Global Cylinder Deactivation System Market Size, Share, Growth Analysis By Component (Valve Solenoid, Engine Control Unit, Electronic Throttle Control), By Actuation Method (Overhead Camshaft Design, Pushrod), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle), By Application (Start-Stop Systems, Idle-Stop Systems, Extended Idling / Thermal-Mgmt Systems), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174312

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component Analysis

- By Actuation Method Analysis

- By Fuel Type Analysis

- By Vehicle Type Analysis

- By Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Cylinder Deactivation System Company Insights

- Recent Developments

- Report Scope

Report Overview

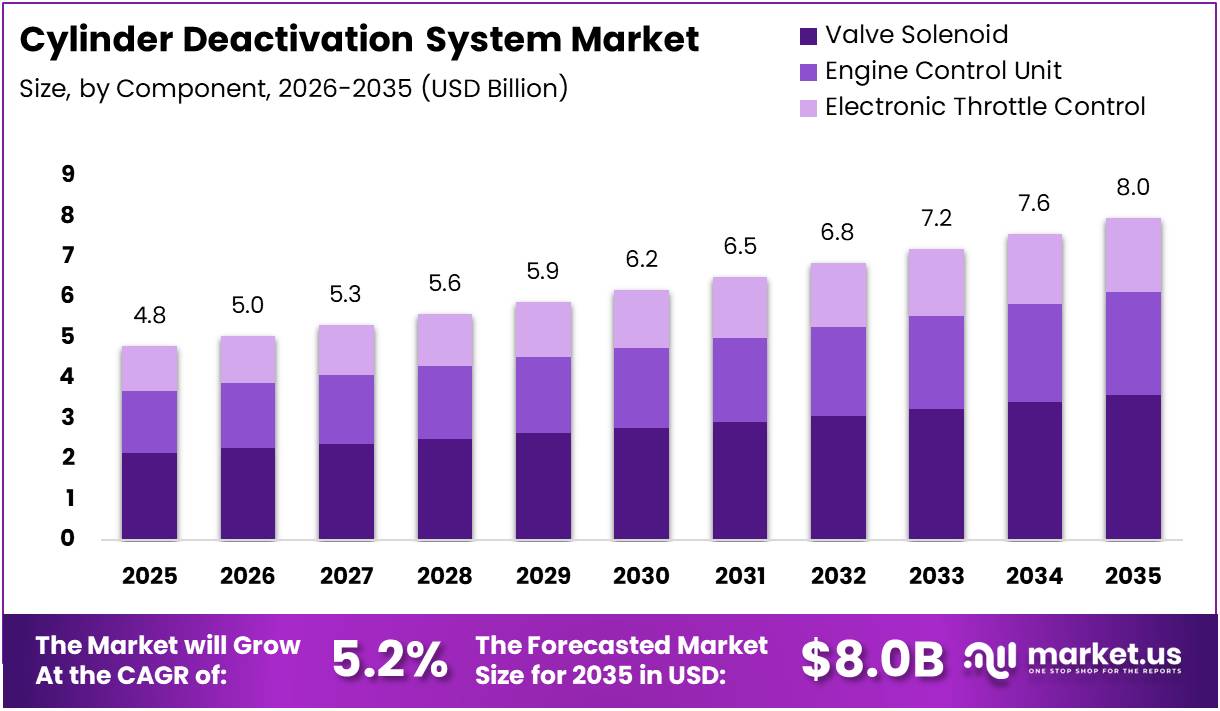

The Global Cylinder Deactivation System Market size is expected to be worth around USD 8.0 Billion by 2035, from USD 4.8 Billion in 2025, growing at a CAGR of 5.2% during the forecast period from 2026 to 2035.

The Cylinder Deactivation System Market represents a transformative segment within automotive powertrain technology. Essentially, this innovative solution temporarily shuts down specific cylinders during low-load driving conditions, thereby optimizing fuel consumption. Consequently, automakers increasingly adopt this technology to meet stringent emission standards while enhancing vehicle performance and operational efficiency across passenger and commercial vehicle segments.

