Global Data Trust and Integrity Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Lineage and Provenance, Data Quality Monitoring and Scoring, Metadata Management and Cataloging, Audit and Compliance Reporting, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Government and Public Sector, Retail and E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177731

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Data Trust and Integrity Market size

- Key Takeaway

- Key Data Trust and Integrity Statistics

- Report Overview

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User Industry

- Regional Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Data Trust and Integrity Market size

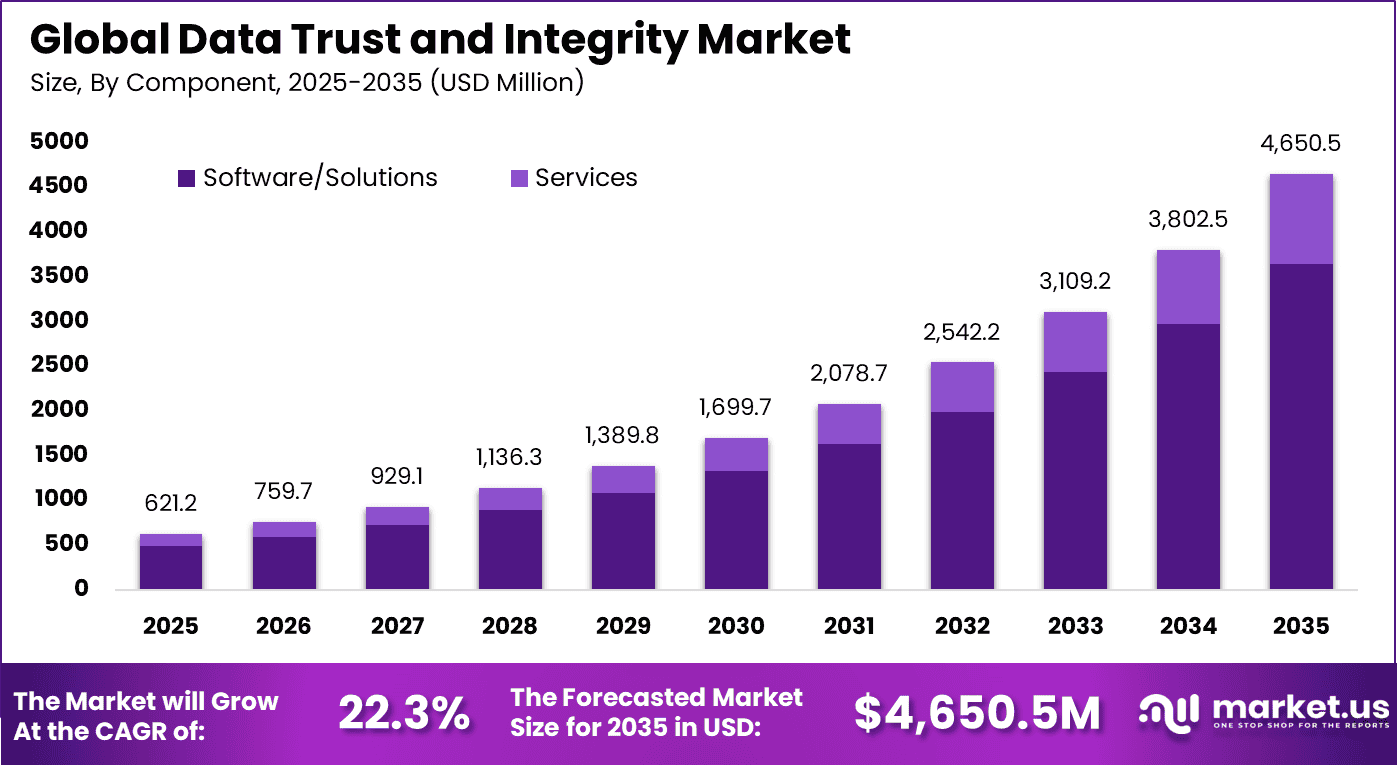

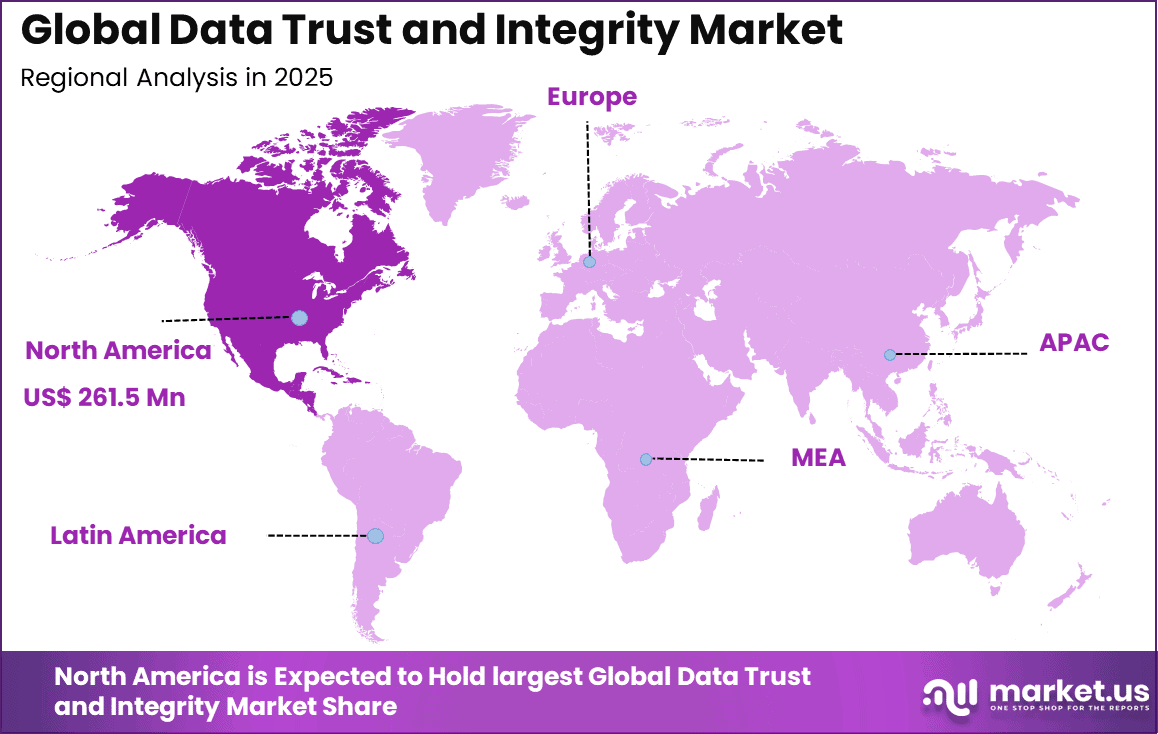

The Global Data Trust and Integrity Market size is expected to be worth around USD 4,650.5 million by 2035, from USD 621.2 million in 2025, growing at a CAGR of 22.3% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 42.1% share, holding USD 261.5 million in revenue.

Recent surveys highlight significant challenges in data trust and integrity within enterprises. A Drexel LeBow and Precisely study found that 67% of data and analytics professionals do not fully trust their organization’s data for decision-making. Data quality emerged as the top integrity challenge for 64% of respondents, with 77% rating their organization’s data quality as average or worse. Only 12% believe their data meets the standards needed for AI applications.

On the consumer side, trust in organizations’ data handling remains low. Thales’ 2025 Consumer Digital Trust Index, based on over 14,000 respondents across 14 countries, showed no sector earning trust from more than 50% of consumers to protect personal data. Some 63% feel too much burden falls on individuals for data protection, and 19% were notified of a personal data compromise in the past year.

Data breaches underscore the financial stakes of integrity failures. IBM’s 2024 Cost of a Data Breach Report pegs the global average cost at USD 4.88 million per incident. These figures point to ongoing priorities for governance, quality controls, and transparency in 2025 and beyond.

