Global Data Pipeline Monitoring Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Pipeline Performance & Health Monitoring, Data Quality & Drift Detection, Cost & Resource Optimization, End-to-End Lineage Tracking, Others), By End-User Industry (IT & Technology, BFSI, Retail & E-commerce, Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175868

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- U.S. Data Pipeline Monitoring Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- End-User Industry Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

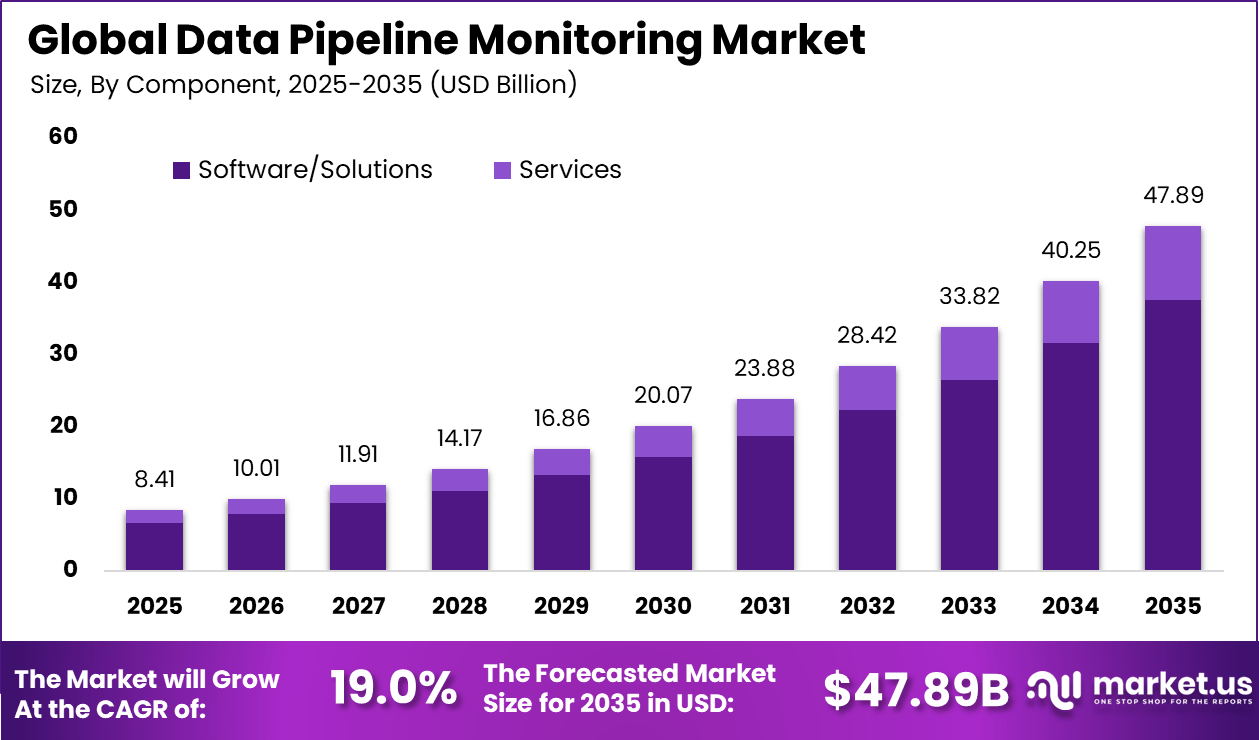

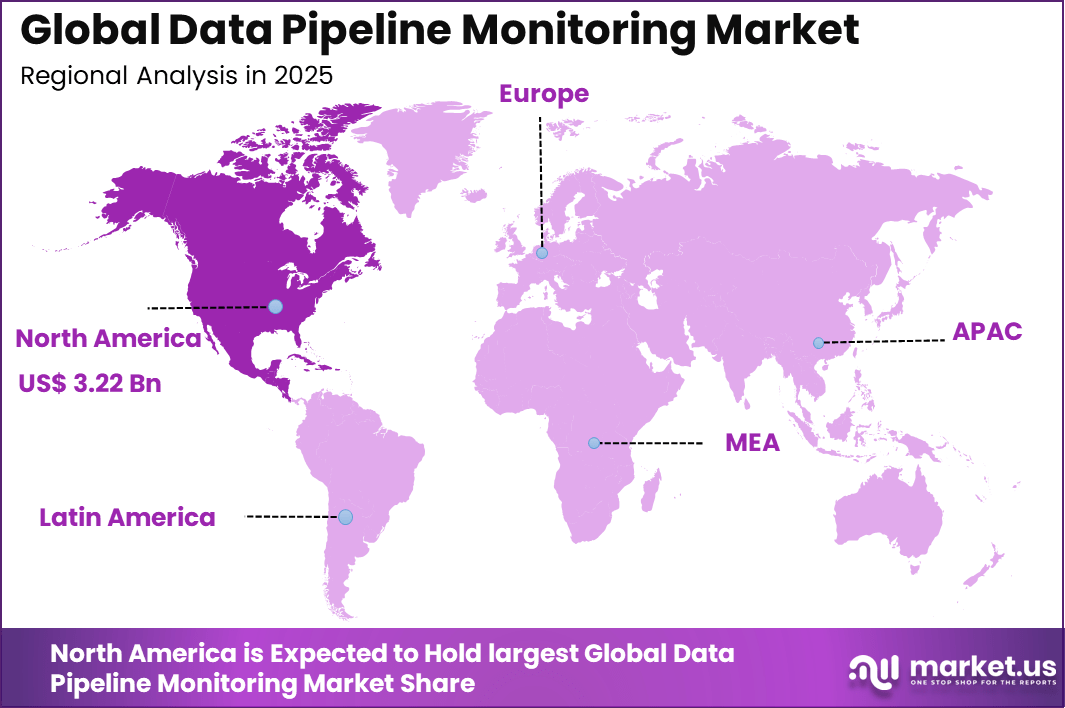

The Global Data Pipeline Monitoring Market was valued at USD 8.41 billion in 2025 and is projected to expand rapidly to approximately USD 47.89 billion by 2035, registering a strong CAGR of 19.0% over the forecast period. North America dominated the market in 2025, capturing more than 38.4% share and generating USD 3.22 billion in revenue, reflecting rising enterprise dependence on real-time data reliability, observability, and automated monitoring solutions.

The Data Pipeline Monitoring Market refers to the ecosystem of tools, software, and services that oversee the movement of data through its lifecycle from source to destination while ensuring reliability, accuracy, and performance. Data pipeline monitoring practices involve tracking the flow of data across ingestion, transformation, and delivery stages to detect issues such as delays, errors, or data loss before they impact business processes.

One major factor propelling growth in the data pipeline monitoring market is the steep increase in enterprise data volumes generated from digital, operational, and automated systems. As organizations accumulate and process vast amounts of structured and unstructured data, the ability to ensure consistent flow and reliable integration becomes more challenging. Monitoring systems help identify disruptions and maintain data quality, which is necessary to support analytical insight and decision making.

