Global Decylalcohol (CAS 112-30-1) Market Size, Share Analysis Report By Raw Material (Natural, Synthetic), By Content (Less-than 96%, 96-98%, Greater-than98%), By Application (Surfactants, Plasticizers, Cleaning Agent, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160137

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

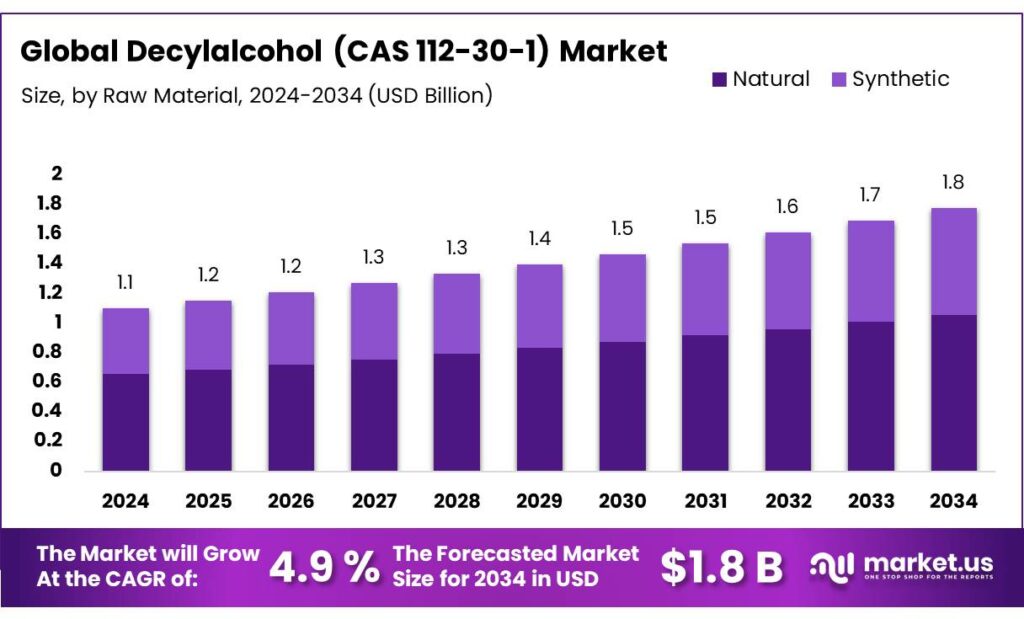

The Global Decylalcohol (CAS 112-30-1) Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Decyl alcohol (CAS 112-30-1), also known as 1-decanol, is a straight-chain fatty alcohol with ten carbon atoms. It is a colorless to light yellow viscous liquid with a characteristic sweet, fatty odor. In industrial applications, decyl alcohol serves as a versatile chemical intermediate and functional agent, utilized in the production of plasticizers, lubricants, surfactants, and solvents.

Its applications extend to oilfield operations, textile processing, and as an anti-foaming agent in various industrial processes. Decyl alcohol is primarily produced through the hydrogenation of decanoic acid, which occurs in modest quantities in coconut oil (about 10%) and palm kernel oil (about 4%).

Government initiatives and regulations play a significant role in shaping the decylalcohol market. In the United States, the Food and Drug Administration (FDA) has recognized decylalcohol as a Generally Recognized as Safe (GRAS) substance when used as a flavoring agent or adjuvant in food products products under 21 CFR Parts 170-186. Such regulatory approvals facilitate its inclusion in consumer goods, thereby expanding its market potential.

In India, the chemical industry is undergoing significant transformation, supported by government initiatives aimed at enhancing global value chain participation. The National Institution for Transforming India (NITI Aayog) has outlined strategies to increase India’s share in the global chemical value chain from 3.5% to 12% by 2040. These initiatives include introducing operational expenditure (Opex) subsidy schemes to incentivize incremental production of chemicals based on import bills, export potential, and end-market criticality.

Key Takeaways

- Decylalcohol (CAS 112-30-1) Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 4.9%.

- Natural held a dominant market position, capturing more than a 59.6% share of the decyl alcohol market.

- >98% held a dominant market position, capturing more than a 49.9% share of the decyl alcohol market.

