Global Data Center Logical Security Market Size, Share, Industry Analysis Report By Component (Solutions (Threat and Application Security Solutions, Access Control and Compliance, Data Protection Solutions, Others), Services (Consulting & Advisory Services, Managed Security Services (MSS))), By Data Center Type (MidSize, Small Enterprise, Large), By Vertical (BFSI, Media and Entertainment, Healthcare, Energy & Utilities, Government, Manufacturing, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160427

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts Viewpoints

- Role of generative AI

- US Market Size

- By Component

- By Data Center Type

- By Vertical

- Key Market Segment

- Emerging Trends

- Top 5 Use Cases

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Player Analysis

- Recent Development

- Report Scope

Report Overview

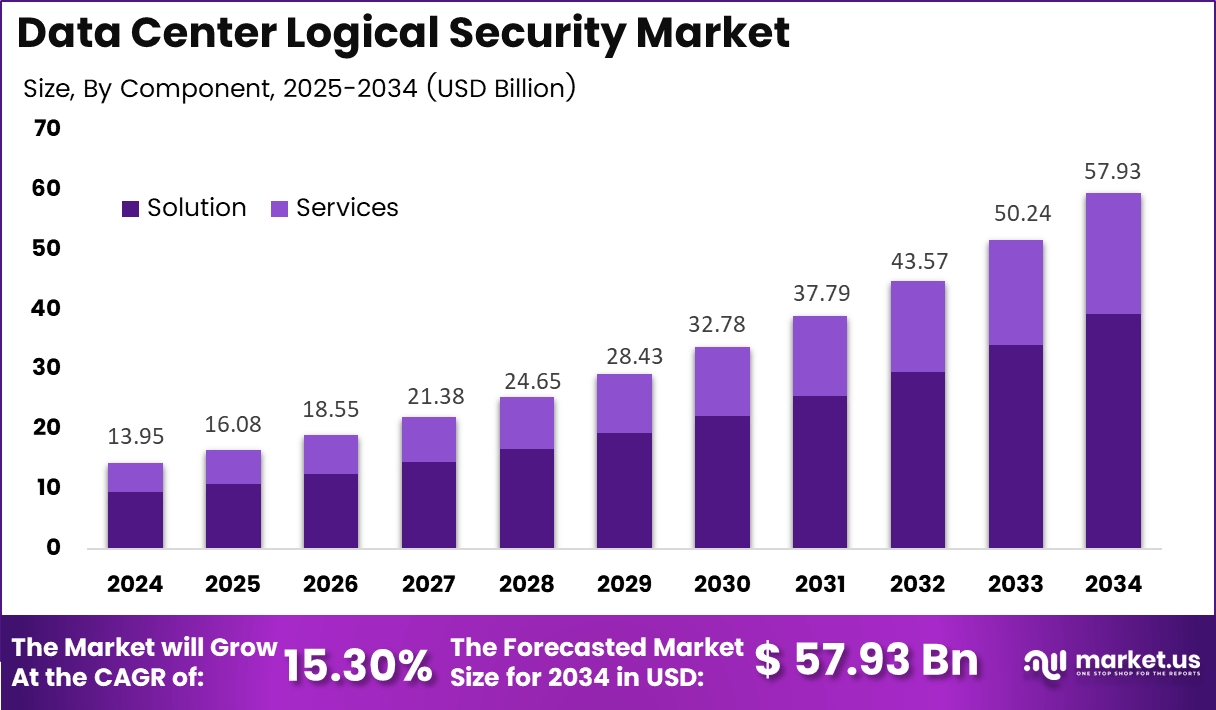

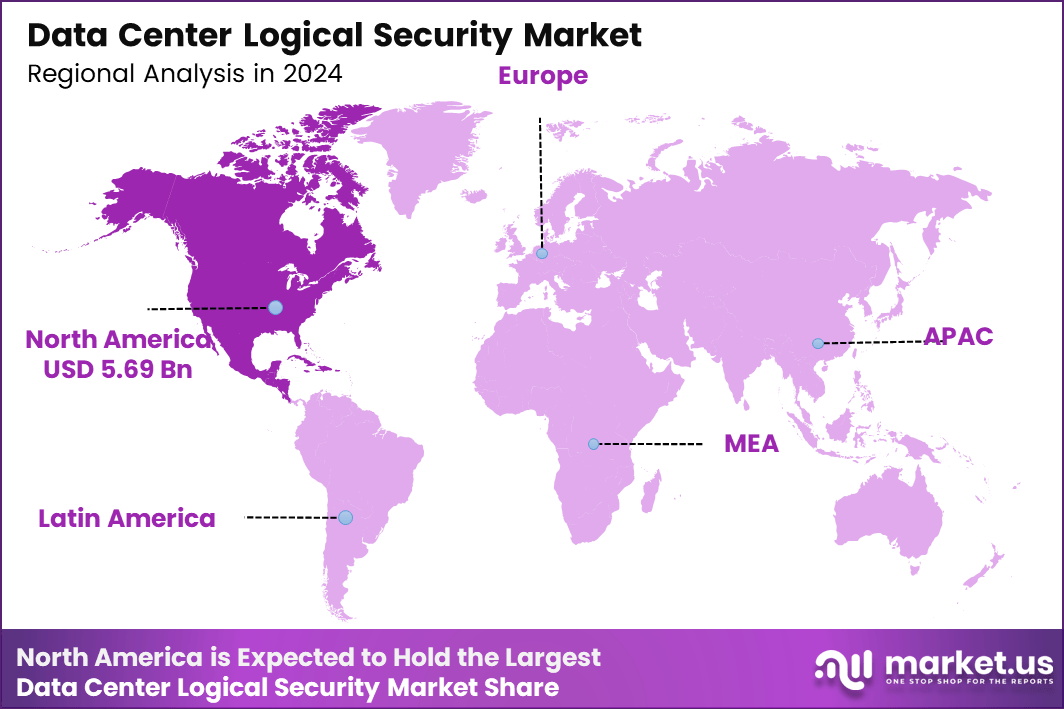

The Global Data Center Logical Security Market size is expected to be worth around USD 57.93 billion by 2034, from USD 13.95 billion in 2024, growing at a CAGR of 15.30% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.8% share, holding USD 5.6 billion in revenue.

The data center logical security market focuses on protecting the digital environment within data centers through software, systems, and services that manage access, monitor networks, and prevent unauthorized use. Logical security includes firewalls, intrusion detection systems, identity and access management, encryption, and monitoring tools. These solutions are essential for protecting sensitive data stored and processed in enterprise, cloud, and colocation facilities.

The main driver of this market is the rising frequency of cyberattacks targeting cloud and on-premise data centers. Growth in digital services, online transactions, and remote working has increased the number of threats against stored data. The adoption of virtualization, containerization, and multi-cloud platforms has also widened the scope of potential vulnerabilities, prompting organizations to strengthen their logical defense systems.

Demand for data center logical security solutions is strongest among large enterprises, financial institutions, and hyperscale cloud service providers. These organizations manage high volumes of data and must ensure compliance with regional and international data privacy regulations. Smaller and mid-sized data centers are also adopting security platforms as digital transformation progresses.

Several technologies are being widely adopted in this market. These include zero-trust network access, identity and access management, behavioral analytics, multi-factor authentication, and encryption for both stored and transmitted data. Artificial intelligence and machine learning are increasingly used for threat detection and predictive analysis. Cloud-based security platforms and managed security services are also gaining acceptance because they offer scalability and lower upfront cost.

Key Takeaways

- The Solutions segment dominated with 67.8%, driven by the rising need for advanced security software and network protection frameworks.

