Global Computer Vision Market By Component (Hardware, Software), Product Type (Smart Camera-Based Computer Vision System, PC-Based Computer Vision System), By Application (Quality Assurance & Inspection, Positioning & Guidance, Measurement, Identification, Predictive Maintenance, 3D Visualization & Interactive 3D Imaging Modelling), By Vertical (Industrial, Non-Industrial), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 56728

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

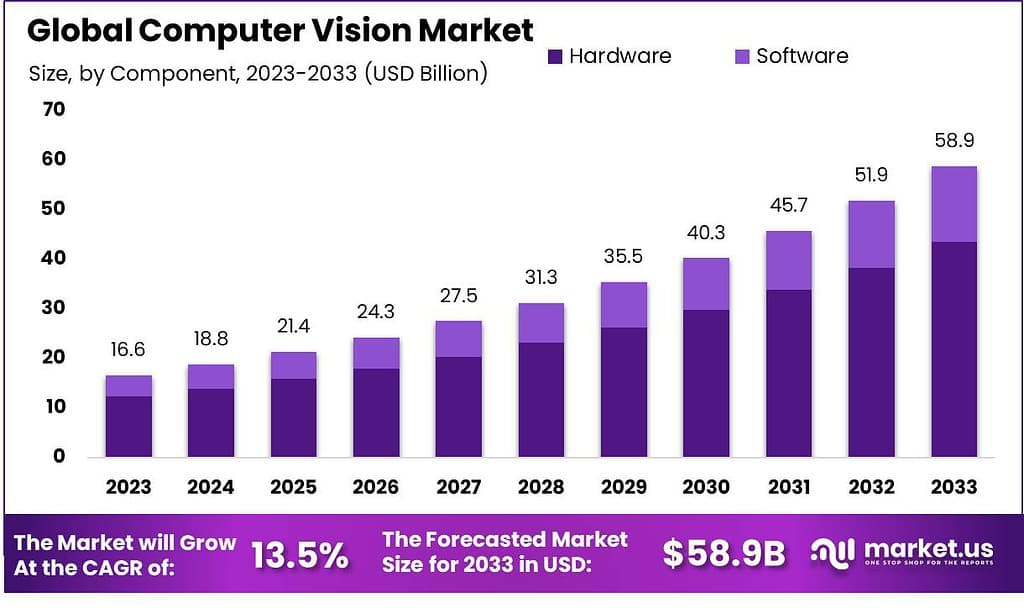

The Global Computer Vision Market size is expected to be worth around USD 58.9 billion by 2033 from USD 16.6 billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2024 to 2033.

Computer Vision is a field of artificial intelligence that focuses on enabling computers to understand and interpret visual information from images or videos. It involves the development of algorithms and techniques that allow computers to analyze, process, and extract meaningful insights from visual data.

The Computer Vision market offers solutions that can perform tasks such as object detection, image classification, facial recognition, gesture recognition, and scene understanding. These capabilities have practical implications in areas like autonomous vehicles, medical imaging, surveillance systems, augmented reality, and quality control in manufacturing.

The market for Computer Vision is expected to continue expanding as more industries recognize the value and potential of these technologies. The demand for Computer Vision solutions is driven by the need for automation, efficiency, and enhanced decision-making processes. By leveraging Computer Vision algorithms and techniques, businesses can achieve improved accuracy, speed, and productivity in various visual-based tasks.

However, challenges remain in the widespread adoption of Computer Vision, including the need for robust and scalable algorithms, data privacy concerns, and ethical considerations. Efforts are being made to address these challenges and further advance the capabilities of Computer Vision systems.

Key Takeaways

- The Computer Vision Market is projected to reach USD 58.9 billion by 2033, an impressive increase from its valuation in 2023 of USD 16.6 billion at a compound annual compound rate of 13.5% over its forecast period from 2024-2033.

- Hardware dominates the market, capturing more than 74% market share, driven by advancements in technology and the integration of high-resolution cameras with powerful GPUs.

