Global Confined Space Monitoring Market Size, Share Report By Component (Hardware (Gas Detectors, Particulate & Dust Monitors, Environmental Monitors,Sampling Pumps & Tubes), Software, Services (Calibration & Maintenance Services, Rental Services,Training & Consulting Services)), By Technology (Wireless, Wired), By End-User (Oil & Gas,Utilities (Water & Wastewater), Construction & Infrastructure, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 168853

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

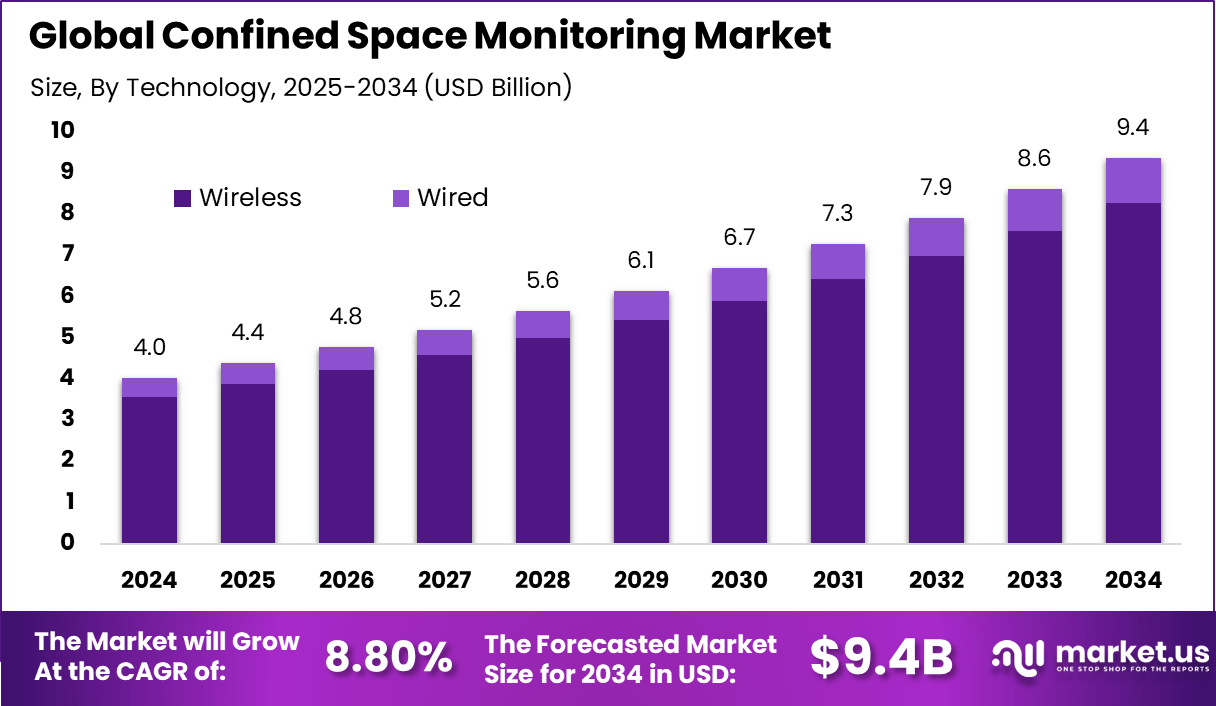

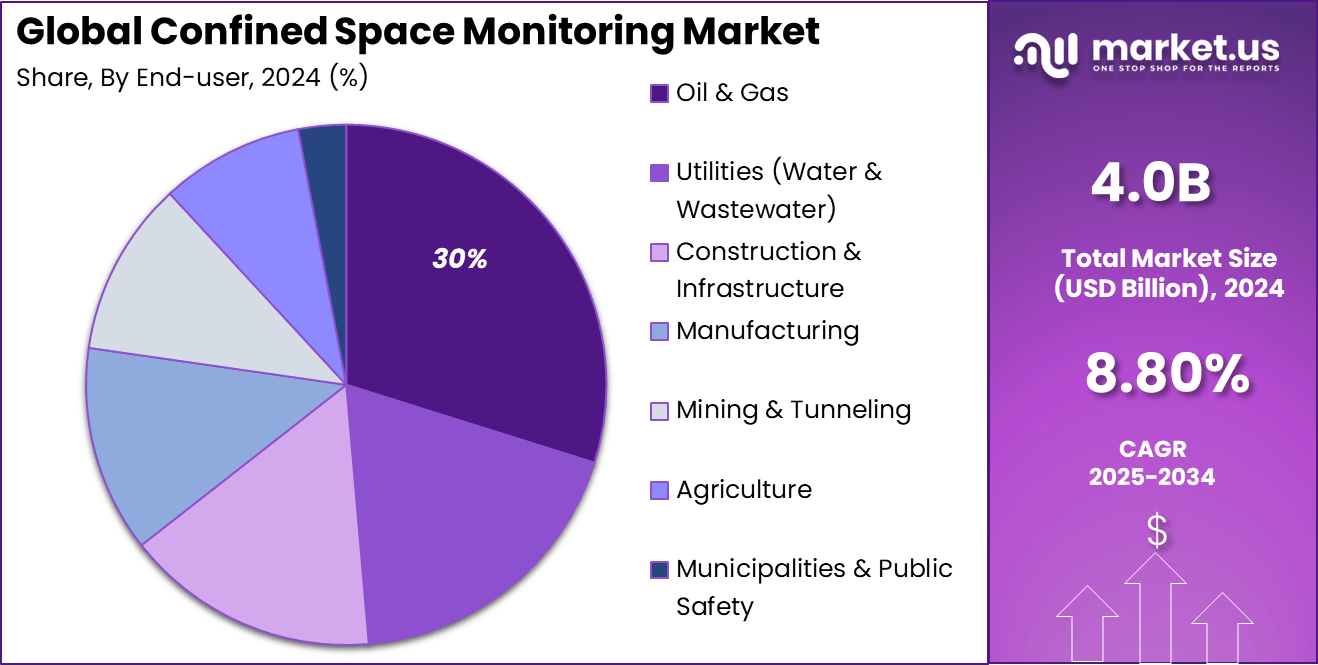

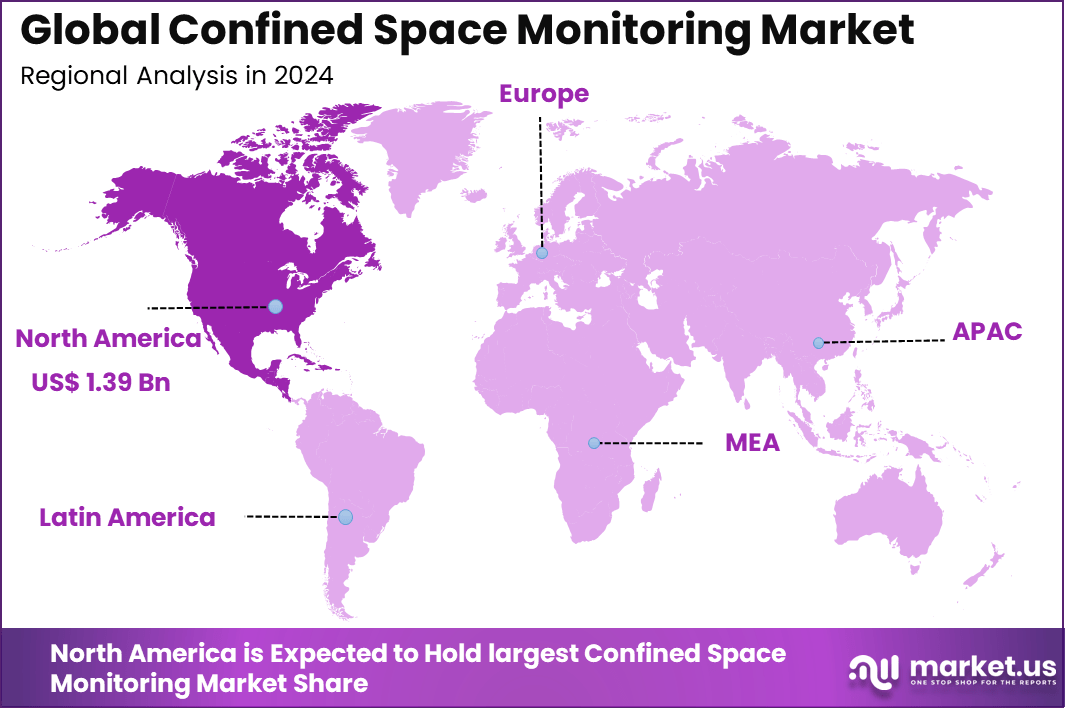

The Global Confined Space Monitoring Market generated USD 4.0 billion in 2024 and is predicted to register growth from USD 4.4 billion in 2025 to about USD 9.4 billion by 2034, recording a CAGR of 8.80% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 34.7% share, holding USD 1.39 Billion revenue.

