Global Data Lineage Market Size, Share and Analysis Report By Solution Type (Automated Data Lineage Platforms, Business Intelligence and Reporting Lineage, Data Pipeline and ETL Lineage, Code-Based and Manual Lineage Tools, Others), By Business Objective (Regulatory Compliance and Audit, Impact Analysis and Change Management, Data Quality and Trust, Cloud Migration and Modernization, Others), By Deployment Model (Cloud-Based SaaS, On-Premises Software, Hybrid Deployment), By End-User (Data Governance and Stewardship Teams, Data Engineers and Architects, Data Analysts and Scientists, Business and Compliance Users, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175901

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Solution Type

- By Application

- By Deployment Model

- By End-User Role

- By Region

- Investment Opportunities

- Business Benefits

- Emerging Trend Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Report Overview

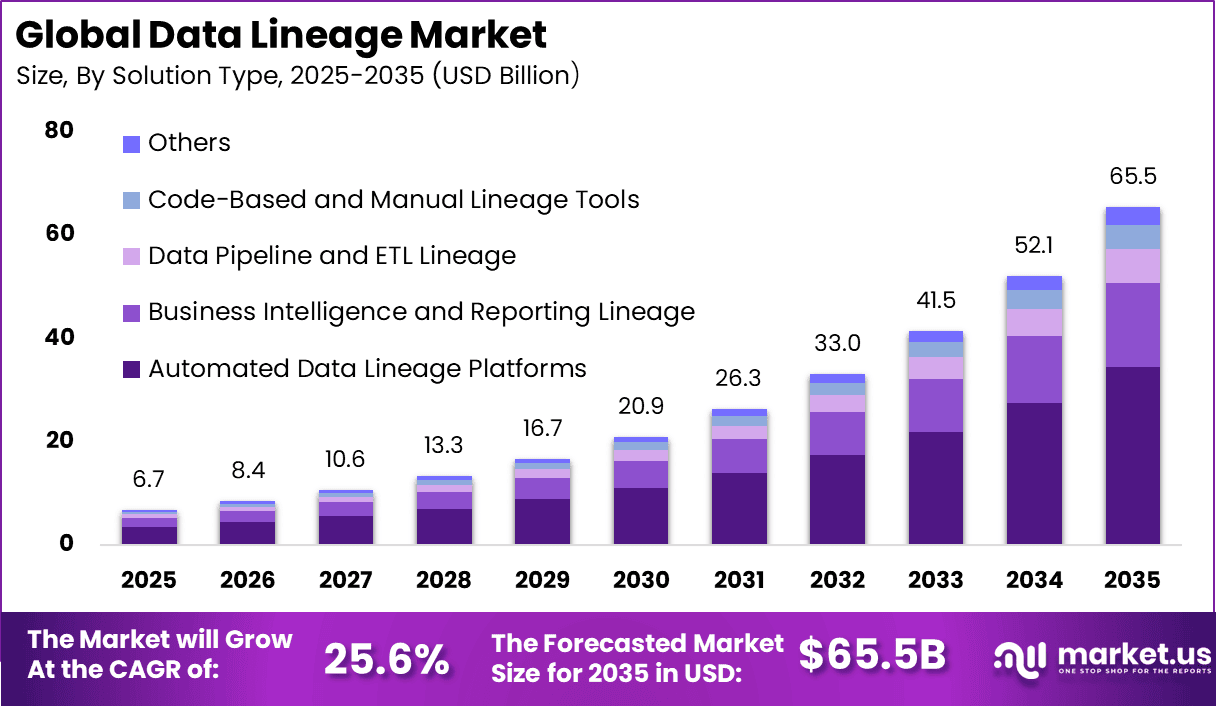

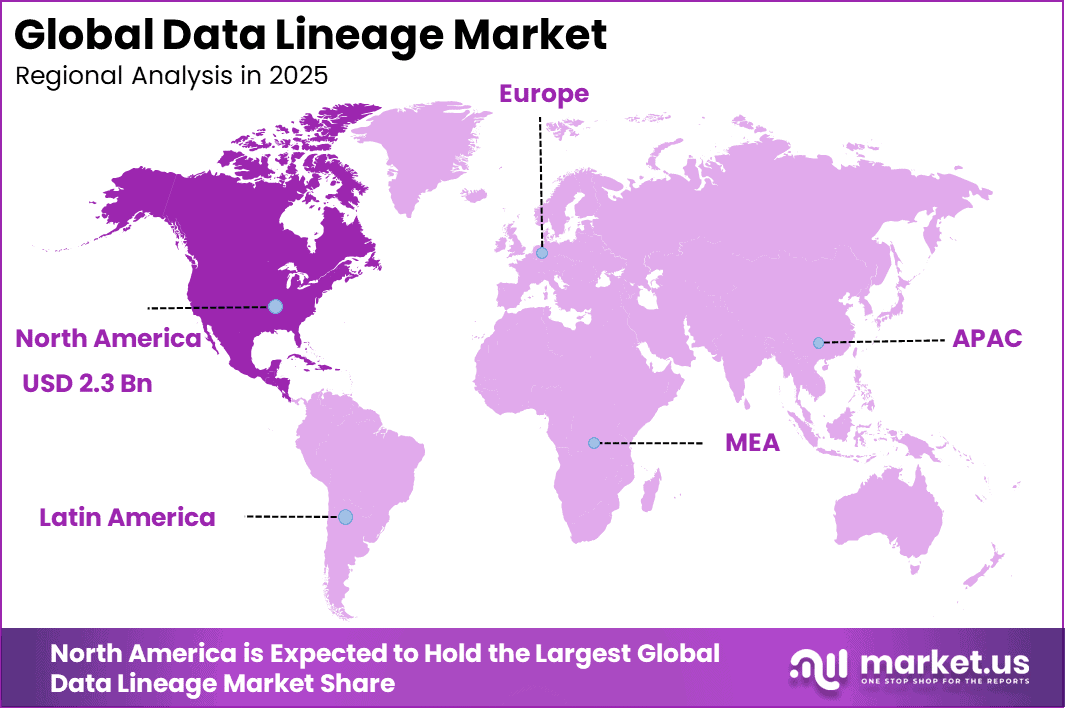

The Global Data Lineage Market represents a high-conviction data infrastructure investment opportunity, expanding from USD 6.7 billion in 2025 to nearly USD 65.5 billion by 2035, growing at a CAGR of 25.6%. North America’s dominant market position, capturing more than 35.1% share and USD 2.3 billion in revenue, underscores strong regional leadership in enterprise data management and long-term value creation potential.

The Data Lineage market refers to the range of technologies and services that help organizations track, record, and visualize the flow of data across systems from its point of origin to its final use or destination. This process involves documenting where data comes from, how it is transformed, and how it moves through various pipelines and systems before being consumed for decision-making or reporting.

