Global Dairy Herd Management Market Size, Share Analysis Report By Offering (Hardware, Software, Services), By Application (Milk Harvesting, Breeding, Feeding, Cow Comfort And Heat Stress Management, Health Management, Others), By End-User (Large-Scale Dairy Farms, Medium-Scale Dairy Farms, Small-Scale Dairy Farms) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161916

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

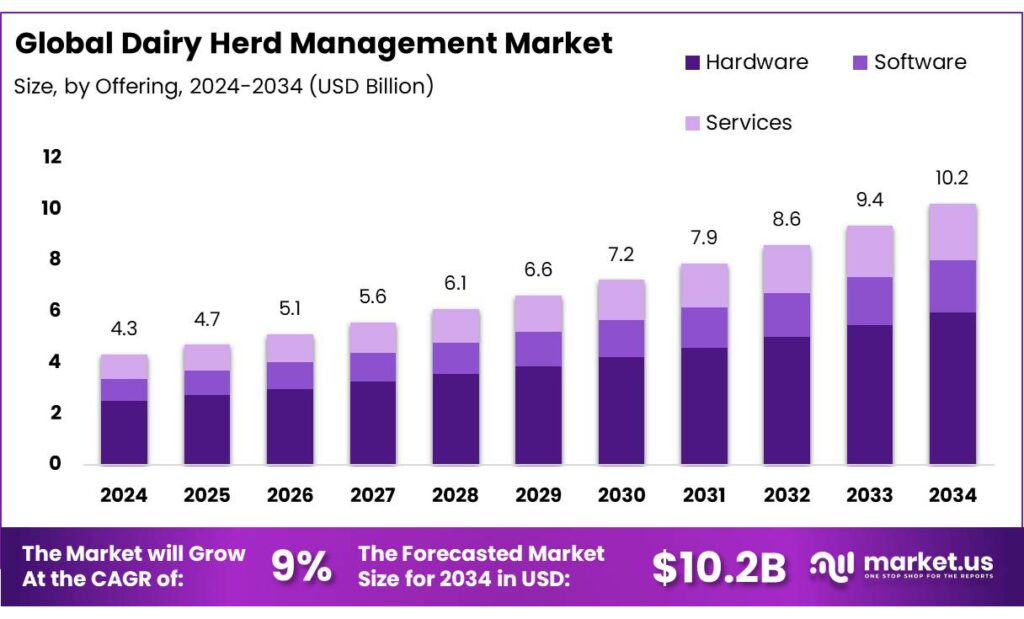

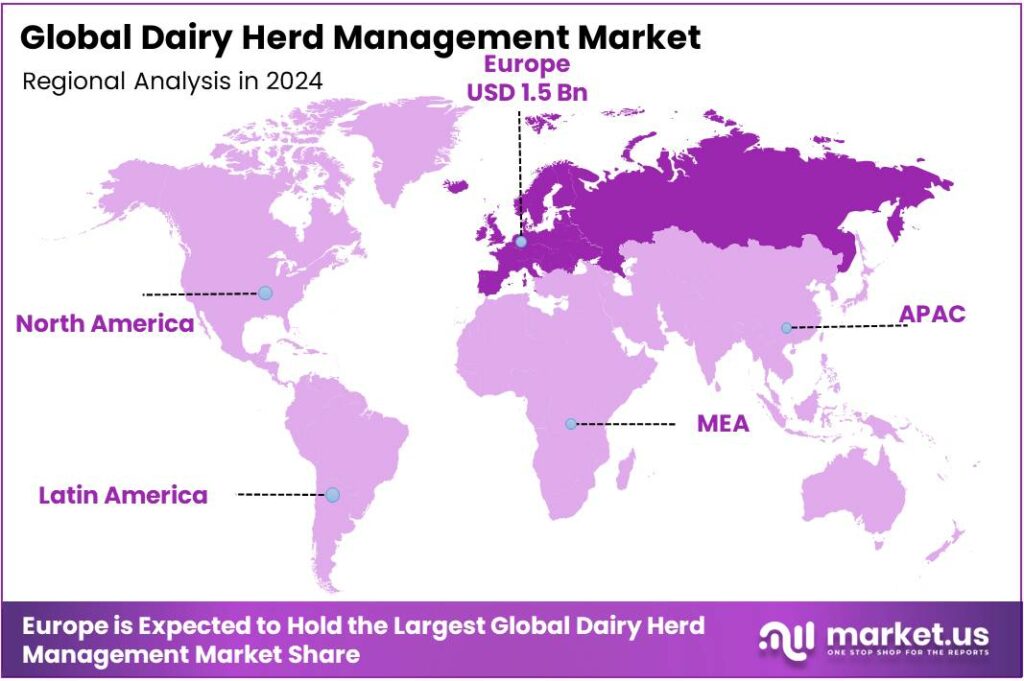

The Global Dairy Herd Management Market size is expected to be worth around USD 10.2 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024 European held a dominant market position, capturing more than a 35.2% share, holding USD 1.5 Billion in revenue.

The dairy herd management sector can be defined as the combined set of practices, services and technologies applied to maintain, reproduce, feed, monitor and market dairy cattle to optimise milk yield, animal health and farm profitability. The sector is geopolitically distributed and vertically integrated in some markets while remaining small-holder dominated in others; global milk production reached 965.7 million tonnes in 2023, reflecting continued volume expansion principally driven by Asia.

Policy support underpins the industrial landscape. In the European Union, the Common Agricultural Policy remains a third of the EU budget and in 2023 disbursed €38.16 bn in direct payments plus €12.95 bn for rural development, shaping herd management priorities on welfare, emissions, and digitalization via national Strategic Plans. In the United States, USDA’s Dairy Margin Coverage (DMC) program provides counter-cyclical protection; the Government Accountability Office reports ~$2.7 bn paid to farmers during 2019–2024, and the 2025 enrollment window opens Jan 29–Mar 31, 2025. Such instruments stabilize cash flows, enabling investment in precision feeding, health monitoring, and milking upgrades.

Primary driving factors for change in herd management include demand growth for dairy products, animal genetics and reproductive technologies, feed and nutrition quality, disease control, and regulatory and policy support. World and regional demand is forecast to grow—OECD-FAO modelling projects world milk production to continue expanding at roughly 1.5% p.a. over the coming decade, reaching about 1,039 million tonnes by 2032—which creates upward pressure on intensification and herd efficiency. At the same time, sustainability and emission-reduction imperatives are incentivising investment in methane mitigation, manure management and resilient feed systems.

Government initiatives and development finance are instrumental in shaping herd management practices, particularly in high-growth markets. In India—the world’s largest milk producer—milk output was reported at 239.3 million tonnes in 2023–24, supported by programs such as the Rashtriya Gokul Mission and National Dairy Plans that finance genetics, artificial insemination networks and cooperative infrastructure to raise per-animal productivity and incomes. Public-private partnerships and donor-backed projects have targeted farmer training, cold-chain development and breed improvement to close productivity gaps.

Key Takeaways

- Dairy Herd Management Market size is expected to be worth around USD 10.2 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 9.0%.

- Hardware held a dominant market position, capturing more than a 56.2% share.

- Milk Harvesting held a dominant market position, capturing more than a 35.7% share.

