Global Cybersecurity Analytics Market Size, Share, Growth Analysis By Component (Solutions [Security Information and Event Management (SIEM), Threat Intelligence Platform (TIP), Security Analytics Platform, User and Entity Behavior Analytics (UEBA), Incident Response Platform, Others (Network Traffic Analysis, etc.)], Services [Managed Security Services, Professional Services {Consulting, Integration and Implementation, Training and Support}]), By Deployment Mode (Cloud, On-premises), By Enterprise Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI (Banking, Financial Services, and Insurance), Healthcare, Government & Public Sector, Retail, Manufacturing, Energy & Utilities, IT & Telecom, Aerospace and Defense, Others (Education, Transport, etc.)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165741

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role Of Security

- Industry Adoption

- Emerging Trends

- US Market Size

- By Component

- By Deployment Mode

- By Enterprise Size

- By Industry Vertical

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The Cybersecurity Analytics Market is experiencing rapid expansion as governments, enterprises, and digital service providers intensify their focus on advanced security intelligence capabilities. With rising global cyber threats, increasing cloud adoption, and the growing sophistication of ransomware and data breaches, organizations are shifting from reactive security frameworks to predictive analytics-driven protection.

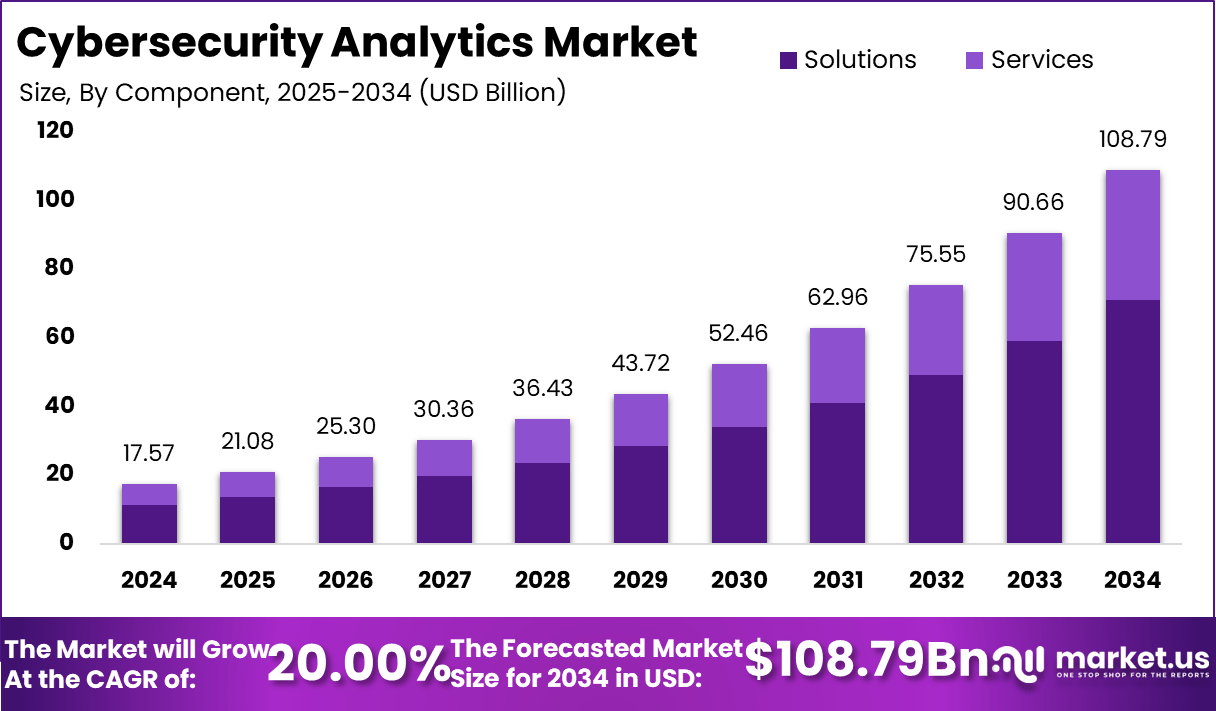

In 2024, the market stood at USD 17.57 billion, reflecting strong demand for tools that support behavioral analytics, anomaly detection, automated incident response, and real-time monitoring across complex IT environments. Supported by advancements in artificial intelligence, big data platforms, and machine learning models, the market is expected to grow at a robust 20% CAGR, reaching USD 108.79 billion by 2034.

