Global Connected Manufacturing Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Technology (Machine Execution Systems, Programmable Logic Controller, Enterprise Resource Planning, SCADA, Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Product Lifecycle Management, Plant Asset Management, Others), By End-use (Automotive, Aerospace & Defense, Chemicals & Materials, Healthcare, Industrial Equipment, Electronics, Food & Agriculture, Oil & Gas, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158317

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

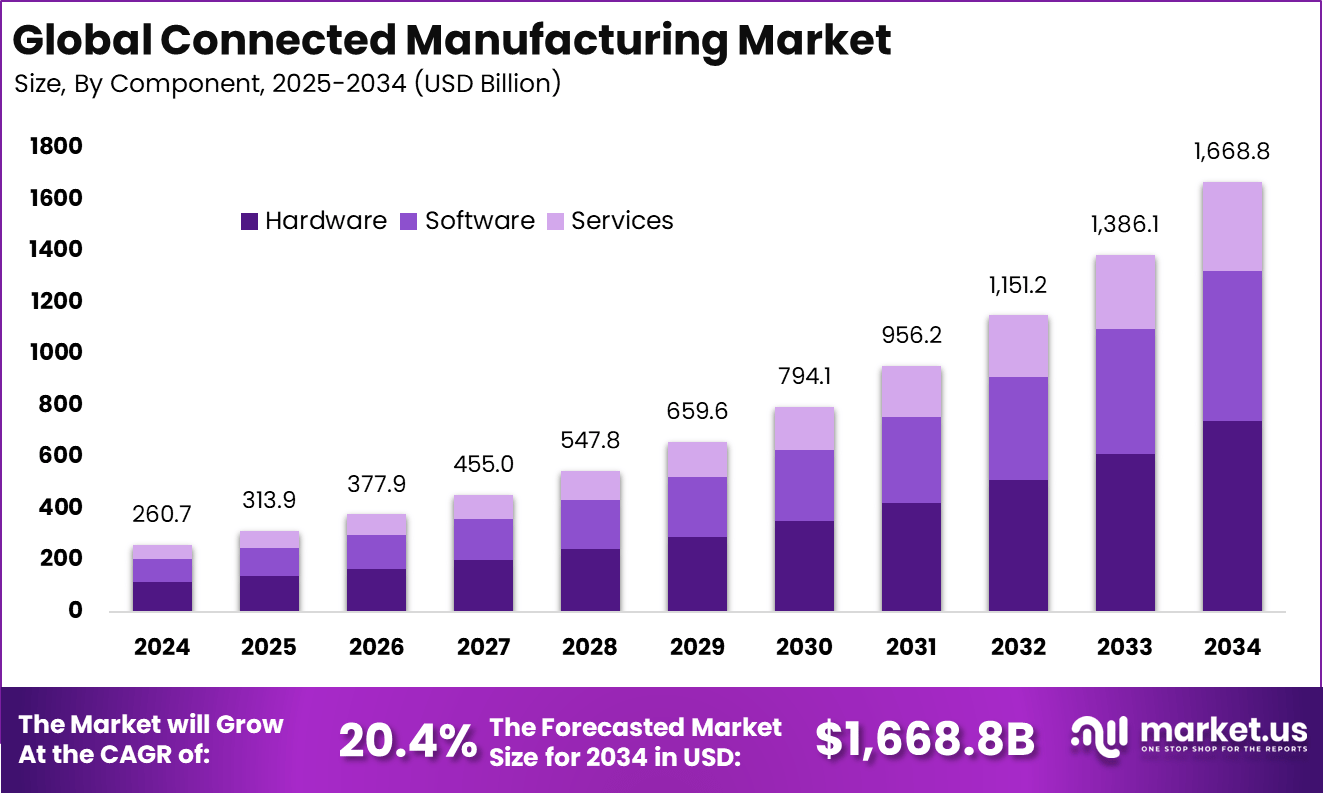

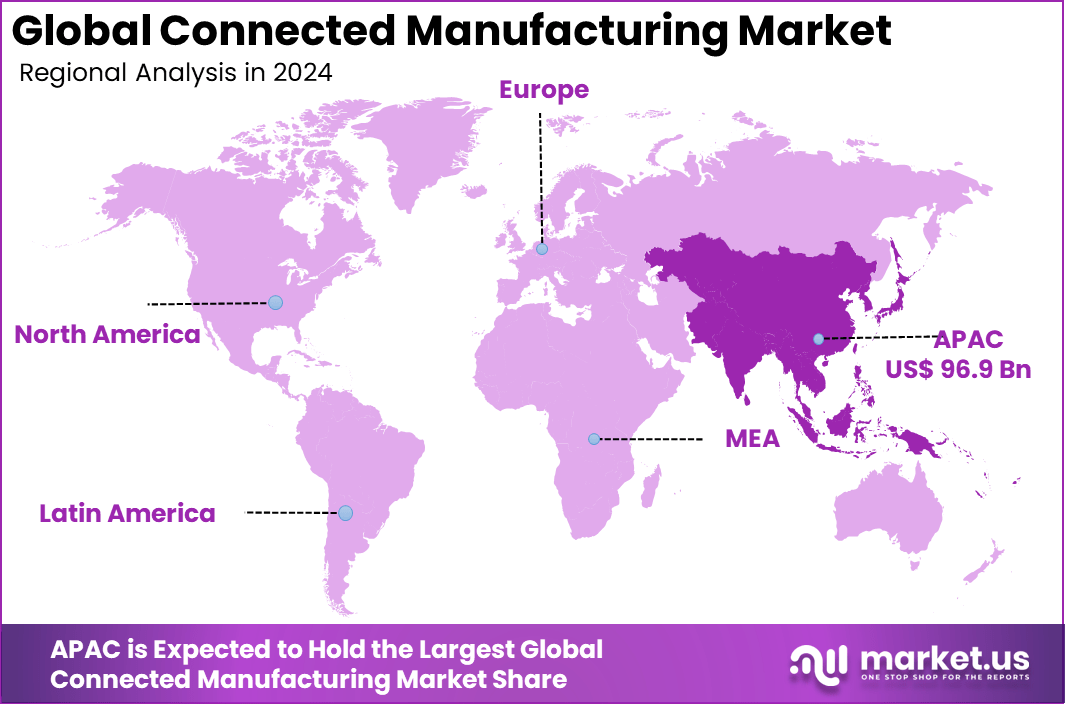

The Global Connected Manufacturing Market size is expected to be worth around USD 1,668.8 billion by 2034, from USD 260.7 billion in 2024, growing at a CAGR of 20.4% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.2% share, holding USD 96.9 billion in revenue.

The Connected Manufacturing Market refers to the integration of advanced digital technologies, data analytics, and connected devices within manufacturing environments. It relies on the Industrial Internet of Things (IIoT), artificial intelligence, cloud platforms, and automation to interconnect machines, processes, and workers. This ecosystem allows real-time monitoring, predictive maintenance, and data-driven decision-making across the supply chain.

