Global Contract Services In Packaging Market Size, Share, Growth Analysis By Material (Plastics, Paper & Paperboard, Glass, Metal, Others), By Packaging Type (Primary, Secondary, Tertiary), By End-use (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168707

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

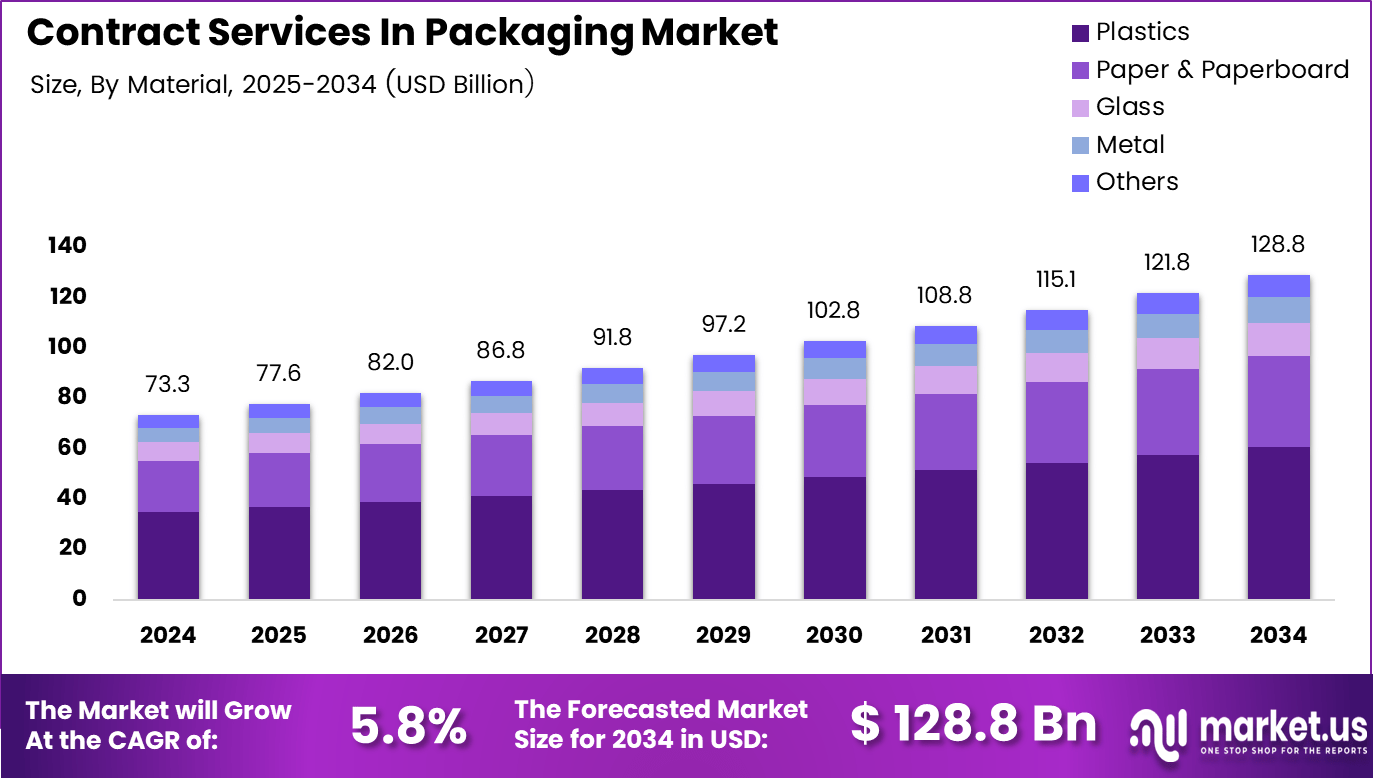

The Global Contract Services In Packaging Market size is expected to be worth around USD 128.8 billion by 2034, from USD 73.3 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Contract Services in Packaging Market represents a rapidly expanding service ecosystem where brands outsource packaging operations to specialized partners. This market supports faster product launches, ensures regulatory compliance, and enhances supply-chain flexibility. It enables companies to reduce in-house production burdens while maintaining consistent quality across primary, secondary, and tertiary packaging formats.

