Global Corrugated Fanfold Packaging Market Size, Share, Industry Analysis Report By Wall Type (Single Wall, Double Wall, Triple Wall), By Flute Type (C Flute, B Flute, E Flute), By Printing Technology (Flexographic Printing, Digital Printing, Lithographic Printing), By End Use (Shipping & Logistics, E-Commerce, Electronics & Home Appliance, Pharmaceutical, Personal Care & Cosmetics, Furniture, Food & Beverage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165619

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Investment and Business Benefits

- Regional Analysis

- By Wall Type

- By Flute Type

- By Printing Technology

- By End Use

- Key Market Segments

- Emerging Trends

- Growth Factors

- Top 5 Use Cases

- Driver

- Restraint

- Opportunity

- SWOT Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

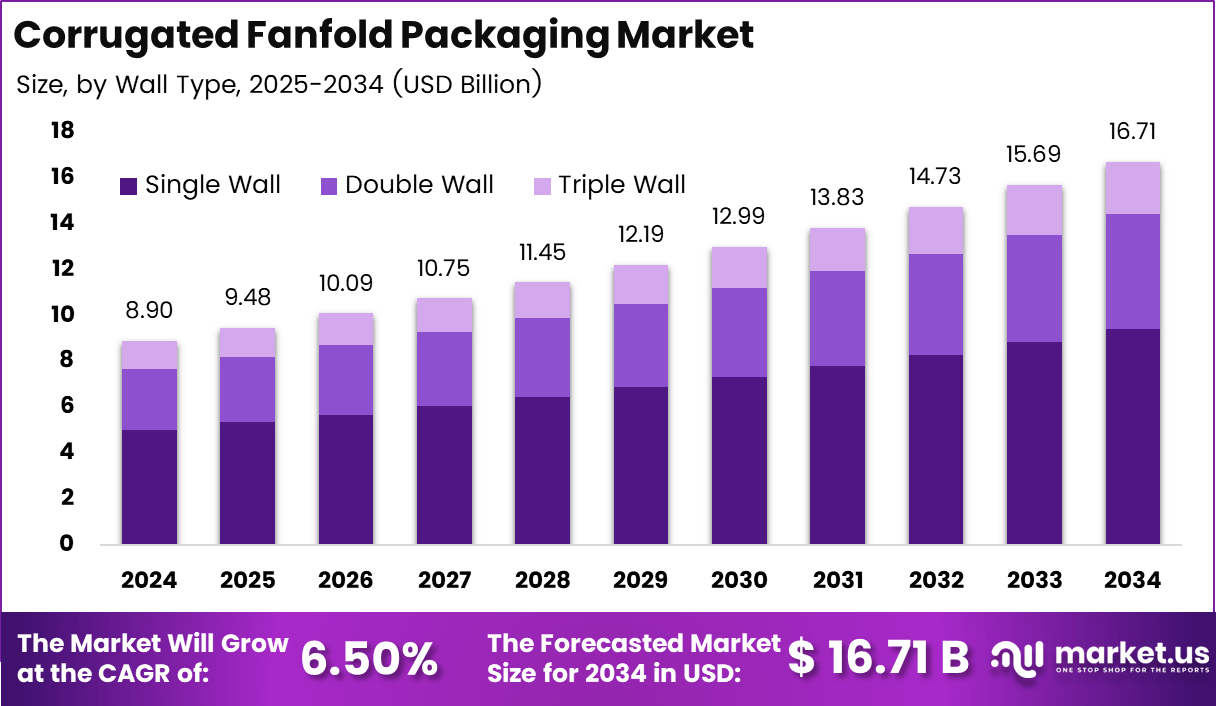

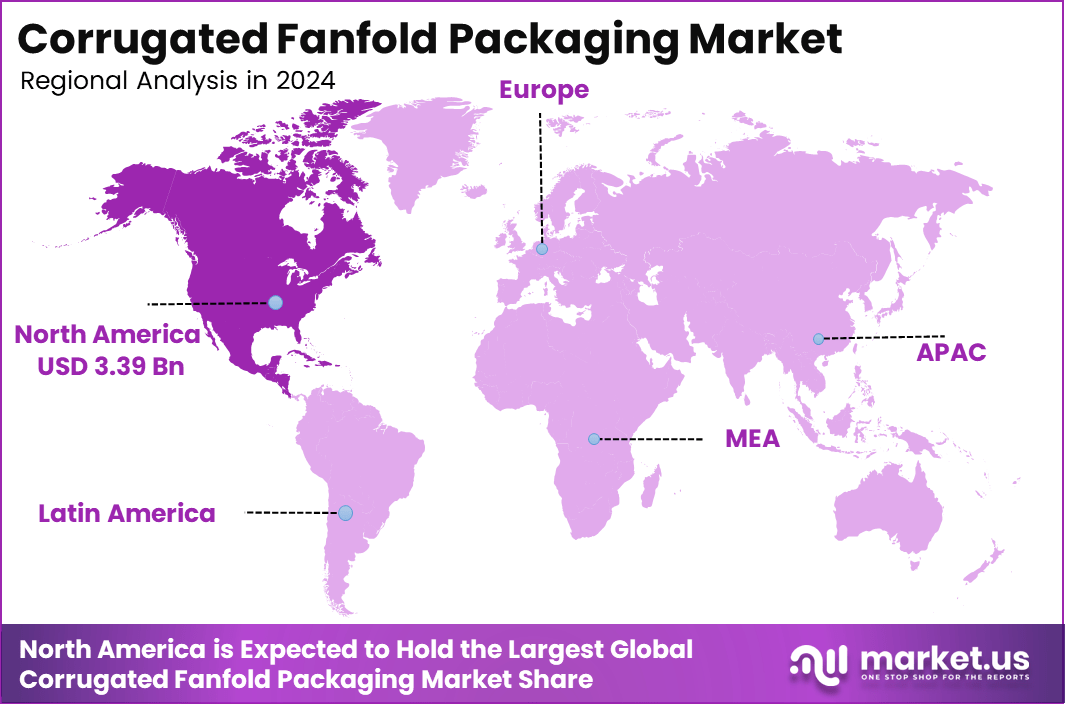

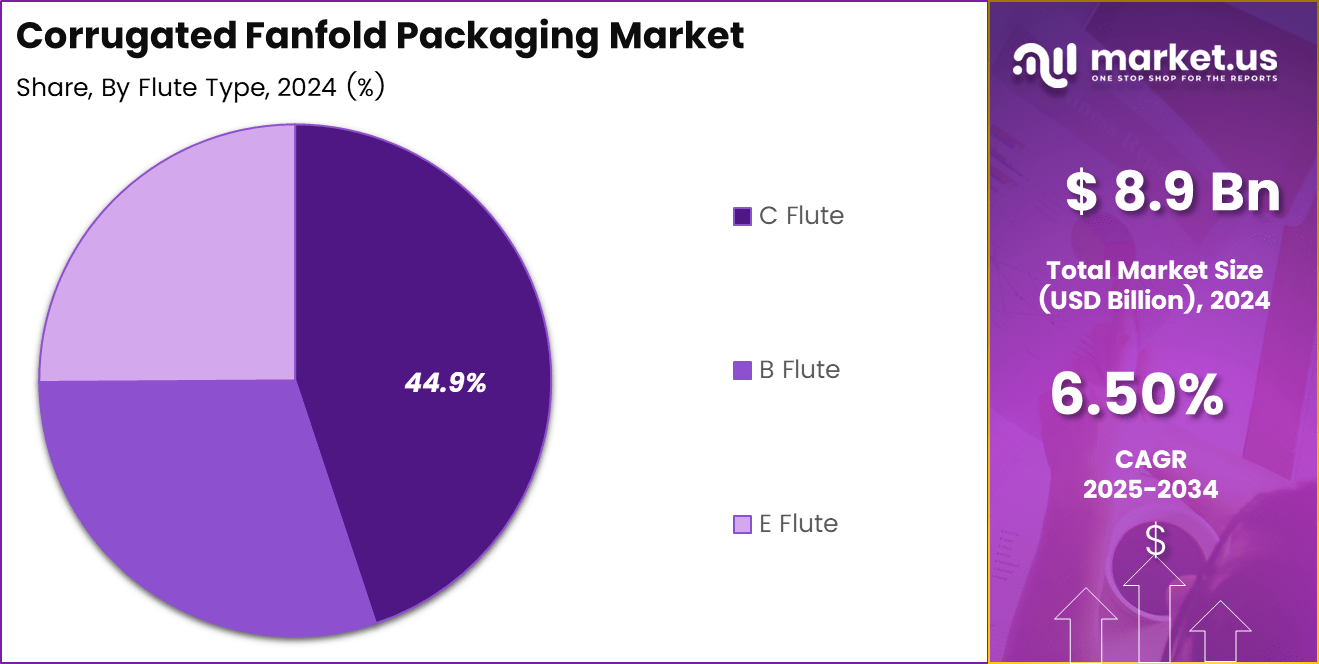

The Global Corrugated Fanfold Packaging Market reaches USD 8.9 billion in 2024, with C Flute holding the largest share at 44.9%, reflecting its strength in durability and versatility. North America leads the industry, holding a share value of 38.20% valued at USD 3.39 billion, driven by strong retail and logistics networks.

