Global Data Broker Market Size, Share Analysis Report By Data Type (Consumer Data (Demographic data, Behavioral data, Purchase data, Social media data, Location data), Business Data (Firmographic data, Technographic data, Financial data, Industry-specific data)), By Application (Marketing and Advertising, Risk Management and Fraud Detection, People Search and Background Checks, Credit Scoring and Financial Services, Recruitment and HR Analytics, Customer Relationship Management (CRM), Healthcare Analytics, Others), By End-User Industry (BFSI (Banking, Financial Services, Insurance), Retail and E-commerce, Media and Entertainment, Healthcare, Government, Telecommunications, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150207

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

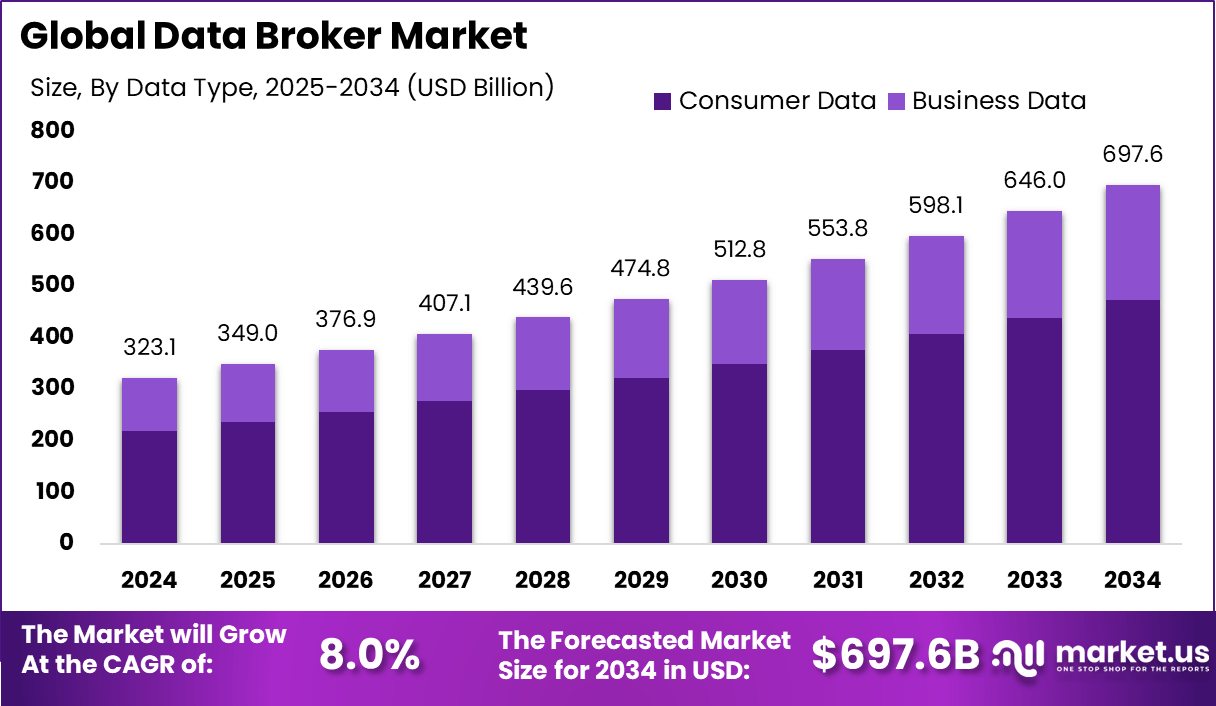

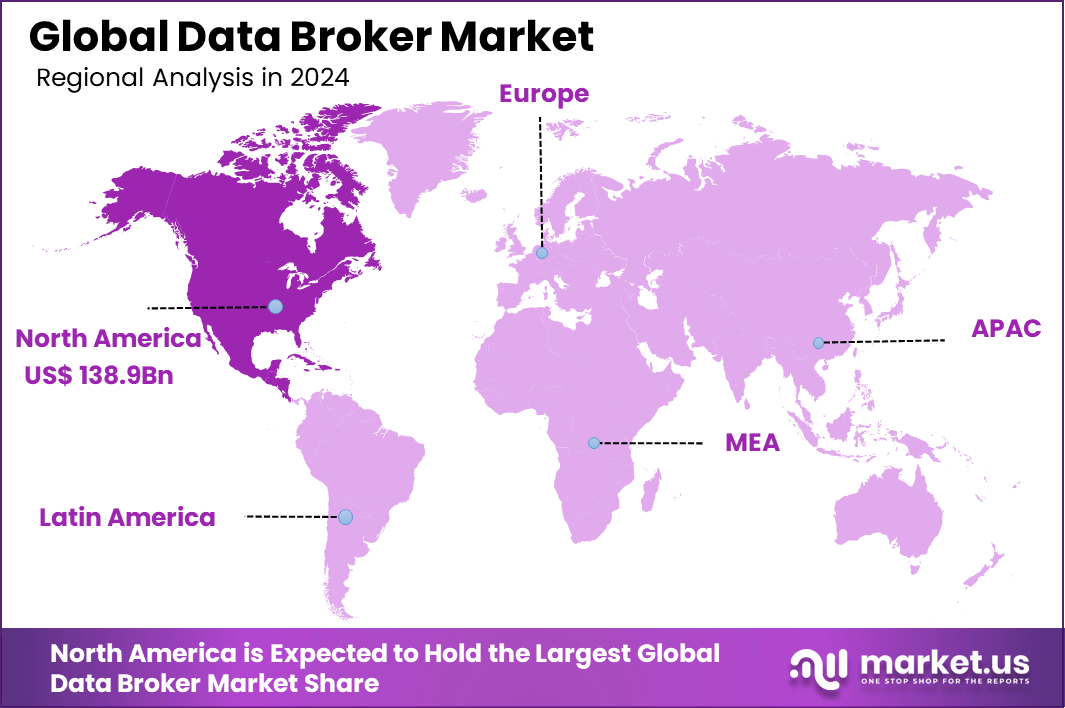

The Global Data Broker Market size is expected to be worth around USD 697.6 Billion By 2034, from USD 323.1 billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43% share, holding USD 138.9 Billion revenue.

A data broker is a company that collects, processes, and sells personal or business data to third parties. These firms gather information from various sources, including public records, online activities, and purchase histories, to create detailed profiles of individuals or organizations. The data is then sold or licensed to clients for purposes such as targeted advertising, risk assessment, and fraud prevention.

The global data broker market is experiencing substantial growth, driven by the increasing demand for data-driven decision-making across various industries. Several factors are driving the expansion of the data broker market. The surge in e-commerce activities has led businesses to seek consumer insights for targeted marketing strategies.

