Global Construction Adhesive Market By Type (Acrylic, Polyurethane, Polyvinyl Acetate, and Epoxy), By Application (Onsite, Offsite, and Civil), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 28176

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

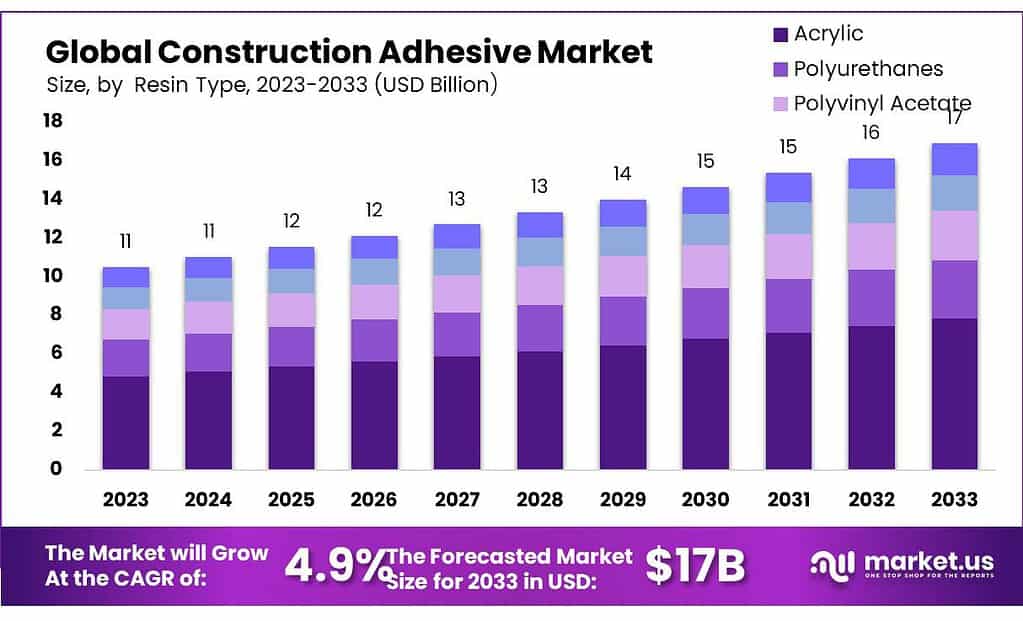

The Construction Adhesive Market size is expected to be worth around USD 17 billion by 2033, from USD 10.5 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The demand for construction adhesives will rise due to increasing infrastructure investments worldwide. According to the United Nations report on infrastructure in 2021 (UNRi), increasing infrastructure investments can increase the global GDP by 0.6%.

This can increase even more in some countries, such as Brazil and the U.S., with an average of 1.3% and 1.5% respectively. As 60% of infrastructure investment will be attracted to emerging economies, it is expected that these countries will continue to be key markets for construction adhesives.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth and Forecast: The Construction Adhesive Market is anticipated to grow significantly, reaching approximately USD 17 billion by 2033, from USD 10.5 billion in 2023, with a projected CAGR of 4.9%.

- Drivers for Growth: The surge in demand is propelled by increased construction activities, particularly in residential housing and infrastructure sectors worldwide.

- Resin and Technology Insights: Acrylic adhesives dominated the market in 2023 with over 44% market share. Meanwhile, water-based products contributed about 44.0% to the global revenue in 2023.

- Application Scenarios: Adhesives play a pivotal role across various construction applications including countertop and drywall lamination, flooring, roofing, and concrete jobs.

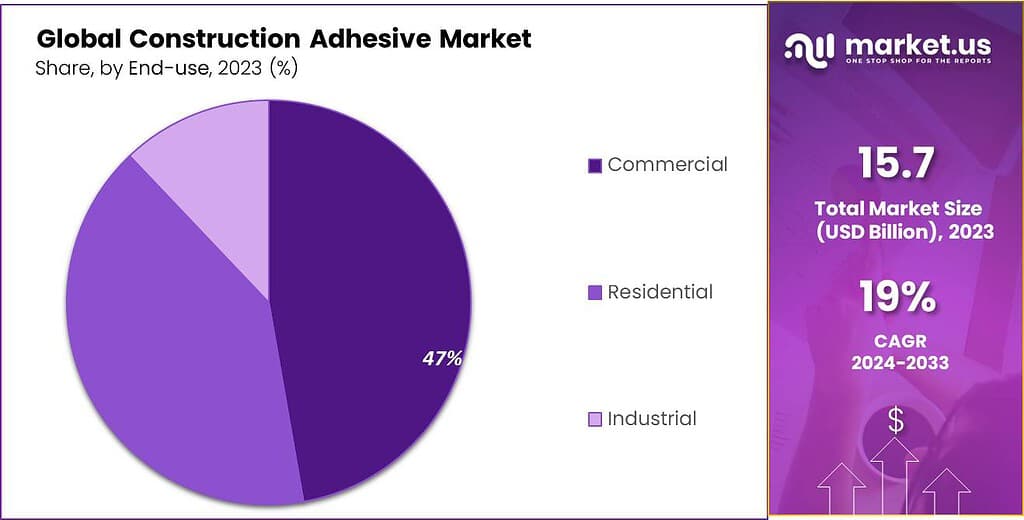

- End-Use Segments: The commercial sector led in using construction adhesives, holding over 47.4% of the market in 2023.