Cloud native architectures now dominate modern data platforms, with 71% of deployments running in cloud environments and delivering up to 3.7x return on investment. The shift from batch to real time processing is driving 26% of market growth, as streaming analytics expand the market from USD 27.6 billion to USD 147.5 billion by 2031.

Data quality issues affect nearly 31% of enterprise revenue, with organizations facing 67 incidents per month that take around 15 hours to resolve. AI adoption has reached 88%, delivering up to 10x productivity gains, while 84% of organizations use Kubernetes to manage scalable data pipelines. Small data teams are relying on automation to handle pipelines expected to become 3 to 4x more complex by 2030.

Demand for data pipeline monitoring tools and services has risen as organizations prioritize data reliability, operational transparency, and regulatory compliance. In sectors such as financial services, healthcare, and e-commerce, real-time decision making relies on accurate and continuous data flow, making proactive monitoring essential to business operations. Data teams seek solutions that prevent silent failures or inconsistency in analytical outputs, as these can lead to flawed insights and operational missteps.

For instance, in November 2025, Splunk Observability added navigator tools and AI dashboard support, making pipeline monitoring sharper for hybrid environments. It’s gaining traction with teams needing quick visibility into data health amid rising complexity.

Key Takeaway

- In 2025, the software and solutions segment led the global data pipeline monitoring market with a 78.5% share, reflecting strong demand for platforms that ensure pipeline reliability and performance.

- The cloud based deployment model dominated with an 86.3% share, supported by scalability, ease of integration, and real time monitoring capabilities.

