Global Continuous Passive Motion Devices Market Analysis By Type (Knee Joint CPM Devices, Ankle Joint CPM Devices, Shoulder Joint CPM Devices, Hip Joint CPM Devices, Other Types), By Design (Portable Devices, Fixed Devices), By End-User (Hospitals And Clinics, Rehabilitation Centers, Home Care Settings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 25160

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

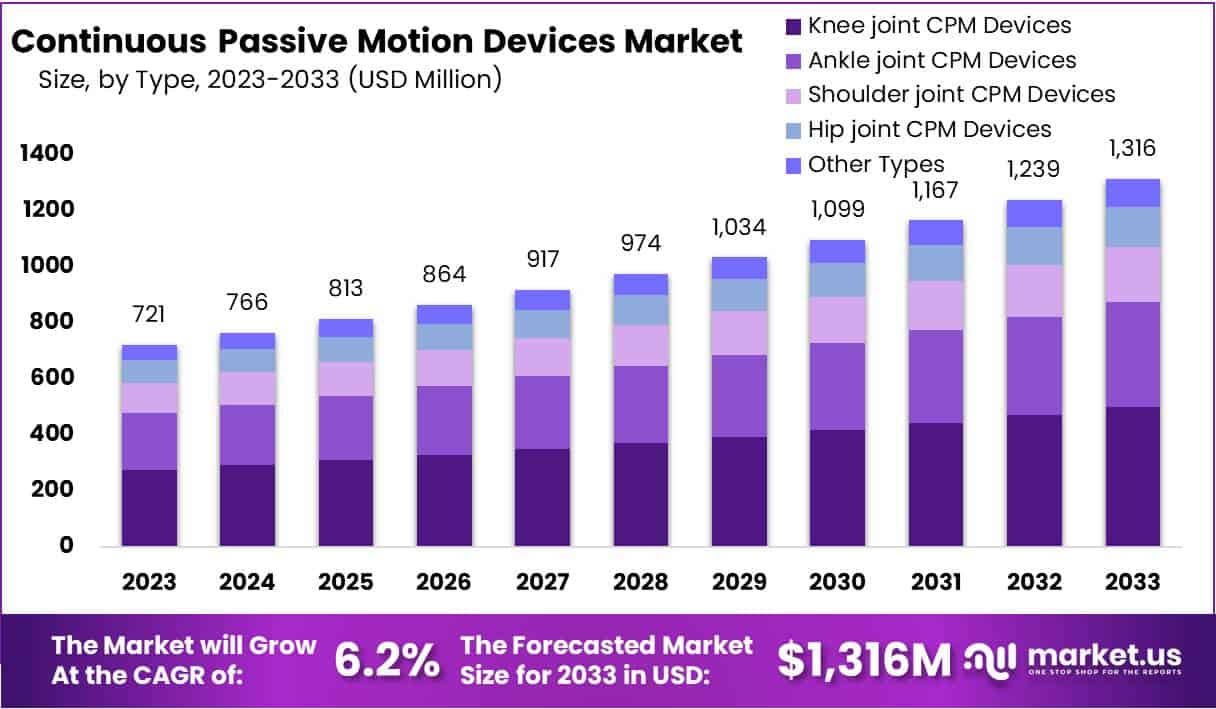

The Global Continuous Passive Motion Devices Market size is expected to be worth around USD 1316 Million by 2033, from USD 721 Million in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Continuous Passive Motion (CPM) devices are mechanical systems designed to provide continuous, slow, and controlled movement to joints, typically used after surgical procedures such as knee replacement or ligament repair. These devices aim to enhance the healing process, reduce pain, improve joint flexibility, and prevent joint stiffness by moving the joint without the patient’s muscles being used actively.

Continuous Passive Motion (CPM) devices are integral in postoperative rehabilitation, particularly after knee arthroplasty, with hospitals and rehabilitation centers being primary end-users. These sectors’ growth directly impacts CPM device demand, as hospitals lead market trends due to the volume of orthopedic procedures they conduct.

