Global Cold Spray Coatings Market Size, Share, And Business Benefits By Material (Nickel, Copper, Aluminum, Titanium, Magnesium, Others), By Technology (High Pressure, Low Pressure), By Application (Corrosion Protection, Wear Resistance, Thermal Barrier Coatings, Others), By End-use (Aerospace, Automotive, Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153582

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

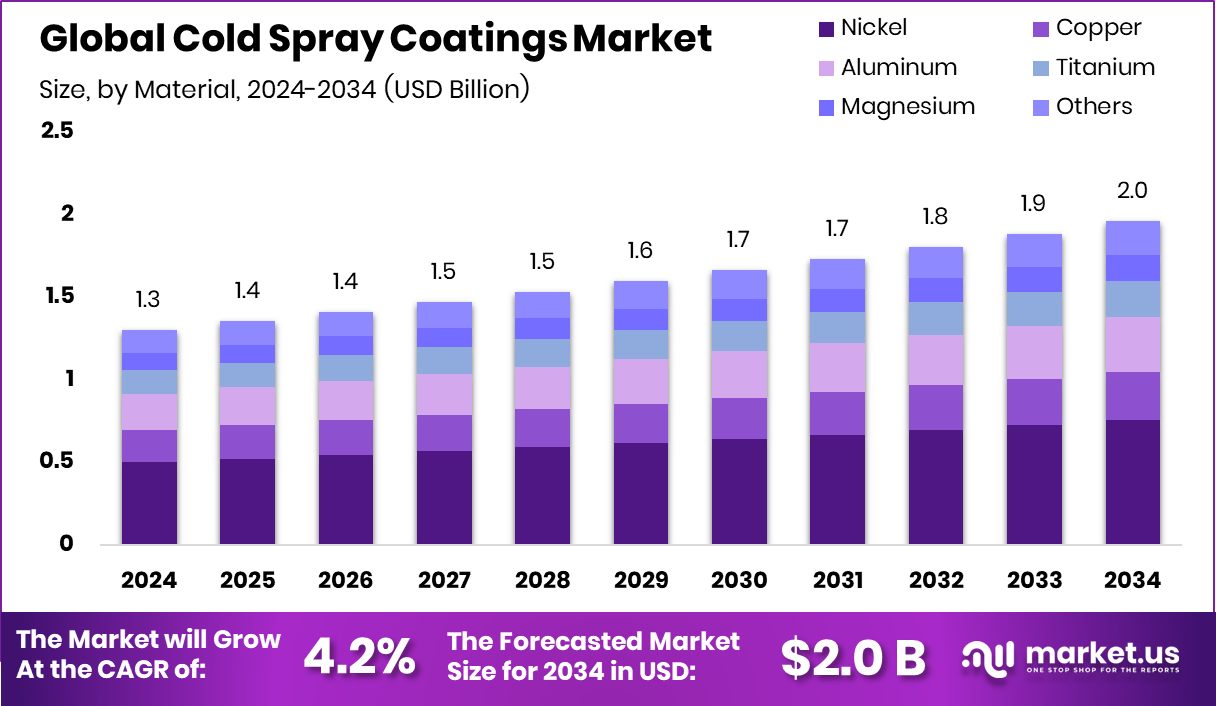

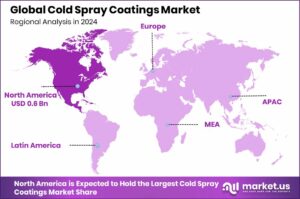

The Global Cold Spray Coatings Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. North America’s 47.9% dominance reflects rising demand for surface restoration in the aerospace and defense sectors.

Cold spray coating is a solid-state deposition technique where metal powders are accelerated to high velocities using compressed gas and sprayed onto a surface without melting the particles. Unlike traditional thermal spray methods, cold spray operates at relatively low temperatures, which helps maintain the original properties of the substrate and the powder. This process is particularly effective for applying coatings on heat-sensitive materials and allows for the buildup of thick, dense layers with strong adhesion and minimal oxidation or thermal degradation.