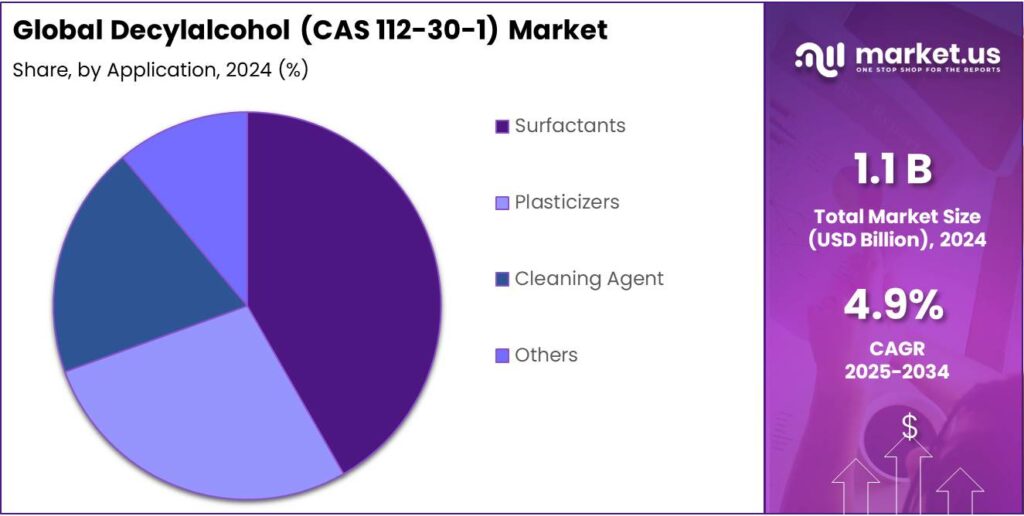

- Surfactants held a dominant market position, capturing more than a 45.1% share of the decyl alcohol market.

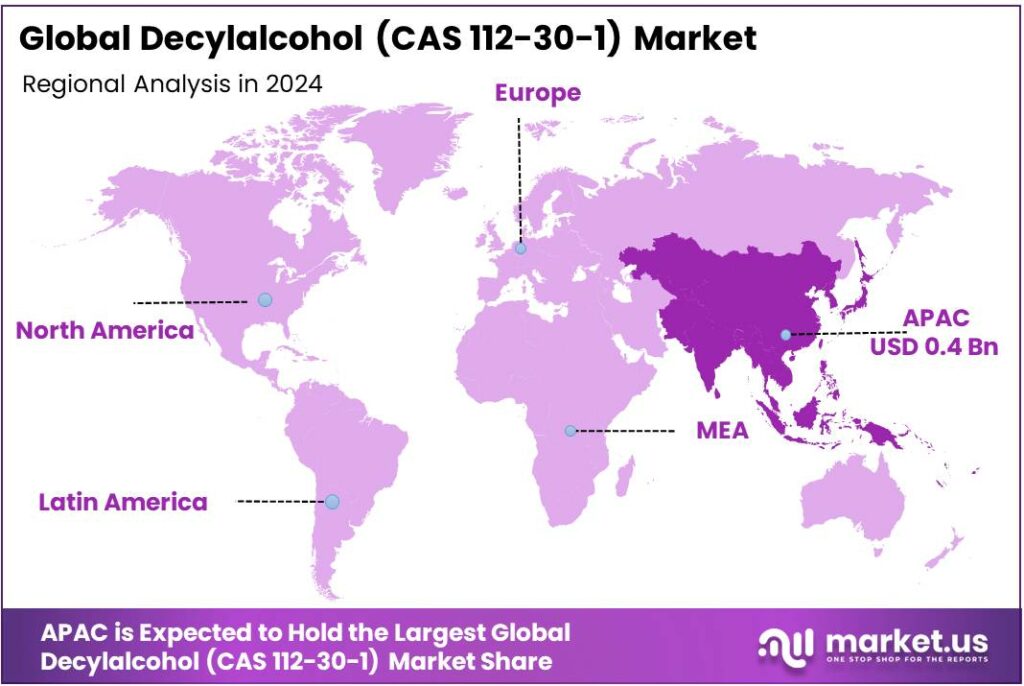

- Asia Pacific region held a dominant position in the decyl alcohol market, accounting for 38.5% of the global share, equivalent to an estimated market value of USD 0.4 billion.

By Raw Material Analysis

Natural Decyl Alcohol dominates with 59.6% share in 2024

In 2024, Natural held a dominant market position, capturing more than a 59.6% share of the decyl alcohol market. The preference for natural raw materials is driven by the growing demand for eco-friendly and sustainable products in industries such as personal care, cosmetics, and pharmaceuticals.

Manufacturers are increasingly sourcing decyl alcohol from natural feedstocks like coconut and palm kernel oils, which offer consistent quality and align with environmental regulations. This trend has strengthened the natural segment’s market presence and is expected to maintain steady growth into 2025, supported by rising consumer awareness and government initiatives promoting sustainable chemical production.

