Global Data Governance and Compliance Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Compliance Management, Risk Management, Audit Management, Incident Management, Data Quality and Security Management, Process Management, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Government and Public Sector, Retail and Consumer Goods, IT and Telecommunications, Manufacturing, Energy and Utilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178339

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

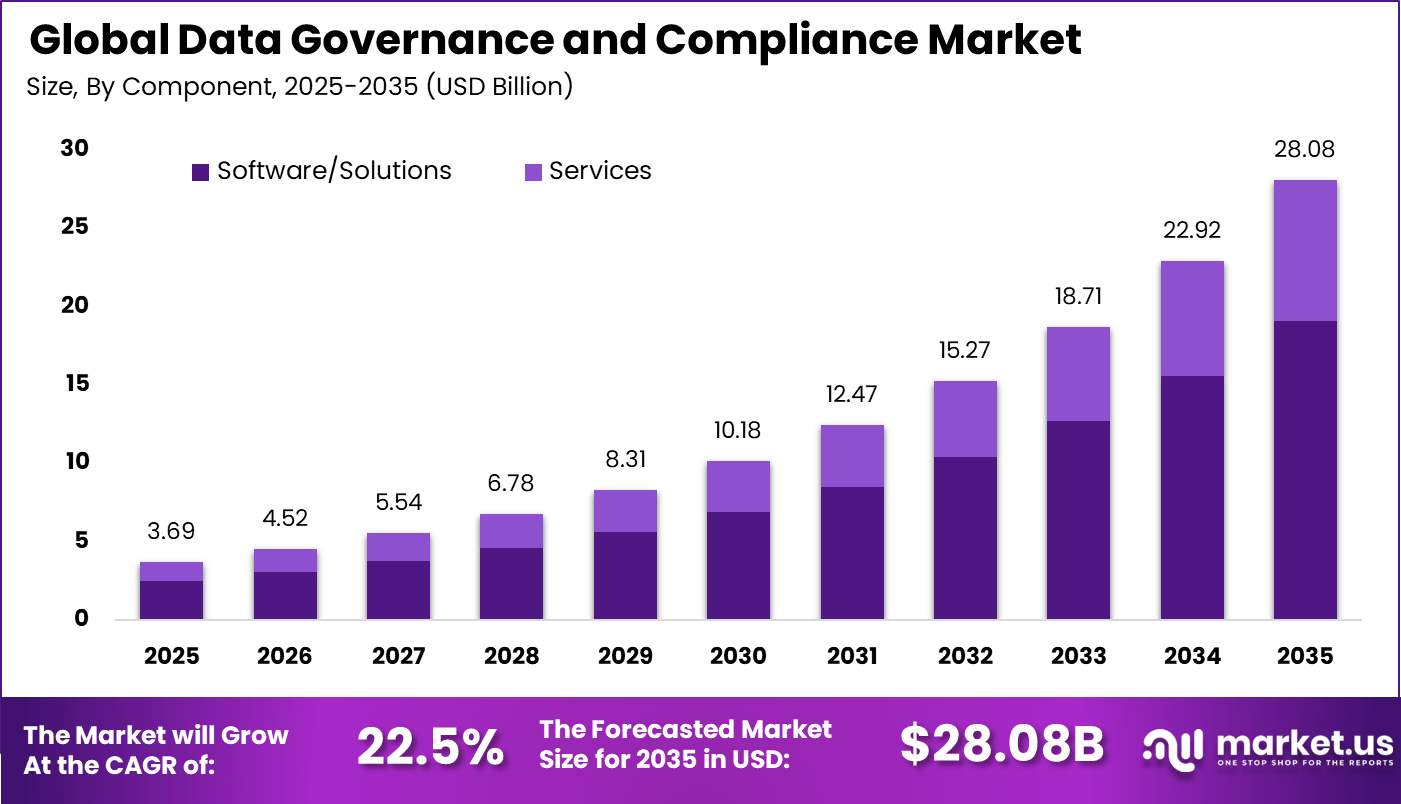

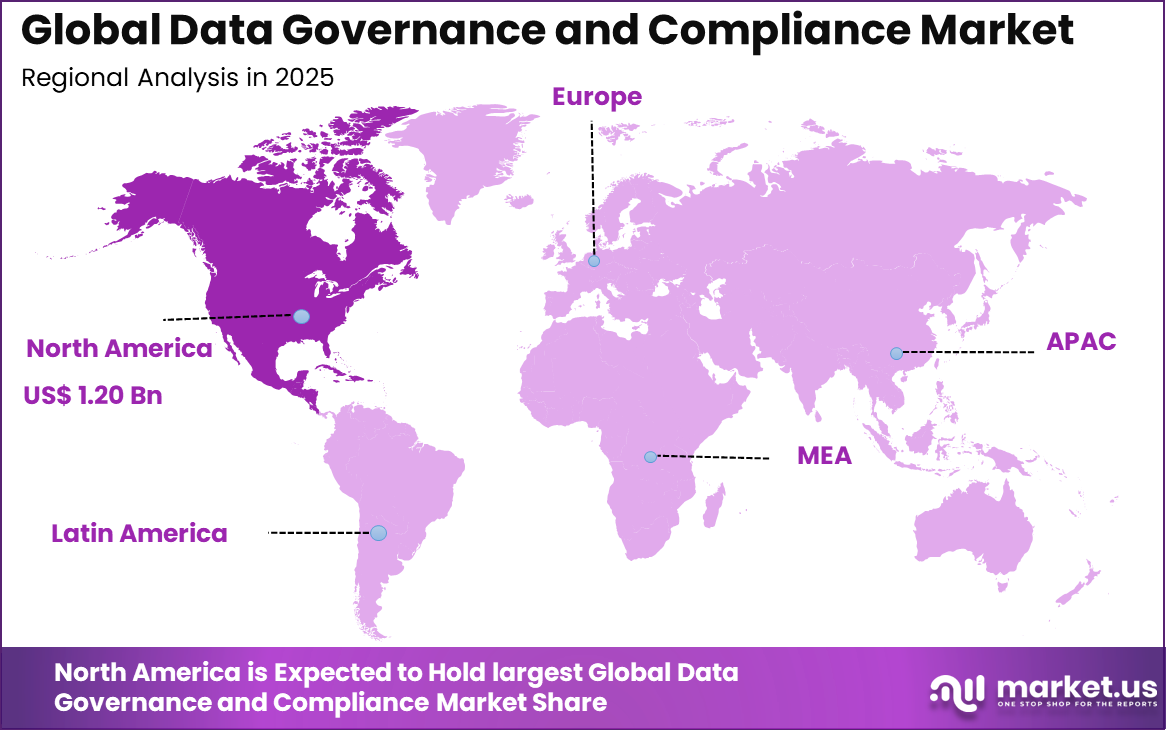

The Global Data Governance and Compliance Market size is expected to be worth around USD 28.08 billion by 2035, from USD 3.69 billion in 2025, growing at a CAGR of 22.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 32.62% share, holding USD 1.20 billion in revenue.

The Data Governance and Compliance Market refers to solutions and services that help organizations manage data quality, data ownership, privacy controls, and regulatory adherence across their systems. It includes software platforms for data cataloging, metadata management, policy enforcement, audit reporting, and risk monitoring. These solutions ensure that enterprise data is accurate, secure, and used in line with internal policies and external regulations.

As digital transformation accelerates across industries, structured data oversight has become a core business requirement rather than a support function. The market has expanded steadily due to increasing data volumes and stricter regulatory environments. Organizations are required to demonstrate transparency in how data is collected, processed, stored, and shared. Data governance frameworks are being embedded into enterprise IT strategies to support compliance readiness and operational efficiency.

One of the primary drivers of this market is the tightening of global data protection regulations. Laws related to privacy, financial reporting, and sector specific compliance have increased the burden on organizations to maintain traceable and auditable data systems. Regulatory penalties and reputational risks associated with non compliance have encouraged companies to invest in structured governance frameworks. As cross border data transfers increase, harmonizing compliance standards across regions has also become a priority.

