Global Data Lake Monitoring Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Quality and Integrity Monitoring, Pipeline and ETL Job Monitoring, Cost and Performance Optimization, Security and Compliance Monitoring, Metadata and Lineage Tracking, Others), By End-User Industry (Banking, Financial Services, and Insurance, IT and Telecommunications, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Media and Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178103

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End-User Industry

- North America Overview

- Increasing Adoption Technologies

- Investment Opportunities

- Key Market Segments

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

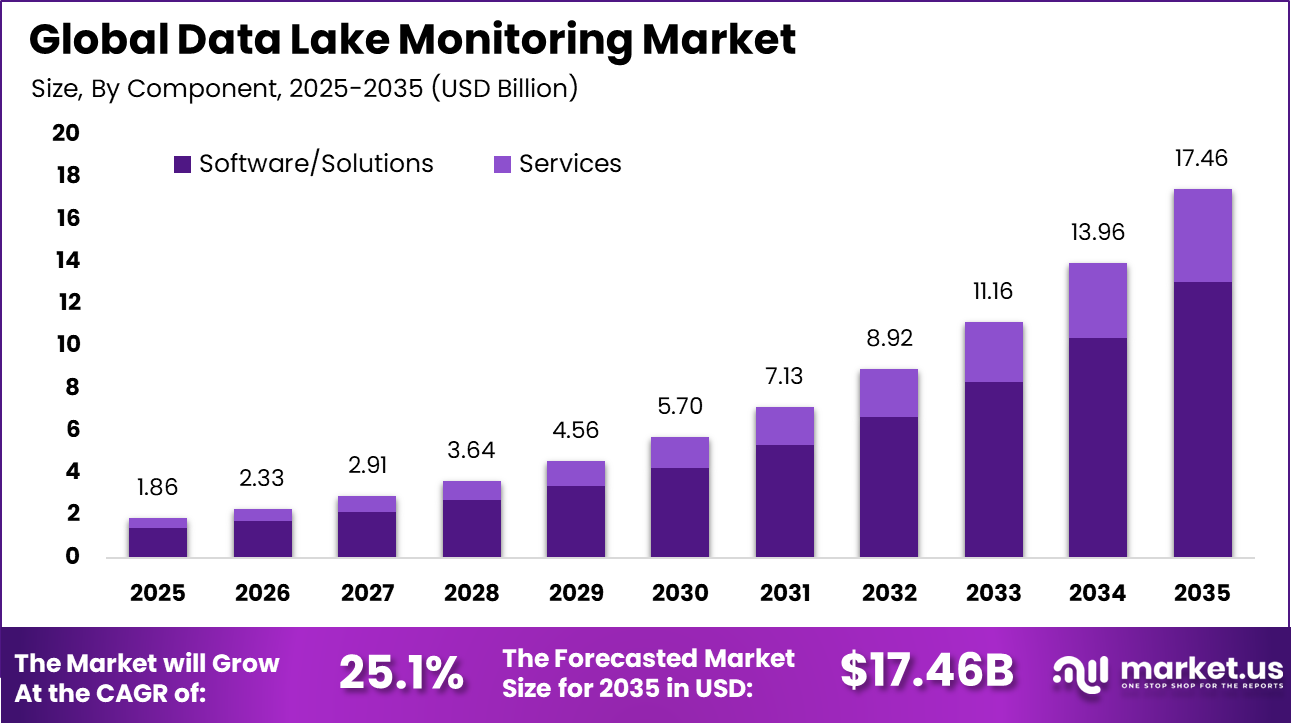

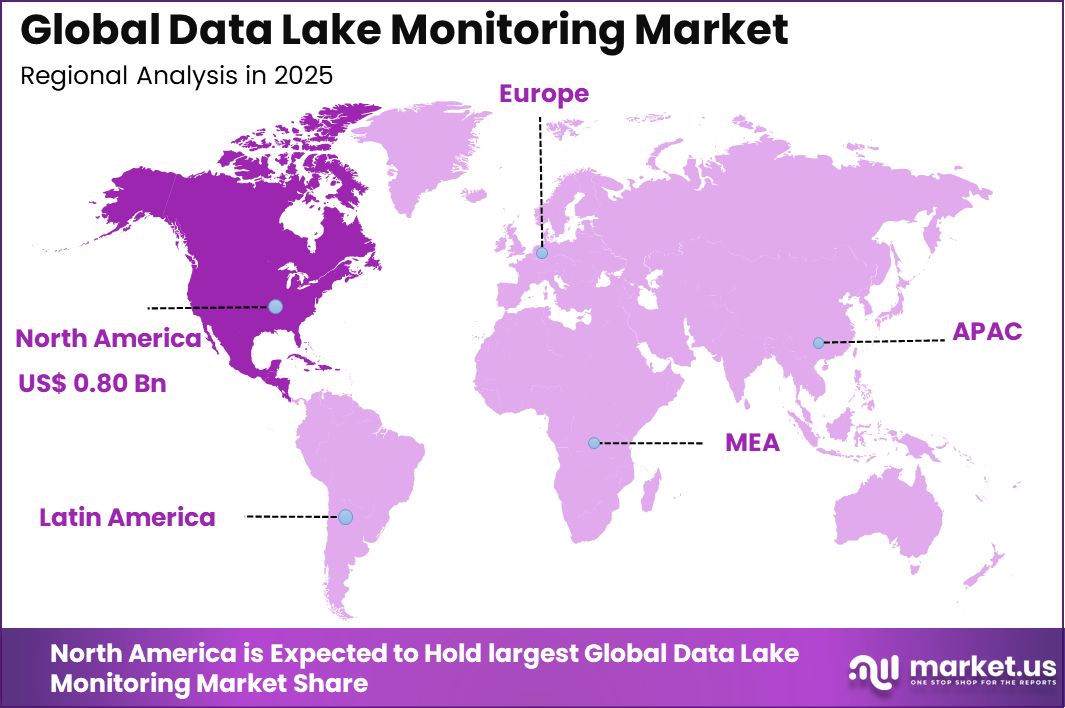

The Global Data Lake Monitoring Market size is expected to be worth around USD 17.46 billion by 2035, from USD 1.86 billion in 2025, growing at a CAGR of 25.1% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 43.15% share, holding USD 0.80 billion in revenue.

The data lake monitoring market refers to the collection of technologies and services that oversee the performance, health, and quality of data within data lakes. This market has grown as enterprises generate and store increasing volumes of unstructured and structured data. Monitoring ensures that data remains accessible, reliable, and compliant with organizational standards. Effective monitoring supports operational continuity across complex data environments.

The scope of the data lake monitoring market includes tools that track ingestion, transformation, and storage processes. Monitoring also involves alerting on anomalies and ensuring data governance policies are enforced. As data lakes are often central to analytics and decision making, visibility into their performance is essential for business operations. The market reflects the priority organizations place on dependable data infrastructure.

