Global Concrete Admixtures Market Size, Share, Growth Analysis By Product Type (Plasticizers, Superplasticizers, Accelerators, Retarders, Air-Entraining Agents, Corrosion Inhibitors, Shrinkage-Reducing Admixtures, Waterproofing Admixtures, Others), By Form (Liquid, Powder), By Application (Residential Construction, Commercial Construction, Infrastructure [Roads & Highways, Bridges, Tunnels, Dams], Industrial Construction), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175690

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

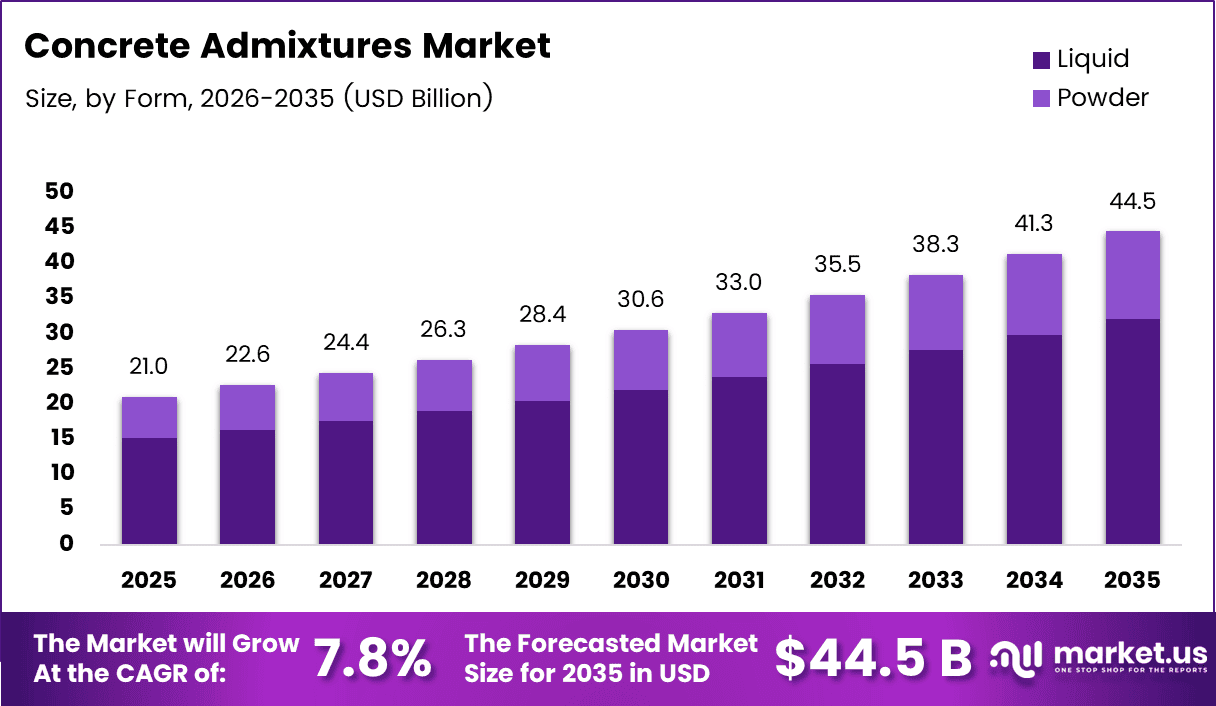

The Global Concrete Admixtures Market size is expected to be worth around USD 44.5 billion by 2035, from USD 21.0 billion in 2025, growing at a CAGR of 7.8% during the forecast period from 2026 to 2035.

As a market research expert, I view the Concrete Admixtures Market as a vital enabler of construction efficiency and durability. It includes materials added during concrete mixing to enhance workability, strength, and longevity. Consequently, admixtures support optimized performance across residential, commercial, and infrastructure construction projects.

Concrete admixtures increasingly improve construction speed and quality consistency. Moreover, rapid urbanization and large-scale infrastructure development continue to drive demand. Governments prioritize long-lasting public assets, thereby encouraging admixture adoption to extend concrete service life and reduce long-term maintenance costs.