Connected manufacturing improves productivity, reduces downtime, and enables greater flexibility in production systems. The market is driven by the increasing need for operational efficiency, reduced costs, and higher production flexibility. Rising global competition is encouraging manufacturers to adopt smart technologies that provide real-time visibility into operations.

According to Keevee, about 75% of manufacturers are raising their investments in automation technologies, with robotics and AI driving much of this expansion. Automated processes are boosting production efficiency by up to 30%, while streamlined workflows are helping to reduce waste and downtime, directly improving overall operational performance.

Despite these advantages, around 38% of manufacturers continue to face challenges due to the high upfront costs associated with automation. However, scalable solutions and clear ROI analyses are increasingly helping companies justify these investments, making automation a more accessible and sustainable strategy for long-term growth in the manufacturing sector.

For instance, in October 2024, Sanmina announced the launch of its 42Q Connected Manufacturing platform, which provides real-time visibility to distributed manufacturing operations. This new platform is designed to enhance efficiency, reduce downtime, and improve decision-making by offering a seamless connection across various manufacturing sites.

Key Takeaway

- In 2024, the Hardware segment led with 44.3% share, showing its critical role in enabling connected manufacturing.

- The Discrete Control Systems segment captured 18.5% share in 2024, highlighting demand for automation and precision control.

