Global Data Infrastructure Monitoring Market Size, Share and Analysis Report By Deployment Mode (Cloud-based, On-premises), By Application (Database and Warehouse Performance Monitoring, Data Pipeline and ETL Infrastructure Health, Storage and Compute Resource Utilization, Network and Connectivity for Data Systems, Others), By End-User Industry (IT and Technology, Banking, Financial Services, and Insurance, E-commerce and Retail, Telecommunications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177574

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Deployment Mode

- By Application

- By End-User Industry

- Regional Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

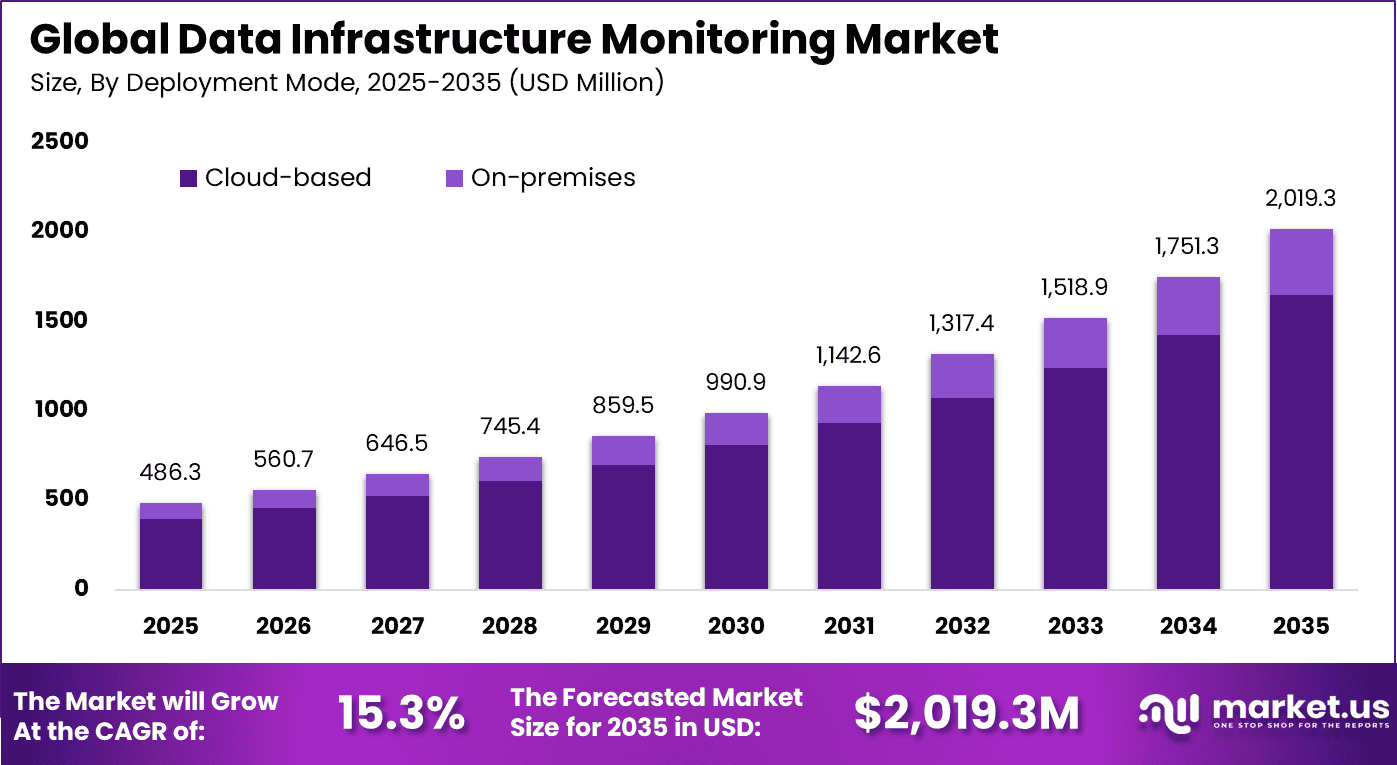

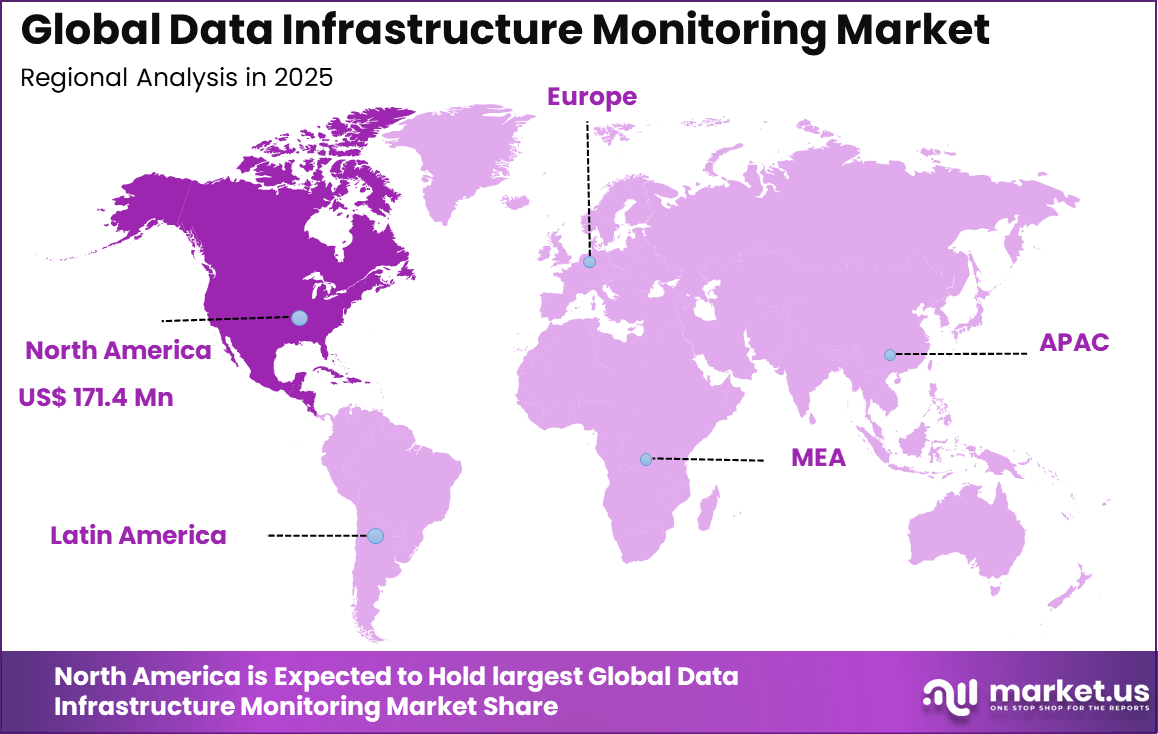

The Global Data Infrastructure Monitoring Market size is expected to be worth around USD 2,019.3 million by 2035, from USD 486.3 million in 2025, growing at a CAGR of 15.3% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 35.26% share, holding USD 171.4 million in revenue.

The Data Infrastructure Monitoring Market refers to tools and platforms used to track the performance, availability, health, and reliability of data infrastructure components across modern IT environments. These components include data pipelines, storage systems, databases, data processing engines, and network layers that support analytics and business operations. Monitoring ensures that data systems operate as expected and that failures are detected before they affect users or applications.

The market has become critical as organizations rely on continuous data availability for decision making. Modern data infrastructures are distributed across cloud, hybrid, and on premises environments. This complexity makes traditional infrastructure monitoring insufficient for data specific issues. Industry observations indicate that more than 65% of enterprises experience data related outages that are not immediately detected by standard IT monitoring tools.

Top driving factors are being linked to the rising cost of downtime and the operational risk of outages in always on digital services. In Uptime Institute reporting, 54% of respondents said their most recent significant outage cost more than $100,000, and 16% said it exceeded $1 million, which keeps monitoring and prevention spending high on the priority list.

