Global Data Center Insulation Market By Material Type (Mineral Wool, Polystyrene, Polyurethane, Flexible Elastomeric Foam, Polyethylene And Others), By Product Type (Sheets And Rolls, Panels, Pipe Section, Tiles, Boards And Slabs, Wired Mat And Others), By Insulation Type (Thermal Insulation And Acoustic Insulation), By Installation Method (New Construction, Retrofit / Renovation), By Application (Walls And Partitions, Roofs And Ceilings, Pipe, Air Duct, Equipment, Raised Floors, Others) By End-Use (IT And Telecom, BFSI, Healthcare, Retail And E-commerce, Entertainment And Media, Manufacturing, Energy And Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 138658

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Material Type Analysis

- Insulation Type Analysis

- Installation Method Analysis

- Product Type Analysis

- Application Analysis

- End-Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunity

- Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Key Players Analysis

- Key Development

- Report Scope

Report Overview

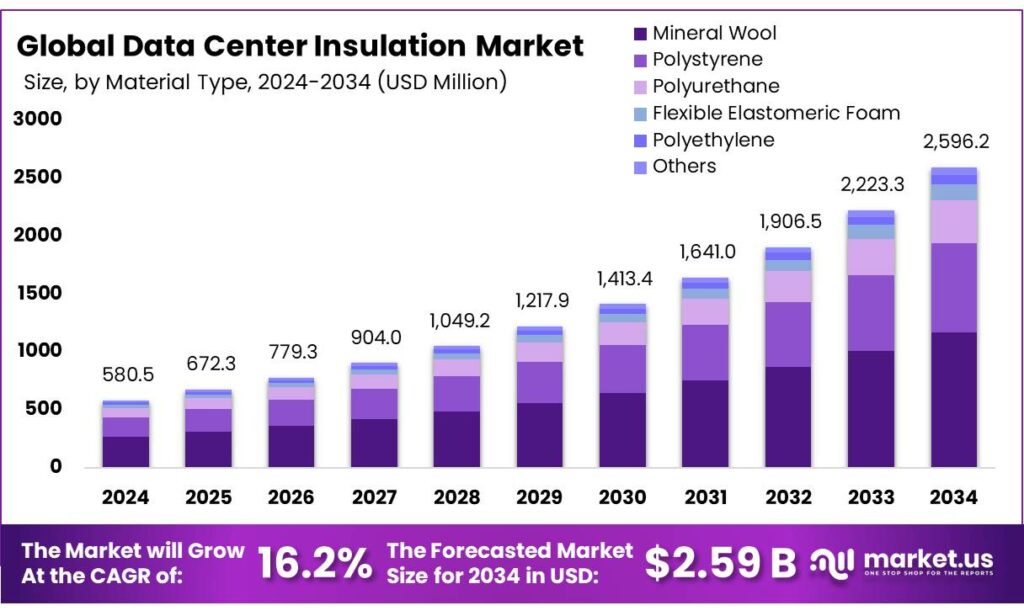

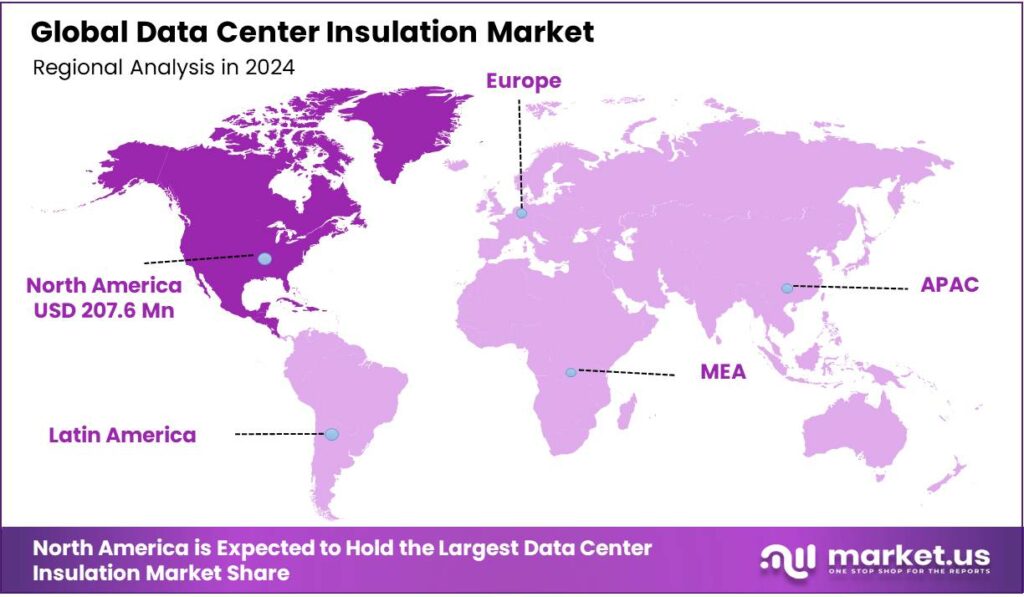

The Global Data Center Insulation Market size is expected to be worth around USD 2596.2 Million by 2034, from USD 580.48 Million in 2024, growing at a CAGR of 16.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 35.8% share, holding USD 207.6 Million in revenue.

The Global Data Center Insulation Market represents a critical segment of the broader data center infrastructure ecosystem, focusing on thermal and acoustic insulation solutions that enhance energy efficiency, operational stability, and sustainability. Data centers serve as the backbone of the digital economy, hosting vast volumes of data essential for global connectivity, cloud computing, and enterprise operations.