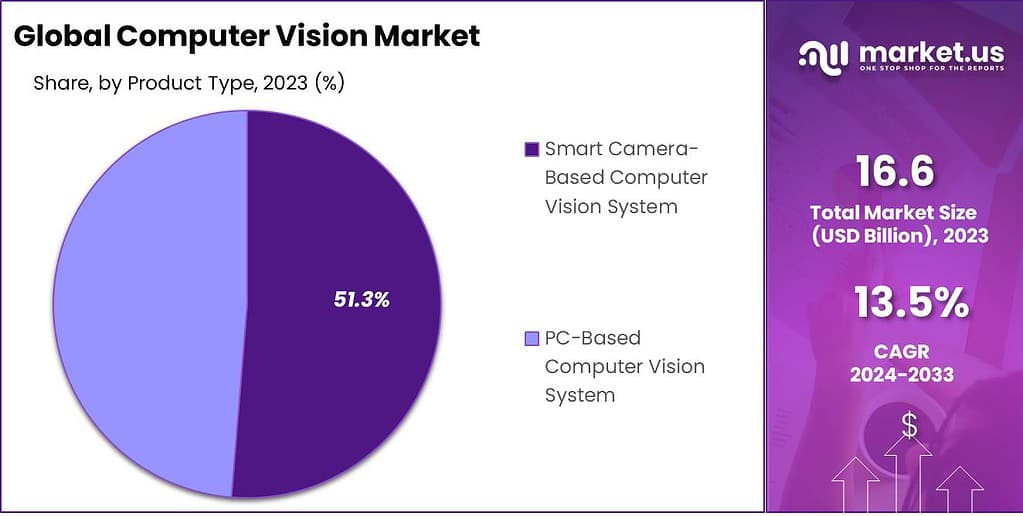

- In 2023, Smart Camera-Based Computer Vision System holds a dominant market position, accounting for over 51.3% share.

- PC-Based Computer Vision Systems represent the remaining market share, with 48.7%.

- Quality Assurance & Inspection leads the market with over 25% share in 2023, playing a crucial role in ensuring product quality and adherence to industry standards. Other significant segments include Positioning & Guidance, Measurement, Identification, Predictive Maintenance, and 3D Visualization & Interactive 3D Imaging Modelling.

- In 2023, the Industrial vertical holds the dominant market share of over 48%. It finds extensive application in manufacturing, aerospace, automotive, and other industries, enhancing productivity and reducing operational costs. The Non-Industrial vertical encompasses healthcare, retail, and agriculture applications.

