Debt Collection Software Market Size, Share, Upcoming Investments Report By Component (Software (Consulting, Integration & Implementation, Training & Support), Services), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By End-User (Healthcare, Financial Institutions, Collection Agencies, Government, Telecom & Utilities, Others (Real Estate & Retail)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 135269

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- North America Debt Collection Software Market Size

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- End-user Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

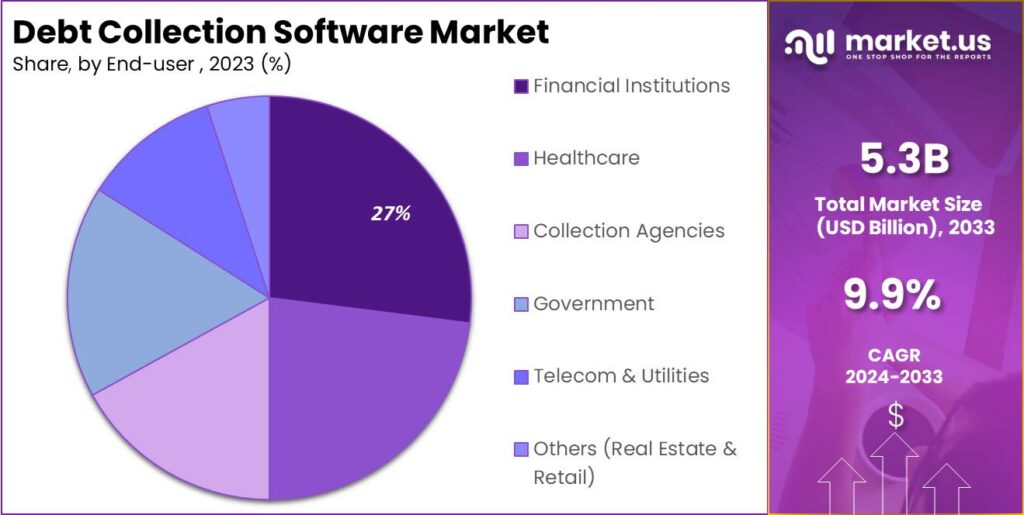

The Global Debt Collection Software Market size is expected to be worth around USD 13.6 Billion By 2033, from USD 5.3 billion in 2023, growing at a CAGR of 9.9% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 30.4% share, holding USD 1.6 Billion revenue.

Debt collection software is a specialized type of program designed to assist businesses in managing and automating the process of recovering outstanding debts. This software typically features tools for tracking debtor accounts, automating communications, and generating reports, all aimed at increasing the efficiency of the collections process. These tools also help to ensure compliance with regulations related to debt recovery practices.

The Debt Collection Software Market is experiencing growth driven by increasing demand from financial institutions, healthcare providers, and government agencies to efficiently manage debt recovery processes. As businesses seek more effective ways to minimize financial losses through bad debts, the adoption of debt collection software is increasing. This market encompasses a range of software products tailored for small businesses to large enterprises, offering both on-premise and cloud-based solutions to cater to diverse operational needs and compliance standards.

Several factors contribute significantly to the growth of the debt collection software market. The primary driver is the need for higher efficiency in collection operations, allowing businesses to recover debts more quickly and with fewer resources. Another crucial driver is the demand for compliance with increasingly stringent regulations, which these software solutions facilitate by automating compliance checks and updates.

There is a robust demand for debt collection software that offers customization, scalability, and integration with existing infrastructure. Organizations are looking for solutions that not only streamline collections but also maintain customer relations and compliance with local laws. The demand is particularly strong among large enterprises and financial institutions that manage numerous accounts with varying degrees of credit risk.

According to the International Monetary Fund (IMF), private debt levels, including loans and debt securities, remain a significant concern for global economies. In the United States, private debt accounted for 219.33% of GDP, with loans representing 102.21% of GDP, indicating a high reliance on borrowing. Similarly, the United Kingdom reported private debt at 194.86% of GDP, reflecting a significant burden on the financial system. Meanwhile, China recorded private debt at 141.41% of GDP, showcasing the rapid credit expansion driven by its growing economy.

