Global Data Security Observability Market By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Access and User Behavior Monitoring, Data Classification and Sensitive Data Discovery,Others), By End-User Industry (Banking, Financial Services, and Insurance, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177748

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Driver Impact Analysis

- Restraints Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User Industry

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

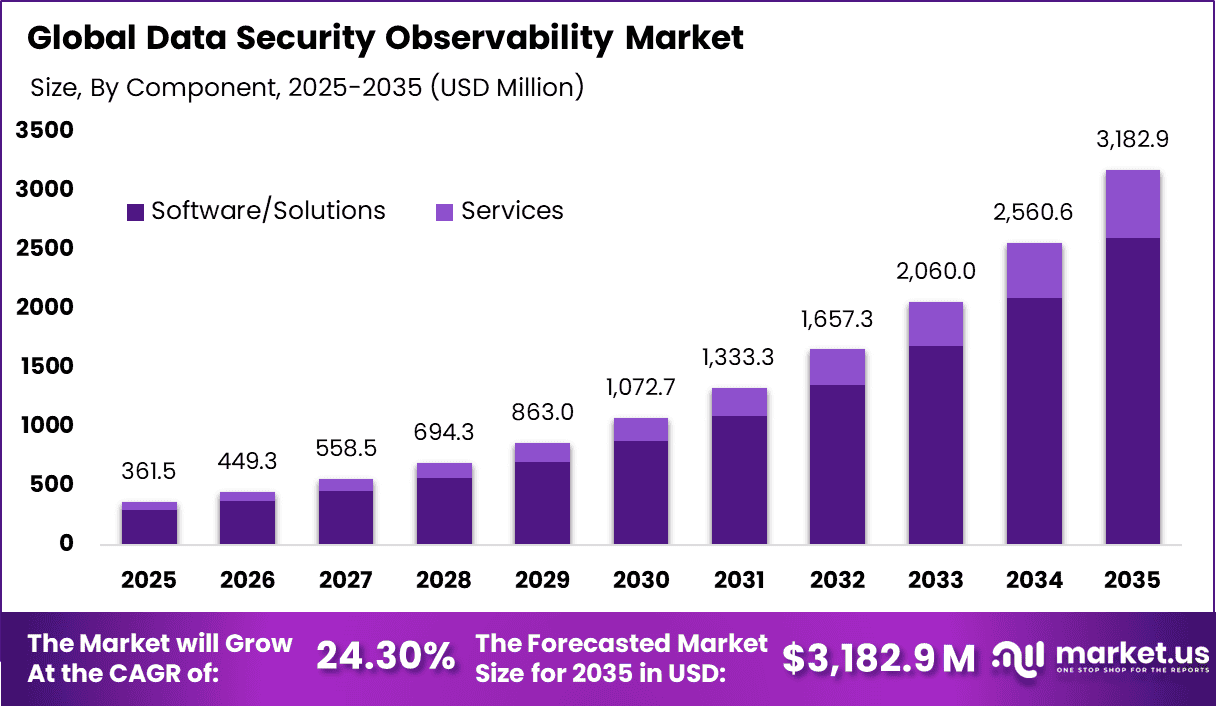

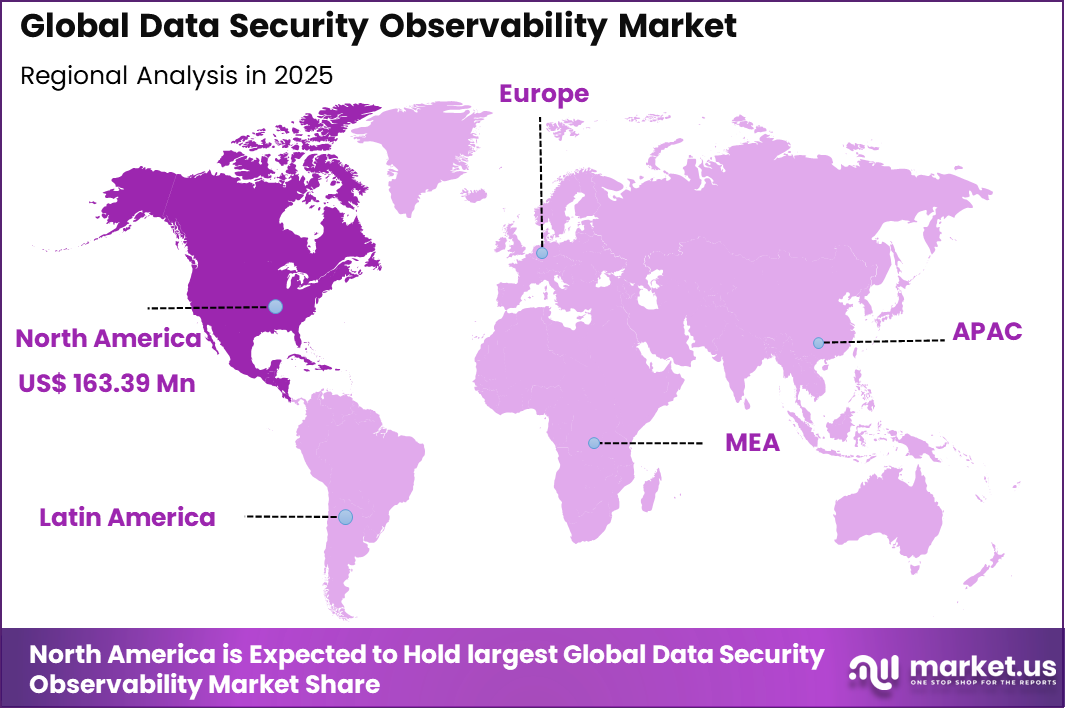

The Global Data Security Observability Market generated USD 361.5 million in 2025 and is predicted to register growth from USD 449.3 million in 2026 to about USD 3,182.9 million by 2035, recording a CAGR of 24.30% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 45.2% share, holding USD 163.39 Million revenue.

The Data Security Observability Market refers to technologies and solutions that enable organizations to monitor, analyze, and understand the behavior of data assets in real time. These solutions collect signals from data systems, security tools, and application activity to provide visibility into threats, vulnerabilities, and anomalous behavior. Observability focuses on deriving insights from logs, metrics, and traces related to data access and usage. As data volumes and complexity grow, observability has become a foundational requirement for effective security operations.

The market has expanded in response to the increasing frequency and sophistication of cyber threats targeting sensitive data. Traditional security monitoring methods are often insufficient to detect subtle or emerging risks across distributed environments. Data security observability solutions provide a structured approach to correlating diverse security signals and generating actionable insights. Consequently, organizations use observability to strengthen their security posture, reduce risk exposure, and support compliance with internal policies and external regulations.

One major driving factor for the Data Security Observability Market is the escalation of data breaches and cyberattacks across industries. High profile incidents have made clear the limitations of traditional perimeter based security methods. Organizations are deploying observability tools to gain comprehensive insights into data flows and security events. Continuous monitoring enables earlier detection of suspicious activity and supports faster incident response.

Demand for data security observability solutions is most pronounced among enterprises with large data estates and complex IT infrastructures. Sectors such as financial services, healthcare, telecommunications, and government exhibit strong demand due to the critical nature of their data and stringent regulatory requirements. These organizations often need real time visibility to maintain operational stability and detect threats before they escalate.

Top Market Takeaways

- By component, software/solutions account for 81.7% of the market, unifying logs, telemetry, and security analytics into a single observability layer.

