Global Concentrated Photovoltaic Market Size, Share Analysis Report By Type (High Concentrated Photovoltaic (HCPV), Low Concentrated Photovoltaic (LCPV)), By Application (Utility, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164603

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

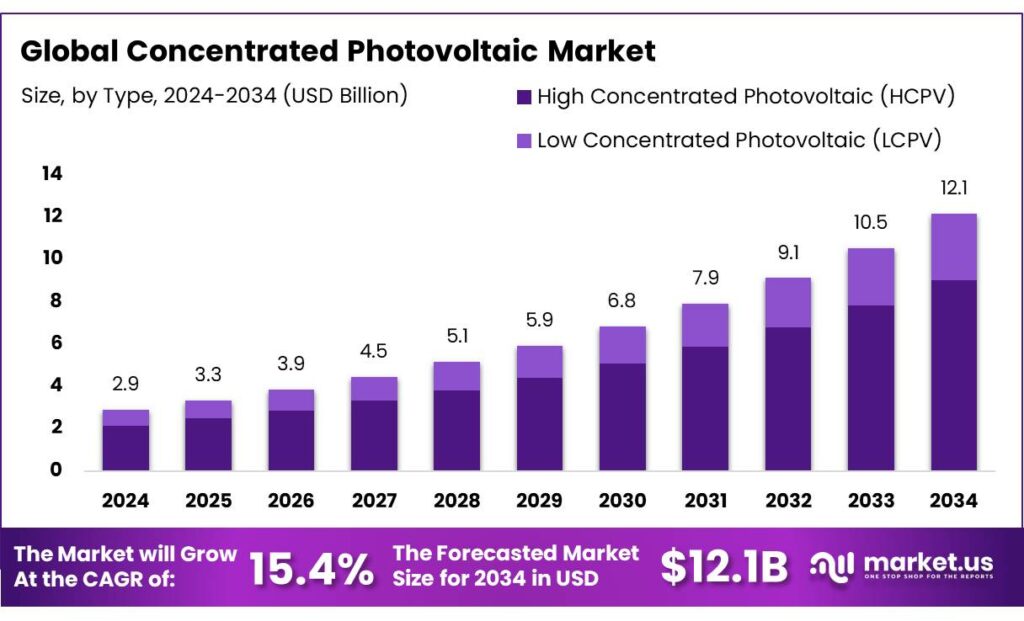

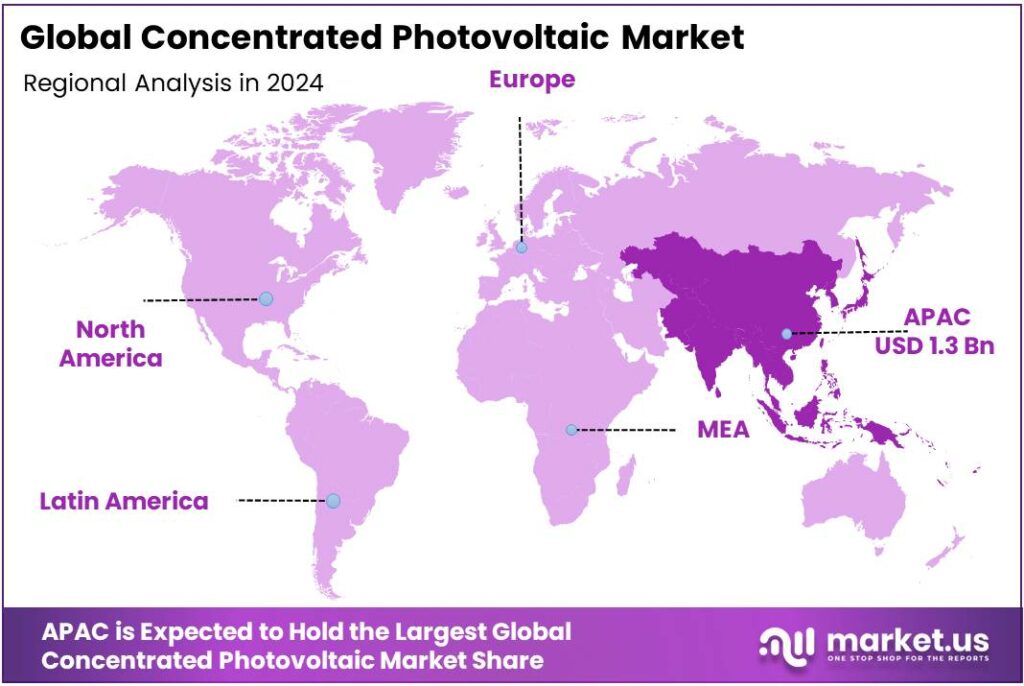

The Global Concentrated Photovoltaic Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.9% share, holding USD 1.3 Billion in revenue.

Concentrated photovoltaics (CPV) use optical concentrators and multi-junction (III-V) solar cells on dual-axis trackers to convert high levels of direct normal irradiance (DNI) into electricity. CPV’s appeal is top-end efficiency: research multi-junction cells now exceed 47% conversion efficiency under concentration, a benchmark tracked and certified by NREL’s long-running “Best Research-Cell Efficiency” program.

Industrial momentum in solar is strong, creating a supportive backdrop for niche CPV deployments in very sunny locations. Global PV additions almost doubled in 2023, with ~430 GW installed, and module prices kept falling through 2024, according to the IEA. Cumulative PV capacity hit ~1.6 TW by end-2023, per IEA-PVPS, underscoring scale in supply chains and power electronics that CPV projects can leverage. IRENA estimates renewables added 585 GW in 2024, of which solar was 452 GW (+32% y/y), reflecting policy and cost tailwinds that also support high-irradiance solar options.

