Global Commercial Vehicle Steel Wheels Market Size, Share, Growth Analysis By Type (16-18 inches, 13-15 inches, 19-21 inches, 21-22.5 inches), By Wheel (Stamped Steel Wheels, Forged Steel Wheels, Others), By Vehicle (Heavy Commercial Vehicles (HCV), Light/Medium Commercial Vehicles (LCV/MDV)), By Application (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176478

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

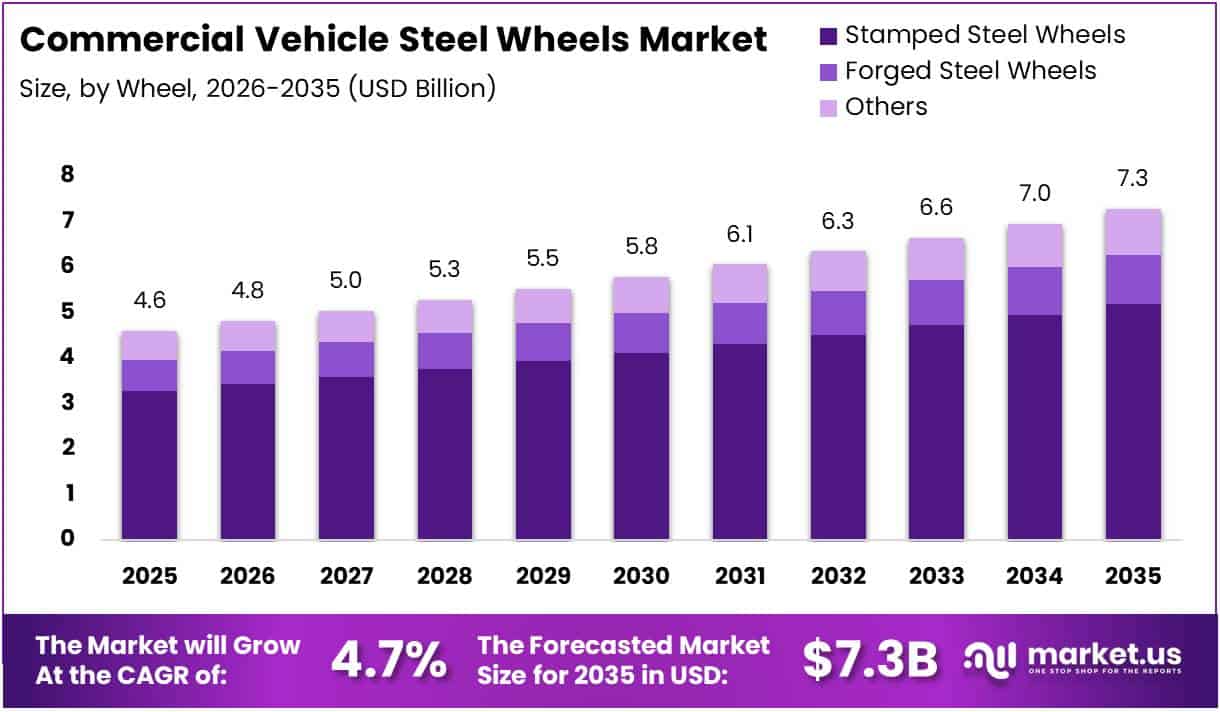

The Global Commercial Vehicle Steel Wheels Market size is expected to be worth around USD 7.3 Billion by 2035 from USD 4.6 Billion in 2025, growing at a CAGR of 4.7% during the forecast period 2026 to 2035.

Commercial vehicle steel wheels serve as essential components in heavy-duty trucks, buses, and medium-duty commercial vehicles. These wheels provide structural support and load-bearing capacity for demanding transportation applications. Steel wheels remain the preferred choice due to their durability, cost-effectiveness, and proven performance across diverse operating conditions.

The market demonstrates steady growth driven by expanding freight logistics networks and increasing commercial vehicle production worldwide. Steel wheels offer superior strength-to-weight ratios compared to alternative materials in heavy-duty applications. Moreover, their ability to withstand extreme loads and harsh environments makes them indispensable for commercial fleet operators.

Emerging economies are experiencing significant infrastructure development, consequently boosting demand for commercial vehicles and replacement wheels. Fleet expansion in logistics, construction, and public transportation sectors drives consistent market growth. Additionally, urbanization trends continue to increase intercity and intracity commercial vehicle operations, supporting sustained wheel demand.

