Global Commercial Payment Cards Market By Card Type (Purchase Card, Business Card, And Other Cards), By Application (Small Business Card And Large Business Card), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Feb. 2024

- Report ID: 21609

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Commercial Payment Cards Market size is expected to be worth around USD 33.69 billion by 2032 from USD 15.750 Billion in 2022, growing at a CAGR of 7.9% during the forecast period 2023 to 2032.

Commercial payment cards refer to credit cards, charge cards, or prepaid cards specifically designed for business use. These cards are issued to companies or business entities and are used for various financial transactions, including purchasing goods and services, managing expenses, and tracking business-related expenses. Commercial payment cards offer businesses a convenient and secure way to manage their financial transactions, streamline payment processes, and gain insights into their spending patterns.

The commercial payment cards market encompasses the issuance, usage, and acceptance of these cards. This market has witnessed significant growth in recent years, driven by several factors. Firstly, the increasing adoption of digital payment solutions and the shift away from traditional paper-based processes have propelled the demand for commercial payment cards. Businesses are embracing the benefits of electronic payments, such as improved efficiency, enhanced security, and simplified expense management.

Furthermore, the globalization of business and cross-border transactions has further fueled the demand for commercial payment cards. These cards provide businesses with the flexibility to make payments internationally, access foreign currency, and simplify expense reconciliation across multiple currencies. The integration of commercial payment cards with online platforms and mobile wallets has also enhanced their convenience and accessibility, making them an indispensable tool for businesses operating in the digital age.

Additionally, the commercial payment cards market is driven by the increasing focus on financial transparency, accountability, and compliance. Businesses are seeking robust payment solutions that enable them to track and monitor expenses, set spending limits, and generate detailed reports for auditing and compliance purposes. Commercial payment cards offer advanced reporting and expense management features, empowering businesses to gain better control over their finances and meet regulatory requirements.

Market Dynamics

Trends

Automation to Boost Market Growth

The commercial payment card sector has seen automation become a major factor. Small businesses can benefit from the automation capabilities of many commercial payment cards. Many business credit cards allow you to upload transaction data automatically into your company’s accounting software. This makes it easier to track expenditures accurately and without errors. Automatically uploading expenses makes it easier to track departmental spending and helps you see the individual departments’ performance. Certain commercial payment cards also allow business owners to limit what can be bought and when it can be used. They can also restrict how much money can be spent in a given time periods, such as per day, week, or month. This trend will ensure the market rises to new heights. All these developments are the main reason for the market’s expansion.

Drivers

Increasing Security & Control to Give the Market an Extra Boost

The commercial payment card market allows corporations to manage expenditures based on merchant categories (MCC), day of the week, and hour. Spending can be monitored in real time via a range of messaging platforms (including email and SMS). With the introduction of a standard tokenization mechanism, the commercial payment cards programmed by American Express, Visa, MasterCard, or American Express will allow businesses to have more control and reduce fraud. The expansion of the commercial card market will be aided by the increasing demand for services and the development of new products.

Option to Lower Cost to Encourage Market Expansion

Organizations can reduce transaction costs by using commercial payment cards. They have access to historical spending information and data expansion. Administrators can set spending limits, and users can submit claims online. They can also change their passwords using a self-service gateway. The overall product’s popularity is increasing and will continue to increase in the future. This product’s characteristics are driving market growth.

Restraints

Payments Failure of Products Restricts Market Expansion

Failure of commercial payment cards is another factor that decreases their market share. Card failure rates can be high due to factors beyond the merchant’s control. Commercial payment cards have a downside: customer disputes. The company must usually refund the client if they challenge their charges. The market will grow if this problem is solved.

Commercial Payment Cards Market Scope:

A commercial card is a credit card allotted by companies for their employees to purchase on behalf of their organization. These cards are issued as co-branded cards with retailers; commercial cards assist businesses to manage their expenses by collecting all charges made by employees in a single place. Commercial cards are issued through a financial institution. This kind of partnership allows companies to earn rewards and discounts for purchases they were already going to make at the co-branded company. Commercial cards come in different variations; one is corporate credit card and small-business credit cards.