Demand for data governance and compliance solutions is being observed across industries such as banking, healthcare, retail, telecommunications, and manufacturing. In highly regulated sectors, compliance reporting and audit readiness remain core priorities. In less regulated industries, governance is increasingly viewed as a strategic enabler for analytics, digital innovation, and customer trust. This shift from reactive compliance to proactive data management is broadening the addressable market.

For instance, in October 2025, SAP Datasphere advanced data governance with AI-driven automation and compliance tools tailored for 2025 regulations like GDPR and DPDP Act. The platform emphasizes clear data ownership, role-based access, and automated quality checks to support AI/ML workloads without slowing innovation.

Key Takeaway

- In 2025, the Software and Solutions segment accounted for 68.0% of the Global Data Governance and Compliance Market, reflecting strong reliance on integrated platforms for policy enforcement, data cataloging, and risk monitoring.

- The Cloud-based deployment model captured 58.0% share, supported by scalable infrastructure, centralized data control, and easier regulatory updates across distributed environments.

- Large Enterprises represented 71.0% of the market, driven by complex data ecosystems, cross-border compliance requirements, and higher regulatory exposure.

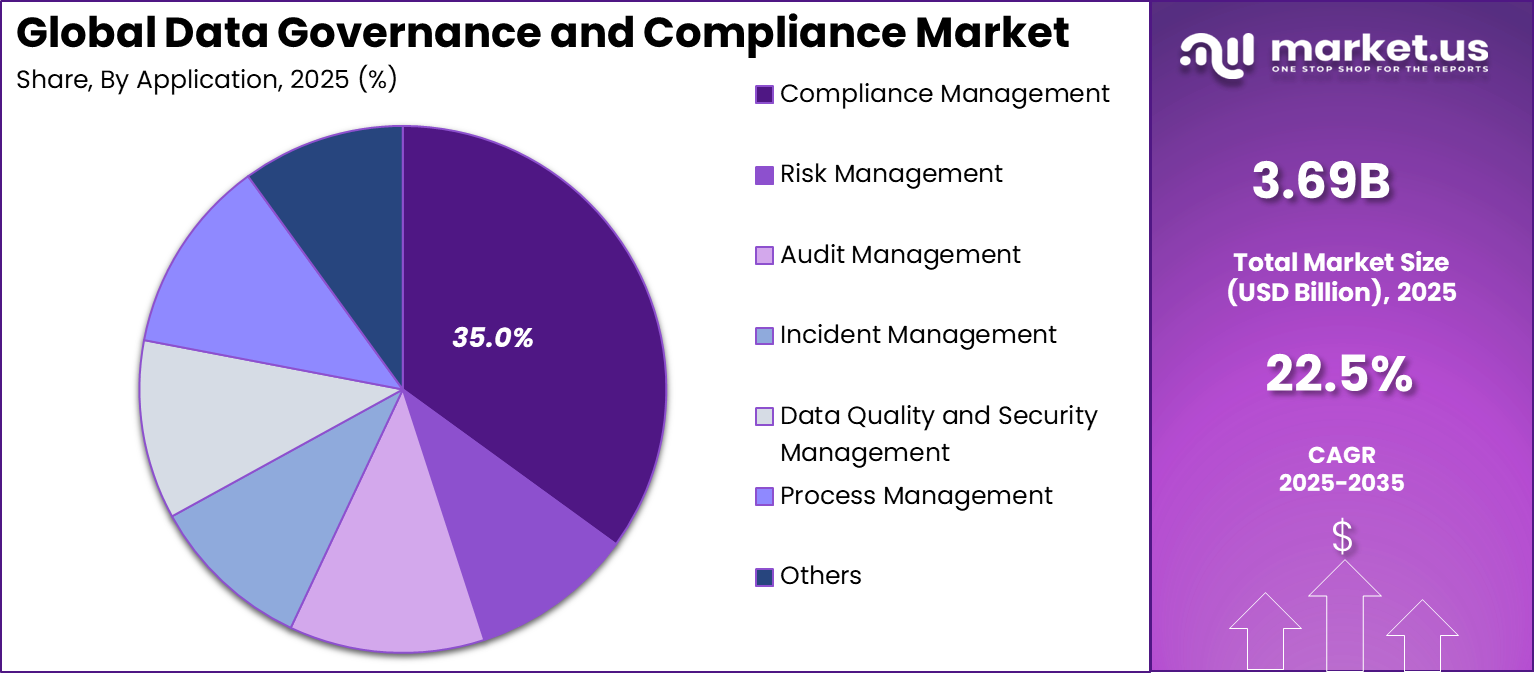

- The Compliance Management segment held 35.0% share, highlighting increased focus on audit readiness, regulatory reporting, and automated policy tracking.

- The Banking, Financial Services, and Insurance sector accounted for 32.0%, supported by strict financial regulations, data protection mandates, and fraud risk oversight.

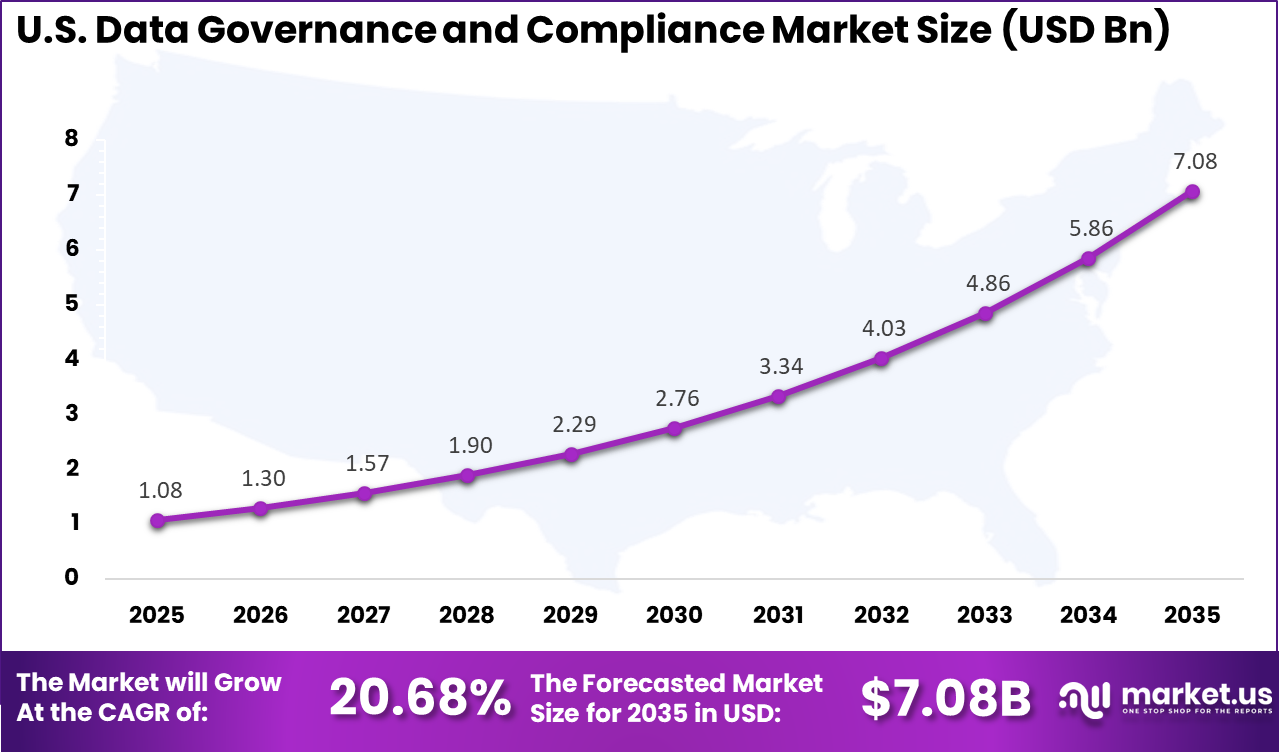

- The U.S. Data Governance and Compliance Market was valued at USD 1.08 billion in 2025, expanding at a CAGR of 20.68%, reflecting sustained investment in regulatory technology and enterprise risk management.

