Global Data Converter Market Size, Share, Industry Analysis Report By Type (Analog-to-Digital Converters, Digital-to-Analog Converters), By Sampling Rate (High-Speed Data Converters, General-Purpose Data Converters), By Industry Vertical (IT & Telecommunications, Manufacturing, Consumer Goods & Electronics, Media & Entertainment, Test & Measurement, Healthcare & Life Sciences, Other Industry Verticals), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 64675

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- Investment and Business Benefits

- U.S. Data Converters Market Size

- Type Analysis

- Sampling Rate Analysis

- Industry Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

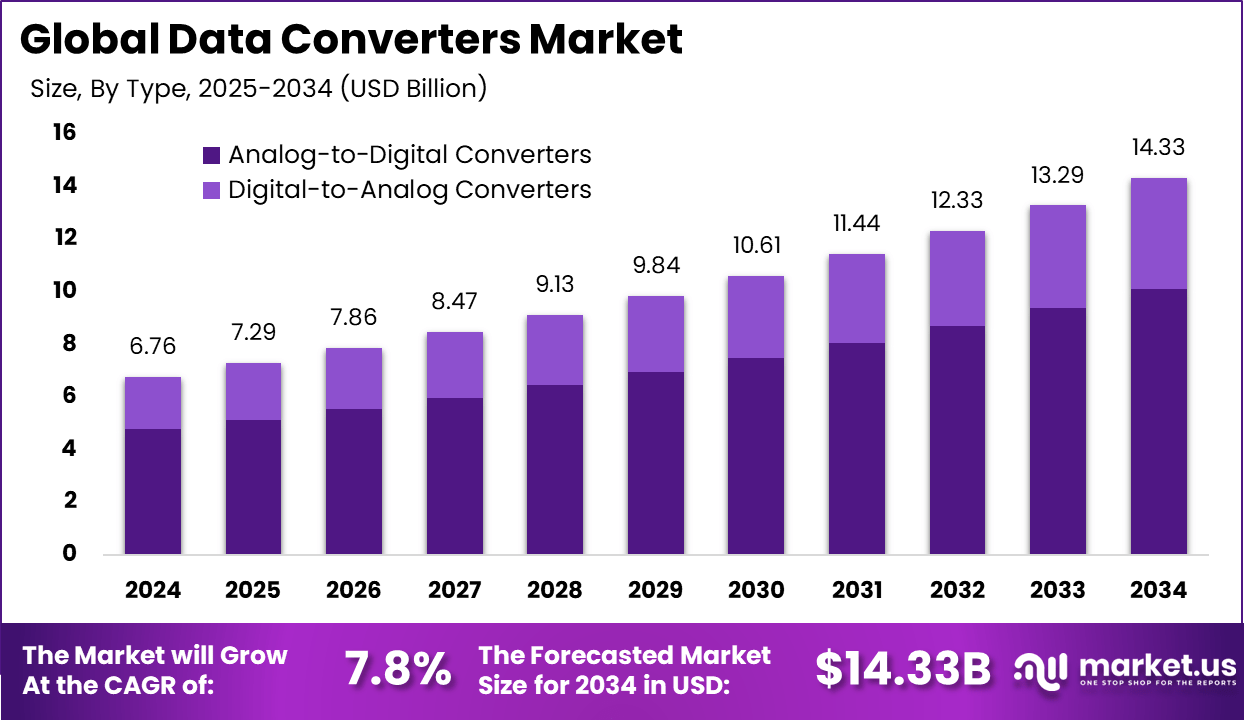

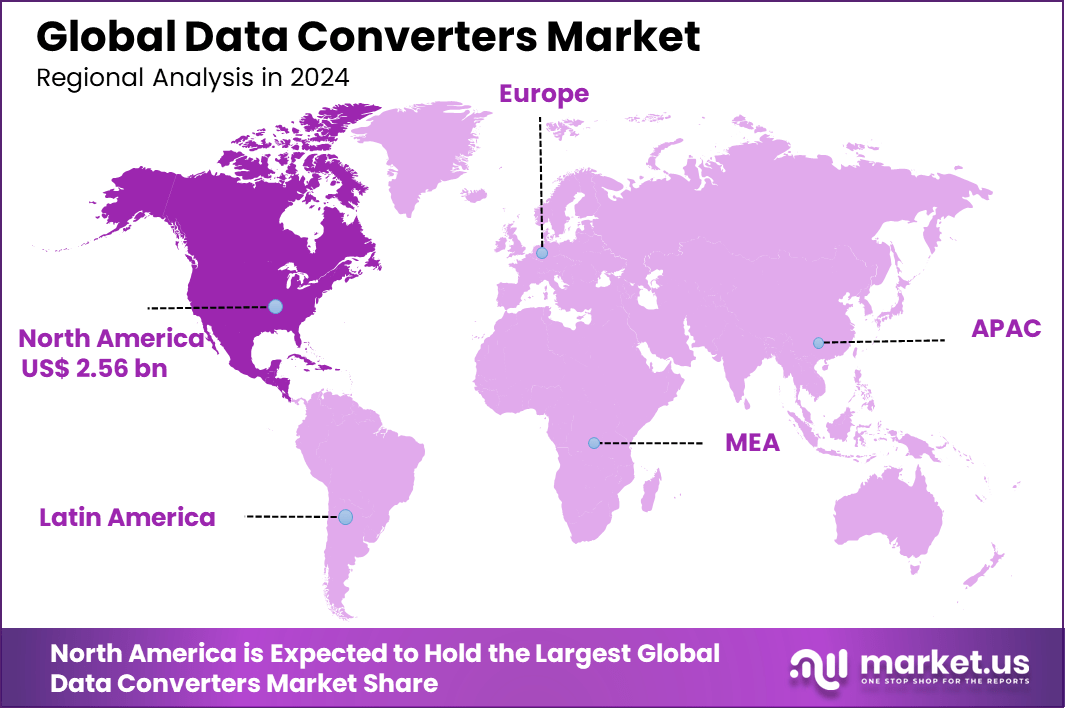

The Global Data Converter Market generated USD 6.7 billion in 2024 and is predicted to register growth from USD 7.29 billion in 2025 to about USD 14.3 billion by 2034, recording a CAGR of 7.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.4% share, holding USD 2.56 Billion revenue.

The data converter market has been expanding as industries shift toward advanced digital architectures. Increased demand for devices that convert analog signals into digital formats and vice versa is supporting wider adoption across electronics, communications and industrial systems. Growth reflects the rising use of high performance sensing, measurement and signal processing technologies in modern applications.

The growth of the market can be attributed to rising adoption of high resolution sensors in automotive systems, industrial automation and smart devices. The expansion of communication infrastructure, particularly in wireless networks and broadband systems, increases the need for accurate data conversion at higher speeds. Continued miniaturization of electronic products is also pushing manufacturers to integrate converters with higher efficiency and lower power consumption.

Demand for data converters is strongest in sectors that rely on real-time data processing and high signal integrity. The communications sector is a major user, as fast and reliable data transfer is essential for 5G, cloud, and edge computing. Consumer electronics, automotive, healthcare, and industrial automation are also major markets, as these industries require converters that can handle complex signals and deliver accurate results.

Advancements in technology are making data converters faster, more energy-efficient, and easier to integrate into a wide range of devices. The development of high-speed, low-power converters is especially important for mobile and IoT applications, where battery life and performance are critical. Integration with AI and edge computing platforms is also expanding the use cases for data converters, enabling smarter and more responsive systems.

Key Takeaways

- Analog-to-Digital Converters led the market in 2024, securing a 70.6% share, reflecting their essential role in converting real-world signals for digital systems.

- High-Speed Data Converters dominated the sampling rate category with 74.7%, driven by demand in advanced communications, imaging, and high-performance electronics.