The confined space monitoring market has expanded as industries strengthen safety practices for workers operating in enclosed or hazardous environments. Growth reflects rising regulatory expectations, increased automation in safety operations and the need for continuous monitoring of air quality, movement and communication within restricted spaces. These systems support real time visibility in environments where traditional oversight is difficult.

The growth of the market can be attributed to increasing workplace safety requirements, stronger enforcement of occupational health guidelines and rising awareness of risks linked to confined spaces. Industries that frequently operate in tanks, tunnels, silos and underground facilities rely on monitoring systems to detect gas levels, heat, movement and potential emergencies. The push for zero accident work environments further accelerates adoption.

Demand is rising across oil and gas facilities, chemical plants, wastewater treatment sites, construction zones, mining operations, power generation units and transportation infrastructure projects. These sectors face high risk conditions that require real time alerts, remote oversight and rapid response capabilities. Companies managing maintenance or inspection activities in enclosed areas also rely on monitoring tools to protect contractors and operational staff.

Key technologies supporting adoption include multi gas sensors, wearable safety devices, wireless telemetry, thermal cameras, radar based movement detection, remote video monitoring, geofencing, AI driven anomaly detection and cloud based dashboards. Modern systems combine environmental sensing with worker location tracking to provide comprehensive situational awareness. Remote command centers allow supervisors to intervene without entering dangerous zones.

Top Market Takeaways

- By component, hardware dominates with 74.5% share, including gas detectors, sensors, communication devices, and control panels essential for real-time monitoring and worker safety in hazardous environments.

- By technology, wireless/portable devices lead with 88.3% share, favored for their flexibility, ease of deployment, and ability to monitor remote or inaccessible locations, especially in dynamic industrial settings.

- By end-user, oil & gas holds 30.2% share, driven by the sector’s high risk of exposure to hazardous gases, oxygen deficiency, and explosions, requiring robust monitoring systems to protect personnel and comply with stringent safety regulations.

- Regionally, North America commands about 34.7% market share, supported by strict workplace safety regulations from agencies like OSHA, early adoption of advanced technologies, and a large concentration of oil & gas, chemical, and manufacturing industries.