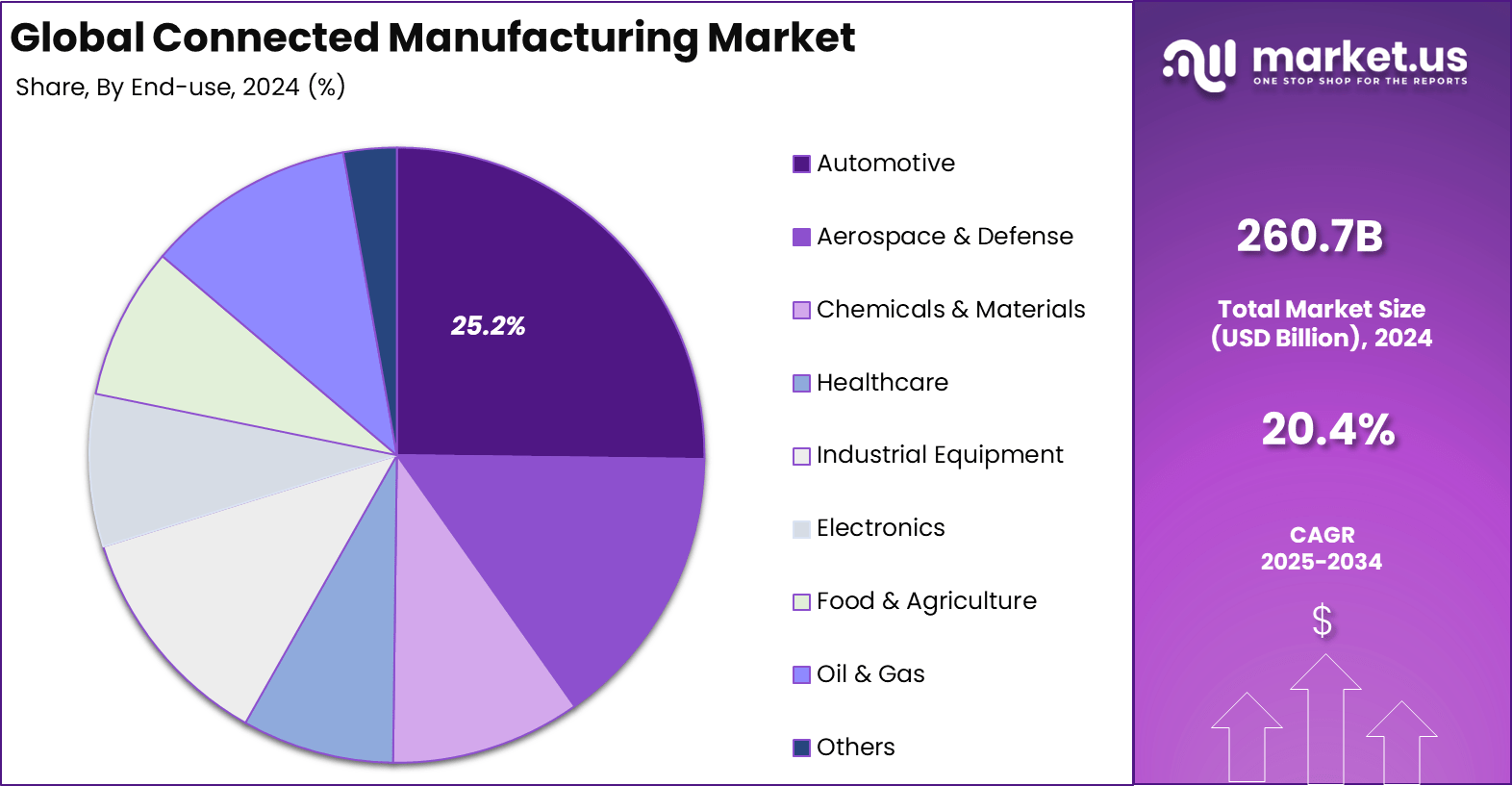

- The Automotive sector dominated with 25.2% share in 2024, driven by smart factories and connected vehicle production.

