Global Concrete Recycling Equipment Market Size, Share, Growth Analysis By Product Type (Crushers, Shredders, Screener and Trommels, Conveyor, Separator, Hopper & Feeders, Washing and Dewatering Equipment, Others), By Mobility Type (Portable, Stationary), By End-User (Infrastructure, Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175965

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

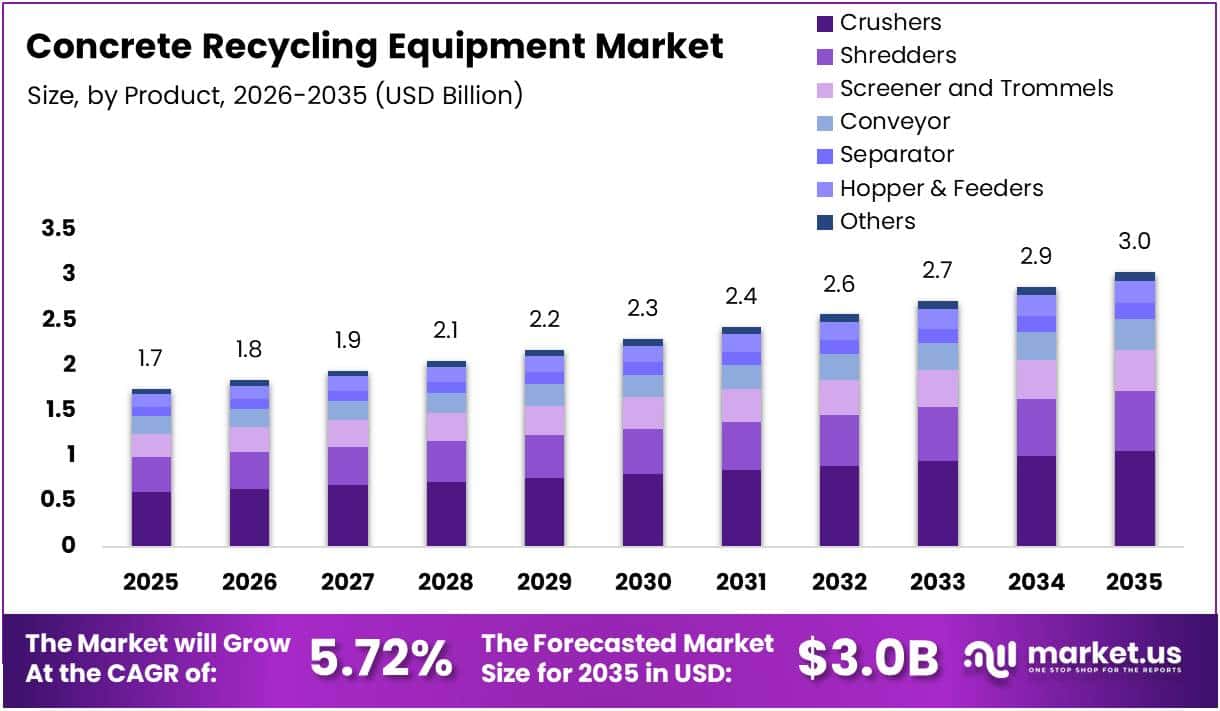

The Global Concrete Recycling Equipment Market size is expected to be worth around USD 3.0 Billion by 2035 from USD 1.74 Billion in 2025, growing at a CAGR of 5.72% during the forecast period 2026 to 2035.

Concrete recycling equipment comprises specialized machinery designed to process construction and demolition waste into reusable aggregates. These systems include crushers, screeners, separators, and washing units that transform discarded concrete into valuable materials. The equipment enables sustainable waste management practices across construction sites globally.

The market experiences steady expansion driven by increasing environmental awareness and stringent waste management regulations worldwide. Construction industries are shifting toward circular economy models that prioritize resource recovery and waste minimization. Moreover, rapid urbanization and infrastructure modernization projects generate substantial demolition waste requiring efficient recycling solutions.

Government initiatives promoting sustainable construction practices significantly boost market adoption. Many regions have implemented mandatory recycling targets and landfill restrictions that encourage concrete waste processing. Additionally, rising costs of virgin aggregates make recycled materials economically attractive for construction projects. Therefore, contractors increasingly invest in recycling equipment to reduce material expenses.