Growth remains strong as sustainability-focused construction gains regulatory backing. Additionally, public investment in transportation networks, smart cities, and industrial facilities boosts market momentum. Regulatory emphasis on reduced cement usage and improved durability further strengthens adoption, positioning admixtures as essential to low-carbon and compliant construction practices.

admixtures enhance specialized cement applications. According to industry sources, high alumina cement uses OPC manufacturing processes with added lime, bauxite, and clinker. It requires a minimum alumina content of 32%, making it suitable for high-temperature environments where admixtures ensure consistent performance.

Operationally, admixtures support standardized construction practices. According to construction engineering guidelines, the ideal cement mix ratio is 1:2:4, representing cement, sand, and coarse aggregates. Therefore, admixtures optimize this ratio by improving flowability, reducing water demand, and enhancing both early and long-term concrete strength.

According to NatureShield evaluations, acrylic, acrylic PUD, hybrid PUD, and PUD binders were tested for abrasion and scratch resistance. Emulsions were incorporated at 1.75% solids, while dispersions used 2.5%. NatureShield 80 improved abrasion resistance, while 60 and 70 enhanced scratch performance.

Furthermore, according to NatureShield® data, larger dispersion particle sizes improved matting performance at gloss 60° and 85°. Product formulations demonstrate bio-based content between 91% and 99%, with VOC levels as low as 0.00–0.01, highlighting sustainable opportunities within advanced concrete admixture technologies.

Key Takeaways

- The Global Concrete Admixtures Market is projected to reach USD 44.5 billion by 2035, growing from USD 21 billion in 2025 at a CAGR of 7.8%.

- By product type, Plasticizers dominated the market with a share of 28.9%, supported by widespread adoption in concrete workability enhancement.

- By form, Liquid admixtures accounted for the largest share of 72.1%, driven by ease of handling and consistent dispersion.

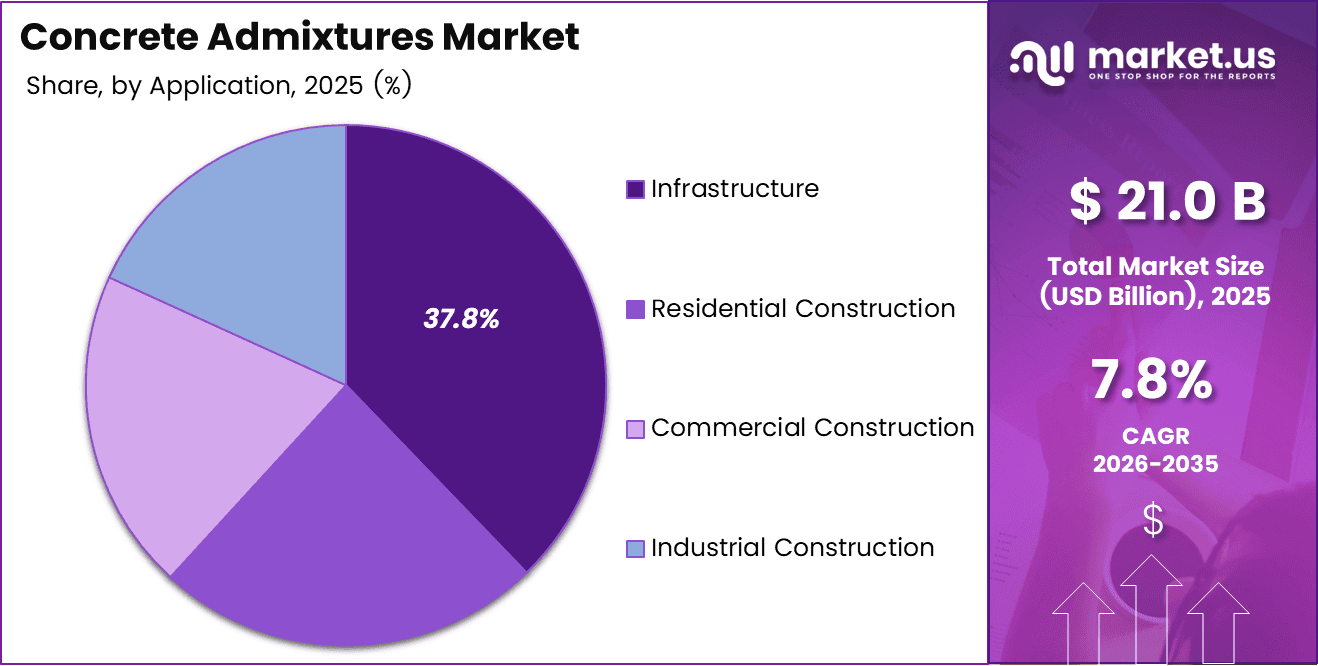

- By application, Commercial Construction led demand with a market share of 37.8%, reflecting strong urban development activity.