Market growth demonstrates remarkable momentum driven by escalating environmental concerns and fuel economy regulations. Manufacturers actively integrate cylinder deactivation systems into gasoline and diesel engines, recognizing substantial cost-saving opportunities. Furthermore, this technology enables compliance with evolving global emission norms without compromising driving dynamics, positioning it as a critical solution for sustainable automotive development.

Government investments significantly influence market expansion through supportive regulatory frameworks and emission reduction mandates. Various regulatory bodies worldwide enforce stricter Corporate Average Fuel Economy standards, compelling automakers to adopt advanced fuel-saving technologies. Additionally, government incentives for eco-friendly vehicles accelerate market penetration, creating favorable conditions for cylinder deactivation system manufacturers and suppliers globally.

The technology delivers compelling operational advantages that resonate with both manufacturers and end-users. Industry research demonstrates substantial efficiency improvements, making cylinder deactivation systems financially attractive investments for automotive companies. These performance gains translate directly into reduced operational costs and lower carbon footprints for vehicle owners seeking economical transportation solutions.

Technical assessments reveal impressive fuel economy enhancements at light engine loads. Research indicates that cylinder deactivation improves engine fuel efficiency by up to 15% through reducing pumping work, raising indicated thermal efficiency, and enhancing combustion efficiency. Meanwhile, engine heat rejection to coolant decreases by approximately 13% when deactivating cylinders, extending coolant warm-up time to thermostat-opening by 10 seconds.

Market opportunities expand as electrification trends reshape the automotive landscape. Hybrid vehicle architectures particularly benefit from cylinder deactivation integration, maximizing efficiency during combustion-engine operation. Simultaneously, aftermarket potential grows as retrofit solutions gain traction among fleet operators seeking immediate fuel savings without complete vehicle replacement investments.

Key Takeaways

- The global Cylinder Deactivation System Market is projected to grow from USD 4.8 Billion in 2025 to USD 8.0 Billion by 2035, at a 5.2% CAGR.

- Valve Solenoid leads the component segment with a market share of 44.8%, making it the dominant system element.

- Overhead Camshaft Design dominates the actuation method segment, accounting for 69.1% of total market share.

- Gasoline engines represent the largest fuel type segment with 79.9% market share, driven by high vehicle penetration.

- Passenger Vehicles hold 69.4% of the market by vehicle type, supported by large production volumes.