Furthermore, the market continues gaining traction as industries shift toward lean manufacturing and streamlined logistics. Companies increasingly adopt outsourced packaging to address fluctuating demand, reduce labour complexities, and focus on core competencies. This transition further strengthens the role of contract packaging providers as key contributors to operational efficiency and time-to-market acceleration.

Additionally, rising product customization trends encourage businesses to rely on external packaging specialists capable of handling multi-SKU portfolios. These specialists support value-added processes such as kitting, labelling, blister sealing, and cold-chain packaging, enabling better product presentation and enhanced fulfilment accuracy. The growing e-commerce sector also accelerates reliance on outsourced packaging to manage fast-moving, high-volume shipments.

Moreover, new government investments aimed at improving manufacturing infrastructure and export packaging standards continue to shape industry dynamics. Regulatory authorities focus on ensuring product traceability, sustainability, and tamper-evident packaging, prompting businesses to partner with compliance-ready service providers. Such policy developments directly influence service demand across pharmaceuticals, food and beverage, and personal care industries.

In parallel, sustainability regulations encourage the adoption of recyclable, compostable, and reusable packaging materials. Contract packaging providers integrate eco-friendly solutions to support corporate sustainability goals and meet emerging environmental compliance standards. This shift positions the market for long-term growth as companies prioritize circular-economy practices.

Towards the quantitative perspective, industry growth correlates strongly with global consumption patterns and regulatory standardization. According to the Survey, packaging volumes expanded by 8% over the past year due to increased FMCG packaging and healthcare product circulation. Similarly, government logistics programmes reported a 12% improvement in packaging efficiency, reinforcing the market’s strong operational outlook.

Finally, the sector benefits from rising investments in automation, with industrial reports indicating a 15% adoption increase in automated sealing, labelling, and inspection systems. These improvements enhance overall service accuracy and reduce cycle times, supporting the continued expansion of Contract Services in the Packaging Market across key industrial segments.

Key Takeaways

- The Global Contract Services in Packaging Market reached USD 73.3 billion in 2024.

- The market is projected to grow to USD 128.8 billion by 2034.

- The industry is expanding at a CAGR of 5.8% from 2025 to 2034.

- Plastics dominated the material segment with a 47.2% share in 2024.