Technological advancements continue reshaping equipment capabilities and efficiency levels. Modern systems integrate automation features and digital monitoring tools that optimize processing operations. However, market growth faces challenges from high initial capital requirements and limited technical expertise among small-scale contractors. Consequently, equipment manufacturers focus on developing cost-effective portable solutions.

According to research, electrochemical concrete recycling reduces carbon emissions by approximately 75-80% relative to conventional cement production processes by avoiding fresh clinker production. Furthermore, recycled cement modified with nanomaterials has demonstrated roughly 40% higher compressive strength than traditional recycled cement. This validates the superior quality of processed materials.

According to research, advanced electrochemical cement and concrete recycling technologies in 2025 can achieve 92-95% material recovery from demolition waste. This exceptional recovery rate demonstrates the efficiency of modern recycling systems. Moreover, these innovations support construction sustainability goals while maintaining material quality standards. The integration of advanced technologies positions concrete recycling as essential infrastructure for future urban development.

Key Takeaways

- Global Concrete Recycling Equipment Market valued at USD 1.74 Billion in 2025, projected to reach USD 3.0 Billion by 2035 at 5.72% CAGR

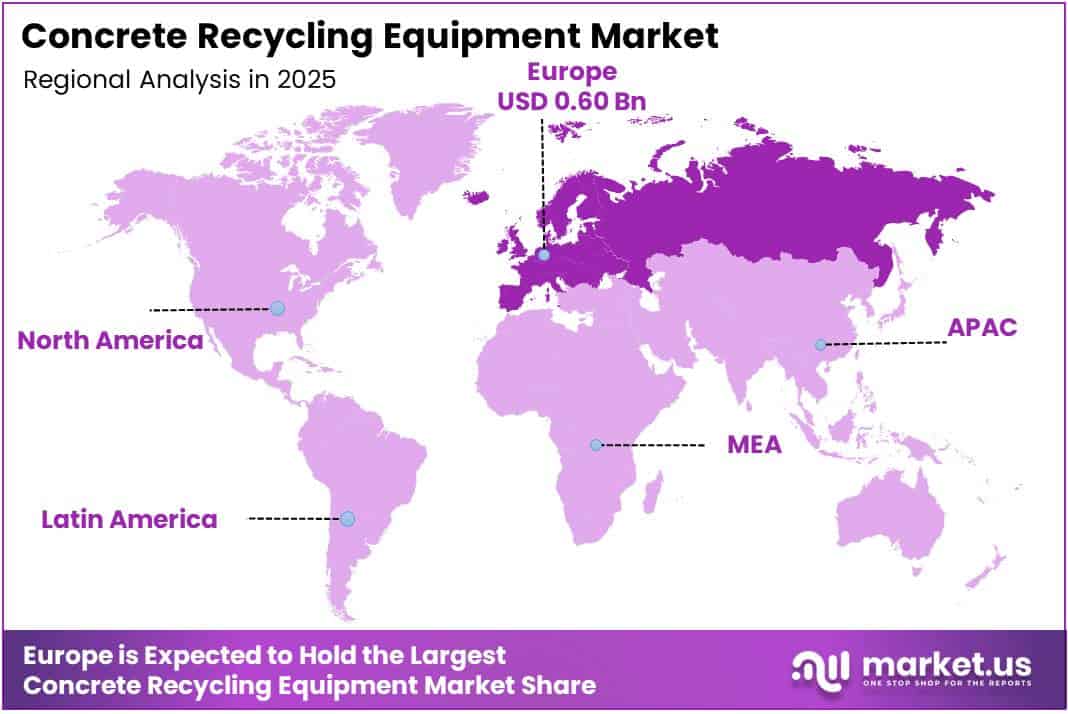

- Europe dominates the market with 34.98% share, valued at USD 0.60 Billion

- Crushers segment leads by product type with 34.82% market share

- Portable equipment holds 51.64% share in mobility type segment

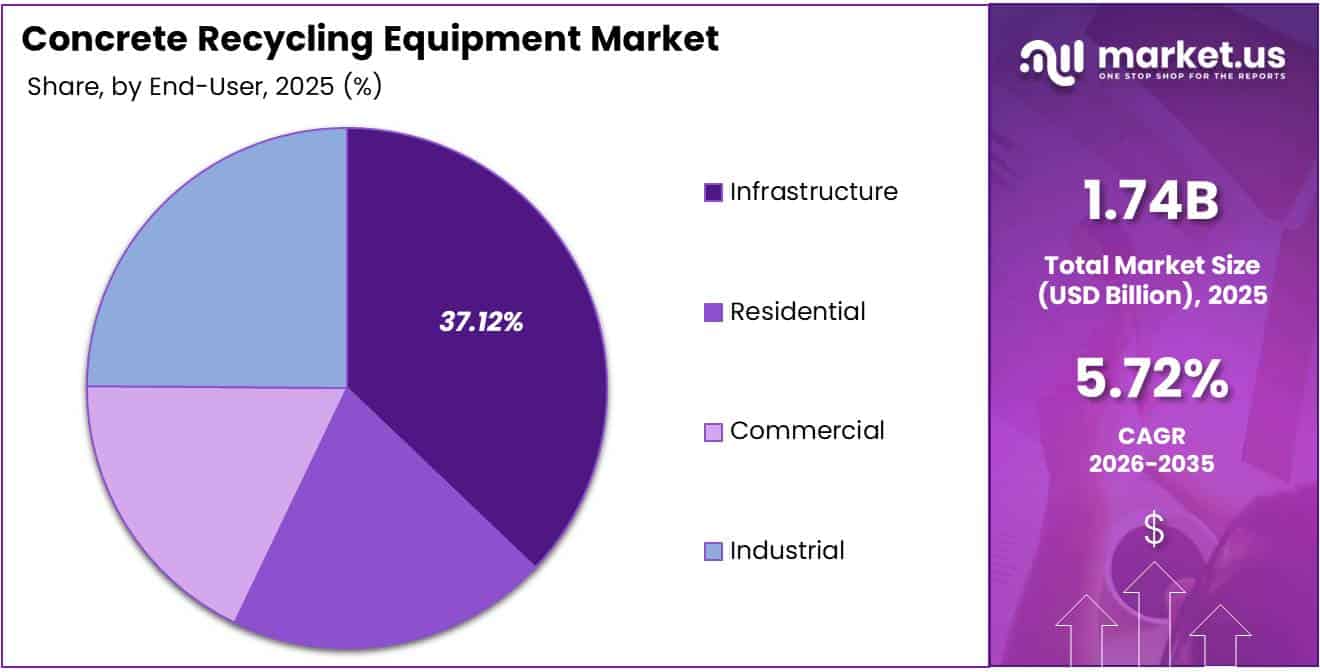

