Global Customer Relationship Management (CRM) Software Market By Solution Type (Customer Experience Management, Customer Service, Salesforce Automation, Social Media Monitoring, CRM Analytics, Marketing Automation, Other Solution Types), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use (IT & Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 67727

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

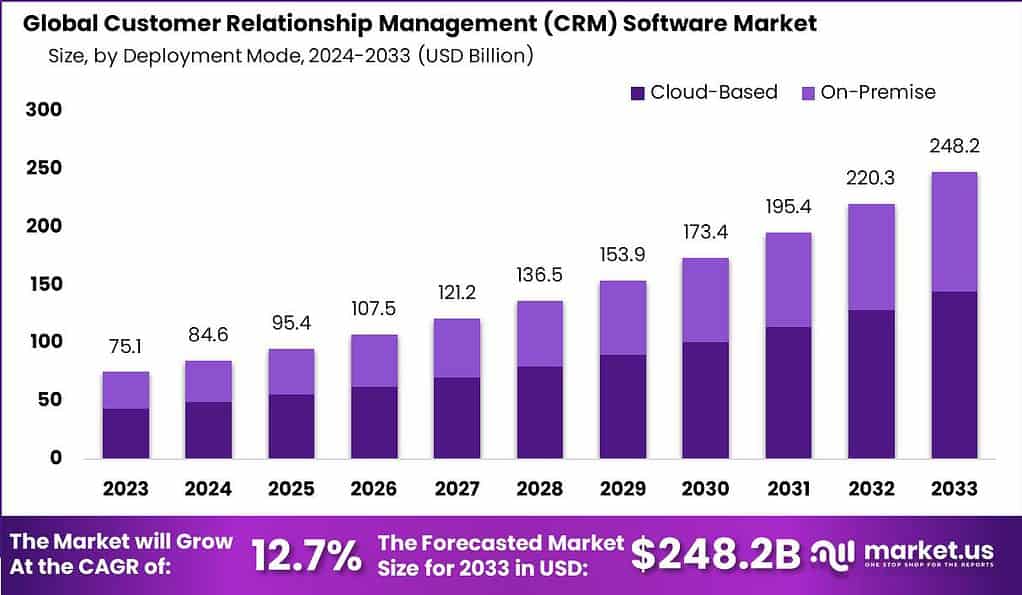

The Global Customer Relationship Management (CRM) Software Market size is expected to be worth around USD 248.2 Billion by 2033, from USD 75.1 Billion in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

Customer Relationship Management (CRM) software is a powerful tool that helps businesses manage and analyze their interactions with current and potential customers. It enables organizations to streamline their sales, marketing, and customer service processes, resulting in improved customer satisfaction, increased sales, and enhanced customer retention.

The CRM software market has been experiencing significant growth in recent years. Several factors contribute to this expansion, including the growing need for businesses to improve customer relationships, increase sales efficiency, and gain insights into customer behavior. As a result, the global CRM software market has witnessed a steady increase in adoption across various sectors, including healthcare, finance, retail, and technology.

Analyst Viewpoint

One of the primary driving factors is the increasing focus on customer-centric strategies. Businesses across industries are recognizing the importance of delivering personalized experiences and building strong relationships with their customers. CRM software enables companies to gather, organize, and analyze customer data, allowing them to tailor their marketing campaigns, sales efforts, and customer service interactions to meet individual needs. This emphasis on customer-centricity is expected to fuel the demand for CRM software.

Furthermore, the integration of CRM software with emerging technologies presents exciting opportunities. The combination of CRM with artificial intelligence (AI), machine learning (ML), and data analytics allows businesses to gain deeper insights into customer behavior, predict buying patterns, and automate personalized interactions.

These technologies enable businesses to deliver highly targeted marketing campaigns, improve sales forecasting accuracy, and enhance overall customer experiences. In April 2022, Salesforce, Inc., a cloud-based software company, rolled out CRM analytics, incorporating advanced features like AI-powered insights tailored for sales, marketing, and service teams across various industries such as BFSI, retail, and IT & telecom.

