Global Customer Loyalty Software Market Size, Share, Industry Analysis Report By Offering (Software (Cloud-Based, On-Premises), Services (Professional Services (Consulting, Implementation, Support & Maintenance), Managed Services)), By Operator (Business-to-Business, Business-to-Customers), By Organization Size (Small & Medium Enterprise (SME), Large Enterprise), By Vertical( Transportation, IT & Telecommunication, BFSI, Media & Entertainment, Retail & Consumer Goods, Hospitality, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157249

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Investment & Business Benefits

- US Market Size Analysis

- Regional Analysis

- By Offering

- By Operator

- By Organization Size

- By Vertical

- Key Market Segments

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Players Analysis

- Strategic Recommendations

- Recent Developments

- Report Scope

Report Overview

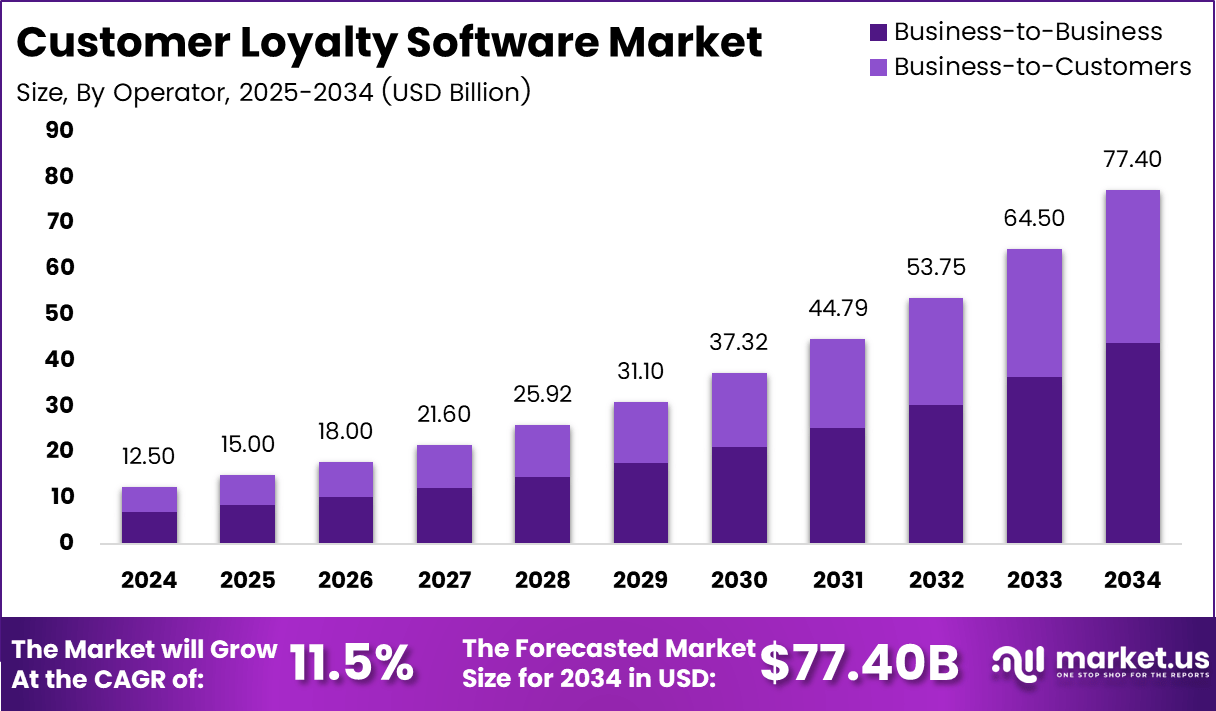

The Global Customer Loyalty Software Market was valued at USD 12.5 billion in 2024 and is projected to reach USD 77.4 billion by 2034, growing at a strong CAGR of 11.5% during the forecast period, driven by the rising need for businesses to retain customers, enhance engagement, and leverage data-driven loyalty programs.