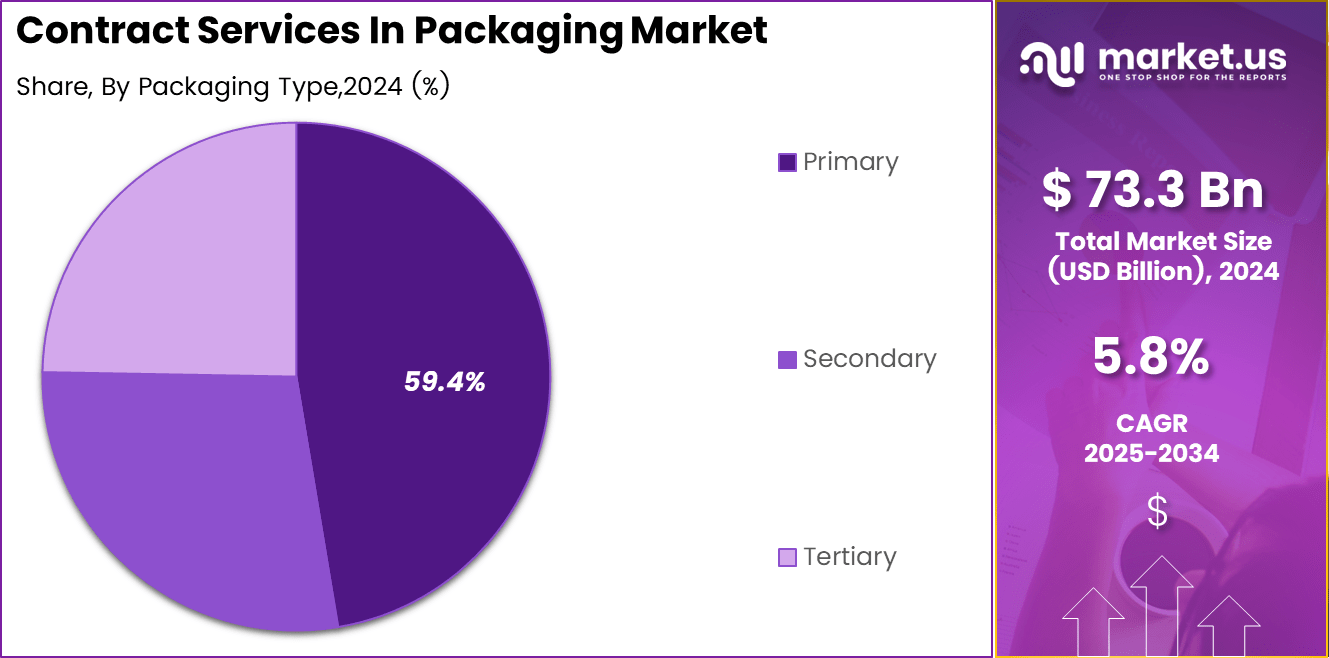

- Primary packaging led the packaging type segment with a 59.4% share in 2024.

- Food & Beverage was the leading end-use segment with a 41.6% share in 2024.

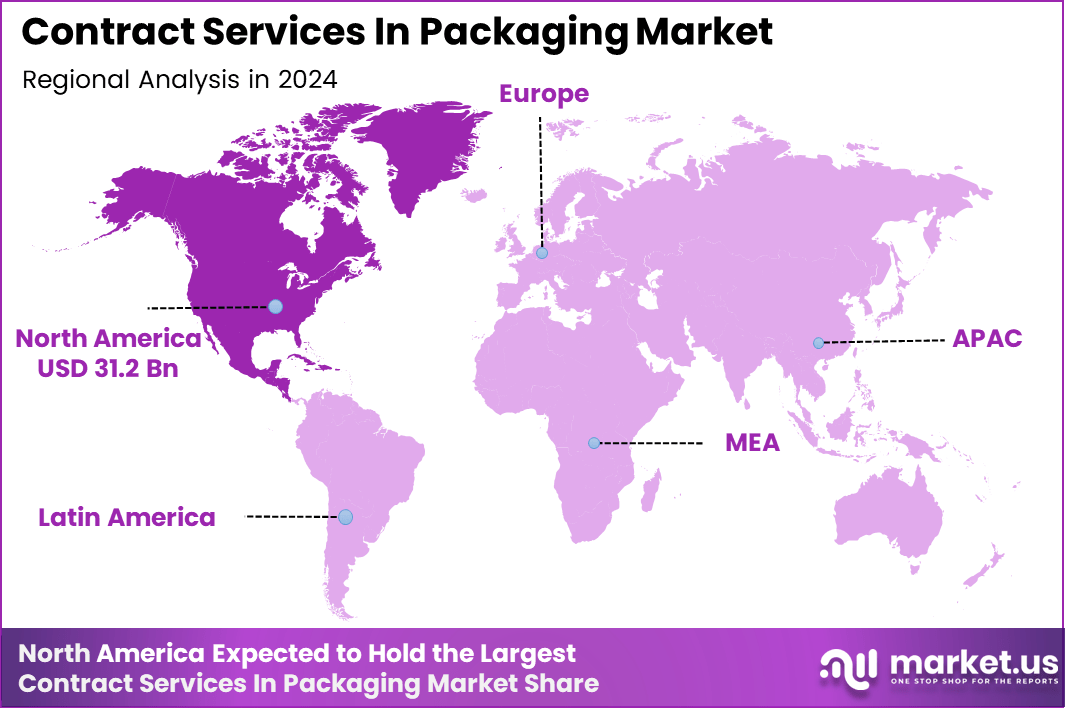

- North America dominated the market with a 42.60% share, valued at USD 31.2 billion.

- The US contributed significantly with packaging service demand reaching USD 2.39 billion in 2024.

By Material Analysis

Plastics dominate with 47.2% due to their flexibility, durability, and widespread acceptance in contract packaging operations.

In 2024, Plastics held a dominant market position in the By Material segment of Contract Services In the Packaging Market, with a 47.2% share. Plastics remain widely preferred as they support cost-efficient packaging, lightweight handling, and strong barrier protection. Their broad adaptability across industries continues driving outsourcing for high-volume packaging needs.