- Large enterprises accounted for 73.9% of market share in 2025, driven by complex data environments and higher requirements for governance and monitoring.

- Data quality and drift detection emerged as the leading application segment with a 41.7% share, as organizations focused on maintaining accuracy and consistency across data pipelines.

- The IT and technology sector held a dominant 52.6% share, reflecting heavy reliance on continuous data flows to support digital services and analytics.

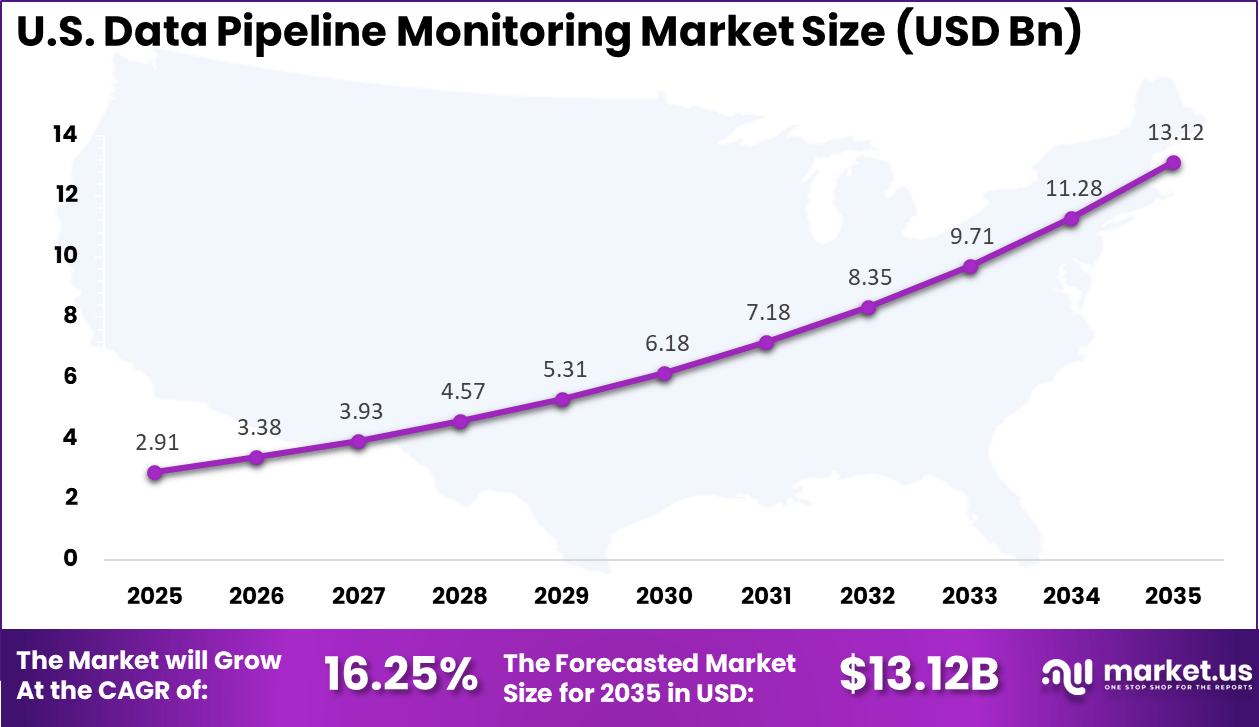

- The US data pipeline monitoring market was valued at USD 2.91 billion in 2025 and is growing at a 16.25% CAGR, supported by strong adoption of cloud and data driven technologies.

- North America led the global market in 2025 with more than 38.4% share, backed by advanced data infrastructure and early adoption of monitoring solutions.