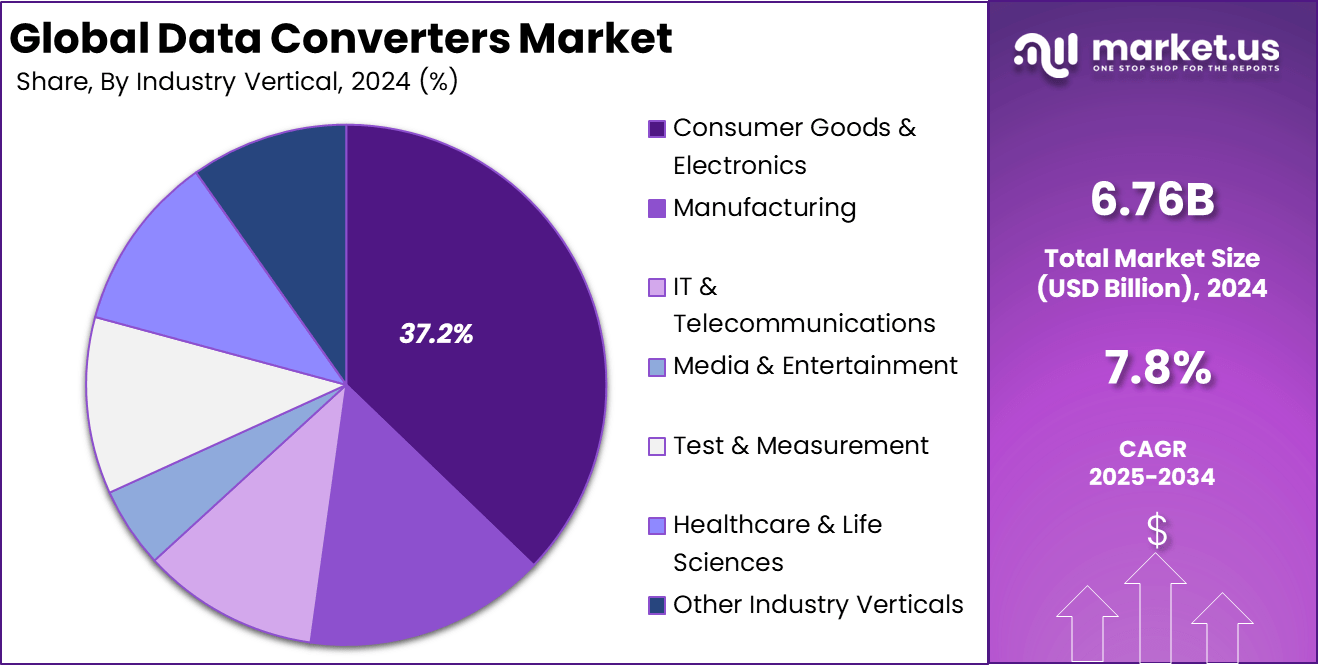

- The Consumer Goods and Electronics sector held 37.2%, supported by strong use in smartphones, appliances, wearables, and connected devices.

- North America accounted for 38.4% of global revenue, supported by technological innovation and strong semiconductor activity.