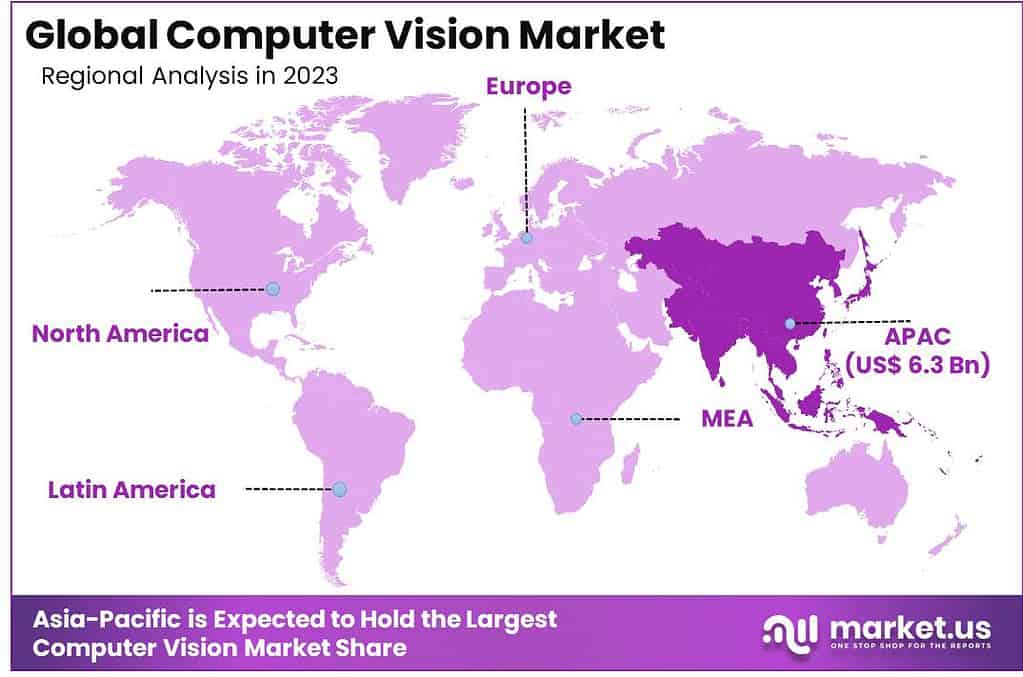

- The Asia Pacific dominates the market, accounting for 38% of global revenue in 2023. China’s significant investments in computer vision technology contribute to its leadership. North America is also experiencing growth, supported by favorable government initiatives.

- Major players in the Computer Vision Market include Cognex Corporation, Keyence Corporation, Intel Corporation, Matterport Inc., OMRON Corporation, National Instruments, Teledyne Digital Imaging Inc., Sony Semiconductor Solutions Corporation, and others.

Component Analysis

The Computer Vision market exhibited a significant segmentation that was by its main components, which are primarily Hardware and Software. Hardware emerged as the leading segment, and has established a dominant market share by capturing more than 74% market share. This is due to the crucial importance of hardware components like cameras sensors, processors, and other components in the development of an ecosystem of computer vision.

The continual advances in technology for hardware and the integration of high-resolution cameras with powerful GPUs, have increased the effectiveness and precision that computer vision technologies. Additionally, the increasing need for computer vision solutions across different industries, such as healthcare, automotive manufacturing, and even healthcare and healthcare, has further contributed to the growth of the hardware market.

In the end, Hardware will continue to hold its dominance in the market for computer vision to the constant technological advancements and the growing acceptance of computer vision solutions across a variety of industries.

Product Type Analysis

In 2023, Smart Camera-Based Computer Vision System held a dominant market position, capturing more than a 51.3% share. This can be attributed to its versatility and ease of integration across various industries. These systems leverage embedded cameras with advanced image processing capabilities, making them a preferred choice for real-time object recognition and tracking.

PC-Based Computer Vision Systems, on the other hand, accounted for the remaining market share. With a share of 48.7%, these systems play a crucial role in applications requiring complex computational power. They are commonly employed in industries such as manufacturing and healthcare, where extensive data processing is necessary for quality control and diagnostics.

Both segments exhibit growth potential, with smart camera-based computer vision systems benefiting from their cost-effective nature and ease of deployment. In contrast, PC-Based Computer Vision Systems continue to thrive in sectors demanding high computational capabilities. The market’s overall positive trajectory indicates a promising outlook for both product types, underlining the continued expansion of computer vision technology across industries.

Application Analysis

In 2023, Quality Assurance & Inspection held a dominant market position, capturing more than a 25% share. This segment’s significance lies in its critical role in ensuring product quality and adherence to industry standards across various sectors. Computer vision systems have been instrumental in automating quality control processes, contributing to improved efficiency and reduced defects in manufacturing.

Positioning & Guidance emerged as another substantial segment. These applications find extensive use in autonomous navigation systems, robotics, and drones. The precision and accuracy provided by computer vision technology make it indispensable for applications requiring real-time spatial awareness and guidance.

Measurement applications held a notable share, driven by the demand for highly accurate measurements in industries like healthcare, metrology, and construction. Computer vision systems enable precise measurements without human errors, enhancing overall operational efficiency.

Identification plays a pivotal role in security and access control. Facial recognition, biometrics, and object identification are key areas where computer vision systems are applied, contributing to enhanced security protocols.

Predictive Maintenance leverages computer vision for equipment and machinery health monitoring. This proactive approach minimizes downtime and maintenance costs, making it a valuable segment for industries reliant on machinery.

Finally, 3D Visualization & Interactive 3D Imaging Modelling finds application in diverse sectors like gaming, architecture, and medical imaging. The immersive and interactive capabilities of computer vision technology continue to drive its adoption for creating realistic 3D models and simulations.