The CPV operating “sweet spot” is where DNI is consistently high—typically ≥ ~1,900–2,100 kWh/m²/year. National labs and standards bodies emphasize performance testing under such conditions. For siting and bankability, developers rely on authoritative DNI datasets, and use IEC 62670-1/-2/-3 for nameplate power, on-sun energy output, and power assessment.

On technology status, the industrial scenario features R&D-led progress in optics, receivers, and micro-CPV designs. Fraunhofer ISE recently demonstrated a micro-CPV module with 36.0 ± 0.4% rated efficiency under IEC 62670-3 conditions, illustrating how advanced optics and multi-junction cells can deliver very high module-level performance when well aligned and cooled.

Policy initiatives remain a driver. In the United States, DOE’s Solar Energy Technologies Office issued a FY-2024 Photovoltaics R&D funding opportunity of up to US$20 million, alongside seed-stage SIPS awards spanning PV and concentrating concepts—signals that public programs still back advanced PV materials, manufacturing, and specialized applications where CPV could compete.

Key Takeaways

- Concentrated Photovoltaic Market size is expected to be worth around USD 12.1 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 15.4%.

- High Concentrated Photovoltaic (HCPV) held a dominant market position, capturing more than a 74.3% share of the global concentrated photovoltaic market.

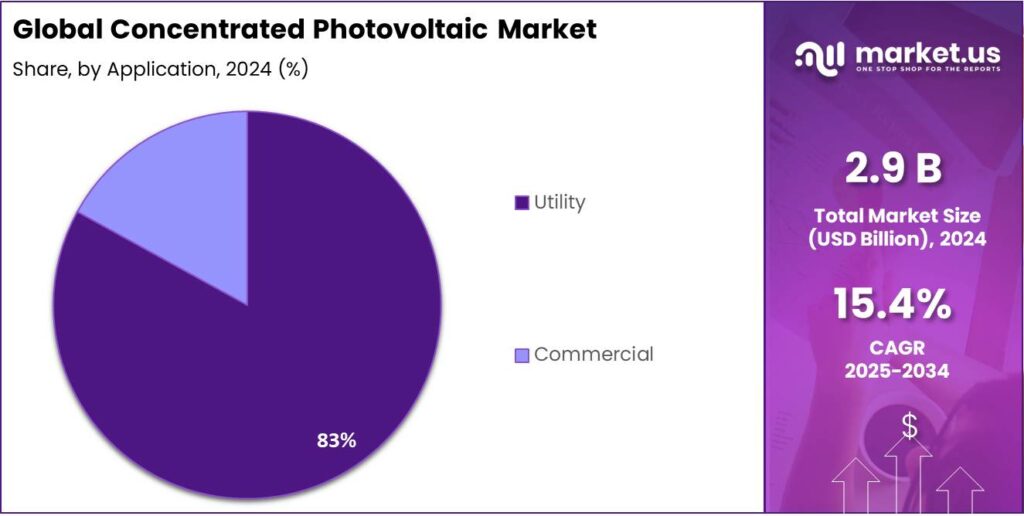

- Utility segment held a dominant market position, capturing more than an 83.8% share of the global concentrated photovoltaic market.