Additionally, the widespread adoption of smartphones and social media platforms has resulted in an exponential increase in data generation, providing data brokers with more information to aggregate and analyze. Furthermore, advancements in data analytics and artificial intelligence have enhanced the ability to process and interpret complex data sets, making data brokerage services more valuable to clients.

The demand for data broker services is on the rise as organizations recognize the value of data in gaining competitive advantages. Businesses across sectors such as finance, healthcare, retail, and advertising are increasingly relying on data brokers to obtain actionable insights into consumer behavior, market trends, and risk factors. This growing reliance underscores the integral role data brokers play in modern business strategies.

According to the findings from vpncentral, the average cost of data for individuals aged 18 to 25 is USD 0.36, underscoring how inexpensively personal information is traded in the data economy. The global data brokerage landscape is highly saturated, with over 4,000 companies operating in this space. Among them, Acxiom stands out with a massive repository of more than 2.5 billion consumer records and a detailed catalog of over 12,000 data attributes.

A combination of data brokers currently covers 90% of U.S. Facebook users, illustrating the extensive reach of behavioral tracking systems. Despite growing awareness of artificial intelligence in personalization, only 24% of organizations are actively deploying AI-driven recommendation systems, though 62% claim familiarity with them. Meanwhile, public awareness remains low – only 43% of individuals understand their “right to be forgotten,” indicating a persistent gap between digital data practices and user rights.