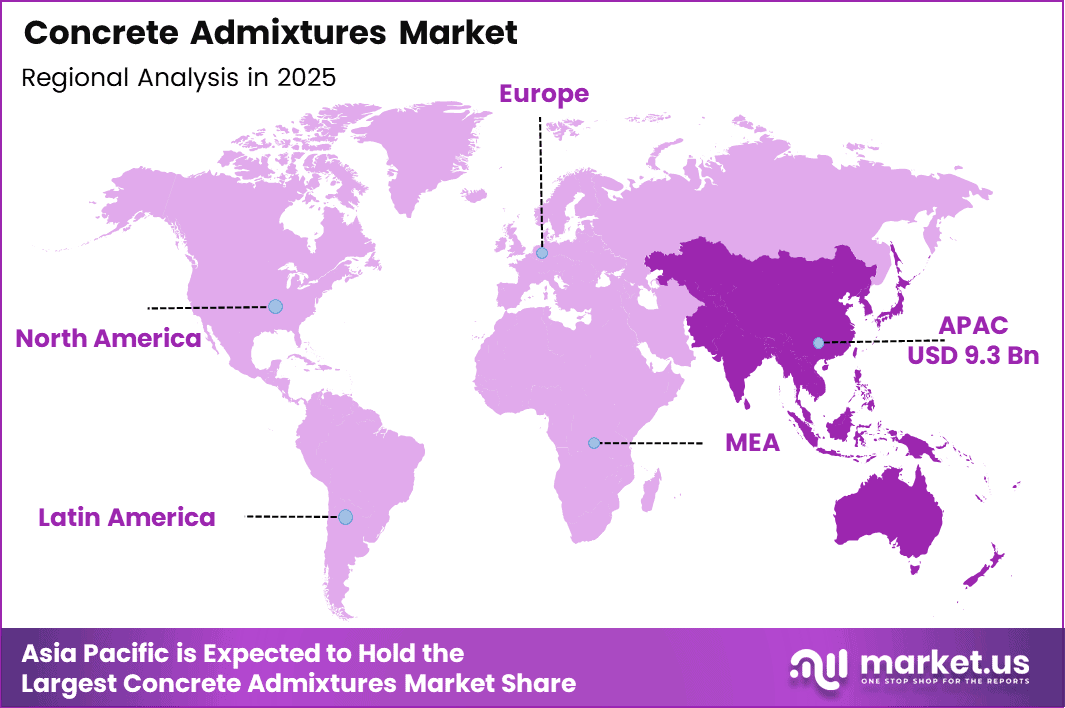

- Regionally, Asia Pacific emerged as the dominant market with a share of 0.445%, generating revenues of USD 9.345 billion in 2025.

Product Type Analysis

Plasticizers dominates with 28.9% due to broad usage in improving concrete workability and cost efficiency.

Plasticizers held a dominant market position in the Concrete Admixtures Market with a 28.9 share, driven by their widespread use in improving concrete flow and reducing water demand. Their application is critical in large-scale residential and infrastructure projects where workability and efficiency are essential for consistent construction quality.

Superplasticizers strengthened market adoption by enabling the production of high-strength concrete with superior slump retention. These admixtures support advanced architectural designs and complex structural requirements, making them increasingly important in high-rise buildings and performance-intensive construction projects.

Accelerators gained importance by significantly shortening concrete setting time in fast-track construction environments. They are commonly used in cold-weather conditions and urgent repair works, helping improve productivity while ensuring early strength development and faster project completion.

Retarders supported extended concrete workability, particularly in hot climates and mass concrete applications. By controlling hydration rates, they allow smoother placement and finishing processes, reducing the risk of premature setting and improving overall construction efficiency.