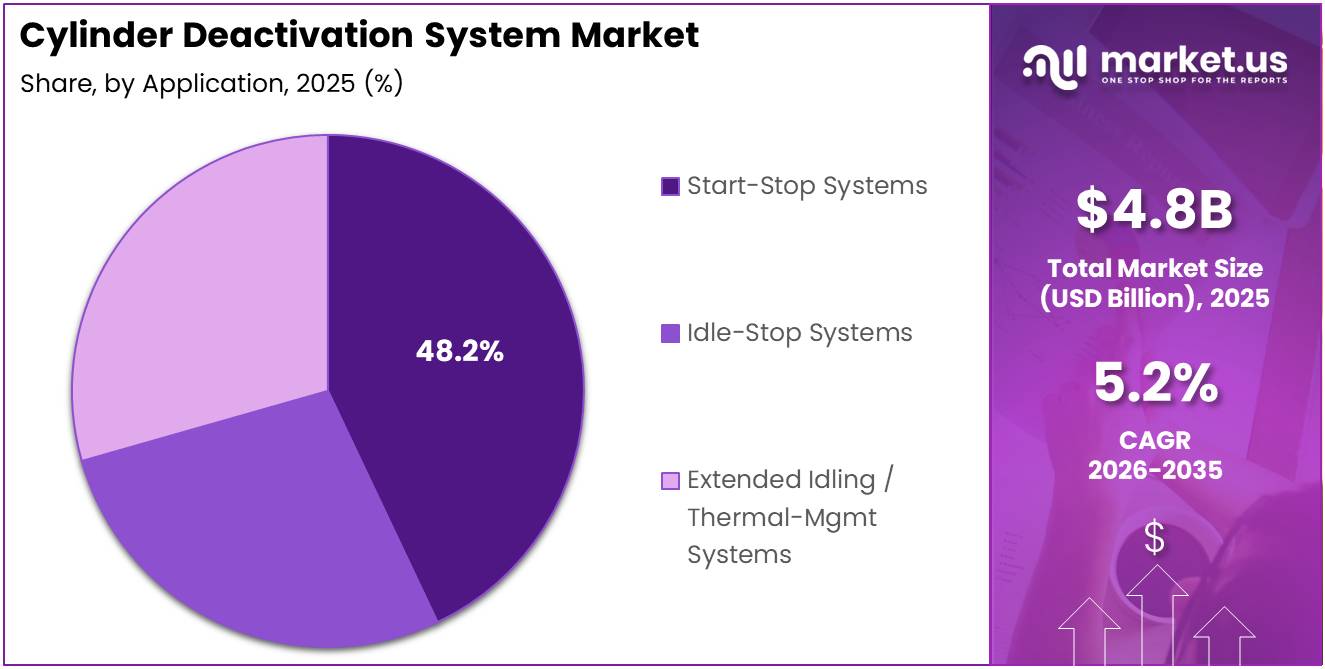

- Start-Stop Systems lead application adoption with 48.2% market share, reflecting strong urban usage.

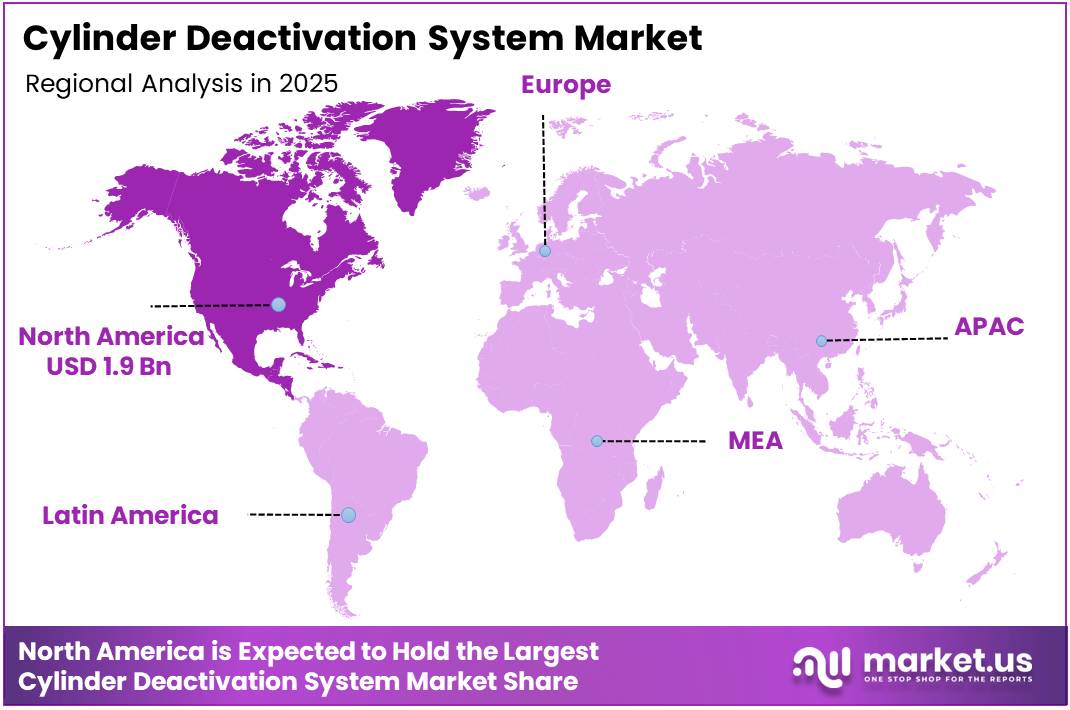

- North America dominates regionally with 41.4% market share, valued at USD 1.9 Billion.

By Component Analysis

Valve Solenoid dominates with 44.8% due to its critical role in precise cylinder control and cost-effective integration.

The Valve Solenoid segment commands 44.8% market share, establishing itself as the foundational component for cylinder deactivation operations. These electromagnetic actuators provide rapid response times and reliable performance in controlling valve lifters, enabling seamless transitions between active and deactivated cylinder modes. Manufacturers prioritize valve solenoids due to their proven durability and cost-effectiveness.

