Global Copaiba Essential Oil Market Size, Share, And Industry Analysis Report By Nature (Conventional, Organic), By Product Type (Pure Copaiba Essential Oil, Blended Copaiba Essential Oil), By Distribution Channel (Specialty Stores, Hypermarkets and Supermarkets, Online Retail, Others), By End-User (Aromatherapy and Personal Care, Pharmaceutical and Nutraceutical, Cosmetics Industry, Food and Beverage, Industrial Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175599

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

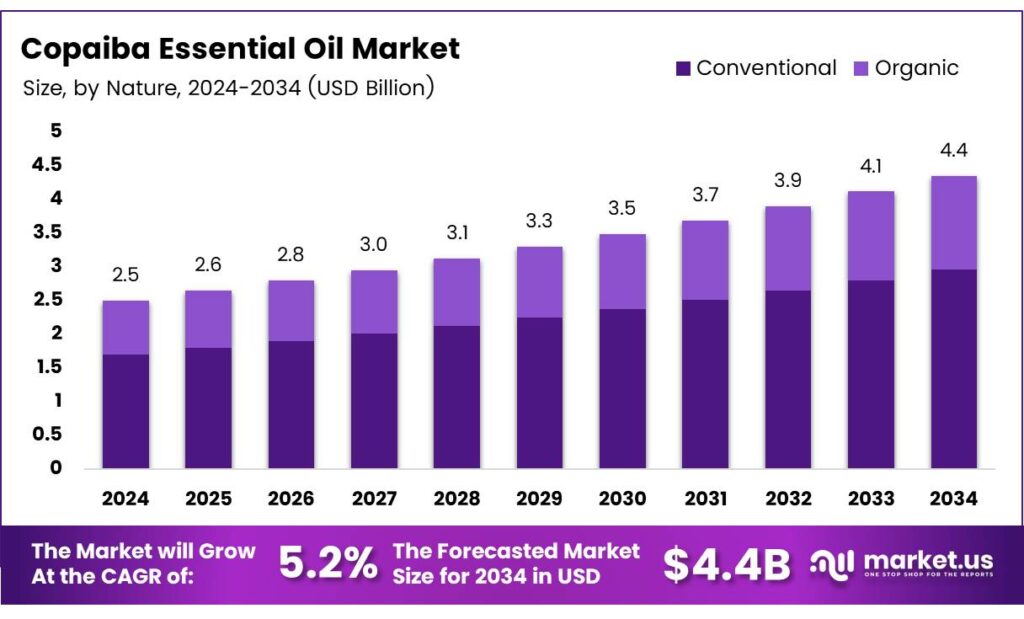

The Global Copaiba Essential Oil Market size is expected to be worth around USD 4.4 billion by 2034, from USD 2.5 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The Copaiba Essential Oil Market represents a niche but steadily expanding segment within natural therapeutics, aromatherapy, and functional personal care. The market revolves around oleoresin extracted from South American copaiba trees and processed into essential oil valued for anti-inflammatory, antimicrobial, and skincare benefits. Rising consumer interest in plant-based healing continues to strengthen overall demand.

Moving forward, analysts observe strong momentum fueled by wellness adoption, clean-label cosmetics, and increasing trials exploring natural actives. Brands are gradually integrating copaiba oil into serums, balms, and aromatherapy blends. Due to its high concentration of beta-caryophyllene, the oil is also gaining visibility in pain-relief formulations, making the market more attractive to formulators.

- Chemical evaluations reveal that its volatile sesquiterpene fraction can range from 10–15% to as high as 80%, influencing viscosity and final market price. Toxicity studies following OECD-423/2001 guidelines tested diluted oleoresin doses at 300 mg/kg up to 2000 mg/kg in controlled models, providing safety data crucial for regulatory acceptance.

Additionally, new product development creates room for innovation across diffusers, natural fragrances, therapeutic oils, and topical solutions. Small cosmetic manufacturers and herbal formulators increasingly test copaiba oil because it provides a differentiating botanical active with strong consumer resonance. This creates favorable entry points for suppliers, producers, and exporters across Latin America.

Key Takeaways

- The Global Copaiba Essential Oil Market is projected to grow from USD 2.5 billion in 2024 to USD 4.4 billion by 2034 at a 5.2% CAGR.

- Conventional Copaiba oil leads the Nature segment with a dominant 58.2% share in 2025.

- Pure Copaiba Essential Oil holds the highest Product Type share at 67.6%, driven by rising demand for authentic extracts.