The data broker market presents numerous investment opportunities. As the demand for data-driven solutions continues to grow, investing in data brokerage firms or related technologies offers potential for significant returns. Emerging markets, in particular, present untapped opportunities due to increasing digitalization and the need for data analytics services.

Key Takeaways

- The Global Data Broker Market is projected to reach USD 697.6 Billion by 2034, expanding at a steady CAGR of 8.0% from 2025, driven by the escalating demand for personalized digital experiences and data-driven decision-making.

- In 2024, the market was valued at USD 323.1 Billion, reflecting widespread enterprise reliance on third-party data aggregation.

- North America led the global market with over 43% share, accounting for USD 138.9 Billion in revenue, supported by advanced data ecosystems and robust digital infrastructure.

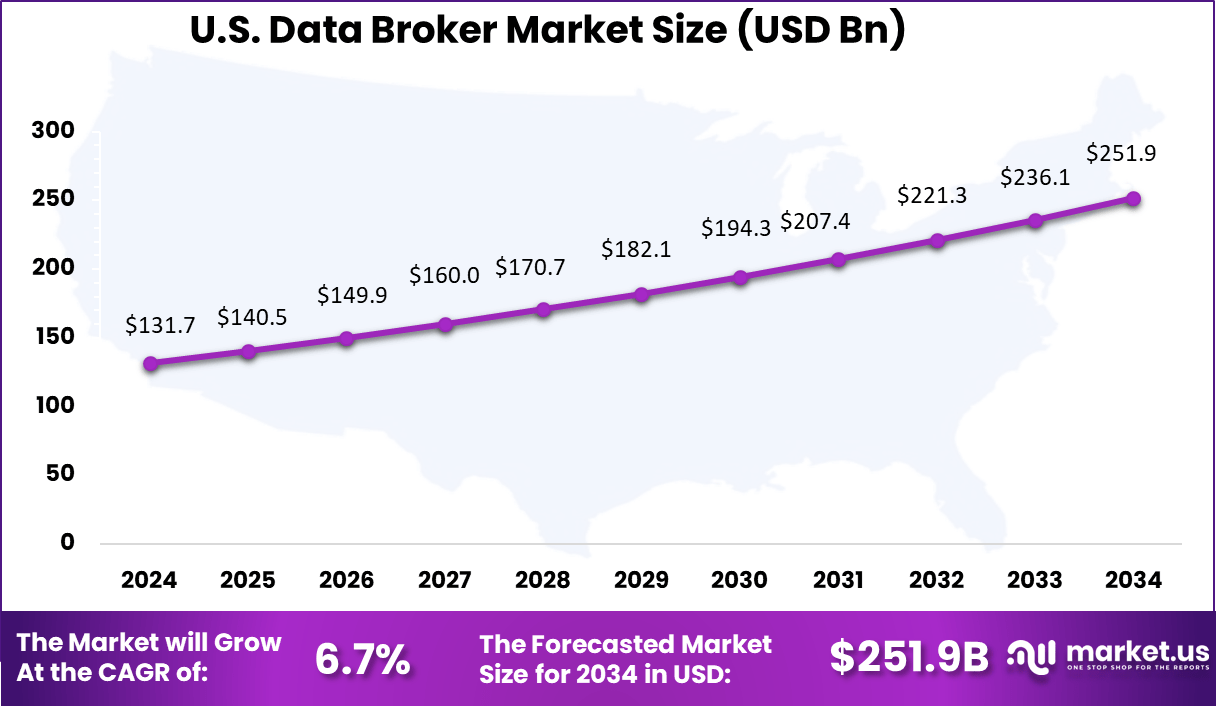

- The U.S. alone contributed USD 131.7 Billion, growing at a moderate 6.7% CAGR, fueled by demand across retail, financial services, and programmatic advertising.

