Global CPE Router Market Size, Share Analysis Report By Product Type (Wired CPE Routers, Wireless CPE Routers), By Application (Residential, Commercial, Industrial), By Connectivity (4G, 5G, Fiber Optic, DSL, Others), By End-User (Telecom Operators, Enterprises, Individuals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150769

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

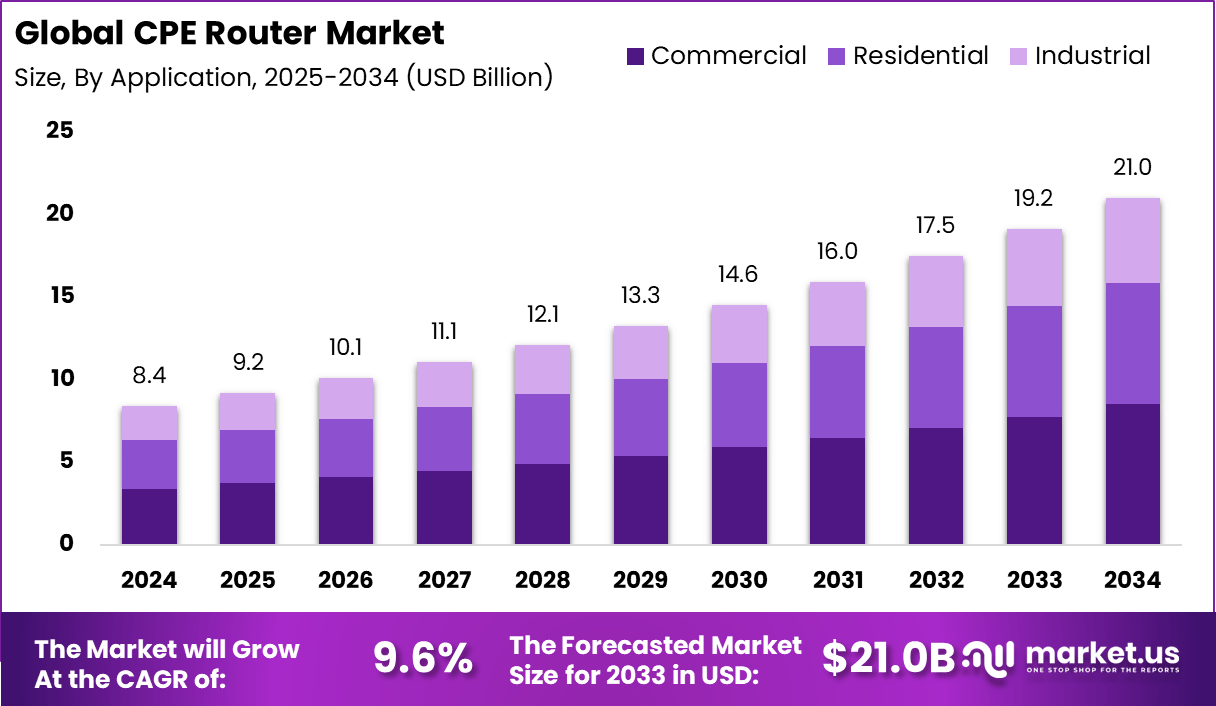

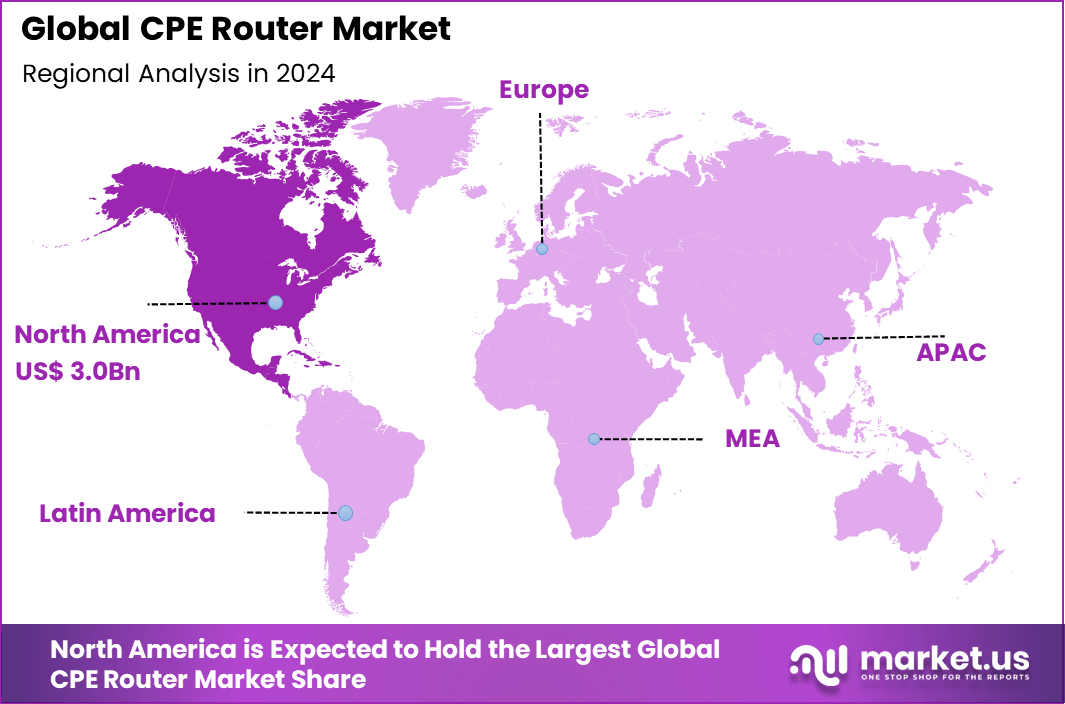

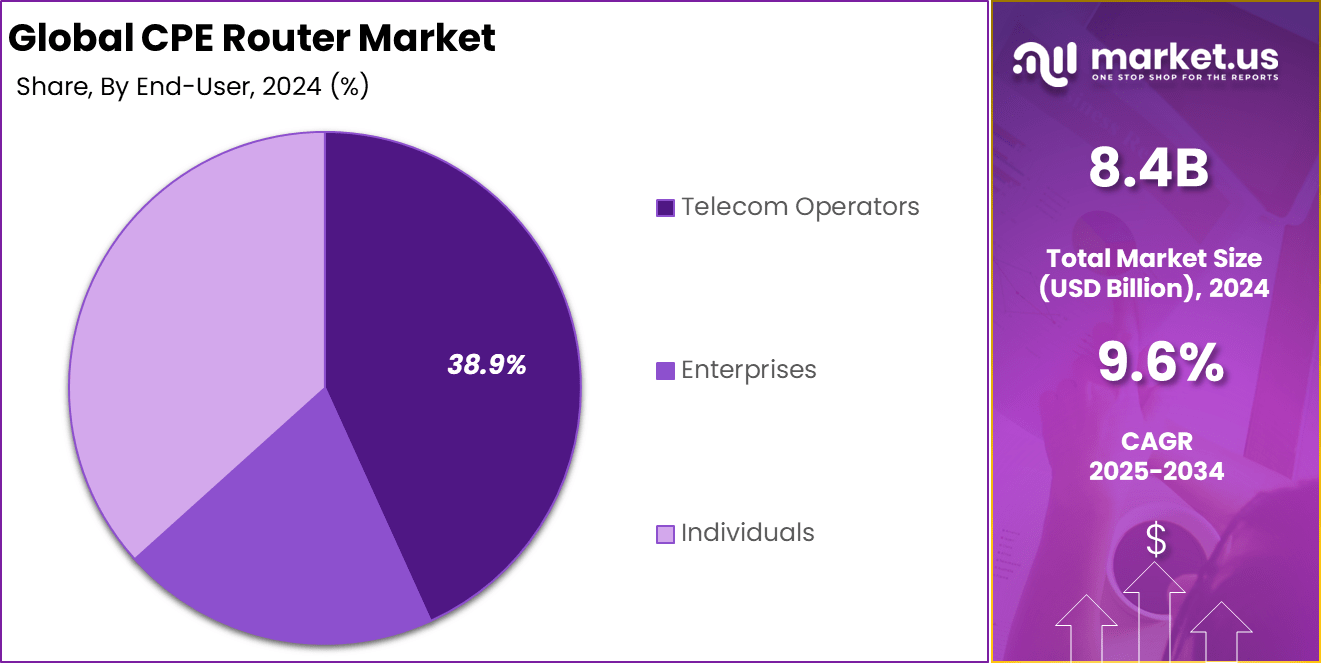

The Global CPE Router Market size is expected to be worth around USD 21.0 Billion By 2034, from USD 8.4 billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.2% share, holding USD 3.0 Billion revenue.