In conclusion, the computer vision market exhibits a diverse landscape of applications, with Quality Assurance & Inspection leading the way. These segments collectively reflect the broad spectrum of opportunities and the pervasive influence of computer vision technology across industries.

Vertical Analysis

In 2023, the Industrial vertical held a dominant market position, capturing more than a 48% share. This significant presence can be explained by the increasing use of computer vision technologies in the industrial setting. Industries like manufacturing aerospace, automotive, and manufacturing have increased reliance on computer vision to ensure the control of quality, automation and detection of defects. The precision and efficiency offered by computer vision systems have significantly contributed to enhancing productivity and reducing operational costs in these sectors.

Conversely, the Non-Industrial vertical accounted for the remaining market share. While not as prominent as its industrial counterpart, this segment encompasses diverse applications in areas like healthcare, retail, and agriculture. In healthcare, computer vision aids in medical imaging and diagnostics, while in retail, it enhances customer experience through shelf monitoring and checkout automation. Additionally, agriculture benefits from computer vision in crop monitoring and precision farming practices.

Key Market Segments

Component

- Hardware

- Software

Product Type

- Smart Camera-Based Computer Vision System

- PC-Based Computer Vision System

Application

- Quality Assurance & Inspection

- Positioning & Guidance

- Measurement

- Identification

- Predictive Maintenance

- 3D Visualization & Interactive 3D Imaging Modelling

Vertical

- Industrial

- Non-Industrial

Drivers

- Automation Demand: The Computer Vision market is on the rise because industries want more automation. Think of factories, hospitals, and cars – they all want computers to “see” and understand things, which makes work faster and better.

- Smart Computers: People are making computers smarter with AI and learning. When computers learn, they get better at understanding images and videos. This makes Computer Vision more popular.

- Lots of Uses: People are finding many ways to use Computer Vision, like self-driving cars, checking medical images, and making shopping easier. This makes Computer Vision useful in many areas.

- Cameras Everywhere: Cameras are everywhere nowadays, in phones, homes, and stores. Computer Vision needs these cameras to work, so as cameras spread, Computer Vision grows too.

Restraints

- Privacy Worries: Some people worry about their privacy because Computer Vision needs to look at lots of images and videos. Laws and rules about privacy might slow down Computer Vision.

- Not So Easy: Making Computer Vision work can be hard. It needs to work with other computer stuff, and that can be tricky. This can make Computer Vision slower to use.

Opportunities

- Healthcare Boost: Doctors and hospitals can use Computer Vision to help patients better. It can help find diseases and do surgeries, which means big chances for Computer Vision in healthcare.

- Better Shopping: Imagine stores where you just take things and walk out, without standing in line. Computer Vision can make this happen and make shopping more fun.

Challenges

- Big Computer Needs: Making Computer Vision work needs very strong computers. These computers can be expensive and use lots of electricity.

- Getting It Right: Computer Vision needs to be very accurate and safe. For things like self-driving cars and medicine, mistakes can be very bad. Making Computer Vision reliable is a big challenge.

Regional Analysis

The Asia Pacific dominated this market and was responsible for 38% of global revenue in 2023. Major players such as Sony Semiconductor Solutions Corporation, OMRON Corporation, and Sony Semiconductor Solutions Corporation are expected to increase market growth in this major region. The demand for Computer Vision in Asia Pacific was valued at USD 6.3 billion in 2023 and is anticipated to grow significantly in the forecast period.

China has already deployed almost 176 million digital cameras to meet its demand for better surveillance. Tech companies have access to huge datasets from the government to help them build models for their computer vision application development. North America is expected to experience significant growth during the forecast period. Favorable government initiatives have contributed to this increase in computer vision adoption. The National Institute of Standards and Technology was a non-regulatory government agency and a U.S. Department of Commerce physical sciences laboratory.

Europe followed closely as a substantial player in the market. The region’s advanced automotive industry and investments in research and development have driven the adoption of computer vision for various applications.

North America maintained a competitive position in the market. The presence of leading technology companies and a strong focus on innovation have bolstered the computer vision market in this region.

