Global Dancewear Market Report By Product Type (Bodywear, Footwear, Accessories), By Application (Theatres, Concerts, Entertainment Industry, Others), By End User (Men, Women, Children), By Distribution Channel (Specialty Stores, Online Channels, Hypermarkets/Supermarkets, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131996

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

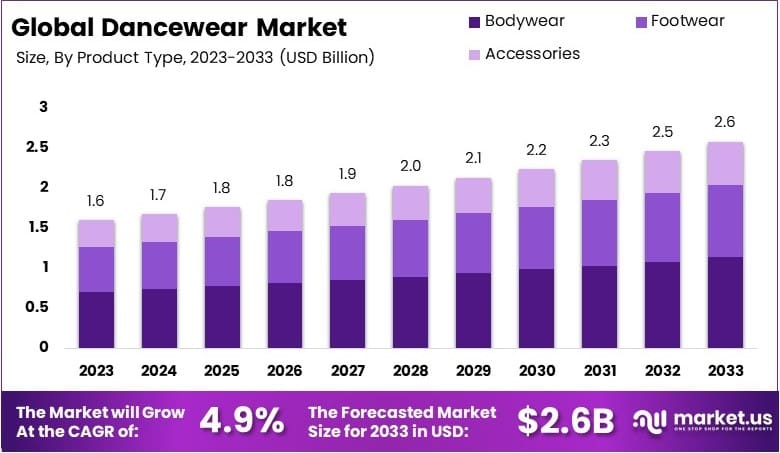

The Global Dancewear Market size is expected to be worth around USD 2.6 Billion by 2033, from USD 1.6 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

Dancewear refers to clothing specifically designed for dance activities. It includes items like leotards, tights, dance shoes, and costumes. These garments are tailored for flexibility, comfort, and performance, enhancing the dancer’s movement and appearance during practice or performances.

The dancewear market consists of the production and sale of dance-specific apparel and accessories. It serves dancers of all levels, from beginners to professionals, across various dance forms like ballet, jazz, and contemporary.

Dancewear is essential for various dance forms, from ballet to hip-hop. It is driven by increasing participation in dance classes, competitions, and performances.

Events like the Dance World Cup have boosted demand, with the 2024 finals in Prague attracting 9,500 dancers from 54 countries and drawing 20,000 supporters. This showcases the strong interest and engagement in dance, positively impacting demand for dancewear globally.

The market shows moderate saturation in developed regions like North America and Europe, where dancewear has high penetration. However, growth opportunities exist in Asia-Pacific and Latin America, where interest in dance as both a sport and cultural activity is increasing.

Demand for specialized dance apparel, such as ballet leotards, jazz pants, and tap shoes, is particularly strong among young and aspiring dancers.

The dancewear market is driven by factors like rising dance participation, increasing dance competitions, and a growing interest in fitness-related dance forms.

Market competitiveness is strong, with leading brands like Capezio, Bloch, and Grishko dominating. These brands focus on high-quality materials, fit, and durability to maintain their market position. However, local brands and new entrants are finding opportunities by offering affordable and trendy designs, especially in emerging markets.

Key Takeaways

- The Dancewear Market was valued at USD 1.6 billion in 2023 and is projected to reach USD 2.6 billion by 2033, with a CAGR of 4.9%.

- In 2023, Bodywear led the product type segment, driven by its essential role in dance performances and practice.

- In 2023, the Entertainment Industry was the largest application segment, fueled by dance-themed productions and events.

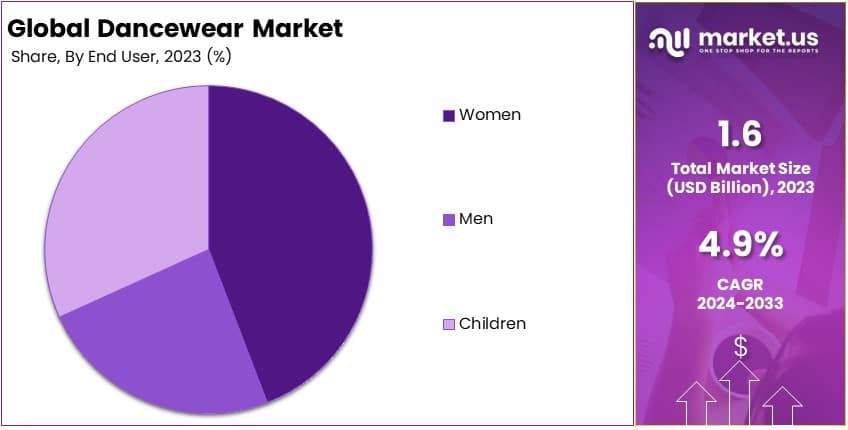

- In 2023, Women dominated the end-user segment, reflecting higher participation rates in dance activities.