The Engine Control Unit segment represents the intelligent backbone of cylinder deactivation technology, processing real-time data from multiple sensors to determine optimal deactivation patterns. Advanced ECUs incorporate sophisticated algorithms that balance fuel efficiency gains against drivability requirements, supporting increasingly complex deactivation strategies across diverse operating conditions.

The Electronic Throttle Control segment facilitates coordinated airflow management during cylinder deactivation events, ensuring smooth power delivery and maintaining engine stability. This component works synergistically with valve solenoids and ECUs to adjust intake air precisely when cylinders transition between states.

By Actuation Method Analysis

Overhead Camshaft Design dominates with 69.1% due to superior precision and widespread adoption in modern engine architectures.

The Overhead Camshaft Design segment captures 69.1% market dominance, reflecting its technical superiority in executing cylinder deactivation with minimal mechanical complexity. OHC configurations position camshafts directly above valve assemblies, reducing intermediate components required for deactivation mechanisms.

The Pushrod segment maintains relevance primarily in larger displacement engines and specific commercial applications where traditional valvetrain architectures remain economically viable. Pushrod-based deactivation systems require additional mechanical linkages, though market share trends indicate gradual migration toward OHC alternatives as efficiency regulations intensify globally.

By Fuel Type Analysis

Gasoline dominates with 79.9% due to extensive market penetration and regulatory alignment favoring efficiency technologies.

The Gasoline segment secures 79.9% market share, driven by widespread global adoption of gasoline-powered vehicles and increasing regulatory pressure to reduce carbon emissions. Cylinder deactivation delivers immediate fuel economy improvements of 5-15% during partial load conditions. Automakers prioritize gasoline applications because deactivation systems integrate seamlessly with existing spark-ignition architectures, requiring minimal redesign.

The Diesel segment represents a specialized application where deactivation technology addresses specific operational challenges inherent to compression-ignition engines. Diesel applications benefit from cylinder deactivation primarily during extended idling periods and low-load cruising. However, diesel’s inherently superior fuel efficiency compared to gasoline reduces the relative advantage of deactivation.

By Vehicle Type Analysis

Passenger Vehicle dominates with 69.4% due to mass-market volumes and stringent fuel economy regulations.

The Passenger Vehicle segment commands 69.4% market share, reflecting the sheer volume of consumer automobiles manufactured globally. Sedans, SUVs, and crossovers equipped with multi-cylinder engines benefit substantially from deactivation during highway cruising and urban traffic. Consumers increasingly demand vehicles that balance performance with fuel economy, creating market conditions where cylinder deactivation becomes a standard feature.

The Light Commercial Vehicle segment addresses fleet operators and business users prioritizing operational cost reduction through improved fuel efficiency. Pickup trucks, delivery vans, and commercial SUVs operating in mixed-use scenarios realize significant fuel savings from deactivation technologies, particularly for vehicles accumulating high annual mileage.

By Application Analysis

Start-Stop Systems dominate with 48.2% due to effective urban efficiency gains and regulatory compliance benefits.

The Start-Stop Systems segment holds 48.2% market share, establishing dominance through its effectiveness in reducing fuel consumption during vehicle stationary periods. These systems automatically shut down engines when vehicles come to complete stops, then rapidly restart upon accelerator engagement. Urban driving cycles provide ideal conditions for start-stop technologies to deliver measurable efficiency improvements.

The Idle-Stop Systems segment offers similar functionality with enhanced sophistication, incorporating predictive algorithms that anticipate driver intentions and optimize restart timing. These advanced systems monitor brake pressure, steering inputs, and navigation data to determine optimal engine shutdown duration.

The Extended Idling / Thermal-Management Systems segment addresses specialized scenarios where vehicles require auxiliary power during prolonged stationary periods while maintaining cabin climate control. Commercial vehicles and emergency responders benefit from deactivation strategies that reduce engine load during extended parking.

