Global Decision Intelligence Market By Component (Platform, Solution, Services), By Deployment Mode (Cloud Based, Premise), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Retail and E-commerce, Manufacturing, Healthcare, Transportation and Logistics, Government and Public Sector Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120346

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

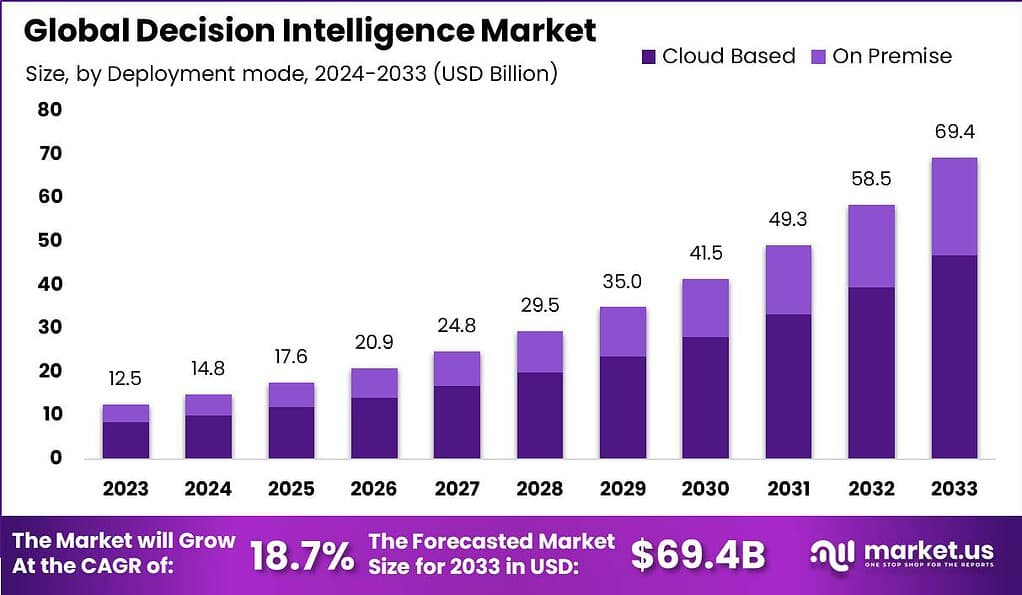

The Global Decision Intelligence Market size is expected to be worth around USD 69.4 Billion By 2033, from USD 12.5 Billion in 2023, growing at a CAGR of 18.7% during the forecast period from 2024 to 2033.

Decision intelligence refers to the use of data, analytics, and artificial intelligence (AI) techniques to support and improve human decision-making processes. It combines various disciplines such as data science, machine learning, and behavioral economics to provide insights and recommendations that aid in making informed decisions.

The decision intelligence market encompasses the products, services, and technologies related to decision intelligence. It includes software tools, platforms, and applications that assist organizations and individuals in analyzing data, modeling complex scenarios, and making better decisions. These solutions leverage advanced algorithms and AI capabilities to process large volumes of data, extract meaningful patterns, and generate actionable insights.

The decision intelligence market has witnessed significant growth in recent years, driven by the increasing availability of data, advancements in AI technologies, and the growing recognition of the importance of data-driven decision-making. Organizations are realizing the potential of decision intelligence in improving operational efficiency, reducing costs, and gaining a competitive edge.

According to a Salesforce survey, while 80% of business leaders acknowledge the critical role of data in decision-making, about 41% of them find it challenging due to data’s complexity and accessibility issues. This indicates a significant gap in data literacy among leaders, impacting their ability to leverage data effectively in strategic decisions.

By 2023, it is predicted that over 33% of large organizations will have analysts who specialize in decision intelligence and utilize decision modeling techniques. These analysts will be proficient in leveraging data, analytics, and AI technologies to support and optimize decision-making processes within their respective organizations. Decision modeling involves creating models that simulate different scenarios and outcomes, enabling organizations to make more informed and effective decisions.

Looking ahead to 2025, it is anticipated that three-fourths of large enterprises will encounter blind spots resulting from a deficiency in intelligent knowledge networks. An intelligent knowledge network refers to a system that facilitates the sharing and dissemination of valuable insights, information, and expertise across an organization. It enables employees to access relevant knowledge and make decisions based on a comprehensive understanding of the available information.

Key Takeaways

- The Decision Intelligence market size is estimated to reach USD 69.4 billion in the year 2033 with a CAGR of 18.7% during the forecast period and was valued at USD 12.5 billion in the year 2023.

- Based on the component, the platform segment has dominated the market with a share of 47.1% in the year 2023.

- Based on the deployment mode, the cloud-based segment is leading the market with a share of 67.5% in the year 2023.

