Global Commercial Security Market Size, Share and Analysis Report By Component (Products, Services), By System Type (Video Surveillance Systems, Access Control Systems, Intrusion Detection & Alarm Systems, Fire Protection Systems, Others), By End-User (Corporate Offices, Retail & Shopping Malls, Banking & Financial Centers, Hospitality, Healthcare Facilities, Others), By Service Type (System Integration & Installation, Remote Monitoring Services, Security Consulting), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176868

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Customer Impact: Trends and Disruptors

- By Component

- By System Type

- By End User

- By Service Type

- Regional Perspective

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Company Evaluation Matrix

- Recent Developments

- Report Scope

Report Overview

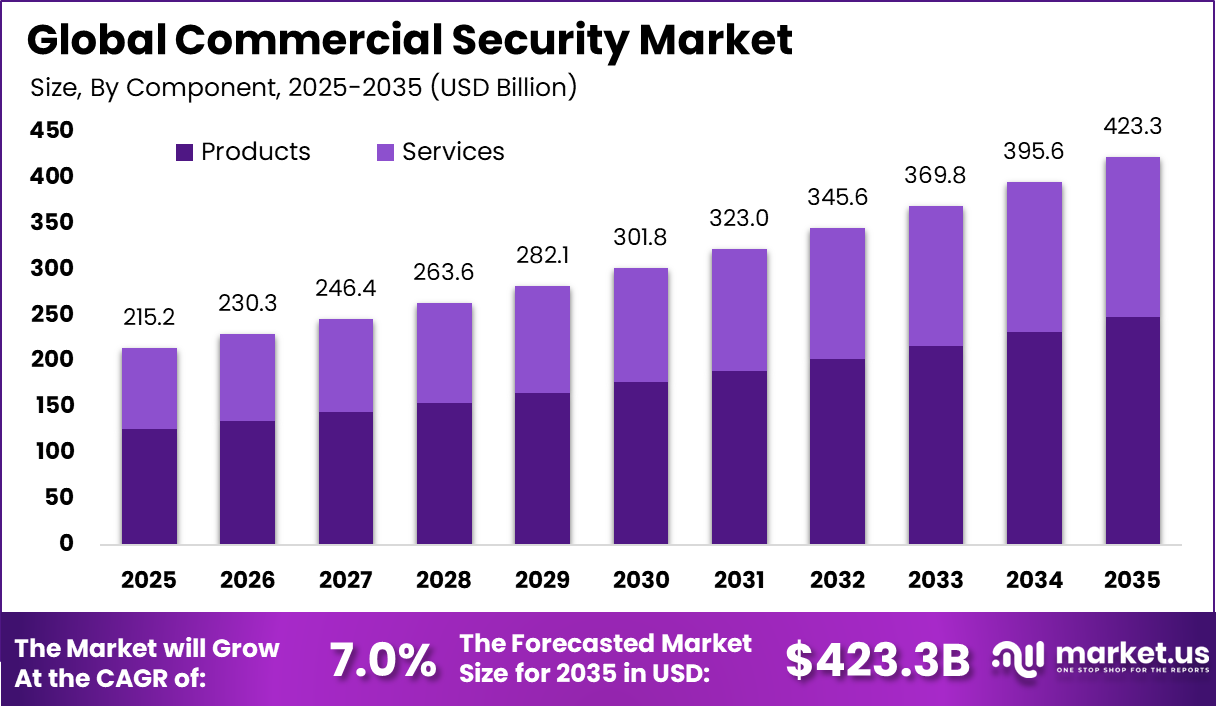

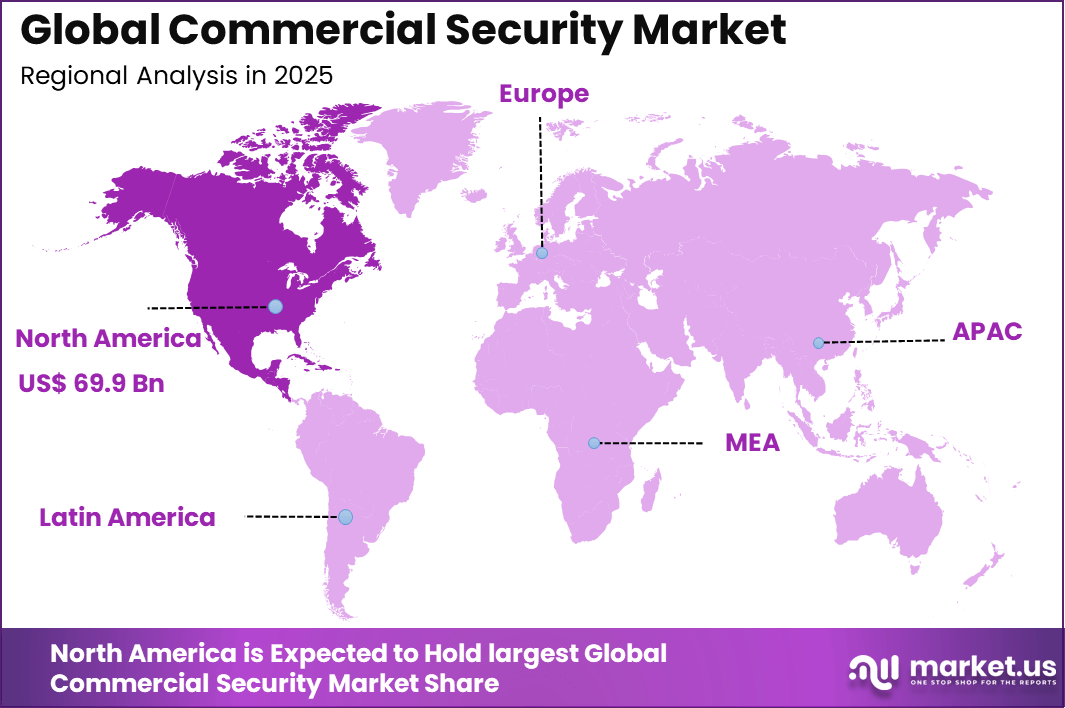

The Global Commercial Security Market size is expected to be worth around USD 423.3 billion by 2035, from USD 215.2 billion in 2025, growing at a CAGR of 7.0% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 32.5% share, holding USD 69.9 billion in revenue.

The commercial security market comprises products and services designed to protect businesses, facilities, assets, and personnel from physical threats, unauthorized access, theft, vandalism, and security breaches. Key solutions include access control systems, surveillance cameras, intrusion detection sensors, alarm systems, and integrated security platforms. Businesses are increasingly adopting layered security frameworks to protect physical and digital assets.

Growth in e-commerce, urban infrastructure development, and regulatory emphasis on workplace safety have strengthened demand for commercial security solutions. Key driver factors in this market include rising security breaches at business locations, expansion of smart building technologies, and greater adoption of real-time monitoring.

Demand Analysis grows from huge losses like $112 billion in retail shrink from theft. Convenience stores report 12,397 burglaries a year, and sites lose tools in 12,979 cases. Firms seek tools to slash these hits and run smoothly. Rising incidents make strong protection a need, not a choice. Businesses count on it to protect bottom lines daily.

For instance, in January 2026, Everon launched an active video monitoring service to enhance commercial security through proactive threat detection and real-time response. The service uses existing camera systems at UL-listed monitoring centers, where agents activate lights, audio alerts, and voice warnings to deter suspicious activity before escalation.

Key Takeaway

- In 2025, the Products segment led the global commercial security market with a 58.7% share, supported by strong demand for physical and electronic security equipment across commercial facilities.

- In 2025, Video Surveillance Systems accounted for 42.3% of the market, reflecting continued investment in monitoring, threat detection, and compliance-driven security infrastructure.