Key Takeaways

- The Customer Relationship Management (CRM) Software Market size is poised to cross USD 84.6 Billion in 2024 and is likely to attain a valuation of USD 248.2 billion by 2033.

- In 2023, the Customer Service segment emerged as the dominant solution type in the CRM software market, capturing a share of more than 24.5%.

- In 2023, the Cloud-Based segment emerged as the dominant deployment mode in the CRM software market, capturing a share of more than 58.3%.

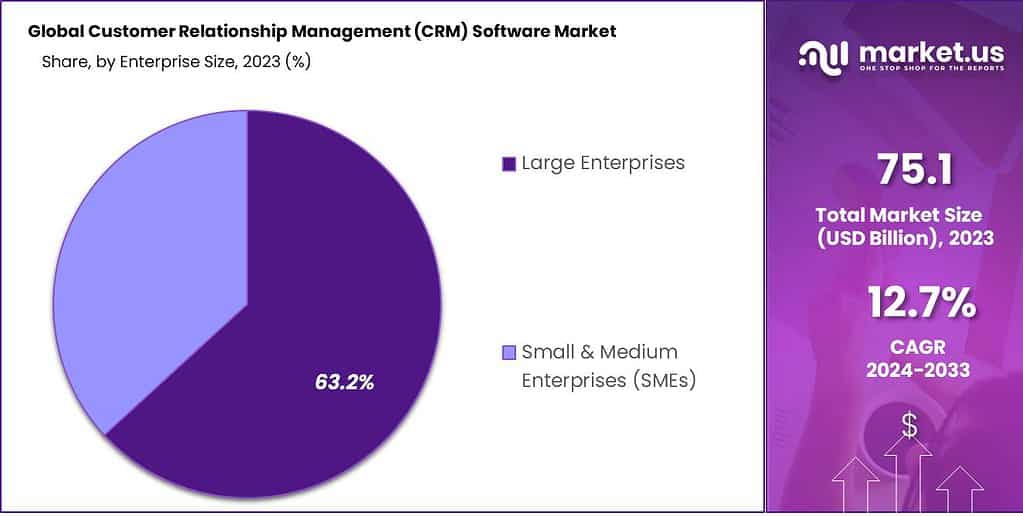

- In 2023, the Large Enterprises segment emerged as the dominant enterprise size category in the CRM software market, capturing a share of more than 63.2%.

- In 2023, the BFSI (Banking, Financial Services, and Insurance) segment emerged as the frontrunner in the Customer Relationship Management (CRM) software market, securing a prominent market position with a share exceeding 23%.

Solution Type Analysis

In 2023, the Customer Service segment emerged as the dominant solution type in the CRM software market, capturing a share of more than 24.5%. This segment’s strong market position can be attributed to several factors that have contributed to its growth and popularity among businesses.

Customer service is a critical aspect of any business’s success, as it directly impacts customer satisfaction, loyalty, and retention. CRM software solutions tailored specifically for customer service enable organizations to effectively manage customer interactions, respond to queries and complaints promptly, and provide personalized support. These solutions typically encompass features such as ticket management, case routing, knowledge base management, and self-service portals.

The dominance of the Customer Service segment can be further explained by the increasing emphasis on delivering exceptional customer experiences. In today’s highly competitive business landscape, organizations are striving to differentiate themselves through superior customer service. CRM software solutions focused on customer service help businesses centralize customer data, enabling support agents to access relevant information quickly and provide efficient and personalized assistance.

Moreover, the rise of omnichannel customer service has contributed to the growth of the Customer Service segment. With customers interacting through various channels such as phone, email, chat, and social media, CRM software solutions offer consolidated platforms that integrate and manage interactions across these channels. This enables businesses to deliver consistent and seamless customer experiences, regardless of the communication channel used.