- By data type, Consumer Data dominated with 68%, as businesses increasingly leveraged personal insights for segmentation, targeting, and predictive analytics.

- In application areas, Marketing and Advertising captured 36%, underscoring the central role of third-party data in optimizing campaigns and enhancing customer acquisition.

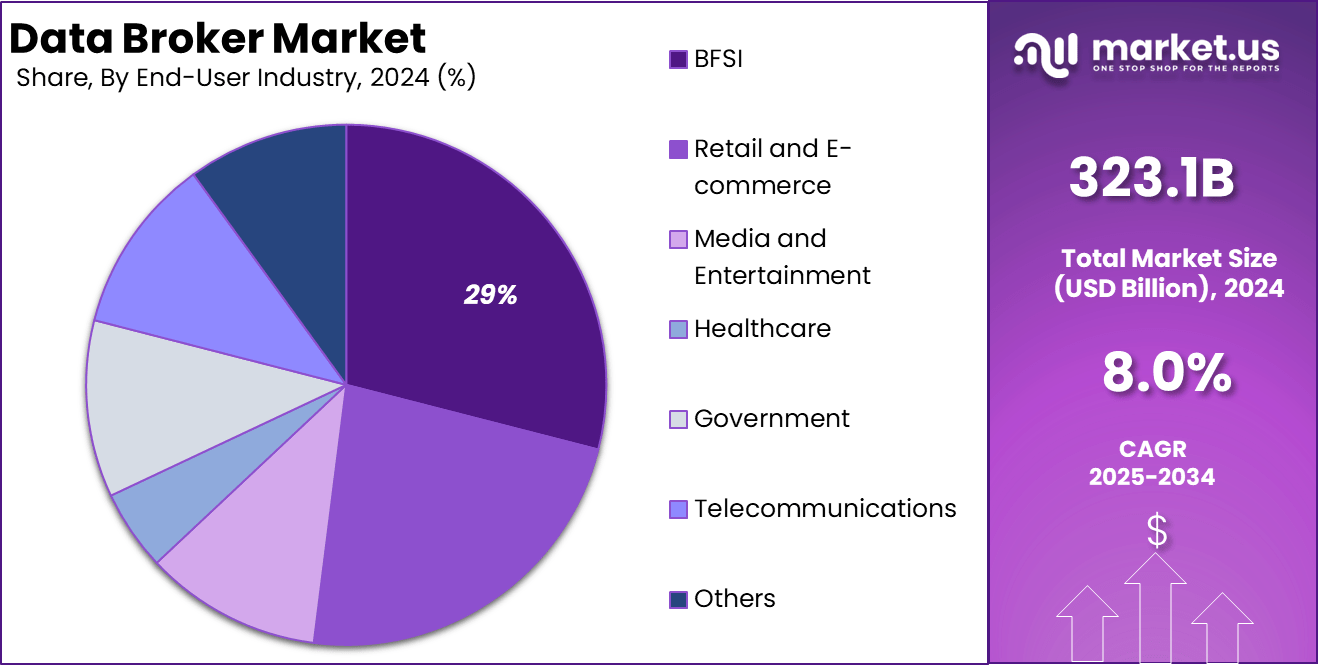

- Among end-user industries, the BFSI sector led with a 29% share, reflecting its need for accurate identity verification, fraud prevention, and customer profiling.

Impact of AI

The integration of artificial intelligence (AI) into the data broker industry has significantly transformed the landscape, enhancing both operational efficiency and the depth of consumer insights. AI-driven algorithms enable the rapid analysis of vast datasets, uncovering patterns and trends that may elude human analysts.

This capability allows data brokers to deliver more precise and actionable insights to their clients, thereby increasing the value proposition of their services. However, the rise of AI in data brokerage also brings heightened scrutiny regarding data privacy.

A significant majority of consumers express concern over how their data is collected and utilized by AI systems. Specifically, 81% of American consumers fear that data collected by companies working with AI will be used in ways that make them uncomfortable. This apprehension underscores the importance of transparency and ethical data handling practices in maintaining consumer trust.

