Global Data Center Power Management Market By Component(Solution, Services), By Data Center Size(Small Data Centers, Medium Data Centers, Large Data Centers), By Industry Vertical(IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Manufacturing, Government and Defense, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128929

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

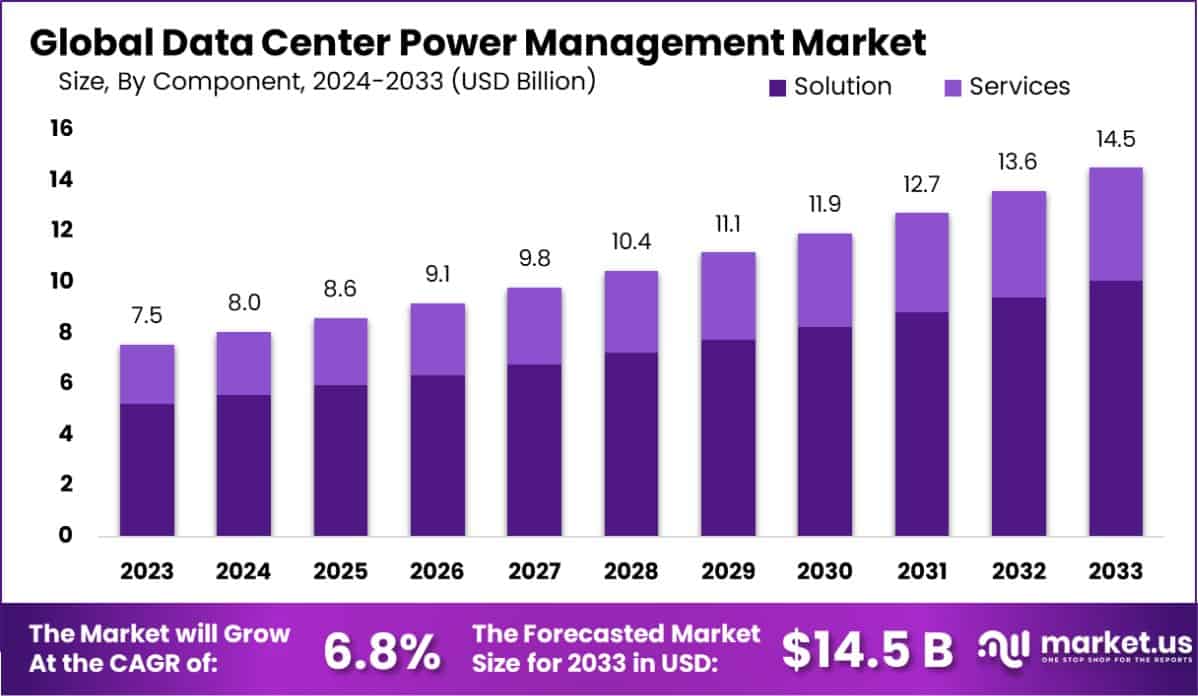

The Global Data Center Power Management Market size is expected to be worth around USD 14.5 Billion By 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033. In 2023, North America dominated a 37.1% market share and held USD 2.78 Billion in revenue from the Data Center Power Management Market.

Data center power management refers to the strategies and technologies used to efficiently control and optimize the energy consumption within a data center. This involves managing electrical infrastructure, cooling systems, and IT equipment to reduce energy waste, lower costs, and minimize environmental impact. Effective power management is crucial as data centers consume a large amount of energy, and optimizing their power usage helps improve performance and sustainability.

The data center power management market is growing as demand for data storage, cloud computing, and internet services expands. With more companies focusing on energy-efficient solutions to meet sustainability goals, the market for advanced power management tools and systems is experiencing significant growth.

Factors driving this market include the increasing complexity of data centers, rising energy costs, and government regulations related to carbon emissions. North America and Europe are key regions leading the adoption of these solutions, while the Asia-Pacific region is emerging due to rapid industrialization and technological advancements.

The integration of IoT and AI for predictive maintenance and the shift towards renewable energy sources present significant opportunities. These innovations help enhance efficiency and sustainability, which are crucial for future developments in the sector.