- Infrastructure sector dominates end-user segment with 37.12% share

Product Type Analysis

Crushers dominate with 34.82% due to their essential role in primary concrete processing operations.

In 2025, Crushers held a dominant market position in the By Product Type segment of Concrete Recycling Equipment Market, with a 34.82% share. These machines provide fundamental size reduction capabilities that transform large concrete debris into manageable aggregate sizes. Additionally, crushers offer versatile configurations suitable for various demolition waste types and project scales.

Shredders represent specialized equipment designed for processing reinforced concrete and mixed construction waste streams. These systems effectively separate metal reinforcements from concrete materials while reducing particle sizes. Moreover, shredders complement crusher operations by handling challenging waste compositions that require preliminary processing before final crushing stages.

Screener and Trommels facilitate precise material classification by separating aggregates into specific size fractions for different applications. These systems ensure quality control by removing contaminants and sorting materials according to construction specifications. Furthermore, screening equipment maximizes material value by producing multiple aggregate grades from single waste streams.

Conveyor systems provide essential material handling capabilities that transport processed aggregates between different equipment stations efficiently. These automated transport solutions reduce manual labor requirements while maintaining continuous material flow throughout recycling operations. Moreover, conveyors minimize material degradation during handling and enable seamless integration of multiple processing stages within recycling facilities.