Key Takeaway

- In 2025, the Software and Solutions segment led the Global Data Trust and Integrity Market with a 78.3% share, reflecting strong demand for dedicated governance and monitoring platforms.

- In 2025, cloud based deployment accounted for 71.6% of total adoption, supported by scalable infrastructure and centralized data oversight.

- In 2025, large enterprises represented 83.4% of the market, driven by complex data environments and strict governance requirements.

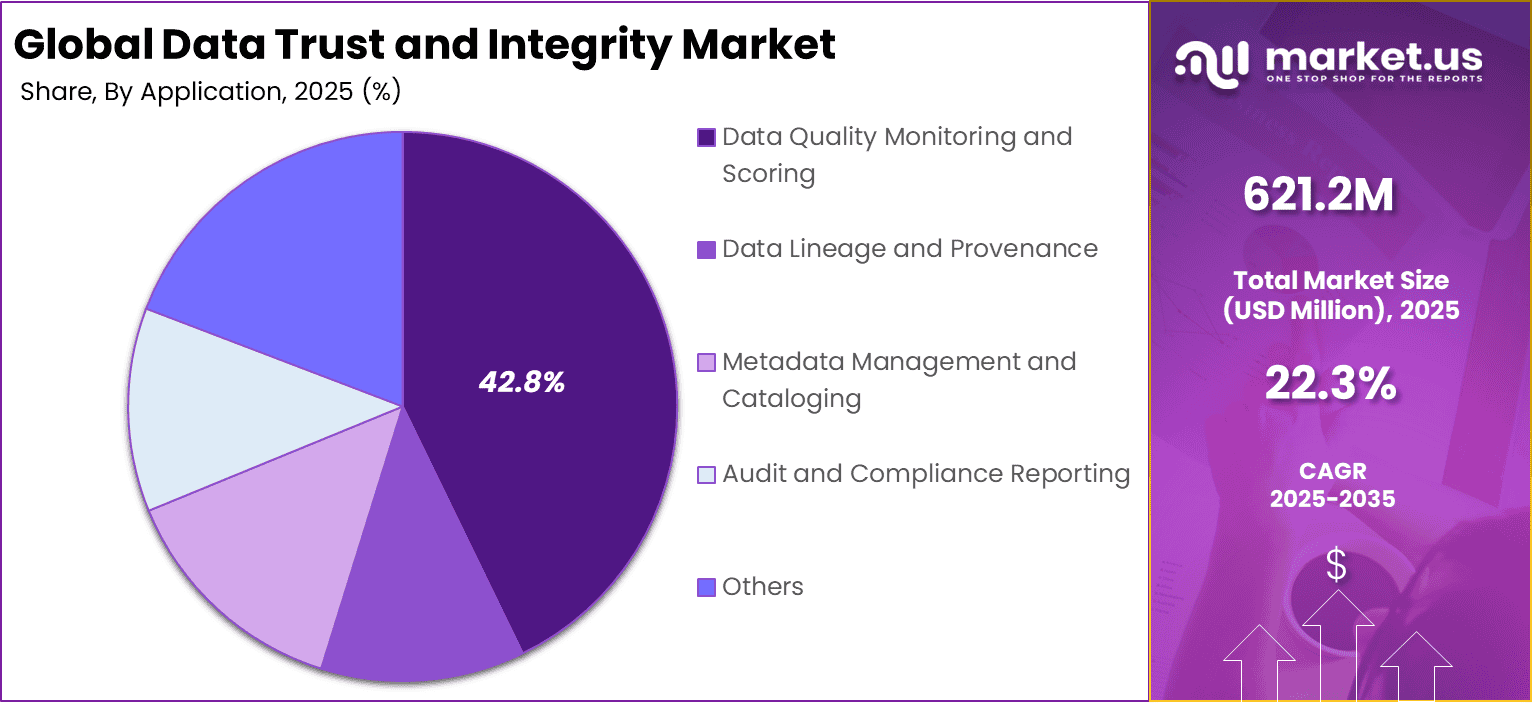

- In 2025, Data Quality Monitoring and Scoring captured a 42.8% share, highlighting focus on accuracy, validation, and reliability assessment.