Government investments in transportation infrastructure and logistics networks create favorable market conditions. Regulatory frameworks emphasizing vehicle safety standards mandate quality wheel components for commercial applications. Therefore, manufacturers focus on producing wheels that meet stringent safety and performance requirements across different regional markets.

The aftermarket segment represents substantial opportunity due to regular wheel replacement cycles in commercial fleets. According to Maxion Wheels, commercial vehicle steel wheels reduced cradle-to-gate CO₂ emissions from 3.87 kg to approximately 1.3 kg CO₂ per kg of wheel, a 66% reduction through improved processes and materials. This advancement demonstrates the industry’s commitment to environmental sustainability.

According to ResearchGate, use of micro-alloyed high-strength steel enables 10-15% wheel weight reduction without reducing load capacity. Furthermore, according to Springer, optimized ventilation hole design reduced steel wheel mass by 8.6% while maintaining fatigue compliance in heavy commercial vehicles. According to World Steel Association, automotive steel wheels achieve over 90% material recyclability at end of life.

Key Takeaways

- Global Commercial Vehicle Steel Wheels Market projected to reach USD 7.3 Billion by 2035 from USD 4.6 Billion in 2025, at 4.7% CAGR

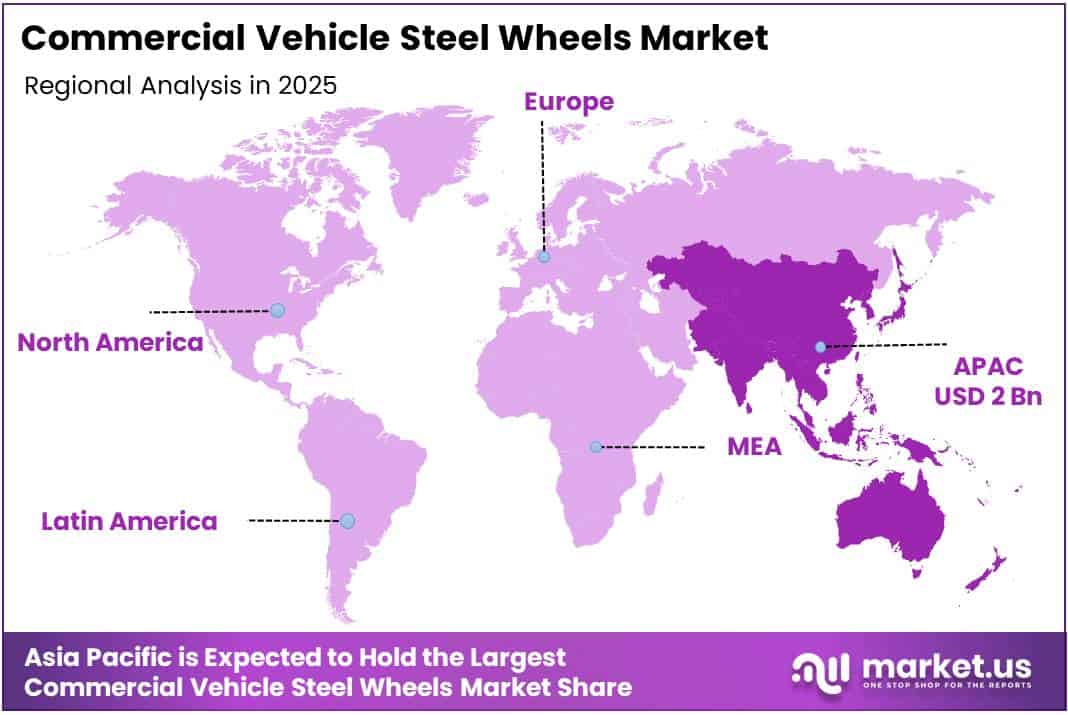

- Asia Pacific dominates with 43.80% market share, valued at USD 2 Billion

- 16-18 inches segment leads by type with 31.7% market share

- Stamped Steel Wheels command 71.2% share in wheel segment

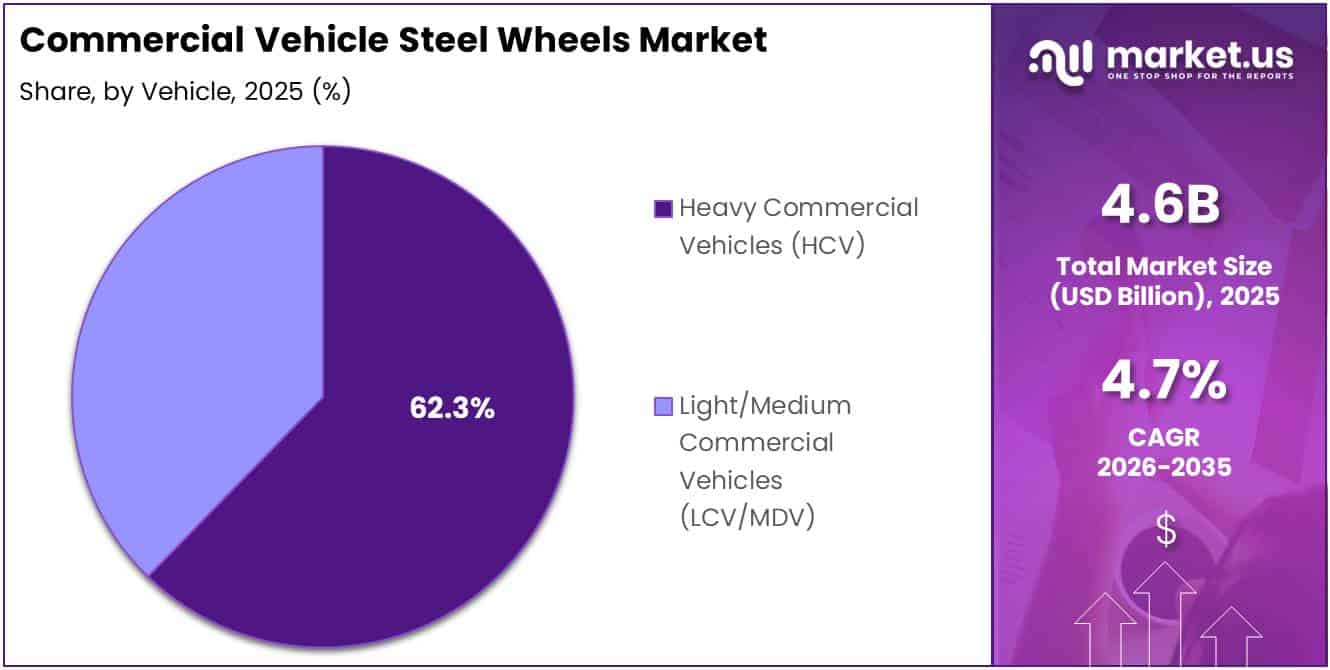

- Heavy Commercial Vehicles represent 62.3% of vehicle segment

- OEM application dominates with 77.8% market share

- Rising commercial vehicle production drives steady market expansion

