Global Content Security Market Size, Share, Industry Analysis Report By Offering (Solution (Email Content Security, Web Content Security, Others), Services), By Organization Size (Small & Medium-Sized Enterprises, Large Enterprises), By Vertical (BFSI (Banking, Financial Services & Insurance), IT & ITeS, Media & Entertainment, Manufacturing, Healthcare, Retail & Ecommerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 160084

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Overall Adoption Trends

- Role of Generative AI

- Analysts’ Viewpoint

- Investment and Business Benefits

- US Market Size

- By Offering

- By Organization Size

- By Vertical

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

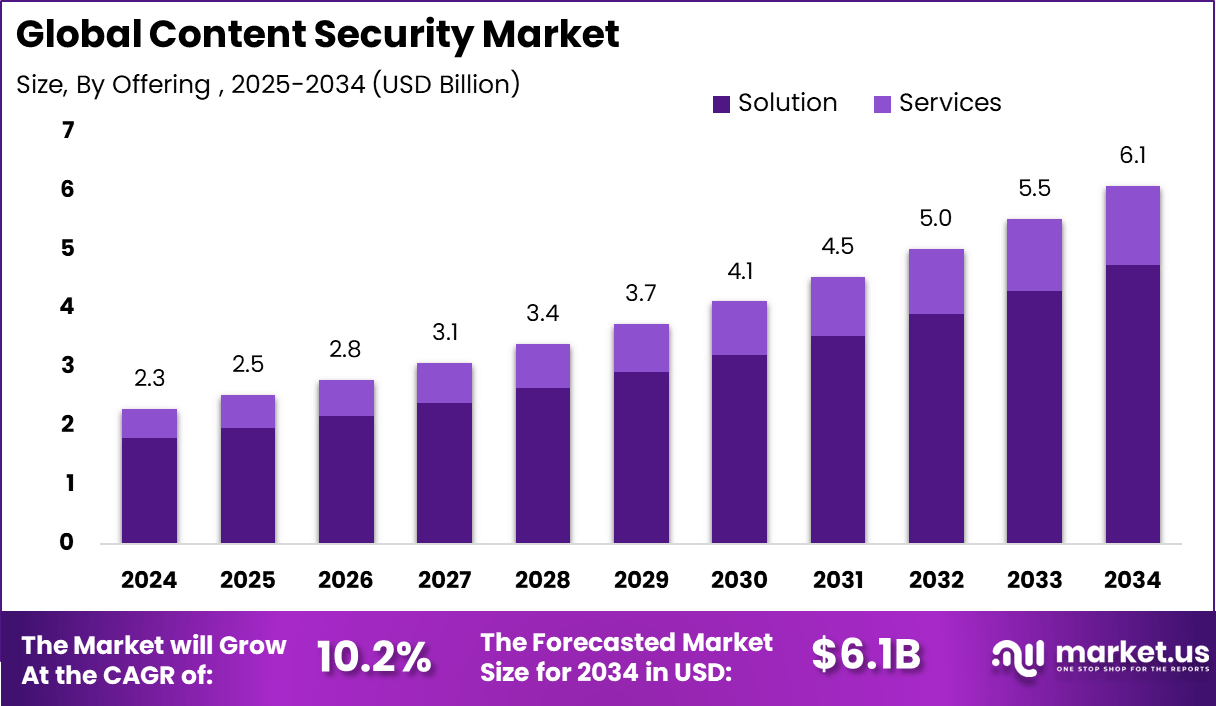

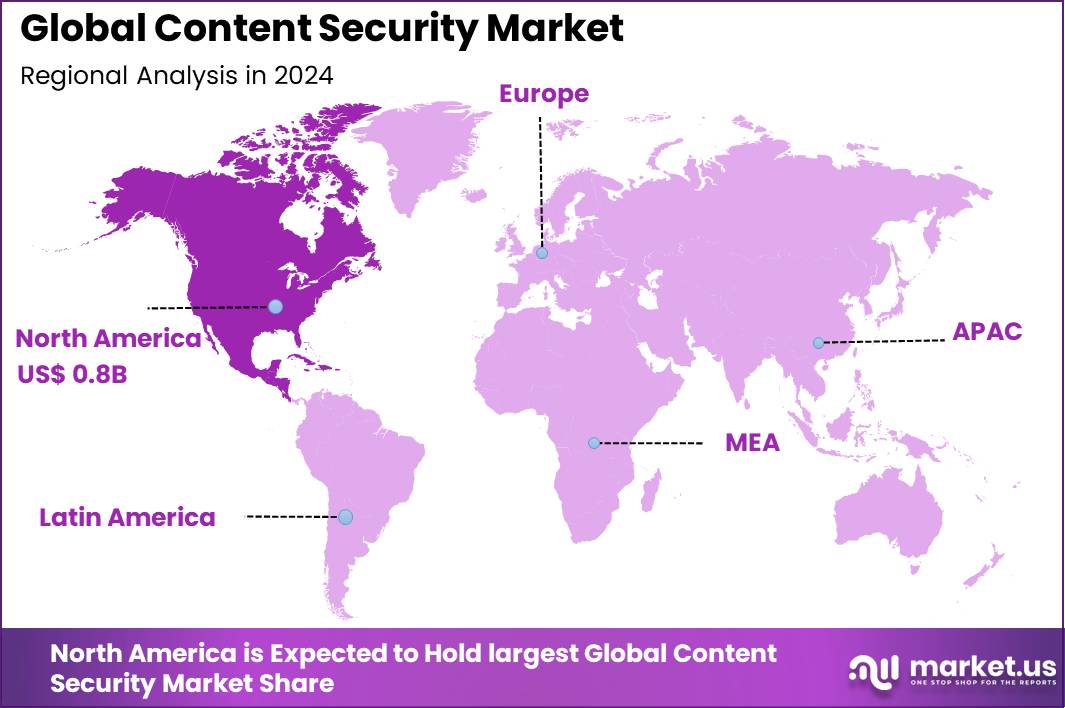

The Global Content Security industry, valued at USD 2.3 billion in 2024, is forecast to advance steadily, reaching USD 2.5 billion in 2025 and surging toward USD 6.1 billion by 2034, at a CAGR of 10.2%. In 2024, North America held a dominan market position, capturing more than a 38.0% share, holding USD 0.8 Billion revenue.

The content security market refers to technologies, tools, and services that protect digital content from unauthorized access, piracy, tampering, or misuse. This includes systems for digital rights management (DRM), watermarking, piracy monitoring, credential sharing detection, content encryption, secure streaming, and policy enforcement. In media, entertainment, and streaming industries, content security ensures that only authorized users can consume content and that piracy is detected and mitigated.

One major driver is the explosion of streaming and digital content distribution. As more media is consumed online, protecting that content becomes critical for revenue preservation. Another driver is the rise in piracy and credential sharing, which lead rights holders to demand stronger security. Regulatory and contractual requirements also push adoption: content owners, studios, broadcasters, and streaming platforms often must enforce rights and licensing terms.

According to Market.us, The digital content creation industry has followed a strong upward path, rising from USD 27.1 billion in 2023 and advancing at a 12.8% compound annual growth rate through the 2024–2033 period. North America held a leading position in 2023, accounting for over 38.1% of global activity and generating about USD 10.3 billion in revenue.

Improvements in encryption, watermarking, forensic tracking, and analytics make more robust content security possible. Also, competition in streaming forces platforms to guard their premium content to maintain subscriptions. Demand is especially strong in the media and entertainment industry – streaming services, broadcasters, film studios, and digital publishers need to safeguard their content.

Key Insight Summary

- Solutions dominate with 78%, as enterprises focus on integrated platforms for threat detection and compliance.