Paper & Paperboard continued expanding adoption as brands transitioned toward sustainable and recyclable packaging formats. These materials offer improved printability and eco-friendly appeal, making them suitable for retail-ready packaging. Rising environmental regulations further motivate companies to outsource responsible paper-based packaging services.

Glass maintained a stable position as a premium material for sensitive or high-value goods. It is favoured for food, beverages, and cosmetics requiring inert, non-reactive, and tamper-resistant packaging. Contract packagers increasingly support glass filling, labelling, and protective wrapping for premium product lines.

Metal packaging gained traction due to its high strength, temperature resistance, and long shelf-life advantages. Contract packaging firms cater to canned foods, aerosols, nutraceuticals, and industrial products employing metal-based solutions for extended durability and product protection.

Others include hybrid, biodegradable, and specialty materials used for niche applications. Brands with unique product specifications rely on contract packagers for customized material sourcing, testing, and assembly to meet regulatory and performance requirements.

By Packaging Type Analysis

Primary packaging dominates with 59.4% due to rising demand for product-ready, safe, and compliant packaging formats.

In 2024, Primary packaging held a dominant market position in the By Packaging Type segment of Contract Services in the Packaging Market, with a 59.4% share. Increasing focus on product safety, sterility, and unit-level packaging continues to strengthen demand for outsourced primary packaging across food, pharmaceuticals, and personal-care sectors.

Secondary packaging expanded as brands opt for outsourced bundling, boxing, and labelling to streamline warehouse and distribution efficiencies. It enhances brand visibility and supports multi-SKU handling. Contract packagers increasingly provide automated carton erecting, shrink-wrapping, and promotional packaging solutions.

Tertiary packaging progressed in adoption due to supply-chain expansion and increasing global shipment volumes. Palletizing, crating, and load-stabilizing services support long-distance transport. Contract packagers help manufacturers optimize logistics-ready packaging for bulk handling and export compliance.

By End-use Analysis

Food & Beverage dominates with 41.6% as brands expand outsourcing to meet high-volume, safety-focused, and regulatory-compliant packaging needs.

In 2024, Food & Beverage held a dominant market position in the By End-use segment of Contract Services in the Packaging Market, with a 41.6% share. Outsourced packaging supports fast turnaround, extended shelf-life, and regulatory labelling for processed foods, beverages, and ready-to-eat products.

Pharmaceutical packaging expanded steadily as companies rely on contract partners for high-precision filling, blistering, serialization, and tamper-proof solutions. Rising global drug production continues strengthening dependence on compliant, cleanroom-ready contract packaging.

Personal Care & Cosmetics observed increasing outsourcing driven by multi-format needs, seasonal product launches, and custom design requirements. Contract package owner offers flexible bottling, labelling service, and assembly for skincare, haircare, and beauty products.

Others include industrial, electronics, and household goods requiring specialized protective packaging. Contract providers deliver custom kitting, cushioning, and bulk packaging solutions to support varied durability and logistics requirements.

Key Market Segments

By Material

- Plastics

- Paper & Paperboard

- Glass

- Metal

- Others

By Packaging Type

- Primary

- Secondary

- Tertiary

By End-use

- Food & Beverage

- Pharmaceutical

- Personal Care & Cosmetics

- Others

Drivers

Rising Demand for Agile Packaging Solutions Drives Market Growth

The Contract Services in Packaging Market is growing due to the rising need for agile packaging that supports rapid product launch cycles across FMCG, personal care, and healthcare. Companies face intense competition, and outsourced packaging partners help them respond faster by offering flexible and ready-to-scale packaging capabilities.

Additionally, brands seek shorter turnaround times to meet seasonal launches and promotional campaigns. Contract packaging providers offer multi-format packaging lines that can switch between various SKUs without major disruptions. This flexibility enables businesses to manage fluctuating orders and reduce idle production time.

Increasing compliance requirements also encourage brands to outsource regulated packaging activities. Pharmaceuticals, nutraceuticals, and medical devices need tamper-evident, serialized, and traceable packaging formats. Contract package owners meet these needs through validated equipment and documentation frameworks, reducing compliance risks for manufacturers.

As regulatory pressure strengthens, businesses increasingly rely on third-party packaging specialists to streamline operations, improve accuracy, and maintain standards. This shift further accelerates the adoption of contract packaging services globally.