Growth in this market is tied to the expansion of cloud computing and digital transformation initiatives. The ability to monitor vast and dynamic data stores aligns with enterprise needs for real time insights. As organizations adopt more advanced analytics, the need to maintain data quality and lineage increases. The market is increasingly viewed as foundational to enterprise data strategies.

One of the principal driving factors of the data lake monitoring market is the rapid increase in data creation across industries. Organizations are challenged with managing large data volumes from diverse sources, which increases complexity. Monitoring solutions help ensure that data flows are managed consistently and errors are detected quickly. Accurate and reliable data is essential for analytics and reporting.

For instance, in October 2025, Microsoft beefed up Azure Data Lake with Azure Monitor’s latest features for real-time performance and security tracking. Data teams now get proactive alerts on lake health, keeping mission-critical analytics humming smoothly.

Key Takeaway

- The Software and Solutions segment accounted for 74.6% of the global revenue share in 2025. This indicates that enterprises are prioritizing dedicated monitoring platforms and integrated toolsets to manage complex data lake environments.

- Cloud-based deployment represented 58.4% of the market in 2025. Adoption has been driven by scalable infrastructure, remote accessibility, and the growing use of multi-cloud data architectures.

- Large Enterprises captured 71.8% of the total market share in 2025. High data volumes, regulatory compliance requirements, and advanced analytics initiatives have supported stronger spending from this segment.