- Specialty Stores dominate distribution with a 36.8% share, reflecting strong consumer trust in curated wellness products.

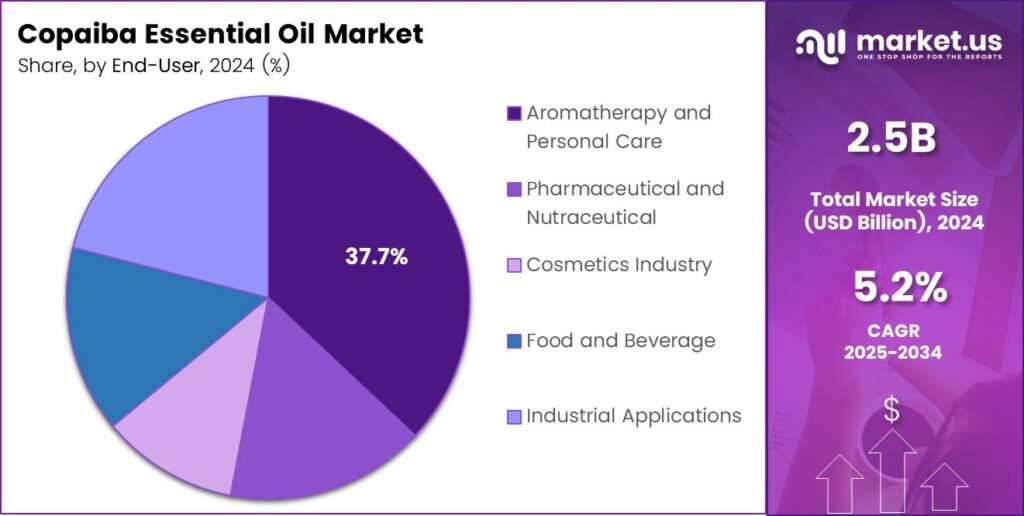

- Aromatherapy and Personal Care is the top end-user segment with a 37.7% market share due to high wellness adoption.

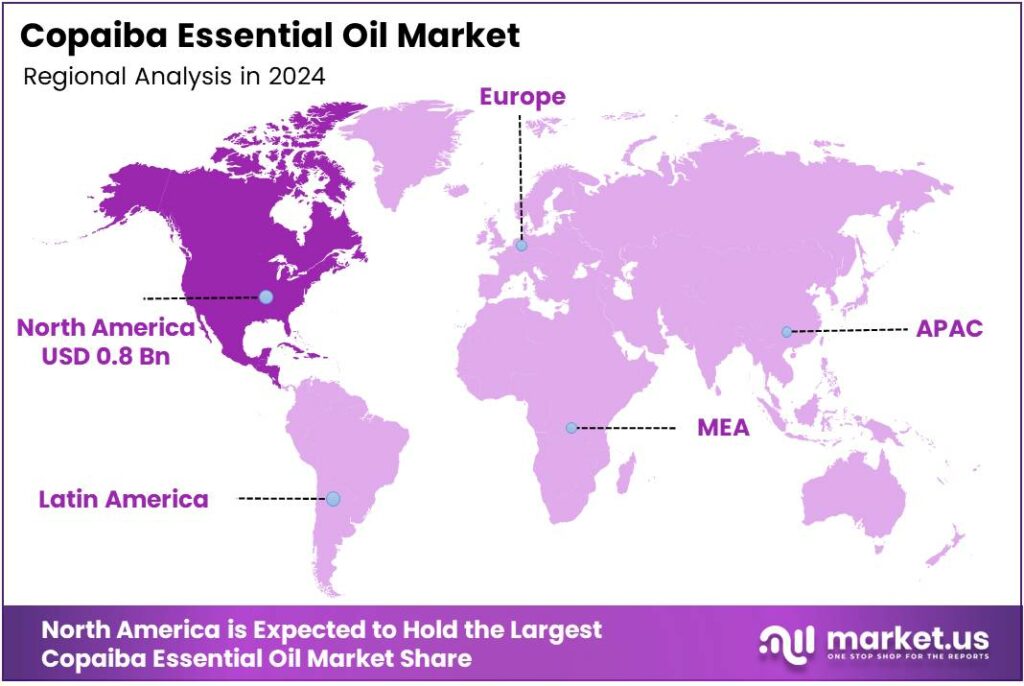

- North America leads regionally with a 32.5% share, valued at USD 0.8 billion in 2025.