Deployment Mode Analysis

In 2023, the Cloud-Based segment emerged as the dominant deployment mode in the CRM software market, capturing a share of more than 58.3%. This segment’s strong market position can be attributed to several key factors that have contributed to the widespread adoption of cloud-based CRM solutions.

Cloud-based deployment offers numerous advantages that have resonated with businesses across various industries. One of the primary drivers of the Cloud-Based segment’s dominance is its scalability and flexibility. Cloud-based CRM solutions allow organizations to easily scale their operations up or down, depending on their needs. This flexibility is particularly beneficial for businesses experiencing growth or fluctuating demands, as they can quickly adjust their CRM capabilities without the need for significant infrastructure investments.

Additionally, the lower upfront costs associated with cloud-based CRM solutions have been a significant attraction for businesses. Unlike on-premise deployments that require substantial investments in hardware, software licenses, and IT infrastructure, cloud-based solutions operate on a subscription-based model. This allows businesses to adopt CRM software with minimal upfront expenses, making it more accessible to organizations of all sizes, including startups and small businesses.

The Cloud-Based segment’s dominance can also be attributed to the ease of implementation and maintenance that cloud-based CRM solutions offer. With on-premise deployments, organizations are responsible for the installation, configuration, and ongoing maintenance of the CRM software and infrastructure. In contrast, cloud-based solutions are managed by the CRM software provider, reducing the burden on businesses’ IT departments and enabling them to focus on their core competencies.

Enterprise Size Analysis

In 2023, the Large Enterprises segment emerged as the dominant enterprise size category in the CRM software market, capturing a share of more than 63.2%. This segment’s strong market position can be attributed to several factors that have contributed to its higher adoption rate among large organizations.

Large enterprises typically have complex and extensive customer relationships, involving a larger customer base and more intricate sales and marketing processes. CRM software provides the necessary tools and functionalities to manage and analyze these relationships effectively. The Large Enterprises segment has witnessed significant adoption as larger organizations recognize the value of CRM software in streamlining their customer-facing operations and enhancing overall business performance.

One key factor driving the dominance of the Large Enterprises segment is the scalability and enterprise-level capabilities offered by CRM software. Large organizations require CRM solutions that can handle high volumes of customer data, accommodate complex sales processes, and support multiple users across different departments and locations. CRM software designed for large enterprises provides advanced features such as robust analytics, customizable workflows, and integration capabilities with other enterprise systems. These features enable large organizations to effectively manage their vast customer base and derive actionable insights from the data collected.

Furthermore, large enterprises often have dedicated sales, marketing, and customer service teams that benefit from the collaborative features of CRM software. These solutions enable teams to share customer information, track interactions, and coordinate activities, resulting in improved communication and streamlined workflows. The ability to centralize customer data and align various departments around a unified CRM system is particularly advantageous for large enterprises with complex organizational structures and multiple business units.

End-Use Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment emerged as the frontrunner in the Customer Relationship Management (CRM) software market, securing a prominent market position with a share exceeding 23%. This significant market dominance can be attributed to several factors that highlight the industry’s unique requirements and challenges.

The BFSI sector heavily relies on effective customer management to foster enduring relationships and build customer loyalty. CRM software plays a pivotal role in enabling financial institutions to streamline their operations, enhance customer service, and deliver personalized experiences. The software facilitates efficient management of customer information, tracks interactions, and automates various processes, including lead generation, customer onboarding, and cross-selling opportunities. These functionalities empower BFSI companies to better understand their customers, anticipate their needs, and deliver tailored financial solutions.

Moreover, the BFSI industry is subject to rigorous regulatory compliance standards that demand data security, privacy, and transparency. CRM software equipped with robust security features enables financial institutions to safeguard sensitive customer information, adhere to regulatory guidelines, and mitigate the risks associated with data breaches. The ability of CRM solutions to integrate with other banking systems and applications further enhances the efficiency and effectiveness of operations within the BFSI sector.