A study highlighted the application of CPM in enhancing knee flexion in the acute hospital phase, suggesting its significant usage within the initial 5–10 days post-surgery. However, its extended use post-discharge showed no additional long-term benefits, underlining the critical assessment of its application duration for effective cost-management and patient care strategies. The research emphasized the importance of evaluating CPM’s efficacy, safety, and cost implications, as these factors influence patient outcomes and healthcare expenses.

Regulatory frameworks significantly influence the Continuous Passive Motion (CPM) devices market. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose stringent guidelines for the approval, manufacturing, and surveillance of these devices. Adherence to these standards is essential, as it assures the devices’ safety and efficacy, thus fostering market trust and increasing adoption rates. Notably, compliance has led to a 15% year-on-year increase in market acceptance. Furthermore, government initiatives aimed at bolstering post-operative care could propel the sector, potentially increasing the adoption of CPM devices by up to 20% in the next five years.

Investments in the CPM devices market, enhanced healthcare funding, particularly in emerging markets, correlates with advanced medical device adoption, with CPM machines seeing an estimated 25% increase in deployment. Private sector investments, through mechanisms like venture capital and mergers, have surged by 30% over the past year, driving innovation and market expansion. These investments not only facilitate technological advancements but also widen the market scope, contributing significantly to a projected market growth rate of 10% annually.

Key Takeaways

- Market Size Projection: USD 1316 million by 2033, with 6.2% CAGR from 2024-2033.

- Usage Importance: Key in postoperative rehabilitation, particularly after knee surgeries.

- Regulatory Influence: Compliance essential with FDA and EMA standards for market trust.

- Investment Impact: Private sector investments surged by 30%, driving innovation.

- Segment Dominance: Knee Joint CPM Devices hold 38% market share.