- In 2025, the Banking, Financial Services, and Insurance sector held a 52.6% share, supported by regulatory pressure and risk management priorities.

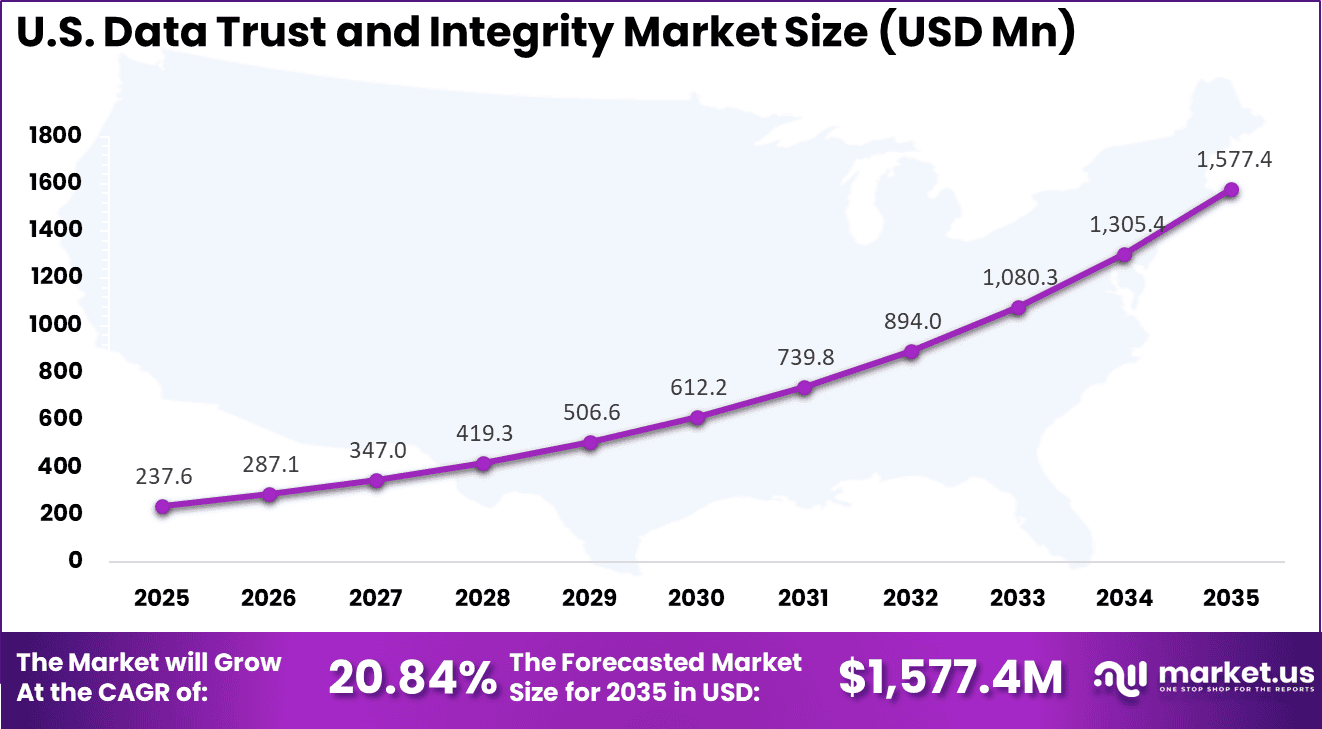

- In 2025, the US Data Trust and Integrity Market was valued at USD 237.6 million and recorded a CAGR of 20.84%, reflecting rapid investment in governance technologies.

- In 2025, North America held more than 42.1% of the Global Data Trust and Integrity Market, supported by mature compliance frameworks and advanced digital infrastructure.