Furthermore, the BFSI segment is characterized by intense competition, and gaining a competitive edge is crucial for sustained growth. CRM software assists financial institutions in analyzing customer data, identifying trends, and generating actionable insights. These insights enable organizations to develop targeted marketing strategies and deliver personalized campaigns to attract new customers and retain existing ones. By leveraging CRM systems, BFSI companies can optimize their sales and marketing efforts, improve customer acquisition rates, and ultimately drive revenue growth.

Key Market Segments

By Solution

- Customer Experience Management

- Customer Service

- Salesforce Automation

- Social Media Monitoring

- CRM Analytics

- Marketing Automation

- Other Solutions

By Deployment Mode

- On-premise

- Cloud

By Enterprise Size

- Small & Medium Enterprise

- Large Enterprises

By End-use

- Retail

- BFSI

- Discrete Manufacturing

- Healthcare

- IT & Telecom

- Government & Education

- Other End-Uses

Driver

Increasing Demand for Enhanced Customer Experience and Engagement

The growth of the global Customer Relationship Management (CRM) software market can be attributed to the increasing demand for enhanced customer experience and engagement. Businesses across various sectors are recognizing the importance of understanding customer behaviors, preferences, and trends to tailor their services and products accordingly. This shift towards customer-centric business models has necessitated the adoption of advanced CRM solutions, which facilitate the effective management of customer data, streamline sales processes, and enable personalized customer interactions.

Furthermore, the competitive landscape of the digital economy mandates the implementation of CRM software to ensure customer loyalty and retention, thereby driving revenue growth. The emphasis on delivering superior customer experiences and the strategic focus on customer engagement strategies have significantly propelled the demand for CRM software.

Restraint

Concerns Over Data Privacy and Security

One of the primary restraints impacting the growth of the global Customer Relationship Management (CRM) software market is the increasing concerns over data privacy and security. With the proliferation of digital channels and the extensive collection of customer data, businesses face significant challenges in ensuring the security and confidentiality of sensitive information. The rising incidents of data breaches and cyber-attacks have heightened apprehensions regarding the vulnerability of CRM systems.

Moreover, the stringent regulatory landscape, exemplified by regulations such as the General Data Protection Regulation (GDPR) in Europe, imposes rigorous data protection obligations on companies, complicating CRM software implementation. These data privacy and security concerns can deter organizations from adopting CRM solutions, thereby hindering market growth.

Opportunity

Integration of CRM with Emerging Technologies

The integration of Customer Relationship Management (CRM) software with emerging technologies presents a substantial opportunity for market growth. Technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and blockchain are revolutionizing the way businesses interact with their customers. AI and ML, for instance, enable the analysis of vast amounts of customer data to predict behaviors and preferences, enhancing personalization and customer service. IoT technology facilitates real-time customer engagement and feedback.

Additionally, blockchain can offer unparalleled data security, building trust in CRM systems. The synergy between CRM software and these technologies not only enhances operational efficiency but also opens new avenues for innovation in customer engagement strategies, thereby offering a competitive edge to businesses.

Challenge

Integration and Compatibility Issues with Existing IT Infrastructure

A significant challenge facing the global Customer Relationship Management (CRM) software market is the integration and compatibility issues with existing IT infrastructure. Many organizations operate on legacy systems that may not be compatible with the latest CRM solutions, leading to integration challenges. The heterogeneity of IT systems across different departments within an organization can complicate the seamless implementation of CRM software. This discordance can result in data silos, operational inefficiencies, and increased costs, undermining the benefits of CRM systems.

Moreover, the necessity for continuous updates and customization to align with evolving business processes and customer needs further exacerbates these challenges. Overcoming the integration and compatibility issues is crucial for organizations to fully leverage the potential of CRM software in enhancing customer relationships and driving business growth.

