Global Cybersecurity in Energy Infrastructure Market By Component (Solution (Network Security, Endpoint Security, Application Security, Data Security, Others), Services (Vulnerability Assessment, Digital Risk and Threat Monitoring, Business Continuity Services, Disaster Recovery, Digital Forensics, Penetration Testing, Threat Intelligence and Others)), By Deployment Model(On-Premise, Cloud-Based), By Enterprise Size (Small and Medium-sized Enterprises (SME), Large Enterprises), By End User (Industrial, Oil and Gas Industry, Transmission and Distribution, Transmission, Distribution, Power Plants, Conventional Power Plants, Nuclear Power Plants, Renewable Energy Power Plants, Natural Gas Plants, Commercial, Residential), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149717

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- US Market Expansion

- North America Growth

- Component Insights

- Deployment Model Insights

- Enterprise Size Insights

- End User Insights

- Key Market Segments

- Emerging Trends

- Business Benefits

- Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

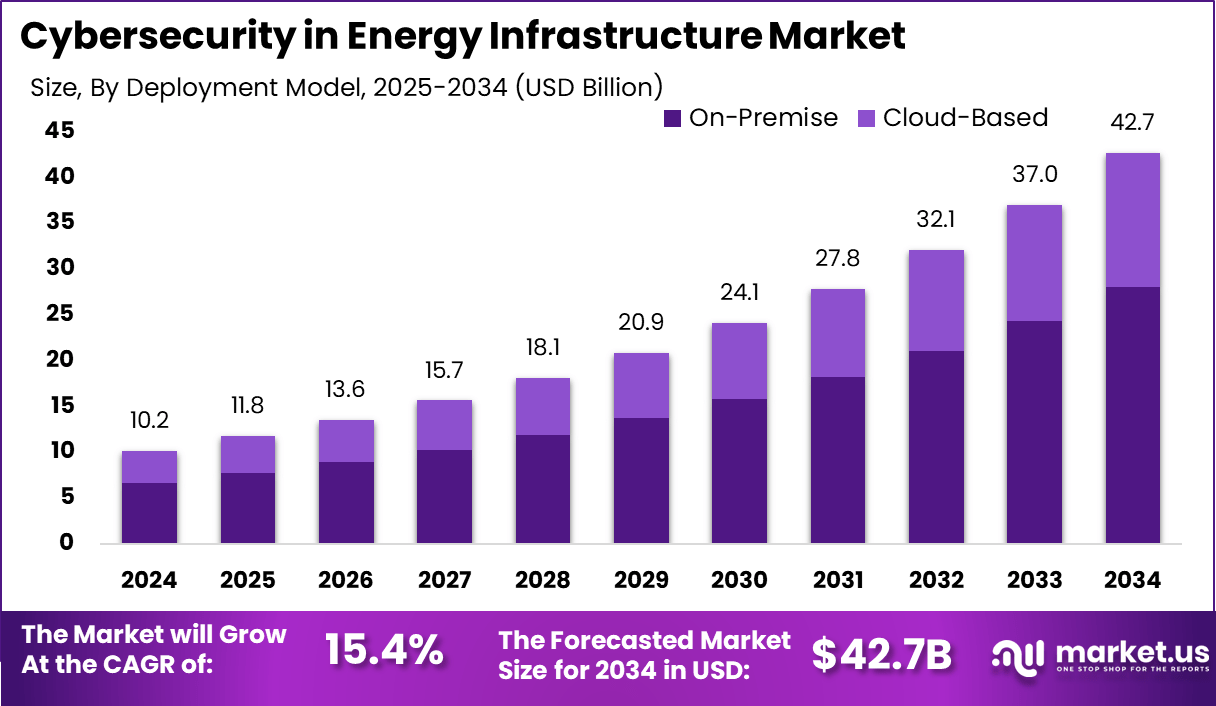

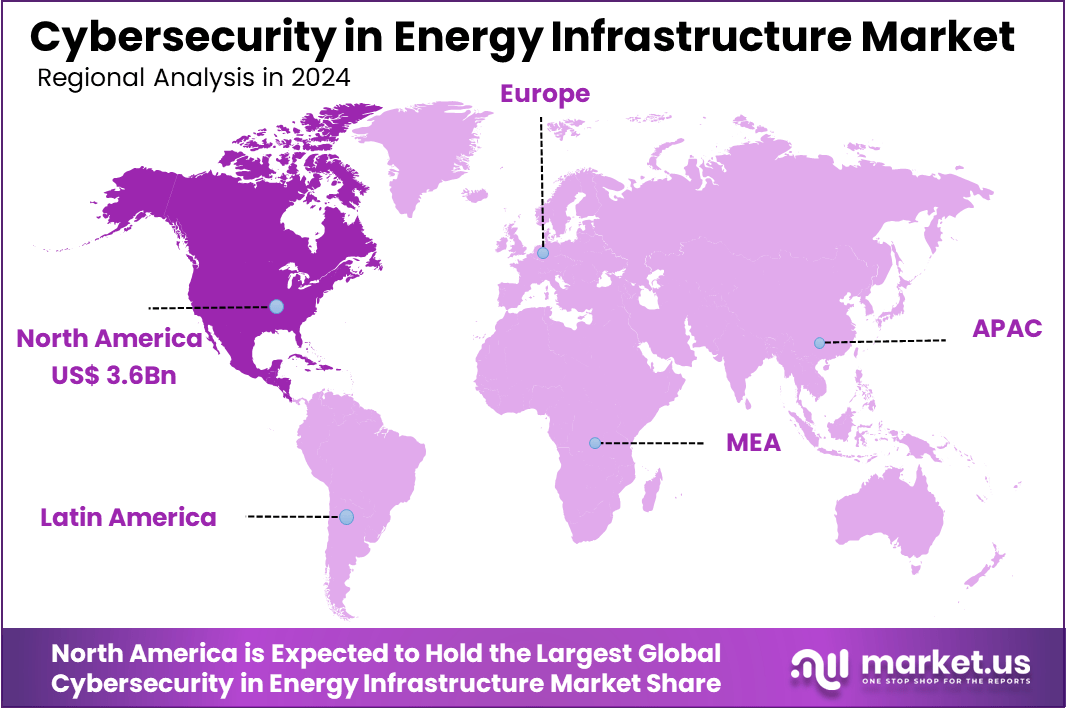

The Global Cybersecurity in Energy Infrastructure Market size is expected to be worth around USD 42.7 Billion By 2034, from USD 10.2 billion in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.5% share, holding USD 3.6 Billion revenue.

Cybersecurity in energy infrastructure encompasses the strategies and technologies employed to protect critical energy systems from cyber threats. These systems include power grids, oil and gas pipelines, and renewable energy installations, all of which are increasingly digitized and interconnected. The integration of advanced technologies like smart grids and IoT devices has enhanced operational efficiency but also introduced new vulnerabilities.

The market for cybersecurity in energy infrastructure is experiencing substantial growth, driven by the escalating frequency and sophistication of cyber threats. Several factors are propelling the demand for cybersecurity in energy infrastructure. The rapid adoption of digital technologies, such as smart grids and IoT devices, has expanded the attack surface for cyber threats.