Market opportunities for debt collection software are expanding with the advent of AI and machine learning technologies. These innovations enhance the software’s capability to analyze debtor behavior, predict payment probabilities, and personalize communication strategies, thereby increasing recovery rates. Furthermore, as more businesses operate globally, there is a growing need for software that can manage debt recovery across different legal systems and currencies.

Technological advancements are profoundly shaping the debt collection software industry. The use of AI and machine learning for predictive analytics allows companies to anticipate debtor payment behaviors and tailor their collection strategies accordingly. Furthermore, innovations in data privacy, through enhanced encryption and secure data handling, ensure that sensitive financial information remains protected.

Key Takeaways

- The global debt collection software market is projected to grow from USD 5.3 billion in 2023 to approximately USD 13.6 billion by 2033, achieving a CAGR of 9.9% during the forecast period (2024-2033). This growth is driven by increasing demand for automation in debt recovery processes and advancements in cloud-based solutions.

- In 2023, North America emerged as the dominant region, capturing over 30.4% market share and generating USD 1.6 billion in revenue. This leadership can be attributed to the region’s early adoption of technology and the presence of key industry players.

- The software segment led the market with a 66.1% share in 2023, highlighting the growing preference for dedicated software solutions that provide efficiency and compliance in debt collection processes.

- The cloud-based solutions segment accounted for a significant market share in 2023, owing to its flexibility, scalability, and cost-efficiency. These attributes make cloud platforms a preferred choice for businesses of all sizes.

- The large enterprise segment dominated the market in 2023, driven by their ability to invest heavily in advanced technology. These organizations leveraged debt collection software to enhance operational efficiency and improve recovery rates.

- Financial institutions were the leading end-users in the market, holding more than a 27% share in 2023. Their consistent focus on improving debt recovery processes and complying with strict regulatory standards contributed to their dominant position.

North America Debt Collection Software Market Size

In 2023, North America held a dominant position in the debt collection software market, capturing more than a 30.4% share with revenues amounting to USD 1.6 billion. This leading status can be attributed to several key factors that differentiate the region from its global counterparts.

Firstly, North America benefits from a mature financial services sector, which has historically been quick to adopt new technologies to enhance operational efficiencies and compliance with stringent regulatory standards. The region’s focus on innovation has led to the early adoption of advanced technologies such as artificial intelligence (AI) and machine learning in debt collection processes.

These technologies improve the effectiveness of collection strategies and optimize interactions with debtors, thereby increasing recovery rates and reducing operational costs. Furthermore, the high prevalence of credit usage among consumers and businesses in North America necessitates robust debt collection solutions.

This demand is compounded by the presence of numerous large financial institutions and an increasing volume of non-performing assets due to economic fluctuations. Debt collection software helps mitigate the risk of bad debts by providing sophisticated tools for monitoring, management, and recovery of dues efficiently.

Additionally, the legal and regulatory landscape in North America, particularly in the United States, imposes strict guidelines on debt recovery practices. Compliance with regulations such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA) is paramount.

Debt collection software tailored to meet these regulatory requirements ensures that businesses can navigate the complexities of legal compliance while maintaining operational efficiency. The software also offers audit trails, secure data handling, and automated regulatory updates, which further solidify its indispensability in the North American market.

Component Analysis

In 2023, the software segment of the debt collection software market held a dominant position, capturing over 66.1% of the market share. This prominence can be attributed to the comprehensive functionality that debt collection software provides to financial institutions and collection agencies.

These tools are crucial for managing and streamlining the collection process, enhancing customer satisfaction through various payment options, and maintaining compliance with regulatory standards. The integration of advanced features like AI and analytics further strengthens the appeal of software solutions by optimizing collection strategies and improving recovery rates.

The software component includes critical functionalities such as consulting, integration and implementation, and training and support services. Consulting services are pivotal as they help tailor the software to the specific needs of an organization, ensuring that the solution effectively addresses unique challenges related to debt collection practices.

Integration and implementation services are also crucial, facilitating seamless incorporation of the software into existing systems, which is essential for maintaining data consistency and operational continuity. Lastly, training and support services are integral to ensuring that users can utilize the software effectively and maximize its benefits for improved collection outcomes and operational efficiency.