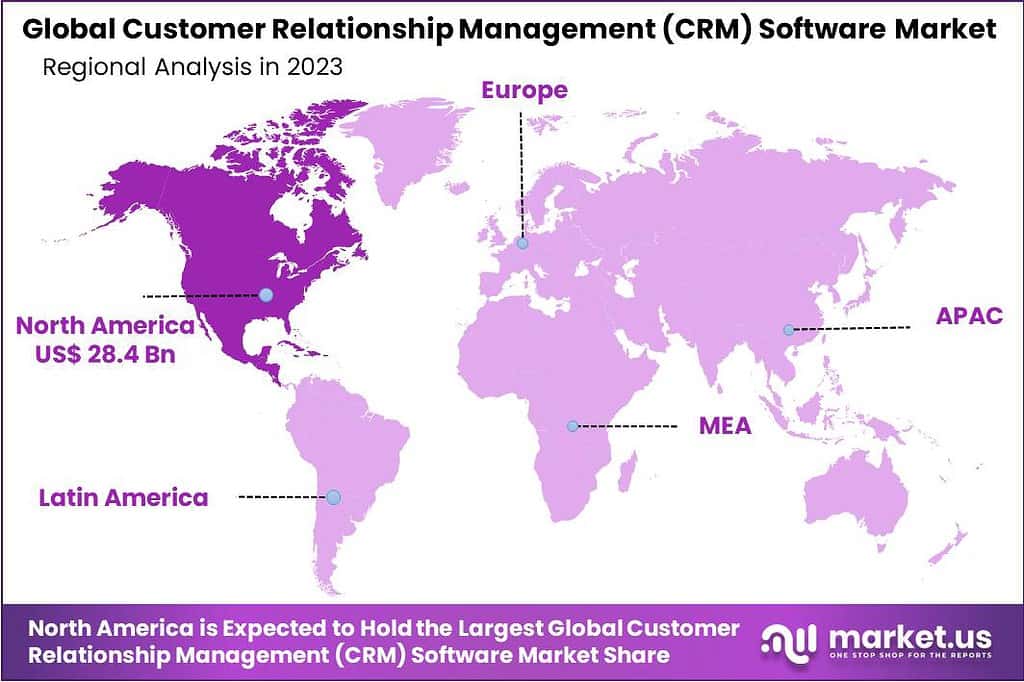

Regional Analysis

In 2023, the North American region emerged as the leader in the Customer Relationship Management (CRM) software market, holding a dominant market position with a share exceeding 37.9%. This significant market dominance can be attributed to several factors that highlight the region’s advanced technological infrastructure, strong business ecosystem, and customer-centric approach.

North America has been at the forefront of digital transformation, with organizations across various industries recognizing the importance of CRM software in driving customer engagement and loyalty. The region’s technologically mature landscape, characterized by widespread internet penetration, advanced communication networks, and high digital literacy rates, has facilitated the rapid adoption of CRM solutions. Businesses in North America have embraced CRM software to gain a competitive edge by delivering personalized customer experiences, optimizing sales and marketing efforts, and improving overall operational efficiency.

Moreover, the region boasts a vibrant and competitive business ecosystem, comprising numerous multinational corporations and innovative startups. These organizations understand the value of CRM software in effectively managing customer relationships and driving revenue growth. With a strong focus on customer-centric strategies, North American companies have been early adopters of CRM solutions, aiming to enhance customer satisfaction and loyalty.

Furthermore, North America is home to several key players in the CRM software market, including technology giants and niche solution providers. These companies continuously innovate and invest in research and development, introducing advanced features and functionalities to meet the evolving needs of businesses. The availability of a diverse range of CRM solutions, tailored to different industry verticals and organizational sizes, has further fueled the market growth in the region.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Customer Relationship Management (CRM) software market is characterized by the presence of several key players, each contributing to the market dynamics through innovation, strategic partnerships, and expansion of product portfolios. These companies play a pivotal role in shaping the market trends, offering solutions that cater to a wide range of industries including retail, banking, healthcare, and IT services.

Top Market Leaders

- Salesforce Inc.