- Based on the organization size, the large enterprise segment has dominated the market with a share of 70.8% in the year 2023.

- Based on the industry vertical, the BFSI segment has contributed to the largest market share with a share of 22.4% in the year 2023.

Component Analysis

In 2023, the platform segment held a dominant market position within the Decision Intelligence market, capturing more than a 47.1% share. This leadership can be attributed primarily to the platform’s ability to integrate and synthesize diverse data sources, providing comprehensive analytics that empower businesses to make informed decisions.

Platforms serve as the foundational infrastructure, enabling users to access, analyze, and manipulate data effectively. As organizations increasingly rely on data-driven strategies to gain competitive advantage, the demand for robust decision intelligence platforms has surged. For instance, in April 2023, Quantexa, a UK-based decision intelligence platform provider, raised USD 129 million in a Series E funding round led by GIC, valuing the company at USD 1.8 billion. This funding will accelerate Quantexa’s decision intelligence platform and expand its other product offerings.

The success of the platform segment is also driven by its versatility and scalability, which are crucial in handling the vast amounts of data generated by modern enterprises. These platforms offer various functionalities including predictive analytics, machine learning capabilities, and real-time decision-making support, which are essential for businesses operating in dynamic markets.

Furthermore, the integration of artificial intelligence within these platforms has enhanced their predictive accuracy and efficiency, making them even more integral to organizational strategy. Moreover, the development of user-friendly interfaces and customizable features within decision intelligence platforms has made them accessible to a broader range of users, from data scientists to business executives.

This ease of use, combined with the ability to deliver actionable insights, supports why the platform segment continues to outperform other components like solutions and services. As the market evolves, it is anticipated that platforms will continue to lead, fueled by technological advancements and the increasing importance of data-centric decision-making in business strategy.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position within the Decision Intelligence market, capturing more than a 67.5% share. This substantial market share is primarily due to the scalability, flexibility, and cost-effectiveness that cloud-based solutions offer. As businesses of all sizes generate increasingly large volumes of data, the cloud provides a scalable infrastructure that can expand to meet growing data needs without the upfront costs associated with on-premise systems.

Furthermore, cloud-based decision intelligence platforms facilitate easier access to advanced analytics and AI tools, which can be deployed rapidly and updated continuously to keep pace with market changes. The lead of the Cloud-Based segment is further reinforced by the shift in business operations towards remote and hybrid work models, a trend accelerated by global shifts in work dynamics over recent years.

Cloud platforms enable teams to collaborate and access critical decision-making tools from any location, enhancing operational efficiency and decision speed. This accessibility makes cloud-based decision intelligence solutions particularly attractive for companies seeking to maintain agility in a fast-evolving market environment.

Moreover, the security advancements in cloud technology have also played a crucial role in its adoption. With enhanced security measures and compliance with stringent data protection regulations, businesses feel more confident in migrating their sensitive data to cloud-based decision intelligence platforms.

As a result, the reliance on cloud deployment is expected to grow, further cementing its leadership in the market. This trend highlights the ongoing shift towards digital and cloud-first strategies across industries aiming to leverage data for strategic advantage.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position within the Decision Intelligence market, capturing more than a 70.8% share. This prominence is largely due to the extensive resources that large enterprises possess, which allow them to invest in advanced decision intelligence solutions to enhance their operational efficiencies and strategic decision-making processes.

Large organizations typically manage complex operations and vast data sets, necessitating robust systems that can handle large-scale data integration, analysis, and real-time decision support. This capability enables them to gain actionable insights and maintain a competitive edge in their respective industries.

In 2023, a survey revealed that 33% of large companies have hired analysts with skills in decision intelligence, especially in decision modeling. These analysts aid data analysts and managers in composing, designing, implementing, and fine-tuning decision models and processes, helping businesses stay competitive and meet customer expectations.

Furthermore, large enterprises often operate on a global scale, facing diverse regulatory environments and market conditions that require agile and well-informed decision-making. Decision intelligence platforms provide these organizations with the necessary tools to analyze market trends, consumer behavior, and operational risks effectively.

The ability to swiftly adapt to changing market conditions and regulatory requirements is crucial for sustaining growth and profitability, thereby driving the adoption of decision intelligence solutions in large enterprises. Additionally, large enterprises are more likely to have the necessary infrastructure and IT expertise to integrate and leverage decision intelligence platforms fully.

This readiness not only facilitates a smoother adoption and implementation process but also maximizes the return on investment in such technologies. As decision intelligence technology continues to evolve, its adoption among large enterprises is expected to increase, further reinforcing their leadership in the market segment.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the Decision Intelligence market, capturing more than a 22.4% share. This significant share can be attributed to the critical need within the BFSI sector for precise risk management, customer segmentation, and regulatory compliance.