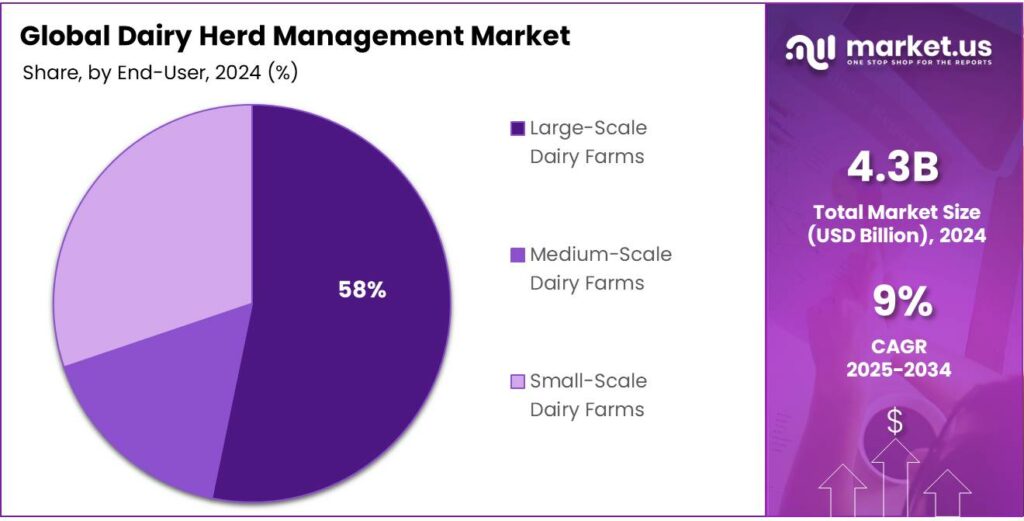

- Large-Scale Dairy Farms held a dominant market position, capturing more than a 53.4% share.

- European region captured a leading position in the global dairy herd management market, representing 35.2% of the total addressable market and generating roughly US$ 1.5 billion.

By Type Analysis

Robotic milking systems lead in adoption among larger dairies.

In 2024, Hardware held a dominant market position, capturing more than a 56.2% share. Robotic milking systems were central to that hardware dominance; these units were increasingly adopted by commercial farms to reduce labor dependency and improve milking consistency. The systems were noted for delivering repeatable milking routines, built-in udder health checks, and data capture that fed herd management platforms, and their capital intensity was offset by measured gains in milking efficiency and labour substitution. In 2025, deployment was observed to continue among scale operations as financing and service models matured.

Automated feeding and mixing equipment constituted a second core hardware segment. Precision feeders and automated mixers were reported to improve ration accuracy and reduce feed waste, thereby supporting milk yield per cow. These technologies were often integrated with herd management software to enable per-group or per-animal feeding profiles, and incremental deployments were seen in both loose-housing and freestall systems during 2024–2025.

By Nature Analysis

Milk Harvesting leads the market with 35.7% share driven by automation and efficiency gains.

In 2024, Milk Harvesting held a dominant market position, capturing more than a 35.7% share. This segment’s leadership was largely supported by the rapid adoption of automated and robotic milking systems, which became the cornerstone of modern dairy operations. Farmers increasingly relied on automated milking units to enhance productivity, maintain hygiene standards, and minimize labor dependency. The integration of sensors and real-time data monitoring tools allowed consistent tracking of milk yield, udder health, and milking frequency, which collectively improved herd performance and overall milk quality.

Commercial dairy farms accelerated investments in multi-stall robotic milking systems to achieve precision control over each milking session. Smaller and mid-scale farms also started adopting semi-automated solutions, encouraged by reduced equipment costs and growing awareness of operational benefits. By 2025, the segment continued to expand as producers sought to optimize milk extraction rates while maintaining animal welfare. The use of automatic cluster removers, teat-cleaning systems, and milk-flow sensors further streamlined milking operations, ensuring consistent throughput with minimal manual intervention.

By Distribution Channel Analysis

Large-Scale Dairy Farms dominate the market with 53.4% share owing to high automation and advanced herd management systems.

In 2024, Large-Scale Dairy Farms held a dominant market position, capturing more than a 53.4% share. The segment’s strong performance was driven by the rapid modernization of large dairy operations that increasingly integrated advanced automation, precision feeding, and data-based monitoring systems. These farms invested heavily in herd management technologies such as automated milking robots, feeding machines, and real-time health tracking sensors to optimize productivity and improve animal welfare. The focus on reducing labor dependency and maximizing yield efficiency placed large-scale farms at the forefront of technological transformation within the dairy industry.

The average herd size in commercial operations continued to rise, allowing economies of scale in both equipment utilization and milk production. Many large farms implemented digital herd management platforms that linked breeding, nutrition, and disease management data, creating a seamless information flow across farm operations. These advancements significantly improved milk yield per cow and reduced production losses, which strengthened the economic viability of large-scale systems.