The cold spray coatings market refers to the global demand, production, and application of cold spray technologies across various sectors such as aerospace, automotive, defense, energy, and electronics. The market is shaped by technological advancements in material science and the rising need for durable, corrosion-resistant, and environmentally safe surface treatments. Industries are increasingly turning to cold spray solutions for repair, restoration, and component life extension.

The market is growing due to the rising need for high-performance coatings that do not compromise material integrity. As industries move toward lightweight and complex components, cold spray is favored for its ability to deposit coatings without thermal stress or distortion, thereby preserving structural strength.

Demand is primarily driven by sectors requiring surface restoration, wear resistance, and component repair. Cold spray’s ability to restore expensive parts to original dimensions without heat-related damage makes it an efficient solution for maintenance-intensive industries. According to an industry report, Titomic Europe secures €800k funding to accelerate Cold Spray Additive Manufacturing advancements.

Key Takeaways

- The Global Cold Spray Coatings Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- In the Cold Spray Coatings Market, nickel material leads with a 38.5% share in 2024.

- High pressure technology dominates the Cold Spray Coatings Market, capturing 69.2% of total adoption globally.

- Corrosion protection remains the primary application, accounting for 47.9% share in Cold Spray Coatings Market.

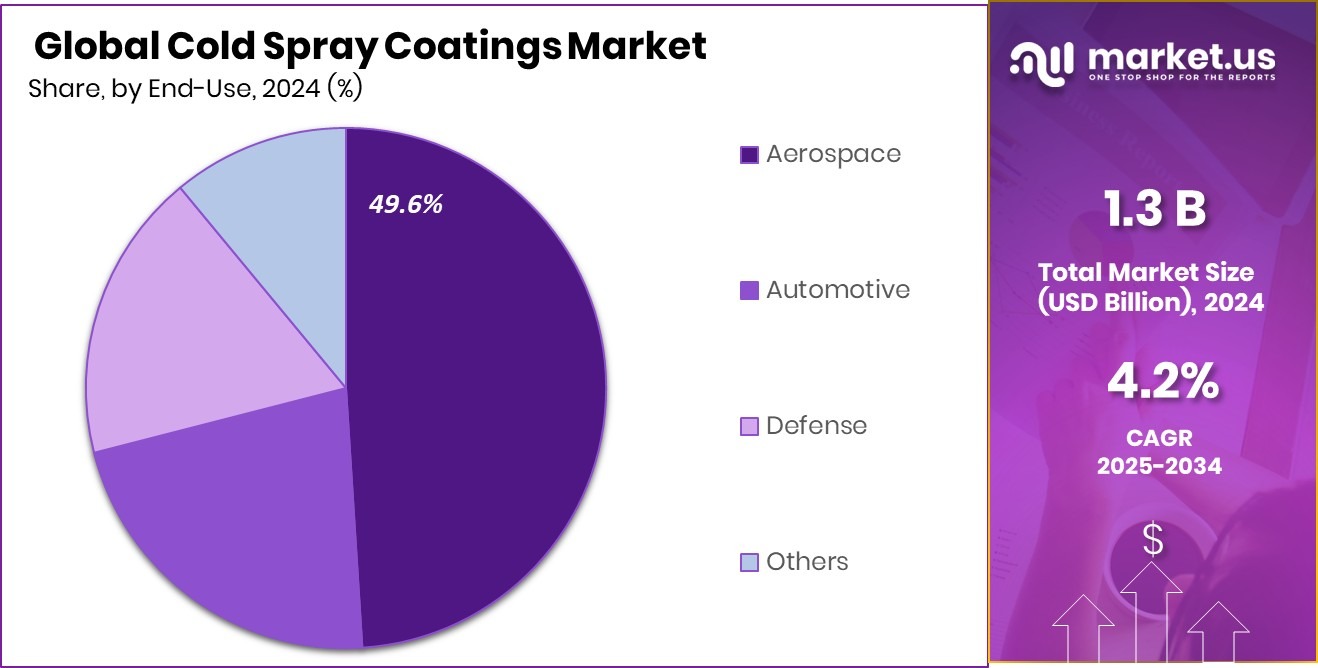

- Aerospace end-use segment holds a dominant 49.6% share in the Cold Spray Coatings Market landscape.