The demand for cybersecurity solutions in the energy sector is on the rise, particularly in regions undergoing significant energy infrastructure modernization. Developing economies are investing in smart grid technologies, which require robust cybersecurity frameworks. Moreover, the increasing frequency of cyber incidents has heightened awareness and urgency among stakeholders to fortify their systems against potential breaches.

The primary motivations for adopting cybersecurity measures in energy infrastructure include the need to protect critical assets, ensure uninterrupted energy supply, and comply with regulatory standards. Cybersecurity investments are also driven by the potential financial and reputational losses associated with cyber incidents. By implementing robust security protocols, energy companies aim to enhance operational resilience and maintain stakeholder trust.

According to cybermagazine research, 42% of critical infrastructure organisations, including those in the energy sector, experienced cyber breaches in 2024. What’s more alarming is that 93% of these firms have reported a noticeable rise in cyberattacks, making cybersecurity a frontline concern.

Human error remains the top driver, accounting for 34% of cloud-based breaches, followed closely by the exploitation of known vulnerabilities (31%) and weak multi-factor authentication practices (20%). Adding to the risk, 30% of critical infrastructure companies also encountered insider threat incidents, highlighting urgent gaps in access control and employee awareness.

Supporting these findings, RenewableUK reports that in 2023, 90% of the world’s largest energy companies faced cybersecurity breaches. The financial toll is equally severe – IBM’s 2024 report states that the average cost of a data breach reached $4.8 million, the highest ever recorded, reflecting a 10% year-on-year surge.