The market is projected to advance at a 6.50% CAGR from 2025 to 2034, ultimately reaching USD 16.71 billion. Increasing demand for sustainable materials and efficient box-on-demand systems continues to boost global adoption across industries.

corrugated fanfold packaging market has become a practical solution for businesses needing adaptable and durable packaging formats for diverse product sizes. Its continuous sheet structure enables brands to create right-sized boxes, reducing void fill, freight costs, and overall material usage. Industries such as electronics, furniture, and online retail increasingly rely on fanfold systems to streamline operations and improve packaging speed.

The format’s durability ensures safe transportation, while its recyclability aligns with global sustainability goals. As companies prioritize efficiency and eco-friendly solutions, corrugated fanfold packaging continues to gain relevance across supply chains, making it a dependable packaging choice for modern, high-volume operations.

Key Takeaways

- North America leads with a 38.20% share, valued at USD 3.39 billion, driven by strong logistics, e-commerce, and packaging automation adoption across industries.

- C Flute dominates the flute type segment at 44.9%, reflecting its superior durability and suitability for protective shipping applications.

- Single Wall is the leading wall type at 56.3%, supported by a high preference for lightweight, cost-efficient corrugated formats across retail, fulfillment centers, and export packaging.

- Flexographic Printing accounts for 49.6%, making it the most widely used printing technology in fanfold packaging due to high-speed production and low-cost plate making.

- Shipping & Logistics holds the largest end-use share at 32.8%, reflecting the heavy dependence on corrugated fanfold for warehousing, freight movement, and parcel distribution.

- The market reaches USD 8.9 billion in 2024 and expands to USD 16.71 billion by 2034, supported by a 6.50% CAGR, indicating consistent long-term demand.

Analysts’ Viewpoint

The corrugated fanfold packaging market is progressing steadily as industries prioritize efficiency, sustainability, and right-sized packaging solutions. The dominance of Single Wall at 56.3% and C Flute at 44.9% signals a clear shift toward lightweight yet durable substrates that reduce material waste and logistics costs. With Flexographic Printing leading at 49.6%, manufacturers benefit from faster turnaround and cost-effective large-volume production. Shipping & Logistics holding 32.8% reinforces the sector’s reliance on fanfold formats for continuous, high-volume packaging operations.