For instance, in October 2025, BMC Software upgraded Control‑M with Control‑M SaaS and embedded AI‑driven advisors for workload automation and infrastructure monitoring. This connects job‑scheduling ecosystems more tightly to resource utilization signals, supporting enterprises in orchestrating complex hybrid data pipelines.

Data infrastructure monitoring underscores the high financial impact of system downtime. Mid to large enterprises report hourly downtime costs exceeding USD 300,000, while the average cost of unplanned IT outages is estimated at USD 14,056 per minute. For Global 2000 companies, these disruptions translate into significant annual losses, even when high uptime service level agreements are in place.

To address these challenges, adoption of automation and AI driven network operations is accelerating. Projections indicate that by 2026, around 30% of enterprises will automate more than half of their network operations. These technologies help improve network performance, enable proactive issue detection, and significantly reduce incident resolution time.

Key Takeaway

- The Cloud-based segment led the market in 2025 with a strong 81.5% share, reflecting rapid enterprise shift toward scalable and remote monitoring solutions.

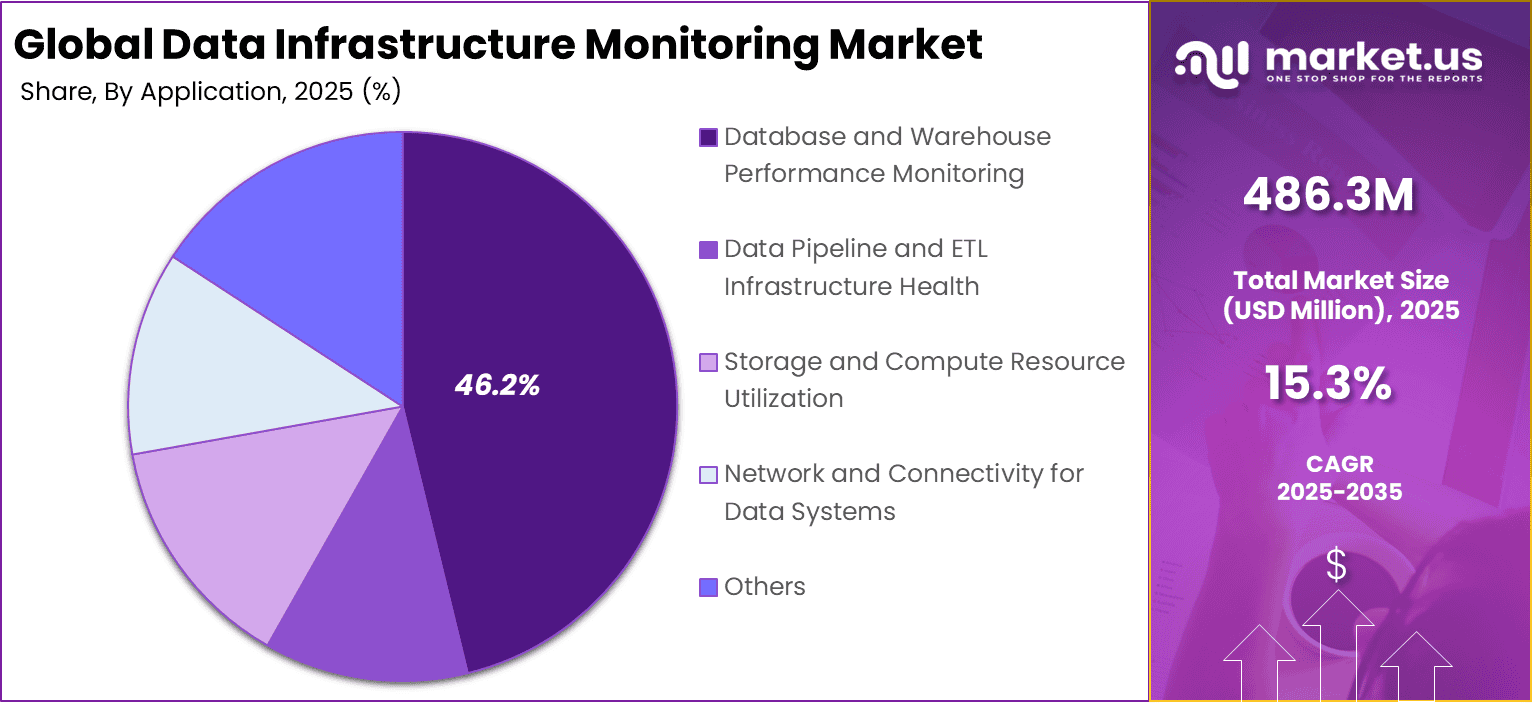

- Database and Warehouse Performance Monitoring accounted for 46.2% of the market, highlighting growing focus on data performance optimization and real-time analytics.

- The IT and Technology sector dominated end-user adoption with a 58.7% share, driven by complex digital infrastructure and high data workloads.

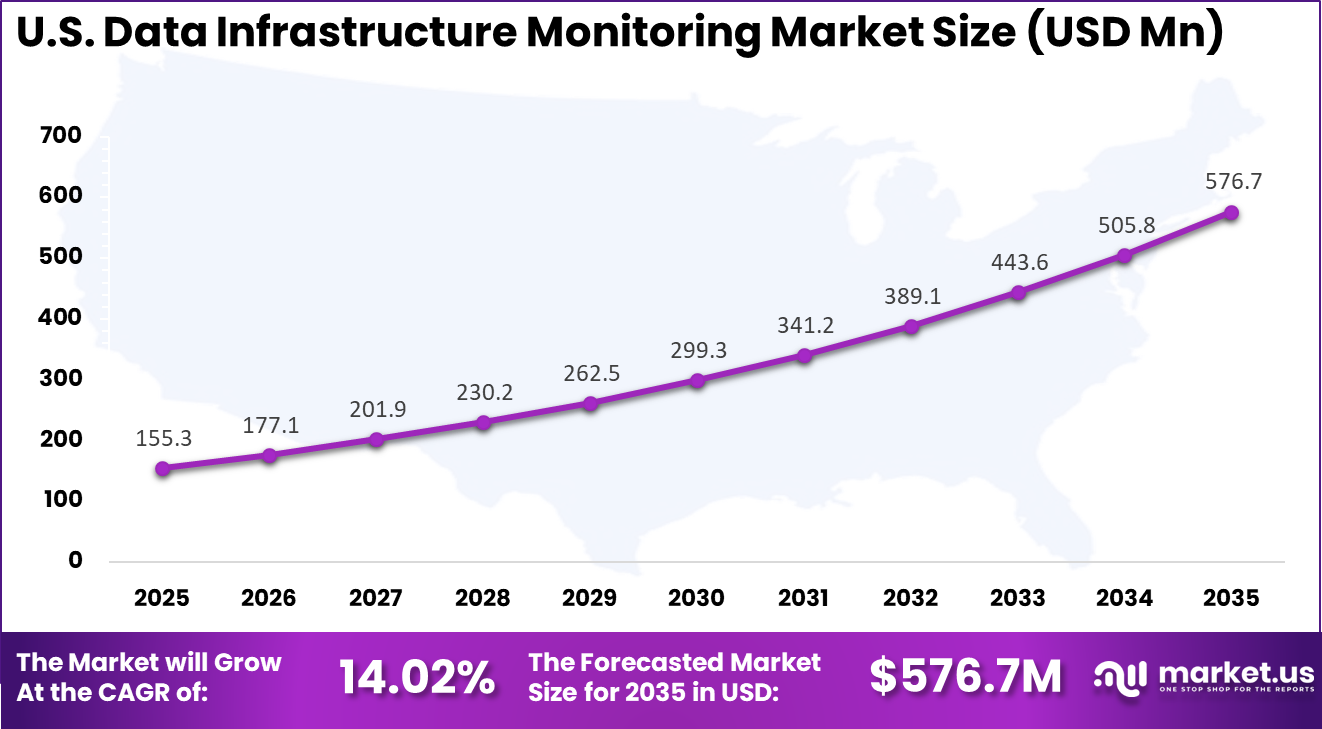

- The U.S. market was valued at USD 155.3 million in 2025 and is expanding at a CAGR of 14.02%, supported by increasing investments in cloud and hybrid environments.