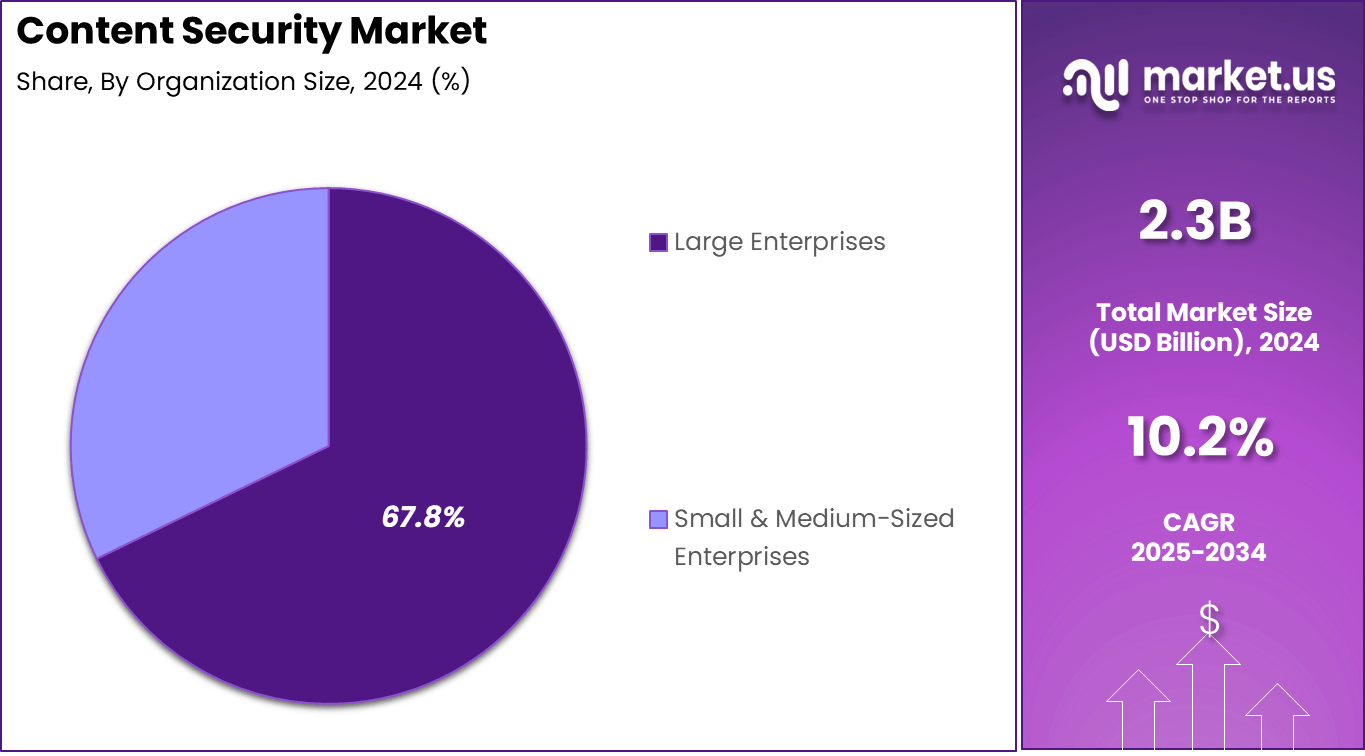

- Large enterprises lead adoption at 67.8%, reflecting their need to safeguard vast amounts of sensitive content.

- BFSI sector accounts for 22%, driven by regulatory mandates and the critical need for secure financial data.

- North America captures 38%, supported by strong cybersecurity regulations and enterprise investments.