North America’s holding share of 38.20% valued at USD 3.39 billion leadership reflects mature automation and e-commerce ecosystems, while APAC’s expansion is largely fuelled by industrial manufacturing and export-oriented supply chains. The market’s rise from USD 8.9 billion in 2024 to USD 16.71 billion by 2034 at a 6.50% CAGR underscores durable long-term demand. Analysts observe that right-sized packaging, sustainability regulations, growing parcel volumes, and box-on-demand technologies will remain the key growth pillars shaping the sector over the next decade.

Investment and Business Benefits

Major investments in the corrugated fanfold packaging market signal strong confidence in scalable corrugated solutions, including fanfold formats. Pratt Industries committed USD 5 billion toward expanding U.S. recycled paper mills and box plants, strengthening domestic corrugated supply infrastructure.

Similarly, Packaging Corporation of America reported quarterly revenue of USD 2.08 billion, supported by higher shipments and paperboard demand. These real-world investments highlight the sector’s continued capital inflow, driven by rising e-commerce volumes, automation upgrades, and sustainability mandates.

For businesses, corrugated fanfold packaging market fanfold packaging improves operational efficiency through right-sized box creation, reduced material waste, and lower freight costs. With corrugated packaging valued at USD 234.18 billion in 2024, the broader market scale ensures wide industry adoption and competitive pricing advantages.

Companies integrating fanfold systems gain faster packaging throughput, minimized inventory of pre-cut boxes, and better adaptability for multi-SKU operations. These benefits strengthen profitability and enhance supply-chain responsiveness across logistics, retail, and manufacturing environments.

Regional Analysis

North America emerges as the largest regional corrugated fanfold packaging market with holding a share of 38.20%, reaching USD 3.39 billion in 2024, supported by advanced logistics networks, high e-commerce penetration, and strong adoption of automated packaging systems. Europe shows steady growth, driven by stringent sustainability regulations and increasing use of recyclable corrugated formats across retail and industrial sectors.

APAC reflects the fastest expansion, powered by large-scale manufacturing, rising online retail activity, and export-oriented packaging demand. Latin America and MEA maintain developing positions, with gradual adoption led by growing distribution networks and modernization of local supply chains.

The graph shows a clear upward trajectory, with the corrugated fanfold packaging market steadily rising each year as industries adopt continuous-sheet fanfold formats to reduce material waste, optimize freight efficiency, and support automated packaging workflows. The combination of sustainability needs and expanding e-commerce shipments remains the major catalyst behind the long-term market expansion.

By Wall Type

The wall type segmentation includes Single Wall, Double Wall, and Triple Wall. Single Wall leads the category with 56.3%, driven by its lightweight structure, lower material cost, and suitability for high-volume packaging across logistics and retail operations. Double Wall and Triple Wall remain essential for heavier, bulkier, or high-protection applications but hold comparatively smaller shares.

By Flute Type

Flute type segmentation comprises C Flute, B Flute, and E Flute. C Flute dominates with 44.9%, supported by its superior durability, crush resistance, and versatility in shipping applications. B Flute offers better printing performance and rigidity, while E Flute is preferred for compact, lightweight, and retail-focused packaging.

By Printing Technology

The printing technology segment includes Flexographic Printing, Digital Printing, and Lithographic Printing. Flexographic Printing holds the highest share at 49.6% due to its speed, cost efficiency, and strong compatibility with high-volume corrugated production. Digital and lithographic printing continue to gain relevance for short runs and premium graphics.

By End Use

End-use segmentation covers Shipping & Logistics, E-Commerce, Electronics & Home Appliance, Pharmaceutical, Personal Care & Cosmetics, and Furniture. Shipping & Logistics leads with 32.8%, reflecting heavy reliance on fanfold packaging for continuous, large-scale transport and distribution activities. Other sectors expand steadily as demand grows for customizable and protective packaging formats.