- Challenges and Opportunities: Stricter environmental regulations pose challenges for manufacturers, but the shift towards sustainable, low-VOC products presents significant growth opportunities in the market.

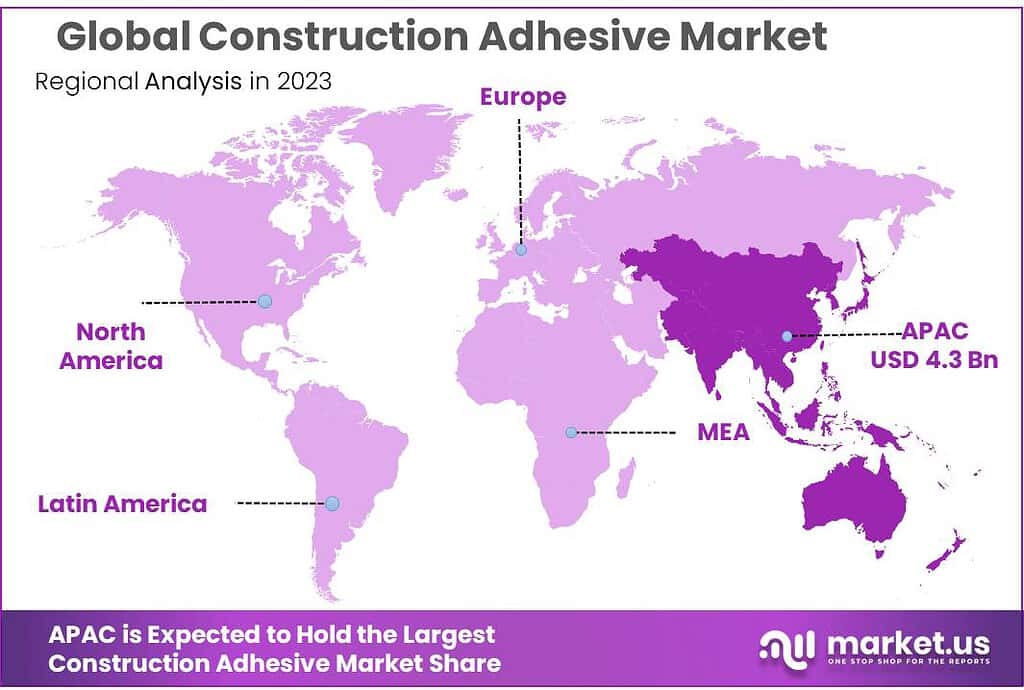

- Regional Analysis: The Asia Pacific region emerged as the largest market, with China as the world’s largest consumer of adhesives in construction, holding over 20% market share.

- Key Players and Developments: Major market players like 3M Company, H.B. Fuller Company, and Sika AG, among others, are investing in eco-friendly products and focusing on innovation to meet stringent environmental regulations.

Resin Type Analysis

In 2023, Acrylic Adhesive was the big leader in the construction adhesive market, having more than 44% of the market share. Polyurethane Adhesives were also quite popular, offering strong bonding abilities for construction projects.

Epoxies, which are structural adhesives, are expected to see a 4.8% increase in revenue during the forecast period. These adhesives can be used to bond various substrates in construction. These adhesives are used for laminated woods such as roofs, decks and walls. They are highly resistant to heat and chemicals and can be used to bond metal, glass, wood and other plastics.

The polyurethane market accounted for over 11.0% of the total volume in 2021. It is expected to continue growing at a rapid pace. The adhesives of polyurethane are paintable and can be used in both hot and cold environments. They can be used for both interior and exterior construction.

Technology Analysis

Water-based products made up nearly 44.0% of the global market’s revenue in 2021. This technology has a higher moisture resistance than other adhesives. This will likely contribute to the growth in the market. Vendors of water-based construction adhesives will likely have new opportunities due to product development and increased R&D expenditure.

Solvent-based products are highly performative in construction and will likely see lucrative growth over the projected period. This segment is expected to continue seeing positive growth in both structural and non-structural markets.

Market players are investing in R&D to develop advanced solutions that will increase their market share. Because of their excellent bond strength and durability in harsh environments, reactive adhesives are expected to see healthy growth.