- Aftermarket growth driven by fleet replacement and refurbishment activities

Type Analysis

16-18 inches dominates with 31.7% due to widespread compatibility with medium and heavy commercial vehicles.

In 2025, 16-18 inches held a dominant market position in the By Type segment of Commercial Vehicle Steel Wheels Market, with a 31.7% share. This size range offers optimal balance between load capacity and vehicle maneuverability for standard commercial applications. Additionally, this segment benefits from high production volumes and established supply chains across major manufacturing regions.

13-15 inches wheels serve light commercial vehicles and smaller delivery trucks requiring compact wheel solutions. This segment addresses urban delivery fleets where vehicle size constraints necessitate smaller wheel dimensions. However, the segment maintains steady demand through e-commerce logistics and last-mile delivery applications requiring agile vehicle configurations.

19-21 inches wheels cater to specialized heavy-duty applications demanding enhanced load distribution and stability. These larger wheels support premium commercial vehicles and specialized transport equipment. Moreover, this segment shows growth potential through increasing adoption in long-haul trucking and heavy construction equipment applications.

21-22.5 inches wheels represent the largest size category designed for extra-heavy commercial vehicles and specialized industrial applications. This segment serves ultra-heavy-duty trucks, mining equipment, and construction vehicles requiring maximum load-bearing capacity. Furthermore, these wheels provide superior stability and durability for vehicles operating under extreme weight conditions and demanding operational environments.

Wheel Analysis

Stamped Steel Wheels dominates with 71.2% due to cost-effective manufacturing and proven durability across applications.