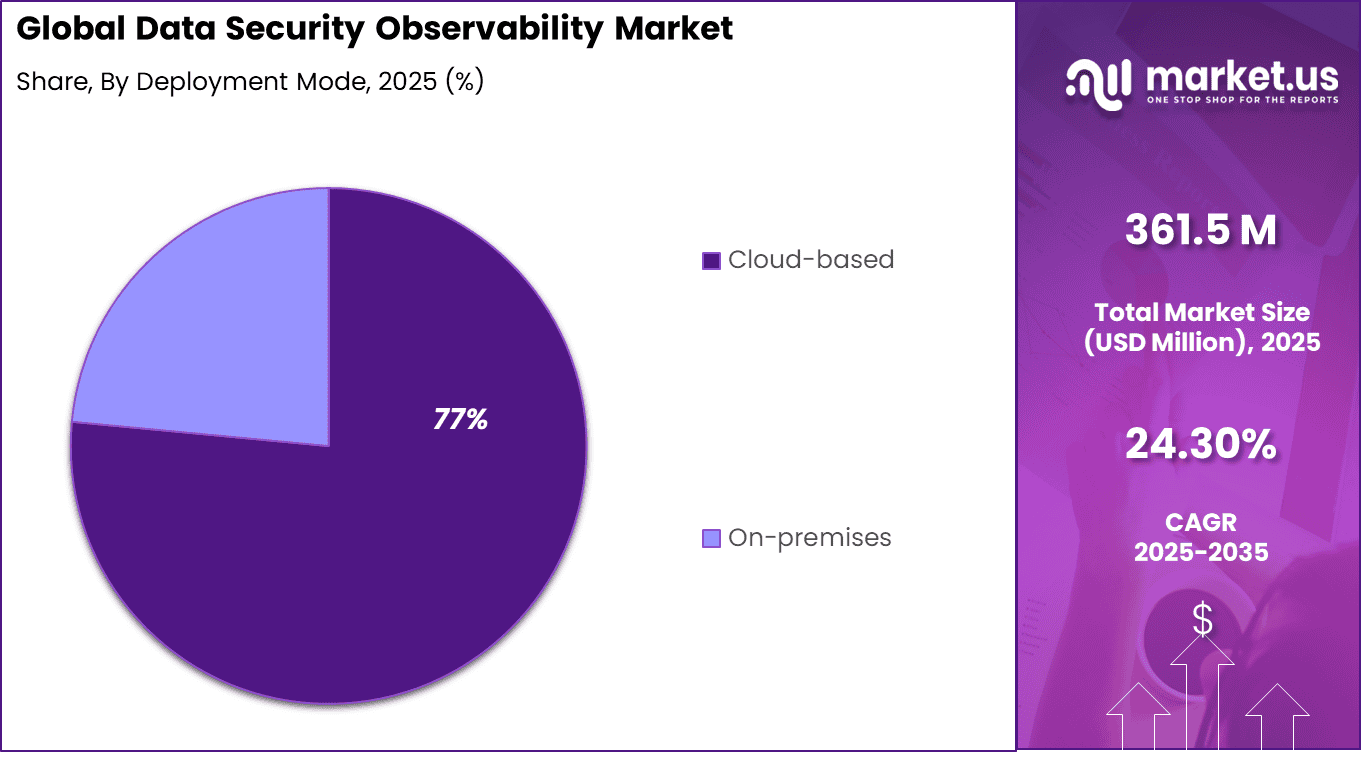

- By deployment mode, cloud-based models represent 76.5%, ideal for monitoring distributed hybrid data estates and evolving applications.

- By organization size, large enterprises hold 84.3% share, prioritizing continuous observability for complex environments and audits.

- By application, data access and user behavior monitoring captures 47.2%, detecting abnormal patterns, insider threats, and policy violations.

- By end-user industry, banking, financial services, and insurance (BFSI) account for 52.8%, relying on compliant data for risk, fraud, and regulations.