Data lineage provides a clear audit trail and a complete picture of the data life cycle, which makes it easier for teams to understand where data originates and how it changes over time. This market includes tools, platforms, and solutions that support data governance, compliance, and quality management by offering transparency and traceability for enterprise data.

As organizations handle increasing volumes of data across complex cloud, hybrid, and on-premises environments, the ability to trace data lineage becomes essential for maintaining trust and integrity in analytics and business intelligence. Data lineage systems help document transformations, dependencies, and data flow paths in a way that supports operational reliability and strategic planning.

One of the main drivers of the Data Lineage market is the growing complexity of data environments within enterprises. Modern data ecosystems incorporate multiple data sources, cloud platforms, analytics tools, and real-time processing pipelines, which make it difficult to manually track how data flows and changes across systems. Data lineage technologies automate tracking by providing a clear view of data flows and transformations without manual documentation.

Demand for data lineage solutions is anchored in the need for accurate data governance and trusted analytics. As organizations rely more on data to drive strategic decisions, the ability to trace the origin and transformation of data becomes critical to validating the quality and reliability of insights. Without lineage capabilities, data teams struggle to pinpoint errors, verify assumptions, and build confidence in reporting outputs.

Top Market Takeaways

- By solution type, automated data lineage platforms led the market with 52.7% share, driven by the need for end to end visibility across complex data pipelines.

- By application, regulatory compliance and audit accounted for 48.3%, reflecting growing focus on transparency, traceability, and governance in data management.

- By deployment model, cloud based SaaS solutions dominated with 68.9%, supported by scalability, faster deployment, and lower infrastructure management effort.