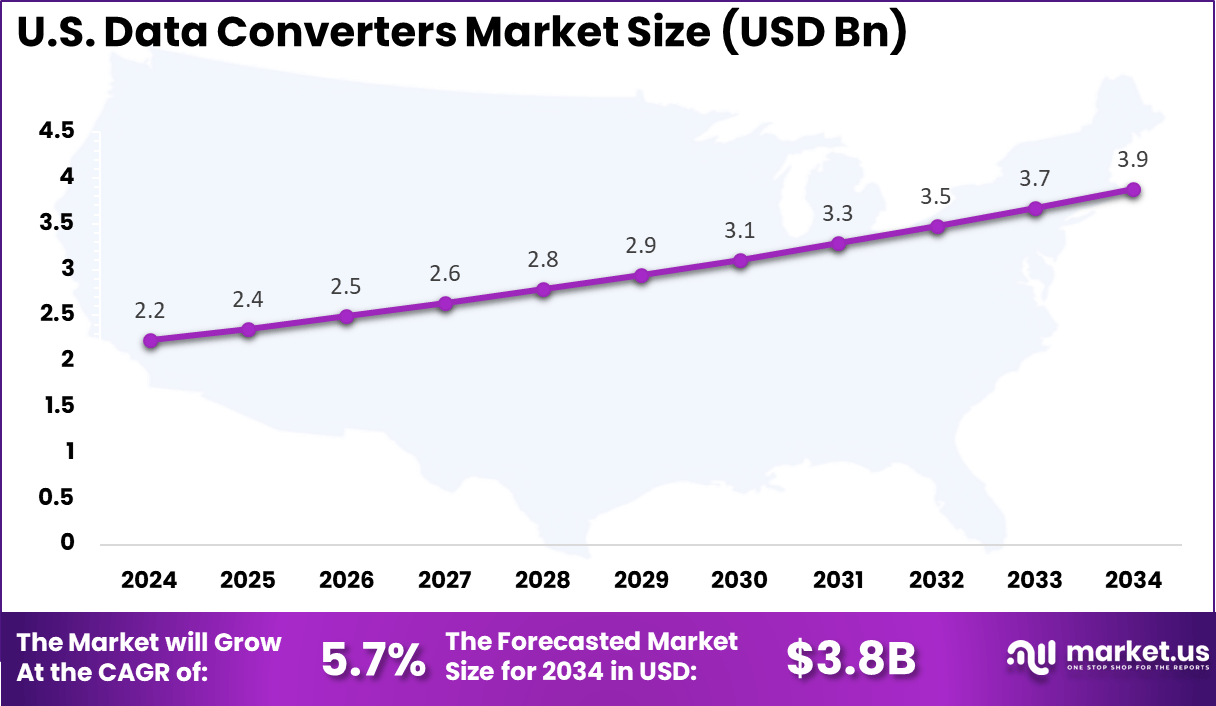

- The U.S. market reached USD 2.23 billion, expanding steadily at a 5.7% CAGR, backed by ongoing adoption in electronics, telecom, and automation applications.

Role of Generative AI

Generative AI is improving data converters by enabling the creation of realistic synthetic data. This helps train and test data conversion systems better without relying entirely on real data. Over 70% of industries using AI report faster data processing and improved accuracy, showing how generative AI enhances converter performance. It reduces manual work by automating complex data analysis, which speeds up how data is interpreted in sectors like healthcare and telecommunications.

Beyond training, generative AI allows data converters to adapt to different data conditions dynamically. This results in more reliable and precise conversions, especially in fields with strict privacy needs like finance and autonomous vehicles. As investments in AI-powered infrastructure rise, generative AI is becoming key in pushing the limits of data conversion technology and boosting overall system efficiency.

Investment and Business Benefits

Investment opportunities are rich in sectors embracing digitization and connectivity. Telecom infrastructure expansions, electric and autonomous vehicles, healthcare technology upgrades, and smart factory implementations all require advanced data converters. Governments supporting domestic semiconductor capabilities and private investments in chip manufacturing add momentum.

Emerging markets represent considerable growth potential as they build out communications and industrial digitization. The steady trend towards more integrated and multifunctional data conversion chips also opens opportunities for innovation and entry.

Businesses benefit from data converters through improved product performance, accuracy, and faster data processing, enabling better decision-making and user experiences. Outsourcing data conversion services offers cost savings, access to technical expertise, and quicker product development cycles. Reliable converters help companies comply with industry standards, reducing operational risks and bolstering consumer confidence.

U.S. Data Converters Market Size

The market for Data Converters within the U.S. is growing tremendously and is currently valued at USD 2.23 billion, the market has a projected CAGR of 5.7%. This growth is largely driven by the rapid adoption of advanced telecommunications infrastructure, especially 5G networks, which require high-speed and high-accuracy data processing.

Additionally, expanding consumer electronics sectors, such as smart devices and wearables, fuel demand for efficient data conversion technologies to enhance performance and user experience. Industrial automation and the rise of the Internet of Things (IoT) also contribute significantly to this growth.

Increased investments in aerospace, defense modernization, electric vehicles, and precision healthcare systems create strong demand for reliable and precise data converters. Together, these factors create a robust ecosystem promoting innovation and market expansion in the U.S. data converters sector.

For instance, in September 2025, Texas Instruments Inc. revealed a breakthrough in low-power, high-accuracy analog-to-digital converters (ADCs) aimed at prolonging battery life in portable medical devices. This development further strengthens TI’s position as a front-runner in energy-efficient data converters, vital for healthcare and IoT applications in the U.S. market.