By Content Analysis

High-purity >98% Decyl Alcohol leads with 49.9% share in 2024

In 2024, >98% held a dominant market position, capturing more than a 49.9% share of the decyl alcohol market. This high-purity segment is favored across pharmaceutical, cosmetic, and specialty chemical applications where product consistency and performance are critical. The growing emphasis on quality standards and regulatory compliance has further strengthened the demand for >98% decyl alcohol. Year-on-year, the segment has shown steady growth and is expected to continue its strong market presence in 2025, driven by rising industrial requirements and the preference for high-grade raw materials in sensitive formulations.

By Application Analysis

Surfactants lead with 45.1% share in 2024 due to broad industrial use

In 2024, Surfactants held a dominant market position, capturing more than a 45.1% share of the decyl alcohol market. The strong demand is driven by its extensive use in detergents, personal care products, and cleaning agents, where decyl alcohol functions as a key fatty alcohol for emulsification and foaming properties. Industrial growth in household and personal care sectors has supported the adoption of decyl alcohol in surfactant formulations. The segment is expected to maintain steady growth in 2025, supported by increasing consumer focus on high-performance cleaning and cosmetic products that rely on reliable and efficient surfactant ingredients.

Key Market Segments

By Raw Material

- Natural

- Synthetic

By Content

- < 96%

- 96-98%

- >98%

By Application

- Surfactants

- Plasticizers

- Cleaning Agent

- Others

Emerging Trends

Growing Demand for Sustainable and Natural Ingredients

A significant trend in the decyl alcohol (CAS 112-30-1) market is the increasing demand for sustainable and natural ingredients, particularly in the personal care and cosmetics industries. As consumers become more environmentally conscious, there is a notable shift towards products that are both effective and eco-friendly. Decyl alcohol, a naturally derived fatty alcohol, aligns perfectly with this trend due to its biodegradable properties and mild, non-toxic nature.

This growth is largely driven by the increasing incorporation of decyl alcohol in personal care products such as shampoos, moisturizers, and facial cleansers. Its ability to act as an emollient, emulsifier, and thickening agent makes it a versatile ingredient in these formulations. Countries like China, India, and Japan are witnessing a surge in demand for personal care products, driven by rising disposable incomes and an increasing preference for natural ingredients. This regional growth presents significant opportunities for decyl alcohol producers to expand their market presence.

Furthermore, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have recognized decyl alcohol as a safe ingredient for use in food products under certain conditions, listing it as a flavoring agent or adjuvant. This approval not only broadens the scope of its applications but also enhances its credibility among consumers and manufacturers alike.

Drivers

Sustainability and Eco-Friendly Demand

One of the primary driving factors for the growth of decyl alcohol (CAS 112-30-1) is the increasing global demand for sustainable and eco-friendly products. As consumers and industries alike become more environmentally conscious, there is a significant shift towards using renewable and biodegradable materials in various applications.

Decyl alcohol, a long-chain fatty alcohol, is predominantly derived from natural sources such as palm kernel oil and coconut oil. This natural origin makes it a preferred choice over synthetic alternatives, aligning with the growing trend towards sustainability. In fact, natural raw materials accounted for 57.1% of decyl alcohol production in 2024, highlighting the industry’s commitment to eco-friendly practices.

The demand for decyl alcohol is particularly strong in the personal care and cosmetics industries, where it is used as an emollient, emulsifier, and thickening agent in products like lotions, creams, and shampoos. Consumers are increasingly seeking products that are not only effective but also environmentally responsible. This shift in consumer preference is driving manufacturers to adopt natural ingredients like decyl alcohol to meet market demands.

Furthermore, regulatory bodies worldwide are implementing stricter environmental regulations, encouraging the use of biodegradable and non-toxic substances in consumer products. For instance, the U.S. Food and Drug Administration (FDA) has approved decyl alcohol for use as a flavoring agent in food products under certain conditions, recognizing its safety and suitability for natural formulations.

Restraints

High Production Costs

One of the significant challenges facing the decyl alcohol (CAS 112-30-1) industry is the relatively high production costs associated with its manufacturing. Decyl alcohol is typically derived from natural sources like palm kernel and coconut oil, which, although renewable, can be expensive to process. The extraction and purification processes involved in producing high-quality decyl alcohol contribute to the overall cost of the product.

These higher costs can limit its adoption, particularly in price-sensitive industries or regions where cheaper synthetic alternatives may be more readily available. As a result, manufacturers may face challenges in passing on the costs to consumers, potentially restricting market growth. The increasing pressure to reduce production costs without compromising quality presents a significant hurdle for the decyl alcohol market in maintaining competitive pricing against other chemical ingredients.

Furthermore, the decyl alcohol market is influenced by the volatility of raw material prices. The prices of key raw materials used in the production of decyl alcohol, such as palm kernel oil, have been highly volatile. This volatility can be attributed to various factors, including supply disruptions, pent-up demand, and significant peaks and troughs in overall market demand.