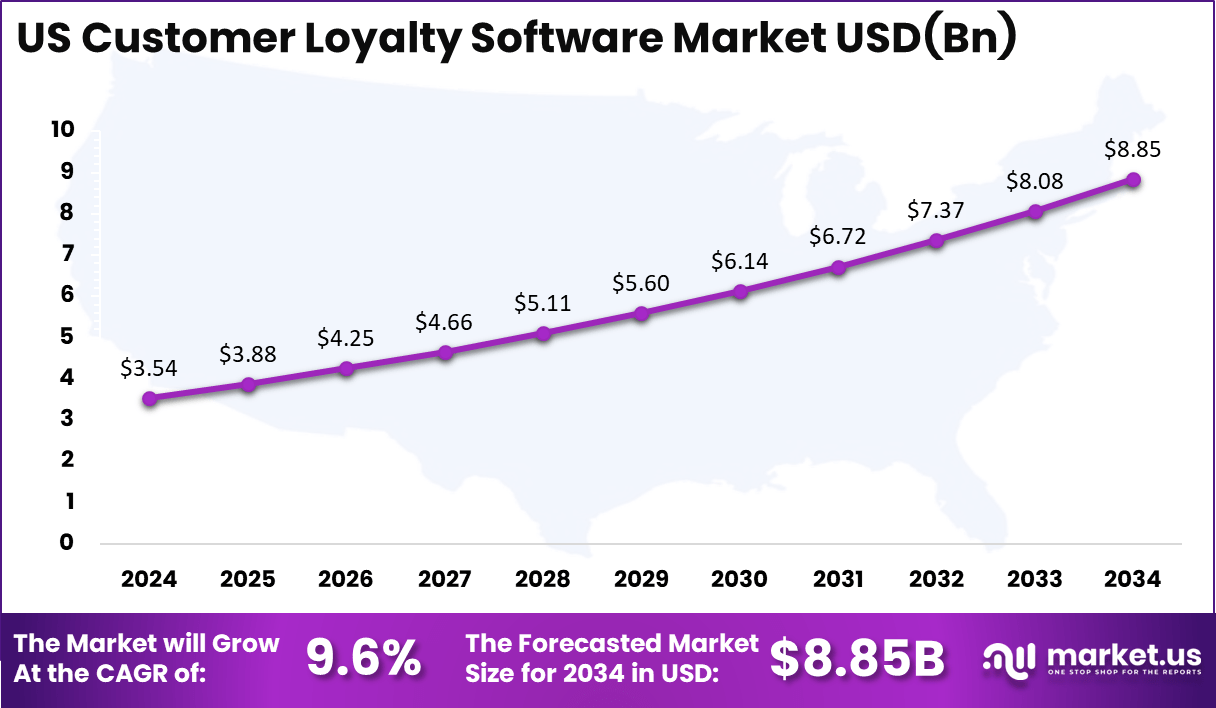

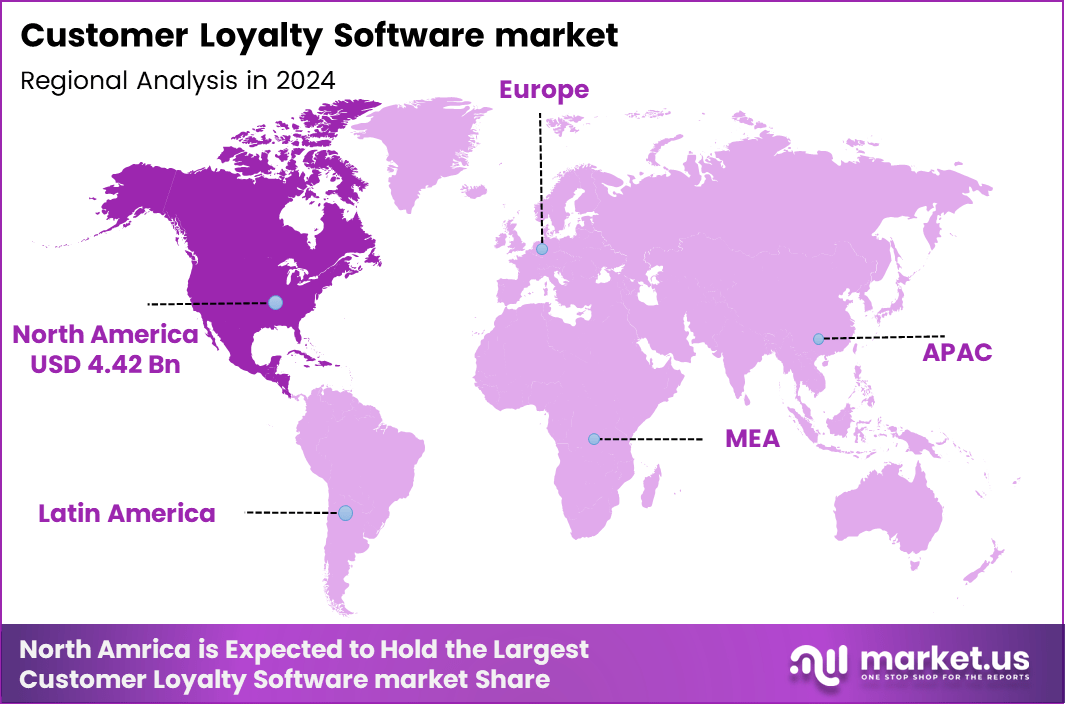

Within this, the US market is expected to expand from USD 3.54 billion in 2024 to USD 8.85 billion by 2034, at a CAGR of 9.6%, while North America, with a market size of USD 4.42 billion in 2024, continues to hold the leading regional share due to high adoption of advanced CRM tools, rapid digital transformation, and strong focus on customer-centric strategies.

The Customer Loyalty Software Market refers to digital solutions designed to build, manage, and optimise loyalty programs that reward recurring customer behaviour. These platforms support businesses in delivering points, perks, discounts, or recognition in exchange for repeat purchases or engagement. They automate the tracking of customer actions and rewards, helping firms to nurture loyalty, deepen customer relationships, and analyse behaviour patterns

Top driving factors for this market include the increasing demand for personalized customer experiences and the need for businesses to strengthen customer retention in a competitive environment. Companies recognize that loyalty programs not only retain customers but also increase purchase frequency and customer lifetime value. The integration of advanced technologies such as artificial intelligence and data analytics enables more precise customer profiling and targeted rewards, further fueling adoption.