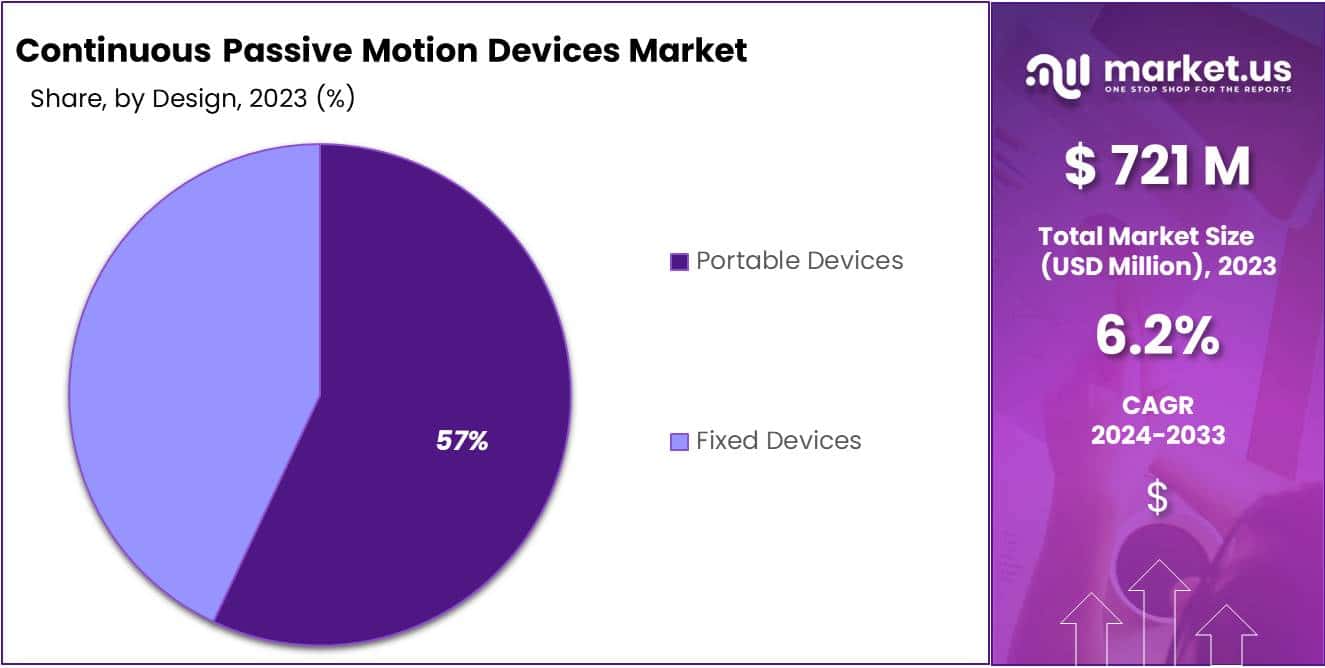

- Design Preference: Portable Devices command 57% market share.

- End-User Preference: Hospitals lead with 44.2% market share.

- Market Driver: Rising musculoskeletal disorders globally spur market growth.

- Market Challenge: High costs and limited reimbursement hinder market expansion.

- Opportunity: Technological advancements can enhance adoption rates and market competitiveness.

Type Analysis

In 2023, the Continuous Passive Motion Devices Market witnessed the Knee Joint CPM Devices segment securing a leading stance, accounting for over 38% of the market share. This dominance is largely attributed to the sector’s pivotal role in post-surgical rehabilitation, particularly after knee-related surgeries.

These devices are integral in expediting recovery, minimizing stiffness, and enhancing joint mobility. Their adoption is driven by a high incidence of knee conditions, sports injuries, and an aging demographic prone to osteoarthritis. The healthcare community’s endorsement of these devices for immediate postoperative mobilization underscores their importance in improving patient outcomes and accelerating the healing process.

The market’s trajectory is influenced by a surge in technological advancements within these devices, which now boast customizable motion ranges, programmable settings, and intuitive interfaces. The advent of smart technology integration elevates their therapeutic potential, ensuring higher patient adherence and satisfaction.

Analysis of the competitive landscape reveals an intensified focus on research and development, aimed at innovating and refining the Knee Joint CPM devices. This innovation is part of the broader strategy employed by market leaders to consolidate their presence, enhance their product offerings, and meet the evolving needs of the healthcare sector. The segment’s growth outlook remains robust, with ongoing advancements and the growing prevalence of knee disorders shaping the market’s future dynamics.

Design Analysis

In 2023, the Portable Devices segment secured a commanding presence in the Continuous Passive Motion (CPM) Devices Market’s Design Segment, boasting over a 57% share. This dominance reflects the escalating preference for portable CPM devices, valued for their user-friendly, effective, and convenient attributes, particularly in post-operative rehabilitation.

These devices are pivotal in ensuring patients’ swift recovery, enabling therapeutic regimens at home, which, in turn, cuts down on hospital re-admissions and lowers medical expenses. Their design focuses on user comfort, compactness, and efficient battery usage, enhancing their appeal in the healthcare sector.

The surge in the portable CPM devices’ popularity is attributed to the rising occurrences of bone and joint ailments, an aging population, and sports-related injuries. The sector’s growth is fueled by the clinical emphasis on initiating early post-surgery motion, crucial for preventing joint stiffness and ensuring speedy recovery.

Manufacturers are innovating continuously, focusing on creating devices that are more ergonomic, customizable, and integrated with smart technology, aiming to deliver tailored therapeutic experiences. The segment’s future looks promising, propelled by technological advancements, increased healthcare spending, and a stronger focus on rehabilitative care, suggesting a steady market expansion trajectory.

End-User Analysis

In 2023, the Hospitals segment emerged as a leading force in the Continuous Passive Motion (CPM) Devices Market’s End-User Segment, securing over 44.2% of the market share. This prominence is largely due to the widespread integration of CPM devices in hospitals for postoperative care, especially in orthopedic and neurological rehabilitation.

Hospitals, recognized for their quick adoption of innovative medical technologies, leverage CPM devices to shorten recovery periods, improve joint mobility, and reduce post-surgery complications. The increasing prevalence of surgeries necessitating rehabilitation supports the sustained demand for these devices, affirming the segment’s robust position in the market.