Air-entraining agents enhanced concrete durability by improving resistance to freeze-thaw cycles. Their use remains consistent in regions exposed to extreme temperature variations, where they help protect structures from weather-related stress and long-term deterioration.

Corrosion inhibitors addressed the growing need for reinforcement protection in concrete structures. Their adoption is increasing in coastal and high-moisture environments, where they play a vital role in extending structural lifespan and reducing maintenance costs.

Shrinkage-reducing admixtures helped minimize cracking risks associated with drying and curing. They are gaining adoption in slabs, flooring systems, and precast components, supporting improved dimensional stability and surface integrity.

Waterproofing admixtures supported moisture resistance in basements and underground structures. These admixtures enhance protection against water ingress, contributing to long-term durability and structural reliability in below-ground applications.

Other admixtures included niche formulations designed for specialized construction requirements. These products cater to custom performance needs and support unique applications where standard admixtures may not deliver optimal results.

Form Analysis

Liquid dominates with 72.1% due to ease of handling and uniform dispersion.

Liquid held a dominant market position in the By Main Segment Analysis segment of Concrete Admixtures Market, with a 72.1% share. Liquid admixtures allow precise dosing, faster mixing, and consistent performance across ready-mix applications.

Powder admixtures maintained relevance in remote and dry-storage-friendly environments. They offer longer shelf life and are commonly used in bagged cement and small-scale construction projects.

Application Analysis

Commercial Construction dominates with 37.8% driven by large-scale urban development.

Commercial Construction held a dominant 37.8% share in the Concrete Admixtures Market, driven by strong investments in offices, malls, hospitals, and mixed-use developments. These projects increasingly required high-performance concrete to meet structural strength, durability, and design efficiency standards. As a result, admixtures played a critical role in supporting large-scale commercial builds.

Residential Construction maintained steady demand for concrete admixtures due to ongoing housing projects and rapid urban expansion. Builders focused on improving durability while keeping construction costs optimized. Admixtures supported consistent quality and long-term performance in residential structures.

Infrastructure projects widely utilized concrete admixtures to enhance the lifespan of public assets. The need to improve load-bearing capacity and structural reliability drove adoption. Admixtures helped infrastructure withstand heavy usage and environmental stress.

Roads and Highways relied on concrete admixtures to improve pavement strength and durability. These solutions enhanced resistance to traffic loads, weather impact, and surface wear. This resulted in extended service life and reduced maintenance requirements.

Bridge construction adopted advanced concrete admixtures to ensure corrosion resistance and structural stability. Exposure to harsh environmental conditions increased the need for durable concrete solutions. Admixtures supported long-term safety and structural longevity of bridges.

Tunnel projects required concrete admixtures for controlled setting and effective waterproofing. Managing moisture and structural stability was essential in underground construction. Admixtures improved construction efficiency and long-term tunnel performance.

Dam construction benefited from the use of admixtures in mass concrete applications. These admixtures supported temperature control during curing processes. This helped reduce cracking risks and improved overall structural integrity.

Industrial Construction applied concrete admixtures to meet heavy-load and chemical resistance requirements. Facilities such as factories and processing plants demanded high-strength and durable concrete. Admixtures ensured performance reliability in harsh industrial environments.

Key Market Segments

By Product Type

- Plasticizers

- Superplasticizers

- Accelerators

- Retarders

- Air-Entraining Agents

- Corrosion Inhibitors

- Shrinkage-Reducing Admixtures

- Waterproofing Admixtures

- Others

By Form

- Liquid

- Powder

By Application

- Residential Construction

- Commercial Construction

- Infrastructure

- Roads & Highways

- Bridges

- Tunnels

- Dams

- Industrial Construction

Drivers

Accelerated Urban Infrastructure Development Driving High-Performance Concrete Demand

As an analyst, I see urban infrastructure growth as a major driver for the concrete admixtures market. Cities are expanding rapidly, creating demand for stronger and more durable concrete. Admixtures help improve strength, workability, and setting control, making them essential for large residential and public construction projects.

Moreover, the rising adoption of ready-mix and precast concrete strongly supports market growth. These construction methods require consistent quality and faster execution. Admixtures enable uniform mixing, better flow, and reduced curing time, which aligns well with commercial construction schedules and productivity goals.