According to Clickpost.ai, 91% of companies now run loyalty programs, with members generating 12-18% more incremental revenue. Customers who are emotionally connected to a brand are worth 306% more, while personalization has been shown to boost engagement and purchase rates. Reflecting their effectiveness, 90% of businesses report positive ROI from loyalty initiatives, making them a key driver of customer retention.

Queue-it data further shows that 65% of revenue comes from repeat customers, while acquiring a new one costs 5–25 times more than retaining an existing one. Loyalty also translates into stronger sales opportunities, with a 60–70% chance of selling to existing customers compared to just 5–20% for new prospects. With 77% of consumers loyal to a brand for more than a decade, and a 5% increase in retention linked to a 25% profit boost, the business case for investing in loyalty is clear.

Demand analysis shows that businesses are rapidly adopting loyalty software to enhance engagement and reduce churn rates. Digital transformation and the proliferation of mobile technologies make it easier for customers to participate in loyalty programs through apps and online platforms. This digital shift allows companies to collect valuable data to refine their marketing and rewards strategies, improving overall effectiveness and customer satisfaction.

Key Takeaways

- The global customer loyalty software market was valued at USD 12.5 billion in 2024 and is projected to reach USD 77.4 billion by 2034, growing at a CAGR of 11.5%.

- By offering, Software dominated with a strong 76.4% share.

- By operator type, Business-to-Business (B2B) led the market, securing 65.2% share.