- North America maintained a leading position with over 32.62% of the global market share in 2025, supported by mature regulatory frameworks and strong adoption of governance automation tools.

Key Insights Summary

- 71% of organizations have established a formal data governance program in 2024, up from 60% in the previous year, indicating steady adoption across industries.

- A centralized data governance framework delivers an average financial benefit of USD 3.01 million, while poor data quality continues to cost organizations approximately USD 12.9 million annually.

- The average cost of a data breach reached USD 4.88 million in 2024, reinforcing the financial importance of structured governance and compliance controls.

- The primary benefits of governance programs include improved data quality and analytics at 58%, followed closely by enhanced cross-team collaboration at 57%.

- 62% of organizations identify data governance as a major challenge for AI initiatives, highlighting the dependency of AI performance on structured, trusted data environments.

- Operational complexity remains high, with 50% of organizations relying on five or more tools for data management. In addition, 55% manage more than 1,000 data sources, and 78% expect further growth in data volume and diversity.

- The leading strategic driver is better decision-making, cited by 65% of organizations, followed by operational efficiency at 57% and data privacy and security at 52%.

- Regulatory compliance is a key motivator, with 51% of organizations identifying it as a primary driver for governance investments. Non-compliance with privacy regulations can result in penalties of up to 4% of global revenue.

- Structured compliance processes generate measurable savings, with regular audits delivering an average benefit of USD 2.86 million, and formal incident response frameworks saving approximately USD 1.89 million.

- Data quality remains the top governance challenge, reported by 56% of organizations, while governance complexity continues to increase alongside expanding digital ecosystems.

By Component

Software and solutions account for 68.0% of the data governance and compliance market. Organizations are increasingly deploying centralized governance platforms to manage data quality, lineage, access control, and policy enforcement. As regulatory requirements become more stringent, automated tools are being implemented to ensure continuous monitoring and audit readiness.

These solutions provide structured frameworks that define ownership, classification, and usage policies for enterprise data. The growing complexity of digital ecosystems has strengthened reliance on governance software. Modern governance platforms integrate metadata management, risk assessment, and reporting dashboards within a single interface.

Automated compliance checks reduce manual workload and minimize regulatory exposure. Integration with enterprise resource planning and analytics systems enhances transparency across departments. Strong encryption and role-based access controls further support data protection mandates. The operational importance of governance software explains its leading share in this segment.

For Instance, in June 2025, Collibra released major updates to its platform, focusing on software innovations like GenAI-powered data quality and automated workflows. These enhancements strengthen software solutions by giving users better lineage tracking and observability, helping teams enforce governance policies easily. The release pushes proactive data handling, vital for compliance in busy enterprises.

By Deployment Mode

Cloud-based deployment represents 58.0% of the market, reflecting the ongoing shift toward cloud infrastructure. Organizations prefer cloud-based governance tools due to scalability, centralized monitoring, and lower infrastructure maintenance. Cloud environments allow real-time compliance tracking across geographically distributed operations. This ensures consistent enforcement of regulatory standards and internal policies.

As enterprises expand digital operations, cloud governance solutions provide flexibility and efficiency. Cloud deployment also enables automated updates to align with evolving regulatory frameworks. Businesses benefit from improved disaster recovery capabilities and secure remote accessibility. Centralized dashboards offer unified visibility into data usage and policy adherence.

For instance, in December 2025, AWS rolled out new governance tools in its cloud services, including better monitoring with CloudTrail and Config for compliance. This supports cloud-based deployments by simplifying multi-account management and regulatory alignment, like GDPR and HIPAA. Organizations gain easier cost controls and security, speeding up cloud adoption for scalable data governance.