Key Takeaways

- The global cybersecurity in energy infrastructure market is forecasted to reach USD 42.7 billion by 2034, rising from USD 10.2 billion in 2024, supported by a robust CAGR of 15.4% during 2025-2034.

- In 2024, North America led the market with a 35.5% share, generating USD 3.6 billion in revenue, primarily driven by rising threats to energy grids and stricter regulatory mandates.

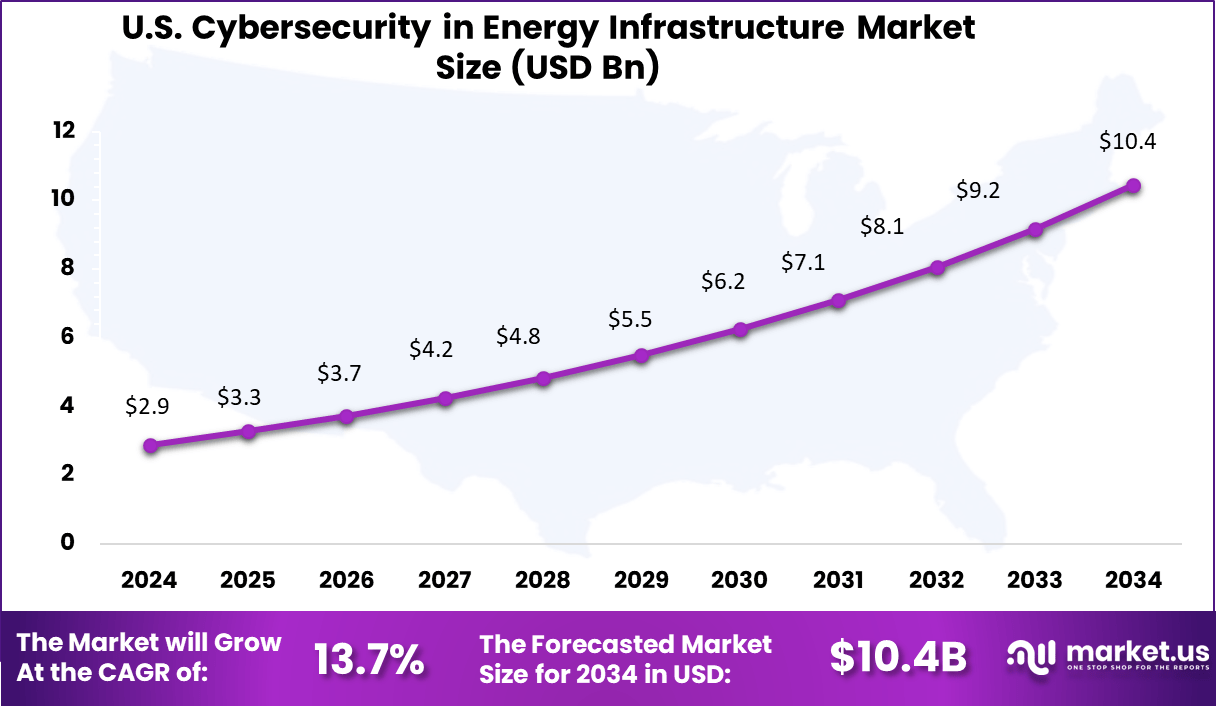

- The U.S. market alone contributed USD 2.9 billion in 2024 and is projected to touch USD 10.4 billion by 2034, expanding steadily at a 13.7% CAGR, as utilities increase investment in digital risk resilience.

- Solution-based offerings dominated the landscape, capturing 80.2% share, owing to high demand for advanced intrusion detection, network monitoring, and encryption tools.

- The on-premise deployment model held a significant 65.7% share in 2024, as critical energy operators continue to prefer in-house control over sensitive infrastructure data.