The Data Center Power Management market is at a pivotal juncture as it adapts to the demands of escalating data traffic and the pressing need for sustainable operational frameworks. Key growth drivers in this market include the surge in cloud services adoption, the expanding footprint of big data technology, and stringent energy efficiency mandates across global jurisdictions. These factors compel data center operators to invest in advanced power management solutions that not only bolster operational reliability but also optimize energy consumption.

A significant development underscoring this trend is the U.S. Department of Energy’s COOLERCHIPS initiative, which has infused $40 million into 15 projects designed to revolutionize data center cooling systems. This initiative is pivotal as it addresses the thermal management challenges posed by increasing rack densities that exacerbate power consumption and heat production. With an ambitious goal to enhance cooling efficiency by at least ten times, the initiative is also fostering advancements in integrated decision support software.

This software aims to interlink various modeling tools to improve the design of next-generation data centers, enhancing their reliability, energy efficiency, and carbon management. The allocation of $3,484,484 to develop this decision support framework indicates a strategic move towards integrating sophisticated analytical tools in data center design and operation, paving the way for a more resilient and energy-efficient infrastructure.

Key Takeaways

- The Global Data Center Power Management Market size is expected to be worth around USD 14.5 Billion By 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

- In 2023, Solution held a dominant market position in the By Component segment of the Data Center Power Management Market, capturing more than a 69.5% share.

- In 2023, Large Data Centers held a dominant market position in the data Center Size segment of the Data Center Power Management Market, capturing more than a 50.9% share.

- In 2023, IT and Telecommunications held a dominant market position in the industry Vertical segment of the Data Center Power Management Market. capturing more than a 26.3% share.

- North America dominated a 37.1% market share in 2023 and held USD 2.78 Billion in revenue from the Data Center Power Management Market.

By Component Analysis

In 2023, Solution held a dominant market position in the By Component segment of the Data Center Power Management Market, capturing more than a 69.5% share. The robust market share is primarily attributed to the increasing adoption of advanced power management solutions that enhance energy efficiency and reduce operational costs in data centers.

These solutions include Uninterruptible Power Supplies (UPS), Power Distribution Units (PDU), and energy storage systems, which are critical for maintaining uninterrupted power supply and managing power distribution effectively.

On the other hand, Services associated with data center power management, though smaller in market share, are experiencing significant growth. Services such as installation, maintenance, and consulting are vital for the optimal utilization of power management solutions.

They ensure that data center operations are not only efficient but also compliant with regulatory standards regarding energy consumption and carbon emissions. As data centers continue to expand in size and complexity, the demand for these services is expected to see an upward trajectory, supporting the overall growth of the market.

By Data Center Size Analysis

In 2023, Large Data Centers held a dominant market position in the By Data Center Size segment of the Data Center Power Management Market, capturing more than a 50.9% share. This dominance is driven by the substantial power requirements and the complexity of managing extensive IT infrastructures that large data centers entail. The deployment of advanced power management solutions in these facilities is crucial for ensuring operational continuity, optimizing energy consumption, and minimizing downtime.

Conversely, Medium Data Centers have also been integrating more sophisticated power management technologies but at a slower pace compared to their larger counterparts. These centers focus on balancing cost with efficiency, driving steady demand for modular power solutions that offer scalability.

Small Data Centers, while holding the smallest market share, are increasingly adopting power management solutions as they aim to maximize operational efficiency and reduce energy costs. The trend towards digital transformation and the adoption of cloud services even on smaller scales have made power management a critical aspect for these data centers, indicating potential growth in this segment moving forward.

By Industry Vertical Analysis

In 2023, IT and Telecommunications held a dominant market position in the By Industry Vertical segment of the Data Center Power Management Market, capturing more than a 26.3% share. This sector’s significant reliance on data centers for managing extensive data traffic and ensuring high uptime standards makes effective power management crucial. As data consumption and the need for cloud services continue to surge, telecom operators and IT service providers are increasingly investing in advanced power management solutions to enhance efficiency and reduce operational costs.

BFSI (Banking, Financial Services, and Insurance) also remains a key adopter, driven by the need for high-security data transactions and constant uptime, which require robust power management systems to prevent data loss and service interruptions.