Drivers Impact Analysis

Key Driver Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Rapid growth of cloud data pipelines and real time analytics +4.1% North America, Europe, Asia Pacific Short to medium term Rising complexity of data architectures across enterprises +3.4% Global, strongest in North America Medium term Increased adoption of AI and machine learning workloads +2.8% North America, developed Asia Pacific Medium to long term Growing focus on data reliability and business continuity +2.3% Global Short term Expansion of data driven decision making across industries +1.9% Global Long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact High implementation and integration complexity -2.6% Global Short to medium term Shortage of skilled data engineering professionals -2.1% North America, Europe Medium term Budget constraints among small and mid sized enterprises -1.8% Asia Pacific, Latin America Medium term Fragmented data environments across legacy systems -1.5% Europe and emerging markets Medium to long term Data privacy and compliance concerns -1.2% Europe, North America Long term U.S. Data Pipeline Monitoring Market Size

The market for Data Pipeline Monitoring within the U.S. is growing tremendously and is currently valued at USD 2.91 billion, the market has a projected CAGR of 16.25%. The market grows due to rapid cloud adoption, surging AI and ML demands for reliable data, and strict rules like CCPA pushing quality checks. Enterprises here handle massive volumes from digital shifts, needing real-time alerts to cut downtime and boost analytics.

In 2025, North America held a dominant market position in the Global Data Pipeline Monitoring Market, capturing more than a 38.4% share, holding USD 3.22 billion in revenue. This lead stems from advanced digital infrastructure, rapid cloud and AI adoption, and is home to key vendors like Datadog and Monte Carlo.

Strict regulations such as CCPA and HIPAA demand robust data quality tracking, while tech hubs fuel innovation in observability tools. Enterprises invest heavily in DataOps for reliable pipelines amid massive data growth, securing the region’s top spot.

For instance, in December 2025, Splunk Observability Cloud introduced navigator and dashboard support for AI technologies, enhancing pipeline health monitoring and resource utilization tracking. This development strengthens North American dominance through advanced observability for complex data environments.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity North America Advanced cloud adoption and large scale data operations Very High Mature Europe Regulatory driven data governance and quality focus High Mature Asia Pacific Rapid digital transformation and cloud migration Medium to High Developing Middle East Smart infrastructure and enterprise digitalization Medium Developing Latin America Gradual adoption of analytics platforms Low to Medium Early stage Africa Emerging enterprise data modernization Low Early stage Component Analysis

In 2025, The Software/Solutions segment held a dominant market position, capturing a 78.5% share of the Global Data Pipeline Monitoring Market. This dominance is due to organizations increasingly relying on specialized tools to keep data flowing smoothly and reliably. Software solutions help teams track data as it moves through ingestion, transformation, and storage layers, ensuring integrity and catching issues early before they affect analytics or reporting.

Additionally, as data volumes grow and organizations require deeper insight into pipeline performance. Teams find that software with built-in alerts, quality metrics tracking, and anomaly detection improves confidence in data operations and supports better decision making. It also enables centralized monitoring across hybrid environments.

For Instance, in October 2025, Datadog launched new integrations for dbt Cloud and Temporal in its observability platform. These software updates give data teams clear views into model runs, job reliability, and workflow failures. It helps fix slow pipelines quickly, boosting software use in monitoring setups. This move shows how software tools stay ahead in handling AI data needs.

Deployment Mode Analysis

In 2025, the Cloud-Based segment held a dominant market position, capturing a 86.3% share of the Global Data Pipeline Monitoring Market. Cloud environments offer the scalability and flexibility needed for modern data pipeline monitoring. As more organizations move workloads to cloud platforms, they want solutions that can grow with demand and provide real-time visibility without heavy infrastructure investment.

Cloud deployments make it easier for teams to unify monitoring across distributed systems and get centralized insights into pipeline health. Businesses value the ability to update monitoring tools quickly, integrate with other cloud services, and avoid the maintenance overhead typical of traditional on-premises systems.

For instance, in December 2025, AWS enhanced its CloudWatch with better anomaly detection for cloud pipelines. The update supports real-time monitoring across hybrid setups, making cloud deployment smoother for scaling data flows. Teams pick it for easy access and low costs, fueling cloud growth.

Organization Size Analysis

In 2025, The Large Enterprises segment held a dominant market position, capturing a 73.9% share of the Global Data Pipeline Monitoring Market. They generate vast amounts of data and have complex systems that demand precise oversight. These organizations often operate numerous data pipelines feeding analytics, reporting, and operational systems. Monitoring solutions help them ensure that data remains accurate and timely at every stage of the flow.

Larger companies also tend to have more advanced data teams and higher expectations for performance and governance. They invest in monitoring frameworks that offer deep insights, automated alerts, and integration with other enterprise systems.