Latin America and the Middle East & Africa are emerging players in the market, with growing potential. These regions are in the early stages of computer vision adoption, driven by developments in healthcare and agriculture sectors.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

These key players will focus on growing their product line and expanding their reach by purchasing business annual reports and technologies. Probiotics (a China-based computer vision company) acquired At Site A/S, a visual inspection service provider. Robotics closed this deal to develop an AI-enabled offshore wind turbine inspection technology. Snap Inc., a U.S. social media company, acquired AI Factory, a Ukraine-based computer vision start-up, in January 2020. Snap Inc. hoped to use this acquisition to enhance its social media app with a new Cameos feature. Cameos turn a person’s image into an animated video.

Top Key Players

These are the top players(Industry experts) in the global market for computer vision:

- Cognex Corporation

- Keyence Corporation

- Intel Corporation

- Matterport Inc.

- OMRON Corporation

- National Instruments

- Teledyne Digital Imaging Inc.

- Sony Semiconductor Solutions Corporation

- sony corporation

- cadence design systems, inc.

- teledyne technologies

- Basler ag(Germany

- allied vision technologies

- Other Key Players

Recent Development

- In June 2022, Visionary.ai partnered with Innoviz Technologies to enhance 3D computer vision performance for applications such as drones, robots, and smart cities. The collaboration combines ISP software and LiDAR sensors.

- In March 2022, Intel Corporation announced its solutions are transforming patient rooms and critical care environments in the healthcare sector. These solutions improve patient outcomes, operational effectiveness, and minimize risks to patients and medical staff.

- In January 2022, Amazon Web Services (AWS) released AWS Panorama in the Asia Pacific region. AWS Panorama is a software development kit that utilizes computer vision to optimize operations. It enables businesses to automate visual inspection tasks, identify bottlenecks in industrial processes, evaluate manufacturing quality, and ensure worker safety within their facilities.

Report Scope

Report Features Description Market Value (2023) USD 16.6 Billion Forecast Revenue (2033) USD 58.9 Billion CAGR (2023-2032) 13.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software), Product Type (Smart Camera-Based Computer Vision System, PC-Based Computer Vision System), By Application (Quality Assurance & Inspection, Positioning & Guidance, Measurement, Identification, Predictive Maintenance, 3D Visualization & Interactive 3D Imaging Modelling), By Vertical (Industrial, Non-Industrial) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Cognex Corporation, Keyence Corporation, Intel Corporation, Matterport Inc., OMRON Corporation, National Instruments, Teledyne Digital Imaging Inc., Sony Semiconductor Solutions Corporation, sony corporation, cadence design systems, inc., teledyne technologies, Basler ag(Germany, allied vision technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Computer Vision?Computer Vision is a field of artificial intelligence that enables computers to interpret and understand visual information from images or videos. It involves teaching computers to "see" and make sense of the world through visual data.

How big is the computer vision market?The Global Computer Vision Market size is expected to be worth around USD 58.9 billion by 2033 from USD 16.6 billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2024 to 2033.

What are the key applications of computer vision technology?Computer vision has a wide range of applications, including quality assurance in manufacturing, autonomous vehicles, healthcare (medical image analysis), retail (cashier-less stores), security and surveillance, agriculture (crop monitoring), and more.

What are the major drivers of growth in the Computer Vision Market?Key drivers include the increasing demand for automation across industries, the integration of AI and machine learning with computer vision, the need for enhanced quality control, and advancements in hardware such as sensors and cameras.

Where is Computer Vision used in real-life applications?Computer Vision is used in various real-life applications, including autonomous vehicles, healthcare for medical image analysis, facial recognition for security, retail for inventory management, and industrial automation.

How does Computer Vision impact healthcare?Computer Vision plays a significant role in healthcare by aiding in disease diagnosis, medical image analysis, surgical assistance, and patient monitoring. It helps healthcare professionals make more accurate and timely decisions.

-

-

- Cognex Corporation

- Keyence Corporation

- Intel Corporation

- Matterport Inc.

- OMRON Corporation

- National Instruments

- Teledyne Digital Imaging Inc.

- Sony Semiconductor Solutions Corporation

- sony corporation

- cadence design systems, inc.

- teledyne technologies

- Basler ag(Germany

- allied vision technologies

- Other Key Players