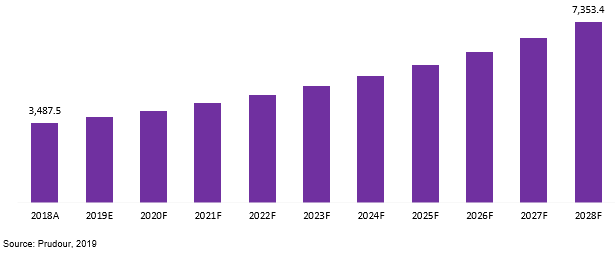

trending_up Total Revenue in 2018$ 3,742.1 Mn

trending_up Market CAGR of the Next Ten Years7.7%

no_encryption Market Value (US$ Mn), Share (%) and Growth Rate (%) Comparison 2012-2028Purchase this report or a membership to unlock the market value (US$ Mn), share (%) and growth rate (%) comparison for this industry.- By Type

- By Region

- By Application

no_encryption Leading Companies Financial HighlightsPurchase this report or a membership to unlock the leading companies financial highlights for this industry.trending_up Market Revenue of the Next Ten Years$ 7,353.4 Mn

Commercial Payment Cards and solutions help large corporations, midsize companies, small businesses, and government entities. Card provider companies’ solution streamlines procurement and payment processes, manage information and expenses (such as travel and entertainment) and reduce administrative costs. There are different types of card offerings, including travel, small business debt, and credit card, purchasing, and other cards.

Global Commercial Payment Cards Market Revenue (US$ Mn), 2018–2028

Snowballing number of corporate card service providers in Europe is one of the major factors driving the growth of the commercial payment cards market in this region.

However, increased card frauds along with security breaches and identity theft are some significant risks which might hamper the target market in the future. Nonetheless, the increasing popularity of other payments solutions and digital commerce in the picture is expected to boost the market growth for many years.

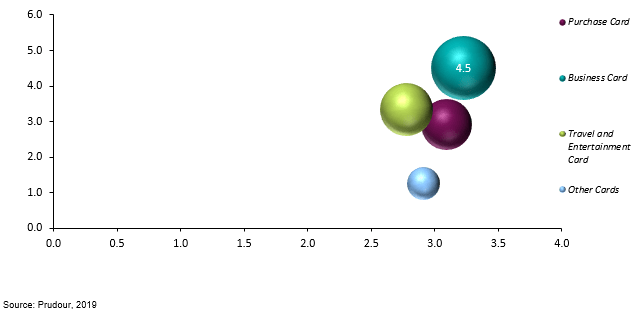

Global Commercial Payment Cards market is segmented based on Card type, application, and region. Based on Card type, the market is segmented into Purchase Card, Business Card, Travel and Entertainment Cards and Other Cards. The Business Card segment accounts for the majority share and is expected to register the highest growth over the forecast period. Based on application, the market is segmented into Small Business Card and Large Business Card. The Large Business Card segment accounts for a majority share in the global Commercial Payment Cards market.

Global Commercial Payment Cards Market by Card Type, 2018

Based on the region, the market is segmented into North America, Europe, APAC, South Americ, and Middle East Africa. The APAC accounts for the majority share in the global Commercial Payment Cards market and is expected to register the highest growth rate over the forecast period.

The research report on the global Commercial Payment Cards market includes profiles of some of the major companies such as JPMorgan Chase & Co, Bank of America Corporation, Citigroup Inc., Wells Fargo & Company and Barclays PLC.

Key Market Segments

Type

- Purchase Card

- Business Card

- Travel and Entertainment Cards and Other Cards

Application

- Small business card

- Corporate card

Key Market Players

- JPMorgan Chase & Co

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company and Barclays PLC

For the Commercial Payment Cards Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 33.69 billion

Growth Rate

7.9%

Forecast Value in 2032

USD 15.750 million

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Commercial Payment Cards MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Commercial Payment Cards MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- JPMorgan Chase & Co

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company and Barclays PLC