- Oracle Corporation

- SAP SE

- Sage Group plc

- Adobe Inc.

- HubSpot

- SugarCRM Inc.

- Freshworks Inc.

- IBM Corporation

- Copper CRM, Inc.

- Zendesk Inc.

- Zoho Corporation

- Other Key Players

Recent Developments

1. Salesforce Inc.:

- March 2023: Announced the acquisition of Mulesoft, an API integration platform provider, for $3.5 billion, aiming to enhance customer journey orchestration and data integration capabilities.

- September 2023: Launched “Einstein Analytics for Customer 360,” a unified analytics platform offering AI-powered insights for deeper customer understanding and personalized engagement.

2. Oracle Corporation:

- January 2023: Launched the “Oracle Fusion Cloud Customer Data Management” platform, consolidating customer data from various sources to provide a holistic view and improve personalization.

- June 2023: Partnered with Microsoft to offer seamless integration between Oracle CX and Microsoft Dynamics 365, catering to businesses using both platforms.

3. Adobe Inc.:

- April 2023: Announced the beta launch of “Marketo Engage Marketplace,” a platform connecting businesses with pre-built integrations and solutions for Marketo Engage, their marketing automation solution.

- October 2023: Released “Adobe Experience Platform Data Governance,” a tool enabling better data control and privacy compliance within their CRM offerings.

4. HubSpot:

- May 2023: Announced the acquisition of Zopto, a customer service platform aimed at expanding their offerings in conversational AI and omnichannel support.

- November 2023: Launched “HubSpot Service Hub Enterprise,” a new tier tailored for larger businesses with advanced service management needs, including predictive analytics and self-service options.

Report Scope

Report Features Description Market Value (2023) US$ 75.1 Bn Forecast Revenue (2033) US$ 248.2 Bn CAGR (2024-2033) 12.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution Type (Customer Experience Management, Customer Service, Salesforce Automation, Social Media Monitoring, CRM Analytics, Marketing Automation, Other Solution Types), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use (IT & Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Salesforce Inc., Oracle Corporation, SAP SE, Sage Group plc, Adobe Inc., HubSpot, SugarCRM Inc., Freshworks Inc., IBM Corporation, Copper CRM Inc., Zendesk Inc., Zoho Corporation, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Customer Relationship Management (CRM) software?Customer Relationship Management (CRM) software is a technology tool designed to help businesses manage interactions and relationships with their customers. It typically includes features for sales management, contact and lead management, customer support, and marketing automation.

How big is Customer Relationship Management (CRM) Software Industry?The Global Customer Relationship Management (CRM) Software Market size is expected to be worth around USD 248.2 Billion by 2033, from USD 75.1 Billion in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

Who are the key players in the Customer Relationship Management (CRM) Software Market?Some key players operating in the Customer Relationship Management (CRM) Software Market include Salesforce Inc., Oracle Corporation, SAP SE, Sage Group plc, Adobe Inc., HubSpot, SugarCRM Inc., Freshworks Inc., IBM Corporation, Copper CRM Inc., Zendesk Inc., Zoho Corporation, Other Key Players

What industries commonly use CRM software?CRM software is widely used across various industries, including but not limited to, finance, healthcare, retail, e-commerce, manufacturing, and telecommunications. Any business that values customer relationships and aims to improve customer interactions can benefit from CRM.

What challenges do businesses face when implementing CRM software?Challenges in CRM implementation may include resistance from employees, data migration issues, selecting the right CRM solution, and ensuring proper training for users. Overcoming these challenges is essential for a successful CRM implementation.

Customer Relationship Management (CRM) Software MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Customer Relationship Management (CRM) Software MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Salesforce Inc.

- Oracle Corporation

- SAP SE

- Sage Group plc

- Adobe Inc.

- HubSpot

- SugarCRM Inc.

- Freshworks Inc.

- IBM Corporation

- Copper CRM, Inc.

- Zendesk Inc.

- Zoho Corporation

- Other Key Players