By Organization Size

Large enterprises hold 71.0% of the data governance and compliance market. These organizations manage vast data volumes across multiple departments and global locations. Structured governance frameworks are essential to maintain consistency, security, and regulatory compliance. Centralized compliance platforms enable standardized policy enforcement and reduce operational risk.

Enterprise-scale adoption is driven by complex regulatory obligations and digital transformation initiatives. Large enterprises also face heightened scrutiny from regulators and stakeholders. Automated compliance monitoring ensures transparency and accountability in reporting processes.

Integration with internal audit systems enhances risk management and documentation accuracy. Strong governance capabilities improve data reliability for analytics and decision making. The scale and regulatory exposure of large enterprises explain their dominant share.

For Instance, in November 2025, IBM earned top marks in IDC MarketScape for data protection services aimed at large-scale transformations. Their focus on AI governance and multi-agent DLP suits big enterprises handling complex data lifecycles and privacy needs. It helps giants avoid pitfalls through strong change management and business-focused security.

By Application

Compliance management accounts for 35.0% of the market share. Organizations are investing in systems that monitor adherence to industry regulations, privacy standards, and internal governance policies. Automated compliance platforms reduce manual audit preparation and strengthen regulatory reporting accuracy.

Real-time alerts help identify policy violations and potential risks early. This proactive approach minimizes financial and reputational exposure. Compliance management solutions often include document tracking, audit trails, and reporting tools. These capabilities ensure that regulatory requirements are consistently met across business functions.

Enterprises rely on structured workflows to manage approvals and documentation. Integration with risk management frameworks enhances oversight and operational discipline. Growing regulatory complexity continues to drive adoption in this application segment.

For Instance, in July 2025, Informatica upgraded its IDMC with AI tools for MDM governance and a Data Catalog Scanner for compliance tracking. These features automate audits, lineage mapping, and risk scoring against regs like the EU AI Act, making compliance management smoother. Enterprises now handle regulatory needs with less effort and better visibility.

By End-User Industry

The Banking, Financial Services, and Insurance sector represents 32.0% of the data governance and compliance market. Financial institutions operate under strict regulatory frameworks that require transparent data handling and reporting. Governance platforms help manage transaction records, customer data, and risk documentation efficiently.

Automated monitoring ensures compliance with privacy laws and financial reporting standards. This reduces exposure to regulatory penalties and operational disruptions. Financial institutions also depend on accurate data for risk modeling and fraud detection. Governance systems provide traceability and access control to protect sensitive information.

Audit readiness and real-time compliance tracking are critical operational priorities. Strong oversight frameworks enhance stakeholder confidence and regulatory trust. The sector’s regulatory intensity explains its significant share in the market.

For Instance, in September 2025, Collibra topped the Forrester Wave for AI and data governance solutions, highlighting compliance for regulated sectors like BFSI. Their platform unifies policies and traceability for AI models, aiding banks with audits and risk controls. This leadership boosts trust in financial data handling amid strict rules.

Regional Overview

North America accounts for 32.62% of the global data governance and compliance market. The region benefits from advanced regulatory structures and high enterprise technology adoption. Organizations prioritize structured governance to address privacy regulations and cybersecurity requirements. Continuous investment in compliance automation strengthens market stability. Strong digital transformation initiatives further support regional growth.

For instance, in February 2026, IBM Corporation launched Watsonx. governance 2.0 from Armonk, New York, enhancing AI data lineage and compliance tracking for regulated industries. The platform automates GDPR/CCPA adherence with real-time audits, solidifying North American leadership in enterprise data governance.

The United States leads regional activity with a market value of USD 1.08 Bn and a CAGR of 20.68%. Enterprises across finance, healthcare, and technology sectors are expanding governance frameworks. Increased focus on data privacy and cross-border compliance drives demand for automated solutions. Investment in cloud-based compliance infrastructure continues to rise.

For instance, in January 2026, Informatica Inc. launched AI-powered data governance enhancements in its Intelligent Data Management Cloud, strengthening compliance capabilities for GDPR and CCPA regulations. This Redwood City-based leader solidified U.S. dominance by enabling enterprises to automate data classification and policy enforcement at scale.