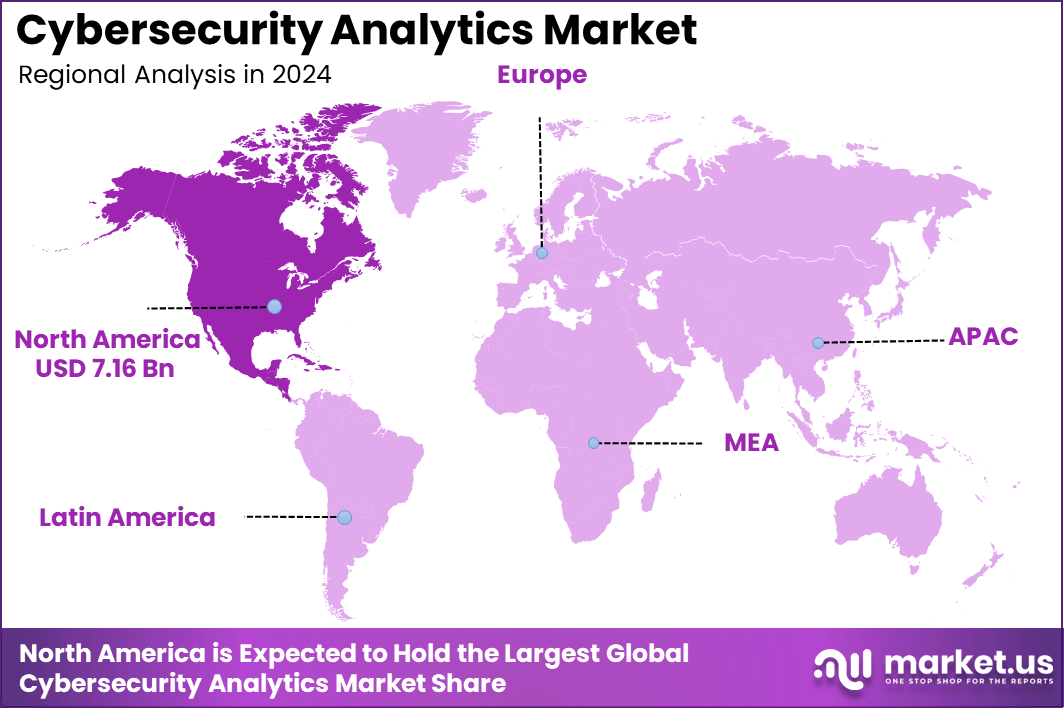

North America remains the most prominent region, holding 40.8% of the global market and generating USD 7.16 billion in 2024. The region’s dominance stems from elevated cybersecurity spending, heavily regulated industries, early adoption of cloud and IoT-based systems, and continuous innovation in threat intelligence and security operations platforms.

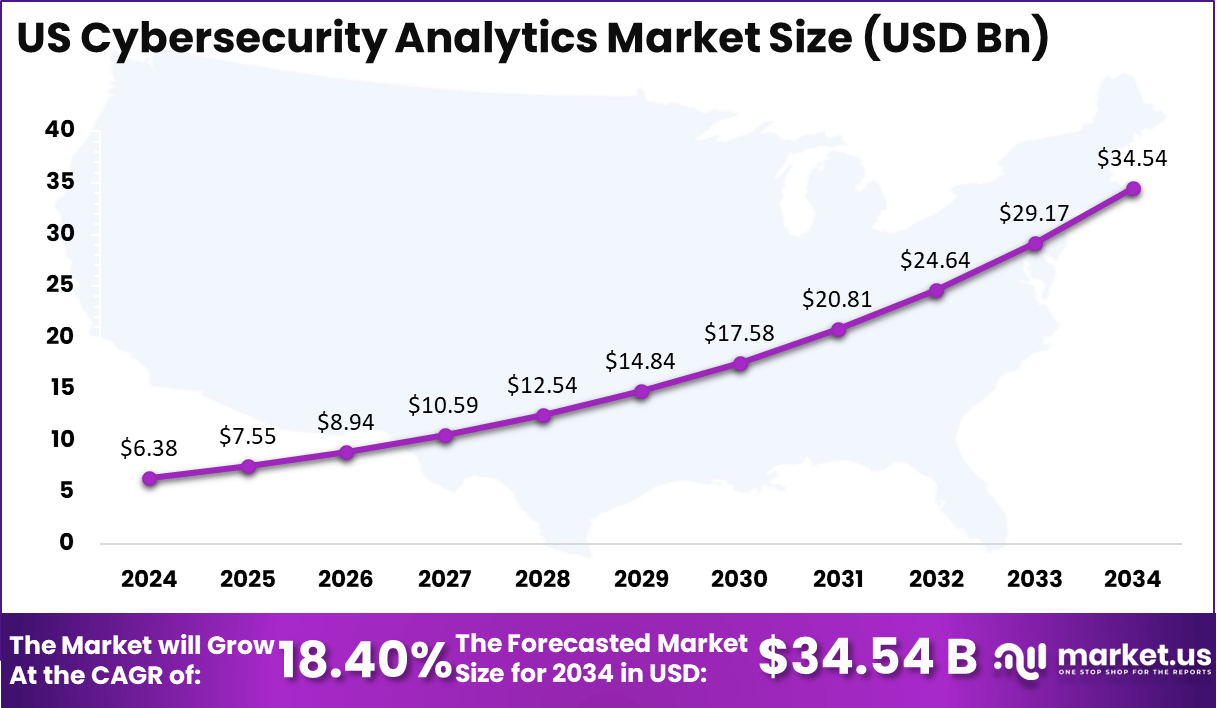

The US forms the core of this leadership position, with the market valued at USD 6.38 billion in 2024. Driven by federal cybersecurity mandates, expanding enterprise digitalization, and escalating attack volumes, the US market is projected to reach USD 34.54 billion by 2034, advancing at an estimated 18.4% CAGR over the forecast period.