However, these facilities are also among the most energy-intensive building types, with temperature regulation being a key operational challenge. High-quality insulation plays a pivotal role by minimizing unwanted heat transfer, stabilizing internal conditions, reducing reliance on energy-intensive cooling systems, and extending equipment lifespan.

- The global data center demand is projected to grow from 4 GW in 2019 to 53.1 GW by 2027, nearly tripling over the period.

Growing regulatory pressures and sustainability mandates are accelerating demand for effective insulation. For instance, the European Union’s Energy Efficiency Directive requires data centers over 500kW to disclose energy consumption and emissions, while the UK has rejected large-scale server farm proposals due to energy supply concerns. Despite these regulatory shifts, the lack of a standardized methodology for whole life carbon assessments continues to complicate the measurement of a data center’s total carbon footprint. Nonetheless, as operators face stricter efficiency reporting and rising energy costs, insulation is increasingly recognized as a strategic enabler of compliance and resilience.

Key Takeaways

- The global data center insulation market was valued at USD 580.48 million in 2024.

- The global data center insulation market is projected to grow at a CAGR of 16.2% and is estimated to reach USD 2596.2 Million by 2034.

- Between material types, mineral wool accounted for the largest market share of 46.0%.

- Among product types, sheets & rolls dominated the market with the largest share of 32.8%.

- Based on insulation type, thermal insulation held the majority of the share of 73.1%.

- New construction dominated the market of data center insulation with a market share of 76.0%.