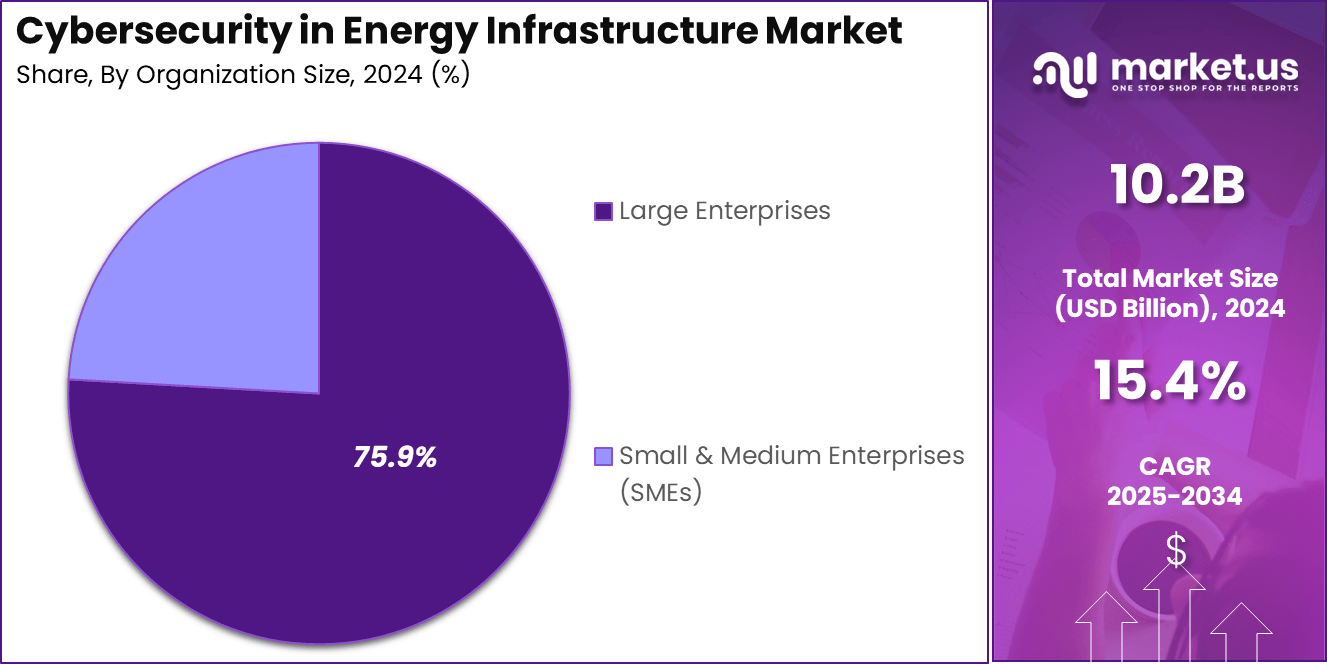

- By enterprise size, large enterprises accounted for 75.9% of the market, largely due to their vast asset networks, complex risk environments, and high compliance obligations.

- The industrial end-user segment led with a 40.3% share, as oil & gas, nuclear, and grid operators are becoming prime targets for cyberattacks, prompting aggressive security upgrades.

Analysts’ Viewpoint

The growing emphasis on cybersecurity presents lucrative investment opportunities in the energy sector. Companies specializing in cybersecurity solutions are poised for growth, as energy providers seek to upgrade their security infrastructure. Investments in research and development of innovative security technologies, as well as in workforce training and development, are critical areas with significant potential for returns.

The regulatory landscape for cybersecurity in energy infrastructure is becoming increasingly stringent. Governments and regulatory bodies worldwide are introducing policies and standards to ensure the protection of critical energy systems. For example, the North American Electric Reliability Corporation (NERC) has established Critical Infrastructure Protection (CIP) standards that mandate specific cybersecurity measures for energy providers.

US Market Expansion

The US Cybersecurity in Energy Infrastructure Market is valued at approximately USD 2.9 Billion in 2024 and is predicted to increase from USD 5.5 Billion in 2029 to approximately USD 10.4 Billion by 2034, projected at a CAGR of 13.7% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant market position in the cybersecurity for energy infrastructure sector, capturing over 35.5% of the global market share and generating approximately USD 3.6 billion in revenue. This leadership is primarily attributed to the region’s advanced energy infrastructure, stringent regulatory frameworks, and heightened awareness of cyber threats targeting critical systems.

The United States, in particular, has witnessed a significant surge in cyberattacks on utilities, with incidents increasing by 70% compared to the previous year. Such alarming trends have propelled substantial investments in robust cybersecurity measures to safeguard the energy sector.

The region’s proactive approach is further reinforced by regulatory mandates like the North American Electric Reliability Corporation’s (NERC) Critical Infrastructure Protection standards, which compel energy providers to implement comprehensive security protocols.

Component Insights

In 2024, the Solution segment held a dominant market position in the cybersecurity for energy infrastructure market, capturing more than an 80.2% share. This significant lead can be attributed to the escalating need for robust security measures to protect critical energy systems from sophisticated cyber threats.