- In 2023, Specialty Stores were the leading distribution channel, offering a variety of dancewear products.

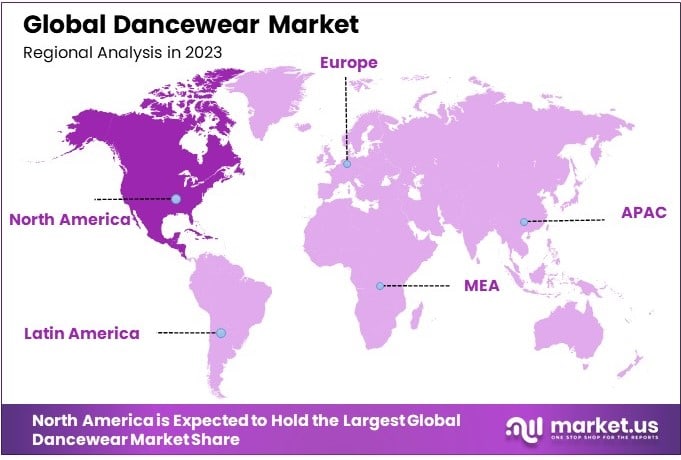

- In 2023, North America was the dominant region, driven by the popularity of dance and established dancewear brands.

Product Type Analysis

Bodywear dominates the Dancewear Market due to its essential role in dancer comfort and performance.

The “Product Type” segment of the Dancewear Market includes Bodywear, Footwear, and Accessories. Notably, Bodywear is the dominant sub-segment, capturing a significant market share due to its fundamental importance in dance.

Specifically, this category includes items like leotards, unitards, tutus, and costumes, which are essential for dancers across various styles and levels. Bodywear is crafted to allow freedom of movement while providing the necessary support and comfort, both of which are vital for any performance.

Furthermore, the demand for high-quality bodywear that combines functionality with aesthetics drives continuous innovations in this category. This includes the use of advanced fabrics that offer enhanced stretch, durability, and moisture-wicking properties.

In addition, Footwear—comprising ballet slippers, tap shoes, and jazz shoes—holds critical importance but is typically tailored to specific dance styles, thereby influencing its market reach. Meanwhile, Accessories, such as belts, hairpieces, and bags, are essential yet complementary items that support dancers’ needs and complete the ensemble without being classified as primary dancewear.

Application Analysis

The Entertainment Industry leads in application due to the expansive use of dancewear in performances and productions.

The Entertainment Industry is the most significant consumer of dancewear, primarily due to the extensive use of dance in television, film, music videos, and live performances. This sector demands high volumes of dancewear to outfit performers across a wide range of shows and productions, often requiring a mix of custom and off-the-shelf pieces.

Moreover, the visual aspect of dancewear in the movies and entertainment industry is crucial, influencing trends and styles worldwide. This segment’s dominance is fueled by the constant need for new, visually appealing dance costumes that capture the audience’s imagination and make dance performances memorable.

In contrast, theatre and concert applications, while impactful, tend to be more seasonal and event-driven. These settings often require specific types of dancewear aligned with particular themes or productions, thereby adding unique demands within the broader dancewear market.

End User Analysis

Women are the primary end users, reflecting the high participation rates in dance-related activities.

The “End User” segment encompasses Men, Women, and Children. Among these, Women dominate this market segment, primarily due to higher participation rates in dance across both amateur and professional levels. To meet this demand, dancewear designed for women includes a broad range of styles and sizes to accommodate various dance forms and body types.

In addition, women’s dancewear is crafted not only for functionality but also with a focus on aesthetic appeal, reflecting the blend of performance and presentation essential in dance. This emphasis on style and comfort, along with the diversity of dance disciplines practiced by women—from ballet to hip-hop—drives substantial demand within this segment.

On the other hand, men’s and children’s dancewear, while critical, cover smaller portions of the market. Men’s dancewear is designed to meet the specific needs of male dancers, providing support and mobility suited to their physique. Meanwhile, children’s dancewear focuses on accommodating growing bodies, emphasizing adjustability and durability to withstand rigorous use.

Distribution Channel Analysis

Specialty Stores lead as the preferred distribution channel for dancewear due to their focused product assortments and expert service.

Specialty Stores are the most prominent channel in the dancewear market, primarily because they provide customers with not only dancewear but also valuable expertise and service that can be essential when selecting appropriate attire.

The option to try on various items and receive professional guidance in-store plays a crucial role in the buying process, particularly for technical items such as pointe shoes or performance costumes, which require precise fitting.

Conversely, Online Channels are expanding rapidly, driven by the convenience they offer and often broader inventory selections. Nonetheless, the tactile and fitting aspects of dancewear shopping still support the continued dominance of physical stores. Meanwhile, hypermarkets and supermarkets provide accessibility and competitive pricing, yet they typically lack the specialized products and knowledgeable staff found in specialty dancewear stores.

