Global Cooling Tower Market Report By Product (Open circuit, Closed circuit, Hybrid), By Type (Wet, Dry, Hybrid), By Material (Fibre-reinforced plastic, Steel, Concrete, Wood, HDPE), By Application (HVAC, Chemicals & Petrochemicals, Pharmaceutical, Power Generation, Food & Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122766

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

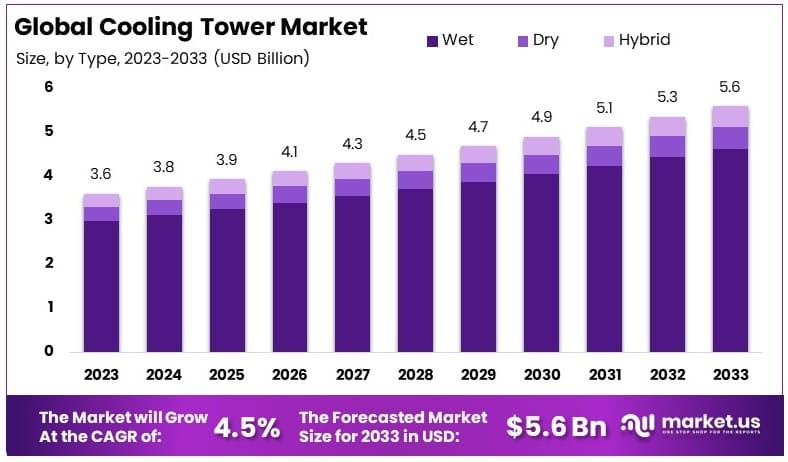

The Global Cooling Tower Market size is expected to be worth around USD 5.6 Billion by 2033, from USD 3.6 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

The cooling tower market encompasses systems used to remove heat from water and release it into the atmosphere. Cooling towers are essential in industries where heat generation is significant, such as power generation, HVAC, and various manufacturing processes.

The market is characterized by innovations aimed at improving efficiency and reducing water consumption. Strategic growth in this market is linked to the expanding industrial activities worldwide and the need for more energy-efficient cooling solutions.

The cooling tower market is experiencing dynamic growth, closely linked to the escalating global demand for energy. As projections indicate, global energy consumption is set to increase by nearly 50% by 2050 from 2020 levels, reflecting a steep upward trajectory in energy needs.

Notably, total world energy consumption reached an estimated 580 million terajoules in 2022, marking a substantial rise from approximately 300 million terajoules in 1980. Despite a temporary decline of about 1% in 2020 due to the COVID-19 pandemic, energy demand rebounded with an approximate 5% growth in 2021 and an expected further increase of 4% in 2022.

This surge in energy usage underscores the vital role of cooling towers, which are essential components in power plants, manufacturing facilities, and HVAC systems for effective heat dissipation. The heightened energy consumption necessitates increased efficiency in thermal management, propelling the demand for advanced cooling technologies. Cooling towers play a crucial role in enhancing energy efficiency and reducing water usage, aligning with global sustainability goals.

Given the continuous rise in energy demand, the cooling tower market is set to expand, driven by the need for sustainable and efficient cooling solutions. Manufacturers are likely to innovate in the design and operation of cooling towers to meet the evolving requirements of energy production and industrial processes, making the sector a critical area for investment and development in the context of a growing global economy.

Key Takeaways

- Market Value: The Cooling Tower Market was valued at USD 3.6 billion in 2023, and is expected to reach USD 5.6 billion by 2033, with a CAGR of 4.5%.

- Product Analysis: Open circuit towers dominated with 43.2%; essential for their efficiency in various industrial cooling processes.

- Type Analysis: Wet cooling towers dominated with 82.7%; preferred due to their effectiveness in heat dissipation.

- Material Analysis: Fibre-reinforced plastic dominated with 29.4%; crucial for its durability and resistance to corrosion.

- Application Analysis: HVAC dominated with 55.4%; critical due to the growing demand for climate control systems.

- Dominant Region: APAC held 31.2% market share; significant due to rapid industrialization and infrastructure development.

- High Growth Region: North America projected substantial growth; driven by advancements in energy-efficient cooling technologies.