As energy infrastructures become increasingly digitized, the demand for comprehensive solutions – encompassing network security, endpoint protection, application security, and data safeguarding – has surged. These solutions are essential in mitigating risks associated with the integration of smart grids, IoT devices, and cloud-based operations within the energy sector.

The prominence of the Solution segment is further reinforced by the sector’s proactive approach to adopting advanced technologies such as artificial intelligence and machine learning for threat detection and response. The implementation of these technologies enables real-time monitoring and swift mitigation of potential cyber incidents, thereby enhancing the resilience of energy infrastructures.

Moreover, compliance with stringent regulatory frameworks and industry standards necessitates the deployment of comprehensive cybersecurity solutions, solidifying their pivotal role in the sector’s defense strategy.

Deployment Model Insights

In 2024, the On-Premise deployment model held a dominant position in the cybersecurity for energy infrastructure market, capturing more than a 65.7% share. This preference is largely attributed to the energy sector’s stringent requirements for data sovereignty, regulatory compliance, and direct control over critical systems.

Energy companies often manage sensitive operational technologies (OT) and industrial control systems (ICS) that demand high security and minimal latency. On-premise solutions provide the necessary control and customization to meet these specific needs, ensuring that cybersecurity measures are closely aligned with the unique operational requirements of energy infrastructure.

Furthermore, the adoption of on-premise solutions is reinforced by the sector’s reliance on legacy systems and the need for tailored security protocols. Many energy infrastructures operate with established systems that are deeply integrated into their operational processes, making on-premise deployments more practical and secure.

This approach allows for comprehensive oversight and the ability to implement security measures that are specifically designed to protect against threats targeting energy systems. While cloud-based solutions offer scalability and flexibility, the critical nature of energy infrastructure often necessitates the enhanced control and security that on-premise deployments provide.

Enterprise Size Insights

In 2024, the Large Enterprises segment held a dominant position in the cybersecurity market for energy infrastructure, capturing more than a 75.9% share. This dominance is primarily due to the complex and expansive nature of large enterprises, which operate extensive energy infrastructures that are often spread across multiple regions and jurisdictions.

Such vast operations necessitate comprehensive cybersecurity measures to protect against sophisticated cyber threats that could disrupt critical energy services. Large enterprises have the financial and technical resources to invest in advanced cybersecurity solutions, including real-time threat detection systems, incident response teams, and continuous monitoring capabilities, ensuring the resilience and reliability of their energy infrastructure.

Moreover, large enterprises are subject to stringent regulatory requirements and industry standards that mandate robust cybersecurity practices. Compliance with these regulations not only compels large enterprises to implement advanced security measures but also drives continuous investment in cybersecurity to adapt to evolving threats.

End User Insights

In 2024, the Industrial segment held a dominant position in the cybersecurity market for energy infrastructure, capturing more than a 40.3% share. This leadership is primarily attributed to the increasing digitization and automation within industrial operations, which, while enhancing efficiency, also expose critical systems to sophisticated cyber threats.

Industrial facilities, including manufacturing plants and processing units, rely heavily on Operational Technology (OT) systems such as Supervisory Control and Data Acquisition (SCADA) and Distributed Control Systems (DCS).

The integration of these systems with Information Technology (IT) networks has expanded the attack surface, making them prime targets for cyberattacks that can disrupt operations, compromise safety, and result in significant financial losses.

Furthermore, the industrial sector’s prominence is reinforced by stringent regulatory requirements and the critical nature of its operations. Compliance with standards such as the North American Electric Reliability Corporation Critical Infrastructure Protection (NERC CIP) mandates the implementation of robust cybersecurity measures to safeguard against potential threats.

Additionally, high-profile incidents, like the 2021 Colonial Pipeline ransomware attack, have heightened awareness and prompted increased investment in cybersecurity solutions tailored for industrial environments. These factors collectively underscore the industrial segment’s leading role in the cybersecurity landscape of energy infrastructure.