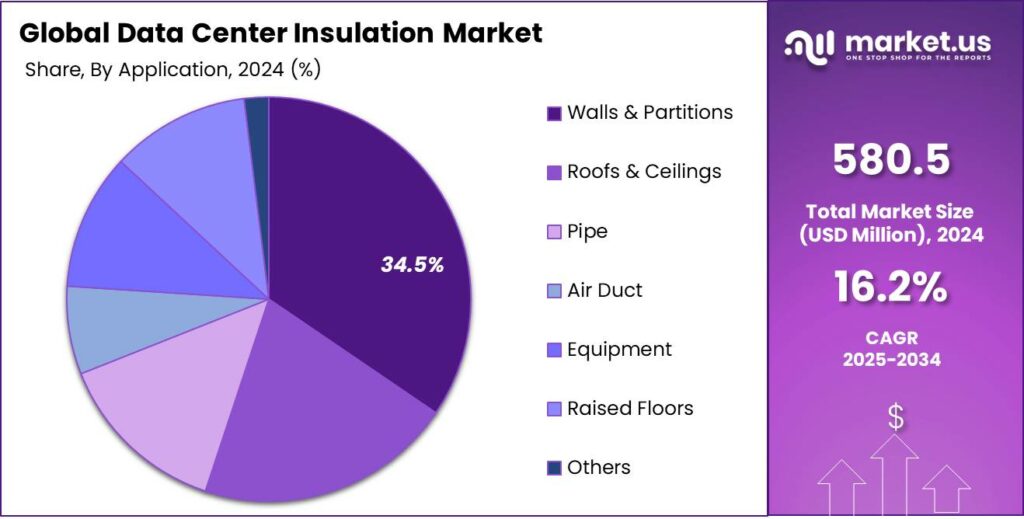

- Among applications, walls & partitions accounted for the majority of the market share at 34.5%.

- IT & Telecom accounted for 41.2% owing to the exponential rise in data consumption.

- North America is estimated as the largest market for Data Center Insulation with a share of 35.8% of the market share.

- Asia-Pacific was estimated second largest growing market after Europe with a CAGR of 20.7%

Material Type Analysis

Mineral Wool Materials are Majorly Used For Insulation In The Data Center

Based on material type, the market is further divided into mineral wool, polystyrene, polyurethane, flexible elastomeric foam, polyethylene, & others. As of 2024, the mineral wool dominated the data center insulation market with a 46.0% share. Driven by its superior thermal, acoustic, and fire-resistant properties, which make it highly suitable for mission-critical environments such as data centers. Data centers require stable temperature control to ensure server performance and energy efficiency, and mineral wool offers exceptionally low thermal conductivity, effectively minimizing heat transfer and reducing energy consumption for cooling systems.

Its natural non-combustibility and high fire resistance further enhance safety, a vital consideration in facilities that house sensitive digital infrastructure. Additionally, mineral wool provides excellent sound absorption, helping mitigate noise from HVAC systems and high-capacity servers, thereby contributing to a quieter operational environment.

Global Data Center Insulation Market, By Material Type, 2020-2024 (USD Mn)

Material Type 2020 2021 2022 2023 2024 Mineral Wool 150.24 172.18 197.91 229.55 267.10 Stone Wool 57.17 66.13 76.24 88.14 101.70 Glass Wool 93.08 106.05 121.68 141.40 165.40 Polystyrene 97.65 111.63 127.55 146.60 169.09 Polyurethane 46.50 53.03 60.45 69.34 79.88 Flexible Elastomeric Foam 17.13 19.53 22.28 25.57 29.47 Polyethylene 10.83 12.41 14.20 16.29 18.74 Others 9.57 10.92 12.42 14.17 16.20 Insulation Type Analysis

The market is categorized as insulation type into thermal insulation & acoustic insulation. Among both thermal insulation accounted for 73.1% mainly due to its critical role in optimizing energy efficiency and ensuring the stable operation of data centers. These facilities are among the most energy-intensive infrastructures worldwide, with cooling systems consuming a significant share of total energy use. Thermal insulation minimizes unwanted heat transfer, reduces the burden on HVAC systems, and helps maintain consistent internal temperatures, thereby lowering power consumption and improving Power Usage Effectiveness (PUE). The growing adoption of hyperscale and colocation facilities, where operational costs are tightly linked to energy performance, has further accelerated demand for thermal solutions.

Global Data Center Insulation Market, By Insulation Type, 2020-2024 (USD Mn)

Insulation Type 2020 2021 2022 2023 2024 Thermal Insulation 243.83 278.41 318.40 366.93 424.36 Acoustic Insulation 88.08 101.28 116.42 134.58 156.13 Installation Method Analysis

Installation methods are categorised into new construction, retrofit/renovation. Among these, new construction dominates the market with a share of 76.0% primarily due to its crucial role in maintaining operational efficiency and reducing energy consumption. Data centers are among the most energy-intensive facilities worldwide, and effective thermal insulation directly reduces heat transfer, minimizing the load on HVAC and cooling systems. This not only improves Power Usage Effectiveness (PUE) but also lowers operational costs and aligns with sustainability goals and ESG compliance. Compared to acoustic insulation, thermal solutions are more broadly deployed across critical applications such as walls, partitions, ceilings, pipes, and raised floors, where maintaining temperature stability is vital for equipment resilience and performance.

