Global Customer Communication Management (CCM) Market Size, Share, Industry Analysis Report By Component (Software, Services), By Deployment (On-Premises, Cloud), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises), By Vertical (BFSI, Government, Healthcare, IT & Telecom, Travel & Hospitality, Retail & Ecommerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167573

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

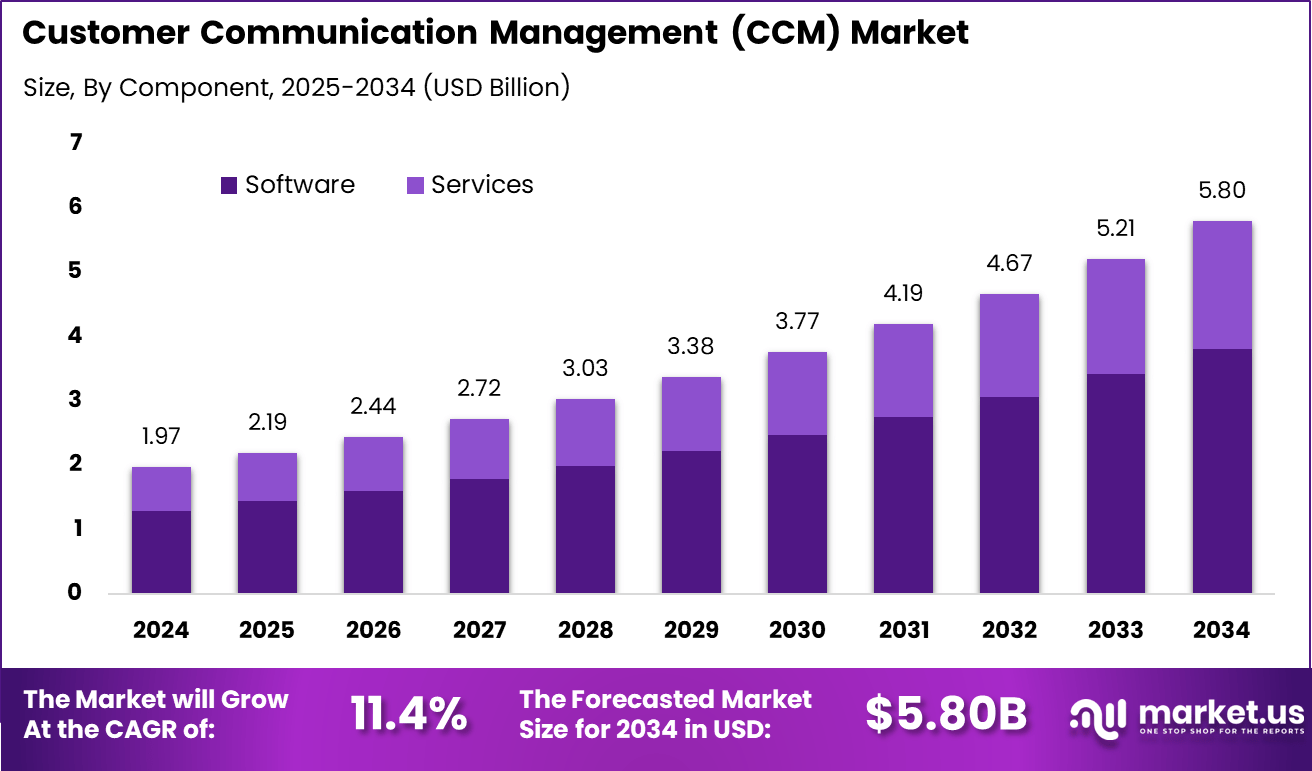

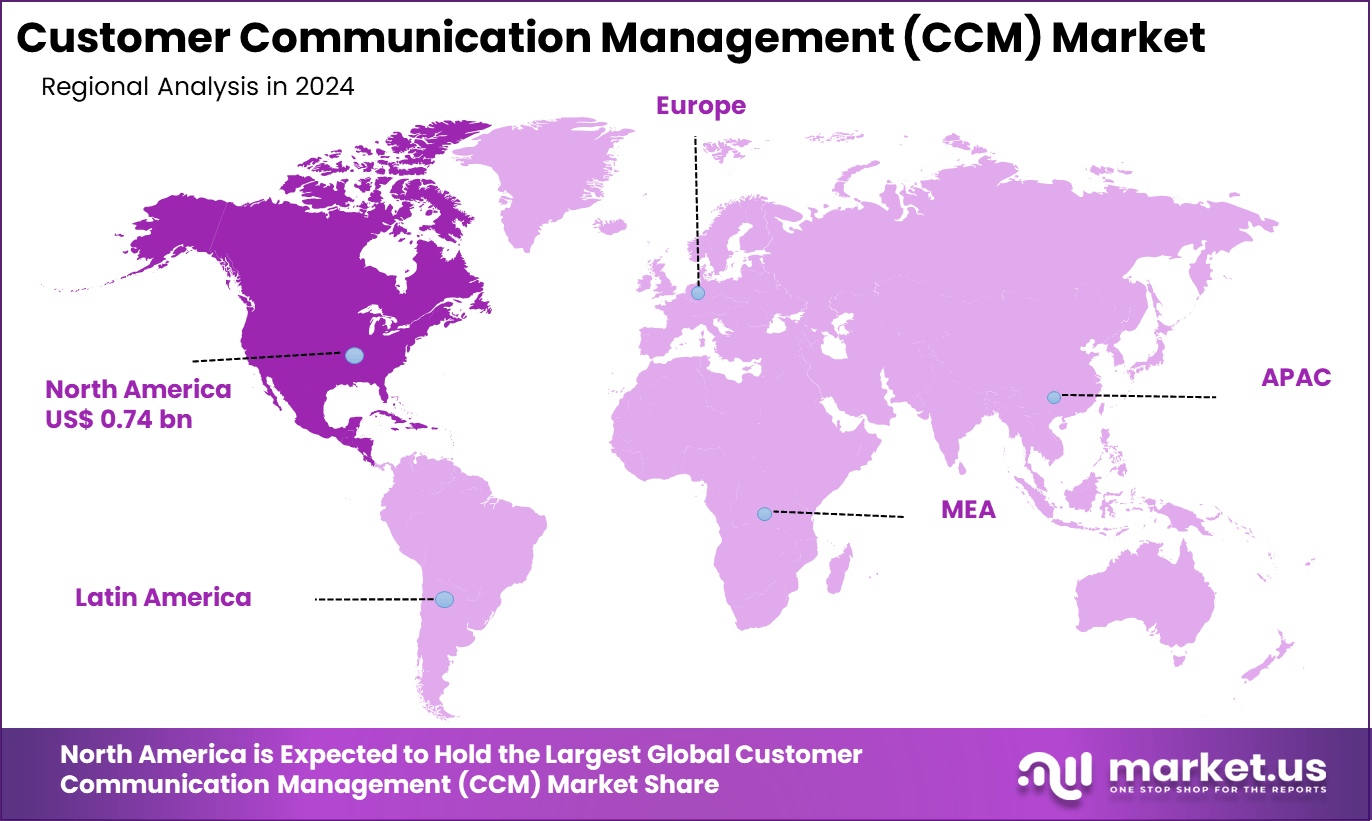

The Global Customer Communication Management (CCM) Market size is expected to be worth around USD 5.80 billion by 2034, from USD 1.97 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.8% share, holding USD 0.74 billion in revenue.

The customer communication management market has expanded as organisations modernise how they create, manage and deliver personalised communications across digital and print channels. Growth reflects rising customer expectations for consistent and timely information, increasing adoption of omnichannel engagement and the shift from legacy document systems to cloud based platforms. CCM now plays an essential role in supporting customer experience strategies across industries.