Key Market Segments

By Component

- Solution

- Network Security

- Network Security Firewalls

- Intrusion Prevention Systems (IPS) / Intrusion Detection Systems (IDS)

- Network Segmentation

- Remote Access

- Mobile Security

- Zero Trust Network Access (ZTNA)

- Others

- Endpoint Security

- System Hardening

- Patch Management

- Endpoint Detection and Response

- File Integrity Monitoring

- Multi-factor Authentication (Password Management)

- Endpoint App White/Blacklist

- Others

- Application Security

- Database Security

- Static App Testing

- Dynamic App Testing

- VoIP Security

- Web Application Firewall

- Anti-Malware

- Data Security

- Data Classification

- Data Integrity Monitoring

- Data/Drive Encryption

- Public Key Infrastructure (PKI)

- Data Loss Prevention (DLP)

- Others

- Others

- DDoS Prevention

- Message Security

- Web Content Filter

- DMZ

- Others

- Network Security

- Services

- Vulnerability Assessment

- Digital Risk and Threat Monitoring

- Business Continuity Services

- Disaster Recovery

- Digital Forensics

- Penetration Testing

- Threat Intelligence

- Security Information and Event Management

- Implementation and Integration Services

- Training and Education Services

- Others

By Deployment Model

- On-Premise

- Cloud-Based

By Enterprise Size

- Small and Medium-sized Enterprises (SME)

- Large Enterprises

By End User

- Industrial

- Oil and Gas Industry

- Transmission and Distribution

- Transmission and Distribution Type

- Transmission

- Distribution

- Power Plants

- Conventional Power Plants

- Nuclear Power Plants

- Renewable Energy Power Plants

- Natural Gas Plants

- Commercial

- Residential

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The energy sector is witnessing a surge in sophisticated cyber threats, driven by the integration of digital technologies and the increasing complexity of supply chains. Notably, the rise of Ransomware-as-a-Service (RaaS) has lowered the barrier for cybercriminals, enabling them to launch targeted attacks with minimal technical expertise.

These attacks often exploit vulnerabilities in third-party vendors, emphasizing the need for comprehensive supply chain risk management. Additionally, the adoption of Zero Trust Architecture is gaining traction, promoting continuous verification of user identities and limiting access to critical systems, thereby reducing the potential attack surface.

Artificial Intelligence (AI) and Machine Learning (ML) are becoming double-edged swords in the cybersecurity landscape. While they offer enhanced threat detection capabilities, adversaries are also leveraging these technologies to automate attacks and craft more convincing phishing campaigns.

Furthermore, the proliferation of Internet of Things (IoT) devices in energy systems introduces new vulnerabilities, as many of these devices lack robust security measures. The convergence of Information Technology (IT) and Operational Technology (OT) systems necessitates a unified security approach to safeguard critical infrastructure from evolving cyber threats.

Business Benefits

Investing in robust cybersecurity measures offers significant business advantages for energy companies. Firstly, it ensures operational continuity by protecting critical infrastructure from disruptions caused by cyberattacks. Secondly, enhanced cybersecurity fosters compliance with regulatory requirements and industry standards, mitigating the risk of legal penalties and fines.

It also positions companies as reliable partners in the energy market, attracting investments and facilitating collaborations. Moreover, a strong cybersecurity posture enables the safe integration of innovative technologies, such as smart grids and renewable energy solutions, driving efficiency and sustainability. Ultimately, prioritizing cybersecurity not only protects assets but also supports long-term business growth and resilience.

Driver

Regulatory Mandates Accelerating Cybersecurity Investments

The energy sector is experiencing a significant push towards enhanced cybersecurity, primarily driven by evolving regulatory requirements. Governments and regulatory bodies are implementing stringent cybersecurity standards to protect critical infrastructure from increasing cyber threats.

For instance, the U.S. government’s cybersecurity implementation plan outlines 32 high-impact initiatives aimed at securing the energy ecosystem, emphasizing the integration of secure-by-design principles throughout the product life cycle.

These regulatory mandates compel energy companies to invest in advanced cybersecurity measures to ensure compliance and safeguard their operations. The emphasis on regulatory compliance not only mitigates potential legal and financial repercussions but also enhances the overall resilience of energy infrastructure against cyberattacks.

Restraint

High Costs of Cybersecurity Implementation

Despite the recognized importance of cybersecurity, the high costs associated with implementing comprehensive security measures pose a significant restraint for energy companies. The financial burden includes expenses related to upgrading legacy systems, deploying advanced security technologies, and hiring skilled cybersecurity professionals.

A survey revealed that the median recovery costs for critical infrastructure sectors like energy have quadrupled to $3 million over the past year, highlighting the substantial financial impact of cyber incidents.