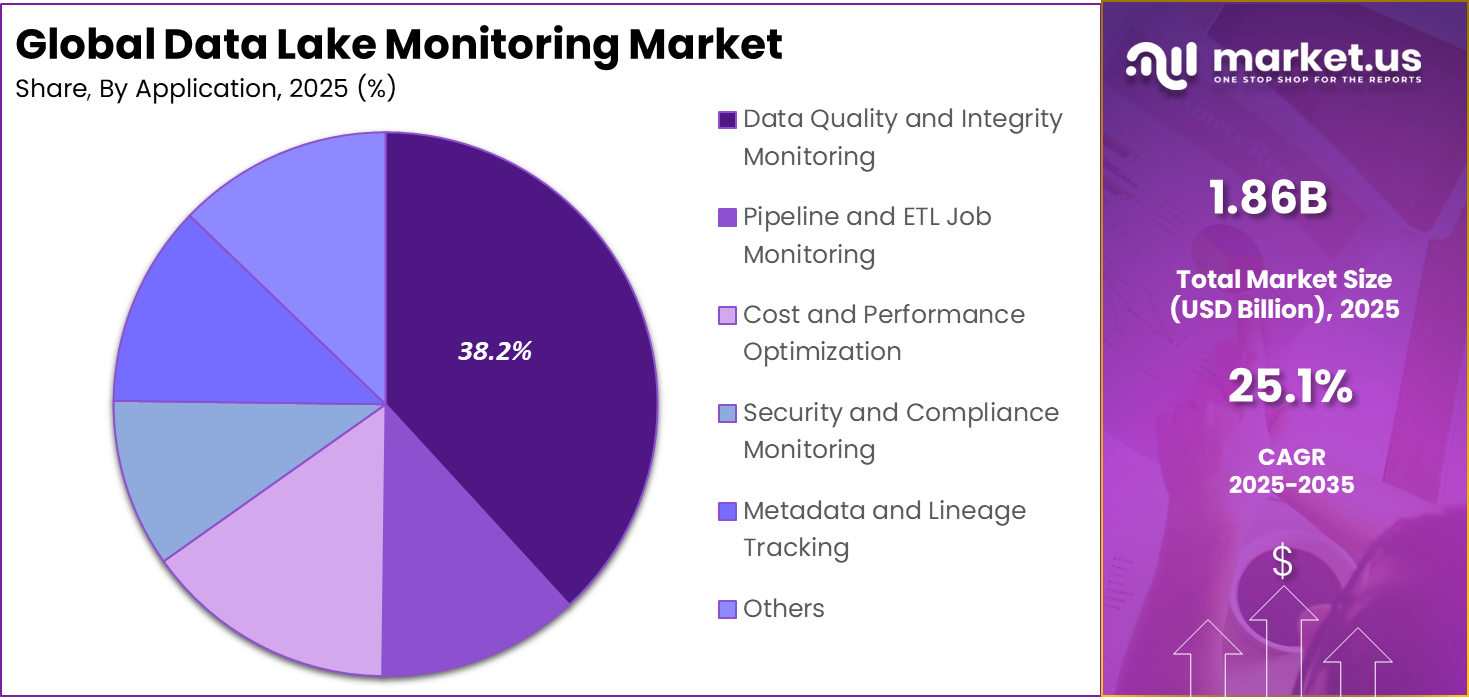

- Data Quality and Integrity Monitoring led by application, securing 38.2% of the market share. Organizations are increasingly focusing on maintaining data accuracy, consistency, and governance across distributed storage systems.

- The Banking, Financial Services, and Insurance sector contributed 29.5% of total market demand in 2025. Rising regulatory scrutiny and risk management requirements have accelerated adoption within financial institutions.