Key Data Trust and Integrity Statistics

- Around 64% of organizations identify data quality as the primary obstacle affecting overall data integrity.

- Data governance concerns rose sharply, with an 89% increase in priority between 2023 and 2024.

- Nearly 49% of organizations report lacking adequate tools to automate data quality processes.

- About 45% struggle with inconsistent data definitions and formats across systems.

- Approximately 43% cite overwhelming data volume as a major challenge to maintaining integrity.

- Poor data quality results in average annual losses of USD 12.9 million per organization, driven by financial errors, missed revenue opportunities, and customer dissatisfaction.

- Data professionals spend 25% or more of their working time preparing and cleaning data instead of focusing on analysis and strategic tasks.

- Adoption of strong data quality practices can improve employee productivity by up to 20%, reflecting measurable operational benefits.

- Organizations with active governance programs report a 60% improvement in data quality and a 57% improvement in analytics quality.

- Close to 60% of organizations now operate an ongoing data governance program, reflecting broader strategic commitment to integrity management.

Report Overview

The data trust and integrity market focuses on technologies that ensure data accuracy, consistency, lineage, and reliability across enterprise systems. These solutions help organizations verify that data remains complete and unaltered throughout its lifecycle. As businesses rely more on analytics, automation, and AI, confidence in underlying data has become critical. Data trust frameworks are therefore treated as a foundation for digital decision making.

A primary driver of the data trust and integrity market is the increasing volume and complexity of organisational data. As data flows through multiple systems, applications, and cloud environments, the risk of errors, inconsistency, and unauthorized modification grows. Data trust and integrity solutions provide automated validation, reconciliation, and lineage tracking so that stakeholders can confidently rely on the data they consume.

Demand for data trust and integrity solutions is strongest among enterprises operating analytics at scale. Financial services, healthcare, energy, and digital platforms depend on high confidence data for daily operations. These organizations experience frequent data changes that must be validated continuously. Trust solutions help maintain reliability without slowing innovation.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising enterprise demand for trustworthy AI and analytics outputs +5.4% North America, Europe Short to medium term Increasing regulatory focus on data governance and accountability +4.6% Europe, North America Medium term Expansion of cloud-based data sharing ecosystems +4.1% Global Medium term Growing incidents of data manipulation and misinformation +3.8% Global Short term Adoption of zero-trust architecture and data validation frameworks +3.4% North America, Asia Pacific Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Complexity of implementing enterprise-wide data governance -3.8% Global Short to medium term High integration costs across multi-cloud environments -3.3% North America, Europe Medium term Limited awareness among mid-sized organizations -2.9% Asia Pacific, Latin America Medium term Fragmented data standards across industries -2.5% Global Medium term Shortage of skilled data governance professionals -2.1% Global Medium to long term By Component

Software and solution based offerings accounted for 78.3% of adoption, reflecting enterprise preference for scalable and configurable platforms that integrate directly into existing data ecosystems. These solutions continuously assess data accuracy, completeness, consistency, and lineage across multiple systems. Centralized dashboards provide a unified view of data health, reducing the need for manual verification. This approach simplifies governance while improving operational efficiency.

Software based platforms allow rules and validation logic to be updated as data usage and regulatory requirements evolve. Organizations benefit from long term flexibility without rebuilding infrastructure. Automated scoring and validation features further enhance value by quantifying data trust levels. As data volumes and complexity increase, software centric solutions continue to dominate.

Advanced analytics within these platforms support proactive issue detection rather than reactive correction. Data teams can prioritize remediation based on risk and impact. This improves resource allocation and reduces downstream disruption. Software solutions therefore remain the backbone of the data trust and integrity market.

For Instance, in January 2026, Collibra launched Collibra AI Governance. This new software product helps organizations manage trusted AI data with automated governance features, making it easier to ensure data quality and compliance in complex environments. It strengthens software dominance by addressing AI-driven integrity needs head-on.