Restraints

Limited Interoperability Between Legacy Systems Restrains Market Growth

The Contract Services in Packaging Market faces challenges due to limited compatibility between older manufacturing systems and modern contract packaging technologies. Many companies continue operating with legacy equipment that restricts smooth data exchange or operational integration with outsourced partners.

This lack of interoperability often leads to delays in workflow synchronization, extended line setup times, and higher coordination costs. Contract packaging providers must frequently adjust their systems to match client requirements, increasing operational complexity and reducing overall efficiency.

Another key restraint is the high variability in raw material availability, particularly in plastics, paperboard, and specialty packaging materials. Price fluctuations and supply disruptions make it difficult for contract packagers to maintain consistent output, especially when serving industries with strict quality specifications.

Growth Factors

Increasing Demand for Sustainable Outsourced Packaging Creates Strong Opportunities

The Contract Services in the Packaging Market present major opportunities as companies increasingly shift toward sustainable packaging. Growing preference for biodegradable, recyclable, and compostable materials encourages brands to outsource to providers equipped with eco-friendly technologies and certified sustainable processes.

Outsourced partners help businesses reduce environmental impact by offering lightweight materials, optimized packaging designs, and waste-reduction strategies. This capability supports sustainability commitments and improves brand reputation among environmentally conscious consumers.

Additionally, the rise of pharmaceutical and biotechnology service startups generates strong opportunities for end-to-end outsourced packaging. These companies often lack in-house capabilities and rely on contract packagers for clinical trial packaging, sterile sealing, labelling, and temperature-controlled logistics. This trend supports long-term service demand across emerging health-focused markets.

Moreover, the adoption of AI-driven quality inspection systems opens new avenues for advanced contract packaging services. Automated vision systems enhance defect detection, reduce human error, and improve traceability. This technology allows contract packagers to offer high-precision services suitable for regulated industries.

Emerging Trends

Shift Toward Micro-Fulfillment Packaging Hubs Drives Market Trends

The Contract Services in Packaging Market is experiencing notable trends driven by the shift toward micro-fulfillment packaging hubs. Urban consumption growth pushes companies to locate packaging centres near major cities, enabling faster delivery, reduced logistics costs, and improved last-mile efficiency.

These decentralized hubs help brands manage same-day or next-day fulfilment expectations in e-commerce and retail. Contract packaging providers support this shift by offering compact, high-efficiency facilities capable of handling rapid order cycles and customized packaging requests.

Another major trend shaping the market is the rising adoption of serialization and digital traceability in outsourced packaging workflows. Industries such as pharmaceuticals, food, and cosmetics increasingly require serialized labels, QR codes, and digital tracking to ensure safety and regulatory compliance.

Contract packagers integrate advanced tracking systems to monitor product movement, authenticate items, and reduce the risk of counterfeiting. These capabilities enhance transparency and build consumer trust while meeting evolving global regulations.

Additionally, digital traceability allows businesses to improve supply-chain accuracy through real-time data sharing with logistics partners and retailers. This digital transformation strengthens collaboration and enhances overall operational visibility.

Together, micro-fulfillment adoption and digital traceability advancements represent key market trends accelerating the evolution of contract packaging services.

Regional Analysis

North America Dominates the Contract Services in Packaging Market with a Market Share of 42.60%, Valued at USD 31.2 Billion

North America held the leading position due to its mature FMCG, pharmaceutical, and e-commerce ecosystems that rely heavily on outsourced packaging to streamline fulfilment. The region’s strong logistics networks and rapid adoption of automation further enhance scalability for contract service providers. With a market share of 42.60% and a valuation of USD 31.2 billion, the region benefits from strict regulatory packaging standards, rising SKU diversification, and increasing demand for customized, small-batch packaging formats.

Europe Contract Services in the Packaging Market Trends

Europe shows steady expansion supported by strong sustainability mandates that push brands toward recyclable and compliant outsourced packaging solutions. High consumer demand for premium, well-designed packaged goods strengthens the need for specialized contract services across cosmetics, food, and healthcare sectors. Additionally, the EU’s growing emphasis on traceability and safety encourages companies to rely on professional partners for complex packaging workflows.