Additionally, strict building codes increasingly promote long-life and high-durability structures. Governments now emphasize safety, resilience, and reduced maintenance. Admixtures support compliance by improving resistance to cracking, weathering, and corrosion, thereby extending the lifespan of concrete structures.

Furthermore, chemical admixtures are widely used to optimize cement consumption. This helps reduce material costs and supports sustainability goals. By lowering cement usage without compromising strength, admixtures play a key role in efficient and responsible construction practices.

Restraints

Volatility in Raw Material Prices Impacting Admixture Manufacturing Costs

From a market perspective, raw material price volatility remains a key restraint. Many admixtures rely on petrochemical and specialty chemical inputs, which are sensitive to global supply changes. Price fluctuations directly affect production costs and reduce profit stability for manufacturers.

As a result, unpredictable pricing often leads to cautious purchasing decisions among construction firms. Budget uncertainty can delay projects or limit the use of advanced admixture solutions, especially in cost-sensitive markets.

Another major restraint is limited technical awareness among small-scale contractors. Many builders still rely on traditional concrete practices and lack knowledge of admixture benefits. This slows adoption, particularly in rural and semi-urban construction activities.

Consequently, inadequate training and limited on-site expertise restrict market expansion. Without proper guidance, contractors may avoid admixtures due to perceived complexity or cost concerns.

Growth Factors

Expanding Use of Admixtures in Green and Sustainable Building Projects

Growth opportunities in the concrete admixtures market are closely linked to green construction. Sustainable buildings increasingly require materials that reduce cement usage and emissions. Admixtures support these goals by improving efficiency and enabling low-carbon concrete formulations.

Additionally, rapid infrastructure investment in emerging economies creates strong market potential. Governments are funding roads, railways, and urban facilities, driving demand for durable concrete solutions supported by admixtures.

Demand for specialty admixtures is also rising in high-rise and mega projects. These structures require high strength, controlled setting, and improved durability, creating opportunities for advanced admixture applications.

Technological progress further enables customized admixture formulations. Manufacturers can now develop solutions tailored to specific climate conditions, project requirements, and performance needs.

Emerging Trends

Rising Preference for Water-Reducing and Superplasticizer Admixtures

A key trend in the concrete admixtures market is the growing preference for water-reducing and superplasticizer products. These admixtures improve flow and strength while lowering water content, supporting efficient and high-quality construction.

There is also increased focus on low-carbon and eco-friendly admixture solutions. Builders and regulators prefer products that support sustainability goals and reduce environmental impact.

Another emerging trend is the integration of smart admixtures. These solutions help monitor performance, control setting time, and improve consistency in complex construction projects.

Finally, the growing use of admixtures in 3D-printed and advanced concrete applications reflects innovation. These technologies require precise control, making admixtures a critical component of future construction methods.

Regional Analysis

Asia Pacific Dominates the Concrete Admixtures Market with a Market Share of 44.5%, Valued at USD 9.3 billion

Asia Pacific represents the leading region in the Concrete Admixtures Market, driven by rapid urbanization and large-scale infrastructure development. In 2025, the region accounted for a dominant share of 44.5%, reaching a market value of USD 9.3 billion. Strong construction activity across residential, commercial, and infrastructure projects continues to support sustained demand.

North America Concrete Admixtures Market Trends

North America demonstrates steady growth supported by renovation activities and advanced construction standards. The region emphasizes high-performance and durable concrete solutions, increasing the adoption of specialty admixtures. Strong regulatory focus on building safety and sustainability further supports market expansion.

Europe Concrete Admixtures Market Trends

Europe shows consistent demand due to strict environmental regulations and emphasis on sustainable construction. The market benefits from refurbishment of aging infrastructure and rising use of low-carbon concrete solutions. Admixtures play a key role in meeting durability and compliance requirements.

Middle East and Africa Concrete Admixtures Market Trends

The Middle East and Africa region is driven by infrastructure expansion, smart city projects, and commercial construction. Extreme climate conditions increase demand for admixtures that enhance durability and setting control. Public investments continue to support long-term market development.

Latin America Concrete Admixtures Market Trends

Latin America experiences moderate growth supported by urban housing and transport infrastructure projects. Governments are gradually increasing investments in roads and public facilities, encouraging admixture usage to improve concrete performance and reduce maintenance costs.