The growth of the market can be attributed to increasing digital transformation initiatives, higher demand for personalised communications and stronger regulatory requirements for accurate customer outreach. Companies require CCM platforms to centralise messaging, automate document workflows and ensure compliance with communication standards. Rising use of mobile apps, web portals and digital statements further supports market expansion.

According to Quadient, 56% of leading organizations are prioritizing AI driven personalization to enhance customer experiences, while about two thirds rely on automation to manage multichannel communication. Nearly 90% of companies using AI in customer communication report better efficiency or improved personalization, and cloud or hybrid models account for just over half of global CCM deployments.

Research shows that personalization increases click through rates by 41% and raises open rates by 26%, while interactive content drives 52.6% higher engagement and can double conversions. Poor communication caused 20% of consumers to switch providers in 2025, rising to 25% among people aged 18 to 43. Strong omnichannel strategies support 89% retention compared with 33% for brands without, and 81% of consumers ignore irrelevant messages.

For instance, In September 2025, Sefas Innovation Inc. was recognized as a global leader in Customer Communication Management for enterprise communication processing and post composition solutions. The company has been expanding its capabilities in multichannel communication orchestration and document reengineering. This progress reflects its focus on helping enterprises manage complex, high volume customer communications more efficiently.

The market is seeing rapid adoption of cloud computing, automation tools, artificial intelligence, and analytics. Improved software covers almost 66% of implementations, with businesses using CCM to tailor communications for every customer by drawing from different systems. The industry is also integrating voice and visual communication analytics, enabling companies to measure satisfaction and quickly react to customer frustration for faster service agent training and better results.

Key Takeaway

- In 2024, the Software segment led the Global Customer Communication Management Market with a 65.7% share.

- In 2024, the Cloud segment dominated the market with a 60.2% share.

- Large Enterprises accounted for the highest usage in 2024 with a 72.1% share.