Separator equipment isolates contaminants and unwanted materials from concrete aggregates to ensure final product quality meets construction specifications. Advanced separation technologies utilize magnetic, air classification, and density-based methods to remove metal, wood, and lightweight debris. Furthermore, separators enhance aggregate value by producing cleaner materials suitable for demanding construction applications.

Hopper and Feeders control material intake rates and regulate consistent flow into crushing and screening equipment for optimal processing efficiency. These components prevent equipment overload while ensuring steady material supply that maximizes throughput and operational productivity. Additionally, well-designed feeding systems reduce wear on downstream equipment by controlling material size and feed velocity.

Washing and Dewatering Equipment removes fine particles, dust, and contaminants from recycled aggregates while managing water resources efficiently. These systems employ various technologies including scrubbers, hydrocyclones, and filter presses to achieve desired cleanliness levels. Moreover, closed-loop water treatment systems enable environmental compliance by recycling process water and minimizing discharge requirements.

Others category encompasses dust suppression systems and auxiliary equipment that support safe and environmentally compliant recycling operations. Dust control technologies protect worker health and prevent environmental pollution during crushing and material handling activities. Furthermore, supplementary equipment includes control systems, power units, and safety devices essential for complete recycling plant functionality.

Mobility Type Analysis

Portable equipment dominates with 51.64% due to flexibility and on-site processing capabilities that reduce transportation costs.

In 2025, Portable held a dominant market position in the By Mobility Type segment of Concrete Recycling Equipment Market, with a 51.64% share. Mobile systems enable contractors to process concrete waste directly at demolition sites, eliminating expensive hauling requirements. Additionally, portable equipment provides operational flexibility for projects with varying locations and temporary site conditions.

Stationary systems offer higher processing capacities and permanent installation advantages for dedicated recycling facilities. These fixed plants provide continuous operations with optimized material handling and processing efficiency. Moreover, stationary equipment suits large-scale recycling operations where consistent waste volumes justify permanent infrastructure investments and long-term operational planning.

End-User Analysis

Infrastructure dominates with 37.12% due to massive concrete consumption in road, bridge, and public works projects.

In 2025, Infrastructure held a dominant market position in the By End-User segment of Concrete Recycling Equipment Market, with a 37.12% share. Government-funded infrastructure projects generate substantial demolition waste during renovation and modernization activities. Additionally, infrastructure developments increasingly incorporate recycled aggregates to meet sustainability targets and reduce environmental impact.

Residential sector utilizes concrete recycling equipment for housing demolition and renovation projects across urban and suburban areas. Growing home renovation activities and urban redevelopment initiatives drive residential sector demand. Moreover, residential contractors adopt portable recycling solutions to manage waste efficiently while complying with local environmental regulations.

Commercial segment encompasses office buildings, retail centers, and hospitality facilities requiring concrete recycling during construction and demolition phases. Commercial projects increasingly prioritize sustainability certifications that mandate waste recycling and resource recovery. Furthermore, commercial developers recognize cost savings from utilizing recycled aggregates in new construction projects while reducing landfill disposal expenses.

Industrial segment encompasses manufacturing facilities, warehouses, and processing plants requiring concrete recycling during facility expansion and demolition projects. Industrial operations generate specific concrete waste types including foundation materials and structural elements containing various additives.

Key Market Segments

By Product Type

- Crushers

- Shredders

- Screener and Trommels

- Conveyor

- Separator

- Hopper & Feeders

- Washing and Dewatering Equipment

- Others (dust suppression systems, etc.)

By Mobility Type

- Portable

- Stationary

By End-User

- Infrastructure

- Residential

- Commercial

- Industrial

Drivers

Increasing Construction and Demolition Waste Generation Globally

Rapid urbanization and infrastructure modernization across developing and developed nations generate substantial construction and demolition waste volumes. Cities worldwide face mounting challenges managing concrete debris from aging buildings and obsolete infrastructure requiring replacement. Consequently, concrete recycling equipment becomes essential infrastructure for sustainable waste management operations.

Growing environmental consciousness among construction stakeholders drives adoption of recycling practices as standard operating procedures. Contractors recognize ecological benefits of diverting concrete waste from landfills while recovering valuable aggregate materials. Moreover, rising landfill costs and capacity constraints make on-site recycling economically attractive compared to traditional disposal methods.