- North America held over 35.26% of the global market in 2025, supported by early technology adoption and advanced data center infrastructure.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rapid growth in cloud-native and hybrid data environments +4.2% North America, Europe Short to medium term Increasing dependence on real-time data for business operations +3.6% Global Medium term Rising incidents of data pipeline failures and outages +3.1% Global Short term Expansion of AI and analytics workloads requiring high availability +2.5% North America, Asia Pacific Medium term Demand for centralized observability and performance monitoring +1.9% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High integration complexity across multi-cloud environments -2.9% Global Short to medium term Limited in-house expertise in data observability tools -2.4% Asia Pacific, Latin America Medium term Budget constraints among mid-sized enterprises -2.0% Emerging Markets Medium term Data privacy and compliance concerns -1.7% Europe, North America Medium term Tool sprawl and interoperability challenges -1.5% Global Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Data observability and monitoring platform providers Very High Medium North America, Europe Strong SaaS-based growth Cloud service and infrastructure providers High Medium Global Complementary service expansion Enterprise analytics and BI vendors Medium Medium Global Platform integration opportunity Private equity firms Medium Medium North America, Europe Consolidation of niche monitoring tools Venture capital investors High High North America Innovation in real-time monitoring Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Real-time data pipeline monitoring and alerting systems +4.5% Immediate issue detection Global Short to medium term AI-driven anomaly detection and root cause analysis +3.8% Predictive failure prevention North America, Europe Medium term Centralized observability dashboards +3.2% Unified infrastructure visibility Global Medium term Integration with DevOps and DataOps workflows +2.6% Operational efficiency Global Medium to long term Cloud-native monitoring with automated scaling +2.1% Performance optimization Global Long term By Deployment Mode

Cloud-based deployment holds a dominant position in the data infrastructure monitoring market, accounting for 81.5% of total adoption. This high share reflects the ongoing transition of enterprises toward cloud-native and hybrid IT environments. Organizations are increasingly managing distributed workloads across public cloud, private cloud, and multi-cloud platforms, which requires centralized and scalable monitoring systems.

Cloud-based solutions provide flexibility and allow real-time visibility into infrastructure performance without heavy upfront hardware investment. The preference for cloud deployment is also supported by its ability to support automation, remote accessibility, and continuous updates.

Businesses benefit from faster implementation cycles and reduced maintenance burden compared to traditional on-premises systems. As data volumes continue to increase and digital services expand, scalable monitoring frameworks become essential. Cloud platforms are therefore positioned as the backbone for modern infrastructure observability strategies.

For Instance, in October 2025, Dynatrace enhanced its cloud-native monitoring with Grail data lakehouse updates, improving analysis for multi-cloud deployments. The platform now maps dependencies faster, aiding quick issue spotting in dynamic cloud infrastructures. This supports the heavy shift to cloud-based tools for scalable performance oversight.

By Application

Database and warehouse performance monitoring represents 46.2% of application usage within the market, highlighting its operational importance. Databases and data warehouses serve as core systems for storing, processing, and retrieving enterprise data. Monitoring tools in this segment track query performance, system latency, workload distribution, and resource utilization.

Ensuring optimal database performance is critical to maintaining application responsiveness and service reliability. As organizations adopt analytics, business intelligence, and artificial intelligence tools, the demand on data warehouses continues to rise.

Performance monitoring enables early detection of bottlenecks, storage inefficiencies, and processing delays. This helps reduce downtime and supports consistent delivery of data-driven insights. The growing reliance on structured and unstructured data has strengthened the need for continuous oversight of database environments.