Decision intelligence platforms provide the necessary tools for analyzing large volumes of complex financial data quickly and accurately, which is essential for making informed decisions in a sector characterized by its high transaction volumes and stringent regulatory standards. Moreover, the BFSI sector is increasingly leveraging decision intelligence to enhance customer experience and operational efficiency.

These platforms help in identifying trends, predicting customer behavior, and offering personalized financial products, thereby not only improving customer satisfaction but also driving revenue growth. As financial institutions continue to face competitive pressures, the adoption of advanced analytics and machine learning technologies provided by decision intelligence solutions enables them to stay competitive and innovative.

Additionally, the growing emphasis on financial security and fraud detection has propelled the adoption of decision intelligence in the BFSI sector. These platforms employ sophisticated algorithms to detect unusual patterns and potential fraudulent activities, ensuring enhanced security for financial transactions. With the continual advancements in decision intelligence technologies and increasing digital transactions, the BFSI segment’s reliance on these solutions is expected to grow, further solidifying its leadership position in the market.

Key Market Segments

Component

- Platform

- Solution

- Services

Deployment Mode

- Cloud-Based

- On-Premise

Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Industry Vertical

- BFSI

- IT and Telecommunications

- Retail and E-commerce

- Manufacturing

- Healthcare

- Transportation and Logistics

- Government and Public Sector

- Other Industry Verticals

Driver

Increasing Adoption of AI and IoT Technologies

The significant driver propelling the growth of the decision intelligence market is the increasing integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies across various industries. This integration enhances the capability of decision intelligence platforms to generate actionable business insights from big data, thereby improving decision-making processes and operational efficiencies within organizations. The market benefits from the continuous advancements in these technologies, which provide a more structured approach to data analysis and decision-making .

Restraint

High Cost and Complexity of Implementation

A major restraint in the decision intelligence market is the high cost and complexity associated with implementing these solutions. For many businesses, especially small and medium-sized enterprises, the initial investment and the expertise required to deploy and maintain decision intelligence systems can be prohibitive. Additionally, the need for ongoing updates and training adds to the total cost of ownership, making it challenging for some businesses to adopt these advanced technologies.

Opportunity

Expansion into Emerging Markets

There is a significant opportunity for the decision intelligence market to expand into emerging markets, where there is a rapidly growing demand for advanced analytics and data-driven decision-making tools. These regions present a relatively untapped customer base that is beginning to recognize the benefits of implementing decision intelligence systems to enhance competitiveness and operational effectiveness. The potential for growth in these markets is supported by increasing technological adoption and digital transformation initiatives.

Challenge

Data Privacy and Security Concerns

One of the primary challenges facing the decision intelligence market is addressing data privacy and security concerns. As businesses increasingly rely on data to make critical decisions, ensuring the security and compliance of these systems with international data protection regulations becomes paramount. This challenge is compounded by the varying levels of regulatory requirements across different regions, which can hinder the deployment of uniform decision intelligence solutions globally.

Growth Factors

- Advanced Analytical Technologies: The integration of advanced technologies like AI and machine learning in decision intelligence tools enables enhanced data analysis and better decision-making processes.

- Digital Transformation Initiatives: Accelerated digital transformation across industries is driving the demand for decision intelligence to optimize operations and improve decision accuracy.

- Increasing Data Availability: With more data being generated from multiple sources, there is a growing need for technologies that can effectively manage and utilize this information, thereby pushing the growth of decision intelligence solutions.

- Demand for Operational Efficiency: Organizations are focusing on improving efficiency and reducing operational costs, which decision intelligence can substantially support by identifying inefficiencies and suggesting improvements.

- Expansion into Emerging Markets: As decision intelligence technologies mature, there is significant growth potential in emerging markets where digital adoption is increasing.

Emerging Trends

- Cloud-Based Solutions: There is a notable shift towards cloud-based decision intelligence solutions, which offer scalability, ease of integration, and cost efficiency, thus driving their adoption.

- Focus on Real-Time Decision-Making: The ability to make decisions in real-time is increasingly crucial, driven by the need for agility and responsiveness in today’s fast-paced business environments.

- Increased Use of Predictive Analytics: Predictive analytics are becoming a fundamental part of decision intelligence, enabling businesses to forecast trends and make proactive decisions.

- Growth of AI and Automation: Automation and AI continue to be significant trends, enhancing the decision-making process by automating routine tasks and providing deeper insights into data.

- Expansion of Decision Intelligence Across Verticals: Decision intelligence is expanding across various industry verticals, including healthcare, finance, and retail, indicating its broad applicability and value in diverse settings.