Cybersecurity analytics has emerged as a critical force in strengthening digital resilience as organizations navigate an environment marked by rapidly evolving cyber threats. As businesses accelerate cloud migration, adopt connected devices, and operate across highly distributed networks, the volume of data moving across digital ecosystems continues to surge.

This expansion has created new vulnerabilities, making traditional security approaches insufficient. Cybersecurity analytics addresses this gap by transforming large-scale security data into actionable insights, enabling faster detection, deeper threat visibility, and more accurate incident response. By leveraging machine learning, behavioral modeling, and real-time monitoring, security teams can identify anomalies, prevent breaches, and reduce response times across complex IT infrastructures.

The technology is becoming an essential component of modern security operations centers as cyberattacks grow more targeted, automated, and financially damaging. With ransomware, identity theft, social engineering, and supply-chain attacks rising worldwide, organizations are prioritizing analytics-driven protection to strengthen their defense posture.

Governments and regulatory bodies are also tightening compliance standards, pushing enterprises to adopt more intelligent and predictive security frameworks. As a result, cybersecurity analytics is progressing from a supportive tool to a strategic necessity, helping organizations move from reactive threat management to proactive and preventive security operations that safeguard their digital assets and long-term business continuity.

The cybersecurity analytics sector has seen major consolidation and large-scale transactions this year. One of the headline deals is the planned acquisition of Israeli cloud-security vendor Wiz by Alphabet Inc. for approximately USD 32 billion, announced in March 2025 – a move that underscores how critical analytics and cloud threat visibility have become.

In a similarly big deal, Palo Alto Networks secured approval in November 2025 for its USD 25 billion acquisition of identity-security firm CyberArk Software, reflecting the growing linkage between identity analytics and broader security operations. At a more mid-market level, the Israeli startup Veriti was acquired by Check Point Software Technologies in May 2025 in a deal estimated at “over USD 100 million,” demonstrating that analytics-focused exposure-management tools are attractive targets.

On the funding side, analytics-centric cybersecurity firms continue to raise capital: the platform category labelled “Cybersecurity Analytics Software” shows USD 1.69 billion raised across 58 rounds through October 2025. Meanwhile, Q3 2025 venture-capital funding in cybersecurity broadly reached USD 3.3 billion – down from USD 5.1 billion in Q2 – but still reflecting substantial investment interest in analytics and AI-powered threat detection.

Also relevant, up-and-coming startup Nebulock (AI threat-hunting) raised USD 8.5 million in July 2025 as it launched its autonomous threat-response platform, signalling investor appetite for next-gen analytics approaches. Taken together, these developments illustrate a market where analytics capabilities (especially those powered by AI and machine learning) are increasingly central to cybersecurity strategy, both for large platform players and niche innovators.

Key Takeaways

- The Cybersecurity Analytics Market reached USD 17.57 billion in 2024 and is projected to grow at a 20% CAGR, achieving USD 108.79 billion by 2034.

- North America leads the market with a 40.8% share, valued at USD 7.16 billion in 2024.

- The US market contributed USD 6.38 billion in 2024 and is expected to reach USD 34.54 billion by 2034 at an 18.4% CAGR.

- By Component, Solutions dominate the market with a 65.2% share due to rising adoption of AI-based security analytics tools.