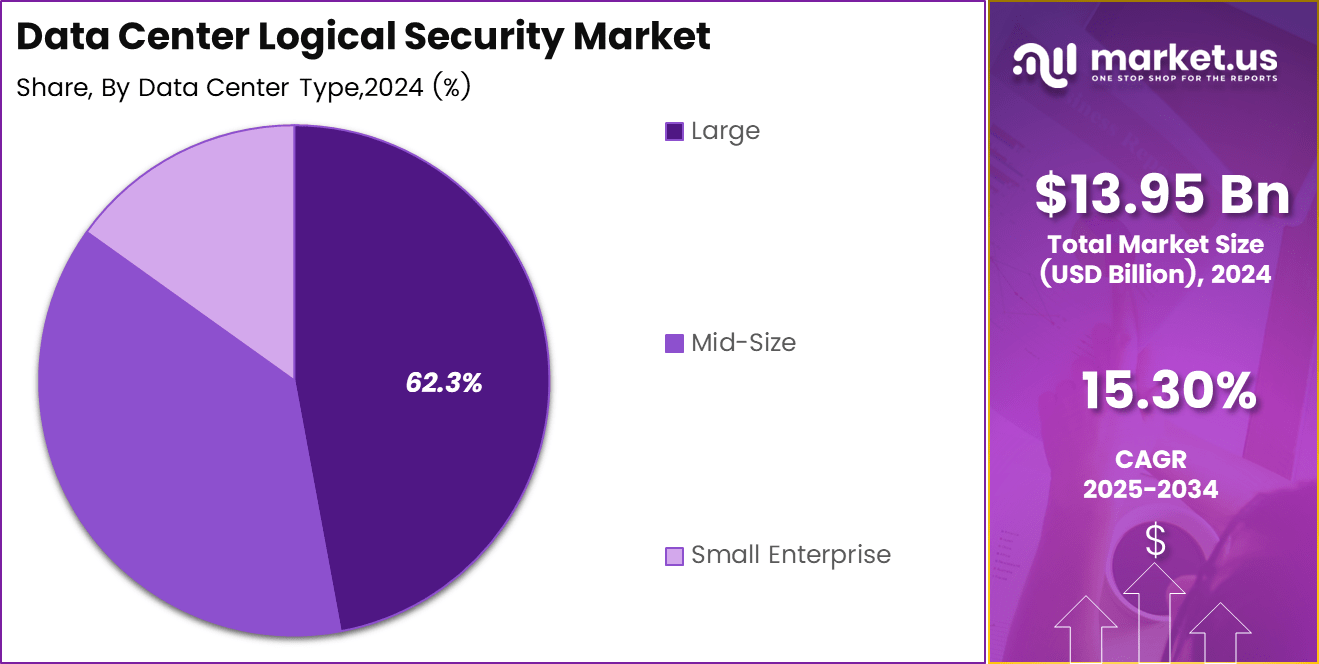

- Large data centers accounted for 62.3%, reflecting higher investment in multi-layered cybersecurity across hyperscale facilities.

- The BFSI sector held 32.12%, supported by strong regulatory compliance needs and protection of sensitive financial data.

- North America led the global market with 40.8% share, backed by growing cloud adoption and stringent data protection standards.