Application Analysis

Countertop and drywall Lamination is one place. Adhesives help stick things together for countertops and drywalls. Flooring is another area where adhesives come in handy.

They help glue down flooring materials. Roofing is a big one. Adhesives help seal and stick roofing materials together. Manufactured Housing also uses adhesives to hold things in place.

Panels in construction need adhesives to stay together. Concrete jobs also use adhesives to bond things. Joint Cement for construction work also relies on adhesives. In different parts of construction, adhesives play a big role in holding things together.

By End-Use

In 2023, the Commercial sector was at the top in using construction adhesives, holding over 47.4% of the market. Residential use was also significant, where people used these adhesives for home building and repairs.

The residential construction sector is expected to benefit from incentives for first-time home buyers worldwide. The Canadian government introduced a tax-free First Home Savings account in its 2022 budget. This will allow first-time homebuyers to save USD 40,000. From 2022 to 2030, the commercial segment will experience a 5.6% growth in revenue.

Incentives and government packages are expected to increase infrastructure and the residential sector, positively impacting the growth of the construction adhesive market. Mexico, for example, is creating a multi-billion infrastructure package to support investment in roads, ports, energy, and telecommunications.

In 2021, the revenue share for industrial applications was over 30%. The industrial segment is expected to grow in the future by increasing FDIs, especially in emerging countries. In December 2021, for example, the Maharashtra government signed MoUs in India worth approximately USD 659.7 million in various sectors, including steel, electric cars, space, research, food processing, and ethanol production.

Note: Actual Numbers Might Vary In The Final Report

Market Segments

By Resin Type

- Acrylic

- Polyurethanes

- Polyvinyl Acetate

- Epoxy

- Other Resin Types

By Technology

- Acrylic

- Polyurethanes

- Polyvinyl Acetate

- Epoxy

- Others

By Application

- Countertop and drywall Lamination Flooring

- Roofing

- Manufactured Housing

- Panels

- Concrete

- Joint Cement

By End-use

- Residential

- Commercial

- Industrial

Drivers

The demand for construction adhesives has surged due to increased construction activities in both residential housing and infrastructure sectors. These adhesives are essential in numerous construction processes, from carpet laying and tile installation to wallpaper hanging and exterior insulation systems.

Infrastructure investments such as airports, bridges, dams, and metro stations have driven growth in the construction industry. Furthermore, rising middle-class populations globally have led to an increased need for housing – increasing construction adhesive market growth.

India, Brazil, China, Indonesia, and Vietnam have experienced rapid population growth, urbanization, and rising income levels that have led to an explosion in adhesive construction demand. India’s government has introduced subsidy schemes like PMAY to encourage the construction of permanent houses for economically weaker sections – this initiative should further drive up construction adhesive demand.

Large-scale projects such as India’s Delhi-Mumbai Industrial Corridor (DMIC) will create new cities and industrial hubs, creating new job opportunities, tripling industrial production, and increasing exports. This development is anticipated to drive the construction adhesives market in the APAC region significantly.

Restraints

Environmental regulations in North America and Europe are significantly impacting the construction adhesives market. Due to increasing environmental concerns, manufacturers in these regions are shifting towards eco-friendly adhesive products. Companies like Henkel and Franklin International have introduced environmentally-conscious adhesives, such as the OSI Green Series and Titebond GREENchoice, to align with green building processes.

The regulations in these regions have become stricter, leading to bans on solvent-borne construction adhesives in many countries. There’s now a requirement for adhesives to have low Volatile Organic Compounds (VOCs), typically less than 10%, in major parts of the world. Bodies like the Epoxy Resin Committee and the European Commission oversee and enforce these regulations.

However, these stringent environmental laws pose challenges for manufacturers. They struggle to completely transition their focus to producing green and eco-friendly products, affecting their business revenue. This restraint hampers the growth potential of the construction adhesives market in these regulated regions.

Opportunities

The increasing demand for eco-friendly and sustainable products has created a substantial opportunity in the construction adhesives market. There’s a growing trend towards using green adhesives with low Volatile Organic Compound (VOC) levels due to stringent regulations by regulatory authorities like USEPA, Europe’s REACH, LEED, and other regional bodies.

To meet these regulations, manufacturers are focusing on producing environmentally friendly adhesives. These green solutions are made from renewable, recycled, or biodegradable materials, aligning with sustainability goals. These products not only comply with regulations but also promote healthier indoor environments for occupants.

This shift towards a more sustainable product portfolio has opened up significant growth prospects for the industry. Major players are investing in the development of these environmentally friendly construction adhesives to cater to the rising demand for low-VOC and green solutions.

Challenges

Developed countries like the US, Germany, the UK, Japan, and various Western European nations present unique construction adhesive market challenges due to their established infrastructures. These regions boast robust yet well-kept systems covering public, commercial, and transportation sectors; therefore limiting new construction projects as compared with emerging economies.