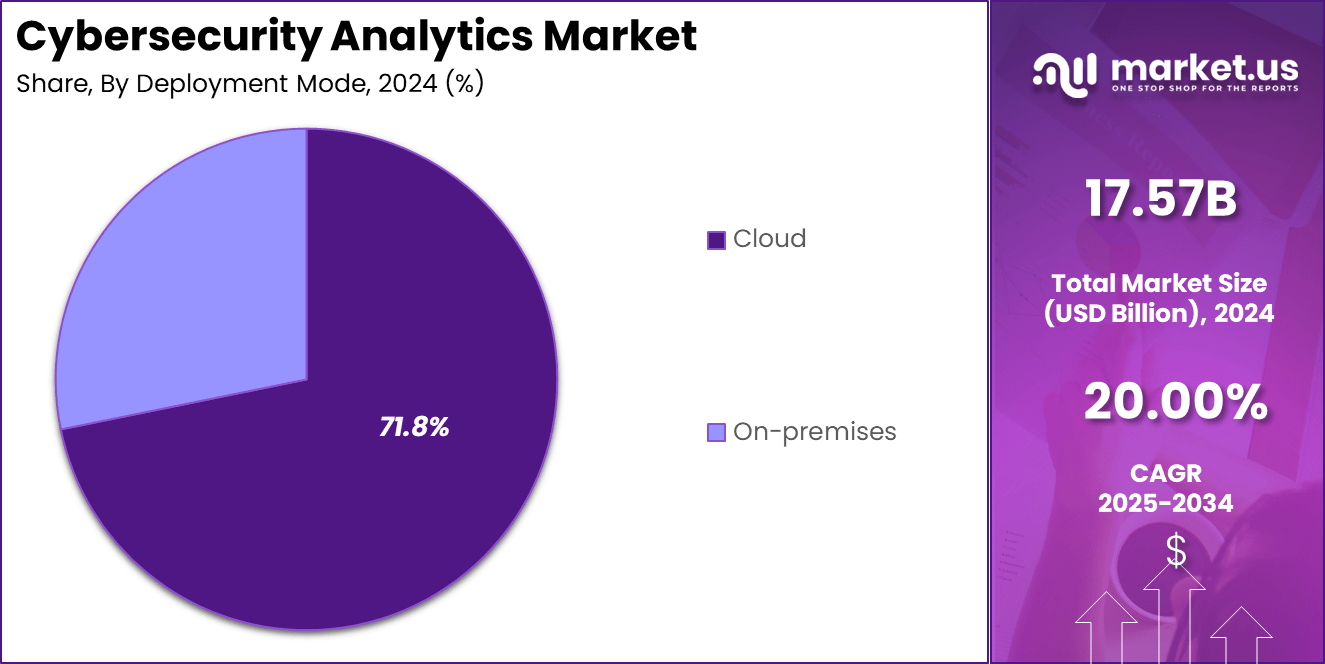

- By Deployment Mode, Cloud deployment leads with 71.8%, driven by rapid cloud migration and demand for scalable threat analytics.

- By Enterprise Size, Large Enterprises hold 74.6%, reflecting higher investment capacity and complex security needs.

- By Industry Vertical, BFSI accounts for 23.5%, supported by strict compliance requirements and high exposure to financial cyber threats.

Role Of Security

Security plays a critical role in protecting digital systems, personal data, and organizational assets in an era where cyber threats are growing faster than traditional defenses can manage. As digital adoption accelerates, security frameworks help reduce vulnerabilities, prevent unauthorized access, and maintain business continuity.

According to the FBI’s Internet Crime Report, reported cybercrime losses in the US reached USD 12.5 billion in 2023, highlighting the financial impact of poor security controls. Globally, ransomware attacks increased by 73% year-over-year (as per the UK’s National Cyber Security Centre), pushing organizations to adopt advanced protective layers, including multi-factor authentication, endpoint security, and real-time analytics.

Security also safeguards critical infrastructure. The US Cybersecurity and Infrastructure Security Agency (CISA) reported that 14 of 16 critical sectors experienced targeted cyber incidents in the past year, illustrating the need for stronger risk management.

Effective security frameworks help organizations comply with data protection laws such as GDPR, under which companies faced over EUR 1.9 billion in fines in 2023 for violations. With cyberattacks projected to cost the global economy USD 9.5 trillion in 2024 (World Economic Forum), the role of security extends beyond prevention—it ensures resilience, trust, and stability across digital ecosystems.

