Global Data Conversion Services Market Size, Share, Industry Analysis Report By Service Type (HTML Conversion Services, XML Conversion Services, Document Conversion Services, Media Format Conversion Services, SGML Conversion Services, Catalog Conversion Services, Others), By Data Type (Structured Data, Unstructured Data), By Enterprise Size (Small and Medium Enterprise, Large Enterprises), By Industry Vertical (IT & Telecom, Media & Publishing, Healthcare, Education, BFSI, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167169

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Role of Generative AI

- U.S. Market Size

- Service Type Analysis

- Data Type Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Investment and Business Benefits

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

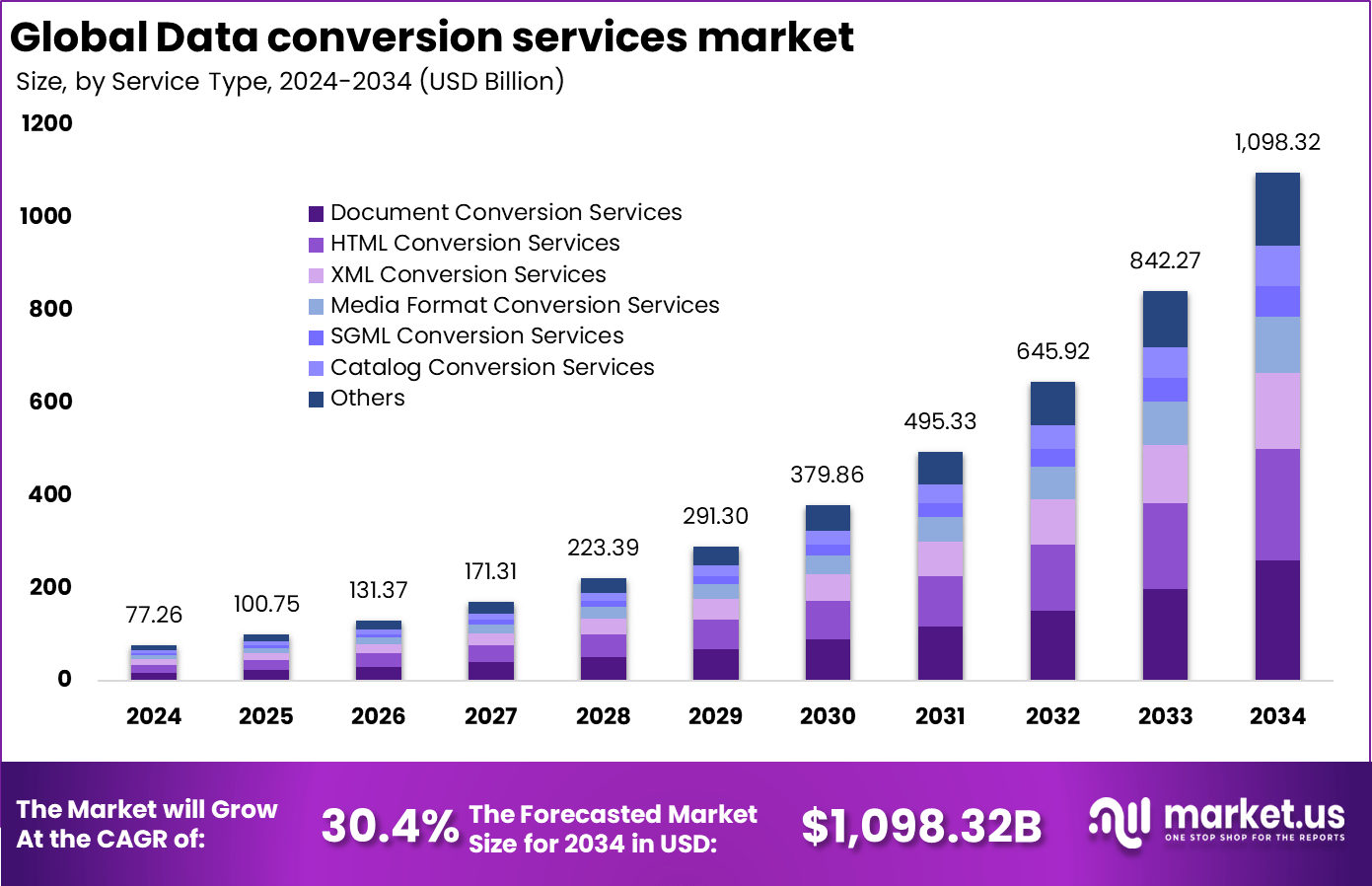

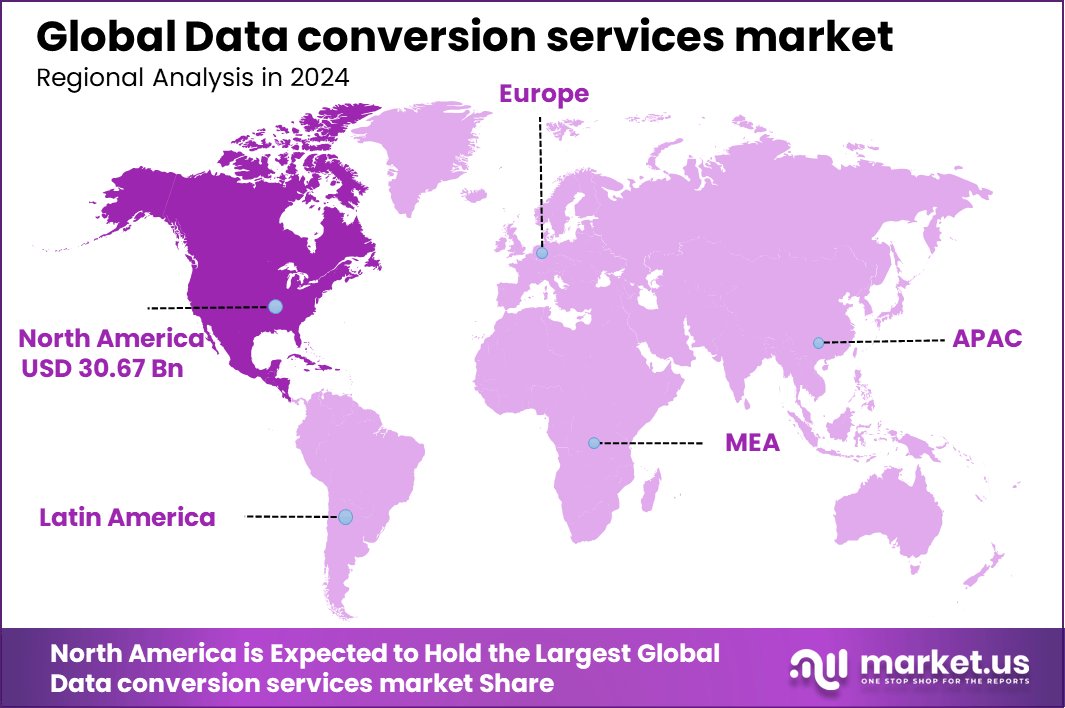

The Global Data conversion services market size is expected to be worth around USD 1,098.32 billion by 2034, from USD 77.26 billion in 2024, growing at a CAGR of 30.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.7% share, holding USD 30.67 billion in revenue.

The data conversion services market is expanding steadily as organizations handle increasing volumes of digital information. Annually, enterprises process billions of data records that require conversion to compatible formats for effective utilization. For instance, more than 80% of companies report challenges managing legacy data within modern systems, pushing demand for expert conversion support. This market supports smooth digital transformation by changing unusable or outdated data into actionable formats.

Top driving factors include escalating requirements for regulatory compliance and the surge in data diversity. Over 70% of businesses face regulatory audits where proper data formatting and accessibility are critical, prompting widespread adoption of professional conversion services.