In 2024, North America held a dominant market position in the Global Data Converters Market, capturing more than a 38.4% share, holding USD 2.56 billion in revenue. This dominance is largely driven by the region’s advanced communication infrastructure and early adoption of 5G technology, which creates strong demand for high-speed and efficient data converters.

Additionally, the well-established aerospace, defense, and consumer electronics sectors further boost market growth by requiring reliable and precise data conversion for critical applications. Moreover, significant investments in semiconductor manufacturing, R&D, and government support in the U.S. foster innovation and maintain the region’s competitive edge.

The growing prevalence of IoT devices, increasing automation in manufacturing, and expanding automotive electronics also play crucial roles in driving North America’s leading market share in data converters. These factors collectively strengthen the region’s position as a key hub for data converter technologies.

For instance, in October 2025, Analog Devices Inc. announced the launch of its latest high-performance data converter series designed to enhance signal processing in 5G infrastructure and autonomous vehicle applications. This innovation underlines Analog Devices’ leadership in advancing data conversion technologies critical for next-generation connectivity and sensing systems in North America.

Type Analysis

In 2024, the Analog-to-Digital Converters segment held a dominant market position, capturing a 70.6% share of the Global Data Converters Market. Analog-to-Digital Converters (ADCs) are prevalent in industries like telecommunications, healthcare, and industrial automation. Their ability to deliver high accuracy and resolution makes them essential for applications demanding precise data conversion, such as medical imaging and sensor monitoring.

This segment is led by delta-sigma ADCs, which are favored for their superior noise performance and efficiency at low sampling rates. The rising adoption of IoT devices and automation technologies further drives the use of ADCs, especially in environments where real-time data monitoring and signal fidelity are critical. This growing reliance on ADCs highlights their importance in powering advanced electronics and systems.

For Instance, in September 2025, Analog Devices Inc. highlighted its leadership in analog-to-digital converter (ADC) technologies at Citi’s Global Technology Conference. The company emphasized its broad industrial sector growth, with robust design wins in consumer products like smartphones, wearables, and gaming devices. ADCs remain central to these developments due to their critical role in converting real-world signals to digital formats for diverse applications.

Sampling Rate Analysis

In 2024, the High-Speed Data Converters segment held a dominant market position, capturing a 74.7% share of the Global Data Converters Market. The segment is driven by their capacity to handle fast-changing signals in emerging communication and industrial applications. They are crucial in supporting 5G network infrastructure, aerospace technologies, and high-frequency data analytics, where rapid and accurate signal processing is mandatory.

The need for high-speed performance comes from sectors requiring real-time data transmission, including telecommunications and industrial automation. As digital systems grow more complex and demand faster processing, high-speed converters play a fundamental role in ensuring seamless data flow and system reliability, making them a dominant segment in the market.

For instance, in November 2025, Microchip Technology highlighted its launch of the industry’s first 3nm PCIe Gen 6 switch, marking a significant milestone in high-speed data transfer technology. This innovation reflects Microchip’s drive to enhance high-speed data conversion capabilities, particularly for applications demanding high bandwidth and low latency, such as AI computing and enterprise data centers.

Industry Vertical Analysis

In 2024, The Consumer Goods & Electronics segment held a dominant market position, capturing a 37.2% share of the Global Data Converters Market. This dominance is due to the massive demand for devices like smartphones, wearables, and smart home products. These products rely heavily on efficient data converters to enhance performance, battery life, and user experience by accurately processing signals from sensors and input devices.

This industry segment grows alongside consumer interest in interconnected devices and digital entertainment. Constant innovation and the drive for smarter, faster gadgets keep fueling this sector’s demand for advanced data conversion technologies, reinforcing its significance in the overall market.

For Instance, in November 2025, STMicroelectronics continued its ongoing share repurchase program, signaling confidence in growth prospects tied to its semiconductor solutions used widely in consumer electronics. The company’s investments focus on enabling smarter devices with improved power and energy management through sophisticated data conversion technologies.

