Global Copper Foil Market By Product (Electrodeposited Copper Foil, and Rolled Copper Foil), By Application (Circuit Boards, Batteries, Electromagnetic Shielding, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 15669

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

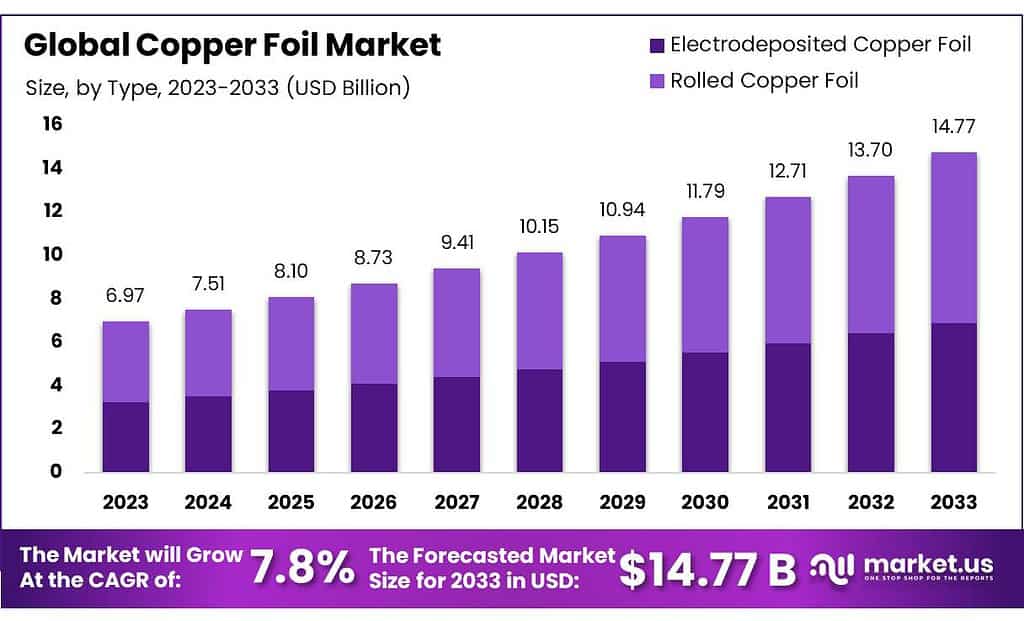

The Copper Foil Market size is expected to be worth around USD 35.3 billion by 2033, from USD 6.97 Bn in 2023, growing at a CAGR of 7.8% during the forecast period from 2023 to 2033.

Due to increased internet penetration, indirect growth is likely to continue as the market grows. Internet usage is rising rapidly in developed and developing nations, which has led to growth in the demand for laptops, tablets, mobile devices, and computers. In emerging countries such as India, cheap data plans, greater bandwidth availability, and increased awareness due to government programs help bridge the digital ga

*Actual Numbers Might Vary In The Final Report

Key Takeaways

Market Growth and Size Projection: Market Size Expected to reach USD 35.3 billion by 2033 from USD 6.97 billion in 2023. CAGR Anticipated growth at a rate of 7.8% from 2023 to 2033.

Types of Copper Foil

- Rolled Copper Foil: Holds over 52% market share in 2023 due to flexibility and durability, widely used in electronics, especially in flexible PCBs and batteries.

- Electrodeposited Copper Foil: Recognized for superior surface quality, preferred in high-quality applications like high-frequency circuits.

Thickness Categories

- Below 10 µm: Known for extreme thinness, suitable for high-frequency circuits and electromagnetic shielding.

- 10-50 µm: Mid-range thickness, balancing flexibility and durability, used in various electronics, transformers, and batteries.

- 50-100 µm: Thicker foils for applications requiring robust conductivity and durability like power distribution systems.

- Above 100 µm: Offer substantial strength and conductivity, used in heavy-duty applications like power transmission.