Additionally, the rapid increase in diverse data types such as audio, video, text, and images strengthens the need to convert unstructured information into structured and usable formats. The demand for faster decision making from real time insights is also rising, supported by the fact that more than 65% of businesses now prioritize timely data access to maintain a competitive edge.

For instance, in May 2025, Informatica deepened its partnership with Databricks to launch the CLAIRE Modernization Agent, an AI agent that automates the complex migration of Hadoop-based data lakes to cloud-native platforms. This innovation helps customers accelerate cloud data modernization while preserving existing workloads and business logic.

Key Takeaway

- In 2024, the Document Conversion Services segment held a leading 23.7% share, reflecting strong demand for digitization and format transformation across industries.

- The Unstructured Data segment dominated with 66.8%, highlighting the increasing need to convert large volumes of unorganized data into usable formats for analytics and storage.

- The Large Enterprises segment captured 60.6%, driven by their extensive legacy data, compliance needs, and large-scale digital transformation initiatives.

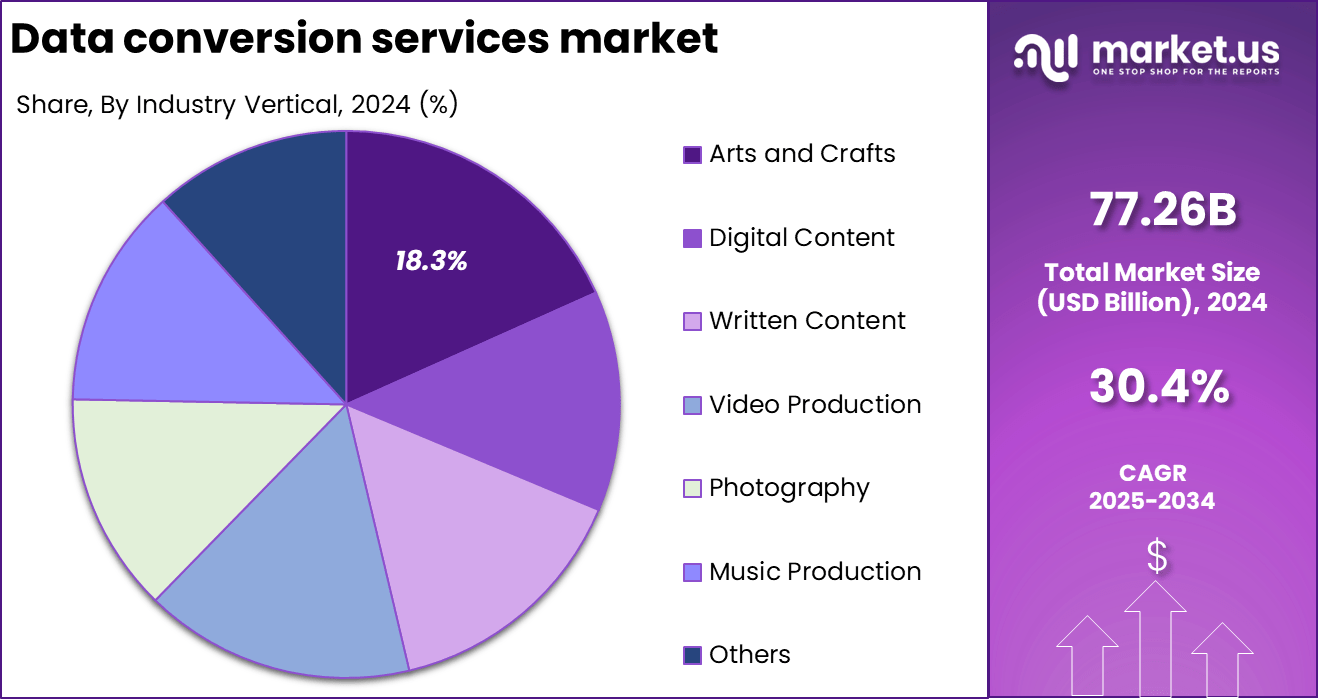

- The IT & Telecom segment accounted for 18.3%, showcasing continuous demand for data migration, digitization, and system modernization.