Key Market Segments

By Component

- Valve Solenoid

- Engine Control Unit

- Electronic Throttle Control

By Actuation Method

- Overhead Camshaft Design

- Pushrod

By Fuel Type

- Gasoline

- Diesel

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

By Application

- Start-Stop Systems

- Idle-Stop Systems

- Extended Idling / Thermal-Mgmt Systems

Drivers

Rising Global Fuel Efficiency Mandates Across Passenger and Commercial Vehicles Drives Market Growth

Governments worldwide are implementing stricter fuel economy standards to reduce carbon emissions and combat climate change. These regulations push automakers to adopt technologies that improve mileage without sacrificing performance. Cylinder deactivation systems provide a practical solution by shutting down specific cylinders during light-load conditions, significantly reducing fuel consumption.

Automakers focus on meeting emission targets while avoiding complete shifts to electric powertrains. Cylinder deactivation enhances existing engine efficiency, offering a cost-effective alternative. This helps manufacturers comply with environmental regulations while maintaining production flexibility and consumer preferences for traditional engines.

Variable displacement engines are gaining popularity in mid-size sedans, SUVs, and large vehicles. These systems allow engines to run on fewer cylinders when full power isn’t needed, improving fuel economy during highway and urban driving. As regulatory pressures increase and fuel cost awareness grows, cylinder deactivation systems are becoming essential in modern vehicle design.

Restraints

High Integration Complexity in Small-Displacement Engines Restrains Market Expansion

Integrating cylinder deactivation into smaller engines presents significant technical challenges. Entry-level vehicles use compact, cost-optimized powertrains where adding this technology increases complexity and costs. The required components—specialized lifters, control modules, and hydraulic systems often make the technology economically unviable for budget vehicle segments.

Engineering modifications needed for seamless cylinder switching in small engines frequently outweigh fuel-saving benefits. Manufacturers must redesign engine architectures and recalibrate control units, adding development time and expenses. This makes automakers hesitant to implement the technology in lower-margin vehicle lines where price competitiveness is critical.

Consumer concerns about long-term reliability further restrain adoption. Vehicle owners worry about potential mechanical failures, increased maintenance costs, and reduced engine lifespan. Reports of valve issues and rough operation in early implementations have created skepticism, particularly in markets prioritizing durability over marginal efficiency gains.

Growth Factors

Expanding Use in Hybrid and Mild-Hybrid Powertrains Creates Growth Opportunities

Hybrid vehicles represent a promising avenue for cylinder deactivation technology. These powertrains combine electric motors with combustion engines, and deactivation enhances efficiency by optimizing engine operation across driving modes. The system shuts down unnecessary cylinders when electric propulsion handles low-speed driving, maximizing fuel savings.

Emerging markets show rising demand for fuel-efficient vehicles as fuel prices increase and environmental awareness grows. Countries in Asia, Latin America, and Africa are seeing expanding middle-class populations seeking affordable yet economical transportation. Cylinder deactivation delivers improved fuel economy without high electrification costs, making it attractive for price-sensitive markets.

Light commercial vehicles and pickup trucks increasingly adopt cylinder deactivation systems. These segments traditionally prioritized power over efficiency, but customer expectations are changing. Fleet operators and buyers now seek vehicles delivering strong performance while reducing operational costs, opening substantial market opportunities in these high-volume segments.

Emerging Trends

Integration with Start-Stop and Dynamic Fuel Management Systems Shapes Market Trends

Modern cylinder deactivation systems increasingly combine with technologies like start-stop and dynamic fuel management. This integration creates sophisticated engine control strategies optimizing efficiency across diverse driving conditions. The synergy allows vehicles to seamlessly switch between operational modes, maximizing fuel savings during various traffic situations.

Software-driven engine optimization is transforming cylinder deactivation operations. Advanced algorithms analyze real-time driving patterns and load requirements to determine optimal activation strategies. Adaptive driving modes learn individual styles and automatically adjust parameters, improving both efficiency and driver experience through smooth power delivery.

Automakers invest heavily in next-generation valve control and hydraulic lifter technologies. Improved mechanical components enable faster, quieter cylinder transitions and reduce wear concerns. Advanced hydraulic systems with better oil pressure management ensure consistent operation across temperatures and engine speeds, addressing earlier reliability concerns while expanding operational capabilities.

Regional Analysis

North America Dominates the Cylinder Deactivation System Market with a Market Share of 41.4%, Valued at USD 1.9 Billion

North America leads the global cylinder deactivation system market, accounting for 41.4% market share with a valuation of USD 1.9 billion. The region’s dominance stems from stringent CAFE standards and emission regulations that push automakers toward fuel-efficient technologies. Strong presence of major automotive manufacturers and high consumer awareness regarding fuel economy further accelerate market growth in this region.