By Deployment Mode

Cloud based deployment represented 71.6% of usage, driven by the need for scalable, real time monitoring across distributed data environments. Cloud platforms enable continuous integrity checks without disrupting live data operations. Organizations benefit from faster implementation and the ability to scale monitoring as data grows. This aligns with cloud first enterprise data strategies.

Cloud delivery supports always on validation and instant alerting when integrity thresholds are breached. Data teams can respond quickly before errors affect analytics or customer outcomes. Centralized access also supports collaboration across teams and regions. These capabilities improve response speed and governance consistency.

Security maturity in cloud environments has strengthened enterprise confidence in this deployment model. Encryption, access controls, and compliance certifications protect sensitive data assets. As a result, cloud based deployment has become widely accepted across regulated industries.

For instance, in November 2024, Precisely advanced its Data Integrity Suite for cloud with new connectors and AI intelligence. The hybrid agents and workflow tools make cloud deployments more efficient for large-scale management. This update drives cloud growth by enabling seamless observability and trust.

By Organization Size

Large enterprises accounted for 83.4% of adoption due to their complex data operations and higher exposure to data related risk. These organizations manage vast volumes of data across departments, geographies, and digital channels. Data trust failures can impact financial reporting, regulatory compliance, and customer decisions. Formal integrity controls are therefore essential.

Large enterprises also operate under stricter regulatory scrutiny and internal governance standards. Continuous monitoring supports compliance consistency and audit readiness. Standardized trust metrics help align data quality expectations across business units. This strengthens overall data governance.

Greater investment capacity enables adoption of advanced trust and integrity platforms. Large organizations often integrate these tools with analytics, AI, and governance systems. This reinforces their leading role in market adoption.

For Instance, in July 2025, Alation was named a Leader in the Forrester Wave for Data Governance Solutions. Its agentic AI platform automates governance for enterprises, earning top strategy scores. Large firms benefit from federated workflows that embed trust into operations at scale.

By Application

Data quality monitoring and scoring accounted for 42.8% of usage, highlighting the importance of measurable and transparent data reliability. Scoring frameworks assign trust levels based on accuracy, completeness, timeliness, and consistency. This allows organizations to understand data health at a granular level. Trust scores also support governance and decision prioritization.

Automated monitoring detects quality issues early in data pipelines before they affect reporting or AI models. Response teams can intervene quickly to correct root causes. This reduces operational risk and improves confidence in insights. Consistent scoring also supports accountability across data owners.

As analytics and AI adoption expands, organizations require reliable inputs to avoid flawed outcomes. Data quality scoring provides a standardized and repeatable validation method. This continues to drive strong adoption in this application area.

For Instance, in November 2025, SAS launched Data Maker in Microsoft Marketplace. This synthetic data generator tackles scarcity for AI, with validation ensuring quality scores match real data. It accelerates monitoring by providing trustworthy datasets for model training and insights.

By End User Industry

Banking, financial services, and insurance accounted for 52.6% of adoption due to their dependence on accurate, traceable, and compliant data. Financial decisions, risk assessments, and regulatory reporting rely heavily on trusted data. Integrity failures can result in financial loss and reputational damage. Strong trust controls are therefore critical. Regulatory oversight in BFSI requires demonstrable data governance and transparency.

Trust and integrity platforms support lineage tracking and audit documentation. This reduces compliance risk and improves regulator confidence. Automated controls also lower manual governance effort. Ongoing digital transformation has increased data complexity within BFSI organizations. Continuous trust monitoring helps manage this scale effectively. The sector remains the leading end user industry.

Regional Analysis

North America accounted for 42.1% of market adoption, supported by advanced data governance practices and cloud maturity. Enterprises in the region prioritize data reliability for analytics and AI. Strong regulatory frameworks further support adoption.

For instance, in October 2025, IBM was named a Leader in the 2025 IDC MarketScape for Worldwide Data Integration Software Platforms. IBM Watsonx.data integration delivers AI-powered capabilities for trusted data across hybrid environments, combating silos and ensuring reliable AI outcomes. This recognition reinforces North America’s dominance in data integrity solutions.