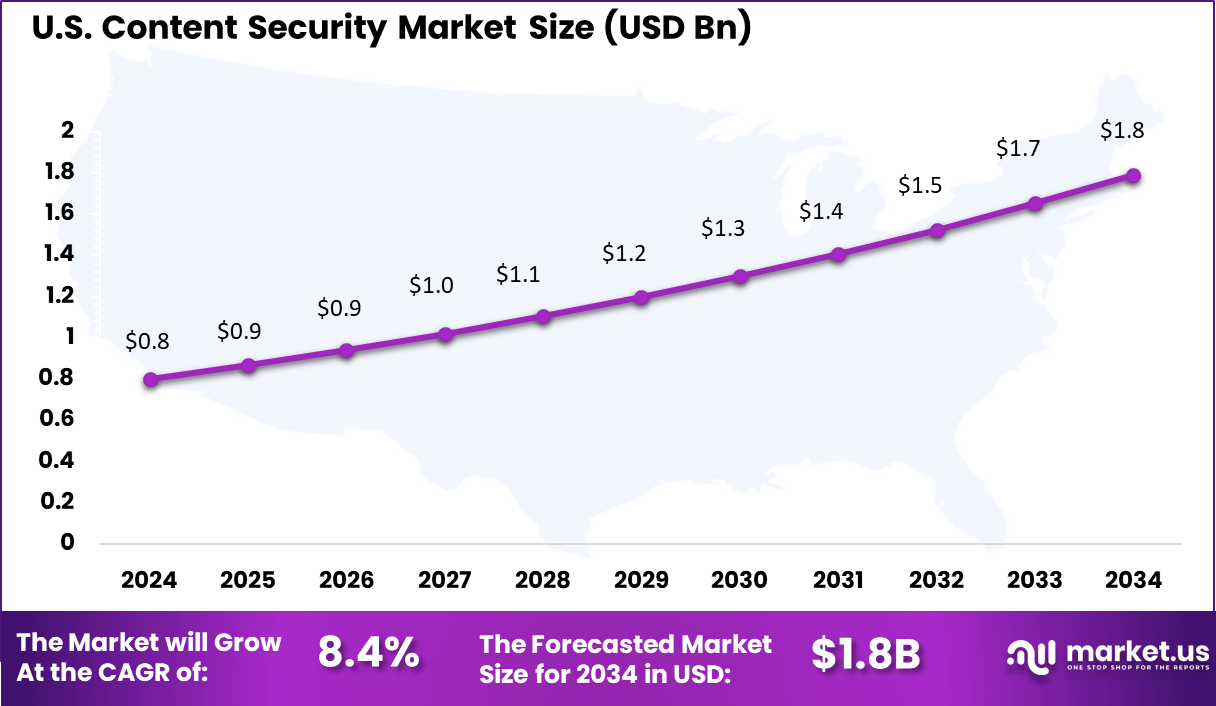

- The US market reached USD 0.80 billion and is growing at a CAGR of 8.4%, highlighting steady demand for advanced content protection solutions.

Overall Adoption Trends

CSP adoption has been around for more than a decade, but the reality is that adoption across the web is still low. Back in 2020, studies showed that only 6.3% of websites included a CSP header or meta tag, while just 7% of the top 1 million sites had a valid CSP in place. Adoption has improved over time, rising from 1.5% in 2017 to 6.3% by mid-2020, but even with this growth, CSP remains far from being a standard security practice.

Factors guiding adoption

Adoption tends to be higher among larger and more popular sites. For example, in 2020, nearly 25% of the top 1,000 websites had implemented CSP, compared to a much lower percentage across the broader web. The difficulty of implementation plays a central role in slowing adoption. CSP requires developers to carefully map out all legitimate content sources, which is both complex and time-consuming.

For legacy platforms filled with inline code, CSP often demands full rewrites, making it an expensive and often avoided task. Deployment strategy also matters. While many organizations use CSP in enforcing mode, insecure whitelisting has left policies open to bypass.

Others deploy in report-only mode as a gradual step, but without follow-through, this approach does little to reduce real-world attack risk. At the same time, the growing prevalence of attacks like cross-site scripting and Magecart-style supply chain intrusions is renewing attention to CSP as a necessary defense.

Future trends shaping adoption

Between 2024 and 2025, several industry trends are beginning to push CSP adoption forward. Serverless computing is making CSP deployment easier by consolidating control over hosted resources. AI-driven security tools are also emerging, which can flag misconfigurations and automatically optimize CSP policies at scale.

Alongside this, the rise of DevSecOps practices is embedding CSP checks into development pipelines, improving ongoing compliance and reducing the patchwork nature of past implementations. On a broader level, the shift toward zero trust architectures is also influencing CSP adoption.

Since zero trust is based on continuous verification and minimum access, CSP aligns well with this principle by limiting untrusted scripts and third-party code. Combined with supply chain concerns, where compromised external services pose direct risks, CSP is increasingly being viewed not just as a compliance tool but as a necessary safeguard in modern web security strategies.