- The North America market value reached approximately USD 0.6 billion, showing strong industrial adoption.

By Material Analysis

Nickel dominates Cold Spray Coatings Market with 38.5% material share.

In 2024, Nickel held a dominant market position in the By Material segment of the Cold Spray Coatings Market, with a 38.5% share. This leadership can be attributed to nickel’s excellent corrosion resistance, thermal stability, and strong adhesion characteristics, which make it highly suitable for a wide range of industrial applications. Nickel-based coatings are widely used for protecting components exposed to harsh environments, such as in aerospace, marine, and energy sectors, where surface durability and longevity are critical.

The increasing need for extending the life of expensive metallic parts has further driven the use of nickel in cold spray applications. Its capability to form dense, uniform layers without thermal distortion ensures reliable performance, especially for repairing worn or damaged parts. Additionally, nickel’s compatibility with various base materials and its resistance to oxidation under demanding service conditions have made it a preferred choice for maintenance and restoration processes.

The cold spray process allows nickel to be applied efficiently without melting, preserving both the coating’s and the substrate’s mechanical properties. As industries continue to prioritize sustainability and cost-efficiency, nickel coatings are expected to maintain their strong presence in the market. The 38.5% share in 2024 reflects this sustained preference and utility across industrial use cases.

By Technology Analysis

High Pressure technology leads with a 69.2% market adoption rate.

In 2024, High Pressure held a dominant market position in the By Technology segment of the Cold Spray Coatings Market, with a 69.2% share. This dominance is driven by the superior deposition efficiency and high bonding strength achieved through high-pressure systems. The ability of this technology to accelerate particles to supersonic speeds ensures dense coating formation with excellent adhesion, which is essential for applications demanding durability and structural reliability.

High-pressure cold spray systems are particularly effective for depositing harder materials like nickel and titanium, making them ideal for wear-resistant and corrosion-resistant coatings. The precision and control offered by high-pressure technology also enable the restoration of critical components to their original specifications, reducing the need for full part replacement and thereby lowering operational costs.

Industries requiring high-performance coatings—such as aerospace, defense, and heavy machinery—prefer high-pressure systems for their ability to produce consistent, high-quality results. Additionally, this technology supports the formation of thick layers without thermal distortion, preserving the mechanical properties of the base material.

By Application Analysis

Corrosion Protection application drives demand, holding 47.9% market share.

In 2024, Corrosion Protection held a dominant market position in the By Application segment of the Cold Spray Coatings Market, with a 47.9% share. This significant share reflects the growing industrial need to safeguard critical components from degradation caused by moisture, chemicals, and harsh operating environments. Cold spray coatings are widely recognized for their ability to form dense, oxide-free layers that provide a strong barrier against corrosion without subjecting the base material to high temperatures.

Industries operating in the marine, energy, and infrastructure sectors rely heavily on corrosion protection to extend the life cycle of metal parts and reduce maintenance costs. The cold spray process enables precise application of corrosion-resistant materials such as nickel and aluminum, ensuring uniform coverage and long-term performance. As a result, asset integrity is preserved even in aggressive service conditions.

The preference for cold spray in corrosion protection is also influenced by its suitability for in-situ repairs, allowing for efficient surface restoration without disassembly. The process’s ability to apply coatings without altering the substrate’s microstructure further supports its growing adoption.

By End-use Analysis

Aerospace sector accounts for 49.6% of Cold Spray Coatings use.

In 2024, Aerospace held a dominant market position in the By End-use segment of the Cold Spray Coatings Market, with a 49.6% share. This commanding presence is largely due to the sector’s high demand for lightweight, corrosion-resistant, and structurally reliable components. Cold spray technology has become an essential method in aerospace maintenance, repair, and overhaul (MRO) operations, enabling the restoration of expensive parts without compromising their structural integrity.

The process is especially valued for its ability to deposit coatings without generating heat, which is critical in aerospace applications where material properties and tolerances must be preserved. Components such as turbine blades, engine parts, and structural frames benefit from cold spray coatings, which enhance wear resistance and extend service life without introducing thermal stress.