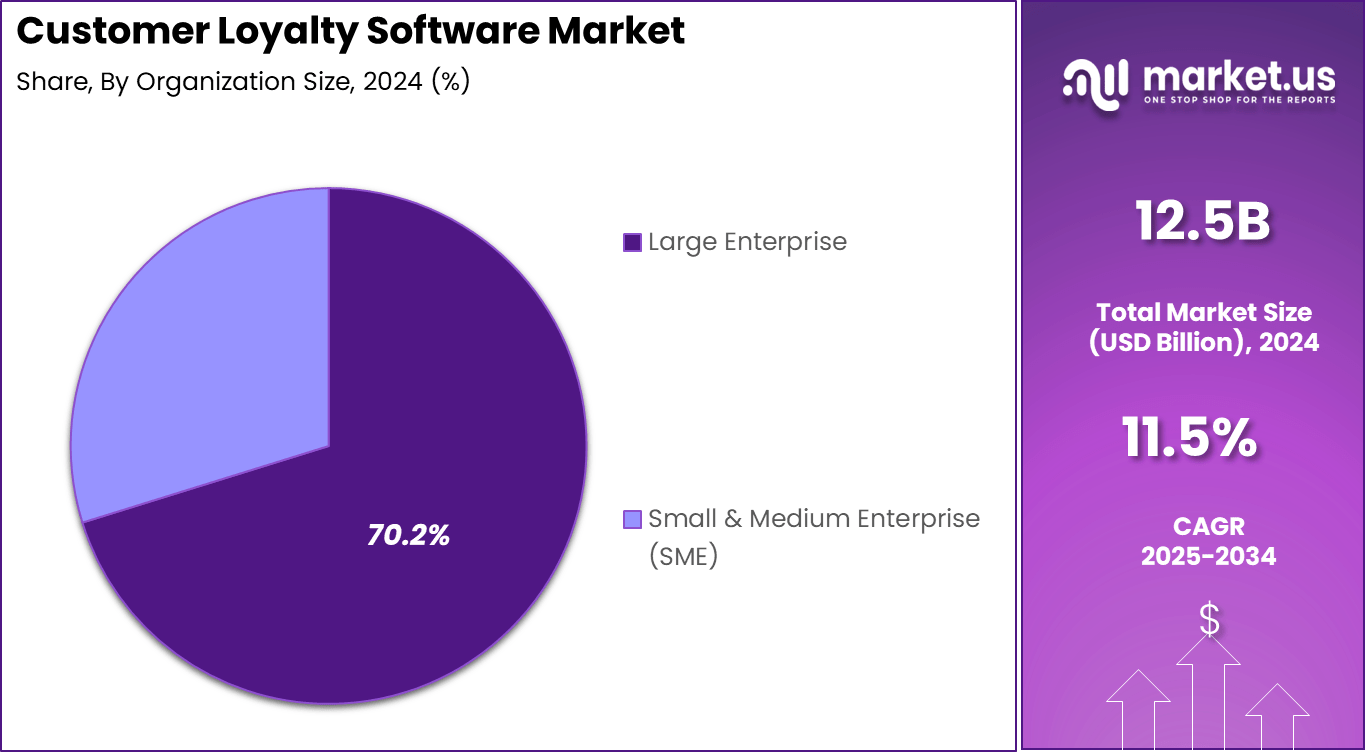

- By organization size, Large Enterprises were the primary adopters, holding 70.2% share.

- By vertical, IT & Telecommunication emerged as the leading sector, contributing 32.6% share.

Investment & Business Benefits

Increasing adoption of technologies such as AI, machine learning, and cloud computing is transforming loyalty software. AI-driven personalization engines create tailored offers in real-time, while machine learning analyzes customer behavior patterns for predictive rewards and churn prevention. For instance, AI-powered loyalty programs are expected to boost customer retention by 5-10% and increase revenue by up to 25%. Cloud-based solutions offer scalability and cost-effectiveness, making it simpler for businesses of all sizes to implement and customize programs aligned with their goals. The global cloud-based loyalty market, valued at USD 5 billion in 2023, is projected to grow significantly, with major platforms seeing 10-15% year-on-year revenue growth.

Investment opportunities exist in developing innovative loyalty platforms with advanced AI capabilities, omnichannel integration, and robust analytics. The rise of digital commerce, with global e-commerce sales reaching USD 6.3 trillion in 2023, and increasing customer expectations, creates a fertile ground for new software solutions that provide seamless and personalized loyalty experiences. The customer loyalty software market, valued at USD 12.5 billion in 2024, is projected to reach USD 77.4 billion by 2034, driven by this innovation and the increasing need for businesses to engage more deeply with customers.