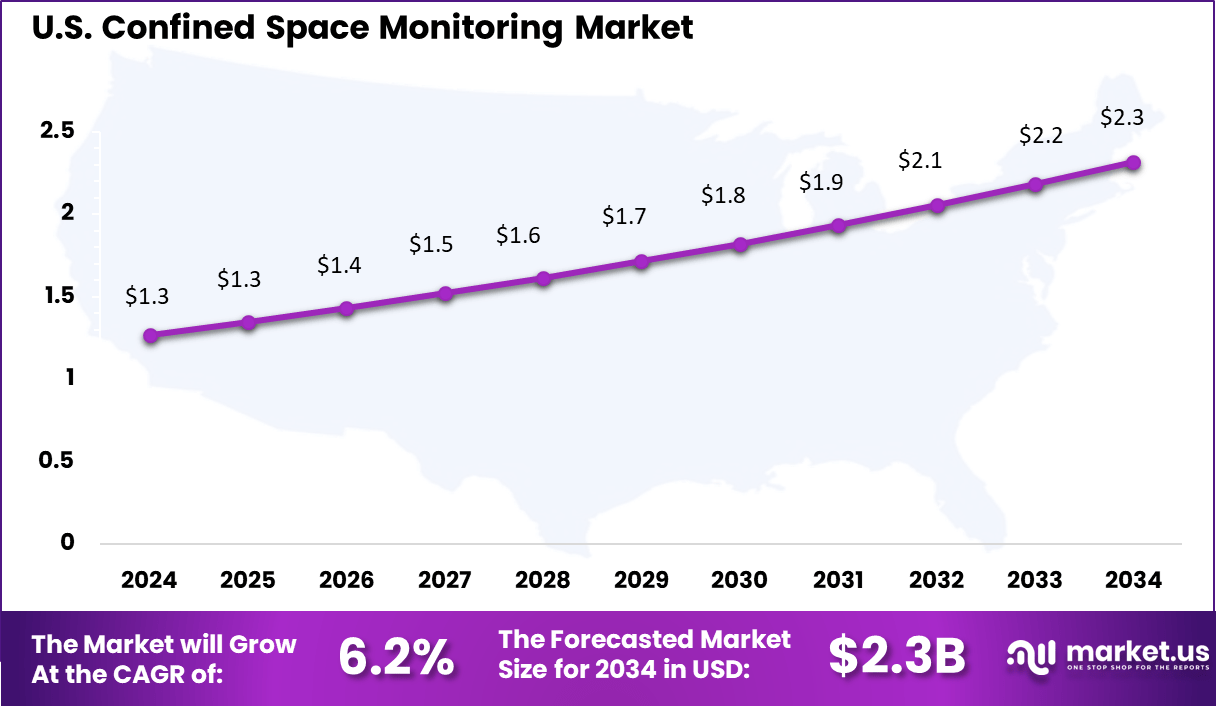

- The U.S. market size is estimated at approximately USD 1.27 billion in 2025.

- The market is growing at a CAGR of 6.2%, driven by increased regulatory pressure for worker safety, technological advancements in IoT-enabled and wireless monitoring, and expansion in energy sector monitoring.

Key Statistics

- Confined space incidents lead to about 100 deaths each year in U.S. workplaces, and some reports indicate numbers closer to 200, with 60% involving would-be rescuers.

- More than 60% of fatalities occur when coworkers enter the space to attempt a rescue, showing how quickly secondary incidents escalate.

- Over 4.8 million confined space entries take place each year in the United States, reflecting how common these operations are across industries.

- The leading cause of death is exposure to oxygen-deficient or toxic atmospheres, often entered without full atmospheric testing.

- Experts estimate that more than 11,000 injuries could be prevented each year through proper monitoring, clear rescue plans, and strict compliance with safety procedures.

By Component

Hardware leads the confined space monitoring market with a dominant 74.5% share, forming the foundation for all monitoring operations. This segment includes gas detectors, sensors, communication devices, and control panels that are essential for detecting hazardous atmospheric conditions, tracking personnel, and ensuring safe entry and exit from confined spaces.

The demand for rugged, reliable hardware is especially strong in industries like oil & gas, mining, and utilities, where environments are harsh and operational risks are high. Manufacturers focus on developing compact, multi-gas detection devices and wireless-enabled sensors to meet evolving safety requirements.

By Technology

Wireless and portable devices hold a commanding 88.3% share, revolutionizing how confined space monitoring is conducted. These technologies offer flexibility, ease of deployment, and scalability, allowing monitoring to be extended to remote or inaccessible locations without the need for complex wiring.

Portable devices empower field teams to carry monitoring equipment with them, enabling real-time hazard detection and immediate response, which is crucial for dynamic or unpredictable environments. The integration of IoT, low-power wide-area networks (LPWAN), and 5G connectivity is accelerating the adoption of wireless monitoring systems.

By End-User

The oil & gas sector accounts for 30% of the confined space monitoring market, driven by the inherently hazardous nature of operations involving exploration, production, refining, and transportation. Confined spaces such as storage tanks, pipelines, and drilling rigs present constant risks of exposure to flammable or toxic gases, oxygen deficiency, and other atmospheric hazards. Stringent safety regulations and the high cost of potential accidents necessitate the adoption of advanced monitoring solutions.

Oil & gas companies invest heavily in safety infrastructure and operational efficiency, making them leading adopters of confined space monitoring technologies. The sector’s focus on compliance and risk mitigation ensures continued demand for sophisticated monitoring systems capable of protecting workers and assets in high-risk environments.

Key Reasons for Adoption

- Stricter government regulations on workplace safety are forcing companies to invest in confined space monitoring to avoid penalties and legal liabilities.

- Rising awareness of the dangers in confined spaces, like toxic gases and oxygen deficiency, is pushing organizations to adopt advanced monitoring systems for worker protection.

- Technological advancements in IoT sensors, wireless communication, and cloud platforms make real-time monitoring easier and more affordable.

- Companies want to reduce downtime and accident-related costs by proactively identifying risks and preventing incidents before they happen.

- Remote monitoring capabilities allow supervisors to oversee multiple sites without physically entering hazardous areas, improving operational efficiency.

Benefits

- Real-time gas and environmental monitoring helps prevent exposure to dangerous conditions, reducing the risk of injury or fatalities.

- Continuous data collection and analytics enable predictive maintenance and proactive hazard mitigation, leading to fewer incidents and improved safety records.