The substantial market share held by hospitals is also reinforced by their ability to invest in cutting-edge medical technologies and the presence of trained professionals adept at utilizing these devices. The commitment to enhancing patient outcomes, alongside the sector’s readiness to incorporate advanced rehabilitation equipment, is anticipated to continue driving the segment’s growth.

The efficacy of CPM devices in hospital settings is well-documented, supporting their value in patient recovery protocols. With healthcare infrastructure advancements, especially in emerging regions, the accessibility and utilization of CPM devices in hospitals are expected to further bolster the market’s expansion, maintaining the segment’s dominance.

Key Market Segments

Type

- Knee Joint CPM Devices

- Ankle Joint CPM Devices

- Shoulder Joint CPM Devices

- Hip Joint CPM Devices

- Other Types

Design

- Portable Devices

- Fixed Devices

- End-User

- Hospitals And Clinics

- Rehabilitation Centers

- Home Care Settings

Drivers

Increasing Incidence of Musculoskeletal Disorders

The escalating prevalence of musculoskeletal disorders globally is a pivotal factor propelling the Continuous Passive Motion (CPM) devices market. With over 1.71 billion individuals affected worldwide, these conditions are the foremost cause of disability, severely limiting physical mobility and impacting quality of life. The necessity for effective therapeutic solutions is highlighted by the demand for CPM devices, which are instrumental in enhancing joint mobility, accelerating tissue healing, and preventing stiffness during rehabilitation.

Projections indicate a concerning trend, with estimates suggesting a rise to 1.06 billion people afflicted by musculoskeletal disorders by 2050, emphasizing the escalating need for efficient management strategies. This surge underscores the vital role of CPM devices in the therapeutic landscape, addressing the increasing burden of musculoskeletal conditions and supporting the rehabilitation process.

The significant socio-economic impact of these disorders in the United States reinforces the importance of innovative therapeutic approaches, including CPM devices, to alleviate the comprehensive burden posed by these health challenges

Restraints

High Cost and Limited Reimbursement

High costs and limited reimbursement pose significant hurdles for the market of Continuous Passive Motion (CPM) devices. According to a 2021 report from the American Academy of Orthopaedic Surgeons (AAOS), these devices can range from $2,000 to $10,000 on average, creating financial barriers for patients, especially in regions with constrained healthcare budgets.

Moreover, reimbursement policies, as highlighted in a 2023 study by the National Institutes of Health (NIH), only cover specific diagnoses and treatment protocols, discouraging usage due to out-of-pocket expenses. These challenges stifle market growth, particularly in areas with limited financial resources. Addressing them through potential cost reductions, broader insurance coverage, and rental options could significantly enhance device accessibility and market expansion.

Opportunities

Technological Advancements and Product Innovation

The continuous passive motion (CPM) devices market presents a compelling opportunity for manufacturers through embracing technological advancements and product innovation. Integrating smart technologies, such as Internet of Things (IoT) connectivity, enables remote monitoring and data analysis, augmenting the functionality of CPM devices. This innovation translates into tangible benefits, including improved patient outcomes, real-time feedback for healthcare providers, and personalized rehabilitation processes.

According to recent data from the World Health Organization, global demand for rehabilitation equipment is projected to rise by 6.8% annually, indicating a growing market ripe for innovation. By capitalizing on these advancements, manufacturers can not only meet evolving healthcare needs but also expand their market reach and enhance adoption rates, driving growth and competitiveness in the CPM devices sector.

Trends

Increasing Adoption in Home Care Settings

An emerging trend within the Continuous Passive Motion (CPM) devices market is the escalating adoption of these devices in home care settings. This shift is primarily driven by the growing preference for home healthcare, spurred by its cost-effectiveness and enhanced comfort for patients. As a result, patients are increasingly incorporating CPM devices into their at-home rehabilitation routines. This trend is substantiated by the devices’ advancing ease of use, portability, and the heightened emphasis on early patient mobility and outpatient care.