Europe Cylinder Deactivation System Market Trends

Europe holds a substantial market position driven by aggressive EU CO2 emission targets and Euro 7 norms. The region’s focus on downsized turbocharged engines with cylinder deactivation technology and the growing adoption of hybrid powertrains support market expansion. Premium vehicle segments particularly favor these systems for enhanced fuel efficiency.

Asia Pacific Cylinder Deactivation System Market Trends

Asia Pacific exhibits rapid growth potential due to increasing vehicle production in countries like China, India, and Japan. Rising fuel prices, growing environmental concerns, and implementation of stricter emission standards across emerging economies drive adoption. The expanding middle-class population and increasing demand for fuel-efficient vehicles create significant opportunities for cylinder deactivation system manufacturers.

Middle East and Africa Cylinder Deactivation System Market Trends

Middle East and Africa represent an emerging market with moderate adoption rates influenced by growing automotive sales and gradual implementation of emission regulations. While fuel prices remain relatively lower in oil-rich nations, increasing awareness about fuel efficiency and environmental sustainability gradually drives technology adoption in the region.

Latin America Cylinder Deactivation System Market Trends

Latin America shows steady growth driven by recovering automotive production and rising consumer preference for fuel-efficient vehicles. Brazil and Mexico lead regional adoption due to their established automotive manufacturing bases. Economic fluctuations and evolving emission norms continue to shape market dynamics in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cylinder Deactivation System Company Insights

Eaton continues to hold a leadership position due to its early commercialization of cylinder deactivation hardware and its strong penetration across North American passenger and light commercial vehicles. The company’s focus on compact, durable valvetrain solutions aligns well with OEM priorities around fuel efficiency compliance without major engine redesigns, reinforcing its long-term relevance in the segment.

Schaeffler Technologies is increasingly differentiated by its precision mechanical engineering and system-level expertise in valvetrain actuation. In 2025, its emphasis on modular and lightweight deactivation components supports both gasoline and hybridized powertrains. This positions Schaeffler favorably as automakers seek scalable solutions that can be adapted across multiple engine platforms.

Robert Bosch GmbH plays a strategic role through its strong control electronics and software capabilities integrated with cylinder deactivation systems. Bosch’s strength lies in optimizing real-time engine management and smooth transition logic, which enhances drivability and emission performance. Its broad OEM footprint enables rapid adoption across global vehicle programs.

BorgWarner leverages its powertrain portfolio to offer highly integrated cylinder deactivation solutions that complement turbocharging and transmission technologies. The company’s focus on system efficiency and reduced friction supports OEM efforts to balance performance with regulatory pressure. BorgWarner’s alignment with next-generation internal combustion architectures sustains its competitive momentum in 2025.

Top Key Players in the Market

- Eaton

- Schaeffler Technologies

- Robert Bosch GmbH

- BorgWarner

- Ford Motor Company

Recent Developments

- In February 2025, Ducati unveiled the XDiavel V4 motorcycle engine featuring advanced cylinder deactivation technology, designed to reduce engine load at low RPMs and enhance overall fuel efficiency and ride comfort.

- In February 2024, Cummins announced the next-generation X15 diesel engine for North America, integrating cylinder deactivation as a core element of its HELM platform to support compliance with 2027 EPA regulations.

Report Scope

Report Features Description Market Value (2025) USD 4.8 Billion Forecast Revenue (2035) USD 8.0 Billion CAGR (2026-2035) 5.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Valve Solenoid, Engine Control Unit, Electronic Throttle Control), By Actuation Method (Overhead Camshaft Design, Pushrod), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle), By Application (Start-Stop Systems, Idle-Stop Systems, Extended Idling / Thermal-Mgmt Systems) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Eaton, Schaeffler Technologies, Robert Bosch GmbH, BorgWarner, Ford Motor Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cylinder Deactivation System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cylinder Deactivation System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Eaton

- Schaeffler Technologies

- Robert Bosch GmbH

- BorgWarner

- Ford Motor Company