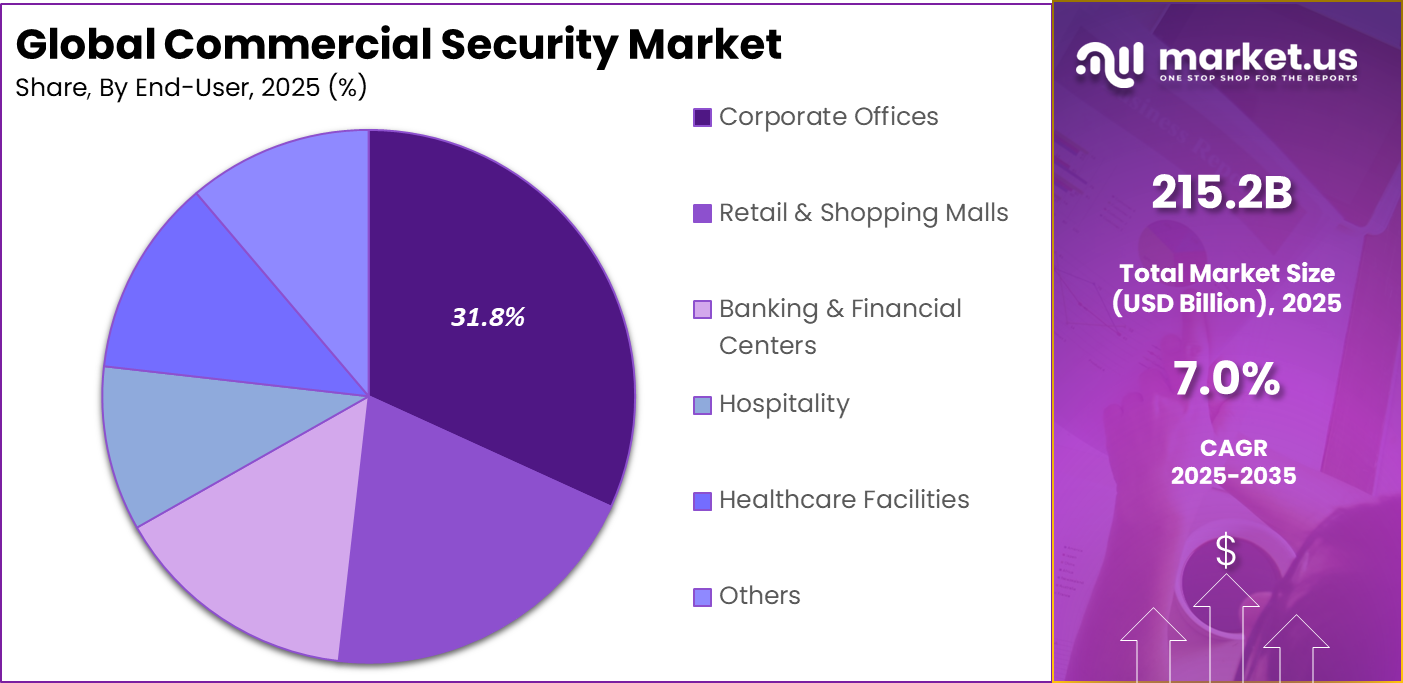

- In 2025, Corporate Offices emerged as the largest end-use segment with a 31.8% share, driven by rising focus on workplace safety, asset protection, and access control.

- In 2025, System Integration & Installation services dominated with a 52.6% share, highlighting the importance of professional deployment, system interoperability, and ongoing maintenance.