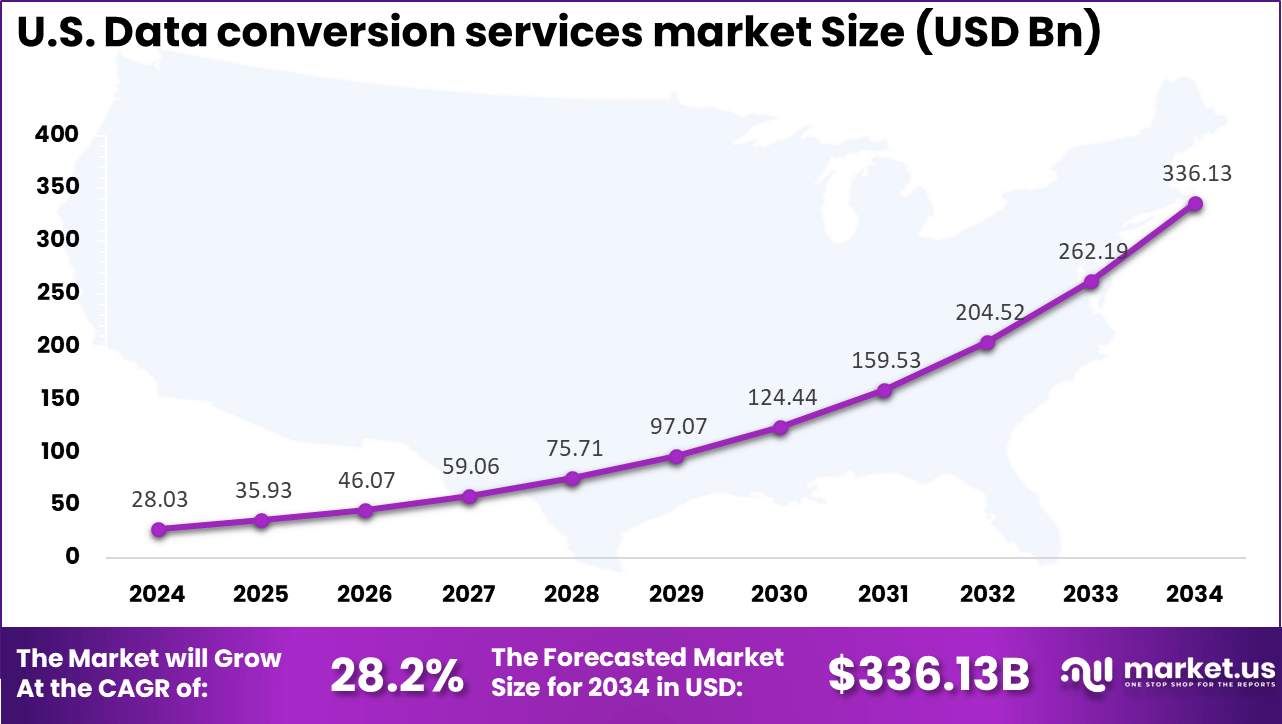

- The US market reached USD 28.03 billion in 2024 and is expanding at a strong CAGR of 28.2%, supported by rapid cloud adoption and enterprise data modernization projects.

- North America led the global market with over 39.7% share, backed by advanced IT infrastructure and aggressive digital transformation across industries.

Analysts’ Viewpoint

Adoption of technologies is increasing with automation playing a key role. Artificial intelligence and machine learning are employed by nearly 60% of data conversion providers to reduce manual errors and accelerate processing. Cloud platforms enable flexible, scalable data transformation accessible across regions, with over half of enterprises using cloud-based conversion solutions.