Government regulations increasingly mandate waste recycling targets and restrict landfill disposal of recyclable construction materials. Many jurisdictions implement strict permitting requirements that favor projects incorporating waste recovery systems. Additionally, public infrastructure projects often require contractors to demonstrate concrete recycling capabilities as qualification criteria for bidding opportunities.

Restraints

High Initial Investment Costs and Limited Technical Expertise Limit Market Adoption

Substantial capital requirements for acquiring concrete recycling equipment create financial barriers for small and medium-sized contractors. Initial investments include machinery costs, transportation expenses, and operational training programs that strain limited budgets. Therefore, smaller construction firms often rely on third-party recycling services rather than investing in dedicated equipment.

Limited technical expertise among construction workforce poses operational challenges for effective equipment utilization and maintenance. Many contractors lack trained personnel capable of operating sophisticated recycling systems efficiently and safely. Moreover, inadequate understanding of recycling processes leads to suboptimal material recovery rates and equipment underutilization.

Fragmented market conditions with inconsistent recycling standards across different regions create uncertainty for equipment manufacturers and contractors. Varying regulatory requirements and quality specifications complicate equipment design and operational protocols. Additionally, absence of standardized testing methods for recycled aggregates affects market confidence and limits widespread adoption of recycling practices.

Growth Factors

Technological Advancements and Infrastructure Development Accelerate Market Expansion

Emerging economies experience rapid infrastructure development that generates substantial concrete recycling opportunities for equipment manufacturers. Urbanization trends across Asia, Latin America, and Africa create growing demand for sustainable construction practices. Additionally, government initiatives promoting green building standards encourage contractors to invest in recycling equipment and technologies.

Integration of artificial intelligence and automation technologies enhances concrete recycling equipment efficiency and operational capabilities. Smart systems optimize crushing parameters, monitor material quality, and predict maintenance requirements through advanced sensors. Moreover, automated controls reduce labor costs while improving processing consistency and aggregate quality standards.

Development of portable and modular concrete recycling solutions addresses contractor needs for flexible and cost-effective processing systems. Mobile equipment enables on-site waste processing that eliminates transportation expenses and accelerates project timelines. Furthermore, modular designs allow equipment scaling based on project requirements and facilitate easy relocation between construction sites.

Emerging Trends

Digital Transformation and Circular Economy Models Reshape Market Landscape

Adoption of mobile concrete crushers for on-site recycling transforms traditional waste management approaches across construction projects. Contractors increasingly deploy portable systems that process demolition waste directly at job sites, eliminating hauling costs. Moreover, on-site recycling reduces project environmental footprints while providing immediate access to recycled aggregates for construction activities.

Increased use of recycled aggregate in road and pavement construction demonstrates growing acceptance of processed materials. Transportation departments worldwide specify recycled concrete as acceptable base course and subbase materials. Additionally, successful performance of recycled aggregates in infrastructure projects encourages broader application across various construction segments and building types.

Implementation of circular economy models in construction sector promotes waste minimization and resource recovery as core business principles. Industry stakeholders collaborate to establish material tracking systems and quality certification programs for recycled products. Furthermore, circular approaches create new business opportunities for recycling equipment providers and specialized waste processing service companies.

Regional Analysis

Europe Dominates the Concrete Recycling Equipment Market with a Market Share of 34.98%, Valued at USD 0.60 Billion

Europe leads the global concrete recycling equipment market with 34.98% share, valued at USD 0.60 Billion, driven by stringent environmental regulations and advanced waste management infrastructure. European Union directives mandate high recycling rates for construction waste, compelling contractors to invest in processing equipment. Moreover, mature construction markets prioritize sustainability certifications that require concrete recycling capabilities throughout project lifecycles.

North America Concrete Recycling Equipment Market Trends

North America demonstrates strong market growth supported by infrastructure renewal programs and green building initiatives across United States and Canada. Federal and state regulations encourage concrete waste diversion from landfills through tax incentives and recycling mandates. Additionally, aging infrastructure generates substantial demolition waste requiring efficient processing solutions for material recovery and reuse applications.