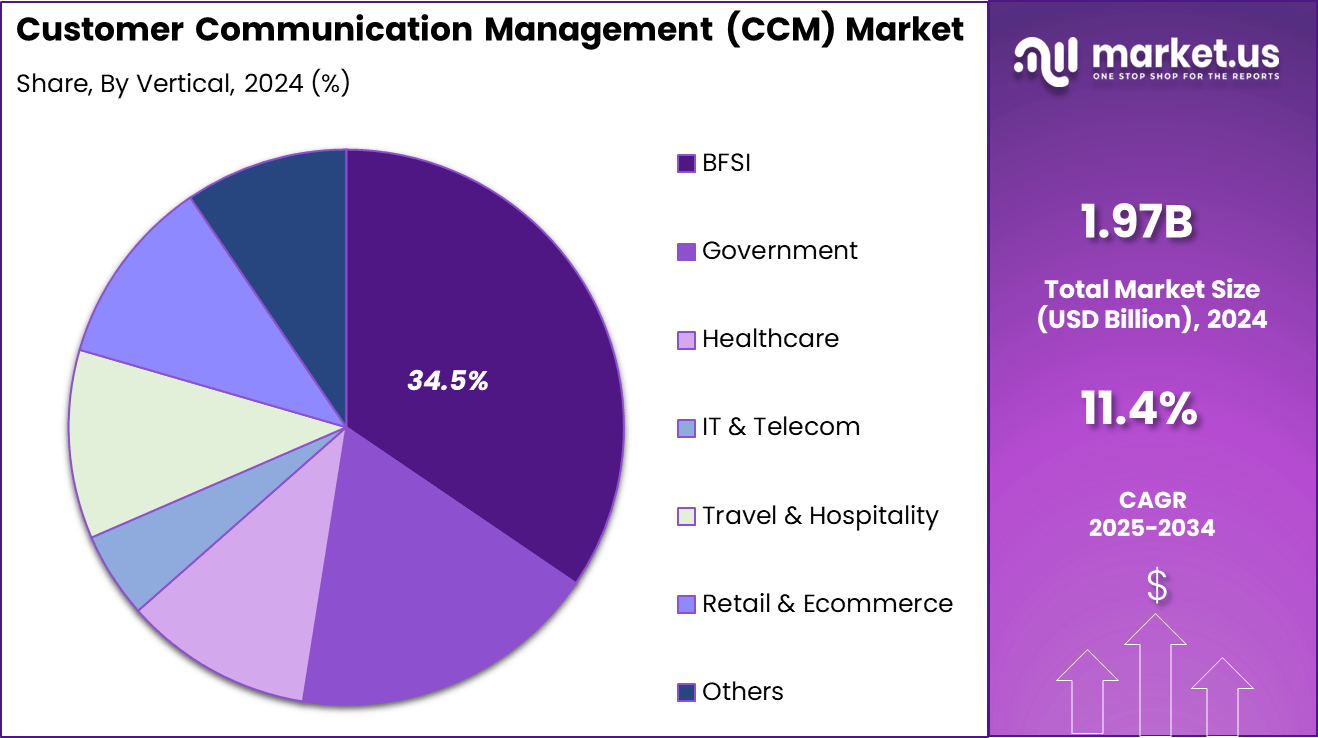

- The BFSI segment held the top industry share in 2024 with 34.5%.

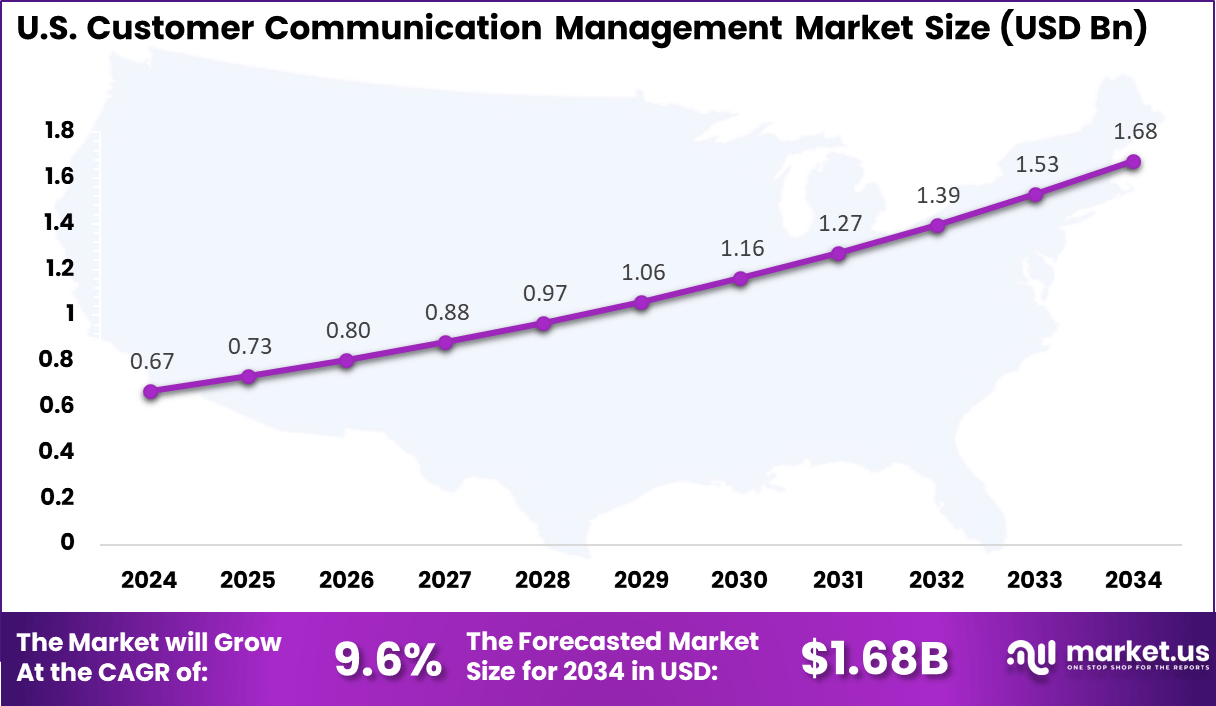

- The U.S. CCM Market reached USD 0.67 Billion in 2024 with a strong 9.6% CAGR.