The existing structures in these countries are designed and built to endure, incorporating high-quality materials and construction techniques that reduce the frequency of repairs or renovations. This characteristic longevity decreases the demand for construction adhesives as these infrastructures require fewer interventions involving adhesion solutions.

Consequently, while there might be some growth in construction activities in these regions over the coming years, it may not be substantial enough to significantly drive up the demand for construction adhesives in comparison to regions undergoing more extensive infrastructure development.

Regional Analysis

Asia Pacific APAC had the largest revenue share at over 41% in 2023, and Europe spent flat on infrastructure. It saw an increase of 1.5% y/o in November 2023 compared to last year. The EU Construction Outlook Report predicts that construction will grow by 2.5% between 2021 and 2022.

The Asia Pacific was the largest market region and is expected to maintain its dominance over the forecast period. China is the world’s largest consumer of adhesives used in construction. It held a market share exceeding 20% by 2023. Massive infrastructure investments will promote construction adhesives. China’s state railway operator, in August 2020, announced plans to double China’s high-speed rail network within the next 15 years.

North America’s construction sector is a major contributor to global GDP. The key factors driving residential construction growth are strong economic growth, increased household formation, and low mortgage interest rates. The forecast period will see a decline in multi-family housing demand, which could have a moderate impact on residential construction.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Construction adhesive market players are focused on developing new products that are environmentally friendly and emit low VOC emissions. They are also focusing on products that can bond to different substrate types, have high bonding strength and provide consistent performance.

Market players will continue to be focused on the development of eco-friendly products. These products have a minimal environmental impact and will see a rise in product demand in the future. The following are some of the major players in the global market for construction adhesive:

Key Market Players

- 3M Company

- H.B. Fuller Company

- Sika AG

- Dow Inc.

- Bostik (Arkema Group)

- Henkel AG & Co. KGaA

- Franklin International, Inc.

- Avery Dennison Corporation

- Illinois Tool Works Incorporation

- DAP Products Inc.

Recent Developments

In February 2022, H.B. Fuller Company acquired Apollo, the United Kingdom’s independent manufacturer of liquid adhesives, coatings, and primers for the roofing, industrial, and construction markets. This acquisition was expected to help H.B. Fuller to expand its share in key construction markets across Europe and the United Kingdom.

In June 2023, H.B. Fuller Company, the world’s largest provider of pureplay adhesives, announced that it had finished two strategic acquisitions that will accelerate the transformation of the company’s portfolio toward more highly specified applications and enhance the diversification of H.B. Fuller’s Construction Adhesives (CA) business.

In April 2023, US adhesives manufacturer HB Fuller announced its intentions to shut down a North American construction adhesives plant and leave a facility in Argentina.

Report Scope

Report Features Description Market Value (2023) USD 2.77 Bn Forecast Revenue (2033) USD 7.1 Bn CAGR (2023-2032) 9.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Petroleum Based, Coal Based), By Grade(Super-premium, Premium-grade, Intermediate-grade), By Application(Electrode, Silicon metals & ferroalloys, Carbon black, Rubber compounds, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape PHILLIPS 66, SHELL GLOBAL, SUMITOMO CORPORATION, Indian Oil Corporation Ltd, MITSUBISHI CHEMICAL CORPORATION, TOKAI CARBON CO., LTD, ASBURY CARBONS INC, ESSAR OIL LTD, Reliance Industries Ltd, HEG LIMITED, GrafTech International Ltd., NIPPON STEEL CORPORATION, PETROLEUM COKE INDUSTY, BAOSTEEL GROUP, mott corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What Are Construction Adhesives?Construction adhesives are bonding agents used in the building and construction industry to join materials such as wood, metal, concrete, ceramic, and plastic. They offer strong adhesion, flexibility, and durability, serving as an alternative or complement to traditional fastening methods like nails or screws.

How Does Market Fragmentation Affect the Industry?The construction adhesive market is diverse and fragmented, with numerous players offering a wide range of products. This diversity promotes innovation and allows for specialized products catering to specific construction needs.

What Are the Primary Applications of Construction Adhesives?- Flooring Installation: Bonding wood, laminate, vinyl, and tile flooring.

- Carpentry and Woodworking: Joining wooden surfaces, cabinets, and furniture.

- Wall Treatments: Installing paneling, tiles, and decorative elements.

- Concrete and Masonry: Bonding bricks, stones, and concrete elements in construction.

Construction Adhesive MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Construction Adhesive MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- H.B. Fuller Company

- Sika AG

- Dow Inc.

- Bostik (Arkema Group)

- Henkel AG & Co. KGaA

- Franklin International, Inc.

- Avery Dennison Corporation

- Illinois Tool Works Incorporation

- DAP Products Inc.