The United States leads regional activity with a market value of USD 237.6 Mn and a CAGR of 20.84%. Large enterprises and financial institutions are key contributors. Investment in data governance and trust technologies remains strong.

Ongoing innovation continues to reinforce regional leadership. Integration with analytics and AI platforms has improved effectiveness. As data driven decision making expands, data trust and integrity remain critical capabilities.

For instance, in June 2025, Precisely launched AI-powered enhancements to its Data Integrity Suite, introducing automated data quality, observability, governance, and location intelligence. These advancements enable enterprises to build trustworthy data foundations for AI and analytics at scale. Precisely’s innovations solidify U.S. leadership in data trust technologies.

Increasing Adoption Technologies

Cryptographic validation and hashing technologies are increasingly adopted to protect data integrity. These techniques detect unauthorized changes and ensure immutability where required. They are especially important in audit sensitive and regulated environments. Technology adoption strengthens tamper resistance. Metadata driven lineage and validation technologies are also widely adopted. These tools track data origin, movement, and transformation logic across systems.

Lineage enables verification of data authenticity and consistency. This visibility supports both trust and accountability. Automation and continuous validation technologies further support adoption. Automated checks run continuously rather than periodically. This reduces reliance on manual intervention and improves detection speed. Continuous validation aligns with real time data usage.

Organizations adopt data trust and integrity technologies to reduce business risk caused by incorrect data. Errors discovered late are costly to fix and difficult to trace. Early detection prevents downstream impact. This proactive protection improves operational stability. Another reason is consistency across teams and systems. Different teams often interpret or modify data differently. Trust frameworks enforce shared definitions and controls. This alignment reduces internal disputes and confusion.

Investment and Business Benefits

Investment opportunities in this market exist in platforms that unify data trust, integrity, and governance capabilities. Organizations prefer consolidated solutions over fragmented tools. Unified platforms reduce complexity and improve adoption. This convergence supports long term platform value. There are also opportunities in industry specific trust solutions.

Regulated sectors have unique integrity requirements. Tailored solutions deliver higher relevance and accuracy. Specialization creates defensible market positions. Another investment area is trust frameworks designed for AI and analytics pipelines. Ensuring training and inference data integrity is increasingly important. Platforms that address this need attract strong interest. AI driven demand strengthens investment appeal.

For organizations, data trust and integrity solutions improve confidence in analytics and reporting. Reliable data reduces rework and corrective actions. Teams spend less time questioning data and more time using it. Productivity improves across functions. From a financial perspective, strong data integrity reduces costly errors and compliance issues. Preventing incorrect reporting avoids penalties and reputational damage. Over time, preventive controls deliver measurable savings. The return on investment increases as data dependency grows.

Emerging Trends Analysis

An emerging trend in the data trust and integrity market is the integration of continuous monitoring and observability. Instead of periodic audits, organisations are adopting systems that continuously assess data quality, schema changes, and unexpected data shifts. Continuous observability improves early detection of integrity issues and supports proactive remediation before business processes are affected.

Another trend is the use of explainable trust metrics and dashboards that present trust scores alongside key performance indicators. This approach helps business stakeholders understand data reliability in context, rather than through technical metrics alone. Trust scores become part of decision-making workflows.

Growth Factors Analysis

One of the key growth factors for the data trust and integrity market is rising adoption of AI and automated decision systems. These systems amplify the consequences of poor data quality. Ensuring trustworthy and accurate data becomes a prerequisite for safe and responsible automation. The structural link between automation and data integrity drives sustained demand.

Another growth factor is the cost of data failures. Inaccurate data can lead to flawed strategic decisions, compliance breaches, customer dissatisfaction, and financial losses. Organisations recognise that investing in data integrity tools can prevent costly missteps. This economic motivation supports expanded adoption and integration within enterprise data environments.