Global Data Center Insulation Market, By Installation Method, 2020-2024 (USD Mn)

By Installation Method 2020 2021 2022 2023 2024 New Construction 252.53 288.65 330.46 381.17 441.09 Retrofit / Renovation 79.39 91.04 104.35 120.34 139.39 Product Type Analysis

The Data Center Insulation Market Was Dominated By the Sheets And Rolls.

Based on the product type, the market is further divided into sheets and rolls, panels, pipe sections, tiles, boards & slabs, wired mat & others. Among them, sheets and rolls accounted for 32.8% primarily due to their versatility, ease of installation, and cost-effectiveness in large-scale projects. Data centers require extensive insulation coverage across walls, ceilings, ductwork, and equipment housings to ensure optimal temperature regulation and energy efficiency.

Sheets and rolls, often made of mineral wool, fiberglass, or elastomeric foams, offer flexibility and adaptability, allowing installers to cut and fit them into complex architectural layouts and around irregular surfaces. Their lightweight nature and ability to be layered also improve thermal and acoustic performance, making them suitable for both retrofits and new constructions. Additionally, sheets and rolls provide excellent moisture resistance and fire-retardant properties, essential for protecting sensitive IT infrastructure from operational risks.

Global Data Center Insulation Market, By Product Type, 2020-2024 (USD Mn)

By Product Type 2020 2021 2022 2023 2024 Sheets & Rolls 107.03 122.57 140.93 163.66 190.57 Panels 67.59 77.59 89.04 102.77 119.03 Pipe Section 45.66 51.92 59.07 67.63 77.76 Tiles 30.48 34.87 39.87 45.85 52.92 Boards & Slabs 57.95 66.39 76.02 87.59 101.37 Wired Mat 13.66 15.53 17.65 20.15 23.09 Others 9.55 10.82 12.23 13.86 15.75 Application Analysis

The Data Center Insulation Market Was Dominated By the Sheets And Rolls.

Based on the application, the market is further divided into walls & partitions, roofs & ceilings, pipe, air duct, equipment, raised floors, and others. Among them, walls & partitions accounted for 34.5% due to their critical role in maintaining thermal stability, energy efficiency, and operational reliability within facilities. Data centers operate with high heat loads generated by dense server racks, and insulated walls and partitions form the first barrier against unwanted heat transfer, reducing reliance on HVAC systems and lowering Power Usage Effectiveness (PUE).

They also help create segmented thermal zones such as hot and cold aisles, optimizing airflow management and minimizing cooling inefficiencies. With rising energy regulations and sustainability goals in North America, Europe, and Asia, operators are prioritizing advanced wall insulation materials with high R-values, durability, and environmental compliance, making this segment the largest application area within the data center insulation market.

Global Data Center Insulation Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Walls & Partitions 116.15 131.49 149.67 172.58 200.34 Roofs & Ceilings 68.23 78.45 89.99 103.53 119.42 Pipe 46.27 52.99 60.66 69.84 80.70 Hot Pipe 28.93 32.98 37.64 43.25 50.03 Cold Pipe 13.33 15.44 17.83 20.65 23.86 Others 4.01 4.57 5.19 5.94 6.80 Air Duct 23.90 27.30 31.15 35.72 40.90 Equipment 34.81 40.32 46.69 54.36 63.26 Chillers 11.36 13.56 16.21 19.50 23.28 Cooling Tanks 9.33 10.65 12.16 13.96 16.09 Air Handlers 6.70 7.62 8.65 9.85 11.24 Others 7.43 8.48 9.67 11.05 12.66 Raised Floors 35.70 41.37 47.83 55.46 64.46 Others 6.86 7.78 8.82 10.01 11.40 End-Use Analysis

The Data Center Insulation Market Was Dominated By the IT & Telecom.