In response to these concerns, data brokers are investing in robust data protection measures and compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These efforts aim to ensure that data collection and processing are conducted responsibly, balancing the benefits of AI-driven insights with the imperative of safeguarding individual privacy .

US Market Expansion

The US Data Broker Market is valued at approximately USD 131.7 Billion in 2024 and is predicted to increase from USD 182.1 Billion in 2029 to approximately USD 251.9 Billion by 2034, projected at a CAGR of 6.7% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant position in the global data broker market, capturing over 43% of the total market share, with revenues amounting to USD 138.9 billion. This leadership is primarily attributed to the region’s advanced digital infrastructure, widespread adoption of data-driven decision-making across industries, and the presence of major data brokerage firms. T

he United States, in particular, has been at the forefront, with significant investments in big data analytics and a robust ecosystem of data providers and consumers. The region’s emphasis on personalized marketing strategies and real-time consumer insights has further propelled the demand for data brokerage services.

Moreover, North America’s regulatory environment, while increasingly attentive to data privacy concerns, has historically been more permissive compared to other regions, allowing data brokers to operate with relative flexibility. This has enabled the accumulation and analysis of vast datasets, facilitating more precise targeting and segmentation for businesses.

The integration of artificial intelligence and machine learning technologies has also enhanced the capabilities of data brokers in the region, enabling more sophisticated data processing and predictive analytics. As a result, North America continues to be a pivotal market for data brokerage, setting trends and standards that influence global practices.

Data Type Analysis

In 2024, the Consumer Data segment held a dominant market position, capturing more than 68% of the global data broker market share. This leadership is attributed to the increasing demand for detailed consumer insights that drive personalized marketing strategies and enhance customer engagement.

Businesses across various sectors – such as retail, finance, and healthcare – rely heavily on demographic, behavioral, purchase, social media, and location data to tailor their offerings and improve decision-making processes. The proliferation of digital platforms and the surge in online activities have significantly contributed to the vast accumulation of consumer data, making it a valuable asset for companies aiming to understand and predict consumer behavior.

The prominence of the Consumer Data segment is further reinforced by the integration of advanced analytics and artificial intelligence in data processing. These technologies enable data brokers to extract meaningful patterns and trends from large datasets, providing businesses with actionable insights.

Moreover, the growing emphasis on customer-centric approaches and the need for real-time data have propelled the demand for consumer data. As companies strive to stay competitive in a rapidly evolving market, the reliance on comprehensive consumer data is expected to continue its upward trajectory, solidifying its leading position in the data broker industry.

Application Analysis

In 2024, the Marketing and Advertising segment held a dominant position in the global data broker market, capturing more than 36% of the total market share. This significant lead is primarily driven by the increasing demand for personalized marketing strategies and targeted advertising campaigns.

Businesses across various industries are leveraging data broker services to gain deeper insights into consumer behavior, preferences, and purchasing patterns. By analyzing demographic information, online activities, and social media interactions, companies can tailor their marketing efforts to specific audience segments, thereby enhancing customer engagement and conversion rates.

The proliferation of digital platforms and the widespread use of connected devices have resulted in an exponential increase in data generation. Data brokers collect and analyze this vast amount of information to create comprehensive consumer profiles. These profiles enable businesses to deliver highly targeted advertisements, optimize marketing budgets, and improve return on investment (ROI).

End-User Industry Analysis

In 2024, the Banking, Financial Services, and Insurance (BFSI) sector held a dominant position in the global data broker market, capturing over 29% of the total market share. This leadership is primarily driven by the sector’s reliance on data-driven strategies for risk assessment, fraud detection, and personalized financial services.

Financial institutions utilize data brokers to access comprehensive consumer profiles, enabling more accurate credit scoring and targeted marketing efforts. The integration of advanced analytics and machine learning algorithms further enhances the sector’s ability to predict customer behavior and tailor services accordingly.

Moreover, the increasing digitalization of financial services has led to a surge in online transactions and interactions, generating vast amounts of data. Data brokers play a crucial role in aggregating and analyzing this information, providing insights that help financial institutions improve operational efficiency and customer experience.