Key Market Segments

By Offering

- Hardware

- Automated Milk Management Systems

- Feeding/Nutrition Management Systems

- Reproduction Management Systems

- Herd Health Management Systems

- Sorting & Identification Systems

- Others

- Software

- On-premise

- Cloud-based

- Services

- Installation Services

- Maintenance & Repair Services

- Consulting & Training Services

- Others

By Application

- Milk Harvesting

- Breeding

- Feeding

- Cow Comfort & Heat Stress Management

- Health Management

- Others

By End-User

- Large-Scale Dairy Farms

- Medium-Scale Dairy Farms

- Small-Scale Dairy Farms

Emerging Trends

Precision, Data-Integrated Dairy: Sensors, Genomics and Robotics Converge

A clear, fast-moving trend in dairy herd management is the shift toward precision, data-integrated decision-making—tying together sensors, genomic testing and automated milking to lift productivity while protecting animal welfare. The macro pull is strong: the OECD-FAO projects world milk production to grow ~1.8% per year to ~1,146 Mt by 2034, with much of the increase coming from higher yield per cow rather than simply more cows. That production path pushes farms to adopt tools that convert animal-level data into timely actions on heat, health, fertility and milking routines.

On-animal and in-parlor sensors are becoming the everyday “eyes and ears” of the dairy. Activity, rumination and milk-quality monitors flag trouble early, reduce antibiotics use and help time insemination precisely. Automation is spreading too: peer-reviewed evidence shows automatic milking systems (AMS) can increase milk output by ~2–12% versus twice-daily conventional milking, largely by enabling more frequent, lower-stress milking and steadier routines. In practice, that productivity lift is paired with gentler handling and better cow autonomy, which farmers consistently cite as a quality-of-life gain for both animals and people on the farm.

Genomics is the second pillar of this trend. The U.S. Council on Dairy Cattle Breeding (CDCB) now runs continuous genomic evaluations—weekly, monthly and triannual—so farmers can make rapid mating and culling choices with far higher reliability than pedigree alone. Scholarly work reports >6 million genotyped animals incorporated in U.S. dairy evaluations, underscoring how quickly DNA information has become routine infrastructure for herd improvement. In simple terms: smarter breeding plus better daily data yields healthier cows that produce more milk with fewer setbacks.

Public policy is reinforcing the digital shift. In the European Union’s Common Agricultural Policy, Member States must channel at least 25% of direct-payment budgets into eco-schemes, which often reward measurable welfare and environmental outcomes—exactly the areas where sensors, milk-room analytics and verified records shine. This alignment makes precision herd data not just a management aid but also a route to payment eligibility and risk reduction.

Drivers

Improved Productivity through Enhanced Herd Management

One of the major driving factors behind the push for enhanced herd management in the dairy industry is improved productivity per animal — in simpler terms, getting more and better milk from each cow rather than just increasing the number of cows. When a farmer focuses on herd health, nutrition, comfortable housing, proper milking routines, and reproduction management, there are real, measurable gains.

- For example, in the United States, average milk yield per cow has risen from about 13,000 pounds/year in 1960 to about 28,000 pounds/year today in DHI herds.

This kind of productivity leap doesn’t happen by accident — it comes from applying the kinds of herd-management practices that caring farmers adopt because they want healthier animals, more reliable income, and sustainable farm life. When a cow is healthier, bred appropriately, milked at the right times, fed optimally, and housed in good conditions, she can deliver more milk with fewer health setbacks. In addition, the systems that make this possible—like activity monitors, rumination sensors, fertility tracking and feeding plans—help the farmer spot an issue before it becomes a big problem, thus maintaining consistent production levels.

- According to the joint OECD-Food and Agriculture Organization (FAO) Agricultural Outlook, world milk production rose by about 1.1% in 2024 to around 950 million tonnes. Since expanding the herd size indefinitely has limits, boosting output per cow becomes both practical and essential. That means effective herd management is not just “nice to have” — it becomes a core business strategy for dairy farms.