Based on the end-use, the market is further divided into IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Manufacturing, Energy & Utilities, and Others. Among these, IT & Telecom accounted for 41.2% owing to the exponential rise in data consumption driven by 5G rollout, cloud adoption, and the growing reliance on AI, IoT, and big data analytics. IT and telecom operators run hyperscale and colocation facilities that demand superior energy efficiency and resilience to meet escalating data traffic. Insulation plays a critical role in maintaining thermal stability, reducing HVAC loads, and achieving lower Power Usage Effectiveness (PUE), a key metric in the industry.

Global Data Center Insulation Market, By End-Use, 2020-2024 (USD Mn)

End-Use 2020 2021 2022 2023 2024 IT & Telecom 134.89 154.28 177.05 205.15 238.95 BFSI 49.13 56.05 63.97 73.47 84.75 Healthcare 24.80 28.36 32.43 37.29 43.03 Retail & E-commerce 27.34 31.19 35.59 40.84 47.07 Entertainment & Media 36.12 41.30 47.23 54.30 62.40 Manufacturing 19.47 22.07 25.00 28.50 32.59 Energy and Utilities 9.95 11.25 12.71 14.45 16.50 Others 30.23 35.20 40.84 47.52 55.18 Key Market Segments

By Material Type

- Mineral Wool

- Stone Wool

- Glass Wool

- Polystyrene

- Polyurethane

- Flexible Elastomeric Foam

- Polyethylene

- Others

By Product Type

- Sheets and Rolls

- Panels

- Pipe Section

- Tiles

- Boards & Slabs

- Wired Mat

- Others

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By Application

- Walls & Partitions

- Roofs & Ceilings

- Pipe

- Hot Pipe

- Cold Pipe

- Others

- Air Duct

- Equipment

- Chillers

- Cooling Tanks

- Air Handlers

- Others

- Raised Floors

- Others

By End-Use

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Manufacturing

- Energy and Utilities

- Others

Drivers

Surge in Hyperscale and Edge Data Centers Is Driving The Market Growth.

The surge in hyperscale and edge data centers is significantly accelerating demand in the global data center insulation market. This is largely driven by the exponential growth in digital activity, including cloud computing, AI-based workloads, IoT expansion, 5G infrastructure, and real-time data processing. Hyperscale data centers—large-scale facilities operated by major cloud service providers—require extensive and highly efficient thermal and acoustic insulation systems.

These facilities run thousands of servers simultaneously, generating substantial heat. Insulation is vital to optimize the performance of HVAC systems, improve energy efficiency, and maintain consistent internal temperatures, all while minimizing cooling-related energy costs, which can represent over 40% of a data center’s total energy consumption. Edge data centers, on the other hand, are smaller, decentralized facilities positioned closer to end users to reduce latency and improve service responsiveness.

As illustrated in the chart, there is a consistent and sharp upward trend in the number of hyperscale data centers built globally from 2020 through 2023. The number of these centers grew from 597 to nearly 992 in less than a decade, reflecting a compound annual growth rate well into double digits. This construction boom directly translates into insulation demand across building envelopes—walls, ceilings, ducting systems, pipe insulation, equipment enclosures, and raised floors.

Restraints

Growing Use of Alternative Cooling Technologies Can Hinder The Market Growth For A Certain Extent

The growing adoption of alternative cooling technologies presents a notable challenge to the expansion of the global data center insulation market. Traditionally, thermal insulation has played a central role in enhancing the energy efficiency of data centers, primarily by supporting conventional HVAC-based air cooling systems. Insulation in walls, ceilings, ducts, piping, and equipment enclosures has been essential to maintaining ambient temperatures, reducing thermal losses, and minimizing cooling loads.

However, the emergence and increasing deployment of advanced cooling techniques—such as liquid cooling, immersion cooling, and direct-to-chip solutions—is altering the cooling landscape and, consequently, diminishing the reliance on traditional building-envelope insulation. Liquid cooling technologies, for instance, use water or dielectric fluids to directly absorb heat from processors or server components. These methods are highly efficient, requiring far less energy than air-based cooling and offering higher thermal transfer capacity.