Emerging Trends

One notable trend in the data converter market is the integration of analog and digital components, which enhances performance while allowing for miniaturization of devices. This trend supports the growing demand in sectors like telecommunications and consumer electronics, where space and power efficiency are crucial.

The rise of high-speed data converters is another major trend, as industries adopt faster and higher-resolution converters for applications requiring quick and precise data handling, such as 5G networks and industrial automation. Additionally, the adoption of artificial intelligence and machine learning techniques within data converters is revolutionizing how signal processing and error correction are performed.

AI-enabled converters can adapt to varying signal conditions in real-time, significantly improving accuracy and reducing noise. These capabilities are increasingly important for medical imaging, autonomous vehicles, and smart industrial equipment. Approximately 30% growth is observed in AI-integrated data converters annually, reflecting their rising acceptance across critical fields.

Growth Factors

The growth of data converters is primarily fueled by the demand for high-speed data transmission driven by the expansion of 5G technology and the proliferation of IoT devices. As more industries embrace automation, the need for accurate and efficient data acquisition and processing increases, pushing the adoption of advanced data converters.

Consumer electronics and automotive sectors are heavily investing in these technologies to meet the rising expectations for faster and smarter devices. Energy-efficient designs also promote growth, as low power consumption becomes essential with the rapid increase in connected devices. Furthermore, advancements in wireless communication and digital signal processing contribute significantly to the market’s expansion.

Key Market Segments

By Type

- Analog-to-Digital Converters

- Digital-to-Analog Converters

By Sampling Rate

- High-Speed Data Converters

- General-Purpose Data Converters

By Industry Vertical

- IT & Telecommunications

- Manufacturing

- Consumer Goods & Electronics

- Media & Entertainment

- Test & Measurement

- Healthcare & Life Sciences

- Other Industry Verticals

Drivers

Rising Demand from Consumer Electronics

The growing use of consumer electronics such as smartphones, tablets, and wearable devices is a key driver for the data converters market. These devices require high-speed and efficient conversion of analog signals to digital and vice versa to support high resolution and real-time processing. This surge in consumer demand leads manufacturers to develop data converters with better performance, lower power consumption, and smaller sizes to fit modern electronics.

Since consumer electronics dominate end-user markets globally, their rapid adoption fuels continuous innovation and volume growth in the data converter segment. As more consumers seek advanced features and seamless connectivity, the need for precise data conversion remains essential, supporting steady market expansion.

For instance, in November 2025, Analog Devices reinforced its leadership in data converters by introducing new analog-to-digital converters designed for both high performance and power efficiency. Their portfolio targets applications such as communications and industrial automation, enabling superior conversion performance suited for the growing demands in consumer electronics. This launch underscores their commitment to meeting rising market demands with innovative products.

Restraint

High Cost and Complexity

A significant restraint on the data converters market is the high cost and technical complexity involved in developing high-resolution and high-speed converters. Advanced data converters require sophisticated design expertise, advanced materials, and rigorous manufacturing processes, which increase production costs. This limits broader adoption, especially in cost-sensitive applications such as low-end consumer electronics.

Moreover, the power consumption of high-performance data converters can be considerable, adding to operational costs and complicating integration into compact devices. The shortage of skilled engineers and designers capable of handling complex system-on-chip integrations further slows down the market growth.

For instance, in October 2025, Texas Instruments introduced new power-management chips designed to support AI workloads efficiently. Despite these advancements, TI faces challenges due to the complexity and cost of developing high-performance data converters. The technical expertise needed to integrate such systems and manage power consumption remains a restraint for widespread adoption in cost-sensitive applications.

Opportunities

Expansion with 5G and IoT

The ongoing expansion of 5G networks and rapid growth in Internet of Things (IoT) devices present major growth opportunities for the data converter market. 5G infrastructure demands data converters capable of handling large bandwidths, fast real-time data processing, and low latency. These advanced requirements create space for innovative converter architectures catering to telecommunications and edge computing applications.

At the same time, IoT adoption across various industries increases the volume of data generated and processed. Data converters will play an essential role in transforming analog signals from sensors and devices into digital data streams, supporting smart manufacturing, healthcare, automotive, and smart cities sectors. This broad potential accelerates demand and stimulates technological advancements.