Emerging technology like blockchain is tested for ensuring data traceability during conversion, while robotic process automation enhances handling of repetitive tasks efficiently. These technologies address growing demands of speed, scale, and security. Key reasons for adoption center on ensuring compliance, improving operational efficiency, and focusing internal resources.

Regulatory pressures make accurate data handling vital, with around 75% of organizations citing compliance risk reduction as a top reason for outsourcing conversion. Faster turnaround times free critical personnel to concentrate on core activities, leading to reported productivity gains of up to 30% post-conversion. The accuracy and reliability gained guard against costly errors that could result from flawed manual processing.

Role of Generative AI

Generative AI is playing a growing role in data conversion services by automating complex tasks such as data transformation, cleaning, and schema mapping. It can generate SQL scripts and code that reduce the need for manual coding and human intervention, enhancing both speed and accuracy. Studies show that generative AI improves data processing efficiency by automating data validation and reconciliation, helping businesses maintain data integrity during migrations.

Approximately 70% of data conversion processes now deploy some form of AI to accelerate workflows and reduce errors, making generative AI a key driver in modern data operations. Additionally, generative AI’s ability to interpret unstructured data and convert it into usable formats is vital for industries that depend on diverse and large datasets.

With natural language processing, AI models facilitate better data analysis and integration, particularly for real-time business decisions. Research indicates that AI-driven data conversion tools can lower operational costs by around 30% while boosting data quality, highlighting the tangible benefits of this technology for enterprises.

U.S. Market Size

The market for Data conversion services within the U.S. is growing tremendously and is currently valued at USD 28.03 billion, the market has a projected CAGR of 28.2%. The market is growing due to the increasing need for digital transformation across industries. Businesses are focusing on converting legacy data into digital formats to improve accessibility, compliance, and operational efficiency.

Advancements in AI and cloud technologies further accelerate adoption by enabling faster, more accurate data conversion processes. The sharp rise in unstructured data and demand from large enterprises for seamless integration and real-time analytics also contributes to market expansion. This dynamic environment fuels robust market growth with strong investment and innovation momentum.

For instance, in November 2025, Microsoft introduced SQL Server 2025, featuring AI-driven data management capabilities that enable smarter search, semantic intelligence, and seamless AI model integration, enhancing data conversion and cloud migration solutions at its Microsoft Ignite conference.

In 2024, North America held a dominant market position in the Global Data conversion services market, capturing more than a 39.7% share, holding USD 30.67 billion in revenue. This dominance is due to the region’s early adoption of digital transformation initiatives and advanced IT infrastructure. Leading industries within the region heavily invest in data conversion to support efficient data management, compliance, and analytics.

Moreover, North America’s growth is fueled by robust technology investments, including AI, cloud computing, and big data analytics. The presence of major technology companies and a supportive regulatory environment further drives innovation and adoption, making the region a key hub for data conversion services globally. This leadership position is maintained through continuous advancements and heightened demand across sectors.

For instance, in October 2025, Oracle Collaborated with Microsoft, launched Oracle Exadata Database Service on Oracle Database@Azure, enhancing hybrid cloud data capabilities with scalable, AI-enabled infrastructure supporting complex data conversion and migration tasks.

Service Type Analysis

In 2024, The Document Conversion Services segment held a dominant market position, capturing a 23.7% share of the Global Data conversion services market. This service involves changing physical or digital documents into formats that are easier to manage and access. Many organizations rely on this process to update old archives, enhance workflows, and meet changing data standards.

It remains especially critical for sectors handling large volumes of legacy data that must be made searchable and editable for ongoing use and compliance. The demand for document conversion services is rising as businesses pursue digital transformation. The adoption of automation tools like optical character recognition (OCR) and AI-powered software supports faster, more accurate conversion.

For Instance, in October 2025, IBM Corporation announced new software products and intelligent infrastructure enhancements geared towards enterprise software modernization, which include advanced document conversion capabilities powered by AI. These advancements aim to automate system upgrades and enable smooth modernization processes for large-scale document and data ecosystems.