- North America remained the leading region in 2024 with a 37.8% share.

Role of Generative AI

The role of Generative AI in Customer Communication Management (CCM) plays a transformative part by automating routine customer interactions and delivering personalized content in real time. This technology can reduce decision-making delays and enhance responsiveness, enabling businesses to experiment with new ways to engage customers effectively.

With generative AI, companies can tailor communications dynamically based on customer behavior and context, making messages feel more personal and relevant across multiple channels. Studies show that such AI-driven communication improves engagement rates and boosts customer satisfaction, with responsiveness improvements cutting wait times significantly.

Generative AI also streamlines content creation by significantly reducing the time and effort required for preparing customer messages. It minimizes errors often caused by manual drafting, thus creating more consistent and reliable communication experiences. Around 70% of customer service tasks are reported to be benefiting from AI automation, which frees up human agents to resolve complex issues while AI handles routine queries.

U.S. CCM Market Size

The market for Customer Communication Management (CCM) within the U.S. is growing tremendously and is currently valued at USD 0.67 billion, the market has a projected CAGR of 9.6%. This growth is fueled by the increasing adoption of cloud-based CCM solutions, which offer greater flexibility and scalability for businesses.

Additionally, the rising demand for personalized and omnichannel customer communication drives the market, as companies seek to improve customer engagement and satisfaction. Technological advances such as AI and automation further support efficient communication workflows across industries like banking and telecommunications, boosting market expansion.

For instance, in September 2025, Sefas Innovation Inc. was ranked among world leaders in CCM by ASPIRE for its solutions in Enterprise Communications Processing and AnyPrem CCM Software, emphasizing its expertise in document reengineering and multichannel journey orchestration.

In 2024, North America held a dominant market position in the Global Customer Communication Management (CCM) Market, capturing more than a 37.8% share, holding USD 0.74 billion in revenue. This strong position comes from early adoption of cloud-based CCM solutions and stringent consumer protection regulations that push companies to maintain compliance and transparency in communications.

The region benefits from a robust ecosystem of CCM providers and continuous innovation, particularly in AI and machine learning, which enhances personalized and efficient customer interactions. Additionally, key sectors like telecommunications and BFSI drive high CCM usage, reinforcing market leadership. This foundation supports sustained growth and significant market influence in North America.

For instance, in April 2025, Smart Communications Inc. was recognized as a leader in the 2025 SPARK Matrix for Customer Communication Management (CCM) due to its cloud-native architecture, AI-driven automation, and omnichannel capabilities, which enable enterprises to efficiently scale personalized communications without legacy constraints.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 65.7% share of the Global Customer Communication Management (CCM) Market. Software’s capabilities to streamline and automate the creation, management, and delivery of customer communications.

Businesses prefer solutions that bring together multiple communication functions on a unified platform, which reduces the complexity of handling separate tools and boosts operational efficiency. These integrated solutions also help companies to personalize messaging, ensure compliance, and analyze communication performance, which are crucial for improving customer engagement.

This preference for robust CCM software reflects growing needs for real-time interactions and seamless integration with business systems. Organizations aim to strengthen their customer relationships by delivering targeted, timely messages across channels such as email, SMS, and print. The software’s ability to support these diverse communication styles in a compliant and scalable way solidifies its leadership in the component segment.

For Instance, in March 2025, Messagepoint Inc. unveiled an AI-powered translation tool within its software suite aimed at improving content accuracy and multilingual support in CCM. This innovation reflects the priority on software enhancements that streamline customer communication workflows and personalization.