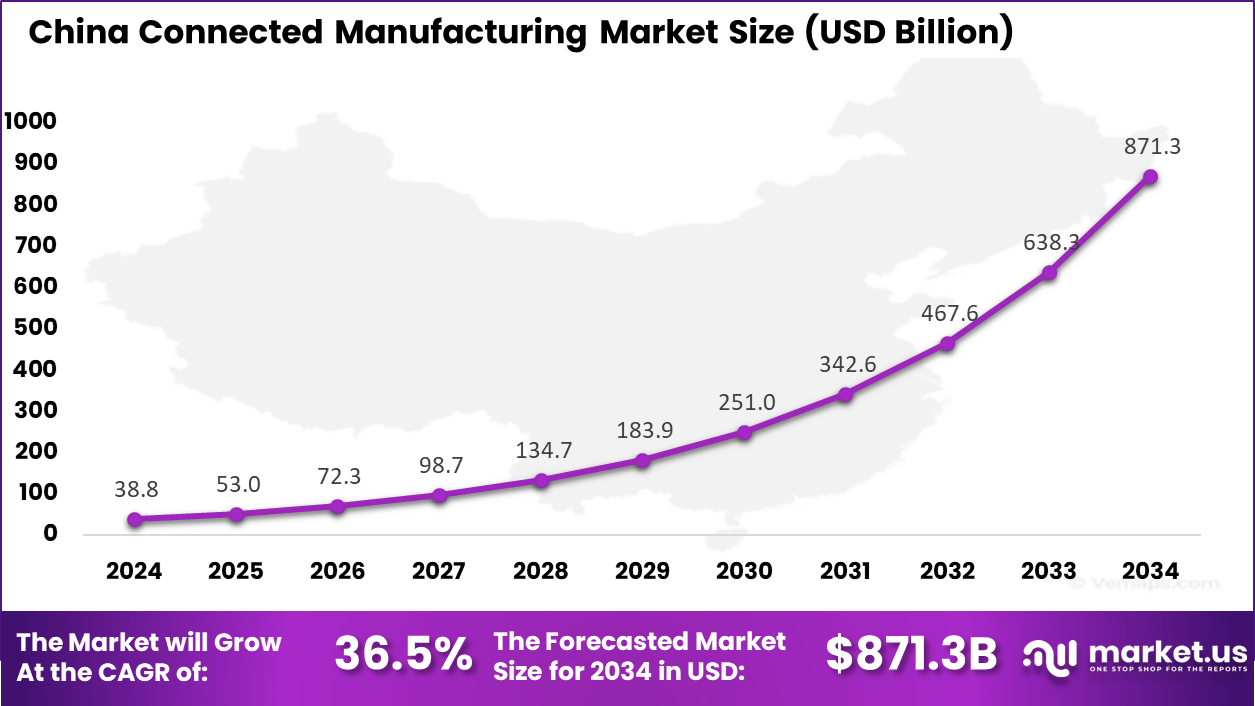

- The China market reached USD 38.8 billion in 2024, expanding at a strong 36.5% CAGR.

- Asia Pacific held 37.2% share in 2024, emerging as the leading region in connected manufacturing adoption.

Role of Generative AI

In connected manufacturing, generative AI is becoming a major player, transforming how factories operate by improving efficiency and decision-making. Around 24% of manufacturing facilities have implemented generative AI, using it for tasks like predictive maintenance, quality control, and demand forecasting.

This technology helps capture expert knowledge, speeding operations and reducing downtime. Generative AI creates content from production data, assisting operators with real-time, context-aware guidance and optimizing supply chains with more accurate predictions. Its rapid adoption signals a strategic shift among manufacturers toward intelligent, data-driven production processes in 2025.

China Market Size

The market for Connected Manufacturing within China is growing tremendously and is currently valued at USD 38.8 billion, the market has a projected CAGR of 36.5%. The market is growing tremendously due to the country’s push for digital transformation and its “Made in China 2025” initiative. This national strategy aims to upgrade Chinese industries by incorporating advanced technologies like IoT, AI, and robotics to enhance manufacturing capabilities.

China’s rapidly expanding manufacturing base, coupled with increasing demand for automation, smart production systems, and sustainable practices, is driving the adoption of connected manufacturing solutions. Additionally, government support and investments in infrastructure further accelerate market growth.

For instance, in September 2025, TBEA accelerated its smart manufacturing efforts in Xinjiang, further contributing to China’s dominance in the global smart manufacturing sector. The company integrated advanced technologies such as AI, IoT, and robotics into its production processes, significantly enhancing efficiency, product quality, and operational flexibility.

In 2024, Asia Pacific held a dominant market position in the Global Connected Manufacturing Market, capturing more than a 37.2% share, holding USD 96.9 billion in revenue. This dominance is due to rapid industrialization, high adoption rates of Industry 4.0 technologies, and government support for smart manufacturing initiatives.

Countries like China, Japan, and South Korea are at the forefront, investing heavily in automation, IoT, and AI-driven solutions to enhance manufacturing efficiency. The region’s strong manufacturing base, cost-effective labor, and focus on sustainability also contribute to its leadership in the connected manufacturing space.

For instance, in August 2025, SIGEnergy reached a major milestone by topping out its Nantong Smart Manufacturing Hub, further advancing its global expansion strategy. This development is a key example of Asia-Pacific’s dominance in smart manufacturing, as the region continues to lead in integrating advanced technologies like automation, IoT, and AI into industrial processes.