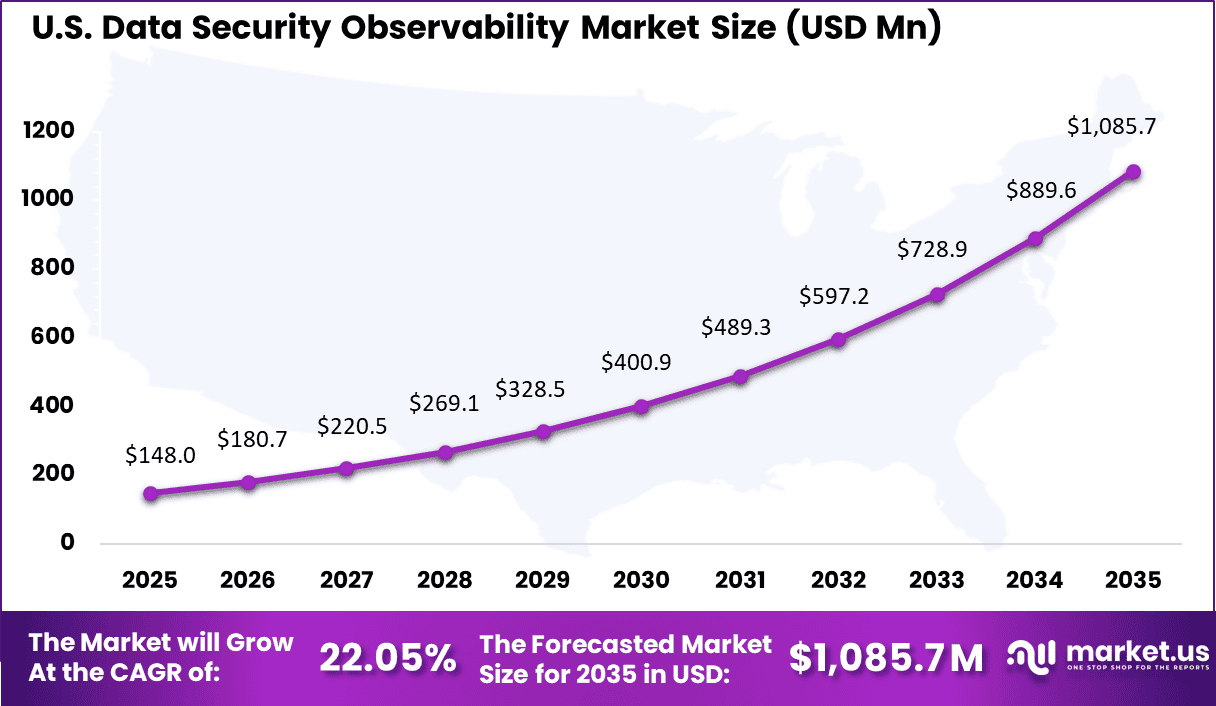

- By region, North America leads with 45.2% of the global market, with the U.S. valued at USD 148.03 million and a projected CAGR of 22.05%.

Key Insights Summary

- Data security ranks as the second highest enterprise priority in 2024 at 43%, closely aligned with broader observability and monitoring investments.

- 82% of organizations report that their Mean Time to Repair for production incidents exceeds one hour, compared with 74% in the previous year, indicating rising system complexity and slower incident resolution.

- 84% of enterprises now integrate security and data operations within a unified analytics platform, reflecting a shift toward consolidated observability environments.

- 40% of organizations plan to reduce security infrastructure spending by consolidating tools, aiming to improve operational efficiency and reduce overlap.

- 63% of security professionals report increasing reliance on log data for anomaly detection, compared with 35% among general observability users, highlighting the growing role of log analytics in threat monitoring and incident response.

Driver Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising complexity of multi-cloud and hybrid IT environments +6.1% North America, Europe Short to medium term Increasing frequency of data breaches and insider threats +5.4% Global Short term Expansion of zero-trust security architecture adoption +4.8% North America, Europe Medium term Growing regulatory mandates for continuous data monitoring +4.2% Europe, North America Medium term Rapid enterprise adoption of AI-driven threat analytics +3.7% Global Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High implementation and integration costs -4.2% Emerging Markets Short to medium term Data fragmentation across security and IT tools -3.6% Global Medium term Shortage of cybersecurity and data observability expertise -3.1% Global Medium term Alert fatigue and false positive management challenges -2.7% North America, Europe Medium term Evolving privacy regulations complicating monitoring scope -2.3% Europe Medium to long term By Component

Software and solutions account for 81.7% of the data security observability market. Organizations require centralized platforms that provide continuous visibility into data access, movement, and exposure risks. These solutions monitor structured and unstructured data across databases, cloud storage, and analytics environments.

Automated alerts and policy enforcement mechanisms help identify vulnerabilities before they escalate into breaches. As data ecosystems become more complex, reliance on advanced security observability software continues to increase. Modern platforms integrate with identity management systems and security information frameworks.

This enables correlation between user activity and data access patterns. Real-time dashboards provide actionable insights for security teams and compliance officers. Automation reduces manual monitoring efforts and improves response time to incidents. The growing need for proactive data risk management explains the dominant share of software solutions.

By Deployment Mode

Cloud-based deployment represents 76.5% of the market, reflecting the rapid migration of enterprise data to cloud platforms. As organizations expand multi-cloud and hybrid infrastructures, visibility into cloud data environments becomes critical. Cloud-based observability tools offer scalable monitoring across distributed workloads. Continuous tracking of permissions, configurations, and data flows strengthens security posture. This supports compliance and operational resilience.