Key Market Segments

By Wall Type

- Single Wall

- Double Wall

- Triple Wall

By Flute Type

- C Flute

- B Flute

- E Flute

By Printing Technology

- Flexographic Printing

- Digital Printing

- Lithographic Printing

By End Use

- Shipping & Logistics

- E-Commerce

- Electronics & Home Appliances

- Pharmaceutical

- Personal Care & Cosmetics

- Furniture

- Food & Beverage

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Emerging trends in the corrugated fanfold packaging market reflect a strong shift toward right-sized, on-demand packaging as companies aim to reduce material waste, shipping costs, and operational inefficiencies. Automation is playing a central role, with large fulfillment centers and logistics hubs adopting box-on-demand systems to manage diverse product sizes.

Sustainability mandates continue to influence purchasing decisions, pushing manufacturers toward recyclable and eco-friendly substrates. Advancements in flexographic and digital printing are enabling higher-quality customization for retail and e-commerce applications. Integration of fanfold systems with warehouse automation and AI-driven packaging workflows is further improving accuracy, speed, and overall supply chain efficiency.

Growth Factors

Growth in the corrugated fanfold packaging market is supported by rising global logistics activity and increasing e-commerce parcel volumes. The corrugated fanfold packaging market expands from USD 8.9 billion in 2024 to a projected USD 16.71 billion by 2034, driven by a 6.50% CAGR. Dominant segments such as Single Wall at 56.3% and C Flute at 44.9% underline strong demand for cost-effective and durable materials.

Shipping and logistics, accounting for 32.8% of end-use, remain a major contributor to market expansion. Flexographic printing’s 49.6% share accelerates high-volume production, while manufacturing growth in APAC and automation adoption in North America continue to strengthen global market penetration.

Top 5 Use Cases

- E-commerce: Right-sized, on-demand boxes for diverse product sizes.

- Shipping & Logistics: High-volume, continuous packaging for warehouse and distribution needs.

- Electronics: Protective, crush-resistant packaging for fragile devices.

- Furniture: Custom long boxes for bulky items without oversized cartons.

- Pharmaceutical & Personal Care: Secure, hygienic transit packaging for regulated products.

Driver

Rising e-commerce shipments and logistics optimization are the primary forces strengthening demand for corrugated fanfold packaging market. Businesses are increasingly shifting to right-sized, on-demand packaging systems to reduce material waste, lower freight expenses, and streamline warehouse operations.

The dominance of Single Wall 56.3% and C Flute 44.9% reflects the preference for cost-efficient and durable substrates that support rapid packing lines. Flexographic printing’s 49.6% share further accelerates production scalability. As online retail, fulfillment automation, and sustainability regulations expand globally, fanfold formats continue to serve as a reliable solution for high-volume packaging needs.

Restraint

Despite strong growth indicators, the corrugated fanfold packaging market faces challenges due to rising raw material costs and fluctuating paperboard supply cycles. These cost pressures directly affect manufacturers relying on high-volume corrugated production, especially small and medium converters.

The limited adoption of automated fanfold machinery in emerging regions also slows market penetration. Variability in kraft paper supply, stricter environmental rules on deforestation, and dependency on recycled fiber quality introduce uncertainties in maintaining consistent output. This restrains the full-scale adoption of fanfold packaging across industries that demand stable pricing and streamlined procurement structures.

Opportunity

The expanding need for sustainable, customized, and efficient packaging presents a significant growth opportunity for fanfold solutions. Increasing adoption of box-on-demand equipment, integration with warehouse automation systems, and the rapid rise of e-commerce logistics create substantial potential for manufacturers. APAC and Latin America offer untapped opportunities as industries modernize production and export activities expand.

Improved digital and lithographic printing capabilities will further support branding, personalization, and short-run packaging. With a forecasted rise to USD 16.71 billion by 2034, driven by a 6.50% CAGR, the corrugated fanfold packaging market is well-positioned to capitalize on innovation in recyclable materials and automated packaging technologies.