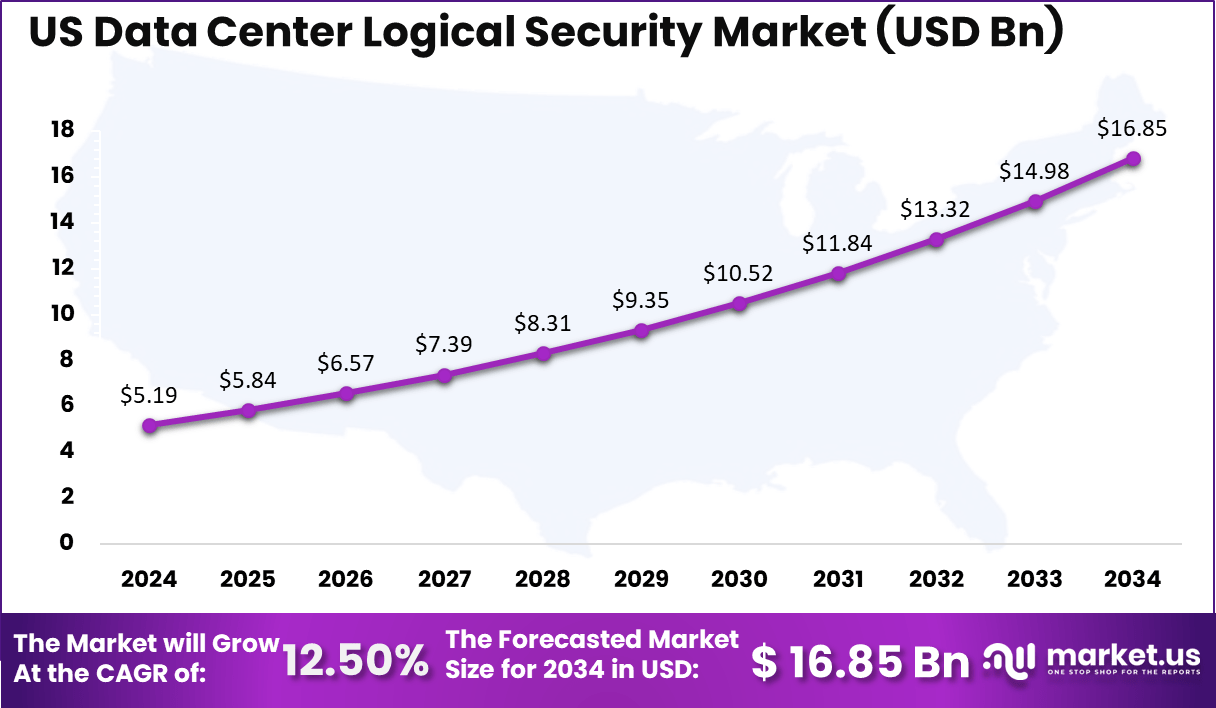

- The US market reached USD 5.19 Billion in 2024 with a solid 12.5% CAGR, propelled by increasing cyber threats and enterprise modernization of data center infrastructure.

Analysts Viewpoints

Investment opportunities arise from expanding digital infrastructure needs and the evolving threat landscape that demands continuous upgrades in logical security technologies. The business benefits of adopting these solutions include enhanced data protection, regulatory compliance, risk mitigation, and operational efficiency.

Companies benefit from reduced downtime due to security breaches and improved customer trust by demonstrating commitment to data privacy and security. Furthermore, integration of AI-driven security tools creates competitive advantages by proactively identifying and neutralizing threats. The regulatory environment strongly influences the market, with governments imposing strict data privacy laws and security standards globally.

Compliance with frameworks such as ISO 27001, NIST Cybersecurity Framework, and SOC 2 has become mandatory for data centers handling sensitive information. These regulations ensure that logical security systems implement multi-layered controls, continuous monitoring, and secure data access protocols. Non-compliance risks heavy penalties, thus encouraging comprehensive adoption of logical security measures.

Role of generative AI

Data center logical security plays a crucial role in safeguarding digital infrastructures from unauthorized access and cyber threats. Generative AI significantly enhances this security by automating monitoring and incident response tasks. It leverages past data patterns to predict potential vulnerabilities and acts swiftly, reducing human error and response time.

Recent insights show that generative AI can boost productivity in data center management by 14% to 19%, streamlining operations such as backup planning, threat detection, and compliance reporting. This intelligent automation makes logical security systems more adaptable and effective against evolving cyber attacks, strengthening overall data protection in data centers.

US Market Size

The US Data Center Logical Security Market showcases significant growth, starting at USD 5.19 billion in 2024 and reaching USD 16.85 billion by 2034. This impressive expansion reflects a robust CAGR of 12.50%, driven by increasing demand for advanced cybersecurity solutions amid rising digital threats and cloud adoption.

The data center logical security market is evolving rapidly, shaped by rising cyber threats and digital transformation. As businesses adopt cloud and edge solutions, demand for robust security grows. With a focus on innovation and compliance, this sector offers a dynamic landscape for growth and investment in 2025.

The data center logical security market in 2024 highlights North America as the dominant region, boasting a value of USD 5.69 billion. This leadership stems from its advanced tech infrastructure and heavy investment in cloud and cybersecurity solutions, making it a key player. The region’s focus on compliance with strict data laws further drives demand, positioning it to hold the largest market share globally.