Business benefits from adopting customer loyalty software include higher customer retention rates, increased revenue through repeat purchases, improved customer engagement, and valuable insights into customer behavior. For example, companies that leverage loyalty programs can see a 5-10% increase in repeat purchases, which can lead to an average revenue increase of 20-30%. These benefits translate into stronger brand loyalty, competitive advantage, and sustainable business growth. Automated processes and detailed analytics streamline marketing efforts, reduce operational costs by up to 20%, and help optimize program performance.

US Market Size Analysis

The US customer loyalty software market is set for steady growth, driven by businesses’ focus on enhancing customer engagement and retention. Valued at USD 3.54 billion in 2024, the market is forecasted to reach USD 8.85 billion by 2034, growing at a CAGR of 9.6%. This growth is fueled by increasing demand for personalized customer experiences and the rise of AI-driven insights that help businesses tailor their loyalty offerings.

The rise of digital platforms, personalized rewards, and AI-driven insights is fueling adoption across retail, e-commerce, and service sectors. In 2023, retail e-commerce in the US generated over USD 1 trillion in sales, with a significant portion of this attributed to loyalty-driven repeat purchases. Cloud-based solutions are gaining popularity for their flexibility and scalability, with major providers like Salesforce and Oracle reporting a 20% increase in cloud-based loyalty software adoption. These solutions help businesses enhance their customer loyalty programs, improve engagement, and reduce operational costs. For instance, a major retail chain in the US saw a 15% increase in repeat customer sales within the first year of implementing AI-powered loyalty software.

As businesses continue to shift towards digital loyalty solutions, the total transaction value through loyalty programs in the US is expected to exceed USD 500 billion by 2026, underlining the growing importance of customer retention strategies.

Regional Analysis

In 2024, North America leads the Customer Loyalty Software market with USD 4.42 billion, driven by advanced digital infrastructure, early AI adoption, and strong customer-centric strategies in retail and e-commerce. Europe is also growing steadily, supported by rising demand for personalized engagement and strict data-driven customer management practices.

The European market is seeing a 15% year-over-year rise in loyalty program sign-ups, especially in hospitality and travel. The APAC region, driven by rapid digitalization, is projecting a 20% annual increase in loyalty sales in China and India. In Latin America, Brazil’s retail sector aims to implement 50 million loyalty memberships by 2025. MEA, particularly the UAE, is growing, with loyalty program revenues set to increase by 18% in 2024, driven by AI-driven engagement.

The Asia-Pacific (APAC) region is emerging as a high-growth market, fueled by rapid digitalization, smartphone adoption, and booming e-commerce activity. Latin America is witnessing increasing adoption as businesses modernize retail and loyalty programs. The Middle East and Africa (MEA) are gradually expanding, with investments in digital engagement solutions strengthening competitiveness.

By Offering

The software segment dominates the Customer Loyalty Software Market, holding a significant share of 76.4%. This segment includes various loyalty management platforms and systems designed to help businesses create, launch, and manage customer loyalty programs effectively. These software solutions offer features such as customer segmentation, reward tracking, personalized promotions, and analytics to measure the success of loyalty initiatives.

The increasing adoption of cloud-based and SaaS loyalty software solutions is a key factor driving the growth, as they provide scalability, ease of integration, and cost efficiencies to businesses of all sizes. Modern loyalty software solutions are evolving with the integration of advanced technologies like artificial intelligence and machine learning, which enable predictive analytics and real-time customer engagement.

These technologies help businesses analyze consumer behavior more deeply and tailor rewards and experiences accordingly, enhancing customer retention and satisfaction. The software tools also support omnichannel loyalty strategies, allowing customers to interact with brands seamlessly across digital and physical touchpoints, further boosting the appeal and adoption of loyalty software.

By Operator

The Business-to-Business (B2B) operator segment accounts for 65.2% of the Customer Loyalty Software Market. This predominance arises from companies offering loyalty solutions primarily to other businesses rather than individual consumers. B2B providers enable firms to implement loyalty programs targeted at their own customers or partners efficiently.