Component Analysis

In 2024, the Hardware segment held a dominant market position, capturing a 44.3% share of the Global Connected Manufacturing Market. This dominance is due to the increasing demand for essential hardware components such as sensors, actuators, robotics, and IoT devices that enable real-time data collection, automation, and improved operational efficiency.

As manufacturers continue to adopt smart manufacturing systems, these hardware solutions are critical in enabling connectivity, enhancing productivity, and supporting advanced technologies like AI and machine learning in production environments.

For Instance, in November 2024, Dixon Technologies incorporated Dixon Teletech to strengthen its IT hardware solutions for connected manufacturing. By leveraging Dixon Teletech’s expertise, the company aims to enhance its hardware offerings, focusing on components such as IoT devices, sensors, and automation systems.

Technology Analysis

In 2024, the Discrete Control Systems segment held a dominant market position, capturing an 18.5% share of the Global Connected Manufacturing Market. This dominance is due to their crucial role in automating and controlling discrete manufacturing processes, such as assembly lines, machinery operations, and packaging.

Discrete control systems enable real-time monitoring, enhanced precision, and efficient production workflows. As manufacturers continue to adopt Industry 4.0 technologies, the demand for these systems increases to optimize performance, reduce downtime, and improve overall production quality.

For instance, in September 2024, the National Institute of Standards and Technology (NIST) released a new version of the SimProceSD software, designed to improve discrete event manufacturing systems. This updated version allows manufacturers to simulate and optimize their production processes, enhancing the control and automation of discrete manufacturing operations.

End-use Analysis

In 2024, the Automotive segment held a dominant market position, capturing a 25.2% share of the Global Connected Manufacturing Market. This dominance is due to the industry’s early adoption of advanced manufacturing technologies like automation, robotics, and IoT for smart production systems.

The automotive sector relies heavily on connected manufacturing to improve efficiency, reduce production costs, enhance product quality, and meet growing demand for electric vehicles. Additionally, the push for sustainability and regulatory compliance further drives innovation and investment in connected manufacturing within the automotive sector.

For Instance, in April 2025, Siemens unveiled its OT Networking Blueprint, transforming automotive manufacturing with digitalization. This innovative solution integrates advanced operational technology (OT) with digital tools, enabling automotive manufacturers to optimize production processes through real-time data and connectivity.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Machine Execution Systems

- Programmable Logic Controller

- Enterprise Resource Planning

- SCADA

- Discrete Control Systems

- Human Machine Interface

- Machine Vision

- 3D Printing

- Product Lifecycle Management

- Plant Asset Management

- Others

By End-use

- Automotive

- Aerospace & Defense

- Chemicals & Materials

- Healthcare

- Industrial Equipment

- Electronics

- Food & Agriculture

- Oil & Gas

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Smart Factories

The increasing demand for smart factories is a key driver for the connected manufacturing market. Smart factories use advanced technologies like IoT, artificial intelligence, and robotics to create a more flexible and efficient production environment.

This demand arises from manufacturers’ need to increase productivity and reduce downtime by enabling real-time communication and automation across their processes. By connecting machines, devices, and systems, companies can better monitor operations, predict issues, and quickly adapt to changes in production needs.

For instance, in June 2025, Honeywell launched an AI-powered manufacturing solution that enhances the capabilities of connected manufacturing. This solution leverages advanced artificial intelligence to optimize production processes, reduce downtime, and improve overall efficiency. By integrating AI with existing manufacturing systems, Honeywell enables real-time data analysis, predictive maintenance, and smarter decision-making.

Restraint

High Cost of Implementation

One significant restraint on connected manufacturing adoption is the high initial cost of investment. Implementing connected manufacturing requires upgrading existing equipment, integrating new digital technologies, and sometimes replacing legacy infrastructure. This process can be expensive, especially for small and medium manufacturers who may lack the capital or resources to fund these changes. Additionally, the cost of training employees to manage and utilize the new systems adds to the financial burden.

These costs can make many organizations hesitant or slow to adopt connected manufacturing solutions fully. The payback period might be longer than expected, causing uncertainty in decision-making. Furthermore, the complexity of integrating various devices and systems can involve additional hidden costs and effort, leading to budget overruns. For many manufacturers, the high upfront investment remains a barrier to quickly adopting connected manufacturing.

For instance, in October 2024, a recent National Association of Manufacturers Outlook Survey revealed that 65% of respondents identified talent shortages and skill gaps as their primary challenge in the manufacturing sector. With nearly two million manufacturing jobs potentially remaining unfilled, this skills gap poses a significant barrier to the adoption of advanced technologies in connected manufacturing.