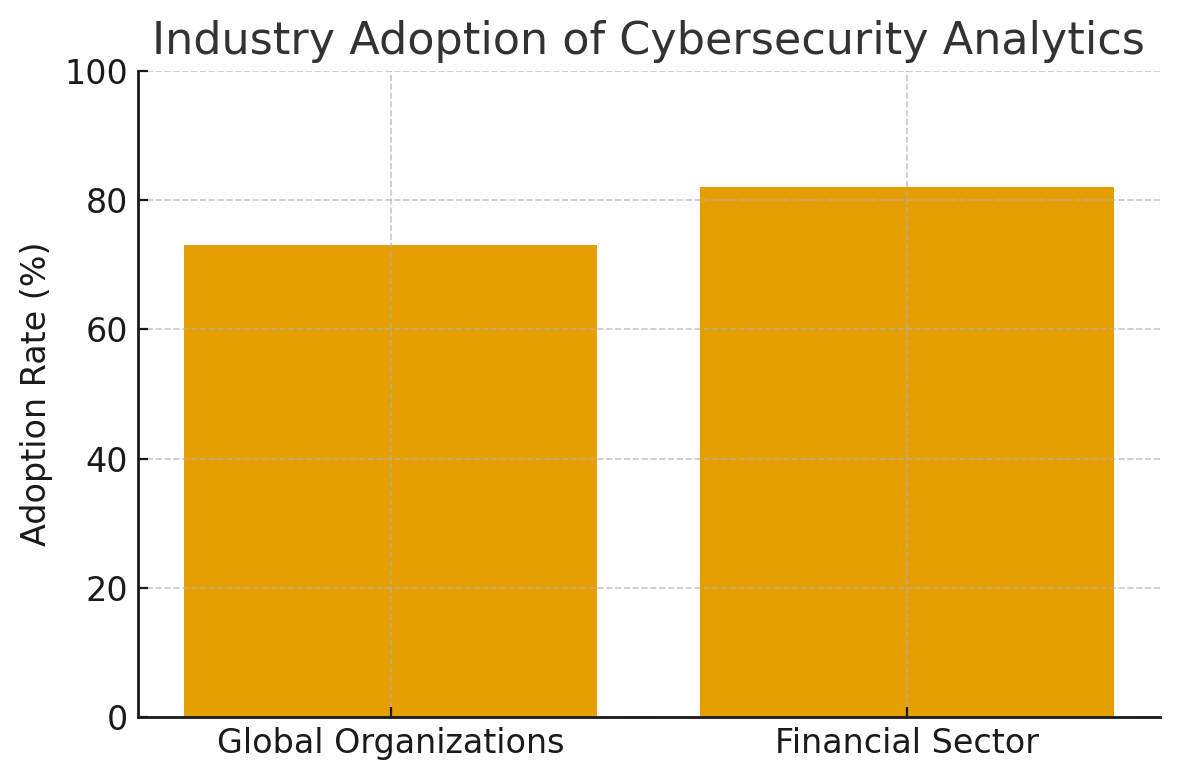

Industry Adoption

Industry adoption of cybersecurity analytics is gaining substantial momentum as organizations across verticals integrate data-driven security solutions into their operations. According to a 2025 study by Arctic Wolf, 73% of organisations globally have now incorporated AI into their cybersecurity strategies, with the financial sector leading at 82% adoption.

The trend reflects increasing uptake among large enterprises: a separate analysis finds that in 2024, large enterprises capture the lion’s share of security analytics investment, given their complex IT estates and greater risk exposure. Organisations in technology-intensive sectors such as finance, banking, and insurance are ahead of the curve, investing in behaviour analytics, identity-based threat detection, and cloud-native platforms.

At the same time, the adoption gap remains wide: a McKinsey survey estimates the total addressable market for cybersecurity technology and services could reach USD 1.5 trillion to USD 2 trillion, suggesting considerable upside for adoption across under-penetrated industries. This confluence of rising threat levels, regulatory pressure, and enterprise digital transformation is driving broad industry adoption of cybersecurity analytics tools and platforms.

Emerging Trends

One major trend is the deep integration of artificial intelligence (AI) into analytics platforms. Many organisations view AI as foundational to security operations: for instance, unsanctioned “shadow AI” deployments are now common and pose data risk, signalling the need for visibility and governance of AI models. Analytics engines are increasingly using machine learning and behavioural models to identify anomalous patterns and insider threat activities in real time.

Another trend is the transition toward an identity-first security perimeter. Organisations are moving from network-centric defence to identity-based frameworks, recognising users and devices as key vectors of risk. At the same time, cloud native environments and hybrid architectures demand continuous monitoring and adaptive analytics rather than periodic scanning. Quantum-safe cryptography and adaptive resilience frameworks are also gaining traction.

As quantum computing becomes more plausible, security analytics must account for future-proof encryption and threat forecasting. Likewise, continuous threat exposure management (CTEM) is emerging as a formal practice: instead of annual vulnerability assessments, organisations analyse and remediate exposure constantly. Finally, the expanding use of generative AI and large-language-model (LLM) technologies means that analytics platforms must not only detect traditional threats but also guard against AI-powered attacks, such as deepfakes and automated phishing.

US Market Size

The US Cybersecurity Analytics Market continues to establish itself as one of the most influential and fast-growing cybersecurity segments worldwide. Valued at USD 6.38 billion in 2024, the market reflects the country’s strong emphasis on digital risk management, advanced threat detection, and AI-driven security investments.

The rapid expansion of cloud environments, widespread adoption of remote and hybrid work models, and rising threats from ransomware and identity-based attacks are driving large-scale demand for analytics-powered security solutions. Enterprises across financial services, healthcare, government, retail, and critical infrastructure are integrating behavioral analytics, automated incident investigation, and continuous monitoring to address increasingly complex cyber risks.

With a strong 18.4% CAGR, the US cybersecurity analytics market is projected to reach USD 34.54 billion by 2034, highlighting the aggressive pace of adoption across both public and private sectors. Federal initiatives, including zero-trust implementation requirements and increased cybersecurity budgets, continue to accelerate industry growth.

Large enterprises remain the primary adopters, but mid-sized organizations are rapidly investing in analytics solutions as compliance requirements tighten and attack surfaces expand. As cyber threats evolve, the US is expected to remain a global leader in cybersecurity analytics innovation, spending, and deployment—strengthening its position as one of the most advanced markets in the cybersecurity ecosystem.