Other regions like Europe, APAC, MEA, and Latin America are emerging players with growing potential. Europe benefits from stringent regulations, while APAC and MEA see rapid digitalization fueling demand. Latin America, though smaller, is gaining traction with increasing business adoption. Each region’s unique needs shape a diverse market landscape, promising opportunities as security solutions evolve.

By Component

In 2024, The solutions segment dominates the data center logical security market with a strong share of 67.8%. Solutions such as threat and application security, access control, and data protection are at the heart of securing data centers from unauthorized access and cyber attacks. These solutions help organizations ensure data confidentiality, integrity, and compliance with growing regulatory demands.

Solutions vary from firewalls, identity access management, encryption tools, to advanced monitoring systems, all designed to defend against evolving cyber threats. The rising need for automated, scalable security frameworks to handle growing data volumes makes these solutions indispensable. This segment’s strength reflects the critical role of proactive, layered security measures in today’s data-driven business landscape.

By Data Center Type

In 2024, Large data centers account for about 62.3% of the logical security market, underscoring their importance as major hubs of enterprise data and cloud services. These centers host vast IT infrastructure supporting business-critical applications, which makes them prime targets for security breaches. The complexity and scale of large data centers require comprehensive security coverage to safeguard numerous network entry points and protect sensitive data streams.

Due to their size, large data centers must implement sophisticated logical security solutions that encompass identity verification, threat detection, and continuous monitoring. The demand for robust access controls and compliance adherence is high in these environments to maintain uninterrupted service delivery and minimize operational risks. Investments in large data center security reflect the necessity of protecting foundational digital infrastructure.

By Vertical

In 2024, The BFSI sector holds the largest share in the data center logical security market, approximately 32.12%, driven by its stringent need to secure sensitive financial and personal data. Banks, insurers, and financial service providers face heightened cyber threats due to the high value of the data they manage and strict regulatory frameworks governing data privacy and security. Logical security solutions in BFSI help prevent fraud, data breaches, and operational disruptions.

With digital transformation accelerating in BFSI, including mobile banking and cloud adoption, the demand for advanced logical security is intensifying. Solutions such as multifactor authentication, encryption, and AI-based threat detection provide the scale and agility this sector needs. Protecting customer trust and maintaining regulatory compliance remain top priorities, making BFSI a key driver of market growth.

Key Market Segment

By Component

- Solutions

- Threat and Application Security Solutions

- Access Control and Compliance

- Data Protection Solutions

- Others

- Services

- Consulting & Advisory Services

- Managed Security Services (MSS)

By Data Center Type

- Mid-Size

- Small Enterprise

- Large

By Vertical

- BFSI

- Media and Entertainment

- Healthcare

- Energy & Utilities

- Government

- Manufacturing

- Education

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Emerging Trends

- Adoption of AI-driven threat detection for real-time anomaly identification.

- Growth in edge computing security with microsegmentation techniques.

- Increasing use of hybrid deployment models combining on-premises and cloud solutions.

- Focus on sustainability with eco-friendly security for green data centers.

- Rise in managed security services to support SMEs with limited expertise.

- Integration of ZeroTrust security models for enhanced access control.

- Expansion of 5Genabled security solutions for faster data processing

Top 5 Use Cases

- Threat Detection and Response: Real-time identification and neutralization of cyber threats like malware and ransomware.

- Access Control Management: Securing data center entry with multifactor authentication and role-based access.

- Data Encryption and Protection: Safeguarding sensitive data during storage and transmission with advanced encryption.

- Compliance Monitoring: Ensuring adherence to regulations like GDPR and CCPA through automated audits.

- Incident Recovery: Rapid restoration of systems and data post-breach with automated backup and recovery tools.

Growth Factors

The growth of the data center logical security market is driven by several key factors. Rising cyber threats, such as ransomware and phishing attacks, push organizations to invest in advanced security solutions to protect critical data. The rapid adoption of cloud computing and hybrid infrastructures increases the need for scalable, robust security measures to manage distributed environments.

Stringent data privacy regulations, like GDPR and CCPA, compel businesses to enhance compliance through sophisticated monitoring tools. The exponential growth of data from IoT devices and big data analytics necessitates stronger data protection and encryption.