Dominant Applications

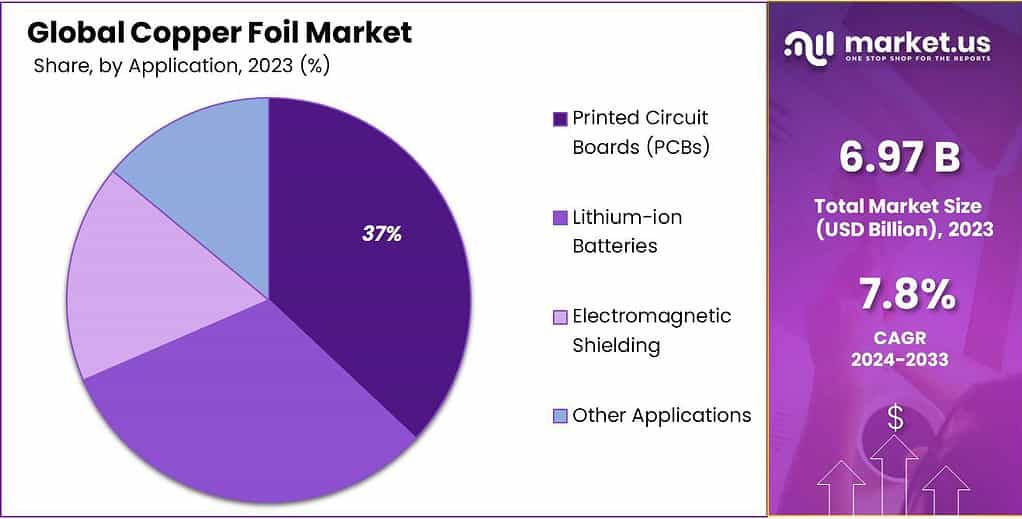

- Printed Circuit Boards (PCBs): Holds over 37% market share due to extensive use in electronics such as smartphones, computers, and consumer electronics.

- Lithium-ion Batteries: Crucial in the growing demand for electric vehicles and portable electronic devices.

- Electromagnetic Shielding: Significant in industries needing protection against electromagnetic interference like aerospace and telecommunications.

Drivers: Escalating demand for electronic products due to increased population, rising disposable incomes, digitization, and IoT proliferation.

Restraints: Potential competition from advanced materials like graphene due to its remarkable properties.

Opportunities: Rising adoption of electric vehicles, demand for renewable energy sources, 5G technology, IoT, and flexible electronics.

Challenges: Competition from graphene, price volatility, technological advancements, regulatory complexities, and global economic influences.