Deployment Analysis

In 2024, the Cloud segment held a dominant market position, capturing a 60.2% share of the Global Customer Communication Management (CCM) Market. Cloud platforms enable businesses to access CCM tools anywhere, making it easier to support remote teams and multi-channel delivery. This deployment style offers faster implementation and simpler maintenance compared to on-premises setups, which encourages greater adoption, especially among companies undergoing digital transformation.

Furthermore, cloud-based CCM solutions facilitate seamless upgrades and integration with other cloud services, improving collaboration and communication consistency. The operational benefits cloud offers include scalability during peak demand and reduced investment in physical infrastructure, aligning well with the needs of both large and growing enterprises aiming to enhance customer communication agility.

For instance, in July 2025, Smart Communications Inc. attracted a majority investment from Cinven, highlighting its leadership in cloud-native CCM technology. The company emphasized its cloud-based SmartHUB™ digital archive launched earlier in the year, bolstering secure and scalable communication deployments.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 72.1% share of the Global Customer Communication Management (CCM) Market. These organizations benefit from CCM platforms that can manage extensive customer data, multiple departments, and varied communication channels efficiently. Large-scale operations require solutions that ensure consistency, compliance, and customization in messaging, which these platforms are designed to deliver.

The deeper pockets of large enterprises also allow them to invest in cutting-edge CCM technologies that integrate analytics, automation, and multichannel delivery. This investment helps them improve customer satisfaction and operational efficiency while supporting large communication volumes that small and medium-sized businesses might find challenging to handle.

For Instance, in June 2024, Cincom Systems, Inc. was acquired by PartnerOne, joining a portfolio that supports large enterprises with flexible software solutions for CCM and complex business process optimization. The acquisition aims to maintain high service levels for enterprise clients, leveraging Cincom’s CCM software.

Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 34.5% share of the Global Customer Communication Management (CCM) Market. Financial institutions rely heavily on CCM solutions to handle sensitive communications that must comply with strict regulations. They often use these platforms to distribute important documents, statements, alerts, and marketing messages tailored to specific client needs, preserving trust and clarity.

Despite the rise of digital channels, BFSI still depends largely on print and SMS communication, sustaining demand for CCM systems that support traditional and digital formats. The sector also benefits from outsourcing CCM services to reduce operational costs while enhancing service quality, giving BFSI a leading position in the market.

For Instance, in August 2025, Sefas Innovation announced multiple partnerships, including one with Beyond Encryption to provide secure document distribution for BFSI clients, addressing regulatory and security needs unique to financial communications.

Emerging trends

Emerging trends in CCM highlight a strong shift toward AI-powered hyper-personalization and omnichannel engagement. Hyper-personalization uses advanced algorithms to customize communication for individual customer preferences and behaviors, addressing the dissatisfaction 76% of customers feel towards generic messaging.

This trend is driving businesses to move beyond static templates towards more interactive and contextually relevant dialogue with customers. Omnichannel CCM ensures seamless customer interactions across email, SMS, social media, and websites, meeting customers wherever they prefer to communicate.

Another important emerging trend is the integration of CCM with broader customer experience management (CXM) and customer relationship management (CRM) platforms. Instead of isolated systems, businesses are adopting integrated ecosystems that unify communication, engagement, and service workflows. This convergence improves data sharing and consistency across channels, enabling a smoother and more connected experience throughout the customer lifecycle.

Growth Factors

Growth factors for the CCM market include the rising demand for digital transformation and enhanced customer experience. As businesses shift to cloud-based solutions, customer communication becomes easier to manage and scale across channels.

The adoption of machine learning and natural language processing is pushing broader market growth, helping companies make customer interactions more productive and context-aware. Small and medium businesses are increasingly recognizing CCM’s role in streamlining communication and improving customer relationships, fueling significant growth in this segment.