For instance, in November 2025, Splunk launched Database Monitoring in Observability Cloud, built on OpenTelemetry for SQL Server and Oracle. It spots slow queries, links app issues to database root causes, and offers AI fixes with code snippets. SRE teams resolve performance drags quicker, fitting the need for efficient warehouse analytics.

By End-User Industry

The IT and technology sector accounts for 58.7% of total market demand, making it the leading end-user industry. Companies in this sector operate complex digital ecosystems that require uninterrupted performance and high system availability. Infrastructure monitoring supports service reliability, application uptime, and efficient workload management.

As digital products and online platforms expand, monitoring tools become essential for maintaining operational stability. Technology firms are often early adopters of observability frameworks and automated monitoring systems. Integration with DevOps practices and agile development cycles further increases demand within this segment.

Continuous infrastructure oversight allows rapid detection of system failures and performance degradation. This strengthens service quality and supports competitive positioning in a highly dynamic market environment.

For Instance, in March 2025, ScienceLogic partnered with GlobalConnect to deliver AI-driven IT monitoring for a vast 152,000-mile network. The SL1 platform unifies observability, cuts noise, and automates root cause analysis for IT ops. Tech firms gain 24/7 visibility, speeding resolutions in complex IT landscapes.

Regional Analysis

North America holds 35.26% of the global market share, establishing it as the largest regional contributor. The region benefits from advanced digital infrastructure, high cloud adoption rates, and strong enterprise IT spending. Organizations across industries such as finance, healthcare, retail, and technology rely heavily on monitoring platforms to ensure system stability.

For instance, in September 2025, Splunk unveiled AI infrastructure and agent monitoring capabilities, featuring unified telemetry correlation and predictive analytics. This reinforces North American dominance by accelerating root cause analysis and ensuring reliable AI operations across complex infrastructures.

Within North America, the United States market was valued at USD 155.3 million, supported by a compound annual growth rate of 14.02%. The country demonstrates high adoption of cloud services, data analytics platforms, and digital transformation initiatives. Enterprises in the US continue to invest in infrastructure monitoring to reduce downtime and manage hybrid IT environments effectively.

For instance, in October 2025, Datadog unveiled major AI innovations at DASH 2025, including Bits AI SRE for autonomous incident response, GPU Monitoring, and Flex Frozen for cost-efficient log storage. These advancements solidify U.S. leadership in data infrastructure monitoring by enabling proactive observability across cloud and AI workloads.

Emerging Trends Analysis

An emerging trend in the data infrastructure monitoring market is unified observability platforms that combine infrastructure monitoring with application performance monitoring (APM) and data observability. This convergence offers end-to-end visibility from user interaction through backend systems and data layers. Unified observability supports faster diagnosis across the entire stack.

Another trend is increased automation in alerting and remediation workflows. Integration with incident management platforms and automated playbooks helps reduce mean time to resolution. Intelligent routing, automated diagnostics, and collaborative incident handling improve operational efficiency.

Growth Factors Analysis

One of the key growth factors for the data infrastructure monitoring market is widespread adoption of cloud and hybrid IT environments. As workloads migrate to cloud services, distributed computing and multi vendor infrastructure become common. Monitoring solutions that provide consistent coverage across clouds and on-premise systems remain essential.

Another growth factor is rising emphasis on digital service reliability. Organisations competing on user experience must minimise service disruptions and maintain high performance. Data infrastructure monitoring supports these expectations by providing early warning and actionable insights. Reliability driven investment continues to support steady market expansion.

Opportunity Analysis

A significant opportunity in the data infrastructure monitoring market lies in artificial intelligence and machine learning integration. These capabilities enhance anomaly detection, predictive analytics, and automated root cause analysis. Platforms that use AI to distinguish between normal and abnormal behaviour reduce manual effort and improve operational accuracy. Intelligent monitoring supports proactive optimisation.

Another opportunity is expansion into edge and IoT enabled environments. As enterprises deploy data processing closer to endpoints, monitoring requirements extend beyond centralised data centres. Data infrastructure monitoring solutions that scale to edge locations and offer unified reporting across distributed sites meet growing demand in IoT intensive industries.