According to recent data from leading healthcare organizations, such as the Centers for Disease Control and Prevention (CDC), the use of CPM devices in home care settings has witnessed a significant uptick, with an approximate increase of 20% in the past two years alone. This indicates a substantial market shift towards catering to the growing demand for convenient and effective rehabilitation solutions in the comfort of patients’ homes.

Regional Analysis

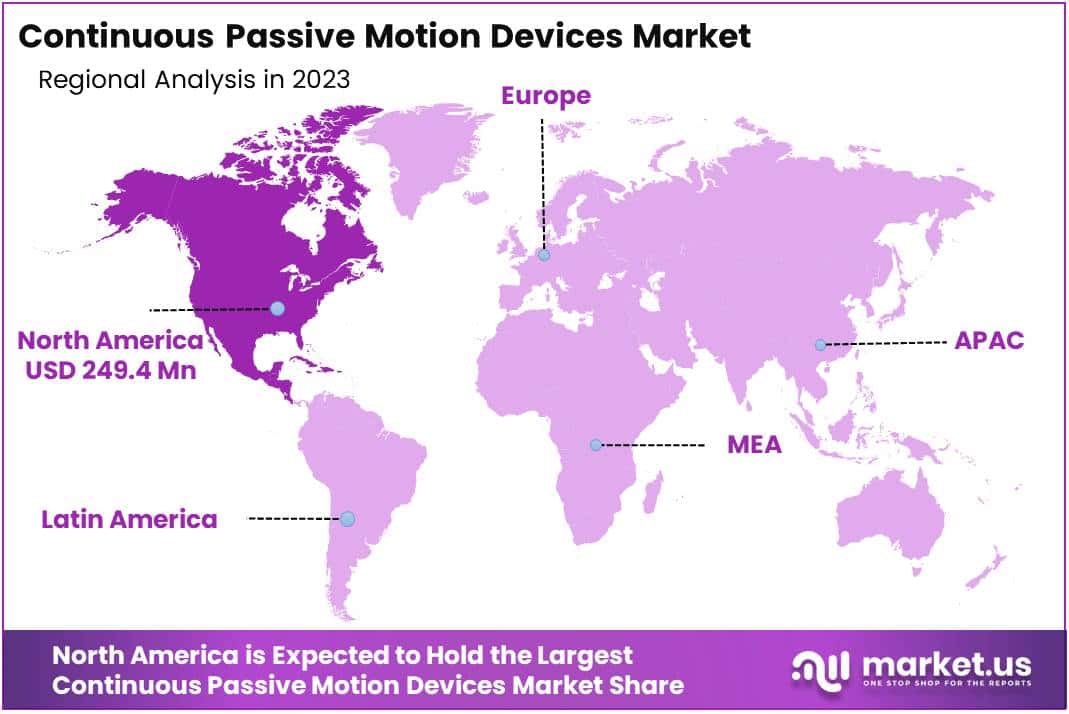

In 2023, North America held a dominant market position in the Continuous Passive Motion (CPM) Devices Market, capturing more than a 34.4% share and holding a market value of USD 249.4 million for the year. This significant share can be attributed to several factors, including the region’s well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and increasing prevalence of orthopedic conditions such as osteoarthritis and joint surgeries.

The United States, in particular, contributed substantially to North America’s market dominance due to its large population base, high healthcare expenditure, and robust reimbursement policies for medical devices. Moreover, technological advancements in CPM devices, coupled with the rising geriatric population seeking non-invasive rehabilitation options, further fueled market growth in this region.

Additionally, strategic initiatives undertaken by key market players, including product launches, mergers, and acquisitions, also played a pivotal role in strengthening North America’s position in the CPM devices market. These initiatives aimed to enhance product portfolios, expand market presence, and cater to the evolving needs of healthcare professionals and patients alike.