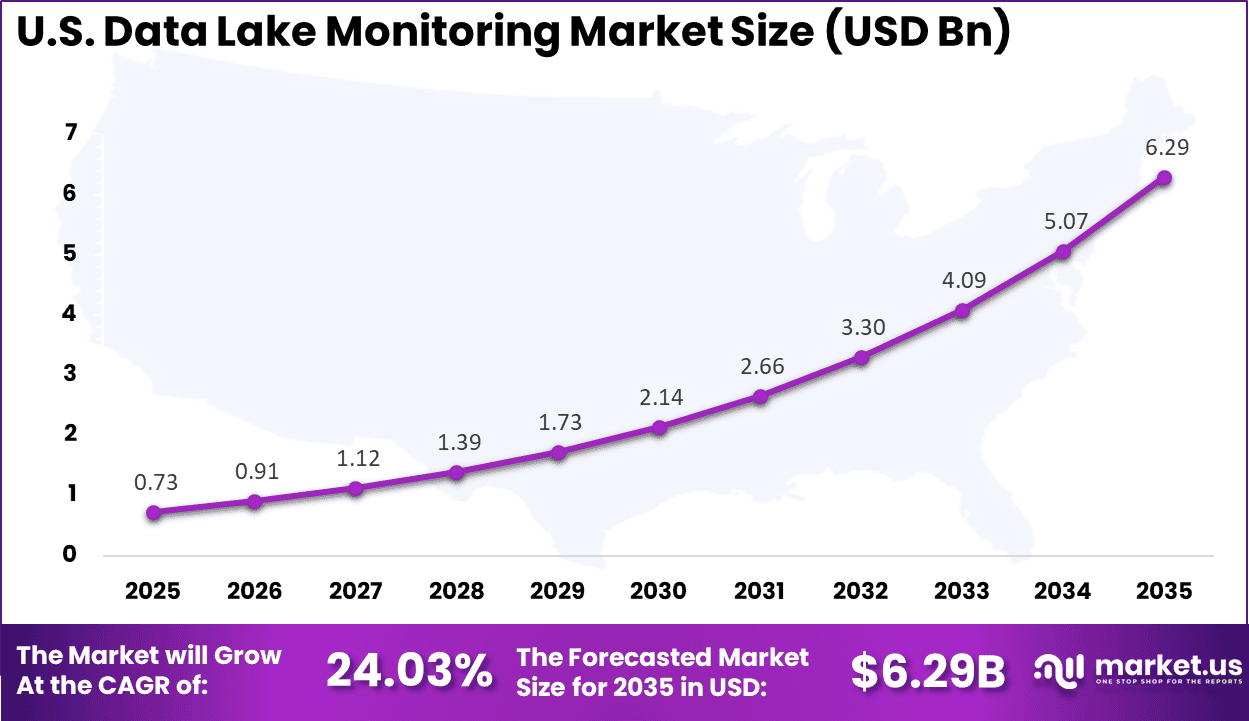

- The United States market was valued at USD 0.73 Billion in 2025 and is projected to expand at a CAGR of 24.03%, reflecting strong enterprise digital transformation activity.

- North America held more than 43.15% of the global market share in 2025. Early adoption of advanced analytics platforms and strong cloud infrastructure ecosystems have reinforced regional leadership.

By Component

Software and solutions dominate the data lake monitoring market with 74.6% share. These tools provide essential capabilities for real-time oversight, automated alerting, and comprehensive data lineage tracking across vast repositories. Organizations rely on them to maintain visibility into data pipelines, ensuring issues like schema drift or access anomalies are caught early. Their scalability makes them indispensable for handling petabyte-scale environments where manual checks fall short.

Software advancements continue to focus on AI-driven anomaly detection and self-healing features. This evolution helps teams prioritize high-impact problems while reducing operational overhead. As data volumes explode, these solutions enable proactive governance, turning potential chaos into trusted assets for analytics and decision-making. Their strong market position reflects the industry’s push for automated, intelligent monitoring that scales with business growth.

For Instance, in April 2025, Datadog acquired Metaplane to boost software capabilities for data lake monitoring. This move integrates advanced observability into solutions, helping teams track data quality across pipelines and warehouses. It empowers software tools to detect issues early, ensuring reliable analytics for enterprises handling complex data flows.

By Deployment Mode

Cloud-based deployments lead with 58.4% of the market. They offer unmatched flexibility for scaling storage and compute resources on demand, which suits dynamic data lake architectures. Teams appreciate the ease of integration with multi-cloud setups and the built-in resilience against hardware failures. This mode supports hybrid strategies where sensitive data stays on-premises while analytics run in the cloud.

The shift to cloud is accelerating due to lower upfront costs and faster deployment times. Features like serverless processing and automated backups make it ideal for organizations with fluctuating workloads. As remote collaboration grows, cloud tools provide secure, anywhere-access for monitoring teams. Their dominance highlights how modern data lakes prioritize agility and cost-efficiency in monitoring.

For instance, in October 2025, Microsoft makes Sentinel data lake generally available on the Azure cloud. This cloud-based tool centralizes security data for monitoring, offering scalable storage and AI insights. Teams can now query historical telemetry easily, driving cloud adoption for flexible, cost-effective data lake deployments.