By Component

Solutions dominate the Cybersecurity Analytics Market with 65.2% share, reflecting the strong organizational shift toward integrated, analytics-driven security platforms that help detect, analyze, and respond to complex threats. The Solutions segment includes various advanced technologies that collectively strengthen security operations.

Security Information and Event Management (SIEM) remains one of the most widely adopted tools, enabling centralized log management and real-time threat correlation. Threat Intelligence Platforms (TIPs) support faster decision-making by aggregating global threat data and helping teams anticipate emerging attack patterns. Security Analytics Platforms extend this capability with machine learning and big-data engines that uncover hidden anomalies across networks, applications, and user behavior.

User and Entity Behavior Analytics (UEBA) is gaining strong traction as enterprises face rising insider threats and credential-based attacks. Incident Response Platforms contribute further by automating investigation workflows and reducing response times during security events. Other solution categories, including network traffic analysis and packet inspection tools, provide additional layers of visibility across hybrid and cloud environments.

The Services segment complements Solutions through Managed Security Services and Professional Services. These include consulting, integration, implementation, training, and ongoing support—primarily adopted by organizations looking to strengthen analytics maturity but lacking internal expertise or dedicated cyber operations teams.

By Deployment Mode

Cloud deployment leads the Cybersecurity Analytics Market with 71.8% share, driven by rapid enterprise migration to cloud environments and the need for scalable, real-time security intelligence. Organizations increasingly prefer cloud-based analytics because they offer faster deployment, elastic storage, continuous updates, and seamless integration with modern digital architectures.

As workloads shift to multi-cloud and hybrid environments, cloud-native analytics tools provide deeper visibility into distributed networks, enabling security teams to detect anomalies, correlate cross-platform threats, and automate responses with greater efficiency. The growing adoption of SaaS applications, remote workforces, and API-driven digital ecosystems further accelerates demand for cloud analytics, especially among large enterprises managing high-volume data streams.

On-premises deployment remains relevant for sectors with strict regulatory and data-sovereignty requirements, such as government, defense, and certain financial institutions. These organizations continue to use on-premises cybersecurity analytics for maximum control over sensitive data, legacy system compatibility, and compliance with internal security policies. However, the segment is expanding at a slower pace due to higher infrastructure costs, limited scalability, and longer implementation timelines compared to cloud models.

Overall, the dominance of cloud deployment reflects the industry’s transition toward flexible, AI-enabled, and continuously updated security analytics solutions that can keep pace with evolving cyber threats across modern digital infrastructures.

By Enterprise Size

Large enterprises dominate the Cybersecurity Analytics Market with 74.6% share, reflecting their extensive digital ecosystems, higher exposure to sophisticated cyber threats, and greater investment capacity. These organizations operate complex IT infrastructures spanning cloud platforms, data centers, IoT devices, and global networks, making advanced analytics essential for real-time threat monitoring and incident response.

Large enterprises increasingly adopt tools such as SIEM, UEBA, and AI-driven analytics to manage high-volume security data and detect anomalies that traditional methods miss. Their regulatory obligations—particularly in sectors like banking, telecom, and healthcare—further drive adoption of automated threat intelligence, risk-scoring tools, and continuous compliance monitoring. With rising ransomware incidents and identity-based breaches, large organizations continue expanding their security operations centers and integrating predictive analytics to strengthen resilience.

Small and Medium-sized Enterprises (SMEs) are also accelerating adoption, but at a slower rate due to budget constraints, smaller IT teams, and limited in-house cybersecurity expertise. Many SMEs rely on cloud-based analytics platforms or managed security services to access advanced monitoring without heavy upfront investments.

As cyberattacks increasingly target smaller businesses—FBI data shows SMEs account for over 40% of reported cyber incidents—analytics adoption is growing. However, the segment remains comparatively smaller, reinforcing the dominant position of large enterprises in cybersecurity analytics.

By Industry Vertical

The BFSI sector leads the Cybersecurity Analytics Market with 23.5% share, driven by the industry’s high exposure to financial fraud, data breaches, identity theft, and regulatory non-compliance risks. Banks, insurance companies, and financial service providers manage enormous volumes of sensitive customer information and high-value transactions, making them prime targets for cybercriminals.

Recent global findings show that financial institutions experience cyberattacks 300% more frequently than other industries, reinforcing the need for advanced analytics solutions. BFSI organizations rely heavily on SIEM, UEBA, real-time transaction monitoring, and fraud-detection analytics to identify anomalies, prevent unauthorized access, and maintain trust.

Increasing adoption of digital banking, mobile payments, open banking APIs, and cloud-native financial services continues to accelerate demand for predictive security intelligence across the sector. Other industries are also rapidly adopting cybersecurity analytics. Healthcare organizations integrate analytics to protect electronic health records, comply with privacy laws, and mitigate ransomware risks.