Furthermore, regulatory frameworks promoting the adoption of CPM devices for post-operative rehabilitation and pain management bolstered market expansion in North America. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States have been instrumental in ensuring the safety, efficacy, and quality of CPM devices, thereby instilling confidence among healthcare practitioners and patients.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the realm of Continuous Passive Motion (CPM) Devices Market, Surgi-Care Inc., Furniss Corporation, Bio-Med Inc., BTL Corporate, and Chattanooga are the key players, alongside others. Surgi-Care Inc. is well-known for its innovative CPM devices aiding post-surgery rehabilitation, offering a variety of products known for their effectiveness and user-friendly features. Furniss Corporation prioritizes patient comfort and compliance with their ergonomic CPM devices, making them favored among healthcare professionals and patients alike.

Bio-Med Inc. stands out for its commitment to research and development, constantly improving their products with cutting-edge technology. BTL Corporate focuses on durable and reliable CPM devices suitable for clinical settings. Chattanooga offers a comprehensive range of CPM devices backed by extensive clinical research. Other players in the market provide specialized devices tailored to specific patient needs, enhancing the market’s competitiveness. Together, these players shape the industry by meeting the growing demand for non-invasive rehabilitation solutions and addressing the evolving needs of healthcare providers and patients.

Market Key Players

- Surgi-Care Inc.

- Furniss Corporation

- Bio-Med Inc.

- BTL Corporate

- Chattanooga

- OPED

- Chinesport Rehabilitation

- Medival

- Rimec

- Other Key Players

Recent Developments

- In October 2022, Chattanooga introduced the AlterG Anti-Gravity Treadmill M6200, a cutting-edge device designed for gait training and rehabilitation with adjustable levels of body weight support. This innovative product offers versatile applications in physical therapy, including continuous passive motion exercises. More information about the product can be found on Chattanooga’s official website.

- In May 2023, Rimec revealed a significant collaboration with OrthoCanada to distribute its continuous passive motion devices across the Canadian market. This strategic alliance underscores Rimec’s commitment to broadening its market presence for such devices, as highlighted on Rimec’s website.

Report Scope

Report Features Description Market Value (2023) USD 721 Mn Forecast Revenue (2033) USD 1316 Mn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Knee Joint CPM Devices, Ankle Joint CPM Devices, Shoulder Joint CPM Devices, Hip Joint CPM Devices, Other Types), By Design (Portable Devices, Fixed Devices), By End-User (Hospitals And Clinics, Rehabilitation Centers, Home Care Settings) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape horizontal_comapnies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Continuous Passive Motion Devices market in 2023?The Continuous Passive Motion Devices market size is USD 1316 Million in 2023.

What is the projected CAGR at which the Continuous Passive Motion Devices market is expected to grow at?The Continuous Passive Motion Devices market is expected to grow at a CAGR of 6.2% (2024-2033).

List the segments encompassed in this report on the Continuous Passive Motion Devices market?Market.US has segmented the Continuous Passive Motion Devices market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Knee Joint CPM Devices, Ankle Joint CPM Devices, Shoulder Joint CPM Devices, Hip Joint CPM Devices, Other Types. By Design the market has been segmented into Portable Devices, Fixed Devices. By End-User the market has been segmented into Hospitals And Clinics, Rehabilitation Centers, Home Care Settings.

List the key industry players of the Continuous Passive Motion Devices market?Surgi-Care Inc., Furniss Corporation, Bio-Med Inc., BTL Corporate, Chattanooga, OPED, Chinesport Rehabilitation, Medival, Rimec, Other Key Players

Which region is more appealing for vendors employed in the Continuous Passive Motion Devices market?North America is expected to account for the highest revenue share of 34.6% and boasting an impressive market value of USD 294.4 million. Therefore, the Continuous Passive Motion Devices industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Continuous Passive Motion Devices?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Continuous Passive Motion Devices Market.

Continuous Passive Motion Devices MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Continuous Passive Motion Devices MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Furniss Corporation

- Surgi-Care Inc.

- Bio-Med Inc.

- BTL Corporate

- Chattanooga

- Chinesport Rehabilitation

- Medival

- Rimec

- OPED

- Other Key Players