- Automated alerts and remote oversight speed up emergency response, minimizing damage and saving lives during critical situations.

- Digital monitoring reduces reliance on manual checks, lowering human error and increasing overall operational efficiency.

- Compliance reporting becomes easier with detailed logs and centralized data, helping companies meet regulatory requirements with less effort.

Usage Trends

- Companies are increasingly adopting cloud-based platforms to monitor multiple confined spaces from a central location, improving coordination and response times.

- Integration of AI and machine learning is enabling predictive analytics for early hazard detection and smarter decision-making in real time.

- Wearable sensors and personal monitoring devices are being used to track individual worker health and safety within confined spaces.

- Drones and robots equipped with cameras and sensors are used for remote inspections, especially in hard-to-reach or high-risk environments.

- Real-time video and audio communication systems allow safety teams to maintain constant contact with workers and intervene quickly if needed.

Emerging Trends

Key Trends Description IoT and AI Integration Real-time monitoring and predictive analytics powered by IoT sensors and AI algorithms for enhanced hazard detection. Cloud-Based Monitoring Solutions Centralized data management and remote access to monitoring systems for improved operational efficiency and safety. Wireless Sensor Networks Adoption of wireless sensors for flexible, scalable deployment in complex confined environments. Automation and Robotics Use of drones and robots for remote inspection and monitoring, reducing human exposure to hazardous conditions. Predictive Maintenance Advanced analytics enabling proactive maintenance and risk mitigation in confined space operations. Growth Factors

Key Factors Description Stringent Safety Regulations Increasing regulatory requirements driving investment in advanced monitoring systems for worker safety. Rising Industrial Automation Growth in automated industrial processes increases demand for reliable confined space monitoring. Expansion of Hazardous Industries Growth in sectors like oil & gas, mining, and manufacturing fuels market expansion. Heightened Worker Safety Awareness Greater focus on occupational health and safety boosts adoption of monitoring technologies. Technological Advancements Continuous innovation in sensors, data analytics, and connectivity solutions supports market growth. Key Market Segments

By Component

- Hardware

- Gas Detectors

- Particulate & Dust Monitors

- Environmental Monitors

- Sampling Pumps & Tubes

- Software

- Services

- Calibration & Maintenance Services

- Rental Services

- Training & Consulting Services

By Technology

- Wireless

- Wired

By End-User

- Oil & Gas

- Utilities (Water & Wastewater)

- Construction & Infrastructure

- Manufacturing

- Mining & Tunneling

- Agriculture

- Municipalities & Public Safety

Regional Analysis

North America held a leading 34.7% share of the confined space monitoring market in 2024, driven by stringent workplace safety regulations and a strong industrial base. The region’s focus on compliance with standards like OSHA, combined with a mature culture of workplace safety, fuels demand for advanced monitoring solutions in sectors such as oil & gas, chemicals, and manufacturing. Investments in digital and wireless monitoring technologies further boost market growth, ensuring real-time hazard detection and improved worker protection in confined environments.

The U.S. dominates within North America, valued at approximately USD 1.27 billion in 2024 and growing at a CAGR of 6.2%. The country’s large-scale industrial operations, extensive oil & gas infrastructure, and emphasis on worker safety drive widespread adoption of confined space monitoring systems.

Leading technology providers and continuous innovation in sensor-based and remote monitoring solutions reinforce the U.S. market’s position as the core growth engine for North America, setting benchmarks for safety and efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Stricter Safety Regulations

The confined space monitoring market grows from stricter safety regulations that require real-time monitoring in hazardous environments. Industries like mining, oil and gas, and industrial maintenance must comply with laws that mandate continuous oversight to prevent accidents and ensure worker safety. These rules push companies to invest in digital monitoring systems that offer reliable data and instant alerts.

Technological advances in sensors and wireless communication also support this trend, making monitoring systems more accurate and easier to deploy. Growing awareness of confined space risks further encourages adoption as organizations seek to protect their workforce and avoid costly penalties.

Restraint

High Costs and Technical Expertise

High costs of advanced monitoring equipment and the need for skilled personnel limit adoption, especially for small and medium enterprises. Setting up and maintaining digital monitoring systems requires significant investment in hardware, software, and training, which can be prohibitive.

The complexity of integrating new systems with legacy infrastructure adds to the challenge. Without enough technical expertise, companies may struggle to operate these systems effectively, slowing wider market penetration.