By Organization Size

Large enterprises hold 71.8% share, driven by their complex data ecosystems spanning multiple sources and regulatory demands. These organizations manage massive volumes requiring robust monitoring for compliance, security, and performance. They invest heavily in solutions that automate audits and enforce data policies across global operations. Their scale demands enterprise-grade tools with advanced RBAC and FinOps integration.

Large firms benefit from monitoring platforms that support petabyte-scale scans and real-time governance. This setup helps them consolidate silos for AI and analytics while mitigating risks like data drift. As digital transformation deepens, these enterprises lead adoption, setting standards for reliability in high-stakes environments. Their market lead underscores the need for sophisticated oversight in expansive data operations.

For Instance, in September 2025, Bigeye expands data quality features for enterprise use. New customizable dimensions and join rules monitor pipelines across large datasets. This helps big organizations track quality precisely, aligning with governance needs in high-volume data environments.

By Application

Data quality and integrity monitoring leads with a share of 38.2%, highlighting its critical importance. Organizations rely on clean and accurate data to support reporting, forecasting, and risk assessment. Monitoring tools evaluate completeness, consistency, accuracy, and timeliness of data stored in lakes. Any deviation from predefined standards can be flagged in real time. This prevents analytical errors and supports stronger business outcomes.

Continuous integrity checks are particularly important in automated data pipelines. As data flows from multiple internal and external sources, inconsistencies can quickly multiply if not monitored. Quality monitoring solutions help enforce validation rules and maintain standard formats. This improves trust in dashboards, predictive models, and regulatory reports. The focus on data reliability continues to drive strong demand within this application segment.

For Instance, in September 2025, Anomalo adds Workflows to unstructured data monitoring. Now generally available, it processes vast documents for quality issues in lakes. Enterprises gain fast insights into integrity, crucial for GenAI, where clean data drives accurate outcomes.

By End-User Industry

The Banking, Financial Services, and Insurance sector accounts for 29.5% of total market share. Financial institutions manage high volumes of sensitive and real-time transactional data. Accurate monitoring is essential to prevent reporting errors and maintain operational stability. Data lakes are widely used to consolidate customer records, trading data, and risk metrics. Continuous monitoring ensures that this information remains consistent and secure.

Regulatory compliance plays a major role in driving adoption within this industry. Financial institutions must meet strict audit, risk, and reporting standards. Monitoring platforms support traceability, lineage tracking, and data validation processes. This reduces compliance risk and enhances transparency for regulators and internal stakeholders. The strong reliance on data-driven decision making further supports the sector’s significant share.

For Instance, in October 2025, Monte Carlo integrates with Databricks for data lake observability. It covers freshness, volume, and schema for BFSI pipelines. This prevents quality issues in transaction data, helping financial teams maintain trust and speed in analytics.

North America Overview

North America holds 43.15% of the regional share in the data lake monitoring market. The region demonstrates strong digital infrastructure and advanced cloud adoption. Enterprises in this region actively invest in analytics modernization and data governance initiatives. Monitoring systems are increasingly integrated with broader enterprise data strategies. This strengthens operational resilience and analytical accuracy.

For instance, in September 2025, Cisco unveiled AI-powered enhancements to its Splunk portfolio at Splunk .conf25, including agentic AI automation and unified data architectures for enhanced data lake observability. Key features include AI troubleshooting agents and Splunk Machine Data Lake for AI-ready analytics, demonstrating North America’s dominance in AI-driven data lake monitoring.

The United States plays a central role in regional growth, supported by strong enterprise technology adoption. The market in the US is expanding at a CAGR of 24.03%, indicating sustained investment momentum. Organizations prioritize regulatory compliance, cybersecurity, and real-time data visibility. The presence of advanced financial, healthcare, and technology sectors further drives demand. Overall, North America remains a leading hub for data lake monitoring innovation and adoption.

For instance, in May 2025, IBM introduced its GenAI Lakehouse at IBM Think 2025, featuring AI-aware telemetry, workload introspection, and hybrid deployment capabilities in DB2 Warehouse. This platform reframes enterprise data readiness for generative AI with proactive governance and anomaly detection, solidifying U.S. leadership in data lake management.

Increasing Adoption Technologies

Several technologies are being adopted to enhance data lake monitoring capabilities across organizations. Machine learning algorithms are being used to detect anomalies in data flows and usage patterns. These algorithms can learn from historical behavior and identify irregularities without extensive manual configuration. The application of machine learning reduces the burden on IT teams and increases detection accuracy.