Governments often recognise that when farmers manage their herds well, the whole rural economy benefits: more stable incomes, more efficient use of feed and resources, fewer losses to disease, and better animal welfare. In India, for instance, under the Kamdhenu Yojna in Uttar Pradesh, subsidies and support were provided so that high-yielding dairy animals become available to farmers and small/marginal operators could participate. This kind of initiative helps farmers invest in better genetics, better housing and care, which leads to higher productivity per cow.

Restraints

High Capital & Operational Costs as a Key Restraining Factor

One of the most significant brake-points slowing advances in herd management within the dairy sector is the sheer scale of investment and ongoing operational costs required to implement modern, effective systems. While the hope and expectation is that adopting technologies and improved practices will increase yield, welfare and sustainability, many dairy producers find the entry barrier daunting—and that has real implications for farm viability and equity.

To begin with, many farms—especially smaller or family-run enterprises—struggle with the upfront capital required to install herd-management technology, upgrade barns or invest in better infrastructure. For example, in developing countries the Food and Agriculture Organization of the United Nations (FAO) identifies that milk production is constrained “by poor-quality feed resources, diseases, limited access to markets and services and dairy animals’ low genetic potential for milk production.” The mention of “limited access to … credit” points directly to financing bottlenecks. In environments where farmers cannot easily borrow or secure subsidies, even if they recognise the value of better herd management, the investment cost becomes a physical barrier.

This cost challenge is made more acute when dairy farmers must also contend with volatile input prices. Feed costs, energy bills, labour and veterinary services all fluctuate—when margins are already tight, the decision to invest becomes risky. Even when government initiatives exist to support modernization, they may not cover the full cost or may only be accessible to certain segments of the industry. For instance, welfare or precision-dairy incentives may be available in major dairy economies, yet many smallholder producers in developing regions find eligibility, administration or co–budget constraints stalling their uptake.

Opportunity

Turning a Waste Problem into New Farm Income

A powerful growth opportunity in dairy herd management is converting manure into biomethane (renewable natural gas) and using the data, routines, and infrastructure of good herd management to run these systems well. Policy momentum and clear numbers back this up. In the European Union, the REPowerEU plan calls for 35 billion cubic metres (bcm) of sustainable biomethane production by 2030, with an estimated €37 billion investment need—creating direct demand for digesters, covered lagoons, feedstock logistics, gas upgrading, and monitoring on dairy farms. This target makes manure management a revenue line rather than a compliance cost, and it rewards farms that already track manure volumes and herd health.

In the United States, the Environmental Protection Agency’s AgSTAR data show 400 manure-based anaerobic digestion systems operating as of June 2024, with more projects moving through the pipeline. That footprint is large enough to prove the model, but still small relative to the national herd—leaving room for scaled adoption of herd-level solids management, gas capture, and nutrient recovery. Better day-to-day herd practices (consistent scraping, fewer leaks, predictable dry-matter) improve digester uptime and gas yield, so disciplined dairy management and energy production go hand in hand.

- In January 2025, USDA announced $120 million in new REAP grants for 516 projects to cut energy costs and expand on-farm renewables—support that dairy operators can pair with private capital or utility off-take agreements. In California, EZ Petroleum will use a $1.3 million grant to install 30 E85 dispensers and seven ethanol storage tanks at seven fueling stations in Winton, Fremont, South San Francisco, Salinas, Richmond and Fresno. This project is expected to increase the amount of ethanol sold by more than 391,000 gallons per year.

Regional Insights

Europe dominates with a 35.2% share and approximately US$ 1.5 billion in 2024.

In 2024 the European region captured a leading position in the global dairy herd management market, representing 35.2% of the total addressable market and generating roughly US$ 1.5 billion in revenue. This dominance is underpinned by a mature dairy industry structure in countries such as Germany, France, the Netherlands and Denmark, where large-scale and technologically advanced dairy operations are prevalent. Strong infrastructure, cooperative dairy models and rising adoption of automated herd management systems—all contribute to Europe’s pre-eminence in this sector.