Data Type Analysis

In 2024, the Unstructured Data segment held a dominant market position, capturing a 66.8% share of the Global Data conversion services market. This category includes emails, PDFs, social media content, images, and videos. Converting this type of data into structured formats is complex but critical for enabling better analysis and business intelligence.

Advanced technologies such as machine learning and natural language processing play a key role in transforming unstructured data into actionable insights. Organizations benefit from improved decision-making and process automation by unlocking valuable information from otherwise unmanageable data sources.

For instance, in July 2025, Oracle launched Oracle Database@AWS, which seamlessly integrates Oracle databases with AWS infrastructure, enabling easier migration and integration of large unstructured data sets. The service supports analytics and AI capabilities to convert and analyze unstructured data effectively in cloud environments.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 60.6% share of the Global Data conversion services market. These organizations manage vast and varied data that needs conversion for digital modernization, migration, and regulatory compliance. The complexity of their IT environments drives the need for reliable, scalable data conversion solutions.

With extensive workflows and global operations, large enterprises prioritize solutions that enhance data accuracy and security. Efficient data conversion supports their digital transformation strategies and helps ensure smooth integration of diverse data formats into centralized systems.

For Instance, in October 2025, Informatica announced its Fall release, featuring AI-driven enhancements to its Intelligent Data Management Cloud. Targeted at large enterprises, this platform enables comprehensive management and conversion of complex, diverse data in AI environments, boosting security and productivity.

Industry Vertical Analysis

In 2024, The IT & Telecom segment held a dominant market position, capturing an 18.3% share of the Global Data conversion services market. Rapid technological advancements and the continuous growth of digital data in this industry drive the need for conversion services. These services support data migration, content digitization, and compatibility with evolving digital platforms.

This sector benefits from fast and precise data conversion to maintain innovation and improve customer experience. The increasing volume of data generated from communication channels and devices requires ongoing conversion efforts to support cloud adoption and service delivery.

For Instance, in November 2025, SAP SE announced Accenture’s launch of an AI-Enabled Data Conversion Manager for SAP Cloud ERP. This AI-powered tool is designed to simplify and accelerate data migrations within IT and telecom enterprises, ensuring seamless transitions to cloud ERP systems while maintaining data integrity.

Investment and Business Benefits

Investment prospects are abundant in industries emphasizing digitalization, telecommunications, healthcare technology upgrades, and smart manufacturing. Expanding telecom infrastructures and the rise of autonomous and electric vehicles create growing needs for sophisticated conversion technologies.

Private and government investments in semiconductor advancements related to data converters also contribute to market momentum. Emerging regions present significant opportunities as they develop digital ecosystems requiring extensive data transformation capabilities.

The benefits of data conversion services include improved system interoperability, enhanced data usability, and preserved data integrity. Quick access to accurately converted data improves operational efficiency and helps businesses make timely, informed decisions.

It supports foolproof compliance with regulations, minimizes risks of data loss or misinterpretation, and facilitates data-driven strategies. Additionally, these services aid long-term data archiving and secure storage, ensuring valuable organizational knowledge is preserved for future use

Emerging trends

Emerging trends in data conversion include the widespread adoption of AI-powered automation and the shift towards real-time data processing. With the rise of IoT devices and cloud ecosystems, companies now require data to be converted and fed into analytics platforms instantly.

More than half of enterprises have adopted real-time data pipelines, enabling quicker insights and faster responses to market changes. Alongside this, cloud-native tools are becoming standard in conversion workflows, offering scalability, security, and easier collaboration across teams and locations.

Another important trend is the focus on metadata-driven conversion techniques that keep track of data lineage and usage history, essential for compliance and auditing purposes. This trend is supported by a rising demand for low-code and no-code platforms that allow non-technical users to perform data conversion tasks independently.

Additionally, data privacy regulations are shaping how conversion processes are designed, requiring built-in encryption and tracking features. These technological and regulatory trends are reshaping the way organizations handle their data, pushing for smarter, faster, and safer conversions.