Opportunities

Sustainability & Circular Economy Focus

The growing emphasis on sustainability presents a significant opportunity for connected manufacturing. Increasing demand for environmentally friendly operations drives manufacturers to adopt technologies that enable energy monitoring, waste reduction, and emissions tracking.

By focusing on resource optimization and recycling, manufacturers can meet regulatory requirements and improve their sustainability credentials. As consumers and regulators reward green practices, companies that implement circular economy models can gain a competitive edge while contributing to a more sustainable future.

For instance, in February 2025, Delta Electronics unveiled its new smart manufacturing and green energy solutions aimed at promoting sustainable manufacturing practices. These solutions integrate advanced technologies such as energy-efficient systems, IoT-enabled devices, and real-time monitoring to optimize production processes and reduce energy consumption.

Challenges

Regulatory Compliance

Manufacturers face increasing complexity when it comes to navigating local and international regulations, especially in areas like data privacy, environmental standards, and labor laws. Complying with diverse, ever-evolving regulations requires significant resources and attention to detail.

Failure to comply can lead to fines, legal consequences, and damage to brand reputation. As manufacturing becomes more connected, companies must continuously update their processes and systems to remain compliant with regulatory frameworks, which poses a significant challenge for global operations.

For instance, in May 2025, the National Association of Manufacturers (NAM) called for smarter AI policy solutions to address the growing influence of AI in manufacturing. With AI playing an increasingly significant role in connected manufacturing, NAM emphasized the need for regulatory frameworks that ensure both innovation and compliance.

Latest Trends

The manufacturing sector is moving towards hyperconnected smart factories where Internet of Things devices collect real-time data from machines, tools, and even worker wearables. This environment allows quick adjustments that reduce errors and enhance productivity. Fully autonomous manufacturing floors are appearing, with robotics managing tasks around the clock.

Additionally, there is a growing trend toward microfactories for customized, on-demand production, halting overproduction and waste. Manufacturers are also focusing on sustainability, incorporating green practices to lower emissions and energy use across operations.

For instance, in March 2025, Mercedes-Benz accelerated the adoption of AI-driven robotics and next-generation automation technologies at its Berlin-Marienfelde plant. The company introduced humanoid robots to enhance digital production processes, transforming the manufacturing environment.

Key Players Analysis

In the connected manufacturing market, Siemens, ABB Ltd., and General Electric lead with strong portfolios in industrial automation and digital factory solutions. Their focus on integrating IoT platforms, advanced analytics, and real-time monitoring enables manufacturers to improve productivity and reduce downtime.

Rockwell Automation, Schneider Electric, and Honeywell International strengthen the market through advanced control systems, edge computing, and industrial software platforms. Their offerings focus on enabling smart operations, predictive maintenance, and seamless connectivity between machines and enterprise systems.

Other players including Emerson Electric and Fanuc UK Limited contribute through automation hardware, robotics, and process management solutions. Their innovations focus on robotics integration, efficient process control, and connected sensors that enhance production agility.

Top Key Players in the Market

- ABB Ltd.

- Siemens

- General Electric

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Fanuc UK Limited

- Others

Recent Developments

- In January 2025, Siemens unveiled breakthrough innovations in industrial AI and digital twin technology at CES, advancing the future of connected manufacturing. These cutting-edge solutions integrate AI-driven insights and real-time simulation, enabling manufacturers to optimize production processes and improve efficiency.

- In November 2024, ABB’s Autonomous Mobile Robot (AMR) was awarded the “Smart Factory Best Connected Production Line” at the Advanced Manufacturing Awards. This recognition highlights ABB’s continued innovation in connected manufacturing, showcasing how its AMR technology is transforming production environments.

Report Scope

Report Features Description Market Value (2024) USD 260.7 Bn Forecast Revenue (2034) USD 1,668.8 Bn CAGR(2025-2034) 20.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (Machine Execution Systems, Programmable Logic Controller, Enterprise Resource Planning, SCADA, Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Product Lifecycle Management, Plant Asset Management, Others), By End-use (Automotive, Aerospace & Defense, Chemicals & Materials, Healthcare, Industrial Equipment, Electronics, Food & Agriculture, Oil & Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Siemens, General Electric, Rockwell Automation Inc., Schneider Electric, Honeywell International Inc., Emerson Electric Co., Fanuc UK Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Connected Manufacturing MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Connected Manufacturing MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens

- General Electric

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Fanuc UK Limited

- Others