By Nature Analysis

Conventional dominates with 58.2% due to wider availability and cost-effective sourcing.

In 2025, Conventional held a dominant market position in the By Nature segment of the Copaiba Essential Oil Market, with a 58.2% share. This segment continues to lead because conventional harvesting methods remain more accessible for producers. Moreover, supply chains supporting conventional oils are well-established, ensuring stable procurement and consistent output.

The Organic segment is expanding steadily as consumers shift toward cleaner beauty and wellness products. Although it trails behind conventional varieties, organic copaiba oil gains recognition for its purity and sustainable extraction. Regulatory support for organic certification also strengthens trust, helping the segment grow despite higher production costs and limited raw material availability.

By Product Type Analysis

Pure Copaiba Essential Oil dominates with 67.6% because of the rising demand for authentic plant extracts.

In 2025, Pure Copaiba Essential Oil held a dominant market position in the By Product Type segment of the Copaiba Essential Oil Market, with a 67.6% share. Its leadership is driven by consumer preference for unadulterated formulas, particularly in aromatherapy and therapeutic applications. This purity-focused shift supports premium pricing and stronger brand loyalty.

The Blended Copaiba Essential Oil segment caters to users seeking affordable or multifunctional formulations. Blends combine copaiba with complementary botanicals, offering enhanced aromatic or skin-care benefits. Although less dominant, this segment grows steadily as brands innovate hybrid products targeting wellness routines, massage therapy, and mainstream cosmetic formulations seeking balanced aroma and performance.

By Distribution Channel Analysis

Specialty Stores dominate with 36.8% due to targeted consumer engagement and expert-led product selection.

In 2025, Specialty Stores held a dominant market position in the Distribution Channel segment of the Copaiba Essential Oil Market, with a 36.8% share. These outlets attract informed buyers who prefer curated natural wellness products, supported by trained staff. Their focused assortment encourages trust and strengthens repeat purchases across aromatherapy and therapeutic categories.

Hypermarkets and Supermarkets remain vital for mass-market visibility. They offer broad accessibility and competitive pricing. Though less specialized, these retail formats benefit from expanding personal care shelves and rising consumer interest in essential oils. Promotional campaigns and bundled offers further strengthen this channel’s contribution to overall category growth.

The Online Retail segment is growing rapidly as consumers shift toward digital shopping. E-commerce platforms provide convenience, detailed product knowledge, and competitive pricing. User reviews and targeted advertising also support decision-making, making online channels increasingly influential within global wellness and beauty product distribution.

Others include small retailers, wellness centers, spas, and direct-selling networks. These channels play a supportive role, particularly in niche markets. Their personalized customer engagement and experiential product demonstrations contribute meaningfully to growth. Although not dominant, these outlets offer unique touchpoints that strengthen brand visibility and customer understanding.

By End-User Analysis

Aromatherapy and Personal Care dominate with 37.7% due to high wellness adoption.

In 2025, Aromatherapy and Personal Care held a dominant market position in the By End-User segment of the Copaiba Essential Oil Market, with a 37.7% share. Its demand rises as consumers adopt essential oils for relaxation, skincare, and emotional well-being. Brands increasingly incorporate copaiba into serums, balms, and diffusers, strengthening market traction.

The Pharmaceutical and Nutraceutical segment uses copaiba oil for potential anti-inflammatory and therapeutic applications. Although still emerging, research-driven interest supports gradual growth. Manufacturers explore supplements and topical treatments utilizing copaiba’s bioactive compounds, creating early opportunities for innovation and product diversification within regulated health sectors.

The Cosmetics Industry leverages copaiba oil for its natural emollient and soothing properties. Formulators use it in creams, lotions, hair serums, and cleansing products. As clean beauty trends intensify, cosmetic brands integrate copaiba to meet consumer expectations for gentler and plant-based ingredients, expanding its functional applications.

The Food and Beverage segment remains niche but steadily growing. Copaiba oil is explored for flavoring and potential functional uses. Regulatory limitations slow expansion, yet consumer curiosity for botanical additives encourages cautious adoption in wellness beverages and specialty food formulations.

The Industrial Applications segment includes uses such as varnishes, resins, and coatings derived from copaiba resin. While smaller, this segment benefits from copaiba’s natural chemical profile, supporting eco-friendly industrial formulations. Rising interest in biodegradable inputs may gradually strengthen this application base.