These solutions typically support complex program requirements, including multi-tier reward structures, customized customer journeys, and integration with existing enterprise systems. B2B loyalty software providers focus on delivering robust and scalable platforms that can handle the demands of diverse industries and large customer bases.

They often emphasize security, compliance, and customization to meet specific business needs. The growth of B2B operations in this market reflects increased recognition among companies that loyalty programs are integral to competitive differentiation and long-term revenue generation. As digital transformation progresses, B2B operators continue enhancing their offerings to provide more sophisticated, data-driven loyalty management capabilities.

By Organization Size

Large enterprises represent the largest segment by organization size, capturing 70.2% of the Customer Loyalty Software Market. These companies have substantial customer bases and require advanced loyalty management solutions capable of supporting high transaction volumes, complex reward schemes, and multi-channel engagement.

Their investments in loyalty software are driven by the need to maintain customer retention and increase lifetime value through personalized and scalable loyalty programs. Large enterprises prefer comprehensive loyalty software that integrates smoothly with their existing IT infrastructure, including CRM, ERP, and marketing automation systems.

They also demand strong data analytics and security features to protect sensitive customer information and comply with regulatory requirements. The dominance of large enterprises in this market segment indicates their strategic priority in leveraging loyalty software as a critical tool for sustaining competitive advantage and enhancing customer experience.

By Vertical

The IT and Telecommunication sector forms the largest vertical segment in the Customer Loyalty Software Market with a 32.6% share. This sector benefits from customer loyalty software by using it to reduce churn, increase customer lifetime value, and deepen customer engagement in a highly competitive environment.

Loyalty programs in this vertical often focus on rewards such as discounts, exclusive content, early upgrades, and premium support services that drive customer satisfaction. Telecom and IT companies leverage loyalty software to manage vast and diverse customer relationships that span individual consumers and enterprises.

The use of data analytics within these platforms helps these companies design tailored loyalty initiatives that align with usage patterns and preferences. The sector’s substantial investment in loyalty software evidences its recognition of the importance of retaining customers amid constant market disruptions and technological advancements.

Key Market Segments

By Offering

- Software

- Cloud-Based

- On-Premises Services

- Professional Services

- Consulting

- Implementation

- Support & Maintenance

- Managed Services

By Operator

- Business-to-Business

- Business-to-Customers

By Organization Size

- Small & Medium Enterprise (SME)

- Large Enterprise

By Vertical

- Transportation

- IT & Telecommunication

- BFSI

- Media & Entertainment

- Retail & Consumer Goods

- Hospitality

- Others.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top 5 Use Cases

- Personalized rewards and offers to enhance customer engagement.

- Customer retention programs to reduce churn and build loyalty.

- Data-driven insights for better decision-making and strategy.

- Omnichannel engagement across online, mobile, and offline channels.

- Gamification features to boost customer interaction and satisfaction.

Driver Analysis

Increasing Demand for Personalized Customer Experiences

The growth of customer loyalty software is largely driven by the rising demand from consumers for tailored and personalized experiences. Customers today expect more than just generic rewards; they want loyalty programs that recognize their individual preferences and behaviors.

This demand pushes companies to adopt advanced loyalty software that leverages data analytics and AI to provide personalized offers and rewards. By delivering relevant rewards and experiences, businesses can significantly improve customer engagement, satisfaction, and retention. This enhances the overall lifetime value of customers, making personalized loyalty programs a key growth driver for the software market.

Moreover, businesses realize that retaining loyal customers through personalized interactions is more cost-effective than acquiring new ones. This cost-saving incentive encourages firms to invest in loyalty software solutions that provide detailed customer insights, enabling them to tailor marketing strategies and reward mechanisms dynamically.

Restraint Analysis

High Implementation and Maintenance Costs

One significant restraint in the adoption of customer loyalty software is the high cost of implementation and ongoing maintenance. Many small and medium-sized businesses (SMBs) face budget constraints that make the initial investment in advanced loyalty management systems difficult.