The CPE (Customer Premises Equipment) Router Market refers to routers and network devices installed at homes or businesses to connect with service providers’ networks. These include 4G/5G gateways, fiber‑optic routers, Wi‑Fi devices, mesh systems, and hybrid access points. CPE routers serve as the interface between the broader telecom or ISP network and the local user environment.

The market is led by residential, enterprise, transportation and industrial applications. Products range from indoor fixed routers to outdoor units with LTE/5G and Wi‑Fi 6/7 capabilities. The market shows strong momentum in APAC, North America and Europe. Top driving factors in the market are chiefly the global demand for high‑speed internet and the growth of smart home and IoT applications.

Consumers and businesses increasingly require reliable, multi‑device connectivity. The remote work and virtual learning trends, which accelerated during the Covid‑19 pandemic, continue to require advanced home networking, anchoring sustained router sales. Increasing adoption of technologies such as Wi‑Fi 6, Wi‑Fi 7, 5G/LTE, and cloud‑managed networks is evident.

Wi‑Fi 6 and 6e offer enhanced throughput and capacity for multiple devices. In parallel, 5G‑enabled CPE routers are being deployed to deliver broadband in locations where fiber is unavailable. Cloud‑managed tools further appeal by simplifying deployment and monitoring at scale. Investment opportunities can be found in emerging markets, notably in Asia‑Pacific and India, where internet penetration is still growing.

The roll‑out of 5G infrastructure opens new avenues, especially for fixed wireless access. Hardware manufacturers investing in energy‑efficient and environmentally sustainable designs may gain favorable positioning as regulatory and consumer attention to green practices intensifies.

Key Takeaways

- The Global CPE Router Market is projected to reach USD 21.0 Billion by 2034, expanding from USD 8.4 Billion in 2024, driven by a steady CAGR of 9.6% over the forecast period. The rising demand for high-speed connectivity and scalable broadband infrastructure continues to push this growth forward.