Key Market Segments

By Product Type

- Bodywear

- Footwear

- Accessories

By Application

- Theatres

- Concerts

- Entertainment Industry

- Others

By End User

- Men

- Women

- Children

By Distribution Channel

- Specialty Stores

- Online Channels

- Hypermarkets/Supermarkets

- Others

Drivers

Rising Popularity of Dance Competitions Drives Market Growth

The rising popularity of dance competitions and events serves as a major driving factor for the dancewear market. As these events grow, they increase the demand for specialized dancewear, with participants requiring high-quality, performance-oriented apparel.

Additionally, growing interest in fitness and dance-based workouts contributes to market growth. Dance-inspired fitness routines like Zumba and barre have surged in popularity, leading to a heightened demand for comfortable, functional dancewear suited for workout sessions.

Furthermore, the expansion of dance studios and schools continues to fuel demand. With more studios opening in urban and suburban areas, there is a sustained need for training apparel. Dancewear brands often partner with these studios to provide customized outfits, which enhances both brand visibility and sales.

Moreover, the increased influence of social media on dance trends further promotes dancewear sales. Platforms such as Instagram and TikTok popularize dance routines, motivating viewers to purchase related apparel to join in on these trends.

Restraints

High Production Costs of Quality Fabrics Restraints Market Growth

High production costs of quality fabrics present a significant restraint in the dancewear market. Premium materials, such as moisture-wicking fabrics and stretchable and antimicrobial textiles, are essential for functional dancewear but increase production costs. Consequently, this often leads to higher retail prices, limiting affordability for some consumers.

Additionally, limited adoption in non-urban areas is another restricting factor. With higher penetration in urban markets where dance studios and events are more prevalent, dancewear faces lower demand in non-urban areas where access to dance facilities is limited.

Furthermore, the availability of low-cost alternatives hampers market growth. Many consumers, especially budget-conscious buyers, choose cheaper apparel options even if they compromise on quality, which affects demand for branded dancewear.

Finally, seasonal demand fluctuations create additional challenges. Demand peaks during specific periods, such as recital and competition seasons, but drops during off-peak times, impacting consistent sales.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Expansion in emerging markets provides significant opportunities for the dancewear market. As dance gains popularity in regions like Asia-Pacific and Latin America, driven by increasing disposable incomes and growing interest in diverse dance forms, demand for dancewear continues to rise.

Moreover, the trend toward sustainable dancewear presents a promising opportunity. With consumers increasingly seeking eco-friendly options, brands are encouraged to offer sustainable choices made from recycled or organic materials. This aligns with global sustainability initiatives and appeals to environmentally conscious buyers.

In addition, the growing popularity of online shopping supports market expansion. E-commerce platforms make it easier for consumers to access a wide range of dancewear, offering convenience and variety. Through online channels, brands can reach a broader audience and increase sales potential.

Lastly, customization and personalization trends provide further growth avenues. Consumers value personalized dancewear that reflects individual style or group identity, such as customized leotards or team uniforms, adding a unique appeal to the market.

Challenges

Rapid Changes in Fashion Trends Challenges Market Growth

Rapid changes in fashion trends present a notable challenge to the dancewear market. As consumer preferences for styles, colors, and designs shift quickly, brands face difficulties keeping up with trends and managing inventory efficiently.

In addition, intense market competition compounds this challenge. With numerous brands and local manufacturers offering similar products, it becomes challenging for any single player to dominate the market. This competition often results in pricing pressures, thereby reducing profit margins.

Moreover, the market’s reliance on dance events and schools poses another challenge. Since dancewear sales are closely tied to the frequency of events, recitals, and class enrollments, any decline in these activities, whether during off-peak seasons or due to unforeseen circumstances, directly impacts sales.

Lastly, inventory management complexities affect growth. Due to the diverse range of sizes, styles, and colors needed in dancewear, managing stock effectively becomes challenging, often leading to either stockouts or excess inventory.

Growth Factors

Strategic Partnerships with Dance Schools Are Growth Factors

Strategic partnerships with dance schools are essential for growth in the dancewear market. By collaborating directly with schools, brands gain access to students, enhancing brand visibility and driving sales.

Furthermore, the expansion of distribution channels significantly contributes to growth. Through a mix of physical stores and online platforms, brands increase consumer accessibility and convenience.

Investment in digital marketing also supports market growth. With social media campaigns, online ads, and influencer collaborations, brands effectively engage consumers and stimulate online sales.

Finally, enhanced product innovation fuels market expansion. By consistently introducing new designs, materials, and features, brands keep the market dynamic and appealing, meeting evolving consumer demands.