These escalating costs can be particularly challenging for smaller energy providers with limited budgets, potentially leading to delayed or inadequate cybersecurity implementations. The financial strain underscores the need for cost-effective solutions and potential government support to ensure all energy sector entities can achieve robust cybersecurity postures.

Opportunity

Leveraging Artificial Intelligence for Enhanced Security

The integration of Artificial Intelligence (AI) presents a promising opportunity to bolster cybersecurity in the energy sector. AI technologies can enhance threat detection capabilities, automate response mechanisms, and predict potential vulnerabilities, thereby improving the overall security posture.

Research indicates that implementing AI solutions in energy infrastructure has led to a 98% improvement in threat detection rates and a more than 70% reduction in response times to cyber incidents. By leveraging AI, energy companies can proactively identify and mitigate cyber threats, ensuring the continuous and secure operation of critical infrastructure.

Challenge

Securing Legacy Systems in a Modern Threat Landscape

A significant challenge in the energy sector’s cybersecurity efforts is the prevalence of legacy systems that were not designed to withstand modern cyber threats. These outdated systems often lack the necessary security features and are difficult to integrate with contemporary cybersecurity solutions. The integration of Internet of Things (IoT) technologies with legacy infrastructure further complicates the security landscape, introducing additional vulnerabilities.

Addressing this challenge requires substantial investments in system upgrades or replacements, which can be financially and operationally taxing. Moreover, the process of modernizing legacy systems must be carefully managed to avoid disruptions in energy supply, making it a complex yet critical aspect of enhancing cybersecurity in the energy sector.

Key Player Analysis

Eaton Corporation plc has strategically expanded its cybersecurity capabilities through key acquisitions. In 2024, Eaton acquired Exertherm, enhancing its thermal monitoring solutions for critical infrastructure. Additionally, the company signed an agreement to acquire Fibrebond Corporation, a move expected to bolster its presence in the data center market.

Siemens has reinforced its position in industrial cybersecurity through strategic acquisitions and partnerships. In 2024, Siemens completed the acquisition of Altair Engineering Inc., a leader in industrial simulation and analysis software, for approximately $10 billion. This acquisition is set to enhance Siemens’ AI-powered design and simulation capabilities

AT&T has restructured its cybersecurity operations to better serve the energy sector. In 2024, AT&T launched LevelBlue, a standalone managed cybersecurity services business formed through a joint venture with WillJam Ventures. LevelBlue offers managed security services, threat intelligence, and consulting, aiming to provide scalable solutions for critical infrastructure protection.

Top Key Players Covered

- Eaton Corporation plc

- Siemens

- AT&T

- Schweitzer Engineering Laboratories, Inc.

- Accenture

- ABB

- Schneider Electric

- General Electric

- Hitachi Energy Ltd.

- IBM Corporation

- Others

Recent Developments

- In April 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) disclosed hardware vulnerabilities in Hitachi Energy’s RTU500 series, which could allow attackers to cause denial-of-service conditions.

- In February 2024, GE Vernova’s Grid Solutions business partnered with Dragos Inc. to offer comprehensive industrial cybersecurity solutions aimed at enhancing the resilience of the electric grid.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Bn Forecast Revenue (2034) USD 42.7 Bn CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution (Network Security, Endpoint Security, Application Security, Data Security, Others), Services (Vulnerability Assessment, Digital Risk and Threat Monitoring, Business Continuity Services, Disaster Recovery, Digital Forensics, Penetration Testing, Threat Intelligence and Others)), By Deployment Model(On-Premise, Cloud-Based), By Enterprise Size (Small and Medium-sized Enterprises (SME), Large Enterprises), By End User (Industrial, Oil and Gas Industry, Transmission and Distribution, Transmission, Distribution, Power Plants, Conventional Power Plants, Nuclear Power Plants, Renewable Energy Power Plants, Natural Gas Plants, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Eaton Corporation plc, Siemens, AT&T, Schweitzer Engineering Laboratories, Inc., Accenture, ABB, Schneider Electric, General Electric, Hitachi Energy Ltd., IBM Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cybersecurity in Energy Infrastructure MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Cybersecurity in Energy Infrastructure MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eaton Corporation plc

- Siemens

- AT&T

- Schweitzer Engineering Laboratories, Inc.

- Accenture

- ABB

- Schneider Electric

- General Electric

- Hitachi Energy Ltd.

- IBM Corporation

- Others