- Analyst Viewpoint: The market is moderately saturated with high competition. Future growth is supported by technological advancements and increased environmental regulations.

- Growth Opportunities: Key players can capitalize on innovations in energy-efficient and sustainable cooling technologies.

Driving Factors

Rapid Industrialization and Urbanization Drives Cooling Tower Market Growth

The cooling tower market is significantly propelled by the global trends of rapid industrialization and urbanization. As industrial activities, including power generation, chemical processing, and manufacturing, continue to expand, the demand for effective cooling solutions escalates. In regions like China, industrialization has led to an increased establishment of power plants that rely heavily on cooling towers for heat management.

Additionally, the urban growth in megacities such as Mumbai and Lagos intensifies the demand for HVAC systems in commercial buildings, further amplifying the need for cooling towers. This surge in both industrial and urban developments directly correlates with an upward trend in the cooling tower market, meeting the cooling needs of diverse sectors.

Increasing Energy Consumption and Environmental Regulations Catalyze Market Expansion

The cooling tower market is increasingly influenced by the rising global energy consumption and stringent environmental regulations. Emerging economies are witnessing a significant rise in energy demands, necessitating the expansion of mobile power plants which depend on cooling towers to manage waste heat efficiently.

Concurrently, environmental regulations aimed at reducing water use and pollution are enforcing the adoption of advanced cooling technologies. For instance, the U.S. Environmental Protection Agency’s rules on water usage have driven industries to invest in innovative cooling towers that optimize water efficiency and minimize environmental impact. This dual pressure of energy needs and environmental stewardship is driving the rapid adoption of more efficient cooling tower systems.

Technological Advancements Propel Cooling Tower Market

Technological innovations are key drivers in the growth of the cooling tower market. The integration of advanced technologies such as IoT-enabled monitoring systems, anti-microbial materials, and hybrid cooling towers is revolutionizing the industry. These advancements enhance operational efficiency and reduce costs, making cooling systems more appealing to industries focused on sustainability and cost-effectiveness.

For example, the introduction of the Nexus Modular Hybrid Cooler by Baltimore Aircoil Company, which merges evaporative and dry cooling, illustrates a significant reduction in water usage by up to 70% compared to traditional systems. Such technological progress is not only improving the performance of cooling towers but also making them indispensable in modern industrial applications.

Restraining Factors

High Initial Investment and Maintenance Costs Restrain Market Growth

The cooling tower market faces significant restraints due to high initial investment and maintenance costs. Purchasing and installing cooling towers require substantial capital, which can be a barrier for small and medium enterprises (SMEs). Additionally, cooling towers need regular maintenance to prevent scaling, corrosion, and microbial growth, which can increase operational costs.

According to the U.S. Department of Energy, a poorly maintained cooling tower can consume up to 50% more energy than a well-maintained one. These ongoing costs and the high initial investment limit the adoption of cooling towers, especially among SMEs with limited financial resources.

Water Scarcity and Quality Issues Restrain Market Growth

Water scarcity and quality issues significantly restrain the cooling tower market. Cooling towers are water-intensive, and in regions facing water scarcity, this presents a major challenge. For example, industries in water-stressed areas like California and parts of India face restrictions on water usage, complicating the operation of traditional cooling towers.

Additionally, poor water quality can lead to scaling and corrosion, reducing equipment lifespan. In regions like the Middle East, where seawater is used, high salinity accelerates corrosion, necessitating more frequent replacements and increasing costs. These issues hinder the growth of the cooling tower market, particularly in regions with water-related challenges.

Product Analysis

Open circuit dominates with 43.2% due to its efficiency and cost-effectiveness in cooling processes.

The Cooling Tower Market, segmented by product, is predominantly led by Open circuit cooling towers, which hold a 43.2% market share. These towers are preferred for their efficiency and cost-effectiveness in many industrial applications. They work by allowing water to come into direct contact with air, which provides a more efficient heat transfer and lowers temperatures effectively. This type of cooling tower is commonly used in industries such as power generation and HVAC due to its ability to handle large volumes of water and its relatively simple maintenance requirements.