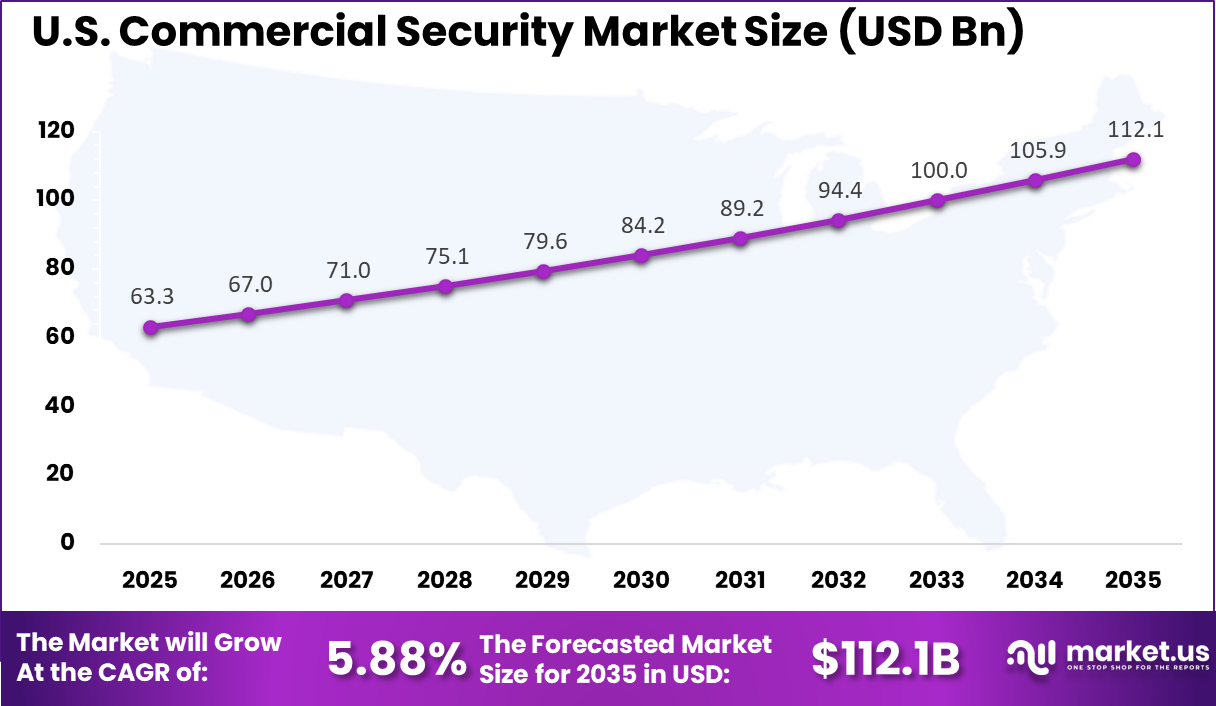

- The U.S. commercial security market was valued at USD 63.3 billion in 2025 and is expanding at a 5.88% CAGR, supported by steady upgrades in commercial security infrastructure.

- In 2025, North America held over 32.5% of the global market, driven by high security spending, early adoption of advanced technologies, and strong regulatory compliance requirements.

Key Insights Summary

Physical Security Threats

- Around 50,000 commercial buildings are burglarized each year, with office properties frequently targeted due to the presence of high-value and easily resold equipment.

- More than 60% of newly constructed commercial properties now include electronic access control as a standard security feature.

- Security spending in the healthcare sector increased by 11% in 2025, driven by rising workplace violence risks and the need to protect controlled drugs and sensitive assets.

Cybersecurity Impact on Business

- Physical security systems such as CCTV, access control, and smart locks are increasingly network-connected, making digital threats a central concern for commercial security teams.

- The global average cost of a data breach reached USD 4.9 million in 2024, representing a 10% year-over-year increase.

- Total global cybercrime costs to businesses are projected to reach USD 10.5 trillion by 2025.

- While 45% of business leaders use AI for automated threat detection, 53% cite AI-driven attacks as their most significant emerging security challenge.

Small Business (SMB) Vulnerabilities

- Approximately 43% of all cyberattacks are directed at small and medium-sized businesses.

- An estimated 60% of small businesses that experience a major cyberattack cease operations within six months.