Asia Pacific Contract Services in Packaging Market Trends

Asia Pacific emerges as the fastest-growing region, driven by expanding manufacturing hubs, rapid urbanization, and the dominance of e-commerce platforms requiring flexible packaging services. Countries such as China, India, and Southeast Asian markets increasingly outsource packaging to enhance operational efficiency and reduce production bottlenecks. Rising investment in automated assembly and kitting further supports the region’s upward growth trajectory.

Middle East & Africa Contract Services in Packaging Market Trends

The Middle East & Africa region shows improving demand as consumer goods, pharmaceuticals, and food sectors expand and shift toward structured packaging standards. Growth in retail modernization and rising import volumes requires reliable contract packaging partners capable of handling diverse product categories. Government-driven industrial development programs also contribute to market adoption.

Latin America Contract Services in the Packaging Market Trends

Latin America experiences gradual growth influenced by increasing consumption of packaged foods, personal care goods, and pharmaceuticals. Economic reforms in key markets strengthen investment in packaging infrastructure and third-party fulfilment services. The region also benefits from the expansion of regional manufacturing clusters that prefer outsourcing to manage cost and operational complexities.

United States Contract Services in Packaging Market Trends

The US remains a critical sub-region within North America, supported by advanced packaging technologies, high automation adoption, and strong regulatory compliance requirements. Growing online retail activity and rising subscription-box demand fuel the need for scalable contract solutions. The country’s robust supply chain and continuous product innovation reinforce its dominant contribution to the regional market size.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Contract Services In Packaging Company Insights

The global Contract Services in Packaging Market in 2024 reflects steady expansion as brands increasingly outsource packaging operations to improve efficiency, meet compliance needs, and manage rising SKU complexity. Among the leading participants, each player contributes unique strengths that shape service quality, scalability, and customer responsiveness across consumer goods, healthcare, industrial, and e-commerce sectors.

WestRock Company remains one of the most influential providers due to its broad packaging portfolio and strong integration across design, converting, fulfillment, and contract packaging. Its expertise in sustainable materials and automated packaging lines positions it as a preferred partner for companies targeting lower waste and optimized supply chain performance.

Sepha strengthens the pharmaceutical and medical device packaging ecosystem through its specialization in leak testing, blister packaging integrity, and quality-assurance technologies. Its contract packaging solutions align well with the rising demand for compliant, high-precision packaging required in regulated healthcare environments.

Peoria Production Solutions delivers labour-intensive kitting, assembly, and fulfillment services, serving clients seeking customizable and hands-on packaging workflows. Its long-standing operational flexibility supports industries handling seasonal demand surges or multi-component packaging requirements across diverse product categories.

ActionPak offers a wide range of contract packaging capabilities, including shrink-wrapping, food packaging, and promotional bundling, making it a strong partner for fast-moving consumer goods and retail campaigns. Its responsiveness and ability to manage short-run and large-volume projects enhance its relevance in fast-changing market environments.

Top Key Players in the Market

- WestRock Company

- Sepha

- Peoria Production Solutions

- ActionPak

- Co-Pak

- Packservice Group

- MDI

- Hollingsworth

- Jonco Industries

- ProStar

Recent Developments

- In Dec 2024, Ardagh Glass Packaging Europe partnered with Hernö Gin to launch a bespoke, sustainable 500 ml glass bottle, emphasizing tailored design and environmental responsibility.The collaboration reflects growing demand for customized contract packaging and premium brand differentiation in the spirits industry.

- In Sep 2024, Veritiv completed the acquisition of Orora Packaging Solutions, strengthening its specialty packaging distribution and contract service capabilities.The deal expands Veritiv’s ability to deliver integrated packaging solutions across industrial, food, and consumer end markets.

Report Scope

Report Features Description Market Value (2024) USD 73.3 billion Forecast Revenue (2034) USD 128.8 billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastics, Paper & Paperboard, Glass, Metal, Others), By Packaging Type (Primary, Secondary, Tertiary), By End-use (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape WestRock Company, Sepha, Peoria Production Solutions, ActionPak, Co-Pak, Packservice Group, MDI, Hollingsworth, Jonco Industries, ProStar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Contract Services In Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Contract Services In Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WestRock Company

- Sepha

- Peoria Production Solutions

- ActionPak

- Co-Pak

- Packservice Group

- MDI

- Hollingsworth

- Jonco Industries

- ProStar