midmark Corporation

- MATACHANA

- Hu-Friedy Mfg. Co., LLC

- Getinge

- Dentsply Sirona

Recent Developments

- In September 2024, the Association for Dental Safety (formerly OSAP) launched Dental Infection Control Awareness Month, focusing on the theme “Embracing a Culture of Safety: Empowering Patients and Dental Teams.” The initiative featured weekly discussions on topics such as hand hygiene, dental unit waterlines, instrument reprocessing, and personal protective equipment, providing dental professionals with a toolkit to enhance infection control practices.

- In July 2024, Midmark Corporation introduced its advanced M9 and M11 Steam Sterilizers, designed to offer improved durability and ease of use for dental teams. These sterilizers optimize instrument processing and ensure compliance, incorporating features that streamline workflow and reduce the time required to train new staff, thus promoting safe and effective care for patients.

- In February 2024, W&H joined as a Super Sponsor for the Organization for Safety, Asepsis, and Prevention (OSAP). This partnership underscores W&H’s commitment to enhancing safety protocols and infection prevention in dental practices, reinforcing its ongoing educational efforts in promoting hygienic standards across the industry.

Report Scope

Report Features Description Market Value (2024) US$ 1.5 Billion Forecast Revenue (2034) US$ 3.5 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments (Sterilization Equipment (Low-temperature Sterilizers and High-temperature Sterilizers), Cleaning and Disinfectant Equipment (Ultrasonic Cleaners and Washer Disinfectants), and Packaging Equipment) and Consumables & Accessories (Surface Disinfectants, Sterilization Packaging Accessories, Sterilization Indicators, Lubrication and Cleaning Solutions, and Instrument Disinfectants)), By End-user (Hospitals, Dental Laboratories, and Dental Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape W&H Dentalwerk, Tuttnauer USA. Co., Ltd, SciCan Ltd, Nakanishi inc, Midmark Corporation, MATACHANA, Hu-Friedy Mfg. Co., LLC, Getinge, Dentsply Sirona. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dental Sterilization MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Dental Sterilization MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- W&H Dentalwerk

- Tuttnauer USA. Co., Ltd

- SciCan Ltd

- Nakanishi inc

- Midmark Corporation

- MATACHANA

- Hu-Friedy Mfg. Co., LLC

- Getinge

- Dentsply Sirona