In 2025, Stamped Steel Wheels held a dominant market position in the By Wheel segment of Commercial Vehicle Steel Wheels Market, with a 71.2% share. This manufacturing method enables high-volume production at competitive costs while maintaining structural integrity. Furthermore, stamped wheels offer excellent consistency and quality control through automated manufacturing processes.

Forged Steel Wheels provide superior strength and fatigue resistance for extreme-duty applications requiring maximum load capacity. This segment serves specialized commercial vehicles operating in challenging environments and harsh conditions. Additionally, forged wheels command premium pricing due to enhanced performance characteristics and longer service life.

Others category includes specialized wheel variants and emerging manufacturing technologies serving niche commercial applications. This segment encompasses custom-designed wheels and innovative production methods targeting specific market requirements. Consequently, manufacturers explore advanced forming techniques to improve wheel performance and reduce material consumption.

Vehicle Analysis

Heavy Commercial Vehicles (HCV) dominates with 62.3% due to extensive use in freight transportation and construction industries.

In 2025, Heavy Commercial Vehicles (HCV) held a dominant market position in the By Vehicle segment of Commercial Vehicle Steel Wheels Market, with a 62.3% share. These vehicles require robust steel wheels capable of supporting substantial payload capacities and withstanding continuous operational stress. Moreover, the segment benefits from expanding logistics infrastructure and increasing freight volumes across regional markets.

Light/Medium Commercial Vehicles (LCV/MDV) represent growing segment driven by urban delivery services and regional distribution networks. These vehicles utilize steel wheels offering reliable performance at competitive price points for fleet operators. Additionally, this segment experiences growth through expanding e-commerce activities and last-mile delivery requirements in urban centers.

Application Analysis

OEM dominates with 77.8% due to direct integration with new commercial vehicle production worldwide.

In 2025, OEM held a dominant market position in the By Application segment of Commercial Vehicle Steel Wheels Market, with a 77.8% share. Original equipment manufacturers prioritize steel wheels for new commercial vehicle production due to proven reliability and cost-effectiveness. Therefore, this segment correlates directly with global commercial vehicle manufacturing volumes and production schedules.

Aftermarket segment serves replacement needs driven by wheel wear, damage, and fleet maintenance requirements throughout vehicle lifecycles. This segment provides consistent revenue streams through regular replacement cycles and fleet refurbishment activities. Additionally, aftermarket demand grows as commercial vehicle populations increase and aging fleets require wheel replacements to maintain operational safety and efficiency.

Key Market Segments

By Type

- 16-18 inches

- 13-15 inches

- 19-21 inches

- 21-22.5 inches

By Wheel

- Stamped Steel Wheels

- Forged Steel Wheels

- Others

By Vehicle

- Heavy Commercial Vehicles (HCV)

- Light/Medium Commercial Vehicles (LCV/MDV)

By Application

- OEM

- Aftermarket

Drivers

Expansion of Global Freight and Logistics Fleets Drives Commercial Vehicle Steel Wheel Demand

Global freight transportation networks continue expanding rapidly to support international trade and e-commerce growth worldwide. This expansion necessitates larger commercial vehicle fleets requiring durable steel wheels capable of withstanding demanding operational conditions. Moreover, logistics companies prioritize reliable wheel solutions that minimize downtime and maintenance costs across extensive fleet operations.

Heavy commercial vehicles operating in freight transportation require wheels with exceptional load-bearing capacity and structural integrity. Steel wheels provide proven performance for trucks and buses carrying substantial cargo weights over long distances. Additionally, the material properties of steel ensure consistent performance under variable load conditions and challenging road environments.

Commercial vehicle operators face continuous wheel replacement needs due to regular wear patterns and operational demands. Long vehicle lifecycles generate sustained aftermarket demand for replacement wheels maintaining fleet operational readiness. Furthermore, fleet managers prioritize cost-effective wheel solutions offering optimal balance between initial investment and long-term durability requirements.

Restraints

Growing Adoption of Lightweight Alloy Wheels Challenges Traditional Steel Wheel Market Share

Automotive manufacturers increasingly adopt aluminum alloy wheels to reduce overall vehicle weight and improve fuel efficiency. This trend challenges traditional steel wheel dominance particularly in light and medium commercial vehicle segments. Additionally, alloy wheels offer aesthetic advantages and performance benefits that attract fleet operators seeking modern vehicle specifications.