U.S. Concrete Admixtures Market Trends

The U.S. market benefits from strong emphasis on infrastructure modernization and commercial construction. Adoption of ready-mix and precast concrete drives admixture demand. Regulatory focus on resilience and sustainability further strengthens long-term market opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Concrete Admixtures Company Insights

The global Concrete Admixtures Market reflects steady expansion supported by infrastructure development, sustainability goals, and performance-driven construction practices. From an analyst viewpoint, leading players are focusing on innovation, application-specific solutions, and regional market penetration. The first four key players continue to shape market direction through technology leadership and diversified product portfolios.

BASF Construction Chemicals maintains a strong market position through its emphasis on advanced chemical formulations and sustainable construction solutions. In 2025, the company’s focus on performance-enhancing admixtures supports complex infrastructure and commercial projects. Its innovation-driven approach aligns well with regulatory requirements and durability-focused construction trends.

Saint-Gobain plays a strategic role by integrating concrete admixtures within its broader construction materials ecosystem. The company benefits from strong distribution networks and a focus on high-performance building solutions. In 2025, its admixture offerings support energy-efficient structures and long-life concrete applications across developed and emerging markets.

MAPEI S.p.A. continues to strengthen its presence through technically advanced and application-specific admixture solutions. The company emphasizes quality consistency and customized formulations, which are increasingly demanded in large-scale and specialized construction projects. Its global reach supports steady adoption across diverse climatic and regulatory environments.

RPM International contributes to market growth through its focus on value-added construction chemicals and performance optimization. In 2025, the company benefits from rising demand for admixtures that improve durability, reduce maintenance needs, and support fast-track construction. Its diversified product strategy enhances resilience across varying construction cycles.

Overall, these key players collectively influence pricing dynamics, technology adoption, and sustainability integration within the Concrete Admixtures Market. Their strategic focus on innovation and performance positions the market for stable growth in 2025.

Top Key Players in the Market

- Sika AG

- BASF Construction Chemicals

- Saint-Gobain

- MAPEI S.p.A.

- RPM International

- Fosroc International

- GCP Applied Technologies

- Chongqing Borida Construction Materials Co.,Ltd.

- MUHU Concrete Admixtures

- CHRYSO Group

- Kao Corporation

- Denka Company

- Euclid Chemical Company

- Ha-Be Betonchemie

- Cemex Admixtures

- Other Key Players

Recent Developments

- In June 2025, Saint-Gobain announced the expansion of its digital construction chemicals platform through the acquisition of Maturix, a Denmark-based provider of real-time concrete monitoring solutions, strengthening data-driven decision-making and digital capabilities in the concrete industry.

- In February 2024, Sika acquired Vinaldom, S.A.S in the Dominican Republic, enhancing its local concrete construction product portfolio and reinforcing its market position, while creating cross-selling opportunities across the Caribbean region.

Report Scope

Report Features Description Market Value (2025) USD 21.0 billion Forecast Revenue (2035) USD 44.5 billion CAGR (2026-2035) 7.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plasticizers, Superplasticizers, Accelerators, Retarders, Air-Entraining Agents, Corrosion Inhibitors, Shrinkage-Reducing Admixtures, Waterproofing Admixtures, Others), By Form (Liquid, Powder), By Application (Residential Construction, Commercial Construction, Infrastructure [Roads & Highways, Bridges, Tunnels, Dams], Industrial Construction) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sika AG, BASF Construction Chemicals, Saint-Gobain, MAPEI S.p.A., RPM International, Fosroc International, GCP Applied Technologies, Chongqing Borida Construction Materials Co.,Ltd., MUHU Concrete Admixtures, CHRYSO Group, Kao Corporation, Denka Company, Euclid Chemical Company, Ha-Be Betonchemie, Cemex Admixtures, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sika AG

- BASF Construction Chemicals

- Saint-Gobain

- MAPEI S.p.A.

- RPM International

- Fosroc International

- GCP Applied Technologies

- Chongqing Borida Construction Materials Co.,Ltd.

- MUHU Concrete Admixtures

- CHRYSO Group

- Kao Corporation

- Denka Company

- Euclid Chemical Company

- Ha-Be Betonchemie

- Cemex Admixtures

- Other Key Players