Opportunity

IoT and AI Integration

IoT and AI integration offer strong opportunities for smarter, more efficient confined space monitoring. Connected sensors and cloud-based platforms allow remote monitoring, real-time analytics, and predictive maintenance, improving both safety and operational efficiency.

Demand for automation and smart factory initiatives drives innovation in monitoring solutions. As more industries adopt Industry 4.0 practices, providers can expand their offerings to include advanced analytics and automated reporting features.

Challenge

Connectivity and Data Security

Connectivity issues in remote or underground locations pose a major challenge for monitoring systems. Unreliable networks can disrupt data transmission, leading to gaps in safety coverage. Ensuring continuous, secure communication is essential but difficult in harsh environments.

Data security and privacy are also critical, as monitoring systems collect sensitive information about workers and operations. Companies must address these concerns to build trust and ensure compliance with evolving regulations.

Competitive Analysis

The confined space monitoring market is highly competitive, with leading providers such as Honeywell International, Drägerwerk, MSA Safety, Industrial Scientific, Teledyne Technologies, RKI Instruments, Trolex, GfG Europe, Johnson Controls, Crowcon Detection Instruments, RAE Systems, Blackline Safety, Oldham, Sensidyne, and Scott Safety.

These companies focus on delivering advanced monitoring solutions, including gas detection, real-time remote surveillance, and wireless connectivity, to ensure worker safety in hazardous environments. Innovation is driven by regulatory requirements, technological advancements in sensors and IoT integration, and the need for reliable, real-time data analytics.

Competition is marked by the development of integrated platforms that combine hardware, software, and cloud-based analytics for comprehensive monitoring and compliance management. Major players invest in R&D to improve sensor accuracy, system durability, and ease of use, while also expanding their service offerings to include predictive maintenance and remote diagnostics.

Geographic growth is led by North America and Europe due to stringent safety regulations, with Asia-Pacific emerging as a key growth region due to increasing industrialization and workplace safety awareness. The market continues to evolve with the adoption of digital solutions and automation, shaping a dynamic and responsive landscape.

Top Key Players in the Market

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Industrial Scientific Corporation

- Teledyne Technologies Incorporated

- RKI Instruments, Inc.

- Trolex Ltd.

- GfG Europe Ltd.

- Tyco International (Johnson Controls)

- Crowcon Detection Instruments Ltd.

- RAE Systems (by Honeywell)

- Blackline Safety Corp.

- Oldham (by Teledyne Gas and Flame Detection)

- Sensidyne, LP

- Scott Safety (by 3M)

- Others

Recent Developments

- October, 2025, Drägerwerk launched its X-Viz Confined Space Monitoring System, enabling remote supervision of multiple confined spaces with integrated gas detection, real-time video feeds, and AI-assisted monitoring to enhance worker safety and regulatory compliance.

- September, 2025, MSA Safety introduced the ALTAIR io 6 Multigas Detector at the National Safety Congress, featuring cellular connectivity, an integrated pump, and compatibility with the MSA Connected Work Platform for real-time monitoring and fleet management in confined space applications.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Bn Forecast Revenue (2034) USD 9.4 Bn CAGR(2025-2034) 8.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Gas Detectors, Particulate & Dust Monitors, Environmental Monitors,Sampling Pumps & Tubes), Software, Services (Calibration & Maintenance Services, Rental Services,Training & Consulting Services)), By Technology (Wireless, Wired), By End-User (Oil & Gas,Utilities (Water & Wastewater), Construction & Infrastructure, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Industrial Scientific Corporation, Teledyne Technologies Incorporated, RKI Instruments, Inc., Trolex Ltd., GfG Europe Ltd., Tyco International (Johnson Controls), Crowcon Detection Instruments Ltd., RAE Systems (by Honeywell), Blackline Safety Corp., Oldham (by Teledyne Gas and Flame Detection), Sensidyne, LP, Scott Safety (by 3M), and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Confined Space Monitoring MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Confined Space Monitoring MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Industrial Scientific Corporation

- Teledyne Technologies Incorporated

- RKI Instruments, Inc.

- Trolex Ltd.

- GfG Europe Ltd.

- Tyco International (Johnson Controls)

- Crowcon Detection Instruments Ltd.

- RAE Systems (by Honeywell)

- Blackline Safety Corp.

- Oldham (by Teledyne Gas and Flame Detection)

- Sensidyne, LP

- Scott Safety (by 3M)

- Others