SWOT Analysis

Strengths

- High demand for right-sized, on-demand packaging supports strong market adoption.

- Single Wall 56.3% and C Flute 44.9% provide an optimal balance of strength and cost-efficiency.

- Flexographic printing’s 49.6% share enables fast, economical, large-volume production.

- Fully recyclable and sustainable material structure strengthens global acceptance.

Weaknesses

- Price volatility in kraft paper and corrugated raw materials impacts cost stability.

- Limited automation adoption in developing countries restricts production efficiency.

- Dependency on consistent fiber quality affects output and performance.

- Initial investment for box-on-demand machinery can be high for SMEs.

Opportunities

- Expansion of global e-commerce, logistics, and fulfillment centers boosts long-term demand.

- Rising adoption of automated packaging lines creates opportunities for fanfold systems.

- Emerging markets (APAC, Latin America) offer high growth potential due to industrial expansion.

- Advancements in digital and lithographic printing enable customization and premium packaging.

Threats

- Growing adoption of alternative lightweight materials may challenge corrugated formats.

- Environmental regulations on deforestation and recycling compliance may increase costs.

- Fluctuations in global trade, freight rates, or supply chain disruptions create market uncertainty.

- Intense competition among corrugated suppliers limits pricing flexibility.

Key Players Analysis

Packaging Corporation of America reported full-year 2024 net sales of USD 8.38 billion, reflecting a strong increase driven by higher containerboard output and stable box demand, according to its SEC 10-K filing. With multiple mills and more than 80 corrugated product plants, the company maintains a strong competitive position across North America.

Pratt Industries recently announced a USD 5 billion investment in U.S. recycled-paper and box-plant expansion, as reported by major U.S. news outlets. As one of the largest privately held corrugated packaging manufacturers, Pratt’s focus on 100% recycled containerboard strengthens its leadership in sustainability-driven markets.

Top Key Players

- Smurfit Kappa Group Inc.

- International Paper Company

- WestRock Company

- DS Smith Plc

- Oji Holdings Corporation

- Mondi Plc

- Papierfabrik Palm GmbH & Co KG

- Menasha Packaging Company, LLC

- Rondo Ganahl Aktiengesellschaft

- Nine Dragons Paper Ltd

Recent Development

- In Dec 2025, VPK Group increased its stake to 50% in UK-based corrugated specialist Ribble Packaging, strengthening its strategic presence in the UK corrugated packaging market and expanding its regional manufacturing and distribution capabilities.

- In Feb 2024, Kite Packaging launched its new corrugated fanfold solution, introducing a space-efficient and customizable packaging format designed to support high-volume packaging operations and improve operational flexibility for UK businesses.

Report Scope

Report Features Description Market Value (2024) USD 8.9 Bn Forecast Revenue (2034) USD USD 16.71 Bn CAGR(2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Wall Type (Single Wall, Double Wall, Triple Wall), By Flute Type (C Flute, B Flute, E Flute), By Printing Technology (Flexographic Printing, Digital Printing, Lithographic Printing), By End Use (Shipping & Logistics, E-Commerce, Electronics & Home Appliance, Pharmaceutical, Personal Care & Cosmetics, Furniture, Food & Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smurfit Kappa Group Inc., International Paper Company, WestRock Company, DS Smith Plc, Oji Holdings Corporation, Mondi Plc, Papierfabrik Palm GmbH & Co KG, Menasha Packaging Company LLC, Rondo Ganahl Aktiengesellschaft, Nine Dragons Paper Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Corrugated Fanfold Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Corrugated Fanfold Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smurfit Kappa Group Inc.

- International Paper Company

- WestRock Company

- DS Smith Plc

- Oji Holdings Corporation

- Mondi Plc

- Papierfabrik Palm GmbH & Co KG

- Menasha Packaging Company, LLC

- Rondo Ganahl Aktiengesellschaft

- Nine Dragons Paper Ltd