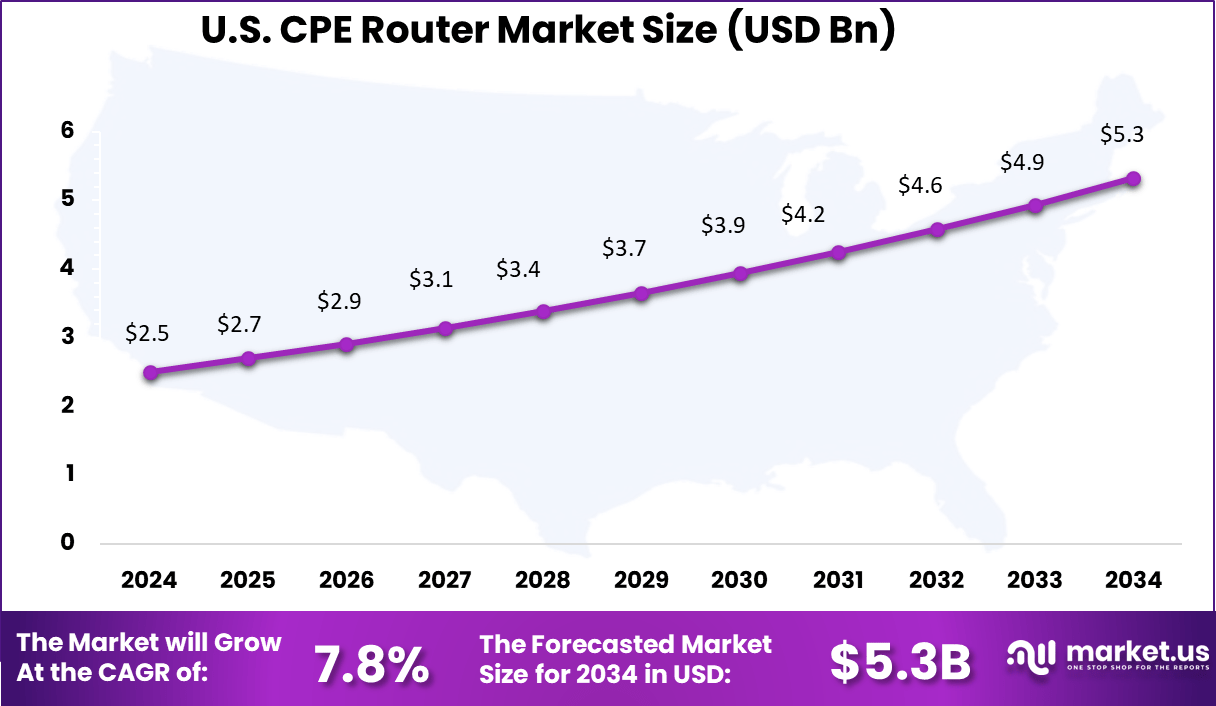

- In 2024, North America led the global market, securing a 36.2% revenue share, with the US alone contributing USD 2.51 Billion, supported by a solid 7.8% CAGR outlook. This regional dominance is attributed to large-scale digitalization initiatives and robust telecom investments.

- Among product categories, Wired CPE Routers accounted for 64.2%, demonstrating stronger preference for reliable and stable wired solutions in enterprise-grade and fixed broadband settings.

- Within the application landscape, the Commercial segment captured 40.5%, reflecting growing deployment in office complexes, retail networks, and public infrastructure requiring consistent internet performance.

- By connectivity, 4G held a 28.7% share, indicating strong adoption in developing areas and among operators bridging the digital divide with cost-effective wireless coverage.

- Telecom Operators remained the leading end-users, claiming 38.9% share, as service providers continue integrating advanced CPE devices to deliver last-mile connectivity and optimize customer experience across expanding networks.

US Market Expansion

The US CPE Router Market is valued at approximately USD 2.5 Billion in 2024 and is predicted to increase from USD 3.7 Billion in 2029 to approximately USD 5.3 Billion by 2034, projected at a CAGR of 7.8% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 36.2% share and generating approximately USD 3 billion in revenue. This leadership is driven by the region’s accelerated roll‑out of 5G networks and robust fiber broadband investments that have enabled service providers and enterprises to rapidly deploy advanced CPE routers.

The presence of major manufacturers and continuous innovation in Wi‑Fi 6/7 and cloud‑managed platforms have further supported North America’s strong performance. North America’s supremacy is also explained by high urbanization levels and heavy consumer demand for seamless, high‑bandwidth connectivity.

The rise of remote work, streaming services, and IoT ecosystems has increased reliance on high‑performance CPE routers in both homes and businesses. Rigorous cybersecurity and regulatory frameworks ensure product reliability and foster consumer confidence, reinforcing continued market dominance.

By Product Type Analysis

In 2024, the Wired CPE Routers segment held a dominant market position, capturing more than a 64.2% share. This leadership reflects the enduring importance of wired connectivity – such as DSL, fiber‑optic, and Ethernet – in delivering stable and high‑speed broadband services.

Enterprises and service providers continue to rely on these routers to support mission‑critical operations, with consistent throughput and minimal latency regarded as essential. The robust infrastructure investments in many regions reinforced this preference, as wired routers are often deployed where fiber or cable networks are already well established.

The dominance of wired CPE routers is also driven by their cost‑efficiency and reliability. In business environments, especially in small to medium enterprises and data centers, wired connectivity ensures dependable performance under heavy traffic loads.

Unlike wireless solutions, which may face interference or require complex mesh configurations for full coverage, wired routers offer plug‑and‑play simplicity and long‑term stability. This translates into lower maintenance costs and predictable operating environments, aligning closely with enterprise IT expectations.

By Application Analysis

In 2024, the Commercial segment held a dominant market position, capturing more than a 40.5% share. This leadership reflects sustained investment by businesses in high-speed, reliable connectivity. Commercial environments – such as offices, retail spaces, hospitality venues, and co-working facilities – require CPE routers that can deliver stable network performance under heavy usage.