Furthermore, the high cost of aerospace components and the need for rigorous safety standards have pushed the industry to adopt advanced coating technologies like cold spray for preventive maintenance and surface protection. The 49.6% market share in 2024 reflects the aerospace sector’s continued reliance on cold spray solutions to reduce downtime, lower replacement costs, and maintain performance efficiency across mission-critical systems.

Key Market Segments

By Material

- Nickel

- Copper

- Aluminum

- Titanium

- Magnesium

- Others

By Technology

- High Pressure

- Low Pressure

By Application

- Corrosion Protection

- Wear Resistance

- Thermal Barrier Coatings

- Others

By End-use

- Aerospace

- Automotive

- Defense

- Others

Driving Factors

Growing Demand for Non-Heat Surface Restoration Solutions

One of the main driving factors for the cold spray coatings market is the increasing demand for surface restoration techniques that do not involve heat. Traditional thermal coating methods can alter the structure and properties of the base material, leading to potential weakening or damage. In contrast, cold spray technology operates at low temperatures, allowing metals to be applied without melting.

This helps preserve the original strength and shape of parts, which is especially important in industries like aerospace and defense. The ability to restore damaged components instead of replacing them saves time and cost. As industries focus more on maintenance and extending equipment life, cold spray coatings are becoming a preferred and reliable solution worldwide.

Restraining Factors

High Equipment Cost Limits Widespread Industrial Adoption

A major restraining factor in the cold spray coatings market is the high cost of equipment and setup. The machines used in cold spray technology require specialized nozzles, high-pressure gas systems, and precise control units, all of which add significant upfront investment. For small and medium-sized companies, this can be a financial challenge, making it hard to adopt the technology despite its benefits.

Additionally, maintenance of such equipment requires trained personnel and regular servicing, further increasing operational costs. These expenses limit the market’s penetration, especially in cost-sensitive industries. Unless equipment costs decrease or financial support improves, adoption of cold spray coatings may remain limited to large-scale industries with higher capital capabilities.

Growth Opportunity

Rising Use in Sustainable Repair and Maintenance

A key growth opportunity for the cold spray coatings market lies in its increasing use for sustainable repair and maintenance practices. Industries are now focusing more on repairing expensive parts rather than replacing them, to save both cost and resources. Cold spray technology allows damaged surfaces to be rebuilt without using heat, preserving the material’s original properties.

This method reduces waste and energy consumption, aligning well with global sustainability goals. Sectors like aerospace, automotive, and energy are finding value in cold spray for extending the life of critical components. As more industries look for eco-friendly and cost-effective maintenance solutions, cold spray coatings are expected to see wider acceptance and long-term market growth.

Latest Trends

Integration with Robotic and Automated Coating Systems

An emerging trend in the cold spray coatings market is the integration of cold spray processes with robotic and automated systems. By combining cold spray guns with robots or CNC machinery, manufacturers are achieving greater precision, consistency, and speed in applying coatings. This automation enables complex part geometries to be coated uniformly, reducing human error and enhancing repeatability.

It also allows for 24/7 operation, increasing productivity and reducing labor costs. As industries such as automotive, aerospace, and industrial manufacturing seek high-volume, accurate surface treatments, robotic cold spray systems are meeting this demand. The trend is expected to continue as automation technologies advance, driving better quality and efficiency in cold spray applications across various sectors.

Regional Analysis

In 2024, North America led the cold spray coatings market with a 47.9% share.

In 2024, North America held the dominant position in the Cold Spray Coatings Market, capturing a 47.9% share and generating approximately USD 0.6 billion in market value. This strong regional presence is driven by the growing need for advanced coating technologies in aerospace, defense, and industrial manufacturing applications. The region continues to benefit from significant investment in maintenance, repair, and overhaul (MRO) activities, where cold spray solutions are increasingly used to extend the lifespan of high-value components without compromising structural integrity.

Europe also demonstrates notable adoption of cold spray coatings, supported by industrial modernization and growing awareness of environmentally friendly repair technologies. In the Asia Pacific region, steady demand is observed due to the expansion of the manufacturing and automotive sectors, although the share remains comparatively lower than in North America.