Emerging Trend Analysis

A significant emerging trend in the data governance and compliance landscape is the increasing adoption of zero-trust data governance strategies in response to concerns about data reliability and security, especially with the growth of artificial intelligence applications. Industry analysis indicates that a zero-trust approach, where no data source is implicitly trusted and strict verification controls are applied, is gaining traction as organizations react to rising volumes of AI-generated and user-generated data.

This trend reflects a shift from traditional perimeter-based models toward governance frameworks that continuously authenticate and validate data integrity across the enterprise. The maturation of zero-trust governance is expected to influence investments in metadata management, access controls, and cross-functional data oversight mechanisms.

The shift toward zero-trust governance also aligns with broader digital transformation goals, where data accuracy, lineage, and accountability are prioritized to support advanced analytics and compliance objectives. Organizations are increasingly structuring governance programs to embed ongoing validation of data sources and implement rigorous policy enforcement at all stages of the data lifecycle.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Compliance Management

- Risk Management

- Audit Management

- Incident Management

- Data Quality and Security Management

- Process Management

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare

- Government and Public Sector

- Retail and Consumer Goods

- IT and Telecommunications

- Manufacturing

- Energy and Utilities

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Dedicated data governance platform providers such as Collibra Inc., Informatica Inc., Alation Inc., and Atlan play a central role in the data governance and compliance market. Their platforms offer data cataloging, lineage tracking, and policy enforcement. These capabilities improve transparency and regulatory readiness. Demand is driven by stricter privacy laws and rising enterprise data complexity.

Enterprise software and analytics vendors such as IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., and Microsoft Corporation integrate governance controls into broader data ecosystems. Google LLC and Amazon Web Services Inc. embed compliance features within cloud environments. Adoption is strong in regulated sectors such as finance and healthcare.

Data quality and master data management specialists such as Reltio Inc., Talend S.A., TIBCO Software Inc., and Precisely focus on data accuracy, consistency, and audit readiness. These players enhance trust in analytics and reporting. Other vendors expand innovation and regional coverage, supporting steady growth in data governance and compliance solutions globally.

Top Key Players in the Market

- Collibra Inc.

- IBM Corporation

- Informatica Inc.

- Oracle Corporation

- SAP SE

- Atlan

- SAS Institute Inc.

- Reltio Inc.

- Talend S.A.

- TIBCO Software Inc.

- Alation Inc.

- Precisely

- Microsoft Corporation

- Google LLC

- Amazon Web Services Inc.

- Others

Recent Developments

- In June 2025, Collibra rolled out major platform updates, including GenAI-powered data quality monitoring and enhanced AI governance features. These innovations automate workflows, provide unified observability, and integrate with Snowflake and Slack, helping enterprises scale data initiatives while maintaining compliance. This keeps Collibra at the forefront of proactive data governance.

Report Scope

Report Features Description Market Value (2025) USD 3.6 Bn Forecast Revenue (2035) USD 28.0 Bn CAGR(2026-2035) 22.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Compliance Management, Risk Management, Audit Management, Incident Management, Data Quality and Security Management, Process Management, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Government and Public Sector, Retail and Consumer Goods, IT and Telecommunications, Manufacturing, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Collibra Inc., IBM Corporation, Informatica Inc., Oracle Corporation, SAP SE, Atlan, SAS Institute Inc., Reltio Inc., Talend S.A., TIBCO Software Inc., Alation Inc., Precisely, Microsoft Corporation, Google LLC, Amazon Web Services Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Governance and Compliance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Governance and Compliance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Collibra Inc.

- IBM Corporation

- Informatica Inc.

- Oracle Corporation

- SAP SE

- Atlan

- SAS Institute Inc.

- Reltio Inc.

- Talend S.A.

- TIBCO Software Inc.

- Alation Inc.

- Precisely

- Microsoft Corporation

- Google LLC

- Amazon Web Services Inc.

- Others