In sectors like Healthcare, Retail and E-Commerce, and Manufacturing, there is a growing focus on digitalization and the use of big data analytics, further pushing the demand for reliable power management to ensure continuous operations. Government and Defense, as well as Other Industry Verticals, though smaller in comparison, are recognizing the importance of energy-efficient and secure data center operations, contributing to the overall growth of the market.

Key Market Segments

By Component

- Solution

- Services

By Data Center Size

- Small Data Centers

- Medium Data Centers

- Large Data Centers

By Industry Vertical

- IT and Telecommunications

- BFSI

- Healthcare

- Retail and E-Commerce

- Manufacturing

- Government and Defense

- Other Industry Verticals

Drivers

Key Drivers in Data Center Power

In the Data Center Power Management market, a major driver is the increasing demand for energy-efficient solutions in data centers. As companies worldwide generate more data, they require more power to manage and store this information. However, the cost of energy and the need to reduce environmental impact push these companies to adopt power management solutions that optimize energy usage.

Technologies like intelligent power distribution units (PDUs) and advanced cooling systems are becoming essential. These tools help data centers cut down on electricity use, reduce operational costs, and support sustainability goals. With businesses focusing on sustainability and efficiency, the market for power management solutions in data centers is set to grow significantly.

Restraint

Challenges in Power Management Adoption

A significant restraint in the Data Center Power Management market is the high initial investment required for advanced power management systems. These technologies, which include automated cooling systems, smart PDUs, and energy monitoring tools, can be quite expensive to install.

For many companies, especially small to medium-sized enterprises, the upfront costs can be a barrier. This financial challenge is compounded by the complexity of integrating these advanced systems with existing data center infrastructure.

As a result, some companies may hesitate to adopt these solutions despite their long-term benefits in energy savings and operational efficiency. This reluctance slows down the overall growth of the market as businesses weigh the costs against the potential benefits.

Opportunities

Expanding Green Tech Opportunities

Data Center Power Management market, there’s a growing opportunity related to the shift toward sustainable and green technologies. As environmental regulations become stricter and public awareness about sustainability increases, data centers are under pressure to reduce their carbon footprint.

This scenario opens up significant opportunities for power management solutions that enhance energy efficiency and leverage renewable energy sources. Innovations such as the use of AI to optimize power distribution and cooling, along with the development of more efficient backup power solutions like fuel cells, are in high demand.

Additionally, the expansion of edge computing requires new data centers to be built closer to users, which further increases the need for effective power management systems to ensure these facilities can operate sustainably and cost-effectively.

Challenges

Navigating Power Management Hurdles

One of the primary challenges in the Data Center Power Management market is the increasing complexity of data center architectures. As data centers evolve to support higher volumes of data and more sophisticated services, managing power efficiently becomes more complex.

Integrating power management solutions with legacy systems poses a significant challenge, as older infrastructures may not be compatible with new technologies without substantial upgrades. Additionally, the rapid pace of technological change means that power management solutions must continually evolve to keep up with new computing technologies and energy standards.

This constant need for updates and compatibility can lead to implementation delays and increased costs, making it difficult for data center operators to maintain optimal efficiency and reliability in their power management practices.

Growth Factors

Driving Power Management Growth

Significant growth factors in the Data Center Power Management market include the escalating demand for data processing and storage driven by big data, IoT, and cloud computing. As digital transformation accelerates across industries, the need for robust, efficient data centers increases.

This demand compels data centers to adopt sophisticated power management systems to ensure reliability, reduce operational costs, and comply with energy efficiency regulations. Additionally, the rising awareness of sustainable practices is pushing data centers towards greener solutions, further fueling the adoption of energy-efficient power management technologies.

These systems not only help manage power distribution and cooling more effectively but also support the integration of renewable energy sources, aligning with global sustainability goals. As such, the market sees continued expansion as more data centers upgrade their facilities to meet modern demands.

Emerging Trends

Trends Shaping Power Management

Emerging trends in the Data Center Power Management market are largely driven by advancements in technology and sustainability efforts. One significant trend is the increasing use of artificial intelligence (AI) and machine learning (ML) in optimizing power usage and cooling systems.