In comparison, Closed circuit and Hybrid cooling towers also play significant roles in the market. Closed circuit towers, which keep the process fluid separate from the air, are vital in industries where contamination needs to be minimized, such as in food processing or pharmaceuticals. Hybrid towers, combining elements of both open and closed circuits, offer versatility and are often selected for their energy efficiency and ability to operate in varying weather conditions.

The growth of the Closed circuit and Hybrid segments reflects a broader industrial trend towards systems that can offer environmental benefits, such as reduced water usage and contamination risk. These segments are expected to grow as industries continue to face regulatory pressures and aim for greater sustainability in their operations. This trend underscores the importance of diverse cooling tower systems to meet specific industrial needs, driving innovations and adaptations in cooling technologies.

Type Analysis

Wet dominates with 82.7% due to its effective cooling mechanism and widespread applicability in industrial settings.

In the Type segment of the Cooling Tower Market, Wet cooling towers are the clear leader, commanding an 82.7% share. Their dominance is attributed to the effective cooling mechanism through evaporation, making them highly suitable for most industrial cooling needs. Wet cooling towers are extensively used across a range of applications, from large-scale power plants to commercial HVAC systems, where high heat loads are common.

Dry and Hybrid cooling towers, while smaller in market share, are crucial in applications where water conservation is a priority or where plume is a concern. Dry cooling towers operate without water, making them ideal for regions with scarce water resources. Hybrid cooling towers, offering the benefits of both wet and dry cooling methods, are increasingly being adopted in industries looking for flexible and efficient cooling solutions.

The growth in the Dry and Hybrid types is driven by increasing environmental concerns and water scarcity issues, pushing industries towards adopting more sustainable cooling methods. This shift is likely to propel further development and technological advancements in these segments, as the demand for efficient and environmentally friendly cooling solutions continues to rise.

Material Analysis

Fibre-reinforced plastic dominates with 29.4% due to its durability and corrosion resistance.

The Material segment of the Cooling Tower Market sees Fibre-reinforced plastic (FRP) as the leading material, holding a 29.4% market share. FRP is favored for its high durability and excellent corrosion resistance, qualities that are essential in harsh industrial environments where chemical exposure and wet conditions are common. Its lightweight nature and ease of fabrication also make FRP a preferred choice in many cooling tower constructions.

Steel, Concrete, Wood, and HDPE materials are also integral to the cooling tower market. Steel is valued for its strength and longevity, though it requires corrosion protection treatments in certain environments. Concrete cooling is chosen for their robustness and long lifespan, making them suitable for heavy-duty applications. Wood, while less common, is used for its natural cooling properties and cost-effectiveness in certain regions. HDPE towers are gaining popularity due to their corrosion resistance and lightweight properties.

The diverse material choices available in the market cater to various industry-specific needs, from chemical resistance to structural strength. The ongoing developments in material science are likely to enhance the performance and sustainability of cooling towers, supporting the market’s growth across different sectors.

Application Analysis

HVAC dominates with 55.4% due to its critical role in maintaining industrial and commercial environmental conditions.

In the application segment of the cooling tower market, HVAC systems stand out with a 55.4% market share. This segment’s prominence is primarily due to the increasing demand for climate control technologies in residential, commercial, and industrial settings. The HVAC industry relies heavily on efficient cooling towers to dissipate heat in large buildings, making them integral to maintaining optimal indoor air quality and comfort levels.

Chemicals & Petrochemicals represent another significant application, where cooling towers are essential in maintaining the temperature for various chemical processes, thereby ensuring safety and efficiency. The pharmaceutical industry also utilizes cooling towers, though to a lesser extent, for maintaining precise environmental conditions crucial for drug manufacture and storage.

Power generation is another key application, as cooling towers are vital in thermal power plants to cool the steam that drives turbines. The food & beverages sector uses cooling towers to maintain specific temperatures during processing to ensure product quality and safety. The ‘Others’ category includes applications such as data centers and institutional facilities, where cooling towers help manage the heat generated by extensive computing equipment, thus ensuring operational efficiency and longevity of hardware.

Each of these segments contributes to the overall growth of the cooling tower market by addressing specific cooling needs across diverse industrial and commercial landscapes. The expansion and technological advancements within these segments will continue to drive the demand for innovative and efficient cooling solutions, sustaining the market growth.