- About 43% of SMBs lack a formal cybersecurity defense plan, and 20% report having no security technology in place.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising security threats across commercial buildings and enterprises +2.1% Global Short term Increased adoption of surveillance and access control systems +1.8% North America, Europe Short to medium term Expansion of smart buildings and connected infrastructure +1.5% North America, Asia Pacific Medium term Regulatory requirements for workplace and public safety +0.9% Europe, North America Medium term Growth in commercial construction and infrastructure projects +0.7% Asia Pacific, Middle East Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High upfront cost of advanced security systems -1.8% Emerging Markets Short to medium term Integration challenges with legacy security infrastructure -1.4% Global Medium term Privacy concerns related to surveillance technologies -1.2% Europe, North America Medium term Skilled labor shortages for installation and maintenance -1.0% Global Medium term Budget constraints among small and mid-sized enterprises -0.8% Emerging Markets Medium to long term Customer Impact: Trends and Disruptors

Customer expectations in the commercial security market are being reshaped by the demand for real time visibility, faster incident response, and simplified system management. Businesses increasingly prefer security solutions that provide centralized dashboards, mobile access, and automated alerts, allowing security teams to respond quickly without constant manual monitoring. This shift is improving operational efficiency while reducing reliance on on site personnel.

Customers are also placing higher value on scalable systems that can grow with business expansion and adapt to changing threat profiles. Key disruptors influencing customer impact include the adoption of intelligent analytics, cloud based security platforms, and mobile enabled access control. Advanced analytics reduce false alarms and improve threat detection accuracy, directly improving user trust in security systems.

Cloud deployment lowers upfront costs and simplifies updates, making advanced security more accessible to mid sized businesses. These disruptors are shifting purchasing decisions away from standalone hardware toward integrated, service oriented security ecosystems.

By Component

Products account for 58.7% of overall adoption in the Commercial Security Market. This dominance reflects sustained investment in physical security equipment such as cameras, access control devices, sensors, and alarms. Organizations prioritize tangible security assets to protect premises and assets.

The strong demand for products is also linked to modernization cycles. Legacy systems are being replaced with higher resolution and network enabled devices. This replacement activity continues to support product led adoption across commercial environments.

For Instance, in January 2026, Johnson Controls International plc showcased new integrated security products at AHR 2026. The company highlighted advanced hardware like sensors and access controls designed for commercial buildings. These innovations focus on seamless connectivity and real-time threat detection, helping businesses upgrade their physical defenses efficiently. Booth demos drew crowds interested in mission-critical reliability.

By System Type

Video surveillance systems represent 42.3% of system type demand. This leadership is driven by the need for continuous monitoring, incident investigation, and deterrence. Video systems provide visual evidence and real time oversight across offices, campuses, and facilities.

The adoption of video surveillance is further reinforced by integration with analytics and remote monitoring. Centralized control improves operational visibility and response time. These capabilities sustain the leading role of video surveillance systems.

For instance, in January 2025, Hanwha Vision Co., Ltd. unveiled key trends for video surveillance, pushing super-intelligent cameras. Their edge AI solutions enable autonomous decision-making with generative AI for intrusion and fire detection. This positions their systems as leaders in commercial setups, offering multi-camera tracking and behavioral analysis for better oversight in offices and stores.

By End User

Corporate offices account for 31.8% of end user demand in the Commercial Security Market. Office environments require layered security to manage employee safety, visitor access, and asset protection. Security systems support controlled entry and internal monitoring.

The growth of hybrid work models has increased the need for flexible security solutions. Offices must secure premises even during variable occupancy. This maintains steady demand from corporate office users.

For Instance, in September 2025, G4S plc released its World Security Report 2025, warning of rising violence threats to executives in corporate offices. The report urges enhanced procedures like risk assessments and online monitoring for office security. It highlights fraud and theft jumps, prompting corporates to bolster protections with layered systems amid hybrid work challenges.

By Service Type

System integration and installation services represent 52.6% of total service demand. These services are critical for aligning multiple security components into a unified system. Professional installation ensures system reliability and compliance with safety standards.

The complexity of modern security environments further supports this segment. Integrated systems reduce operational gaps and improve performance. As security architectures evolve, integration and installation services remain essential.