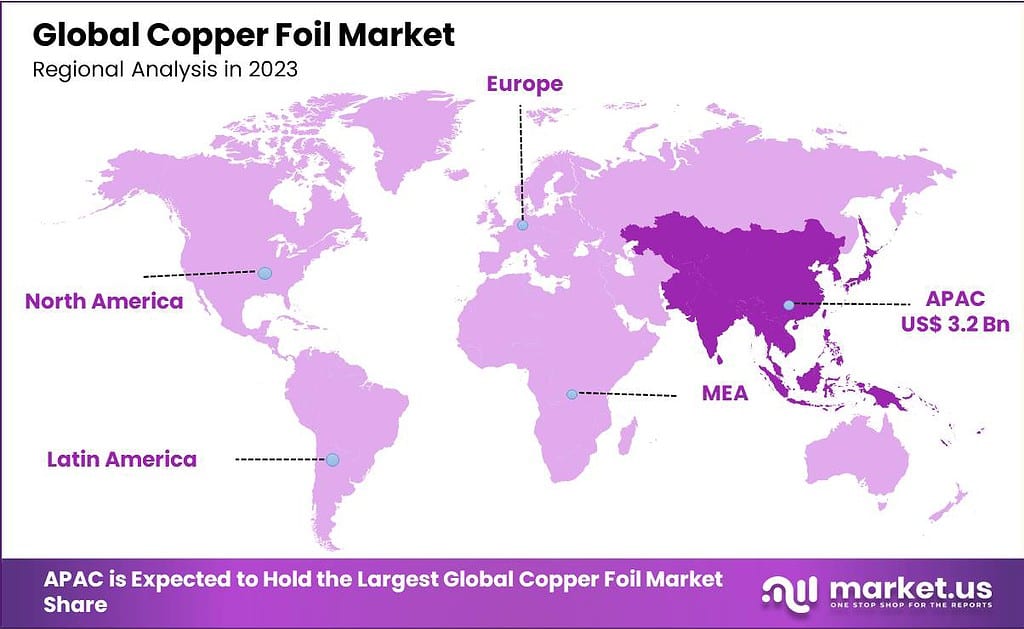

Regional Analysis Asia Pacific: Holds over 60% global market share due to the strong electronics industry, especially in China, South Korea, and Taiwan.

Key Players: SKC, Dusan Group, Chang Chun Group, Circuit Foil LS Mtron, among others.

Type Analysis

Rolled Copper Foil: This type held the majority share, more than 52% in 2023. Rolled Copper Foil is known for its flexibility and durability. It’s widely utilized in applications requiring these specific properties, such as in electronics, where it’s used in flexible printed circuit boards (PCBs) and batteries due to its malleability and excellent electrical conductivity. Its ability to conform to different shapes makes it highly sought after in various industries.

Electrodeposited Copper Foil: This type occupied the rest of the market share. Electrodeposited Copper Foil is recognized for its superior surface quality and precise thickness. It’s often preferred in applications that demand high-quality finishes, such as in advanced electronics where precision is crucial, like in high-frequency circuits and radio frequency shielding.

In summary, Rolled Copper Foil dominated the market due to its adaptability and resilience, while Electrodeposited Copper Foil served specific niche applications requiring precise attributes and superior surface quality. Both types cater to different industry needs within the broader spectrum of copper foil applications.

Thickness Categories

Thickness Categories in Copper Foil: In 2023, the segment categorized by Thickness was a significant player, holding more than 35% of the copper foil market.

Below 10 µm: This category is known for its extreme thinness and flexibility, commonly used in applications requiring ultra-thin layers, such as in high-frequency circuits and electromagnetic shielding.10-50 µm: This category covers a mid-range thickness, suitable for various applications in electronics, transformers, and batteries, offering a balance between flexibility and durability.

50-100 µm: Copper foils within this range are thicker and often used in applications requiring more robust conductivity and durability, such as in power distribution systems and some automotive components.

Above 100 µm: Foils above this thickness range offer substantial strength and conductivity. They find utility in heavy-duty applications like power transmission, large-scale transformers, and certain industrial equipment.

In essence, the Thickness segment of copper foils, particularly the varied thickness categories, holds a considerable portion of the market due to the diverse range of applications each thickness offers within different industries.

Application Analysis

Applications of Copper Foil: In 2023, the segment related to Printed Circuit Boards (PCBs) led the market, holding more than 37% of the copper foil market.

Printed Circuit Boards (PCBs): This application dominates due to copper foil’s widespread use in PCBs, which are fundamental in electronic devices like smartphones, computers, and other consumer electronics.

Lithium-ion Batteries: Copper foils are also crucial in lithium-ion batteries, a segment gaining prominence in the market due to the growing demand for electric vehicles and portable electronic devices.

Electromagnetic Shielding: Copper foil’s role in providing electromagnetic shielding is significant, especially in industries requiring protection against electromagnetic interference, like in aerospace, telecommunications, and medical devices.

Other Applications: This segment encompasses various additional uses where copper foils play a role, such as in construction, automotive, and industrial applications, though their market share might be smaller compared to the dominant sectors.