This segment continues to expand as organizations increasingly recognize the importance of sophisticated debt collection strategies that not only enhance efficiency but also adhere to the evolving regulatory landscape. As businesses across various sectors strive to optimize their receivables management and minimize credit risk, the demand for advanced debt collection software solutions is expected to grow, thus fostering further developments and innovations within this segment.

Deployment Analysis

In 2023, the cloud segment of the debt collection software market held a dominant position due to its substantial benefits in flexibility, scalability, and cost-effectiveness. The widespread adoption of cloud-based solutions is driven by their ability to facilitate seamless data sharing and real-time analytics, which are crucial for effective debt collection strategies.

This deployment model supports the integration of advanced technologies such as artificial intelligence (AI) and machine learning, enhancing the software’s ability to predict debtor behavior and optimize collection processes. The cloud segment’s growth is bolstered by its lower upfront costs and reduced need for on-site maintenance, making it an attractive option for businesses looking to minimize IT expenditures while maximizing operational efficiency.

Moreover, the cloud-based debt collection software is preferred for its robust security features, which are essential for complying with stringent data protection regulations and safeguarding sensitive financial information. These platforms often come equipped with advanced security measures such as encryption, access controls, and regular security updates, which are managed by the service providers. This aspect is particularly appealing to industries such as finance and healthcare, where data security is paramount.

The increasing shift towards digital transformation across various sectors also propels the growth of the cloud segment. As organizations continue to embrace digital workflows, the demand for cloud-based solutions that offer on-demand data access, high scalability, and integration with other digital tools has surged.

This shift is evident in sectors like telecommunications, financial services, and healthcare, where there is a continuous need for innovative solutions to manage increasing volumes of debt-related data and enhance customer interactions in debt collection processes.

Overall, the cloud deployment type of debt collection software is set to expand significantly, fueled by ongoing technological advancements and a growing preference for solutions that offer flexibility, cost efficiency, and enhanced security features. This trend is supported by a broad adoption across industries aiming to optimize their debt recovery strategies and improve operational efficiencies

Enterprise Size Analysis

In 2023, the large enterprise segment maintained a dominant position within the debt collection software market, primarily due to their extensive financial resources which allow for significant investments in advanced technology solutions.

Large enterprises often have complex and voluminous debt recovery needs that necessitate robust, feature-rich software capable of managing vast amounts of data, providing comprehensive analytics, and ensuring compliance with various regulations. These capabilities are essential for minimizing financial risk and enhancing operational efficiencies.

Large enterprises are particularly focused on integrating debt collection software with existing corporate systems, such as ERP and CRM, to streamline processes and improve visibility across financial operations. The adoption of these systems is further driven by the need to comply with stringent global data security and privacy regulations, which are more critical for larger organizations with international operations.

Moreover, the substantial market share of large enterprises is also a reflection of their ability to deploy on-premise solutions, which many prefer for their enhanced control over security and data management. However, the trend is shifting towards cloud-based solutions due to their scalability, reduced upfront costs, and lower maintenance requirements, which are also becoming appealing to large enterprises looking to optimize their collection efforts and adapt to the rapidly changing digital landscape.

Overall, the significant investment capacity and strategic imperative to maintain financial health continue to drive the adoption of sophisticated debt collection software by large enterprises, ensuring their dominance in the market. The ongoing technological advancements in AI and machine learning are likely to further enhance the effectiveness of these solutions, making them an indispensable tool for large organizations aiming to optimize their debt recovery processes and improve their bottom lines.

End-user Analysis

In 2023, the financial institutions segment held a dominant market position within the debt collection software market, capturing more than a 27% share. This prominence is primarily due to the critical role these tools play in enhancing fraud detection capabilities within these institutions.

Financial institutions, which handle sensitive financial information, are particularly susceptible to fraud, making the advanced features of debt collection software like suspicious activity monitoring, multiple account correlations, and device and IP address checks essential for identifying and preventing fraudulent transactions.

Moreover, financial institutions encompass banks and non-banking financial companies that typically have large volumes of consumer debt. The ability of debt collection software to streamline collection efforts, manage accounts receivable efficiently, and improve overall debt recovery rates significantly boosts their operational efficiency.

These solutions not only facilitate compliance with stringent regulatory requirements but also enable institutions to leverage analytical tools for better decision-making and customer segmentation based on debt recovery probabilities.