- Asia-Pacific (APAC) region held a dominant position in the global concentrated photovoltaic (CPV) market, accounting for 45.9% of the total market share, valued at approximately USD 1.3 billion.

By Type Analysis

High Concentrated Photovoltaic (HCPV) dominates with 74.3% due to superior efficiency and large-scale utility adoption

In 2024, High Concentrated Photovoltaic (HCPV) held a dominant market position, capturing more than a 74.3% share of the global concentrated photovoltaic market. This strong position was mainly attributed to the system’s ability to deliver conversion efficiencies exceeding 40%, significantly higher than traditional PV technologies. HCPV systems utilize multi-junction solar cells and advanced optical concentrators, enabling them to generate maximum output under high Direct Normal Irradiance (DNI) conditions, particularly in regions such as the Middle East, North Africa, and parts of the Asia-Pacific.

The rising demand for high-efficiency solar power generation and growing investments in renewable infrastructure during 2024 further boosted the adoption of HCPV systems. Governments and private energy developers focused on optimizing land and energy output, promoting utility-scale HCPV projects capable of generating over 1.5 times more energy per unit area than conventional PV systems. The year 2025 is expected to continue this trend, with increasing installations supported by advancements in tracking technology, optical precision, and cost reduction in high-efficiency multi-junction cells.

By Application Analysis

Utility segment dominates with 83.8% due to large-scale energy generation and government-backed solar projects

In 2024, the Utility segment held a dominant market position, capturing more than an 83.8% share of the global concentrated photovoltaic market. The dominance of this segment was driven by the rising demand for large-scale renewable energy generation and the increasing number of grid-connected solar projects across high solar irradiation regions. Utility-scale concentrated photovoltaic (CPV) systems are primarily deployed in deserts and open land areas where direct sunlight intensity is high, enabling consistent power output with improved energy conversion efficiency.

During 2024, the rapid expansion of solar infrastructure, combined with strong government incentives and national renewable energy targets, encouraged public and private investment in CPV-based utility projects. Countries such as China, India, the United Arab Emirates, and the United States continued to prioritize high-capacity installations to reduce dependence on fossil fuels. These projects typically integrate HCPV systems capable of producing higher output per square meter, ensuring stable electricity supply for industrial and residential grids.

Key Market Segments

By Type

- High Concentrated Photovoltaic (HCPV)

- Low Concentrated Photovoltaic (LCPV)

By Application

- Utility

- Commercial

Emerging Trends

Micro-CPV and CPV-for-Water shaping agri-solar in high-DNI regions

A clear trend in concentrated photovoltaics (CPV) is the shift from “pure power” toward micro-CPV and CPV-for-water solutions that sit close to farms, desalination plants, and irrigation districts. This is being pulled by agriculture’s huge water footprint and the need to power water reliably in sun-belt regions. The Food and Agriculture Organization (FAO) estimates agriculture accounts for about 70% of global freshwater withdrawals, making it the world’s largest water user—so energy innovations that secure water flows have immediate food-system impact.

Two FAO datapoints explain why CPV is being deployed alongside water assets rather than only as grid-power plants. First, the area equipped for irrigation has reached ~350 million hectares (≈22% of cropland), up ~20% since 2000—evidence that irrigation, and its electricity demand, keeps expanding. Second, 171 million hectares—about 62% of the world’s irrigated cropland—face high or very high water stress, so every kilowatt-hour that can drive pumps, conveyance, or desalination translates to resilient harvests.