Opportunity

Green & Sustainable Construction Of Data Centers Creates New Opportunities

The global push toward green and sustainable construction in the data center industry is unlocking substantial new opportunities for growth in the data center insulation market. As environmental regulations tighten and carbon reduction targets become more urgent, data center operators are under increasing pressure to build and retrofit facilities that minimize energy consumption, reduce carbon footprints, and support long-term environmental goals.

One of the most effective ways to achieve these objectives is through advanced insulation systems, which play a pivotal role in reducing energy demand by enhancing thermal efficiency, minimizing heat loss, and optimizing climate control systems. Modern green building certifications—such as LEED (Leadership in Energy and Environmental Design), BREEAM, and ISO 50001—place significant emphasis on energy performance and sustainable material use. High-performance insulation helps data centers meet these benchmarks by reducing the operational energy required for cooling, which constitutes a major portion of a facility’s total electricity consumption.

Trends

Increased Focus on Acoustic Insulation

The growing focus on acoustic insulation is shaping the future of the data center insulation industry by expanding the scope of insulation from purely thermal functions to include sound management. As data centers become increasingly integrated into urban environments and co-located with commercial or residential spaces, noise control has emerged as a critical design requirement.

Data centers generate considerable acoustic pollution through mechanical equipment such as HVAC systems, air handlers, generators, and high-speed cooling fans. Without proper acoustic insulation, these noises can disrupt surrounding operations or violate local noise regulations, particularly in densely populated areas or near sensitive zones such as hospitals and offices. Acoustic insulation materials—such as acoustic foams, mineral wool panels, and composite materials.

Geopolitical Impact Analysis

Geopolitical Scenarios & US Tariff Impact On The Data Center Insulation Market.

Russia-Ukraine War Impact: Raw material scarcity and price hikes came early as the war constricted supplies of petrochemical feedstocks used to manufacture polymers, foams, and elastomers—key components in polyurethane, polyethylene, and polystyrene insulation. The conflict restricted access to crude oil and natural gas from Russia, causing European benchmark gas prices to increase by December 2021, and similar disruptions in oil supply across 2022. This translated directly into higher resin, binder, and foam costs, with manufacturers reporting price spikes of 50–100% for key insulation inputs.

Tariff Impact: U.S. tariffs introduced in April 2025 have significantly increased the cost of data center construction, particularly impacting insulation materials and key building components such as steel and aluminum. These materials imports face a specific 25% tariff, directly raising costs for structural and mechanical systems critical to data center builds. These tariffs are part of Section 232 measures justified on national security grounds, and as of March 2025, previous exclusions and quotas have been terminated, leaving few avenues for relief.

Insulation materials, particularly mineral wool products from China (including rock wool, slag wool, and nonwoven glass wool), are subject to a 10% duty. Steel and aluminum imports now carry a 25% tariff, directly increasing costs for structural frameworks, power infrastructure, and critical equipment such as transformers and switchgear. Routine operations will also become more expensive, as higher equipment costs affect maintenance and upgrades.

Regional Analysis

North America Held the Largest Share of the Global Data Center Insulation Market

In 2024, North America led the global data center insulation market with a 35.8% share, primarily due to its unmatched scale of digital infrastructure and rapid expansion of hyperscale and colocation facilities. The United States, hosting over 2,600 operational data centers and nearly 40% of global capacity, remains the epicenter of global cloud and digital services, while Canada continues to expand in colder regions such as Quebec and Ontario. This high density of facilities intensifies the need for energy efficiency, thermal stability, and acoustic control, making advanced insulation a critical investment for operators aiming to reduce cooling loads, lower Power Usage Effectiveness (PUE), and meet ESG compliance goals.