Role of Generative AI

Generative AI is playing a critical role in content security by both enabling advanced security measures and introducing new risks. In 2025, around 77% of companies use generative AI in security workflows to detect threats and automate responses.

However, challenges persist as 71% of organizations are concerned about new security threats introduced by generative AI, such as data leakage and prompt injection attacks. AI-powered security platforms now actively monitor and filter suspicious activities in content flows to reduce risks, integrating real-time AI-driven threat detection with policy governance to prevent misuse and breaches effectively.

Analysts’ Viewpoint

The technologies gaining traction include AI-powered threat detection, machine learning algorithms for anomaly detection, cloud-based content gateways, and comprehensive filtering solutions that block malicious or inappropriate material in real time.

The adoption of Content Security Policy (CSP) frameworks, which help prevent cross-site scripting and code injection attacks, has notably increased, with over 80% of industries using CSP to reduce breaches. Larger organizations tend to adopt CSP more broadly, but even among the top websites, perfect implementation remains rare, indicating both growing adoption and areas for improvement.

Key reasons organizations adopt content security technologies include the need to mitigate financial loss from data breaches, protect brand reputation, comply with stringent global regulations such as GDPR and CCPA, and support secure digital transformation initiatives. Maintaining customer trust by ensuring data privacy and preventing cyber-attacks is a significant motivator.

Investment and Business Benefits

Investment opportunities in the Content Security market are strong as digital content consumption expands rapidly worldwide. Investors see growth potential in AI and machine learning technologies that improve threat detection and content filtering efficacy. Cloud-based solutions are especially attractive due to scalability and cost-effectiveness. Emerging markets, particularly in Asia-Pacific, with increasing internet penetration and digital ecosystems, offer further expansion prospects.

Mergers and acquisitions also create chances to acquire specialized tech firms and deepen IP portfolios, fostering innovation. Collaborations between media and cybersecurity startups suggest ongoing breakthroughs in securing digital content. Business benefits of deploying content security include increased operational efficiency through automated threat monitoring and filtering, centralized control over content access and permissions, and enhanced compliance management.

These solutions reduce risks of data leaks and cyber intrusions, allowing organizations to focus on core activities with confidence in data safety. Content security systems also support audit capabilities and streamline regulatory reporting. Companies that invest in these solutions often see improved customer confidence and reduced potential legal penalties due to better adherence to data privacy laws.

US Market Size

The U.S. Content Security Market was valued at USD 0.8 Billion in 2024 and is anticipated to reach approximately USD 1.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.4% during the forecast period from 2025 to 2034.

In 2024, North America captured 38% of the overall share in the content security market. The region remains ahead due to early adoption of advanced security solutions and the constant evolution of cybersecurity regulations. Enterprises across different sectors here allocate significant budgets toward digital protection, influenced by the pressure of stricter compliance requirements.

By Offering

In 2024, Solutions accounted for 78% of the content security market, reflecting the clear preference of enterprises for deploying comprehensive platforms to address content risks. These solutions are widely adopted because they cover multiple layers of protection, including cloud data security, network monitoring, and access control.

Organizations are prioritizing end-to-end offerings that can integrate easily with existing IT set-ups, which reduces the complexity of managing multiple security tools. The demand is also driven by constant upgrades and innovation within content security frameworks.

As cyberthreats grow more advanced, these solutions adapt faster with features such as AI-powered detection, encryption, and policy enforcement. This ability to evolve regularly keeps them ahead of standalone services, making solutions the backbone of modern content protection strategies.

By Organization Size

In 2024, Large enterprises accounted for 67.8% of the adoption share. Their larger digital footprints, wide operations, and regulatory requirements make them the most active users of strong content security systems. The need to handle vast amounts of sensitive information, especially across distributed teams and multiple platforms, ensures that these businesses continue to invest heavily in robust frameworks.

Another consideration is the financial impact of a potential breach, which is significantly higher for large enterprises. Beyond monetary loss, regulatory penalties and reputational risks push them toward comprehensive deployment. As remote work and data-sharing models expand, these organizations remain the leaders in enterprise-scale adoption.