For Instance, in May 2025, Unravel Data made CRN’s Cloud 100 list for its AI-driven platform used by big firms. It handles massive data on Databricks and Snowflake with predictive fixes, perfect for enterprise scale. Large teams choose it to manage complex workloads and cut costs efficiently.

Application Analysis

In 2025, The Data Quality & Drift Detection segment held a dominant market position, capturing a 41.7% share of the Global Data Pipeline Monitoring Market. This dominance is because they ensure that accurate and consistent data is fundamental to pipeline reliability. Monitoring tools that focus on quality and drift help detect when data changes unexpectedly or deviates from expected patterns. This kind of insight is essential to avoid corrupted analytics outputs or faulty decisions based on bad data.

As pipelines handle diverse inputs from many systems, quality issues and drift can emerge due to schema changes, source inconsistencies, or processing delays. Organizations increasingly prioritize monitoring that flags these problems early so data teams can investigate and correct issues before they impact business processes.

For Instance, in December 2025, Soda launched Data Observability with AI anomaly detection across datasets. It uses historical data for accurate alerts on quality drifts, with feedback learning to reduce false positives. This helps teams catch data shifts early, vital for trustworthy analytics.

End-User Industry Analysis

In 2025, The IT & Technology segment held a dominant market position, capturing a 52.6% share of the Global Data Pipeline Monitoring Market. Tech companies often operate the most complex and dynamic data pipelines. These organizations depend on continuous data flows to support analytics, cloud services, and customer-facing applications. Monitoring solutions help them maintain performance and quickly resolve issues that could disrupt operations or user experience.

The IT & Technology sector also tends to adopt newer tools faster than other industries, including real-time monitoring, automated diagnostics, and integration with development pipelines. Their focus on innovation drives demand for comprehensive monitoring that can scale with rapid growth in data volume and variety.

For Instance, in December 2025, Google Cloud added Gemini agents to BigQuery for IT data engineering. It automates pipeline builds, transformations, and health checks for streaming data. Tech firms leverage this for real-time analytics, solidifying IT leadership in monitoring adoption.

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Enterprise software vendors Platform differentiation and recurring revenue Medium High Cloud service providers Ecosystem expansion and workload optimization Low to Medium High Venture capital firms High growth data infrastructure platforms High Medium to High Private equity investors Scalable SaaS and long term returns Medium Medium Strategic analytics investors End to end data reliability solutions Medium Medium Technology Enablement Analysis

Technology Enabler Functional Role Impact on Adoption Adoption Timeline Automated pipeline observability tools Early detection of data failures Very High Short term AI driven anomaly detection Predictive monitoring and alerting High Short to medium term Cloud native monitoring architectures Scalable deployment across pipelines Very High Short term Metadata driven data lineage tracking Improved transparency and governance Medium to High Medium term Advanced analytics for performance optimization Cost and efficiency improvements Medium Medium to long term Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Pipeline Performance & Health Monitoring

- Data Quality & Drift Detection

- Cost & Resource Optimization

- End-to-End Lineage Tracking

- Others

By End-User Industry

- IT & Technology

- BFSI

- Retail & E-commerce

- Healthcare

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Data driven transformation across industries is driving demand for data pipeline monitoring solutions as organisations seek to manage increasing volumes of data while maintaining reliability and performance standards. The exponential rise in data volume and complexity due to digital business initiatives requires robust monitoring practices to prevent silent failures, ensure data integrity, and support business analytics. Effective pipeline monitoring is being viewed as an essential component of enterprise data strategy.

Growth in cloud adoption has also contributed to increased investment in monitoring capabilities, with cloud based deployment models offering enhanced scalability and remote access to monitoring dashboards. Organisations are incorporating monitoring solutions to ensure consistent performance across distributed environments and to support complex hybrid architectures. This has encouraged broader adoption of monitoring tools beyond traditional IT teams to include data engineering and analytics functions.

Restraint Analysis

One restraint impacting the data pipeline monitoring market is the complexity associated with integrating monitoring solutions into existing and diverse data environments. Enterprises often operate a range of legacy systems alongside modern cloud based platforms, making it challenging to deploy unified monitoring approaches that cover all pipeline components effectively. Differences in technology stacks and data processing frameworks can create integration hurdles that slow adoption rates.