Challenge Analysis

A major challenge for the data infrastructure monitoring market is balancing deep visibility with performance overhead. Continuous monitoring requires collection and processing of significant telemetry data. If not architected efficiently, monitoring itself can consume infrastructure resources and impact the very systems it observes. Optimising performance and resource use remains a key challenge.

Another challenge is aligning technical insights with business impact. Technical metrics such as CPU usage or query latency must be translated into meaningful business outcomes. Teams must correlate infrastructure signals with user experience and operational objectives. Without clear context, monitoring data may be underutilised.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Application

- Database and Warehouse Performance Monitoring

- Data Pipeline and ETL Infrastructure Health

- Storage and Compute Resource Utilization

- Network and Connectivity for Data Systems

- Others

By End-User Industry

- IT and Technology

- Banking, Financial Services, and Insurance

- E-commerce and Retail

- Telecommunications

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading observability and monitoring providers such as Datadog, Dynatrace, New Relic, and Splunk hold strong positions in the data infrastructure monitoring market. Their platforms provide real-time visibility across servers, containers, databases, and cloud workloads. AI-driven anomaly detection and root cause analysis improve incident response. These vendors benefit from strong enterprise adoption and broad integration ecosystems. Demand is driven by hybrid cloud expansion and rising system complexity.

IT operations and infrastructure management specialists such as SolarWinds, LogicMonitor, and ScienceLogic focus on unified monitoring across on-premises and multi-cloud environments. BMC Software and Micro Focus strengthen legacy system visibility and service management integration. AppDynamics and Riverbed enhance performance analytics. Adoption is supported by increasing downtime costs and digital transformation initiatives.

Cloud platform providers such as Amazon Web Services, Microsoft, Google, and IBM embed monitoring capabilities within native cloud services. These tools offer scalability, automation, and integration with DevOps workflows. Other vendors add competitive depth and regional specialization. This landscape supports continuous innovation and broad adoption of data infrastructure monitoring solutions worldwide.

Top Key Players in the Market

- Datadog

- Dynatrace

- New Relic

- Splunk

- SolarWinds

- LogicMonitor

- ScienceLogic

- Micro Focus

- BMC Software

- IBM

- Microsoft

- Amazon Web Services

- AppDynamics

- Riverbed

- Others

Recent Developments

- In April 2025, Datadog acquired Metaplane, an AI‑powered data observability platform, to close coverage gaps in data‑quality monitoring across the full data lifecycle. The move positions Datadog to extend infrastructure and application observability into data‑stack health, targeting AI‑driven workloads and cloud‑data platforms like Snowflake and Databricks.

- In March 2025, Dynatrace acquired Metis, a specialist in AI‑driven database observability, to strengthen its database‑performance monitoring within the Davis AI engine. The goal is to give DevOps teams a single‑click view from user experience down to database queries, reducing time‑to‑resolution for data‑intensive workloads.

Report Scope

Report Features Description Market Value (2025) USD 486.3 Million Forecast Revenue (2035) USD 2,019.3 Million CAGR(2025-2035) 15.3% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Application (Database and Warehouse Performance Monitoring, Data Pipeline and ETL Infrastructure Health, Storage and Compute Resource Utilization, Network and Connectivity for Data Systems, Others), By End-User Industry (IT and Technology, Banking, Financial Services, and Insurance, E-commerce and Retail, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datadog, Dynatrace, New Relic, Splunk, SolarWinds, LogicMonitor, ScienceLogic, Micro Focus, BMC Software, IBM, Microsoft, Google, Amazon Web Services, AppDynamics, Riverbed, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Infrastructure Monitoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Infrastructure Monitoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Datadog

- Dynatrace

- New Relic

- Splunk

- SolarWinds

- LogicMonitor

- ScienceLogic

- Micro Focus

- BMC Software

- IBM

- Microsoft

- Amazon Web Services

- AppDynamics

- Riverbed

- Others