Driver Analysis

Rising Cyber Threats Demand Enhanced Protection

The increasing sophistication and frequency of cyber attacks are a major driver for the data center logical security market. Organizations are facing growing risks such as ransomware, phishing, and insider threats that target sensitive data housed within data centers.

This escalating threat landscape compels businesses to implement robust logical security measures like identity access management, multi-factor authentication, and encryption to safeguard critical information from unauthorized access and breaches. Protecting digital infrastructure has become crucial for maintaining operational continuity and customer trust in an increasingly connected environment.

Additionally, regulatory mandates requiring strict data protection and breach notification amplify the urgency to adopt strong security frameworks. Data centers form the backbone of digital services globally, and the rising volume of sensitive data processed demands comprehensive logical security solutions to address evolving cyber risks.

Restraint Analysis

High Implementation Costs and Complexity

One key restraint slowing data center logical security adoption is the high initial cost and complexity involved in deploying advanced security systems. Integrating sophisticated tools such as artificial intelligence-enabled threat detection and seamless access controls requires substantial financial investment and technical expertise.

For many organizations, especially smaller enterprises, these upfront costs can be prohibitive and limit their ability to fully implement comprehensive security measures. Technical challenges in integrating diverse security platforms across hybrid and multi-cloud environments further complicate deployment.

The need for skilled cybersecurity professionals to manage complex security solutions intensifies this barrier, as talent shortages remain widespread. Consequently, the combined financial and operational burden can delay or restrict market growth despite rising security demands.

Opportunity Analysis

Growing Cloud and Hybrid Data Center Adoption

The rapid expansion of cloud computing and hybrid data center models presents a significant growth opportunity for logical security solutions. As organizations increasingly shift workloads and sensitive data outside traditional on-premises infrastructure, they require adaptive logical security frameworks capable of protecting assets across distributed environments.

Solutions that provide seamless identity management, encrypted access, and real-time threat analytics across cloud and hybrid infrastructures are in high demand. Moreover, new technologies such as AI and machine learning offer enhanced capabilities for predictive threat detection and automated security management, enabling data centers to stay ahead of emerging risks.

Providers that innovate in scalable, cloud-native security services stand to benefit from accelerating digital transformation and escalating cloud adoption worldwide, opening new revenue streams within this expanding ecosystem.

Challenge Analysis

Managing Evolving Threat Landscape

A persistent challenge in data center logical security is the continual evolution of cyber threats. Attackers consistently develop new techniques to bypass existing defenses, such as advanced persistent threats and zero-day vulnerabilities. Security solutions must keep pace with this dynamic threat environment to detect, analyze, and prevent breaches effectively.

The complexity of monitoring increasingly distributed data center environments with growing IoT device integration adds another layer of difficulty. Organizations need intelligent and adaptive security systems equipped with behavioral analytics and automated response capabilities to counter sophisticated attacks. Balancing security robustness with user convenience and operational efficiency remains an ongoing challenge as cyber threats evolve.

SWOT Analysis

- Strengths: Robust demand driven by rising cyber threats and regulatory compliance needs; advanced technological infrastructure in leading regions like North America.

- Weaknesses: High initial implementation costs limit adoption, especially for SMEs; reliance on constant updates can strain resources.

- Opportunities: Growing integration of AI and automation for predictive security; expansion into emerging markets with increasing digitalization.

- Threats: Rapid evolution of sophisticated cyber attacks outpacing defense updates; potential economic downturns reducing IT budgets.

Key Player Analysis

The Data Center Logical Security Market is led by global technology and cybersecurity providers such as IBM Corporation, Cisco Systems Inc., Hewlett-Packard Enterprise Co., Dell Technologies, and VMware Inc. These companies deliver integrated data center protection solutions that include identity management, firewall control, and virtualization security. Their offerings support secure infrastructure for cloud computing, enterprise networks, and virtualized environments through scalable and automated security frameworks.