Emerging Trends

Use of Eco-Friendly Materials Is the Latest Trending Factor

The use of eco-friendly materials is a significant trend in the dancewear market. Consumers are increasingly interested in sustainable options, driving brands to introduce eco-friendly fabrics like organic cotton and recycled polyester.

Moreover, demand for athleisure-inspired dancewear is another trend shaping the market. Consumers seek versatile clothing that can transition from dance class to casual wear, leading to a blend of athletic and dance apparel.

The growth of dancewear collaborations with influencers further drives market trends. Influencers often promote specific brands or collections, increasing visibility and attracting younger consumers interested in trendy, endorsed products.

Increased demand for gender-neutral dancewear also reflects changing consumer preferences. As societal norms shift towards inclusivity, dancewear brands are introducing unisex designs to cater to a broader audience.

Regional Analysis

North America Dominates the Market Share

North America leads the Dancewear Market, driven by a strong dance culture, high participation rates in dance schools, and the popularity of dance competitions. The region benefits from a well-established network of dance studios and schools, which fuels consistent demand for a variety of dancewear products, including leotards, tights, and dance shoes.

Furthermore, regional characteristics significantly influence the market. Dance styles such as ballet, hip-hop, and jazz are widely practiced, maintaining a steady demand for specialized dancewear. In addition, high disposable incomes and a focus on recreational activities further bolster market growth. Moreover, the rise of online retail platforms has enabled easy access to an extensive range of dance apparel, supporting convenience and expanding consumer choice.

Regional Mentions:

- Europe: Europe’s dancewear market thrives due to a rich dance tradition and numerous ballet schools. Demand is high in countries like the UK, France, and Russia, where ballet and contemporary dance are popular.

- Asia-Pacific: Asia-Pacific shows growing interest in dancewear, driven by increasing dance participation among youth and the rising popularity of dance-based reality shows. Countries like China, Japan, and India are major contributors.

- Middle East & Africa: The Middle East & Africa region is gradually adopting dancewear, with demand fueled by the growth of dance studios and the influence of Western dance styles. Urban centers see the highest demand.

- Latin America: Latin America’s dancewear market benefits from a strong dance culture, particularly in salsa, tango, and samba. Countries like Brazil and Argentina drive demand for both traditional and modern dance apparel.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The dancewear market is dominated by four major players: Bloch International, Capezio, Danskin, and Repetto. These companies drive market growth through strong brand recognition, extensive product ranges, and global distribution.

To begin with, Bloch International stands as a leading player in the dancewear market, offering a diverse range of dance apparel, shoes, and accessories. With a focus on quality materials and fit, along with collaborations with professional dancers, Bloch strengthens its competitive position.

Similarly, Capezio is a key competitor, widely recognized for its dance shoes and apparel. Serving various dance styles, including ballet, tap, and jazz, Capezio emphasizes innovation and comfort, solidifying its status as a preferred brand among dancers worldwide.

In addition, Danskin is known for its stylish and functional dancewear, offering a variety of leotards, tights, and activewear. With a strong retail presence and a dual focus on performance and fashion, Danskin successfully maintains its market share.

Finally, Repetto holds a prominent position in the premium dancewear segment. Renowned for its elegant ballet shoes and apparel, Repetto emphasizes craftsmanship and design, appealing to both professional and amateur dancers. Its established presence in the luxury segment supports its sustained growth.

Collectively, these key players drive the dancewear market by prioritizing comfort, quality, and style. Their strategies continue to shape the market’s future by adapting to the evolving demands of dancers and expanding into diverse dance styles.

Top Key Players in the Market

- Bloch International

- Capezio

- Danskin

- Repetto

- Mirella

- Yumiko

- Wear Moi

- Grishko

- Sodanca

- Ainsliewear

Recent Developments

- Pine Stores: In August 2024, new signage appeared at the former Katz Dancewear and Fancy Dress shop on Newdegate Street in Nuneaton, indicating the arrival of ‘Pine Stores.’ The Katz store had closed earlier in the year, and the new signage suggests a forthcoming retail establishment. Details about the nature of ‘Pine Stores’ remain limited.

- Modibodi: In January 2024, Modibodi introduced the “Class of Confidence” collection, a range of period-proof underwear and dancewear designed for teenagers. The collection features a super slim, absorbent lining with three layers of built-in technology, aiming to provide comfort and discretion during menstruation.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 2.6 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bodywear, Footwear, Accessories), By Application (Theatres, Concerts, Entertainment Industry, Others), By End User (Men, Women, Children), By Distribution Channel (Specialty Stores, Online Channels, Hypermarkets/Supermarkets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bloch International, Capezio, Danskin, Repetto, Mirella, Yumiko, Wear Moi, Grishko, Sodanca, Ainsliewear Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bloch International

- Capezio

- Danskin

- Repetto

- Mirella

- Yumiko

- Wear Moi

- Grishko

- Sodanca

- Ainsliewear