Regulatory frameworks such as ASHRAE 90.1 and California’s Title 24 mandate energy-efficient building practices, further driving insulation adoption. Additionally, the rise of modular and prefabricated data centers in North America has accelerated demand for high R-value and fire-resistant insulation materials, while urban hubs increasingly rely on acoustic insulation to comply with strict noise management rules. In Canada, insulation is equally vital to mitigate condensation risks and maintain thermal envelopes despite colder climates.

Global Data Center Insulation Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 126.46 142.41 160.95 182.53 207.61 Europe 92.60 105.38 119.03 136.42 156.80 Asia Pacific 74.02 88.42 106.01 127.52 153.83 Middle East & Africa 14.94 16.65 18.64 20.93 23.58 Latin America 23.90 26.81 30.19 34.11 38.66 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Innovation, Sustainability, and Expansion Are The Key Strategies Of Major Players Of the Data Center Insulation Market.

Major players in the global data center insulation market adopt strategies focused on innovation, sustainability, and expansion to strengthen their competitive edge. Companies invest heavily in R&D to develop high-performance insulation materials with enhanced fire resistance, acoustic control, and thermal efficiency to meet stricter regulatory frameworks. Strategic partnerships and collaborations with data center operators and construction firms help them secure long-term supply contracts.

The following are some of the major players in the industry

- Saint-Gobain

- Sika AG

- Ventac

- Johns Manville

- Armacell International S.A

- Owens Corning

- IAC Acoustics UK Ltd

- Huamei Energy-saving Technology Group Co., Ltd.

- InsulTech, LLC

- Kingspan Group

- Knauf Group

- Rockwool A/S

- Supreme Industries

- L’ISOLANTE K-FLEX S.p.A.

- Thermaflex

- Other Key Players

Key Development

May 2025: Saint-Gobain UK has announced plans to establish a new stone wool insulation manufacturing facility in Leicestershire, England. Set to commence production in 2027, the plant will utilize all-electric melting technology powered by renewable energy sources. This initiative aims to produce 50,000 tonnes of stone wool insulation products annually under the Saint-Gobain Isover brand, with the potential to double output with further investment.

June 2025: Armacell inaugurated a new aerogel insulation plant in Pune, India, to manufacture its advanced ArmaGel XG product line. The facility doubles Armacell’s aerogel blanket production capacity to meet rising global demand. ArmaGel XGH and XGC are engineered for extreme temperature ranges, including cryogenic and high-heat applications. This strategic investment strengthens Armacell’s commitment to energy-efficient solutions for industrial and data center environments.

Report Scope

Report Features Description Market Value (2024) USD 580.4 Mn Forecast Revenue (2034) USD 2596.2 Mn CAGR (2025-2034) 16.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Mineral Wool, Polystyrene, Polyurethane, Flexible Elastomeric Foam, Polyethylene & Others), By Product Type (Sheets & Rolls, Panels, Pipe Section, Tiles, Boards & Slabs, Wired Mat & Others), By Insulation Type (Thermal Insulation & Acoustic Insulation), By Installation Method (New Construction, Retrofit / Renovation), By Application (Walls & Partitions, Roofs & Ceilings, Pipe, Air Duct, Equipment, Raised Floors, Others) By End-Use (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Manufacturing, Energy & Utilities, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Saint–Gobain, Sika AG, Ventac, Johns Manville, Armacell International S.A., Owens Corning, IAC Acoustics UK Ltd, Huamei Energy-saving Technology Group Co., Ltd., InsulTech, LLC, Kingspan Group, Knauf Group, Rockwool A/S, Supreme Industries, L’ISOLANTE K-FLEX S.p.A., Thermaflex & Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Data Center Insulation MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Data Center Insulation MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Armacell

- Kaimann

- Kingspan Group

- Johns Manville

- Owens Corning

- Rockwool A/S

- Boyd

- Aeroflex Company Limited

- L'isolante K-Flex S.P.A.

- Supreme

- Sika AG

- Iac Acoustics UK Ltd.

- Ventac

- Huamei Energy-Saving Technology Group Co. Ltd.

- Thermaflex

- Auburn Manufacturing, Inc.

- Insultech, LLC

- Other Key Players