Another key driver is regulatory compliance and data security requirements. With strict data privacy laws like GDPR and CCPA, companies must ensure secure and transparent handling of customer information. CCM platforms play an important role in meeting these standards by enabling compliant and auditable communication processes.

Key Market Segments

By Component

- Software

- Document Composition

- Email Marketing

- SMS and Push Notifications

- Interactive Documents

- Others

- Services

- Managed Services

- Professional Services

- Consulting

- Support & Maintenance

- System Integration & Implementation

By Deployment

- On-Premises

- Cloud

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises

By Vertical

- BFSI

- Government

- Healthcare

- IT & Telecom

- Travel & Hospitality

- Retail & Ecommerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growth from Omnichannel Customer Engagement

One main growth driver for the CCM market is the rising need for businesses to stay connected with customers through multiple channels. Customers expect to communicate with companies easily via email, SMS, social media, mobile apps, and voice. CCM systems enable organizations to deliver consistent and personalized messages across all these channels, which helps maintain strong customer relationships and satisfaction.

This demand for omnichannel interaction pushes companies to adopt advanced CCM solutions to manage diverse communication channels effectively. Providing timely and relevant information keeps customers engaged and loyal, which boosts market growth. The adoption of AI and automation further enhances this capability by personalizing interactions at scale and improving operational efficiency.

For instance, In June 2025, Quadient SA advanced its digital financial automation strategy in Europe by acquiring Serensia, a French electronic invoicing platform. The deal enhanced its position in digital compliance and supported customers preparing for mandatory e invoicing. This move aligned with the market shift toward automated and compliant omnichannel customer communication.

Restraint

Data Synchronization and System Complexity

A key restraint limiting CCM market growth is the complexity involved in synchronizing large volumes of customer data across multiple channels and systems. Organizations collect data from numerous sources, but integrating this information efficiently to create a unified customer view is challenging. Inconsistent or fragmented data can disrupt communication workflows and reduce the quality of customer interactions.

Moreover, integrating CCM solutions into existing legacy systems often requires significant technical effort and cost. Smaller businesses face particular difficulties due to limited technical expertise and resources. These factors slow down the adoption and scaling of CCM systems, restraining overall market expansion.

For instance, in November 2025, Pitney Bowes Inc. revealed plans for a debt buyback to proactively manage its long-term liabilities amid shrinking core markets and competitive pressures. The company faces challenges due to declining revenues in key sectors and the cost burdens associated with maintaining and upgrading CCM systems, showing how financial and operational complexity can restrain growth for CCM providers.

Opportunities

Integration of CCM with Cloud Technologies

The increasing use of cloud computing presents a big opportunity for the CCM market. Cloud-based CCM solutions offer scalability, flexibility, and cost benefits compared to on-premises systems. Organizations can easily deploy and manage communications platforms, streamline collaboration, and access advanced analytics in real time.

Adopting cloud CCM makes it easier for businesses, including small and medium enterprises, to leverage sophisticated communication tools without heavy infrastructure investments. This helps them enhance customer experiences and compete better. Market growth is expected to accelerate as more companies move towards cloud-first strategies for their communication needs.

For instance, in August 2025, Smart Communications Inc. secured a majority investment from private equity firm Cinven to scale global growth and innovate in customer communications management technology. This strategic capital infusion highlights the opportunity in expanding cloud-native CCM platforms, enabling broader adoption by regulated industries needing flexible and scalable communication solutions.

Challenges

Ensuring Data Privacy and Security

Data privacy and security concerns create one of the biggest challenges for the CCM market. Handling sensitive customer information demands strict compliance with regulations like GDPR and CCPA. Companies must safeguard data across all communication channels to avoid breaches and penalties.

Meeting these regulatory requirements incurs added costs and operational complexities. It also requires ongoing vigilance to protect customer trust while enabling personalized communications. The pressure to comply with evolving privacy laws slows down CCM adoption in some sectors and demands continuous innovation from solution providers.