Government and public sector agencies depend on analytics for national security monitoring, data governance, and critical infrastructure protection. Retail, manufacturing, energy and utilities, IT and telecom, aerospace and defense, and education are expanding their reliance on behavioral analytics, network monitoring, and automated incident response. However, BFSI remains the largest adopter due to its strict compliance environment and ongoing digital transformation initiatives.

Key Market Segments

By Component

- Solutions

- Security Information and Event Management (SIEM)

- Threat Intelligence Platform (TIP)

- Security Analytics Platform

- User and Entity Behavior Analytics (UEBA)

- Incident Response Platform

- Others (Network Traffic Analysis, etc.)

- Services

- Managed Security Services

- Professional Services

- Consulting

- Integration and Implementation

- Training and Support

By Deployment Mode

- Cloud

- On-premises

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Government & Public Sector

- Retail

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Aerospace and Defense

- Others (Education, Transport, etc.)

Regional Analysis

North America leads the Cybersecurity Analytics Market with a dominant 40.8% share and a 2024 valuation of USD 7.16 billion, reflecting the region’s advanced digital infrastructure, high cybersecurity awareness, and strong regulatory framework. Enterprises across the US and Canada face some of the world’s most sophisticated cyberattacks, prompting accelerated adoption of AI-driven analytics, automated incident response tools, and behavioral monitoring systems.

The rapid expansion of cloud-based services, hybrid work environments, and IoT connectivity has strengthened the need for real-time threat intelligence and predictive analytics. North American organizations invest heavily in cybersecurity modernization, supported by significant federal initiatives, including zero-trust mandates, critical infrastructure protection programs, and updated data privacy regulations.

The United States remains the key contributor to regional dominance due to its large enterprise base, advanced technology sector, and consistently high cybersecurity spending. BFSI, healthcare, telecom, and government agencies are the primary adopters of security analytics, driven by strict compliance requirements and rising attack frequency.

Canada is also experiencing steady growth powered by investments in national cybersecurity strategies and expanding cloud adoption among medium and large enterprises. Overall, North America is expected to maintain its leadership as organizations prioritize proactive threat detection, digital risk protection, and analytics-led security transformation across industries.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The Cybersecurity Analytics Market is primarily driven by the rising frequency, complexity, and financial impact of cyberattacks targeting enterprises, governments, and critical infrastructure. As organizations expand cloud adoption, remote workforces, and API-driven architectures, their attack surfaces continue to grow, increasing the need for advanced analytics capable of real-time threat detection.

The surge in ransomware incidents and identity-based breaches is pushing companies to adopt AI- and ML-driven platforms that identify anomalies faster than traditional tools. Regulatory pressure is another major driver, with regions like North America and Europe enforcing strict data protection laws that require continuous monitoring and behavioral analytics.

Additionally, digital transformation across the BFSI, healthcare, and manufacturing sectors fuels the demand for scalable cloud-based analytics. Growing investments in zero-trust architecture, security operations center modernization, and automated incident response further accelerate market growth, making analytics a core component of enterprise cybersecurity strategies.

Restraint Factors

Despite strong growth, the cybersecurity analytics market faces several restraints that slow adoption, particularly among small and mid-sized organizations. High implementation costs remain a major challenge, as advanced analytics platforms require significant investment in cloud infrastructure, integration, and skilled cybersecurity personnel.

Many organizations lack the expertise needed to manage data-heavy systems, resulting in dependence on third-party service providers. Data privacy concerns also act as a restraint, especially in industries handling sensitive information such as BFSI, healthcare, and government. The complexity of integrating analytics with legacy systems further limits adoption in traditional enterprises.

Additionally, the shortage of skilled cybersecurity professionals—estimated at over 4 million unfilled roles globally—creates operational gaps that hinder effective deployment. False positives, data overload, and the need for continuous tuning of AI models also create adoption barriers, particularly for firms with limited resources. These challenges collectively restrain the market’s full growth potential.

Growth Opportunities

The cybersecurity analytics market holds significant growth opportunities as organizations transition from reactive security operations to predictive, intelligence-driven protection. The rapid expansion of cloud computing, hybrid environments, and IoT ecosystems is generating unprecedented data volumes—creating strong demand for analytics that can correlate threats across multiple platforms.

Emerging markets in Asia-Pacific, Latin America, and the Middle East present major opportunities due to accelerating digital transformation and increasing regulatory frameworks. The rise of zero-trust architecture, identity-first security models, and continuous threat exposure management opens new avenues for analytics tools focused on identity behavior, micro-segmentation, and automated risk scoring.

Advancements in generative AI and machine learning create opportunities for self-learning security systems capable of detecting unknown threats. Managed security services and analytics-as-a-service models provide scalable adoption paths for SMEs, offering sophisticated capabilities at lower costs. Additionally, sectors like healthcare, energy, and manufacturing demand specialized analytics as operational technology and critical infrastructure become key cyber targets.