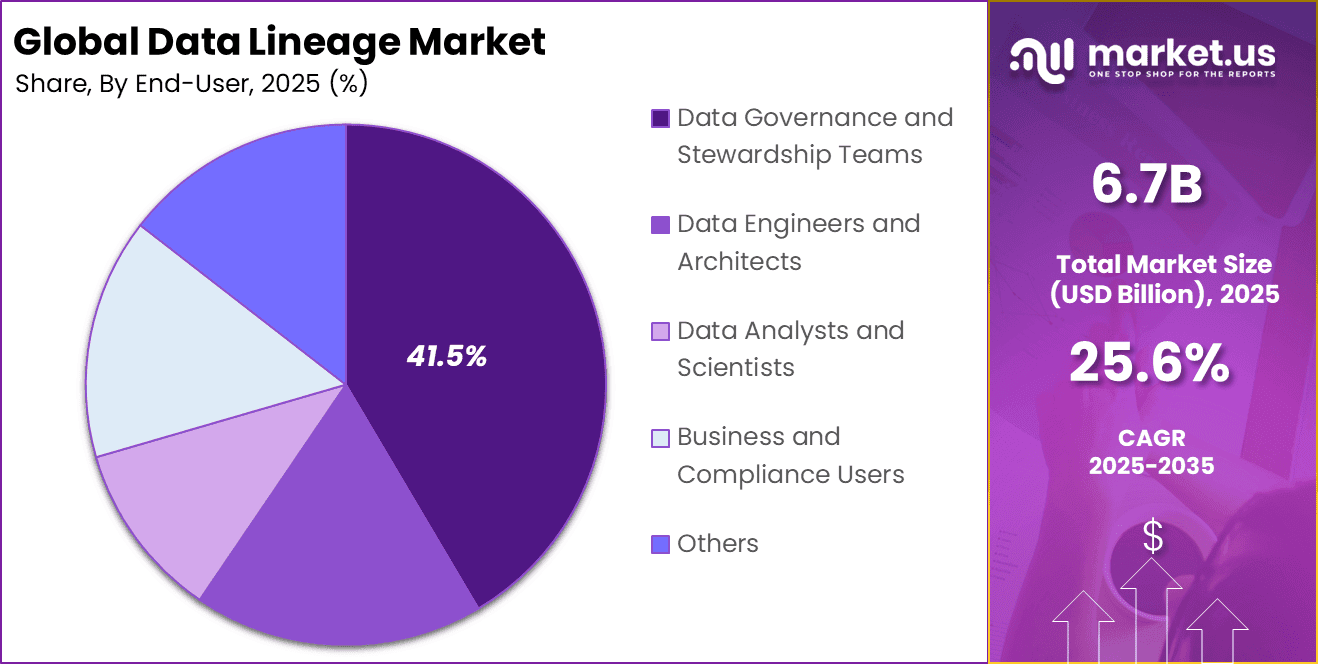

- By end user role, data governance and stewardship teams held 41.5% share, as organizations strengthen ownership and accountability for data assets.