Cloud native monitoring tools are also increasingly adopted. These tools are designed to work with cloud based data lake architectures and integrate with platform services. They provide visibility into performance, cost, and resource utilization within the cloud environment. By aligning with cloud services, monitoring becomes more seamless and efficient for cloud centric organizations.

Organizations adopt data lake monitoring to ensure data reliability and integrity within complex environments. Monitoring provides early detection of issues and supports corrective action before business impact occurs. This reduces downtime and minimizes the risk of data corruption. Strong oversight builds confidence among data consumers.

Another key reason is to support governance and compliance. As regulatory requirements increase, organizations must demonstrate control over data usage and lineage. Monitoring tools help track changes and ensure that policies are applied consistently. This is critical for audit readiness and maintaining trust with stakeholders.

Investment Opportunities

Investment opportunities in the data lake monitoring market are present across technology development and services. Vendors that offer adaptable and scalable monitoring solutions are positioned to benefit from broad enterprise demand. There is opportunity in developing tools that integrate with hybrid and multi cloud environments. Solutions that simplify deployment and management will attract organizational interest.

Another area for investment lies in advanced analytics capabilities. Tools that leverage predictive insights to anticipate issues before they occur provide added value. These capabilities reduce manual oversight and increase automation. Investors may also explore partnerships that extend monitoring into adjacent data management functions.

Service based offerings present additional opportunity, particularly for organizations without in house expertise. Managed monitoring services enable firms to outsource complex oversight tasks to specialists. This lowers barriers to adoption for smaller and mid sized firms. The continued growth of data centric operations suggests that investment in monitoring services will remain relevant.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Data Quality and Integrity Monitoring

- Pipeline and ETL Job Monitoring

- Cost and Performance Optimization

- Security and Compliance Monitoring

- Metadata and Lineage Tracking

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- IT and Telecommunications

- Retail and E-commerce

- Healthcare and Life Sciences

- Manufacturing

- Media and Entertainment

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

A prominent emerging trend in the data lake monitoring domain is the integration of advanced observability and data observability practices directly into data lake environments. Modern observability tools are being designed to provide continuous, real-time insights into the health of data pipelines, including automated monitoring for freshness, schema changes, lineage tracking, and error conditions, enabling proactive identification of anomalies before they impact downstream analytics.

These capabilities are becoming foundational requirements rather than optional enhancements, reflecting an industry shift toward preventative rather than reactive monitoring across distributed data systems. As observability practices mature, they are expected to become standard components of comprehensive data lake monitoring strategies.

Furthermore, this trend is supported by the adoption of machine learning models within monitoring tools to create predictive models of normal data behavior, alerting on deviations such as unexpected missing values or pipeline disruptions. Predictive monitoring facilitates faster resolution of data incidents and enhances trust in analytical outcomes by ensuring that quality and reliability metrics are continually assessed and maintained.

Driver Analysis

The primary driver behind increased adoption of data lake monitoring solutions is the exponential growth of data volumes and complexity in modern enterprise environments. As organizations ingest larger and more diverse datasets spanning structured, semi-structured, and unstructured formats, the pressure to ensure data reliability, performance, and integrity has intensified.

Scalable monitoring frameworks are required to track utilization patterns, service levels, and performance metrics across data lakes to meet operational and analytical expectations. In addition, the proliferation of cloud-native architectures, microservices, and distributed applications has created more sources of telemetry data that must be monitored in real time.

This shift has underscored the need for unified monitoring platforms that can handle operational data alongside business-critical analytics workloads. The increasing reliance on data lakes for AI and machine learning model training further fuels investment in monitoring tools, as data quality directly influences model accuracy and decision-making processes.

Restraint Analysis

A significant restraint in the data lake monitoring ecosystem is the complexity associated with integrating monitoring tools into existing data infrastructures. Data lakes often support diverse data formats and legacy systems, requiring intricate architectural adjustments and custom integrations to ensure monitoring controls work effectively across all components. Such complexity can slow implementation and limit the immediate utility of monitoring platforms if not carefully managed.

Moreover, the requirement for specialized technical skills can restrict the adoption of sophisticated monitoring solutions. Skilled professionals capable of configuring observability frameworks, interpreting complex telemetry data, and tuning alerting mechanisms are in high demand but relatively scarce. This skills gap can reduce the pace at which enterprises deploy comprehensive data lake monitoring practices, particularly in smaller or resource-constrained organizations.