Trending Factors

Several key trends are shaping the future of cybersecurity analytics, beginning with the rapid adoption of AI and machine learning to detect threats faster and reduce manual investigation workloads. Organizations are increasingly embracing behavioral analytics, allowing security teams to identify insider threats, compromised identities, and abnormal user activity with greater accuracy.

Cloud-native analytics platforms are another major trend as enterprises continue migrating workloads to multi-cloud and hybrid environments. The rise of automated incident response, including SOAR integrations, is becoming essential for reducing dwell time and improving remediation speed. Identity-centric security is trending strongly as attackers increasingly target user credentials; this has led to the rapid expansion of identity analytics and UEBA tools.

Continuous Threat Exposure Management (CTEM) is emerging as a preferred approach for ongoing risk scoring and vulnerability prioritization. Additionally, quantum-safe cryptography and AI-driven threat simulation tools are gaining attention as organizations prepare for future cyber risk scenarios.

Competitive Analysis

The competitive landscape of the Cybersecurity Analytics Market is shaped by a mix of established technology leaders, advanced analytics providers, and fast-growing AI-driven security companies. Splunk, IBM, Microsoft, Palo Alto Networks, and CrowdStrike remain at the forefront due to their extensive portfolios in SIEM, XDR, and AI-enabled threat analytics.

Google Chronicle and Snowflake continue to strengthen their positions with cloud-native architectures that support high-volume security data processing and real-time analytics. Rapid7, Exabeam, LogRhythm, Securonix, and Devo compete strongly in behavioral analytics, incident response automation, and next-gen SIEM capabilities, offering scalable platforms favored by both large enterprises and mid-size organizations.

Darktrace and SentinelOne lead in autonomous, AI-driven threat detection, leveraging machine learning models to identify novel attack patterns and reduce manual investigation workloads. RSA Security and ArcSight Micro Focus serve long-established enterprise segments where legacy integrations and compliance requirements remain critical.

Elastic expands its presence through unified search, observability, and security analytics across cloud and on-premises environments. The market remains highly competitive, with vendors differentiating through faster detection, reduced false positives, cloud-native deployment, identity analytics, and integration with zero-trust architectures. Continuous innovation, mergers, and platform consolidation define the landscape as organizations prioritize advanced, scalable, and automated cybersecurity analytics solutions.

Top Key Players in the Market

- Splunk

- IBM

- Microsoft

- Palo Alto Networks

- Rapid7

- Exabeam

- LogRhythm

- Darktrace

- RSA Security

- Google Chronicle

- CrowdStrike

- Elastic

- Exabeam

- Securonix

- Devo

- ArcSight Micro Focus

- SentinelOne

- Snowflake

- Others

Recent Developments

- August 14, 2025: Accenture announced the acquisition of CyberCX, a leading Australia-based cybersecurity services provider, marking Accenture’s largest cybersecurity deal to date and bolstering its analytics and threat-intelligence capabilities across Asia Pacific.

- August 5, 2025: SentinelOne signed a definitive agreement to acquire Prompt Security, an Israeli startup focused on securing generative-AI tools; the transaction includes cash and stock and is intended to extend SentinelOne’s analytics and AI-driven response for Gen AI threats.

- July 1, 2025: Exabeam released its new “Exabeam Nova” platform, incorporating six specialized AI agents designed to automate threat detection, investigation, and response across SOC workflows, reinforcing the move toward analytics-led security operations.

Report Scope

Report Features Description Market Value (2024) USD 17.57 Billion Forecast Revenue (2034) USD 108.79 Billion CAGR(2025-2034) 20.00% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solutions [Security Information and Event Management (SIEM), Threat Intelligence Platform (TIP), Security Analytics Platform, User and Entity Behavior Analytics (UEBA), Incident Response Platform, Others (Network Traffic Analysis, etc.)], Services [Managed Security Services, Professional Services {Consulting, Integration and Implementation, Training and Support}]), By Deployment Mode (Cloud, On-premises), By Enterprise Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI (Banking, Financial Services, and Insurance), Healthcare, Government & Public Sector, Retail, Manufacturing, Energy & Utilities, IT & Telecom, Aerospace and Defense, Others (Education, Transport, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Splunk, IBM, Microsoft, Palo Alto Networks, Rapid7, Exabeam, LogRhythm, Darktrace, RSA Security, Google Chronicle, CrowdStrike, Elastic, Exabeam, Securonix, Devo, ArcSight, Micro Focus, SentinelOne, Snowflake, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Cybersecurity Analytics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Cybersecurity Analytics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Splunk

- IBM

- Microsoft

- Palo Alto Networks

- Rapid7

- Exabeam

- LogRhythm

- Darktrace

- RSA Security

- Google Chronicle

- CrowdStrike

- Elastic

- Exabeam

- Securonix

- Devo

- ArcSight Micro Focus

- SentinelOne

- Snowflake

- Others