Key Market Segments

By Product

- Open Circuit

- Closed Circuit

- Hybrid

By Type

- Wet

- Dry

- Hybrid

By Material

- Fibre-Reinforced Plastic

- Steel

- Concrete

- Wood

- HDPE

By Application

- HVAC

- Chemicals & Petrochemicals

- Pharmaceutical

- Power Generation

- Food & Beverages

- Others

Growth Opportunities

Retrofit and Replacement Market Offers Growth Opportunity

The retrofit and replacement segment in the cooling tower market is ripe for growth, especially in regions with older infrastructure such as the U.S. and Europe. Many cooling systems in these developed economies are nearing the end of their operational life, necessitating upgrades to more efficient models. The U.S. Department of Energy highlights that upgrading to modern, high-efficiency cooling towers can lead to energy savings of up to 20%.

This significant reduction in energy consumption makes retrofitting an attractive strategy for industries aiming to cut operational costs and comply with increasingly stringent energy regulations. As industries continue to seek cost-effective solutions to aging equipment, the demand for advanced cooling tower systems is expected to surge, providing a substantial market opportunity for manufacturers and service providers.

Green Building Initiatives Offer Growth Opportunity

The integration of cooling towers into green building initiatives provides a promising avenue for market expansion. As sustainable construction practices gain momentum globally, the demand for energy-efficient HVAC systems, including cooling towers, is growing. Green building standards like LEED and BREEAM encourage the adoption of efficient cooling solutions by awarding points for such technologies, which enhances a building’s environmental and economic performance.

For instance, the Bullitt Center in Seattle, renowned as the “greenest commercial building in the world,” showcases the use of an advanced cooling tower as part of its strategy to achieve LEED Platinum certification. This trend towards sustainable buildings is likely to increase the demand for innovative cooling technologies, positioning them as essential components in the construction of eco-friendly buildings and driving further growth in the cooling tower market.

Trending Factors

Hybrid and Dry Cooling Systems Are Trending Factors

The trend towards hybrid and dry cooling systems is driven by the global concern over water scarcity. Hybrid cooling systems combine evaporative and dry cooling, reducing water usage while maintaining efficiency. Dry cooling systems, which use air instead of water, are particularly popular in water-stressed regions.

For example, the Ivanpah Solar Power Facility in California’s Mojave Desert uses air-cooled condensers, saving an estimated 1.6 billion gallons of water annually. This significant water conservation is crucial in arid areas, making hybrid and dry cooling systems an attractive solution. The increasing adoption of these systems is expected to expand the cooling tower market, addressing environmental concerns and promoting sustainable practices.

Smart Cooling Towers Are Trending Factors

The integration of IoT and AI in cooling towers is a major trend, enhancing market potential. Smart cooling towers use IoT sensors to monitor water quality, temperature, and energy consumption in real-time. This data is analyzed to optimize performance automatically. For example, Johnson Controls’ Smart Connected Chiller uses this technology to predict maintenance needs and reduce downtime.

The ability to monitor and adjust operations in real-time improves efficiency and reliability, attracting more industries to adopt these advanced systems. The adoption of smart cooling towers is expected to grow, driving market expansion by offering improved performance and reduced operational costs.

Regional Analysis

APAC Dominates with 31.2% Market Share in the Cooling Tower Market

The Asia-Pacific (APAC) region’s commanding 31.2% market share in the cooling tower market can be attributed to several key factors. Rapid industrialization across major economies like China and India has spurred demand for cooling technologies in power generation, manufacturing, and HVAC applications. Additionally, the region benefits from favorable government policies supporting infrastructure development, which in turn drives the cooling tower installations. High ambient temperatures and industrial growth trajectories contribute to the sustained demand for efficient cooling systems.

APAC’s regional characteristics significantly influence its cooling tower market dynamics. The region’s vast geographic and climatic diversity requires robust and varied cooling solutions, which cater to different industrial needs. Urbanization trends have also led to increased construction activities, further integrating advanced cooling technologies into buildings and industrial plants. The presence of key global and local manufacturers in the region supports technological advancements and cost-effective production, enhancing market growth.