Regulatory authorities worldwide implement stringent emission standards requiring commercial vehicle manufacturers to reduce overall vehicle weight. These regulations encourage adoption of lighter wheel materials to improve fuel economy and reduce carbon emissions. Consequently, steel wheel manufacturers face pressure to develop lighter products while maintaining load-bearing capacity and safety standards.

Vehicle weight regulations particularly impact heavy commercial vehicles where every kilogram affects payload capacity and fuel consumption. Manufacturers explore alternative materials and advanced steel alloys to meet regulatory requirements without compromising wheel strength. Therefore, the industry experiences ongoing pressure to innovate and adapt to evolving regulatory landscapes across different markets.

Growth Factors

Rising Commercial Vehicle Production in Emerging Markets Supports Steel Wheel Demand Growth

Emerging economies experience rapid commercial vehicle production growth driven by infrastructure development and economic expansion. These markets prioritize cost-effective steel wheels offering reliable performance for growing commercial transportation fleets. Moreover, increasing local manufacturing capacity supports regional supply chains and reduces dependency on imported wheel components.

Infrastructure development projects worldwide require extensive heavy commercial vehicle fleets for construction and material transportation activities. These projects generate substantial demand for durable steel wheels capable of operating in challenging construction environments. Additionally, government investments in transportation infrastructure create sustained market opportunities for commercial vehicle components including steel wheels.

Fleet operators increasingly adopt standardized wheel designs to simplify maintenance procedures and optimize inventory management across vehicle fleets. Standardization reduces operational complexity and enables more efficient replacement processes for fleet maintenance teams. Furthermore, standardized designs support economies of scale in manufacturing, consequently reducing costs for both producers and end users.

Emerging Trends

Advanced High-Strength Steel Technologies Enhance Wheel Performance and Durability

Manufacturers increasingly utilize high-strength steel alloys to improve wheel durability while reducing weight without compromising load capacity. These advanced materials enable thinner wheel designs maintaining structural integrity under extreme operational conditions. Additionally, high-strength steel formulations extend wheel service life and reduce replacement frequency for commercial fleet operators.

Steel wheel manufacturers apply advanced anti-corrosion coatings to protect wheels from environmental degradation and extend operational lifespan. These protective treatments prove particularly valuable for vehicles operating in harsh climates and corrosive environments. Moreover, enhanced coating technologies reduce maintenance requirements and improve overall cost-effectiveness for fleet operators.

Industry participants emphasize sustainable manufacturing practices including recycled steel utilization and energy-efficient production processes. Environmental considerations drive innovation in steel wheel manufacturing reducing carbon footprint throughout product lifecycle. Furthermore, manufacturers invest in circular economy initiatives enabling comprehensive wheel recycling programs at end of service life.

Regional Analysis

Asia Pacific Dominates the Commercial Vehicle Steel Wheels Market with a Market Share of 43.80%, Valued at USD 2 Billion

Asia Pacific commands the largest market share at 43.80%, valued at USD 2 Billion, driven by extensive commercial vehicle manufacturing in China, India, and Southeast Asian nations. The region benefits from established steel production infrastructure and cost-competitive manufacturing capabilities. Additionally, rapid urbanization and expanding logistics networks throughout Asia Pacific sustain robust demand for commercial vehicle steel wheels.

North America Commercial Vehicle Steel Wheels Market Trends

North America maintains significant market presence supported by mature commercial transportation infrastructure and large freight logistics operations. The region emphasizes high-quality steel wheels meeting stringent safety and performance standards for commercial fleets. Moreover, ongoing fleet modernization initiatives and replacement demand from aging commercial vehicles support steady market growth throughout the region.

Europe Commercial Vehicle Steel Wheels Market Trends

Europe demonstrates stable demand driven by established commercial vehicle manufacturing sectors and comprehensive transportation networks across member states. The region prioritizes advanced steel wheel technologies offering improved fuel efficiency and environmental performance. Additionally, strict regulatory frameworks regarding vehicle safety and emissions influence wheel design specifications and material choices throughout European markets.