The sector’s stringent regulatory requirements also necessitate robust data management practices, which data brokers are well-equipped to support. As the BFSI sector continues to evolve in response to technological advancements and changing consumer expectations, its dependence on data brokerage services is expected to grow, reinforcing its leading position in the market.

Key Market Segments

By Data Type

- Consumer Data

- Demographic data

- Behavioral data

- Purchase data

- Social media data

- Location data

- Business Data

- Firmographic data

- Technographic data

- Financial data

- Industry-specific data

By Application

- Marketing and Advertising

- Risk Management and Fraud Detection

- People Search and Background Checks

- Credit Scoring and Financial Services

- Recruitment and HR Analytics

- Customer Relationship Management (CRM)

- Healthcare Analytics

- Others

By End-User Industry

- BFSI

- Retail and E-commerce

- Media and Entertainment

- Healthcare

- Government

- Telecommunications

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The data broker industry is undergoing significant transformation, driven by technological advancements and evolving consumer behaviors. A notable trend is the integration of artificial intelligence (AI) and machine learning (ML) into data analytics processes.

These technologies enable data brokers to process vast amounts of structured and unstructured data more efficiently, providing clients with deeper insights and predictive analytics capabilities. Additionally, the proliferation of Internet of Things (IoT) devices has expanded the sources of data collection, allowing brokers to gather more granular information on consumer behaviors and preferences.

Another emerging trend is the increasing emphasis on data privacy and regulatory compliance. With the implementation of stringent data protection laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, data brokers are compelled to adopt more transparent and ethical data handling practices.

Business Benefits

Engaging with data brokers offers businesses several strategic advantages, particularly in enhancing marketing effectiveness. By accessing comprehensive consumer data, companies can develop more targeted and personalized marketing campaigns, leading to higher conversion rates and improved customer engagement.

Data brokers provide insights into consumer demographics, purchasing behaviors, and preferences, enabling businesses to tailor their offerings to meet specific market demands. This level of precision in marketing efforts contributes to more efficient allocation of advertising budgets and a better return on investment.

Furthermore, data brokers play a crucial role in risk management and fraud prevention. Financial institutions and other organizations utilize data broker services to verify identities, assess creditworthiness, and detect fraudulent activities. By analyzing patterns and anomalies in consumer data, businesses can identify potential risks and implement measures to mitigate them proactively.

Driver

Rising Demand for Data-Driven Marketing

The data broker market is experiencing significant growth, primarily driven by the increasing demand for data-driven marketing strategies. Businesses across various sectors are leveraging detailed consumer data to tailor their marketing efforts, aiming to enhance customer engagement and conversion rates.

This trend is fueled by the proliferation of digital platforms and the availability of vast amounts of consumer information, enabling companies to gain deeper insights into customer behaviors and preferences. Moreover, advancements in analytics and machine learning technologies have empowered data brokers to provide more precise and actionable insights.

These tools facilitate the analysis of complex datasets, allowing businesses to predict consumer trends and personalize their offerings effectively. As a result, the reliance on data brokers for targeted marketing solutions continues to grow, reinforcing their pivotal role in modern business strategies.

Restraint

Heightened Data Privacy Concerns

Despite the growth prospects, the data broker industry faces significant challenges due to increasing data privacy concerns. Consumers are becoming more aware of how their personal information is collected, stored, and used, leading to heightened scrutiny of data brokers’ practices. This awareness has prompted calls for greater transparency and accountability within the industry.

Regulatory bodies are responding by implementing stricter data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. These regulations impose stringent requirements on data collection and processing, increasing compliance costs for data brokers and potentially limiting their data sources.

Opportunity

Expansion into Emerging Markets

Emerging markets present a substantial opportunity for data brokers seeking growth avenues. As digital adoption accelerates in regions such as Asia-Pacific, Latin America, and Africa, a vast amount of consumer and business data is being generated.