The increasing complexity of financial operations and the need for seamless integration with existing digital banking systems further drive the adoption of sophisticated debt collection platforms by financial institutions. These platforms are instrumental in enhancing customer relationships and ensuring substantial financial health by reducing delinquencies through effective collection strategies.

This segment’s continued growth is underpinned by the evolving landscape of digital transactions and the expanding need for robust security measures, ensuring its pivotal role in the broader adoption of debt collection software solutions.

Key Market Segments

Component Analysis

- Services

- Software

- Consulting

- Integration & Implementation

- Training & Support

Deployment Analysis

- On-premise

- Cloud

Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

End-user

- Healthcare

- Financial Institutions

- Collection Agencies

- Government

- Telecom & Utilities

- Others (Real Estate & Retail)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Automation in Debt Collection

The debt collection software market is experiencing significant growth driven by the escalating demand for automation within the accounts receivable processes. This surge is primarily fueled by the need to enhance efficiency and accuracy in debt collection practices, which is becoming increasingly vital as the volume of transactions and the complexity of debt recovery escalates.

Automation helps in reducing human errors and operational costs while speeding up the recovery process, making it a key driver in the adoption of debt collection software. Financial institutions and collection agencies are among the primary beneficiaries, as these systems streamline their operations and improve overall debt recovery rates. This growth is supported by advancements in AI and machine learning, which further refine collection strategies and improve success rates.

Restraint

High Maintenance Costs

One significant restraint in the debt collection software market is the high maintenance cost associated with these systems. The continuous need for upgrades and integration with existing IT infrastructure can be both complex and costly.

Moreover, the implementation process often requires extensive customization and data migration, which not only adds to the initial expenses but also extends the time needed to achieve a full return on investment.

These factors can deter smaller organizations from adopting sophisticated debt collection platforms, thus inhibiting market growth to some extent. Furthermore, the complexities involved in training staff and integrating new technologies can pose additional challenges, leading to delays and increased costs.

Opportunity

Advancements in Technology and Analytics

The debt collection software market is poised for growth to advancements in technology and the increasing integration of analytics. The use of analytics provides actionable insights into customer behavior, allowing for more effective debt recovery strategies. As industries continue to digitalize, there is a growing demand for platforms that can efficiently manage large volumes of data and automate complex collection tasks.

This is particularly evident in financial sectors and healthcare, where efficient debt recovery is crucial to cash flow management. The adoption of these advanced technologies not only improves operational efficiencies but also enhances customer satisfaction by providing more personalized and timely interactions.

Challenge

Integration with Legacy Systems

A major challenge in the deployment of modern debt collection software is its integration with existing legacy systems. Many organizations operate on outdated platforms that are not readily compatible with the latest software solutions, leading to significant integration challenges. This can result in disruptions and potential data losses during the transition phase.

Moreover, the differing standards and technologies across regions can complicate the implementation process, requiring additional customization and resource allocation. Overcoming these challenges is crucial for organizations to fully realize the benefits of debt collection software, including improved efficiency and compliance with regulatory standards.

Growth Factors

The debt collection software market is propelled by a variety of growth factors that enhance its expansion and integration across multiple sectors. One primary driver is the increasing volume of outstanding debts, which prompts the demand for efficient and robust debt recovery solutions. As businesses seek to optimize their cash flows and reduce bad debts, the role of advanced software becomes crucial in managing these financial challenges effectively.

Technological advancements, particularly in artificial intelligence (AI) and machine learning, play a significant role in this sector. These technologies enhance the predictive capabilities of debt collection software, enabling better risk assessment and debtor profiling. This leads to more effective and personalized debt recovery strategies, significantly boosting recovery rates and reducing the time and resources spent on collections.

Furthermore, regulatory compliance is a major factor driving market growth. With strict laws governing debt collection practices, such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA) in the United States, there is a pressing need for software that ensures compliance while managing collections effectively. This not only helps in avoiding legal penalties but also in maintaining ethical collection practices, which is beneficial for both creditors and debtors.

Emerging Trends

Emerging trends within the debt collection software market include the adoption of cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness, making them accessible to a broader range of businesses, including small and medium-sized enterprises.