Latin America Commercial Vehicle Steel Wheels Market Trends

Latin America experiences growing demand correlating with expanding commercial vehicle production and infrastructure development across key markets including Brazil and Mexico. The region benefits from increasing foreign investment in automotive manufacturing and logistics infrastructure. Furthermore, growing intra-regional trade activities drive commercial vehicle fleet expansion requiring reliable steel wheel components.

Middle East & Africa Commercial Vehicle Steel Wheels Market Trends

Middle East and Africa show emerging market potential driven by construction activities and expanding transportation infrastructure in Gulf Cooperation Council nations and South Africa. The region experiences growing commercial vehicle imports supporting aftermarket wheel demand. Additionally, infrastructure development projects create opportunities for heavy commercial vehicle deployment requiring durable steel wheel solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Maxion Wheels maintains global leadership in commercial vehicle wheel manufacturing through extensive production facilities across multiple continents and comprehensive product portfolios. The company emphasizes sustainable manufacturing practices and technological innovation to reduce environmental impact while maintaining product quality. Moreover, Maxion Wheels serves major commercial vehicle manufacturers through integrated supply chain partnerships and customized wheel solutions for diverse applications.

Accuride Corporation provides specialized steel wheel solutions for heavy-duty commercial vehicles throughout North American markets with focus on durability and performance. The company recently completed financial restructuring to strengthen its capital position and support long-term growth initiatives. Additionally, Accuride maintains strong relationships with commercial vehicle manufacturers and aftermarket distributors ensuring comprehensive market coverage.

Steel Strips Wheels Ltd (SSWL) operates as prominent steel wheel manufacturer serving commercial vehicle markets across Asia with particular strength in Indian subcontinent. The company leverages cost-competitive manufacturing capabilities and established distribution networks to serve both OEM and aftermarket customers. Furthermore, SSWL invests in production capacity expansion to meet growing regional demand for commercial vehicle wheels.

Topy Industries Limited delivers high-quality steel wheels for commercial vehicles through advanced manufacturing technologies and stringent quality control processes in Japanese and international markets. The company emphasizes engineering excellence and product innovation to meet evolving customer requirements for performance and reliability. Moreover, Topy Industries maintains diversified product offerings serving various commercial vehicle segments and applications worldwide.

Key players

- Maxion Wheels

- Accuride Corporation

- Steel Strips Wheels Ltd (SSWL)

- Topy Industries Limited

- Zhejiang Jingu Co., Ltd.

- Zhejiang Jinfei Kaida Wheel

- Mefro Wheels GmbH

- Alcar Holding GmbH

- Central Motor Wheel of America, Inc.

Recent Developments

- In December 2025, Fastco, a Subsidiary of Groupe Touchette, announced the acquisition of ENVY Wheel Brand to expand its commercial wheel product portfolio and strengthen market presence in specialized wheel segments across North American markets.

- In November 2025, Maxion Wheels acquired a 50.1% stake in Polimetal, an Argentine wheel producer, to strengthen its manufacturing footprint in South America and enhance regional production capabilities for commercial vehicle wheels.

- In February 2025, Accuride announced confirmation of its Chapter 11 Plan of Reorganization, refinancing over $400 million of funded debt, securing a $70 million asset-based lending facility and an $85+ million exit facility to strengthen its capital structure for long-term growth.

Report Scope

Report Features Description Market Value (2025) USD 4.6 Billion Forecast Revenue (2035) USD 7.3 Billion CAGR (2026-2035) 4.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (16-18 inches, 13-15 inches, 19-21 inches, 21-22.5 inches), By Wheel (Stamped Steel Wheels, Forged Steel Wheels, Others), By Vehicle (Heavy Commercial Vehicles (HCV), Light/Medium Commercial Vehicles (LCV/MDV)), By Application (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Maxion Wheels, Accuride Corporation, Steel Strips Wheels Ltd (SSWL), Topy Industries Limited, Zhejiang Jingu Co., Ltd., Zhejiang Jinfei Kaida Wheel, Mefro Wheels GmbH, Alcar Holding GmbH, Central Motor Wheel of America, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Vehicle Steel Wheels MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Commercial Vehicle Steel Wheels MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Maxion Wheels

- Accuride Corporation

- Steel Strips Wheels Ltd (SSWL)

- Topy Industries Limited

- Zhejiang Jingu Co., Ltd.

- Zhejiang Jinfei Kaida Wheel

- Mefro Wheels GmbH

- Alcar Holding GmbH

- Central Motor Wheel of America, Inc.