In summary, the Printed Circuit Boards (PCBs) application held a major share, showcasing the widespread use of copper foils in electronics, while other applications like lithium-ion batteries and electromagnetic shielding also play significant roles in the copper foil market.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Type

- Electrodeposited Copper Foil

- Rolled Copper Foil

Thickness

- Below 10 µm

- 10-50 µm

- 50-100 µm

- Above 100 µm

By Application

- Printed Circuit Boards (PCBs)

- Lithium-ion Batteries

- Electromagnetic Shielding

- Other Applications

Drivers

The escalating demand for electronic products is a key force propelling the growth of the copper foil market. This surge in demand is primarily fueled by two major factors: the rapid increase in population worldwide and the augmented disposable incomes among consumers.

As people’s purchasing power rises, there is a heightened interest in and affordability of various electronic gadgets like smartphones, laptops, electronic security devices, and guidance control systems. Copper foil plays a crucial role within these electronic items as a conducting medium owing to its exceptional thermal and electrical properties.

Its inclusion in circuit boards significantly enhances its heat transfer capabilities and mitigates stress caused by uneven heating across the board. Copper’s use in electronic devices ensures optimal performance and durability, contributing significantly to their smooth functioning and long-term viability. Digitization, online education platforms, and IoT proliferation all play an instrumental role in fuelling demand for electronic products. This digital revolution is anticipated to foster an increased need for electronic devices in the foreseeable future, consequently bolstering the growth of the copper foil market.

Restraints

Factors Restraining Copper Foil Market Growth:

The emergence and advancement of graphene sheets pose a potential hurdle to the growth of the copper foil market. Graphene, known for its extraordinary properties, is seen as an attractive replacement material for silicon and copper which are commonly used in conducting applications.

With its flexibility, resilience, self-cooling properties, and self-healing abilities, graphene offers great promise as an appealing option. Graphene sheets can be extensively folded, similar to origami, to create shapes ideal for flexible circuits, especially in applications like flexible displays. Companies are heavily investing in the development of conductive inks derived from graphene, enabling the printing of circuits and efficient electricity conduction.

The utilization of graphene in computing devices enhances their speed while significantly reducing power consumption. Therefore, as graphene continues to advance and find its applications in various technological fields, particularly in computing and flexible displays, it poses a potential challenge to the copper foil market by offering innovative alternatives with superior properties. This competition from graphene may hinder the growth trajectory of copper foil in the market.

Opportunities

Copper foil market growth opportunities are significant with the rising adoption of electric vehicles (EVs) and demand for renewable energy sources like solar panels and wind turbines, both providing significant advancement opportunities. Copper is an integral component in these vehicles owing to its excellent conductivity; copper motors and batteries use copper extensively as part of their composition.

Similarly, renewable energy systems rely on copper for its efficient conduction of electricity, thus driving the demand for copper foil. Moreover, the advent of 5G technology and the expanding Internet of Things (IoT) landscape provide another lucrative avenue. Copper foil plays a critical role in the production of high-frequency circuits essential for these advanced communication systems.

As the world moves towards faster and more connected networks, the demand for copper foil in these applications is expected to grow. The market also witnesses opportunities in the realm of flexible electronics. The popularity of flexible gadgets, including foldable smartphones and wearable devices, is on the rise. Copper foil’s flexibility and conductivity make it an ideal material for flexible circuits and displays, thereby increasing its usage in these products.

Challenges

Graphene Competition: The rise of graphene, a super-advanced material with remarkable properties, poses a challenge to copper foil. Graphene’s abilities to replace materials like copper and its unique features like self-cooling create potential competition for copper foil. Price Uncertainty: Copper prices tend to fluctuate, and these fluctuations can affect how businesses plan and spend.

This volatility in prices can make it tricky for companies using copper foil to maintain stable profits. Tech Changes: The fast-paced evolution of technology might bring challenges for the copper foil market. New tech advancements could introduce alternative materials or methods, impacting the demand for copper foil.

Regulations: Keeping up with environmental rules and regulations can be tough for the copper foil industry. New regulations aimed at reducing environmental impact might require changes in production processes or materials, adding complexities.