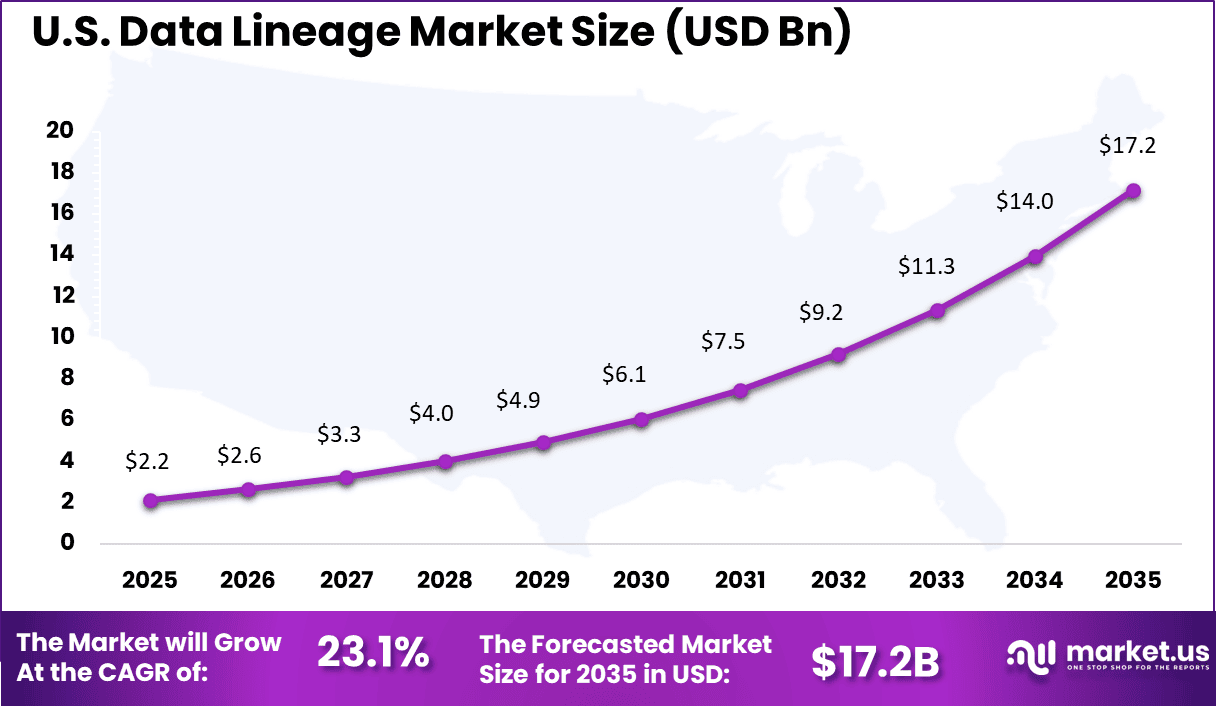

- North America represented 35.14% of the global market, with the US valued at USD 2.15 billion and growing at a 23.15% CAGR, supported by strong regulatory focus and advanced data infrastructure.

Key Insights Summary

Current Adoption Rates

- Overall market adoption stands at around 51% in 2024-2025, showing that business data lineage is now established in roughly half of organizations.

- Adoption is highest among high maturity enterprises, where 93% of Level 4 organizations have implemented business data lineage and 92% use technical lineage.

- In contrast, only 26% of Level 1 organizations have implemented lineage, highlighting a clear gap between low and high data maturity levels.

- Data lineage is increasingly viewed as essential, with nearly 80% of firms prioritizing metadata management and recognizing lineage as a core data capability.

Usage and Implementation Statistics

- Adoption is shifting from static documentation toward automated systems, with about 42% of organizations using AI based metadata cataloging and lineage tools that update in real time.

- Despite progress, a traceability gap remains, as 55% of organizations report difficulty tracing data fully from source to consumption.

- Regulatory pressure is a major driver, as new rules such as the EU AI Act require clear data origin documentation for high risk AI systems, with potential penalties reaching USD 39.82 million for non compliance.

- Organizations using automated data lineage report strong efficiency gains, with up to 95% reduction in time spent on root cause analysis, cutting manual investigation from hours to minutes.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~%) Geographical Significance Expected Timeframe of Impact Rising enterprise focus on end to end data visibility and traceability +6.8% North America, Europe Short to medium term Expansion of cloud native and hybrid data architectures +5.9% North America, Asia Pacific Medium term Increasing regulatory and compliance driven data governance needs +5.2% Europe, North America Medium to long term Rapid adoption of AI, ML, and advanced analytics platforms +4.6% North America, developed Asia Pacific Medium term Growth in automated data pipelines and self service analytics +3.9% Global Long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~%) Geographical Significance Expected Timeframe of Impact High deployment complexity across legacy data environments -3.4% Europe, emerging markets Short to medium term Shortage of skilled data governance and metadata specialists -2.9% North America, Europe Medium term Budget sensitivity among small and mid sized enterprises -2.4% Asia Pacific, Latin America Medium term Integration challenges across fragmented data ecosystems -2.0% Global Medium to long term Data privacy and cross border data management concerns -1.6% Europe, North America Long term By Solution Type

Automated data lineage platforms account for 52.7%, indicating their leading role in managing data traceability. These platforms automatically map data flows across systems and applications. Automation reduces manual documentation efforts and errors. Centralized views improve understanding of data origins and transformations. Accuracy and consistency remain essential.

The dominance of automated platforms is driven by growing data complexity. Organizations operate across multiple data sources and pipelines. Automated tools provide continuous updates as data changes. This improves operational efficiency for data teams. As a result, demand for automated lineage platforms remains strong.

By Application

Regulatory compliance and audit represent 48.3%, making it the primary application area. Organizations use data lineage to demonstrate data accountability. Lineage supports traceability required for audits and reporting. Clear documentation reduces compliance risks. Transparency remains a core requirement.

Growth in this application is driven by increasing regulatory scrutiny. Enterprises must explain how data is sourced and transformed. Data lineage tools simplify audit preparation. Automated reporting improves response times. This keeps compliance-focused usage central to adoption.

By Deployment Model

Cloud-based SaaS deployment holds 68.9%, reflecting strong preference for scalable delivery models. SaaS platforms enable faster implementation without heavy infrastructure investment. Centralized access supports collaboration across teams. Continuous updates improve functionality over time. Flexibility remains a key advantage.