For instance, in August 2025, Sefas Innovation Inc. announced several strategic partnerships with secure document delivery and intelligent document processing providers to address key customer communication challenges, particularly in secure delivery and compliance. These partnerships underline the ongoing challenge CCM vendors face in meeting strict data privacy, security, and regulatory demands while enhancing customer experience across multiple channels.

Key Players Analysis

Quadient, Smart Communications, Messagepoint, and Doxee lead the customer communication management market with strong platforms designed for omnichannel messaging, personalized content creation, and regulatory compliance. Their solutions support large enterprises in financial services, insurance, and utilities. These companies focus on improving communication accuracy, reducing manual processes, and enabling consistent delivery across print, email, and digital channels.

Sefas Innovation, Pitney Bowes, Cincom Systems, Doxim, Topdown Systems, GhostDraft, and Newgen Software strengthen the competitive landscape with robust CCM tools that integrate template management, dynamic content, and customer journey mapping. Their platforms help organizations unify communication strategies, accelerate document generation, and enhance customer engagement.

Crawford Technologies, DataOceans, Solimar Systems, Broadridge, BlueRush, Compart, Eclipse Corporation, and other participants expand the market with flexible CCM solutions for mid-sized businesses and sector-specific needs. Their offerings emphasize ease of deployment, strong API integrations, and enhanced data handling. These companies help organizations modernize legacy communication systems while improving response times and user experience.

Top Key Players in the Market

- Quadient SA

- Smart Communications Inc.

- Messagepoint Inc.

- Doxee S.p.A.

- Sefas Innovation Inc.

- Pitney Bowes Inc.

- Cincom Systems, Inc.

- Doxim Inc.

- Topdown Systems Corporation

- GhostDraft LLC

- Newgen Software Technologies Limited

- Crawford Technologies Inc.

- DataOceans LLC

- Solimar Systems Inc.

- Broadridge Customer Communications, Inc.

- BlueRush Inc.

- Compart AG

- Eclipse Corporation

- Others

Recent Developments

- In April 2025, Messagepoint Inc. was recognized as a leader in the 2025 SPARK Matrix for Customer Communication Management. The company’s cloud-native platform, powered by AI and machine learning, supports scalable omnichannel communications, enabling faster, smarter customer communications for enterprises, especially in regulated industries.

- In August 2025, Smart Communications Inc. secured a major investment shift as Accel-KKR sold a majority interest to private equity firm Cinven. This move follows years of strong growth and development under Accel-KKR, positioning Smart Communications as a leader in cloud-based CCM with expansion into new global markets, including Australia and Europe.

Report Scope

Report Features Description Market Value (2024) USD 1.97 Bn Forecast Revenue (2034) USD 5.8 Bn CAGR(2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (On-Premises, Cloud), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises), By Vertical (BFSI, Government, Healthcare, IT & Telecom, Travel & Hospitality, Retail & Ecommerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Quadient SA, Smart Communications Inc., Messagepoint Inc., Doxee S.p.A., Sefas Innovation Inc., Pitney Bowes Inc., Cincom Systems, Inc., Doxim Inc., Topdown Systems Corporation, GhostDraft LLC, Newgen Software Technologies Limited, Crawford Technologies Inc., DataOceans LLC, Solimar Systems Inc., Broadridge Customer Communications, Inc., BlueRush Inc., Compart AG, Eclipse Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Customer Communication Management MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Customer Communication Management MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Quadient SA

- Smart Communications Inc.

- Messagepoint Inc.

- Doxee S.p.A.

- Sefas Innovation Inc.

- Pitney Bowes Inc.

- Cincom Systems, Inc.

- Doxim Inc.

- Topdown Systems Corporation

- GhostDraft LLC

- Newgen Software Technologies Limited

- Crawford Technologies Inc.

- DataOceans LLC

- Solimar Systems Inc.

- Broadridge Customer Communications, Inc.

- BlueRush Inc.

- Compart AG

- Eclipse Corporation

- Others