Providers have focused on deploying routers with robust Quality of Service (QoS), secure access management, and easy scalability, which align well with enterprise needs. This strong alignment between product capabilities and industry requirements underpins the commercial segment’s leadership.

Commercial adoption is also fueled by the growth of cloud-based applications, video conferencing, and digital point-of-sale systems. These use cases demand low latency and reliable uptime, which commercial-grade CPE routers are designed to provide. Additionally, the need for secure guest networks and adherence to compliance standards has driven companies to invest in routers that offer advanced security protocols.

By Connectivity Analysis

In 2024, the 4G segment held a dominant market position, capturing more than a 28.7% share. This leadership can be attributed to the continued reliance on mature and widely available 4G LTE networks, especially in regions where 5G deployment is still unfolding.

Many telecom operators and service providers favor 4G CPE routers due to their proven performance, dependable connectivity, and cost efficiency. These devices deliver stable speeds of 5-20 Mbps in fixed wireless access (FWA) settings, providing affordable broadband alternatives in areas lacking robust fiber infrastructure. The 4G segment’s strength is also linked to its critical role in bridging digital divides.

In many developing and rural markets, fiber and even DSL networks are not viable, and 4G CPE routers serve as reliable gateways. They offer immediate broadband access, often supported by hybrid access architectures that combine LTE with wired connections to enhance speed and availability. Their plug-and-play simplicity and widespread device compatibility make them a preferred choice for both rural households and small enterprises.

By End-User Analysis

In 2024, the Telecom Operators segment held a dominant market position, capturing more than a 38.9% share. This leadership was driven by ongoing investments from network operators to deploy Customer Premises Equipment at scale for both consumer broadband and enterprise services.

Providers leveraged CPE routers to differentiate their offerings with advanced features such as cloud-managed platforms, enhanced security, and support for Wi‑Fi 6/7 and 5G. By integrating CPE devices into subscription bundles, telecom companies strengthened customer loyalty and generated recurring revenue streams from managed services.

The telecom operator segment’s dominance was reinforced by its foundational role in delivering broadband connectivity. Operators invested heavily in fixed wireless access and fiber-to-the-home networks, relying on CPE routers as critical endpoints.

Leveraging their buying power, they secured large volumes at favorable pricing and drove standardization across markets. These efforts yielded cost efficiencies and consistent quality of service, supporting subscriber growth – especially in metros, suburbs, and previously underserved areas.

Key Market Segments

By Product Type

- Wired CPE Routers

- Wireless CPE Routers

By Application

- Residential

- Commercial

- Industrial

By Connectivity

- 4G

- 5G

- Fiber Optic

- DSL

- Others

By End-User

- Telecom Operators

- Enterprises

- Individuals

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

5G & Wi‑Fi 7 Integration

The convergence of 5G cellular connectivity and Wi‑Fi 7 standards is gaining momentum in the CPE router market. Manufacturers are integrating next‑gen wireless technologies to deliver ultra‑high throughput and low-latency experiences. Wi‑Fi 7, also known as IEEE 802.11be, supports advanced features like multi-link aggregation and 4096‑QAM.

This dual‑radio architecture enables seamless handoffs between networks and optimises performance for high‑bandwidth applications such as AR/VR, 4K/8K streaming, and industrial automation. Hybrid CPE routers that aggregate xDSL or fiber with LTE/5G links are becoming more prevalent in rural and underserved regions.

Driver

Industrial IoT & Edge Adoption

Deployment of Industry 4.0 and IoT applications is driving demand for industrial‑grade CPE routers with enhanced security, reliability, and edge compute functionality. Private 5G networks and ruggedised routers are being widely adopted in manufacturing, energy, and transportation sectors to support automation and real‑time control.

Edge computing capabilities – such as localized data processing – are being embedded within CPE devices. This minimizes latency and reduces backhaul traffic, creating a compelling value proposition in environments demanding real‑time analytics and data sovereignty.

Restraint

Capex & Digital Divide

High initial capital expenditure is restricting widespread adoption, particularly in cost-sensitive residential and rural markets. Advanced routers equipped with multi‑radio 5G and Wi‑Fi 7 modules incur higher costs and deployment complexity, making them less accessible to low-income consumers.