Key Market Segments

By Nature

- Conventional

- Organic

By Product Type

- Pure Copaiba Essential Oil

- Blended Copaiba Essential Oil

By Distribution Channel

- Specialty Stores

- Hypermarkets and Supermarkets

- Online Retail

- Others

By End-User

- Aromatherapy and Personal Care

- Pharmaceutical and Nutraceutical

- Cosmetics Industry

- Food and Beverage

- Industrial Applications

Emerging Trends

Growing Adoption of Clean-Label Aromatherapy Oils Shapes Market Trends

One of the strongest trends in the Copaiba essential oil market is the rising consumer demand for clean-label aromatherapy products. People now carefully read ingredient lists and prefer oils with transparent sourcing, minimal processing, and zero synthetic additives. Copaiba oil’s natural extraction process aligns perfectly with this movement.

Wellness enthusiasts are also exploring Copaiba oil as a gentler alternative to stronger essential oils. Because it is mild on the skin and has a soft, woody aroma, it is gaining popularity in relaxation blends, diffuser oils, and massage therapies. This shift is helping Copaiba oil enter both home-use and professional wellness spaces.

Another ongoing trend is the blend-based formulation approach. Companies are mixing Copaiba oil with lavender, frankincense, and chamomile to create targeted mood-support and skin-repair blends. These combinations offer better synergy and attract consumers looking for multifunctional products.

Drivers

Rising Preference for Natural Healing Oils Drives Market Growth

Growing consumer interest in natural wellness products is one of the strongest drivers of the Copaiba essential oil market. People are shifting away from synthetic ingredients and choosing oils that come from clean, plant-based sources. Copaiba oil, known for its soothing and anti-inflammatory properties, fits perfectly into this trend. This shift is even stronger in regions where herbal remedies are part of daily lifestyle habits.

- Wellness brands and aromatherapy companies have increased their use of Copaiba oil in skincare, pain-relief balms, and stress-relief blends. The oil was highly enriched in sesquiterpenes (94.9%) and concentrated in β-caryophyllene (51.8%), which is one of the main bioactive markers brands look for when they want consistent performance.

Health-focused consumers also appreciate Copaiba oil because it contains a high level of β-caryophyllene, a compound linked to relaxation and inflammation control. With more people exploring natural solutions for anxiety, sleep, and pain, Copaiba oil’s reputation keeps improving. This growing trust is contributing to consistent market expansion.

Restraints

Limited Sustainable Resin Supply Restricts Market Expansion

One major restraint for the Copaiba essential oil market is the limited and region-dependent availability of Copaiba resin. The oil is obtained from Copaifera trees found mainly in the Amazon rainforest, and harvesting requires careful tapping to avoid harming the trees. This sensitive method restricts how quickly supply can grow, especially as demand rises globally.

- The system formed small spherical particles under 100 nm, which matters because smaller droplets usually improve uniformity in gels, sprays, and emulsions. The same work reported 63% bioaccessibility in a simulated digestion model, helping explain why formulators are testing oral-format concepts more seriously than before.

Environmental rules also limit large-scale extraction. Governments in South America have tightened forest-use regulations to protect biodiversity, which adds compliance costs for producers. While these policies are essential for conservation, they slow down production and reduce the volume that can reach international markets.

Growth Factors

Expanding Use in Skincare Innovations Creates Strong Growth Potential

A major opportunity for the Copaiba essential oil market comes from the booming natural skincare and cosmetic industry. Brands are increasingly searching for clean ingredients with proven anti-inflammatory and calming effects. Copaiba oil fits this need, making it a valuable addition to formulations like face serums, acne-care products, and soothing lotions.

- Dermatology researchers are also exploring Copaiba oil for its potential benefits in treating redness, irritation, and mild skin infections. The study reported an entrapment efficiency of around 89.4%, indicating the oil can be held inside droplets rather than separating during storage—an everyday pain point for natural oils.

As scientific evidence grows, more high-end skincare labels may start using Copaiba-based actives in their product lines. This will broaden market demand beyond aromatherapy into premium personal care. E-commerce platforms create further opportunities. Small and mid-sized brands can now sell Copaiba oil directly to global consumers without needing large retail networks.