Opportunity Analysis

An important opportunity in the data lake monitoring market lies in the development of unified platforms that bridge observability, governance, and analytics. Tools that integrate monitoring metrics with metadata catalogs, lineage tracking, and governance workflows can deliver enhanced visibility into data health and lineage, supporting improved compliance and decision-making. This convergence can drive efficiencies by reducing the need to maintain separate systems for monitoring, cataloging, and quality enforcement.

Additionally, the increasing adoption of artificial intelligence and machine learning within monitoring solutions presents a significant growth opportunity. Automated anomaly detection, root cause analysis, and predictive insights powered by AI can improve responsiveness and reduce the risk of data downtime. As organizations prioritize data accuracy for advanced analytics and AI applications, solutions that embed intelligent monitoring capabilities will be positioned for strong demand.

Challenge Analysis

A primary challenge in this sector is ensuring that monitoring systems can scale efficiently with growing data volumes and evolving workloads. Data lakes are designed to hold vast amounts of raw data which, without effective indexing, governance, and management, can lead to performance bottlenecks that complicate monitoring efforts. Ensuring performance and query responsiveness in the face of increasing scale requires optimized architectures and sometimes, significant investment in infrastructure upgrades.

Another persistent challenge is balancing comprehensive monitoring with cost management. Continuous, real-time observability and alerting across extensive data pipelines can incur substantial processing and storage costs, particularly in cloud environments where resource usage is closely tied to expense. Organizations must therefore design monitoring strategies that capture essential metrics without generating excessive overhead. Effective cost optimization in monitoring infrastructures remains a key obstacle for many enterprises.

Key Players Analysis

Observability and monitoring leaders such as Datadog, Splunk, and IBM play a central role in the data lake monitoring market. Their platforms provide real-time visibility into storage layers, query performance, and ingestion pipelines. Advanced analytics and anomaly detection improve data reliability. These vendors benefit from strong enterprise integration and hybrid cloud capabilities. Demand is driven by increasing data lake adoption for analytics and AI workloads.

Cloud and data platform providers such as Amazon Web Services, Microsoft, Google, Snowflake, and Cloudera embed monitoring capabilities within managed data lake services. These platforms support scalability, governance, and performance tracking. Adoption is strong among enterprises managing petabyte-scale datasets and real-time analytics environments.

Specialized data observability providers such as Acceldata, Monte Carlo, Bigeye, Anomalo, Soda, Metaplane, and Hydrolix focus on freshness, quality, and cost optimization. These players enhance proactive issue detection and governance compliance. Other vendors expand innovation and regional presence, supporting steady growth in data lake monitoring solutions.

Top Key Players in the Market

- Datadog

- Splunk

- IBM

- Microsoft

- Amazon Web Services

- Cloudera

- Snowflake

- Acceldata

- Monte Carlo

- Hydrolix

- Bigeye

- Anomalo

- Soda

- Metaplane

- Others

Recent Developments

- In October 2025, Microsoft upgraded Azure Data Lake with Azure Monitor’s enhanced Log Analytics, offering granular visibility into security, performance, and costs. These tools help teams maintain trust in massive data lakes powering AI analytics.

- In November 2025, Soda acquired ML monitoring startup NannyML at Databricks Summit, building the smartest data quality platform. New anomaly detection crushes Prophet by 70% fewer false positives. AI-native monitoring that’s actually useful.

Report Scope

Report Features Description Market Value (2025) USD 1.8 Bn Forecast Revenue (2035) USD 17.4 Bn CAGR(2026-2035) 25.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Quality and Integrity Monitoring, Pipeline and ETL Job Monitoring, Cost and Performance Optimization, Security and Compliance Monitoring, Metadata and Lineage Tracking, Others), By End-User Industry (Banking, Financial Services, and Insurance, IT and Telecommunications, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Media and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datadog, Splunk, IBM, Microsoft, Amazon Web Services, Google, Cloudera, Snowflake, Acceldata, Monte Carlo, Hydrolix, Bigeye, Anomalo, Soda, Metaplane, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Lake Monitoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Lake Monitoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Datadog

- Splunk

- IBM

- Microsoft

- Amazon Web Services

- Cloudera

- Snowflake

- Acceldata

- Monte Carlo

- Hydrolix

- Bigeye

- Anomalo

- Soda

- Metaplane

- Others