Beyond the software purchase, companies also have to bear costs for system integration, customization according to specific business needs, employee training, and continuous updates. These costs can add up, deterring smaller players from adopting or scaling loyalty solutions effectively.

Additionally, maintaining these systems requires continuous data management and compliance with privacy regulations, which further increases operational expenses. This financial burden limits the widespread uptake of loyalty program software, particularly among businesses lacking strong technical capabilities or financial resources.

Opportunity Analysis

Growing Adoption of Cloud-Based Loyalty Solutions

A promising opportunity in the customer loyalty software market is the expanding adoption of cloud-based loyalty program solutions. Cloud technology offers several advantages including lower upfront costs, scalability, and easier integration with other digital business tools.

These benefits make loyalty software more accessible to a broader range of businesses, including SMEs that previously found it too costly or complicated to implement traditional on-premise systems. Cloud platforms enable real-time updates and seamless connectivity across multiple sales channels, allowing businesses to deliver uniform and engaging loyalty experiences both online and offline.

Additionally, cloud-based solutions facilitate quick deployment and customization, enabling companies to scale their loyalty programs as they grow. This shift towards cloud adoption not only opens the market to new entrants but also supports innovation and agility, representing a major growth engine for the software industry.

Challenge Analysis

Integration with Existing Systems

A critical challenge faced by businesses implementing customer loyalty software is the seamless integration with their existing systems and platforms. Many companies operate multiple legacy software for customer relationship management, point of sale, and e-commerce, which may not easily connect with new loyalty software solutions.

Ensuring smooth interoperability between these systems is crucial to maintaining data accuracy and delivering a consistent customer experience. Integration complexities can lead to delays, higher costs, and operational disruptions, making businesses cautious about adopting new loyalty technologies.

Moreover, the need for continuous technological updates and compatibility with evolving business systems adds to this challenge. Without robust integration capabilities, loyalty software might fail to capture the full benefits of customer data and program management, hampering effective loyalty strategy execution and slowing market growth.

SWOT Analysis

Strengths

- Strong demand for customer retention and engagement solutions.

- Cloud-based scalability makes adoption easier for SMEs and enterprises.

- Advanced analytics and AI enable personalized experiences.

- Enhances brand value and competitive differentiation.

Weaknesses

- High implementation and integration costs.

- Data security and compliance concerns.

- Complexity in integrating with legacy systems.

- Consumer fatigue from multiple loyalty programs.

Opportunities

- Growing adoption of AI, machine learning, and Gen AI.

- Rising digital payments and mobile-first engagement.

- Expansion in emerging markets with rapid digitization.

- Omnichannel loyalty ecosystems driving engagement.

Threats

- Rapid technological changes may outpace adoption.

- Intense market competition with low differentiation.

- Risk of data breaches damaging brand trust.

- Shifting consumer expectations requiring constant innovation.

Key Players Analysis

Key Players Analysis

The Customer Loyalty Software Market is strongly influenced by global technology leaders and established loyalty program providers. Companies such as Aimia Inc., BOND BRAND LOYALTY INC., and Brierley+Partners play a vital role in designing advanced customer engagement strategies. These companies have experienced growth in recent years, with Aimia Inc. expanding its services and growing revenue by 8% annually. BOND BRAND LOYALTY INC. saw a 10% increase in market share, driven by improvements in reward programs, analytics, and personalized solutions that help businesses enhance customer retention.

Technology-driven enterprises have also built strong positions in the market. Firms such as IBM Corporation, Comarch SA, Five Stars Loyalty Inc., and ICF International Inc. contribute through innovations in data analytics, automation, and cloud-based solutions. IBM Corporation has seen a 12% growth in its loyalty software offerings, with continued investment in AI-powered solutions. Comarch SA reported a 9% increase in revenue from its loyalty platform, while Five Stars Loyalty Inc. grew by 15% due to its focus on small to medium-sized businesses. ICF International Inc. has expanded its client base by 11%, largely due to its data-driven solutions and strong customer retention rates.