Regional Analysis

North America Dominates the Copaiba Essential Oil Market with a Market Share of 32.5%, Valued at USD 0.8 Billion

North America leads the Copaiba Essential Oil market, driven by its strong natural wellness industry and rising consumer inclination toward plant-based therapeutic oils. The region accounts for a dominant 32.5% share, valued at USD 0.8 billion, supported by growing interest in clean-label solutions and aromatherapy applications. Increased awareness around anti-inflammatory natural extracts and expanding retail distribution channels further reinforce North America’s leadership.

Europe shows steady growth as consumer lifestyles increasingly shift toward herbal remedies and sustainable ingredient sourcing. Regulatory support for natural extracts and the expansion of organic cosmetic formulations enhance demand across major countries. Growing use of copaiba in skincare, wellness supplements, and massage therapy additionally contributes to wider market adoption across the region.

The Asia Pacific region is emerging as a key growth hotspot due to the rising popularity of essential oils in holistic wellness and traditional medicine-inspired personal care. Increasing disposable incomes, expanding e-commerce penetration, and the strong influence of natural beauty trends accelerate regional uptake. The region is expected to see the fastest consumption expansion over the next few years.

The Middle East & Africa market is gradually expanding, supported by growing interest in aromatherapy and premium wellness oils. Rising adoption of natural cosmetic products and increasing demand from spa and wellness centers create new opportunities. The market remains niche but continues to benefit from rising consumer awareness of plant-based therapeutic solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Copaiba essential oil market continues to mature as consumers shift toward plant-based wellness solutions and natural anti-inflammatory products. Market expansion is largely shaped by the strategic activities of leading aromatherapy and ingredient manufacturers who are enhancing sourcing transparency, strengthening retail footprints, and exploring clinically supported product positioning.

doTERRA International remains one of the strongest influencers in the Copaiba category due to its large distributor network and robust direct-selling model. The company continues to invest in sustainable sourcing programs in Brazil, allowing it to secure a consistent resin supply while strengthening its scientific messaging around purity and therapeutic benefits.

Young Living Essential Oils sustains market relevance by expanding its consumer education initiatives and integrating Copaiba oil into lifestyle-focused blends. Its vertically integrated “Seed to Seal” model positions the brand as a trusted premium supplier, helping it retain strong brand loyalty across global aromatherapy users.

IFF (International Flavors & Fragrances) leverages its advanced natural ingredients portfolio and global manufacturing capabilities to support growing demand from personal care, fragrance, and wellness brands. Its technical expertise enables consistent quality control and supports emerging product formulations that incorporate Copaiba resin’s soothing properties.

Robertet Group enhances competitive differentiation through its long-standing expertise in natural extracts and sustainable sourcing partnerships across South America. The company is increasingly aligning Copaiba-derived ingredients with clean-label cosmetics, giving it a stronger foothold in premium skincare and aromatherapy applications.

Top Key Players in the Market

- doTERRA International

- Young Living Essential Oils

- IFF

- Robertet Group

- Berjé Inc

- Wildflower Essentials

- Rocky Mountain Oils, LLC

- Mountain Rose Herbs

- Edens Garden

Recent Developments

- In 2025, doTERRA International will have the most active recent developments in Copaiba essential oil, centered on sustainable sourcing and community impact in Brazil’s Amazon region. doTERRA funded and implemented Copaiba harvesting training for two cooperatives in Brazil, focusing on enhanced safety, best practices, and PPE distribution for harvesters in areas like Apuí and Oriximiná.

- In 2025, IFF offers Copaiba Oil Coeur BLO through its LMR Naturals division as a renewable, readily biodegradable woody note for perfumery. Robertet lists Copaiba oil in its raw materials catalogue as a woody essential oil for fragrances. The company published a Sustainability Statement and a general press release on natural ingredients.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 4.4 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Product Type (Pure Copaiba Essential Oil, Blended Copaiba Essential Oil), By Distribution Channel (Specialty Stores, Hypermarkets and Supermarkets, Online Retail, Others), By End-User (Aromatherapy and Personal Care, Pharmaceutical and Nutraceutical, Cosmetics Industry, Food and Beverage, Industrial Applications) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape doTERRA International, Young Living Essential Oils, IFF, Robertet Group, Berjé Inc, Wildflower Essentials, Rocky Mountain Oils, LLC, Mountain Rose Herbs, Edens Garden Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Copaiba Essential Oil MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Copaiba Essential Oil MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- doTERRA International

- Young Living Essential Oils

- IFF

- Robertet Group

- Berjé Inc

- Wildflower Essentials

- Rocky Mountain Oils, LLC

- Mountain Rose Herbs

- Edens Garden