These technologies enable real-time monitoring and automated adjustments that enhance energy efficiency and reduce waste. Another trend is the adoption of microgrids and renewable energy sources within data centers, promoting sustainability and reducing reliance on traditional power grids.

Furthermore, the shift towards modular data centers, which are scalable and can be deployed quickly, is influencing the need for flexible and efficient power management solutions. These trends are reshaping the landscape of data center operations, leading to more sustainable, efficient, and resilient infrastructures.

Regional Analysis

The Data Center Power Management market is experiencing significant growth and variation across different regions. North America leads the market with a 37.1% share, valued at USD 2.78 billion, driven by the increasing demand for cloud-based solutions and a robust IT infrastructure.

Europe follows, where stringent regulations regarding data center efficiency and sustainability promote advanced power management solutions. The Asia Pacific region is witnessing rapid growth due to the expansion of data centers in countries like China and India, coupled with rising digitalization.

In the Middle East & Africa, growth is fueled by the increasing adoption of green data centers, with countries like Saudi Arabia and the UAE investing heavily in sustainable technology. Latin America, though smaller in comparison, shows potential due to emerging technological advancements and increasing internet penetration, which necessitates robust data center infrastructures.

This regional diversity highlights a global emphasis on efficient and sustainable data center operations, with North America currently dominating the market due to its advanced technological adoption and substantial investments in IT capabilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Data Center Power Management market, key players such as ABB Group, Honeywell International Inc., and Eaton Corporation plc play pivotal roles in shaping the industry’s dynamics.

ABB Group has consistently demonstrated innovation in energy-efficient solutions, which are critical in modern data center operations. In 2023, ABB’s focus on integrating smart technology and IoT into their power management systems has set them apart, enabling data centers to optimize power usage and reduce operational costs significantly. Their advanced analytics and real-time monitoring tools have been particularly effective in preempting system failures and enhancing overall reliability.

Honeywell International Inc. has leveraged its extensive expertise in automation and control technologies to offer customized power management solutions that align with the evolving needs of data centers. Their adaptive and scalable solutions support the dynamic workloads of data centers, enhancing energy efficiency and operational sustainability. Honeywell’s commitment to R&D has also seen the introduction of AI-driven modules that further optimize power consumption and distribution, making it a key player in fostering green data center practices.

Eaton Corporation plc has focused on the development of modular power management solutions that cater to the rapid deployment needs of data centers globally. Their products offer flexibility and high scalability, which are essential for managing the varying power demands of large-scale data center environments. Eaton’s proactive approach to adopting next-generation technologies to improve power backup and maintenance operations underscores its significant influence in the market.

Top Key Players in the Market

- ABB Group

- Honeywell International Inc.

- Eaton Corporation plc

- Schneider Electric SE

- Siemens AG

- Vertiv Group Corp.

- Delta Power Solutions

- Legrand Group

- Analog Devices, Inc.

- Cyber Power Systems, Inc.

- Other Key Players

Recent Developments

- In May 2024, Vertiv Group Corp. introduced a cutting-edge battery storage system expected to extend power backup durations by 25% in data centers.

- In March 2024, Siemens AG acquired a startup specializing in thermal management solutions for data centers, aiming to enhance their cooling technologies.

- In January 2024, Schneider Electric SE launched a new AI-driven power management system designed to reduce energy consumption by 30% in data centers.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Billion Forecast Revenue (2033) USD 14.5 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Solution, Services), By Data Center Size(Small Data Centers, Medium Data Centers, Large Data Centers), By Industry Vertical(IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Manufacturing, Government and Defense, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Group, Honeywell International Inc., Eaton Corporation plc, Schneider Electric SE, Siemens AG, Vertiv Group Corp., Delta Power Solutions, Legrand Group, Analog Devices, Inc., Cyber Power Systems, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Center Power Management MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Power Management MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Group

- Honeywell International Inc.

- Eaton Corporation plc

- Schneider Electric SE

- Siemens AG

- Vertiv Group Corp.

- Delta Power Solutions

- Legrand Group

- Analog Devices, Inc.

- Cyber Power Systems, Inc.

- Other Key Players