Growth Factors

The growth of data conversion services is fueled by the rapid expansion of digital data and the pressing need for data modernization across industries. Companies are investing more in digital transformation initiatives, which require efficient and accurate conversion of legacy data into formats that support analytics and modern applications.

AI-enhanced conversion tools have contributed to a 25% increase in accuracy and have significantly shortened project turnaround times. This growth is also influenced by stringent regulatory requirements that demand precise data handling and reporting.

Industries such as healthcare, finance, and e-commerce are leading the demand for data conversion services because they handle sensitive and diverse data types that must be accurately standardized and integrated. Their growing reliance on data-driven operations means that conversion services are critical to maintaining operational continuity and regulatory compliance.

Key Market Segments

By Service Type

- HTML Conversion Services

- XML Conversion Services

- Document Conversion Services

- Media Format Conversion Services

- SGML Conversion Services

- Catalog Conversion Services

- Others

By Data Type

- Structured Data

- Unstructured Data

By Enterprise Size

- Small and Medium Enterprise

- Large Enterprises

By Industry Vertical

- IT & Telecom

- Media & Publishing

- Healthcare

- Education

- BFSI

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Need for Digital Transformation

The growth of data conversion services is primarily driven by the accelerating digital transformation across industries such as healthcare, finance, and manufacturing. Organizations are generating massive volumes of data that need to be transformed from legacy formats into modern, usable digital formats. This conversion is essential to support cloud migration, analytics, and more efficient operations.

As companies strive to become more data-driven, the need for accurate and timely data conversion services becomes critical, fueling steady market demand. Furthermore, technological advancements such as automation and AI-powered tools have improved the accuracy and speed of data conversion processes. These innovations reduce manual effort, making service delivery more cost-effective and accessible.

For instance, in October 2025, IBM announced the acquisition of Cognitus, a leader in SAP S/4HANA services, boosting its capabilities in AI-enabled data migration and legacy system modernization. This reflects how IBM is helping enterprises accelerate their digital transformation by converting legacy data into modern, cloud-friendly formats with AI-driven automation.

Restraint

High Cost and Complexity

One major restraint for the data conversion services market is the high cost involved, especially for small and medium-sized enterprises. Implementing quality conversion solutions requires substantial investment in technology, skilled personnel, and time. These costs can be prohibitive and create barriers for organizations with limited budgets, slowing adoption rates despite growing awareness of the benefits.

In addition, data conversion can be a complex process because of varied data types and formats spread across legacy systems. This complexity increases the risk of errors, data loss, or corruption, which could lead to operational disruption and financial losses. Concerns over data security when handling sensitive information further hamper growth, as companies may hesitate to outsource or automate conversion tasks without guarantees of protection.

For instance, in November 2025, Oracle expanded its Database@AWS service with new AI-powered database capabilities but emphasized the challenges enterprises face in managing complex, multi-cloud migration projects. The company noted clients often encounter substantial costs and technical complexities in converting and managing large, on-premises legacy data for cloud deployments.

Opportunities

Expansion Through Cloud Migration

The ongoing shift of business operations to cloud platforms presents a significant opportunity for data conversion service providers. As companies move data to cloud environments, they require efficient methods to convert and migrate legacy data into cloud-compatible formats. This expansion in cloud adoption is creating fresh demand for specialized data conversion offerings that ensure seamless transition and real-time data availability.

Moreover, advances in artificial intelligence and big data analytics amplify this opportunity by requiring high-quality, structured data for intelligent decision-making. Providers who integrate AI-driven automation into their services can deliver faster, more accurate conversions, helping organizations harvest valuable insights from their data.

For instance, in June 2025, AWS launched Amazon Transform, an AI-driven service that automates application modernization and infrastructure migration. The tool accelerates the conversion of Windows-based and VMware environments to cloud-native formats, underscoring AWS’s approach to simplifying cloud migration and opening new avenues for growth in data conversion services.