The regional market growth was supported by increasing investment in digital tools, sensor-based monitoring, precision feeding and automated milking solutions, reflecting the drive to improve productivity, animal welfare and regulatory compliance. For example, dairy farms in Northern and Western Europe have moved ahead of other regions in deploying integrated herd-monitoring platforms and data analytics solutions. At the same time, the combined effects of higher labour costs, stricter regulation on animal health and environmental welfare, and a push for sustainability are further accelerating adoption of herd management technologies across European farms.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Established in Sweden and operating globally, DeLaval offers integrated milking robots, barn automation hardware and herd management software that allow dairy farms of all sizes to monitor health, reproduction, yield and environment. The company’s DelPro Farm Manager system supports herd monitoring via PC and mobile, while its voluntary milking system (VMS) is used in modern large dairies.

Afimilk, headquartered in Israel, specialises in herd-monitoring sensors, software and milking parlor automation for dairies with small to large herd sizes. Its AfiFarm software allows management of multiple sites, monitoring of health, fertility and milk production in real time across thousands of cows.

An American-headquartered company, BouMatic provides full-line dairy equipment ranging from milking parlors and robots to herd-management software and hygiene systems. With operations in more than 45 countries and recent acquisitions to expand its product suite, BouMatic emphasises actionable data and integrated systems for dairy producers.

Top Key Players Outlook

- DeLaval Inc.

- GEA Group AG

- Afimilk Ltd.

- BouMatic LLC

- Lely Holding S.A.R.L.

- Fullwood Packo

- SCR Dairy (Allflex Livestock Intelligence)

- VAS (Valley Agricultural Software)

- Dairymaster

- Nedap N.V.

- Sum-It Computer Systems

- DairyComp (Lactanet)

- Trioliet

- MSD Animal Health (SenseHub)

- Deosan Ltd.

- CattleMax

- Smartbow GmbH

- Herdwatch

- MilkingCloud

- Amelicor (DHI-Plus)

- InterHerd+

- CowManager B.V.

- Connecterra (Ida)

- ENGS Dairy

- Others

Recent Industry Developments

In 2024 DeLaval Inc. launched its VMS™ Batch Milking system, which has already been installed in over 10 farms and handles more than 10,000 cows worldwide.

In 2024 Fullwood Packo estimated revenue was approximately USD 225.9 million, while its global workforce was about 512 employees.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Bn Forecast Revenue (2034) USD 10.2 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Services), By Application (Milk Harvesting, Breeding, Feeding, Cow Comfort And Heat Stress Management, Health Management, Others), By End-User (Large-Scale Dairy Farms, Medium-Scale Dairy Farms, Small-Scale Dairy Farms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DeLaval Inc., GEA Group AG, Afimilk Ltd., BouMatic LLC, Lely Holding S.A.R.L., Fullwood Packo, SCR Dairy (Allflex Livestock Intelligence), VAS (Valley Agricultural Software), Dairymaster, Nedap N.V., Sum-It Computer Systems, DairyComp (Lactanet), Trioliet, MSD Animal Health (SenseHub), Deosan Ltd., CattleMax, Smartbow GmbH, Herdwatch, MilkingCloud, Amelicor (DHI-Plus), InterHerd+, CowManager B.V., Connecterra (Ida), ENGS Dairy, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dairy Herd Management MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Dairy Herd Management MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DeLaval Inc.

- GEA Group AG

- Afimilk Ltd.

- BouMatic LLC

- Lely Holding S.A.R.L.

- Fullwood Packo

- SCR Dairy (Allflex Livestock Intelligence)

- VAS (Valley Agricultural Software)

- Dairymaster

- Nedap N.V.

- Sum-It Computer Systems

- DairyComp (Lactanet)

- Trioliet

- MSD Animal Health (SenseHub)

- Deosan Ltd.

- CattleMax

- Smartbow GmbH

- Herdwatch

- MilkingCloud

- Amelicor (DHI-Plus)

- InterHerd+

- CowManager B.V.

- Connecterra (Ida)

- ENGS Dairy

- Others