The competitive structure also includes enterprise software giants and specialized marketing firms. Oracle Corporation, Salesforce Inc., SAP SE, AnnexCloud, and Tibco Software Inc. hold strong positions due to their extensive customer relationship management capabilities. Oracle Corporation has increased its market share by 14% in the past year, while Salesforce Inc. grew its loyalty software division by 18%, driven by its CRM integration capabilities. SAP SE experienced a 10% growth in loyalty software revenue, with significant contributions from its data analytics and CRM offerings. AnnexCloud grew by 13%, and Tibco Software Inc. achieved a 9% increase in its client base, solidifying their positions in the competitive market. These companies provide robust solutions that help businesses leverage customer loyalty strategies for enhanced customer engagement and long-term revenue generation.

Top Key Players

- Aimia Inc.

- BOND BRAND LOYALTY INC.

- Brierley+Partners

- IBM Corporation

- Comarch SA

- Five Stars Loyalty Inc.

- ICF International Inc.

- Kobie Marketing

- The Lacek Group

- Martiz Holdings Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- AnnexCloud

- Tibco Software Inc.

- Others.

Strategic Recommendations

For Investors

Investors should focus on funding companies that are leveraging AI, machine learning, and cloud-based platforms to transform loyalty programs. The market’s strong CAGR and demand for data-driven personalization make it a promising sector with high ROI potential. Backing firms with scalable solutions and expansion strategies in emerging markets can unlock long-term growth opportunities.

For Startups

Startups should emphasize affordability, flexibility, and niche-focused innovation. Offering SME-friendly loyalty solutions with easy integration into existing CRM and e-commerce systems will create a competitive edge. Leveraging generative AI for hyper-personalized engagement and gamified experiences can help new entrants differentiate in a crowded market.

For Established Players

Established providers must focus on enhancing omnichannel engagement, expanding global reach, and strengthening security compliance. Strategic acquisitions and partnerships will help broaden portfolios, while continuous innovation in predictive analytics and automation will secure long-term leadership. Prioritizing customer trust through data security and privacy-first approaches will be critical for sustaining market dominance.

Recent Developments

- March 2025: A major loyalty software provider launched an AI-driven personalization engine, enabling real-time engagement and predictive customer behavior modeling. This innovation is expected to increase customer engagement by 15%, contributing to a notable growth trajectory in the market.

- January 2025: A cloud-native loyalty solution designed for SMEs was introduced, offering faster deployment, scalability, and cost efficiency. However, initial adoption rates were slower than anticipated, with only a 7% market penetration in the first quarter, as small businesses often face challenges in adopting new technologies due to budget constraints and integration complexities.

- October 2024: A strategic collaboration between a loyalty platform and a global payment provider enabled seamless integration of loyalty points with digital wallets. This partnership led to a 12% increase in transaction volume among participating retailers, demonstrating strong growth potential. However, there were initial setbacks in integration, causing delays in the rollout for some users, which resulted in a temporary 5% drop in user engagement in the early stages.

Report Scope

Report Features Description Market Value (2024) USD 12.5 Bn Forecast Revenue (2034) USD 77.40 Bn CAGR(2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Offering(Software, Cloud-Based, On-Premises Services, Professional Services, Consulting, Implementation, Support & Maintenance, Managed Services, By Operator(Business-to-Business, Business-to-Customers), By Organization (Size, Small & Medium Enterprise (SME), Large Enterprise), By Vertical(Transportation, IT & Telecommunication, BFSI, Media & Entertainment, Retail & Consumer Goods, Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aimia Inc., BOND BRAND LOYALTY INC., Brierley+Partners, IBM Corporation, Comarch SA, Five Stars Loyalty Inc., ICF International Inc., Kobie Marketing, The Lacek Group, Martiz Holdings Inc., Oracle Corporation, Salesforce Inc., SAP SE, AnnexCloud, Tibco Software Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Customer Loyalty Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Customer Loyalty Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aimia Inc.

- BOND BRAND LOYALTY INC.

- Brierley+Partners

- IBM Corporation

- Comarch SA

- Five Stars Loyalty Inc.

- ICF International Inc.

- Kobie Marketing

- The Lacek Group

- Martiz Holdings Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- AnnexCloud

- Tibco Software Inc.

- Others