On the technology side, CPV’s efficiency edge is becoming more “deployable.” At the cell level, NREL’s record multi-junction device hit 47.1% under concentrated light, showing the headroom that makes CPV compelling where direct normal irradiance (DNI) is strong. At the module level, Fraunhofer ISE has demonstrated ~36% efficiency for a micro-CPV module under IEC 62670-3 rating conditions—important because standardized rating builds buyer confidence and eases financing.

Policy and public-finance signals reinforce the trend. FAO’s AQUASTAT frames irrigation as a central lever for food security, with agriculture using ~69–70% of withdrawals globally and, in some developing economies, irrigation accounting for up to 95% of all water use—a reality that channels infrastructure and climate funds toward water efficiency and supply, where CPV-powered water can qualify.

Drivers

High Conversion Efficiency in Premium-DNI Zones

One of the most compelling drivers behind the uptake of concentrated photovoltaics (CPV) is their markedly higher conversion efficiency compared with conventional flat‐plate solar systems—and this is especially valuable in regions with abundant direct normal irradiance (DNI). In simple terms, CPV systems focus sunlight using lenses or mirrors onto small areas of very high‐efficiency multi-junction (MJ) solar cells, meaning you can get more electricity per unit of solar input when conditions are favourable.

- For example, review literature indicates CPV systems can achieve efficiencies exceeding 40% in modules under optimal conditions, whereas traditional silicon modules typically deliver only around 15–22% under similar evaluation.

This efficiency advantage becomes especially meaningful in zones where the sun is strong, direct and reliable. A key metric here is DNI—the amount of sunlight arriving on a surface perpendicular to the sun’s rays. Studies show that when DNI values exceed about ~5.4 kWh/m²/day, CPV starts to become more attractive relative to standard PV. What that means in practice: in places where you have clear skies, low atmospheric scattering and high-quality solar resource, CPV can make better use of the available irradiance and deliver more electricity per installation footprint.

A practical way to look at future opportunity: as standard PV module efficiencies plateau around mid-20% in large scale manufacturing, technologies like CPV with potential to push into the 30-40 %+ range offer a differentiated value proposition. If a CPV plant in a high DNI region can consistently generate, say, 10–20 % more energy than a similarly sized conventional PV plant, then that margin can translate into meaningful revenue, faster pay-back and lower levelised cost of electricity (LCOE).

Restraints

Dependence on High-Quality DNI—and the cost squeeze from ultra-cheap flat-plate PV

Concentrated photovoltaics (CPV) rely on very high direct normal irradiance (DNI) and precise dual-axis tracking. That dependency narrows viable sites and raises project risk. CPV modules are also rated under specific “concentrator” conditions (IEC 62670): 1,000 W/m² DNI at 25 °C cell temperature for CSTC, and 900 W/m² DNI for CSOC—numbers that underscore how performance falls away when DNI or thermal control slip.

Operations in dusty, arid zones—the very regions with premium DNI—create further headwinds. NREL documents that soiling can drive annual energy losses of 10–30% on PV systems without adequate cleaning, and CPV optics/receivers are particularly sensitive to dirt and misalignment. That implies higher O&M effort, water logistics, or robotic cleaning to hold yields, which adds cost and complexity relative to commodity flat-plate PV.

IEA reports that in 2023, spot prices for standard PV modules fell ~50% year-on-year amid a supply glut; global PV manufacturing capacity under construction pointed to ~1,100 GW by end-2024, far above demand, locking in very low module pricing. At the upstream level, polysilicon prices plunged to USD 4–5/kg by Q2 2024, after peaking near USD 40/kg in late 2022, further compressing module costs. With this backdrop, IRENA’s global weighted-average utility-scale solar PV LCOE settled around USD 0.043/kWh in 2024, leaving very little price room for CPV’s trackers, optics, and tighter tolerances.

Policy and research programs support advanced PV, but they also amplify mainstream PV scale advantages that indirectly restrain CPV. IEA tracks that by end-2023, polysilicon manufacturing capacity reached roughly 850 GW, with ~95% of new supply-chain facilities in one country—concentration that accelerates learning rates and price drops across the conventional PV ecosystem.