Meanwhile, the Middle East & Africa and Latin America are in early stages of market development, with growth opportunities emerging through industrial infrastructure expansion and gradual adoption of modern coating techniques. However, the overall contribution from these regions remains limited. North America continues to lead the global market, both in terms of market share and value, positioning itself as the core region driving cold spray coating adoption in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ASB Industries (Hannecard Roller Coatings, Inc) maintained its strategic focus on high-performance coating solutions by offering specialized cold spray systems tailored for roller and cylindrical applications. Its deep expertise in roller surface technologies enabled clients in the steel, paper, and converting industries to adopt cold spray coatings for enhanced wear resistance and dimensional accuracy.

Bodycote plc, with its extensive global network and thermal processing capabilities, integrated cold spray services into its portfolio to complement existing heat-treat and deposition offerings. This integration strengthened Bodycote’s value proposition in asset repair and component refurbishment markets, particularly for high-precision aerospace and power-generation parts. Bodycote’s cross-functional collaboration between process engineering and supply-chain teams facilitated turnkey cold spray solutions delivered at scale, reinforcing its competitive edge in comprehensive surface treatment services.

CenterLine (Windsor) Limited, a recognized innovator in deposition technology, advanced its cold spray platform through ongoing R&D investments. The firm’s focus on refining nozzle design, gas control systems, and overall process automation positioned it as a go-to partner for clients requiring ultra-high-velocity coatings. CenterLine’s capability to deliver full-service systems—from equipment supply to operator training—strengthened its adoption by manufacturing and maintenance facilities aiming to internalize cold spray operations for critical components.

Top Key Players in the Market

- ASB Industries (Hannecard Roller Coatings, Inc)

- Bodycote plc

- CenterLine (Windsor) Limited

- Concurrent Technologies Corporation

- Curtiss-Wright Surface Technologies

- Flame Spray Technologies B.V.

- Fujimi Inc.

- Impact Innovations GmbH

- Oerlikon Metco

- Plasma Giken Co., Ltd.

- Praxair S.T. Technology, Inc.

- Titomic Limited

- VRC Metal Systems

- WWG Engineering Pte. Ltd.

Recent Developments

- In June 2024, CenterLine shared its practical gas mixing innovation at CSAT 2024. The presentation detailed a new in-line gas mixing system blending helium and nitrogen to boost coating performance. Tests showed mixed-gas ratios outperform single-gas systems, improving deposition efficiency and bond strength, benefiting industries relying on cold spray restoration and repair.

- In January 2024, Bodycote launched a £60 million share buyback program. While primarily a financial action, this move reflects Bodycote’s strong financial health and confidence in its ongoing investments, including those in surface and cold spray services.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Nickel, Copper, Aluminum, Titanium, Magnesium, Others), By Technology (High Pressure, Low Pressure), By Application (Corrosion Protection, Wear Resistance, Thermal Barrier Coatings, Others), By End-use (Aerospace, Automotive, Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ASB Industries (Hannecard Roller Coatings, Inc), Bodycote plc, CenterLine (Windsor) Limited, Concurrent Technologies Corporation, Curtiss-Wright Surface Technologies, Flame Spray Technologies B.V., Fujimi Inc., Impact Innovations GmbH, Oerlikon Metco, Plasma Giken Co., Ltd., Praxair S.T. Technology, Inc., Titomic Limited, VRC Metal Systems, WWG Engineering Pte. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cold Spray Coatings MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cold Spray Coatings MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ASB Industries (Hannecard Roller Coatings, Inc)

- Bodycote plc

- CenterLine (Windsor) Limited

- Concurrent Technologies Corporation

- Curtiss-Wright Surface Technologies

- Flame Spray Technologies B.V.

- Fujimi Inc.

- Impact Innovations GmbH

- Oerlikon Metco

- Plasma Giken Co., Ltd.

- Praxair S.T. Technology, Inc.

- Titomic Limited

- VRC Metal Systems

- WWG Engineering Pte. Ltd.