The fluctuating prices of raw materials have resulted in increased production costs for decyl alcohol manufacturers, thereby hampering the market’s growth. Manufacturers have been forced to absorb these increased costs or pass them onto consumers, which can impact the affordability and competitiveness of decyl alcohol-based products.

Opportunity

Expansion in Sustainable Personal Care Products

One of the most promising growth opportunities for decyl alcohol (CAS 112-30-1) lies in the expanding demand for sustainable personal care products. As consumers become more environmentally conscious, there is a significant shift towards products that are both effective and eco-friendly. Decyl alcohol, a naturally derived fatty alcohol, aligns perfectly with this trend due to its biodegradable properties and mild, non-toxic nature.

Furthermore, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have recognized decyl alcohol as a safe ingredient for use in food products under certain conditions, listing it as a flavoring agent or adjuvant. This approval not only broadens the scope of its applications but also enhances its credibility among consumers and manufacturers alike.

This growth is largely driven by the increasing incorporation of decyl alcohol in personal care products such as shampoos, moisturizers, and facial cleansers. Its ability to act as an emollient, emulsifier, and thickening agent makes it a versatile ingredient in these formulations.

Regional Insights

Asia Pacific dominates Decyl Alcohol market with 38.5% share valued at USD 0.4 billion in 2024

In 2024, the Asia Pacific region held a dominant position in the decyl alcohol market, accounting for 38.5% of the global share, equivalent to an estimated market value of USD 0.4 billion. The region’s dominance is primarily driven by rapid industrialization, expanding personal care and cosmetic industries, and increasing demand for eco-friendly and bio-based chemicals. Countries such as China, India, and Japan contribute significantly, owing to their large manufacturing bases and growing consumer markets.

The personal care segment in Asia Pacific has seen robust growth, with rising disposable incomes and changing lifestyles fueling the demand for high-quality cosmetic and hygiene products. Decyl alcohol, with its role as a surfactant and emollient, is extensively used in shampoos, conditioners, lotions, and detergents across these markets. Additionally, the region’s textile, pharmaceutical, and specialty chemical sectors utilize decyl alcohol as a solvent and intermediate, further supporting market growth.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ecogreen Oleochemicals is a leading producer of natural fatty alcohols, including decyl alcohol, derived from renewable sources like palm kernel and coconut oils. The company operates production facilities in Indonesia and serves various industries, including personal care, home care, and industrial applications. Ecogreen emphasizes sustainability and quality, offering products certified by Kosher, Halal, ISO 9001, and RSPO SCC standards.

Sasol Limited, a global integrated energy and chemical company, produces decyl alcohol under the brand name ALFOL 10 Alcohol. Derived from petrochemical sources, this high-purity alcohol is used in various applications, including personal care products, solvents, and industrial processes. Sasol focuses on innovation and sustainability in its chemical production.

Global Green Chemicals, part of the PTT Group, manufactures decyl alcohol under the brand name ThaiOL 1098. Sourced from 100% vegetable origin, this product is used in personal care and cosmetic applications as a fragrance enhancer and foam stabilizer. GGC is committed to sustainability, with products certified by Kosher and Halal standards.

Top Key Players Outlook

- Ecogreen Oleochemicals GmbH

- Kao Corporation

- Sasol Limited

- Global Green Chemicals Public Company Limited

- KLK OLEO Ltd.

- LG Chem Ltd.

- Procter & Gamble Chemical Services Pte Ltd

- BASF SE

- Musim Mas Holdings Pte Ltd

Recent Industry Developments

In 2024, Kao’s KALCOL 1098 was utilized in various applications, including personal care products, lubricants, and plasticizers. The product is characterized by its clear, colorless liquid appearance and a minimum alkyl composition of 98% C10.

In June 2024 Ecogreen Oleochemicals GmbH, reported an import turnover of approximately USD 2.96 million, indicating its active role in the global supply chain.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 1.8 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Natural, Synthetic), By Content (Less-than 96%, 96-98%, Greater-than98%), By Application (Surfactants, Plasticizers, Cleaning Agent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ecogreen Oleochemicals GmbH, Kao Corporation, Sasol Limited, Global Green Chemicals Public Company Limited, KLK OLEO Ltd., LG Chem Ltd., Procter & Gamble Chemical Services Pte Ltd, BASF SE, Musim Mas Holdings Pte Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Decylalcohol (CAS 112-30-1) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Decylalcohol (CAS 112-30-1) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ecogreen Oleochemicals GmbH

- Kao Corporation

- Sasol Limited

- Global Green Chemicals Public Company Limited

- KLK OLEO Ltd.

- LG Chem Ltd.

- Procter & Gamble Chemical Services Pte Ltd

- BASF SE

- Musim Mas Holdings Pte Ltd