For Instance, in September 2025, Honeywell International, Inc. partnered with Google Cloud to advance OT cybersecurity integration services. Announced in their 2025 threat report, the collaboration tackles ransomware spikes affecting commercial integrations. This bolsters installation services with defense-in-depth strategies, ensuring secure system setups for factories and offices against cyber-physical risks.

Regional Perspective

North America holds a significant position in the Commercial Security Market, accounting for 32.5% of total activity. The region benefits from high security awareness, established commercial infrastructure, and consistent investment in safety technologies. Security systems are widely embedded in business operations.

Regulatory compliance and risk management priorities further support adoption. Organizations proactively invest in security to manage liability and operational risk. These conditions sustain North America’s strong regional role.

For instance, in January 2026, ADT introduced the ADT+ Security System at CES 2026, transforming commercial and home security with intelligent features that anticipate threats rather than just react. This innovation underscores ADT’s position as a leader in intuitive, connected security solutions across North America.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 63.3 Bn and a growth rate of 5.88% CAGR. Demand is supported by ongoing upgrades of commercial facilities and increased focus on workplace safety. Security systems are treated as long term infrastructure investments.

Adoption in the U.S. is influenced by regulatory requirements and evolving threat landscapes. Businesses prioritize integrated and reliable security solutions. These factors collectively support stable growth in the U.S. market segment.

For instance, in April 2025, Bosch relaunched its Radionix brand at ISC West 2025 with the G Series control panels, offering integrated intrusion, fire alarm, and access control for commercial security. The system provides round-the-clock monitoring, instant alerts, and seamless integration, reinforcing Bosch’s dominance in U.S. commercial security markets.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Commercial security solution providers High Medium Global Stable long-term demand Systems integrators and service providers Medium Low to Medium North America, Europe Recurring service revenue Smart building technology investors Medium Medium Asia Pacific, North America Integration-led growth Private equity firms Medium Medium North America, Europe Consolidation opportunities Venture capital investors Low to Medium High North America Focus on AI-based security innovation Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline AI-based video surveillance and analytics +2.0% Threat detection and monitoring Global Short to medium term Cloud-based security management platforms +1.7% Centralized control and scalability Global Medium term Biometric access control systems +1.4% Secure identity authentication North America, Europe Medium term IoT-enabled sensors and alarms +1.1% Real-time incident response Global Medium to long term Integrated physical and cyber security systems +0.9% Holistic risk management Europe, North America Long term Key Market Segments

By Component

- Products

- Services

By System Type

- Video Surveillance Systems

- Access Control Systems

- Intrusion Detection & Alarm Systems

- Fire Protection Systems

- Others

By End-User

- Corporate Offices

- Retail & Shopping Malls

- Banking & Financial Centers

- Hospitality

- Healthcare Facilities

- Others

By Service Type

- System Integration & Installation

- Remote Monitoring Services

- Security Consulting

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Company Evaluation Matrix

The company evaluation landscape in the commercial security market can be assessed across two primary dimensions: solution breadth and technology maturity. Providers offering end to end portfolios that combine access control, surveillance, intrusion detection, and monitoring services are positioned more favorably than those with narrow, single function offerings. Broad portfolios allow customers to consolidate vendors and simplify system integration, which is increasingly valued in complex commercial environments.

On the technology maturity axis, companies investing in analytics, cloud architecture, and interoperability score higher in long term competitiveness. Vendors that support open interfaces and integration with existing infrastructure reduce switching costs for customers and accelerate adoption. In contrast, providers reliant on closed or legacy systems face higher risk of displacement as customer preferences shift toward flexible and future ready security platforms.