Global Economy Influence: Global factors like trade tensions or economic instability in different regions can affect how much copper foil is needed and produced. This can lead to uncertainties in the market.

Regional Analysis

In Asia Pacific, the biggest market for copper foil, more than 60% of the global share is held. This region sees rapid growth due to its strong electronics industry, mainly in China, South Korea, and Taiwan. Key players here include KINWA, Iljin Materials, Jinbao Electronics, Co-Tech, and LYCT.

Due to incentives offered by China, Asia Pacific is the dominant region in the PCB manufacturing sector. One of the reasons is China’s high manufacturing capacity & low labor wage.

North America’s volume is expected to increase by 9.4% during the forecast period. The U.S. market’s increasing electric vehicle penetration will likely drive demand for copper foil products. America is home to many of the world’s most prominent electric vehicle producers, like Tesla Inc. This company was responsible for more than 75% of all electric cars sold in 2021.

European demand will grow due to the growing demand for hybrid and electric vehicles and energy storage. Europe occupies a leading position in the market for electric vehicles. Regional market growth can also be aided by the rapid deployment of the new registration for electric buses. These registrations rose in Europe from 0.91 million in 2018 up to 1.99 Mn in 2019, according to the International Energy Agency.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Market players tend to use joint ventures and mergers & acquisitions as their key strategies. Over the next few years, small and medium-sized companies will be acquired by large companies to have the most significant market share. In addition, the top players are investing in new factories and increasing their production capacity to improve their competitiveness.

Dusan Corp. has announced that a new copper foil production plant will be built in Hungary for battery applications. This plant, which will have an additional capacity for copper foil of 50,000 tons, is expected to be in operation by 2021. It can produce enough copper foil to produce approximately 2.2 million electric vehicles. The following players dominate the copper foil market:

Market Key Players

- SKC

- Dusan Group

- Chang Chun Group

- Circuit Foil LS Mtron

- Furukawa Electric Co., Ltd.

- Iljin materials co, Ltd.

- Nippon Denkai, Ltd.

- Mitsui Mining & Smelting

- Jinbao Electronics

- XJ Nippon Mining & Metal Products

- Other Key Players

Recent Developments

April 2022: Furukawa Electric Co. Ltd switched to renewable energy to meet all the power requirements at Japan’s Copper Foil Division’s production facility. The company expects to reduce CO2 emissions from electricity use at the plant by a maximum of 30,000 tons per year.

Report Scope

Report Features Description Market Value (2022) USD 6.97 Bn Forecast Revenue (2032) US$ 35.3 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Electrodeposited Copper Foil, Rolled Copper Foil), By Application(Circuit Boards, Batteries, Electromagnetic Shielding, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SKC, Dusan Group, Chang Chun Group, Circuit Foil LS Mtron, Furukawa Electric Co., Ltd., Iljin Materials co, Ltd., Nippon Denkai, Ltd., Mitsui Mining & Smelting, Jinbao Electronics, XJ Nippon Mining & Metal Products, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Copper Foil?Copper foil is a thin sheet of copper that finds extensive use in various industries due to its excellent electrical conductivity, corrosion resistance, and malleability.

What is the Size of Copper Foil Market?Copper Foil Market size is expected to be worth around USD 35.3 billion by 2033, from USD 6.97 Bn in 2023

How Does Market Competition Impact Copper Foil Prices?Competitive Pricing Strategies: Intense competition among manufacturers can lead to competitive pricing. Quality Differentiation: Premium quality copper foil may command higher prices despite competition.

-

-

- SKC

- Dusan Group

- Chang Chun Group

- Circuit Foil LS Mtron

- Furukawa Electric Co., Ltd.

- Iljin materials co, Ltd.

- Nippon Denkai, Ltd.

- Mitsui Mining & Smelting

- Jinbao Electronics

- XJ Nippon Mining & Metal Products

- Other Key Players