Cloud deployments also provide centralized oversight without heavy infrastructure investment. Security teams can monitor access patterns and anomalies across global operations in real time. Automated configuration checks help detect misconfigurations that could expose sensitive information. Integration with cloud-native security controls enhances overall governance. These advantages drive strong adoption of cloud-based observability solutions.

By Organization Size

Large enterprises hold 84.3% of the data security observability market. These organizations manage extensive datasets across multiple departments and geographic regions. Ensuring consistent visibility into who accesses what data is essential for reducing internal and external risks. Observability platforms provide enterprise-wide monitoring and audit capabilities. This strengthens governance and minimizes compliance gaps.

Enterprise-scale operations require automated risk assessment and reporting tools. Manual oversight is insufficient given the volume of data transactions. Observability systems help detect abnormal user behavior and privilege misuse. Integration with enterprise risk management frameworks improves accountability. The scale and regulatory exposure of large enterprises explain their leading share.

By Application

Data access and user behavior monitoring account for 47.2% of market share. Organizations increasingly focus on understanding how employees, contractors, and systems interact with sensitive data. Monitoring tools track login activity, permission changes, and unusual access patterns. This proactive visibility reduces insider threats and accidental data exposure. Continuous tracking supports rapid incident detection and response.

Behavior analytics capabilities strengthen anomaly detection by identifying deviations from normal usage patterns. Automated alerts help security teams investigate potential risks before significant damage occurs. These systems also generate audit trails required for compliance verification. As insider threat concerns grow, adoption of user behavior monitoring continues to expand. This application remains central to data security observability strategies.

By End User Industry

The Banking, Financial Services, and Insurance sector accounts for 52.8% of the market. Financial institutions manage highly sensitive customer and transactional data. Strict regulatory frameworks require comprehensive monitoring and reporting of data access. Observability platforms provide detailed logs and real-time risk assessments. This strengthens compliance and protects institutional reputation.

Financial organizations also face elevated cyber threat exposure. Continuous visibility into access patterns supports early detection of fraudulent or unauthorized activity. Automated compliance reporting reduces audit preparation time. Integration with fraud prevention and risk analytics systems enhances overall security posture. The sector’s heavy regulatory obligations and risk sensitivity drive strong adoption.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Data security and observability platform providers Very High Medium North America, Europe Strong SaaS scalability Cybersecurity vendors expanding into data monitoring High Medium Global Cross-sell and integration growth Cloud infrastructure providers Medium Low to Medium Global Embedded observability services Private equity firms Medium Medium North America, Europe Consolidation of niche platforms Venture capital investors Very High High North America Innovation in AI-native observability Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Real-time data activity monitoring and classification tools +6.5% Continuous threat visibility Global Short to medium term AI-based anomaly detection and behavioral analytics +5.7% Insider and advanced threat detection North America, Europe Medium term Cloud-native observability platforms +4.9% Scalable data security monitoring Global Medium term Integration with SIEM, SOAR, and zero-trust frameworks +4.1% Unified security orchestration Global Medium to long term Automated compliance reporting and risk scoring dashboards +3.4% Regulatory transparency Europe, North America Long term Emerging Trends

The Data Security Observability market is evolving with the integration of continuous monitoring frameworks across hybrid and multi-cloud environments. Organizations are increasingly adopting platforms that provide real-time visibility into data access patterns, configuration risks, and anomalous behavior across structured and unstructured data assets.

This trend reflects a broader shift from reactive security models toward proactive detection and prevention strategies. Continuous observability is being embedded directly into data pipelines to ensure that security controls remain aligned with dynamic cloud workloads. Another emerging trend is the convergence of data security observability with artificial intelligence and behavioral analytics.

Machine learning models are being deployed to identify unusual data movement, privilege misuse, and insider threats that traditional rule-based systems may overlook. These intelligent monitoring capabilities enhance the ability to detect subtle vulnerabilities and policy violations in large-scale data environments. As enterprises increase investments in AI-driven analytics, observability solutions are becoming more adaptive and predictive.

Growth Factors

A core growth driver in this market is the increasing volume and diversity of enterprise data, which expands the surface area that must be secured and understood. As data moves across clouds, applications, and analytics platforms, traditional security approaches struggle to maintain consistent visibility, making observability a necessary capability to spot gaps and anomalies. This helps organisations protect sensitive information and preserve customer trust in daily operations.