Regional Analysis

In 2023, North America held a dominant market position in the Decision Intelligence market, capturing more than a 39.8% share. This significant market share can be attributed to the region’s robust technological infrastructure and early adoption of advanced analytics and artificial intelligence technologies.

North American companies have been at the forefront of incorporating AI into their operational processes, driven by a strong ecosystem of tech giants and startups alike, which contributes to continuous innovation and development in decision intelligence solutions. Moreover, the presence of a highly skilled workforce and extensive investments in research and development activities further support the region’s leading position.

These factors are complemented by favorable government policies that encourage data-driven decision making in industries such as healthcare, finance, and retail, all of which are substantially developed in this region. The high adoption rate of cloud technologies in North America also plays a crucial role, enabling businesses to leverage decision intelligence platforms effectively to gain actionable insights and maintain competitive advantages.

As businesses continue to prioritize digital transformation, North America is likely to maintain its leadership in the Decision Intelligence market, driven by strategic investments and a focus on adopting cutting-edge technologies to enhance decision-making processes. This trend is underpinned by a growing demand for real-time data analysis and the need to navigate complex regulatory environments effectively.

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Decision Intelligence market is characterized by the presence of several major players, each contributing to the sector’s dynamic growth and technological advancements. Key players such as IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, and Amazon Web Services, Inc. play a pivotal role in shaping the market landscape.

These companies are renowned for their robust decision intelligence platforms that integrate advanced analytics, machine learning, and artificial intelligence to enhance business decision-making processes across various industries. IBM and Microsoft, with their extensive portfolios and global reach, are instrumental in driving innovations in decision intelligence solutions.

They offer platforms that help businesses harness the power of big data and predictive analytics to make informed decisions. SAP SE and Oracle Corporation are also crucial in this market, providing comprehensive software solutions that support data integration, real-time analytics, and enterprise performance management.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Amazon Web Services, Inc.

- SAS Institute Inc.

- FICO

- TIBCO Software Inc.

- Domo, Inc.

- Qlik Technologies Inc.

- Alteryx, Inc.

- ThoughtSpot, Inc.

- Other Key Players

Recent Developments

- In February 2024, IBM launched Cloud Pak for Data version 4.8, enhancing data management capabilities, reducing ETL requests, and improving data cataloging to streamline organizational decision-making.

- In January 2024, FICO launched over 20 innovations in its FICO Platform, enabling businesses to integrate data and analytics for better decision-making.

- In June 2023, Alteryx launched an automated decision intelligence feature on the Snowflake data cloud that helped customers drive analytic insights.

- In June 2023, Oracle partnered with Cohere to offer integrated AI services, enhancing decision-making processes and customer experiences by leveraging large language models (LLMs).

Report Scope

Report Features Description Market Value (2023) USD 12.5 Bn Forecast Revenue (2033) USD 69.4 Bn CAGR (2024-2033) 18.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Platform, Solution, Services), By Deployment Mode (Cloud Based, Premise), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Retail and E-commerce, Manufacturing, Healthcare, Transportation and Logistics, Government and Public Sector Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Amazon Web Services, Inc., SAS Institute Inc., FICO, TIBCO Software Inc., Domo, Inc., Qlik Technologies Inc., Alteryx, Inc., ThoughtSpot, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Decision Intelligence (DI)?Decision Intelligence (DI) refers to the integration of artificial intelligence (AI), data analytics, and human decision-making processes to enhance decision-making quality and outcomes. DI systems help organizations leverage vast amounts of data to make more informed, data-driven decisions.

How big is Decision Intelligence Market?The Global Decision Intelligence Market size is expected to be worth around USD 69.4 Billion By 2033, from USD 12.5 Billion in 2023, growing at a CAGR of 18.7% during the forecast period from 2024 to 2033.

Who are the key players in the Global Decision Intelligence Market?IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Amazon Web Services, Inc., SAS Institute Inc., FICO, TIBCO Software Inc., Domo, Inc., Qlik Technologies Inc., Alteryx, Inc., ThoughtSpot, Inc., Other Key Players

Which region accounted for the largest Global Decision Intelligence Market?North America has the largest market share for the Global Decision Intelligence Market with a share of about 39.8% in 2023.

What is the growth rate in the Global Decision Intelligence Market?The Decision Intelligence Market is growing at a CAGR of 18.7% over the forecasted period.

Decision Intelligence MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Decision Intelligence MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Amazon Web Services, Inc.

- SAS Institute Inc.

- FICO

- TIBCO Software Inc.

- Domo, Inc.

- Qlik Technologies Inc.

- Alteryx, Inc.

- ThoughtSpot, Inc.

- Other Key Players