Another limiting factor is the shortage of skilled professionals capable of managing advanced monitoring tools and interpreting complex performance metrics. Organisations may face internal resource constraints when deploying and maintaining comprehensive monitoring solutions, which can result in delayed implementation or reliance on external services. These challenges can suppress growth in regions where technical expertise is less readily available.

Opportunity Analysis

An opportunity within the data pipeline monitoring market lies in expanding managed services and consulting offerings that support organisations with limited internal capabilities. Managed monitoring services can provide continuous oversight, reduce the burden on internal IT teams, and offer expertise in configuration, alerting strategies, and incident response. These services can attract enterprises that require monitoring but lack the necessary technical resources.

Increasing regulatory focus on data governance and compliance creates additional demand for solutions that support audit trails, performance reporting, and issue traceability. Monitoring platforms that offer robust security and compliance features can help enterprises meet regulatory requirements and demonstrate governance over data operations. This presents an opportunity for vendors to differentiate offerings and align with emerging compliance needs.

Challenge Analysis

A key challenge for the data pipeline monitoring market is the rapidly evolving nature of data architectures, which require continuous updates and enhancements to monitoring capabilities. As organisations adopt new data processing frameworks, streaming technologies, and hybrid environments, monitoring solutions must adapt to maintain coverage and relevance. This continual evolution demands significant investment in product development and updates.

Another challenge stems from concerns around data privacy and security, particularly when monitoring platforms handle sensitive information or integrate with multiple data sources. Organisations must ensure secure data flows and meet privacy standards while deploying monitoring tools, which can complicate implementation and necessitate strong governance policies. These concerns can lead to longer deployment cycles and increased operational overhead.

Key Players Analysis

Leading observability platforms such as Datadog and Splunk anchor the market with end-to-end visibility across infrastructure, applications, and data pipelines. Their solutions apply AI to detect anomalies, latency issues, and failure patterns in real time. Unified dashboards and alerting reduce mean time to resolution. Strong integrations with cloud-native stacks support enterprise adoption. These players benefit from broad customer bases and mature ecosystems.

Specialized data observability vendors including Monte Carlo, Acceldata, and Bigeye focus on pipeline health, freshness, and schema changes. Anomalo, Metaplane, and Soda emphasize rapid deployment and analyst-friendly workflows. These platforms help teams prevent downstream analytics failures. Adoption is driven by growing data volumes and real-time decision needs.

Hyperscale and platform providers such as Amazon Web Services, Microsoft, Google, and IBM embed monitoring within broader data services. StreamSets and Unravel Data strengthen pipeline governance and performance tuning. Other vendors add regional depth and innovation. This competitive landscape supports scalable, reliable data operations across cloud environments.

Top Key Players in the Market

- Datadog

- Splunk

- Monte Carlo

- Acceldata

- Bigeye

- Anomalo

- Observe

- Metaplane

- Soda

- Unravel Data

- IBM

- Microsoft

- Amazon Web Services

- StreamSets

- Others

Recent Developments

- In June 2024, Unravel Data unveiled autonomous AI agents for DataOps and FinOps, automating pipeline troubleshooting and cost optimization. These agents analyze streaming data flows to detect bottlenecks proactively, helping enterprises achieve 30% faster resolutions.

- In July 2025, Observe launched Observe Apps, simplifying pipeline monitoring with pre-built dashboards for Kubernetes, CI/CD, and AWS data flows. Users can now link logs to metrics for root cause analysis in minutes, cutting alert fatigue significantly.

Report Scope

Report Features Description Market Value (2025) USD 8.4 Bn Forecast Revenue (2035) USD 47.8 Bn CAGR(2026-2035) 19% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Pipeline Performance & Health Monitoring, Data Quality & Drift Detection, Cost & Resource Optimization, End-to-End Lineage Tracking, Others), By End-User Industry (IT & Technology, BFSI, Retail & E-commerce, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datadog, Splunk, Monte Carlo, Acceldata, Bigeye, Anomalo, Observe, Metaplane, Soda, Unravel Data, IBM, Microsoft, Google, Amazon Web Services, StreamSets, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Pipeline Monitoring MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Pipeline Monitoring MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Datadog

- Splunk

- Monte Carlo

- Acceldata

- Bigeye

- Anomalo

- Observe

- Metaplane

- Soda

- Unravel Data

- IBM

- Microsoft

- Amazon Web Services

- StreamSets

- Others