Additionally, a persistent digital divide exists, as economically weaker regions struggle to afford next‑generation CPE despite infrastructure expansion. Even as demand grows, affordability remains a critical hurdle to universal adoption.

Opportunity

Managed & Cloud‑Based Services

There is strong potential in managed CPE and cloud‑native orchestration services. Enterprises and SME clients are increasingly preferring routers that include remote provisioning, automated updates, monitoring, and security enhancements – managed via cloud platforms.

This trend enables providers to establish recurring revenue models and deepen customer relationships. Combined with AI‑driven diagnostics, cloud‑managed CPE reduces field service costs and boosts network performance – creating a compelling commercial proposition.

Challenge

Security and Protocol Complexity

Security vulnerabilities in remote management protocols, such as TR‑069 (CWMP), pose a significant threat. TR‑069 flaws have been exploited by botnets (e.g., Mirai), compromising entire subscriber populations and undermining customer trust.

Additionally, ensuring interoperability across multi‑radio interfaces (Wi‑Fi, 5G, LPWAN) and handling hybrid aggregation complexities pose technical challenges. Multipath routing protocols like MPTCP require coordinated support and in-depth engineering, raising integration barriers

Key Player Analysis

Cisco launched a new line of Secure Routers (8100–8500 series) at Cisco Live 2025, featuring native SD‑WAN, SASE integration, next‑generation firewall, and post‑quantum security. These routers offer throughput up to three times higher than previous models. Cisco also introduced AI‑powered management tools such as AI‑Canvas and upgraded its Hybrid Mesh Firewall and Zero Trust Network Access solutions to support AI‑driven branch operations.

Huawei has continued its focus on CPE modernization in 2025, integrating AI accelerators in its router lines to handle growing telco network demands. Although detailed announcements are not publicly available, Huawei’s roadmap emphasizes full-stack enhancements in on-premise gateways to support 5G fixed-wireless access and smart‑home ecosystems.

Juniper deployed software updates and enhancements to its SRX series routers in 2025, adding tighter security controls and SD‑WAN improvements. No major acquisitions or hardware refreshes were reported, but the company strengthened its position in enterprise and service‑provider segments via SASE and threat‑intelligence services.

Top Key Players Covered

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- ARRIS International plc

- Netgear Inc.

- Juniper Networks, Inc.

- TP-Link Technologies Co., Ltd.

- D-Link Corporation

- Alcatel-Lucent Enterprise

- Nokia Corporation

- Hewlett Packard Enterprise (HPE)

- ADTRAN, Inc.

- Technicolor SA

- Edgecore Networks Corporation

- Ubiquiti Networks, Inc.

- Fortinet, Inc.

- Belkin International, Inc.

- MikroTik

- DrayTek Corp.

- ASUS Tek Computer Inc.

- Others

Recent Developments

- In June 2025: At Cisco Live, introduced five new Secure Routers (8100 – 8500 series) featuring AI-powered routing, SD‑WAN/SASE, next-gen firewalls, and post‑quantum security – achieving up to 3× throughput improvement.

- In March 2025, ZTE introduced a suite of AI‑powered home network devices at MWC Barcelona. The portfolio includes an AI media center, 4K AI soundbar, Wi‑Fi 7 routers, the first AI‑screen enabled FTTR device, and its ZENIC ONE management platform

Report Scope

Report Features Description Market Value (2024) USD 8.4 Bn Forecast Revenue (2034) USD 21 Bn CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Wired CPE Routers, Wireless CPE Routers), By Application (Residential, Commercial, Industrial), By Connectivity (4G, 5G, Fiber Optic, DSL, Others), By End-User (Telecom Operators, Enterprises, Individuals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Huawei Technologies Co., Ltd., ZTE Corporation, ARRIS International plc, Netgear Inc., Juniper Networks, Inc., TP-Link Technologies Co., Ltd., D-Link Corporation, Alcatel-Lucent Enterprise, Nokia Corporation, Hewlett Packard Enterprise (HPE), ADTRAN, Inc., Technicolor SA, Edgecore Networks Corporation, Ubiquiti Networks, Inc., Fortinet, Inc., Belkin International, Inc., MikroTik, DrayTek Corp., ASUS Tek Computer Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-