By Vertical

In 2024, The BFSI sector represented 22% of the market share. Financial institutions handle highly sensitive information including customer identification data, transaction records, and payment processes. Protecting this content from breaches, ransomware, or insider misuse is critical, making BFSI one of the earliest and most consistent adopters of security solutions.

With increasing digital banking services, insurance claim automation, and online financial platforms, the reliance on airtight security is growing. Consumer confidence in financial services largely depends on trust, and investing in strong content security provides firms with a way to safeguard their reputation as much as their technical infrastructure.

Emerging Trends

Emerging trends in content security highlight increasing adoption of AI-driven threat detection and response systems. Automated cloud security validation has grown, improving vulnerability management by simulating real-life attack scenarios before exploitation. By 2025, 60% of enterprises have restricted or banned the use of generative AI tools to reduce inadvertent exposure of sensitive data.

There is also a sharp rise in advanced adversarial attacks powered by generative AI, with 57% of organizations reporting significant increases in AI-powered cyberattacks last year. The market emphasizes securing AI-generated content alongside conventional data to stay ahead of evolving threats.

Growth Factors

Growth in content security is primarily fueled by the rising cybercrime incidents and the need for compliance with stringent data protection regulations worldwide. Surveys show a 13% rise in cybercrime reports YoY as organizations face increasingly sophisticated phishing, malware, and data breach attempts.

This compels companies across sectors to invest in AI-powered content filtering and security gateways that monitor inbound and outbound data in real time. Cloud adoption and remote workforce expansion also drive demand for scalable and integrated content security solutions, pushing growth despite ongoing threat complexity.

Key Market Segments

By Offering

- Solution

- Email Content Security

- Web Content Security

- Others

- Services

By Organization Size

- Small & Medium-Sized Enterprises

- Large Enterprises

By Vertical

- BFSI (Banking, Financial Services & Insurance)

- IT & ITes

- Media & Entertainment

- Manufacturing

- Healthcare

- Retail & Ecommerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rise in Cyber Threats

The increasing volume and sophistication of cyber threats fuel the need for content security solutions. As more digital content is created and shared globally, organizations face growing risks of data breaches and unauthorized access that can lead to massive financial and reputational damage.

For instance, Cyberattacks on sensitive data have increased sharply, driving companies to strengthen content security and meet regulatory requirements. The growing risk landscape is encouraging the use of AI and machine learning to detect threats and respond rapidly. As a result, organizations are investing in advanced systems that not only protect data but also anticipate evolving attack methods.

Restraint

High Cost of Advanced Solutions

The relatively high investment required for modern content security technologies acts as a major barrier to adoption, especially for small and medium enterprises. These advanced solutions, which often include AI-driven threat detection and cloud integration, come with significant upfront and ongoing expenses.

For instance, smaller firms may find it difficult to allocate sufficient budget without compromising other operational areas. Additionally, the cost challenge is compounded by the need to integrate multiple security tools to address diverse threats across emails, web content, and data loss prevention.

Opportunity

Growth in Cloud-based Solutions

The increasing shift to cloud computing presents a substantial opportunity for the content security market. Cloud environments require robust, scalable security measures to protect data remotely accessed from various locations and devices. For example, as remote work expands, companies demand cloud-based content security systems that offer flexibility without compromising protection.

Adoption of such cloud-native solutions also opens new avenues for service providers to offer scalable subscription models and continuous updates. This trend encourages innovation and broadens market reach as businesses seek efficient ways to secure growing digital content in cloud infrastructures.

Challenge

Evolving Cyber Threat Landscape

One core challenge facing the content security market is the rapid evolution of cyber threats. Attackers continuously develop new methods to bypass security measures, requiring constant innovation from solution providers. For example, zero-day vulnerabilities and sophisticated phishing tactics force ongoing research and prompt response capabilities to protect sensitive content effectively.

Maintaining pace with these threats demands significant investment in R&D and skilled personnel. Organizations must update their defenses regularly to avoid exposure, which can strain budgets and operational focus, making sustained security a complex endeavor.