Another key driver is the rising expectation from regulators and stakeholders for demonstrable data governance and accountability. Organisations are seeking observability tools that not only detect risks but also provide audit trails and context that support compliance reporting and responsible stewardship of data assets. Together, these factors are strengthening the adoption of systematic observability practices that enhance both security posture and organisational resilience.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Data Access and User Behavior Monitoring

- Data Classification and Sensitive Data Discovery

- Threat Detection and Anomaly Analysis

- Compliance Audit and Reporting

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare

- Technology and Telecommunications

- Government and Public Sector

- Others

Regional Analysis

North America accounts for 45.2% of the data security observability market, supported by advanced cybersecurity infrastructure and high cloud adoption across enterprises. Organizations in the region are investing in observability platforms to gain real-time visibility into data flows, access patterns, and potential security gaps across hybrid and multi-cloud environments. Demand is driven by increasing data breaches, stricter privacy regulations, and the need to monitor sensitive data movement across distributed systems.

The United States market is valued at USD 148.03 Mn and is growing at a CAGR of 22.05%, reflecting rapid adoption of proactive data monitoring solutions. Adoption is influenced by rising ransomware threats, insider risk concerns, and expanding use of cloud-native applications. Growth is further supported by integration of observability tools with security operations centers, enabling faster threat detection, improved compliance reporting, and stronger enterprise data governance frameworks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Data-centric security and threat analytics providers such as Varonis and Exabeam play a central role in the data security observability market. Splunk strengthens real-time log analysis and threat detection capabilities. These platforms provide visibility into data access patterns, insider risks, and anomalous behavior. Demand is driven by rising ransomware attacks and stricter data protection regulations.

Cloud and enterprise technology providers such as IBM, Microsoft, Google, and Amazon Web Services embed observability into cloud-native security frameworks. These vendors integrate monitoring, encryption, and compliance controls across hybrid environments. Adoption is strong among large enterprises undergoing cloud transformation.

Cybersecurity platform vendors such as CrowdStrike, SentinelOne, Palo Alto Networks, Forcepoint, McAfee, Rapid7, Qualys, and Tenable enhance proactive risk detection and continuous monitoring. Other vendors expand innovation and regional presence, supporting steady growth in data security observability solutions globally.

Top Key Players in the Market

- Varonis

- Exabeam

- Splunk

- IBM

- Microsoft

- Amazon Web Services

- CrowdStrike

- SentinelOne

- Palo Alto Networks

- Forcepoint

- McAfee

- Rapid7

- Qualys

- Tenable

- Others

Future Outlook

The future outlook for the Data Security Observability Market is positive as organizations increasingly focus on protecting sensitive data and improving threat detection. Demand for data security observability solutions is expected to grow because these systems help monitor, analyze, and respond to security events in real time.

Adoption of advanced analytics, automation, and integration with broader security tools will enhance visibility and reduce risk. Growth can be attributed to rising cyber threats, stricter data protection requirements, and the need for proactive security measures. Overall, the market is expected to expand as businesses prioritize comprehensive data security and observability capabilities.

Recent Developments

- In Q1 2026: Splunk added AI agent monitoring, tracing LLM workflows, token costs, and Cisco AI Defense integration for PII leaks/prompt risks in Observability Cloud.

- In September 2025: CrowdStrike acquired Pangea ($260M) for AI Detection/Response, extending Falcon to runtime AI security like data leakage blocks.

Report Scope

Report Features Description Market Value (2025) USD 361.5 Million Forecast Revenue (2035) USD 3,182.9 Million CAGR(2025-2035) 24.30% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Access and User Behavior Monitoring, Data Classification and Sensitive Data Discovery,Others), By End-User Industry (Banking, Financial Services, and Insurance, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Varonis, Exabeam, Splunk, IBM, Microsoft, Google, Amazon Web Services, CrowdStrike, SentinelOne, Palo Alto Networks, Forcepoint, McAfee, Rapid7, Qualys, Tenable, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Security Observability MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Security Observability MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Varonis

- Exabeam

- Splunk

- IBM

- Microsoft

- Amazon Web Services

- CrowdStrike

- SentinelOne

- Palo Alto Networks

- Forcepoint

- McAfee

- Rapid7

- Qualys

- Tenable

- Others