Opportunity

CPV-powered water for food—desalination and irrigation in high-DNI regions

A big opening for concentrated photovoltaics (CPV) sits at the intersection of water and food. Agriculture uses the majority of the world’s freshwater withdrawals—around 70%—so every cubic metre saved or newly supplied matters for crops, rural jobs, and food prices. That headline number is from the UN Food and Agriculture Organization (FAO), which tracks water use in farming globally.

Where water is short, desalination and long-distance conveyance are becoming essential public services—and they are energy-hungry. The International Energy Agency (IEA) notes that desalination “often requires >1 kWh per m³,” and in 2023 the energy used by desalination services in the Middle East was nearly half of all the energy consumed by the region’s residential sector. That is a huge, steady electricity demand looking for the lowest-cost, most reliable supply.

Reverse-osmosis (RO) plants—the dominant technology—typically need ~3.5–5.0 kWh per m³ of electricity at large scale, according to the IEA’s ETSAP briefing; older thermal processes (MSF) also require ~80 kWh of heat plus 2.5–3.5 kWh of electricity per m³. These are bankable benchmarks that planners and financiers already use.

The World Bank reports MENA now accounts for >53% of global desalination capacity, reflecting both necessity and investment momentum. In Jordan, a flagship US$6 billion desalination-and-conveyance program will deliver ~300 million m³/year to Amman, backed in 2025 by the Green Climate Fund’s largest deal to date—US$295 million in grants and loans—alongside multilateral and bilateral finance.

Regional Insights

Asia-Pacific (APAC) dominates the Concentrated Photovoltaic Market with 45.9% share, valued at USD 1.3 billion in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global concentrated photovoltaic (CPV) market, accounting for 45.9% of the total market share, valued at approximately USD 1.3 billion. This strong presence was primarily driven by the region’s high solar irradiation potential, large-scale renewable energy projects, and supportive government initiatives promoting clean energy deployment.

CPV installations across APAC benefited from declining module costs and improvements in high-concentration photovoltaic (HCPV) system design. The region also witnessed increased adoption in desert and arid zones, particularly in Western China and Northern India, where direct normal irradiance (DNI) levels often exceed 2,000 kWh/m² annually.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arzon Solar LLC (USA) designs and manufactures high-performance CPV systems and is built on the heritage of Amonix technology. Its uModule product features a 2.7 kW DC module with an aperture efficiency of about 30%. Arzon claims energy yields of ~2,500–2,800 kWh per kW in high-DNI environments. The company’s decades of CPV field experience support its position in utility-scale applications in arid climates.

EMCORE (USA) is a provider of compound-semiconductor technologies and entered the terrestrial CPV market by supplying multi-junction GaAs solar cells and high-concentration modules. In 2010, EMCORE formed a joint venture (Suncore Photovoltaics) with San’an Optoelectronics in China for CPV manufacturing. The firm offers utility-scale CPV products optimized for harsh desert conditions and aims to reduce cost per watt through high concentration (>500×).

Everphoton (Taiwan) is focused on high-concentration PV (HCPV) systems, manufacturing modules, Fresnel lenses, sensors and trackers. The company planned the first HCPV power plant in Asia (1 MWp scale) using LED/compound semiconductor and CPV module technology. Its strategic link to LED-packaging firms supports its advanced optics and module manufacturing capabilities.

Top Key Players Outlook

- Arzon Solar

- Emcore

- Everphoton Energy Corporation

- Greenfield Solar

- ISOFOTON

- Morgan Solar

- Pramac

Recent Industry Developments

In 2024, EMCORE announced a terrestrial concentrator solar cell conversion efficiency record of 39% at 1,000× solar illumination.

In 2024 Morgan Solar, announced that its PV DeepSweep platform had covered approximately 2 GW of monitored capacity across utility-scale sites, enabling continuous I-V curve tracing for modules rated up to 800 W.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 12.1 Bn CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High Concentrated Photovoltaic (HCPV), Low Concentrated Photovoltaic (LCPV)), By Application (Utility, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arzon Solar, Emcore, Everphoton Energy Corporation, Greenfield Solar, ISOFOTON, Morgan Solar, Pramac Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Concentrated Photovoltaic MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Concentrated Photovoltaic MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arzon Solar

- Emcore

- Everphoton Energy Corporation

- Greenfield Solar

- ISOFOTON

- Morgan Solar

- Pramac