Adoption of cloud-based SaaS is driven by cloud-first data strategies. Organizations operate data platforms in cloud environments. SaaS lineage tools integrate easily with cloud data stacks. Secure access controls support enterprise requirements. This sustains strong SaaS adoption.

By End-User Role

Data governance and stewardship teams account for 41.5%, making them the leading end-user role. These teams oversee data quality, policies, and standards. Data lineage supports informed governance decisions. Visibility into data flows improves accountability. Consistency across systems remains important.

Adoption among governance teams is driven by oversight responsibilities. Manual tracking becomes difficult as data scales. Lineage platforms provide structured insights. Automated mapping reduces workload. This sustains strong usage by governance and stewardship teams.

By Region

North America accounts for 35.14%, supported by mature data management practices. Organizations in the region invest in data governance and compliance tools. Cloud adoption supports lineage platform deployment. Skilled data professionals accelerate implementation. The region remains influential.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity North America Advanced data governance adoption and large scale analytics Very High Mature Europe Strong regulatory compliance and data transparency mandates High Mature Asia Pacific Rapid cloud migration and enterprise digitalization Medium to High Developing Middle East Smart enterprise initiatives and data modernization Medium Developing Latin America Gradual adoption of data governance platforms Low to Medium Early stage Africa Emerging digital infrastructure investments Low Early stage The United States reached USD 2.15 Billion with a CAGR of 23.15%, reflecting strong market expansion. Growth is driven by regulatory requirements and data modernization efforts. Enterprises prioritize visibility across data pipelines. Automation adoption continues to rise. Market momentum remains strong.

Investment Opportunities

Investment opportunities in the Data Lineage market arise from the broader trend of data governance and data management modernization within enterprises. As more organizations adopt cloud data platforms and data analytics tools, there is increasing demand for solutions that help manage risk and ensure data transparency. Investors may find opportunities in platforms that combine lineage with governance, cataloging, and quality tools, enabling holistic data visibility.

There are also opportunities in developing advanced lineage visualizations and analytics capabilities that help business users understand data flows without deep technical expertise. Tools that offer intuitive interfaces and cross-system lineage views can attract adoption across departments beyond IT teams, expanding the total addressable market. This encourages innovation in user experience and visualization components of lineage solutions.

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Enterprise data platform providers Expansion of governance and metadata portfolios Medium High Cloud service providers Strengthening data management ecosystems Low to Medium High Venture capital firms High growth data infrastructure platforms High Medium to High Private equity investors Long term scalable SaaS investments Medium Medium Strategic analytics investors End to end data transparency solutions Medium Medium Business Benefits

Data lineage solutions provide business benefits by enhancing operational efficiency and reducing risk in data environments. With lineage in place, data teams can troubleshoot data issues faster, eliminate redundant processes, and improve pipeline reliability. This contributes to higher productivity and clearer accountability in managing data assets.

Another benefit is improved decision-making through enhanced data transparency. Stakeholders across the organization can trust insights when they understand the journey of data from source to report. Data lineage supports strategic planning, supports governance frameworks, and helps organizations respond confidently to regulatory requirements, which strengthens overall data management practices.

Emerging Trend Analysis

A notable emerging trend in the data lineage market is the integration of artificial intelligence powered automation to enhance end to end visibility of data flows. Modern solutions are increasingly using automated metadata extraction and intelligent discovery mechanisms to capture lineage in real time, reducing dependence on manual processes and increasing accuracy of lineage maps.

This shift supports rapid identification of data issues at the source rather than after downstream impacts occur, improving operational efficiency and confidence in the data lifecycle. Automated lineage is becoming a baseline expectation for organisations seeking scalable transparency across complex distributed architectures.

Another trend is the blending of technical and business data lineage views to provide actionable insights for broader teams beyond data engineering. Tools now connect lineage information with business context, enabling analysts, governance teams, and executives to trace the origin and transformation of key business metrics. This convergence of technical detail with business semantics enhances decision making and supports cross functional understanding of data dependencies.

Opportunity Analysis

An opportunity in the data lineage market lies in expanding managed services and support offerings for organisations with limited internal data governance expertise. Managed lineage services can lower adoption barriers by providing deployment, maintenance, and optimisation support, helping enterprises realise value quickly without large internal investments. This service led approach can attract small and medium sized organisations that require lineage capabilities but lack dedicated data engineering resources.