Company Quadrant Market Presence Capabilities Highlights Johnson Controls International plc Leader High Smart building platforms, AI-driven analytics, strong global expansion footprint Honeywell International, Inc. Leader High Advanced access control, AI and IoT integration, cost-efficient enterprise solutions Bosch Security Systems, Inc. Leader High Video and surveillance leadership, edge AI capabilities, regulatory compliance strength ADT, Inc. Leader High Monitored security services, strong execution in commercial and residential segments Securitas AB Challenger High Global security services portfolio, technology integration through STANLEY Security Axis Communications AB Leader Medium-High High-performance video solutions, low-light imaging, open ecosystem standards Assa Abloy AB Leader High Access control leadership, cloud-based and mobile credential solutions Allegion plc Challenger Medium Mechanical and electronic locking systems, strong position in selected verticals Carrier Global Corporation Emerging Medium Building system integration, growing focus on smart security offerings Hikvision Digital Technology Co., Ltd. Challenger High (Asia) High-resolution video solutions, competitive pricing, regional compliance constraints Dahua Technology Co., Ltd. Niche Medium Cost-efficient surveillance products, adoption limited by security concerns Hanwha Vision Co., Ltd. Challenger Medium Edge AI analytics, NDAA-compliant solutions, strong outdoor performance STANLEY Security Challenger Medium Service-led security solutions, technology depth supported by Securitas G4S plc Niche Medium Guarding and monitoring services, extensive global service network Verkada, Inc. Emerging Low-Medium Cloud-native deployment model, closed ecosystem, past data security challenges Others Niche Low Startups focused on AI-driven surveillance and perimeter security technologies Top Key Players in the Market

- Johnson Controls International plc

- Honeywell International, Inc.

- Bosch Security Systems, Inc.

- ADT, Inc.

- Securitas AB

- Axis Communications AB

- Assa Abloy AB

- Allegion plc

- Carrier Global Corporation

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Hanwha Vision Co., Ltd.

- STANLEY Security

- G4S plc

- Verkada, Inc.

- Others

Recent Developments

- In June 2025, Honeywell showcased AI-powered surveillance and mobile credentialing at its 2025 Users Group in Phoenix. Panelists highlighted integrated building systems for frictionless access and crowd management, driving smarter commercial security operations.

- In April 2025, Security 101 announced the acquisition of Integrated Systems & Services, Inc.. The acquired firm is known for its strong presence in the Northeast and its experience in high security environments. This move expands Security 101’s capabilities and strengthens its footprint in infrastructure and specialized security markets.

- In March 2025, Johnson Controls introduced major upgrades to its Access Control and Video Surveillance systems. The enhancements are designed to integrate smoothly with existing security infrastructures, improving centralized security management. The updated systems aim to deliver better threat detection, higher operational flexibility, and improved cost efficiency across facilities.

- In March 2025, Guardian Protection expanded its portfolio by acquiring 8,300 commercial and 4,300 residential alarm accounts from Monitronics, known to consumers as Brinks Home. The acquisition significantly increased Guardian Protection’s customer base and market reach.

Report Scope

Report Features Description Market Value (2025) USD 215.2 Billion Forecast Revenue (2035) USD 423.3 Billion CAGR(2025-2035) 7.0% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Products, Services), By System Type (Video Surveillance Systems, Access Control Systems, Intrusion Detection & Alarm Systems, Fire Protection Systems, Others), By End-User (Corporate Offices, Retail & Shopping Malls, Banking & Financial Centers, Hospitality, Healthcare Facilities, Others), By Service Type (System Integration & Installation, Remote Monitoring Services, Security Consulting) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Johnson Controls International plc, Honeywell International, Inc., Bosch Security Systems, Inc., ADT, Inc., Securitas AB, Axis Communications AB, Assa Abloy AB, Allegion plc, Carrier Global Corporation, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Hanwha Vision Co., Ltd., STANLEY Security, G4S plc, Verkada, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Security MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Commercial Security MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Johnson Controls International plc

- Honeywell International, Inc.

- Bosch Security Systems, Inc.

- ADT, Inc.

- Securitas AB

- Axis Communications AB

- Assa Abloy AB

- Allegion plc

- Carrier Global Corporation

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Hanwha Vision Co., Ltd.

- STANLEY Security

- G4S plc

- Verkada, Inc.

- Others