Regional Market Share Analysis:

- North America: Holding approximately 25.6% of the global market, North America benefits from advanced technological adoption and stringent environmental regulations that drive the need for energy-efficient cooling towers.

- Europe: Europe accounts for 22.3% of the market share, driven by similar factors as North America, with additional support from regulatory bodies emphasizing sustainable industrial practices.

- Middle East & Africa: This region commands a smaller share at 9.4%, but is expected to grow due to increasing industrial activities and infrastructural development, particularly in the Gulf countries.

- Latin America: With a market share of 11.5%, Latin America’s growth is propelled by industrialization and modernization efforts in countries such as Brazil and Mexico, which are integrating more efficient cooling technologies to meet their rising industrial needs.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cooling Tower Market is shaped by several key players. Krones AG and MITA Cooling Technologies Srl lead with their advanced technology and extensive product lines. Babcock & Wilcox Enterprises, Inc. and JAEGGI Hybridtechnologie AG also stand out due to their innovative solutions and robust market presence.

HAMON & CIE S.A. and SPX CORPORATION have strong market positions through strategic partnerships and continuous innovation. ILMED IMPIANTI SRL and Kelvion Holding GmbH focus on energy-efficient solutions, enhancing their competitive edge.

JACIR – GOHL and EVAPCO, Inc. emphasize sustainability and advanced cooling technologies. EWK also contributes significantly with its specialized products.

These companies influence the market through continuous R&D, strategic collaborations, and a focus on energy efficiency. Their strong market presence and innovative solutions position them as key players in the Cooling Tower Market.

Market Key Players

- Krones AG

- MITA Cooling Technologies Srl

- Babcock & Wilcox Enterprises, Inc.

- JAEGGI Hybridtechnologie AG

- HAMON & CIE S.A.

- SPX CORPORATION

- ILMED IMPIANTI SRL

- Kelvion Holding GmbH

- JACIR – GOHL

- EVAPCO, Inc.

- EWK

Recent Developments

- April 2024: Protos Paharpur Cooling Towers has received CCI approval to acquire an additional stake in Thyssenkrupp’s India business, strengthening its position in the cooling tower market.

- February 2024: Aggreko has been awarded a U.S. patent for its rental cooling tower systems, which provide efficient and flexible cooling solutions for various applications.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Billion Forecast Revenue (2033) USD 5.6 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Open circuit, Closed circuit, Hybrid), By Type (Wet, Dry, Hybrid), By Material (Fibre-reinforced plastic, Steel, Concrete, Wood, HDPE), By Application (HVAC, Chemicals & Petrochemicals, Pharmaceutical, Power Generation, Food & Beverages, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Krones AG, MITA Cooling Technologies Srl, Babcock & Wilcox Enterprises, Inc., JAEGGI Hybridtechnologie AG, HAMON & CIE S.A., SPX CORPORATION, ILMED IMPIANTI SRL, Kelvion Holding GmbH, JACIR – GOHL, EVAPCO, Inc., EWK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Cooling Tower Market by 2033?The Global Cooling Tower Market is expected to reach USD 5.6 billion by 2033. The market is expected to grow at a CAGR of 4.5% from 2024 to 2033.

Which product type dominates the cooling tower market?Open circuit cooling towers dominate the market, holding a 43.2% share due to their efficiency and cost-effectiveness.

Which region holds the largest share in the cooling tower market?The Asia-Pacific (APAC) region holds the largest share at 31.2%, driven by rapid industrialization and infrastructure development.

Who are the key players in the cooling tower market?Key players include Krones AG, MITA Cooling Technologies Srl, Babcock & Wilcox Enterprises, Inc., JAEGGI Hybridtechnologie AG, HAMON & CIE S.A., SPX CORPORATION, ILMED IMPIANTI SRL, Kelvion Holding GmbH, JACIR – GOHL, EVAPCO, Inc., and EWK.

-

-

- Krones AG

- MITA Cooling Technologies Srl

- Babcock & Wilcox Enterprises, Inc.

- JAEGGI Hybridtechnologie AG

- HAMON & CIE S.A.

- SPX CORPORATION

- ILMED IMPIANTI SRL

- Kelvion Holding GmbH

- JACIR – GOHL

- EVAPCO, Inc.

- EWK