The emergence of cloud native and hybrid architectures also presents opportunities for vendors to innovate lineage solutions that seamlessly operate across these environments. As more organisations migrate workloads to the cloud, demand grows for lineage tools that offer flexible deployment models and integrate with cloud native data platforms. Tailored solutions that support dynamic environments and real time updates can differentiate offerings and address evolving enterprise needs.

Challenge Analysis

A key challenge faced by the data lineage market is maintaining accurate and current lineage information in fast changing data ecosystems. Data pipelines, schemas, and processing logic are frequently updated, requiring lineage tools to continuously adapt to reflect the latest state of the ecosystem. Ensuring that lineage maps remain reliable without extensive manual intervention can be difficult, particularly in complex multi tool environments.

Data privacy and security concerns also present challenges for lineage initiatives. Capturing detailed lineage often involves accessing sensitive metadata and tracking data transformations that may include personal or proprietary information. Organisations must balance lineage transparency with strict data protection requirements, implementing robust security controls to ensure lineage processes do not expose sensitive data or create compliance risks.

Competitive Analysis

Enterprise data governance providers such as Collibra, Informatica, and IBM lead the data lineage market through end-to-end metadata management. Their platforms provide automated lineage across databases, ETL tools, and analytics layers. Strong integration with governance and compliance workflows supports adoption in regulated industries. These vendors benefit from large enterprise deployments and mature partner ecosystems. Demand is driven by audit readiness, data transparency, and regulatory reporting needs.

Specialized lineage and metadata vendors such as MANTA Software, Solidatus, and Octopai focus on deep technical lineage and impact analysis. erwin and Alex Solutions emphasize business-friendly views of lineage. These tools help organizations understand data movement and transformation across complex environments. Adoption is strong during cloud migration and analytics modernization programs.

Platform and catalog-centric providers such as Microsoft, data.world, and Alation embed lineage within broader data discovery solutions. Atlan, Talend, SAP, and Precisely support hybrid and multi-cloud environments. Other vendors add competitive depth and regional reach. This landscape supports steady innovation in automated and business-readable data lineage.

Top Key Players in the Market

- Collibra

- Informatica

- MANTA Software

- Solidatus

- Octopai

- IBM

- erwin

- Alex Solutions

- Microsoft

- data.world

- Alation

- Atlan

- Talend

- SAP

- Precisely

- Others

Recent Developments

- Collibra grabbed headlines by acquiring Raito in June 2025, boosting its data access governance alongside fresh lineage tools for AWS Glue and Airflow. They also rolled out AI Copilot for easier data discovery and model tracking integrations with Azure AI. These steps make end-to-end lineage more automated and user-friendly

- Salesforce sealed a deal to buy Informatica for about $8 billion in May 2025, blending its data management strengths with Salesforce’s AI CRM. This ties into lineage via better ETL and MDM, speeding up trusted data for AI apps. The combo eyes quick wins in sectors like finance and healthcare.

Key Market Segments

By Solution Type

- Automated Data Lineage Platforms

- Business Intelligence and Reporting Lineage

- Data Pipeline and ETL Lineage

- Code-Based and Manual Lineage Tools

- Others

By Application

- Regulatory Compliance and Audit

- Impact Analysis and Change Management

- Data Quality and Trust

- Cloud Migration and Modernization

- Others

By Deployment Model

- Cloud-Based SaaS

- On-Premises Software

- Hybrid Deployment

By End-User

- Data Governance and Stewardship Teams

- Data Engineers and Architects

- Data Analysts and Scientists

- Business and Compliance Users

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 6.7 Bn Forecast Revenue (2035) USD 65.5 Bn CAGR(2026-2035) 25.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution Type (Automated Data Lineage Platforms, Business Intelligence and Reporting Lineage, Data Pipeline and ETL Lineage, Code-Based and Manual Lineage Tools, Others), By Applications (Regulatory Compliance and Audit, Impact Analysis and Change Management, Data Quality and Trust, Cloud Migration and Modernization, Others), By Deployment Model (Cloud-Based SaaS, On-Premises Software, Hybrid Deployment), By End-User (Data Governance and Stewardship Teams, Data Engineers and Architects, Data Analysts and Scientists, Business and Compliance Users, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Collibra, Informatica, MANTA Software, Solidatus, Octopai, IBM, erwin, Alex Solutions, Microsoft, data.world, Alation, Atlan, Talend, SAP, Precisely, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Collibra

- Informatica

- MANTA Software

- Solidatus

- Octopai

- IBM

- erwin

- Alex Solutions

- Microsoft

- data.world

- Alation

- Atlan

- Talend

- SAP

- Precisely

- Others