Prominent cybersecurity firms such as Fortinet Inc., Check Point Software Technologies Ltd., Palo Alto Networks, Trend Micro Inc., Sophos Ltd., FireEye Inc., and McAfee Corp. play a central role in safeguarding data centers from advanced threats. Their platforms combine intrusion prevention, endpoint protection, and threat intelligence to counter ransomware, phishing, and zero-day attacks. Continuous innovation in AI-based detection and behavioral analytics further strengthens their market leadership.

Additional participants including Barracuda Networks, RSA Security LLC, CrowdStrike Inc., Akamai Technologies Inc., F5 Networks Inc., Citrix Systems Inc., Forcepoint LLC, Imperva Inc., Juniper Networks, Splunk Inc., Digital Guardian, and other key players contribute through network visibility, access governance, and data loss prevention (DLP) solutions. Their focus on compliance, real-time monitoring, and cloud-native security continues to drive market growth and operational resilience across global data center infrastructures.

Top Key Player

- IBM Corporation

- Cisco Systems Inc.

- Hewlett-Packard Enterprise Co.

- Fortinet Inc.

- VMware Inc.

- Dell

- Palo Alto Networks

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- McAfee Corp.

- FireEye Inc.

- Trend Micro Inc.

- Sophos Ltd.

- Barracuda Networks

- Juniper Networks

- RSA Security LLC

- Splunk Inc.

- CrowdStrike Inc.

- Akamai Technologies Inc.

- Imperva Inc.

- F5 Networks Inc.

- Citrix Systems Inc.

- Forcepoint LLC

- Digital Guardian

- Others

Recent Development

- In July 2025, Palo Alto Networks announced a $25 billion acquisition of CyberArk, marking its strategic entry into Identity Security. The move integrates privileged access management into Palo Alto’s AI-driven platforms, enhancing protection for human, machine, and AI identities across hybrid data centers and agentic AI environments.

- In February 2025, IBM completed its $6.4 billion acquisition of HashiCorp, incorporating Terraform and Vault into its hybrid cloud and AI ecosystem. This integration strengthened IBM’s automation and security lifecycle management, supporting scalable and secure operations across multi-cloud and on-premises infrastructures.

- In January 2025, Fortinet released emergency patches for over 15 vulnerabilities, including a zero-day flaw (CVE-2025-24472) in FortiOS and FortiProxy that allowed unauthorized super-admin access. The CISA directive required federal agencies to apply patches immediately, reinforcing Fortinet’s critical role in protecting data center firewalls and management interfaces.

Report Scope

Report Features Description Market Value (2024) USD 13.95 Bn Forecast Revenue (2034) USD 57.93 Bn CAGR(2025-2034) 15.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solutions (Threat and Application Security Solutions, Access Control and Compliance, Data Protection Solutions, Others), Services (Consulting & Advisory Services, Managed Security Services (MSS))), By Data Center Type (MidSize, Small Enterprise, Large), By Vertical (BFSI, Media and Entertainment, Healthcare, Energy & Utilities, Government, Manufacturing, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Cisco Systems Inc., Hewlett-Packard Enterprise Co., Fortinet Inc., VMware Inc., Dell, Palo Alto Networks, Fortinet Inc., Check Point Software Technologies Ltd., McAfee Corp., FireEye Inc., Trend Micro Inc., Sophos Ltd., Barracuda Networks, Juniper Networks, RSA Security LLC, Splunk Inc., CrowdStrike Inc., Akamai Technologies Inc., Imperva Inc., F5 Networks Inc., Citrix Systems Inc., Forcepoint LLC, Digital Guardian, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Data Center Logical Security MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Data Center Logical Security MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Cisco Systems Inc.

- Hewlett-Packard Enterprise Co.

- Fortinet Inc.

- VMware Inc.

- Dell

- Palo Alto Networks

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- McAfee Corp.

- FireEye Inc.

- Trend Micro Inc.

- Sophos Ltd.

- Barracuda Networks

- Juniper Networks

- RSA Security LLC

- Splunk Inc.

- CrowdStrike Inc.

- Akamai Technologies Inc.

- Imperva Inc.

- F5 Networks Inc.

- Citrix Systems Inc.

- Forcepoint LLC

- Digital Guardian

- Others