Asia Pacific Concrete Recycling Equipment Market Trends

Asia Pacific represents fastest-growing regional market driven by rapid urbanization and massive infrastructure development across China, India, and Southeast Asian nations. Government investments in smart cities and transportation networks create substantial concrete recycling opportunities. Furthermore, increasing environmental awareness and regulatory frameworks encourage adoption of sustainable construction practices throughout the region.

Latin America Concrete Recycling Equipment Market Trends

Latin America experiences gradual market expansion supported by infrastructure modernization projects and growing environmental consciousness. Brazil and Mexico lead regional adoption through government programs promoting sustainable construction methods. Moreover, urban development initiatives and housing projects generate increasing demolition waste volumes requiring efficient recycling equipment and processing capabilities.

Middle East & Africa Concrete Recycling Equipment Market Trends

Middle East and Africa show emerging market potential driven by construction boom and sustainability initiatives across Gulf Cooperation Council nations. Large-scale infrastructure projects and mega-developments incorporate recycling requirements to meet environmental standards. Additionally, resource scarcity in arid regions encourages concrete waste recovery as viable alternative to virgin aggregate extraction and importation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Sandvik maintains leading market position through comprehensive crushing and screening equipment portfolio designed for concrete recycling applications. The company leverages advanced engineering capabilities to develop high-performance mobile and stationary systems that maximize material recovery rates. Additionally, Sandvik provides extensive service networks and digital solutions that optimize equipment performance and operational efficiency across global markets.

Metso Outotec delivers innovative recycling solutions combining crushing, screening, and material handling technologies for sustainable concrete processing. The company emphasizes automation and intelligence features that enhance productivity while reducing operational costs and environmental impact. Moreover, Metso Outotec supports circular economy initiatives through equipment designed specifically for urban construction waste management and aggregate production applications.

Terex Corporation offers diverse concrete recycling equipment including mobile crushers, screeners, and washing systems serving various construction segments. The company focuses on portable solutions that enable contractors to process waste efficiently at demolition sites and project locations. Furthermore, Terex emphasizes operator-friendly designs and fuel-efficient technologies that reduce operational expenses while maintaining high processing capacities and material quality.

Frumecar specializes in concrete recycling systems with particular strength in washing and water treatment technologies for aggregate cleaning applications. The company provides complete recycling plants that integrate multiple processing stages from crushing through final material preparation. Additionally, Frumecar emphasizes environmental compliance through closed-loop water systems and dust suppression technologies that minimize ecological impact during recycling operations.

Key Players

- Sandvik

- Metso Outotec

- Terex Corporation

- Frumecar

- Komatsu

- Rubble Master

- Eagle Crusher

- Keestrack

- MB Crusher

- Screen Machine Industries

- Atlas Copco

- LiuGong

- Others

Recent Developments

- December 2025 – Astec Industries entered into definitive agreement to acquire CWMF Corporation, expanding its concrete recycling equipment portfolio and market presence. This strategic acquisition strengthens Astec’s position in sustainable construction solutions and enhances technological capabilities for processing construction and demolition waste efficiently.

- July 2025 – Sandvik successfully completed acquisition of Osa Demolition Equipment, bolstering its demolition and recycling equipment offerings globally. The acquisition enables Sandvik to provide comprehensive solutions for concrete recycling applications while expanding service capabilities and customer reach across key construction markets worldwide.

Report Scope

Report Features Description Market Value (2025) USD 1.74 Billion Forecast Revenue (2035) USD 3.0 Billion CAGR (2026-2035) 5.72% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Crushers, Shredders, Screener and Trommels, Conveyor, Separator, Hopper & Feeders, Washing and Dewatering Equipment, Others), By Mobility Type (Portable, Stationary), By End-User (Infrastructure, Residential, Commercial, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sandvik, Metso Outotec, Terex Corporation, Frumecar, Komatsu, Rubble Master, Eagle Crusher, Keestrack, MB Crusher, Screen Machine Industries, Atlas Copco, LiuGong, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Concrete Recycling Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Concrete Recycling Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sandvik

- Metso Outotec

- Terex Corporation

- Frumecar

- Komatsu

- Rubble Master

- Eagle Crusher

- Keestrack

- MB Crusher

- Screen Machine Industries

- Atlas Copco

- LiuGong

- Others