The shift towards cloud infrastructure is supported by its ability to provide real-time data access and integration with other digital financial platforms, enhancing operational efficiency across different geographic locations.

For instance, In June 2023, Secure Trust Bank collaborated with EXUS Software to enhance its collections operations using a data-driven, zero-customization platform. This single-platform approach aims to simplify business processes, improve communication with customers, and provide comprehensive visibility across the customer journey in collections. By adopting such innovative solutions, the bank is expected to set a precedent in the BFSI sector, driving growth in the debt collection software market.

Another trend is the growing utilization of data analytics and digital communication platforms. These tools help in understanding debtor behavior patterns and optimizing communication strategies to increase the likelihood of debt recovery. By leveraging big data, companies can tailor their approaches based on comprehensive analytics, which predict debtor payment behavior and determine the most effective times and methods for contact.

Business Benefits

Debt collection software offers numerous business benefits, including improved efficiency through automation of routine tasks. This not only speeds up the collection process but also frees up valuable resources that can be redirected towards more complex collection cases or other areas of business operations. Automation reduces the potential for human error and ensures consistent follow-up on outstanding debts.

Additionally, the implementation of this software leads to better customer management by maintaining more organized and accurate records of debtor interactions. This is crucial for preserving customer relationships while ensuring effective debt recovery. Enhanced reporting features provide businesses with clear insights into their collection activities and debtor portfolios, facilitating more informed decision-making and strategy formulation.

Key Player Analysis

The key players in the debt collection software market include Fair Isaac Corporation (FICO), Experian, and Constellation Software Inc., among others. These companies are actively reshaping their market strategies through acquisitions, innovative product launches, and strategic divestitures to enhance their competitive positions.

For instance, FICO divested its debt collection and recovery business to focus more on its core analytics and decision management technologies, while Experian has been enhancing its product offerings with platforms like Experian Debt Manager that incorporate advanced analytics and automation to improve debt recovery rates. Constellation Software has expanded its portfolio by acquiring FICO’s debt collection and recovery business, aiming to strengthen its offerings in the financial technology sector

Top Key Players in the Market

- Experian

- Fair Isaac Corporation

- Constellation Software Inc.

- CGI Group Inc.

- TransUnion

- Nucleus Software Exports Ltd.

- Chetu Inc.

- CDS Software

- Pegasystems Inc.

- Temenos Group AG

- AMEYO

- PAIR Finance

- Credgenics

Recent Developments

- On October 4, 2024, Experian completed its acquisition of illion for AU$820 million (approximately US$560 million). This acquisition aims to enhance Experian’s data-driven solutions in Australia and New Zealand, integrating illion’s capabilities into Experian’s existing offerings. The integration is expected to create a unified business that enhances market choice and delivers improved data-driven solutions for customers.

- On April 17, 2024, TransUnion launched a new AI-powered data analytics platform named OneTru. This cloud-based platform consolidates various data analytics and credit risk offerings into a unified portal, allowing financial institutions to streamline their data access and enhance decision-making capabilities

- On April 8, 2024, Perseus Group Software Corp., part of Constellation Software Inc., acquired Valeyo Inc., which provides loan origination technology for Canadian financial institutions. This acquisition aims to enhance Constellation’s technology suite and expand its offerings in the financial services sector.

Report Scope

Report Features Description Market Value (2023) USD 5.3 Bn Forecast Revenue (2033) USD 13.6 Bn CAGR (2024-2033) 9.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software (Consulting, Integration & Implementation, Training & Support), Services), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By End-User (Healthcare, Financial Institutions, Collection Agencies, Government, Telecom & Utilities, Others (Real Estate & Retail)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Experian, Fair Isaac Corporation, Constellation Software Inc., CGI Group Inc., TransUnion, Nucleus Software Exports Ltd., Chetu Inc., CDS Software, Pegasystems Inc., Temenos Group AG, AMEYO, PAIR Finance, Credgenics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Debt Collection Software MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Debt Collection Software MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Experian

- Fair Isaac Corporation

- Constellation Software Inc.

- CGI Group Inc.

- TransUnion

- Nucleus Software Exports Ltd.

- Chetu Inc.

- CDS Software

- Pegasystems Inc.

- Temenos Group AG

- AMEYO

- PAIR Finance

- Credgenics