Competitive Analysis

The Content Security Market is dominated by major cybersecurity vendors such as McAfee, Symantec Corporation, Trend Micro Incorporated, and Cisco Systems, Inc. These companies offer advanced solutions for threat detection, email filtering, web security, and data loss prevention. Their platforms are widely adopted by enterprises to guard against malware, phishing, and unauthorized content access.

Leading network and endpoint security firms including Check Point Software Technologies Ltd., Fortinet, Inc., Palo Alto Networks, Inc., Sophos Group plc, F5 Networks, Inc., and Zscaler, Inc. contribute heavily to secure content delivery and cloud-based protection. Their services cover firewalls, secure web gateways, sandboxing, and zero-trust access.

Specialized players like Proofpoint, Inc., Forcepoint LLC, Barracuda Networks Inc., Mimecast Limited, Digital Guardian, Clearswift (HelpSystems, LLC), WatchGuard Technologies, Inc., Cyren Ltd., Webroot Inc. (OpenText), and Kaspersky Lab strengthen the market with email security, insider threat protection, and endpoint content control.

Top Key Players in the Market

- Proofpoint

- McAfee, LLC

- Symantec Corporation

- Trend Micro Incorporated

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Sophos Group plc

- Forcepoint LLC

- Proofpoint, Inc.

- Zscaler, Inc.

- Barracuda Networks Inc.

- F5 Networks, Inc.

- Mimecast Limited

- Digital Guardian

- Clearswift (HelpSystems, LLC)

- WatchGuard Technologies, Inc.

- Cyren Ltd.

- Webroot Inc. (an OpenText company)

- Kaspersky Lab

- Others

Recent Developments

- August 2025: Trend Micro launched Agentic SIEM, an AI-powered security information and event management product automating threat detection across over 900 data sources. The solution reduces manual alert handling and boosts security operation efficiency.

- August 2025: Palo Alto Networks launched Cortex Cloud Application Security Posture Management (ASPM), a prevention-first security module that uses AI to automatically stop risks before production deployment. This solution integrates native and third-party app security data for comprehensive protection.

- May 2025: Proofpoint made two notable acquisitions: Hornetsecurity, a provider of AI-powered Microsoft 365 security and compliance solutions for SMBs and MSPs, significantly enhancing its cloud security reach; and Nuclei, specializing in compliance archiving and AI-driven data enrichment for collaboration platforms like Microsoft Teams, Slack, and Zoom.

- May 2025: Fortinet announced acquisitions of Next DLP, a cloud-native data protection platform, and Lacework, focused on cloud security and cloud-native application protection, expanding its Secure Access Service Edge (SASE) portfolio and increasing its addressable market by $10 billion.

- January 2025: Check Point Software released its 13th annual security report highlighting a 44% increase in global cyberattacks, emphasizing ransomware proliferation and generative AI’s role in accelerating attacks.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 6.1 Bn CAGR(2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solution (Email Content Security, Web Content Security, Others), Services), By Organization Size (Small & Medium-Sized Enterprises, Large Enterprises), By Vertical (BFSI (Banking, Financial Services & Insurance), IT & ITeS, Media & Entertainment, Manufacturing, Healthcare, Retail & Ecommerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Proofpoint, McAfee LLC, Symantec Corporation, Trend Micro Incorporated, Cisco Systems Inc., Check Point Software Technologies Ltd., Fortinet Inc., Palo Alto Networks Inc., Sophos Group plc, Forcepoint LLC, Proofpoint Inc., Zscaler Inc., Barracuda Networks Inc., F5 Networks Inc., Mimecast Limited, Digital Guardian, Clearswift (HelpSystems LLC), WatchGuard Technologies Inc., Cyren Ltd., Webroot Inc. (an OpenText company), Kaspersky Lab, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Proofpoint

- McAfee, LLC

- Symantec Corporation

- Trend Micro Incorporated

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Sophos Group plc

- Forcepoint LLC

- Proofpoint, Inc.

- Zscaler, Inc.

- Barracuda Networks Inc.

- F5 Networks, Inc.

- Mimecast Limited

- Digital Guardian

- Clearswift (HelpSystems, LLC)

- WatchGuard Technologies, Inc.

- Cyren Ltd.

- Webroot Inc. (an OpenText company)

- Kaspersky Lab

- Others