Data brokers can capitalize on this trend by expanding their operations into these regions, offering services tailored to the unique needs of local businesses. Furthermore, the relatively nascent regulatory frameworks in many emerging markets provide a more flexible environment for data collection and analysis.

By establishing early partnerships and investing in localized data infrastructure, data brokers can position themselves as key players in these growing economies, tapping into new revenue streams and diversifying their global presence.

Challenge

Ensuring Data Accuracy and Quality

One of the critical challenges facing data brokers is maintaining the accuracy and quality of the data they provide. Inaccurate or outdated information can lead to flawed insights, negatively impacting clients’ decision-making processes and eroding trust in data broker services.

Ensuring data integrity requires continuous monitoring, validation, and updating of datasets, which can be resource-intensive. Additionally, the integration of data from diverse sources increases the complexity of maintaining consistency and reliability.

Data brokers must invest in advanced data management systems and employ rigorous quality control measures to address these issues. Failure to do so can result in reputational damage and loss of business, underscoring the importance of data accuracy in sustaining long-term client relationships.

Key Player Analysis

The data broker market remains highly fragmented, with leading companies such as Acxiom LLC, Experian PLC, and Equifax Inc. maintaining a dominant position by leveraging their expansive databases and advanced analytics capabilities. These firms serve a wide range of industries through services that include consumer profiling, credit risk assessment, and targeted advertising solutions.

While some focus on financial and credit-related data, others emphasize behavioral tracking and omnichannel marketing analytics. Their vast infrastructures and technological assets provide a solid foundation to address complex client demands across regions and sectors.

Competition in this space is increasingly defined by technological sophistication and compliance readiness. As artificial intelligence, machine learning, and cloud-based infrastructure become central to operations, companies are differentiating themselves through real-time data processing and predictive modeling.

However, with rising global scrutiny around data privacy and consumer rights, especially under regulations like GDPR and CCPA, major players have shifted focus toward enhancing transparency and trust. Investments in ethical data sourcing and privacy-enhancing technologies are now essential for sustaining growth and securing long-term partnerships.

Top Key Players Covered

- Acxiom LLC

- Experian PLC

- Equifax Inc.

- CoreLogic, Inc.

- TransUnion LLC

- Oracle Corporation

- RELX Group (LexisNexis Risk Solutions)

- Dun & Bradstreet Holdings, Inc.

- Thomson Reuters Corporation

- TowerData Inc.

- Others

Recent Developments

- In April 2024, President Biden signed a significant omnibus foreign relations package that included the Protecting Americans’ Data from Foreign Adversaries Act of 2024. This newly enacted legislation marks a pivotal shift in U.S. data governance by prohibiting data brokers from transferring sensitive personal information to foreign entities associated with Russia, China, Iran, and North Korea.

Report Scope

Report Features Description Market Value (2024) USD 323.1 Bn Forecast Revenue (2034) USD 697.6 Bn CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Data Type (Consumer Data (Demographic data, Behavioral data, Purchase data, Social media data, Location data), Business Data (Firmographic data, Technographic data, Financial data, Industry-specific data)), By Application (Marketing and Advertising, Risk Management and Fraud Detection, People Search and Background Checks, Credit Scoring and Financial Services, Recruitment and HR Analytics, Customer Relationship Management (CRM), Healthcare Analytics, Others), By End-User Industry (BFSI (Banking, Financial Services, Insurance), Retail and E-commerce, Media and Entertainment, Healthcare, Government, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acxiom LLC, Experian PLC, Equifax Inc., CoreLogic, Inc., TransUnion LLC, Oracle Corporation, RELX Group (LexisNexis Risk Solutions), Dun & Bradstreet Holdings, Inc., Thomson Reuters Corporation, TowerData Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acxiom LLC

- Experian PLC

- Equifax Inc.

- CoreLogic, Inc.

- TransUnion LLC

- Oracle Corporation

- RELX Group (LexisNexis Risk Solutions)

- Dun & Bradstreet Holdings, Inc.

- Thomson Reuters Corporation

- TowerData Inc.

- Others