Opportunity Analysis

A significant opportunity in the data trust and integrity market lies in coupling integrity controls with advanced analytics and machine learning workflows. Data scientists and AI systems depend on reliable input data; poor data quality undermines model accuracy and business outcomes. Integrating trust and integrity checks upstream in analytics pipelines improves model performance and reduces error propagation.

Another opportunity is extension of trust frameworks to emerging technologies such as blockchain and decentralised identity systems. These technologies inherently support data provenance and tamper resistance. Data trust solutions that integrate with decentralised frameworks can deliver stronger assurances in supply chain data, cross-enterprise transactions, and shared data ecosystems.

Challenge Analysis

A major challenge for the data trust and integrity market is balancing strict controls with performance and agility. Overly rigid validation and governance rules can slow data flows and reduce flexibility for analytics or operational teams. Designing controls that enforce integrity while preserving performance requires careful trade-offs and continuous refinement.

Another challenge is organisational alignment. Data trust and integrity programmes require collaboration across IT, security, legal, compliance, and business units. Ensuring consistent policies and clear accountability can be difficult in siloed structures. Cultural resistance to change can stall progress.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Data Quality Monitoring and Scoring

- Data Lineage and Provenance

- Metadata Management and Cataloging

- Audit and Compliance Reporting

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare

- Government and Public Sector

- Retail and E-commerce

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Data governance and catalog leaders such as Collibra, Informatica, and Alation play a central role in the data trust and integrity market. Their platforms provide metadata management, lineage tracking, and policy enforcement. These capabilities help organizations improve transparency and accountability across data assets. Precisely and Talend strengthen data accuracy and reliability. Demand is driven by increased reliance on analytics and AI-driven decision making.

Enterprise software and analytics providers such as IBM, Oracle, and SAP integrate trust and integrity controls into core business systems. Microsoft, Amazon Web Services, and Google embed governance and monitoring features within cloud environments. SAS Institute enhances integrity through advanced validation and statistical controls. Adoption is strong in regulated industries such as finance and healthcare.

Data quality and identity-focused providers such as Ataccama and Experian address accuracy, completeness, and consistency challenges. These vendors emphasize automated rule enforcement and anomaly detection. Other emerging providers expand specialized integrity solutions across hybrid data environments. This competitive landscape supports continuous improvement in data reliability, governance, and enterprise-wide trust frameworks.

Top Key Players in the Market

- Collibra

- Informatica

- Alation

- IBM

- Precisely

- Talend

- Ataccama

- SAS Institute

- Experian

- Oracle

- SAP

- Microsoft

- Amazon Web Services

- world

- Others

Recent Developments

- In June 2025, Precisely supercharged the Data Integrity Suite with AI-powered quality checks and governance upgrades. New features spot anomalies and enrich location data, bridging the AI readiness gap for hybrid setups. Practical stuff that actually moves the needle on decision confidence.

- In October 2025, Informatica rolled out its Fall 2025 release for Intelligent Data Management Cloud, introducing unstructured data governance and multi-agent system modeling in CDGC. New AI governance scans Google Vertex AI inventories, letting teams curate GenAI content and enforce policies across AI lifecycles.

Report Scope

Report Features Description Market Value (2025) USD 621.2 Mn Forecast Revenue (2035) USD 4,650.5 Mn CAGR(2026-2035) 22.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Lineage and Provenance, Data Quality Monitoring and Scoring, Metadata Management and Cataloging, Audit and Compliance Reporting, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Government and Public Sector, Retail and E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Collibra, Informatica, Alation, IBM, Precisely, Talend, Ataccama, SAS Institute, Experian, Oracle, SAP, Microsoft, Amazon Web Services, Google, data.world, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Trust and Integrity MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Trust and Integrity MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Collibra

- Informatica

- Alation

- IBM

- Precisely

- Talend

- Ataccama

- SAS Institute

- Experian

- Oracle

- SAP

- Microsoft

- Amazon Web Services

- world

- Others