For instance, in October 2025, STMicroelectronics unveiled a GaN-based flyback converter lineup designed for efficient USB power delivery and fast chargers. This product introduction aligns with the growth of IoT and 5G infrastructure, requiring robust, efficient data conversion solutions to support new power architectures. Their innovations highlight the expanding opportunities for data converters within emerging technologies.

Challenges

Rapid Technology Evolution

One of the challenges in the data converters market is the rapid pace of technological change. Newer technologies like 6G, artificial intelligence, and edge computing evolve fast, requiring ever-increasing performance from converters. This shortens product life cycles and forces companies to invest heavily in research and development to stay competitive.

Additionally, intense competition from major industry players with advanced intellectual property portfolios makes it difficult for smaller companies to enter or sustain their position in the market. Balancing innovation, regulatory compliance, and cost-efficiency amid this fast-changing landscape is a persistent hurdle for market participants.

For instance, in November 2025, Microchip Technology announced new radiation-tolerant transceivers for space systems featuring faster data rates. While this technology signals progress, microchip players must keep pace with rapid advancements in high-speed data conversion and face fierce competition from major firms. Constant innovation and R&D investment are critical to overcoming these challenges in a fast-evolving environment.

Key Players Analysis

Analog Devices and Texas Instruments lead the data converter market with broad portfolios of high-precision ADC and DAC products. Their solutions support industrial automation, communication networks, and measurement systems. Maxim Integrated, Microchip Technology, and STMicroelectronics strengthen adoption with power-efficient and highly integrated converters suited for consumer electronics and automotive applications. Their focus on accuracy and reliability helps meet diverse performance requirements.

Cirrus Logic, Renesas Electronics, and NXP Semiconductors enhance market competitiveness with audio-focused converters, mixed-signal architectures, and embedded designs. These companies serve growing demand in infotainment, smart devices, and connectivity equipment. ON Semiconductor and ROHM Semiconductor add value through converters designed for power management, sensing platforms, and automotive control units, supporting applications that require stable and robust performance.

Other key players contribute through specialized converter types, including high-speed, low-noise, and ultra-low-power variants. Rising deployment of connected devices, automation technologies, and high-bandwidth communication systems is increasing demand for advanced data converters. Continuous improvements in mixed-signal integration and semiconductor design are widening application opportunities and strengthening market growth across industrial, consumer, and automotive sectors.

Top Key Players in Data Converter Market

- Analog Device Inc.

- Texas Instruments Inc.

- Maxim Integrated Products Inc.

- Microchip Technology Inc.

- STMicroelectronics N.V.

- Cirrus Logic Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- ROHM Semiconductor

- Other Key Players

Recent Developments

- In November 2025, Analog Devices showcased advances in mixed-signal and data conversion technologies, highlighting superior performance for AI and high-efficiency power applications in data centers and industrial automation environments. Their solutions support emerging 800 VDC architectures critical for AI workloads.

- In May 2025, Texas Instruments announced a collaboration with NVIDIA to develop power management technologies for future 800V high-voltage DC power distribution systems suited for AI data centers. TI also introduced some of the smallest precision data converters with high resolution and integration, boosting design capabilities.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Bn Forecast Revenue (2034) USD 14.3 Bn CAGR(2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Analog-to-Digital Converters, Digital-to-Analog Converters), By Sampling Rate (High-Speed Data Converters, General-Purpose Data Converters), By Industry Vertical (IT & Telecommunications, Manufacturing, Consumer Goods & Electronics, Media & Entertainment, Test & Measurement, Healthcare & Life Sciences, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Analog Device Inc., Texas Instruments Inc., Maxim Integrated Products Inc., Microchip Technology Inc., STMicroelectronics N.V., Cirrus Logic Inc., Renesas Electronics Corporation, NXP Semiconductors N.V., ON Semiconductor Corporation, ROHM Semiconductor, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Analog Device Inc.

- Texas Instruments Inc.

- Maxim Integrated Products Inc.

- Microchip Technology Inc.

- STMicroelectronics N.V.

- Cirrus Logic Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- ROHM Semiconductor

- Other Key Players