Challenges

Data Security and Compliance Risks

Data security and regulatory compliance represent significant challenges in the data conversion services market. Handling sensitive information during conversion processes exposes companies to potential breaches, which can cause reputational damage and legal penalties. Many firms are cautious about sharing their data with external service providers or using automated tools due to these risks.

Additionally, evolving regulations such as GDPR and other data privacy laws require strict adherence to data handling standards. Ensuring compliance while managing diverse data formats and sources adds complexity to service delivery. Service providers must invest in robust security measures and transparent processes to build trust and meet both client and legislative demands.

For instance, in November 2025, at Microsoft Ignite 2025, the company highlighted enhancements in in-country data processing for its Microsoft 365 Copilot to strengthen data sovereignty and regulatory compliance. This move addresses risks related to data privacy and security in data handling and conversion, which remain a critical concern for enterprises worldwide when outsourcing or automating data conversion tasks.

Key Players Analysis

IBM, Oracle, AWS, and Microsoft lead the data conversion services market with strong cloud platforms and advanced data management tools. Their solutions support large-scale migration, format transformation, and secure data handling for enterprises modernizing legacy systems. These companies focus on improving conversion accuracy, reducing downtime, and enabling smoother transitions to cloud environments.

SAS, SAP, Informatica, Talend, Qlik, and TIBCO strengthen the competitive landscape with specialized ETL, data integration, and metadata management capabilities. Their platforms help organizations convert unstructured and structured data into usable formats for analytics and operational workflows. These providers emphasize automation, data quality enhancement, and compliance readiness.

Invensis Technologies, Syncsort, Damco Solutions, and other participants expand the market with cost-efficient outsourcing and customizable conversion services. Their offerings include document digitization, legacy system mapping, batch processing, and domain-specific data restructuring. These companies help businesses reduce manual effort and accelerate modernization timelines.

Top Key Players in the Market

- IBM Corporation

- Oracle

- Amazon Web Services

- Microsoft

- SAS Institute

- SAP SE

- Informatica

- Talend

- Qlik

- TIBCO Software

- Invensis Technologies Pvt Ltd

- Syncsort

- Damco Solutions

- Others

Recent Developments

- In November 2025, SAP SE announced Accenture’s upcoming launch of an AI-enabled Data Conversion Manager designed for SAP Cloud ERP migrations. This AI-driven tool automates the extraction, mapping, and transformation of data models, speeding up migration processes and reducing manual effort for enterprises moving to SAP’s cloud solutions.

- In July 2025, Amazon Web Services highlighted its Database Migration Service (DMS) as a trusted solution to migrate over 1.5 million databases with minimal downtime. AWS emphasizes AI-assisted schema conversion and accelerated migrations that support both homogeneous and heterogeneous databases, facilitating smooth cloud data platform transitions.

Report Scope

Report Features Description Market Value (2024) USD 77.2 Bn Forecast Revenue (2034) USD 1,098.3 Bn CAGR(2025-2034) 30.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (HTML Conversion Services, XML Conversion Services, Document Conversion Services, Media Format Conversion Services, SGML Conversion Services, Catalog Conversion Services, Others), By Data Type (Structured Data, Unstructured Data), By Enterprise Size (Small and Medium Enterprise, Large Enterprises), By Industry Vertical (IT & Telecom, Media & Publishing, Healthcare, Education, BFSI, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Oracle, Amazon Web Services, Microsoft, SAS Institute, SAP SE, Informatica, Talend, Attunity, TIBCO Software, Invensis Technologies Pvt Ltd, Syncsort, Damco Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Conversion Services MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Data Conversion Services MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Oracle

- Amazon Web Services

- Microsoft

- SAS Institute

- SAP SE

- Informatica

- Talend

- Qlik

- TIBCO Software

- Invensis Technologies Pvt Ltd

- Syncsort

- Damco Solutions

- Others