Global Cold Plasma Market By Product Type (Atmospheric Pressure and Low-Pressure), By Technology (Direct Treatment, Remote Treatment and Electrode Contact), By Application (Wound Healing, Packaging Decontamination, Dentistry, Cancer Treatment, Blood Coagulation and Others), By End-User (Medical Industry, Textile Industry, Electrical & Electronic Industry and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174189

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

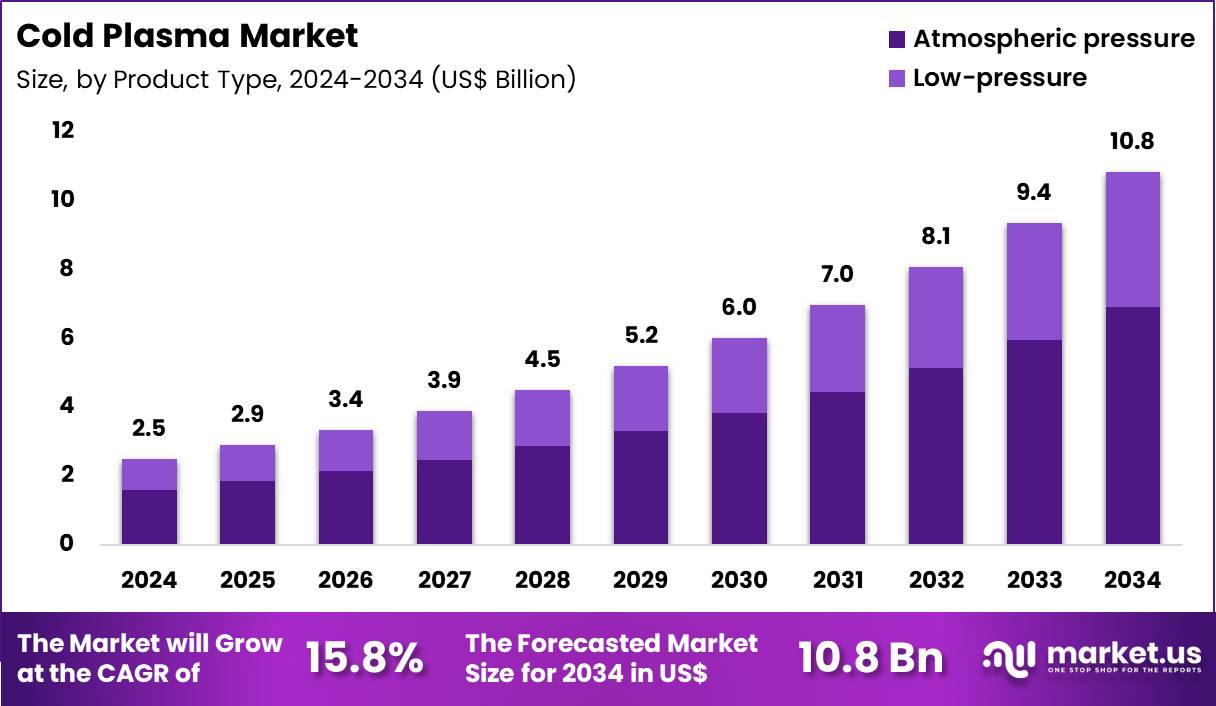

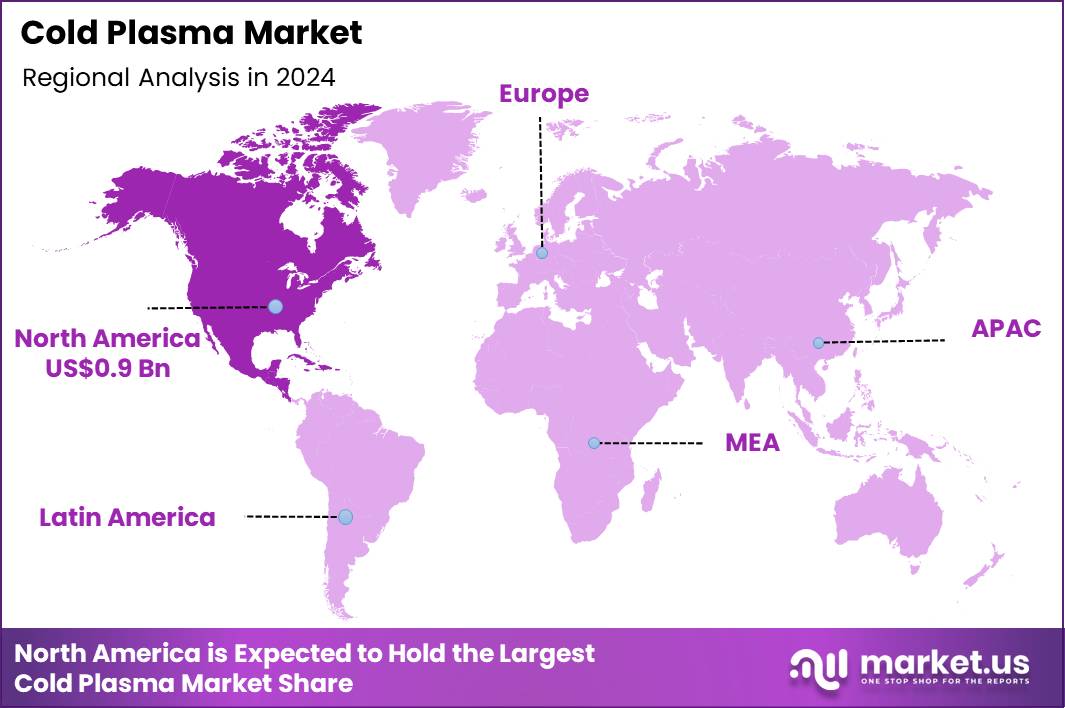

The Global Cold Plasma Market size is expected to be worth around US$ 10.8 Billion by 2034 from US$ 2.5 Billion in 2024, growing at a CAGR of 15.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.4% share with a revenue of US$ 0.9 Billion.

The cold plasma market is expanding as industries increasingly adopt non-thermal surface modification technologies to replace chemical- and heat-intensive processes. Manufacturers use atmospheric cold plasma to activate polymer surfaces before bonding or coating, improving adhesion in automotive and electronics manufacturing, while semiconductor producers rely on it for gentle removal of organic contaminants from delicate substrates.

Food processors apply cold plasma to decontaminate packaging surfaces, extending shelf life without compromising material integrity, and medical device manufacturers use it to sterilize heat-sensitive instruments and improve implant biocompatibility. In December 2024, Plasmatreat GmbH strengthened its presence in Central Europe by opening a sales office in the Czech Republic, enhancing regional customer support and collaboration.

Growth opportunities are emerging in portable cold plasma systems for on-site aerospace maintenance, where conventional methods are impractical, and in high-throughput plasma equipment for roll-to-roll processing of flexible electronics. Cold plasma is also gaining traction in textile finishing for imparting antimicrobial or water-repellent properties, as well as in additive manufacturing to improve interlayer adhesion in 3D-printed polymers.

Recent trends focus on refining dielectric barrier discharge designs for uniform large-area treatment, improving energy efficiency, and integrating real-time monitoring to ensure consistent quality. Companies are also advancing sustainable plasma processes and modular system designs to support versatile, environmentally compliant industrial applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.5 Billion, with a CAGR of 15.8%, and is expected to reach US$ 10.8 Billion by the year 2034.

- The product type segment is divided into atmospheric pressure and low-pressure, with atmospheric pressure taking the lead in 2024 with a market share of 63.7%.

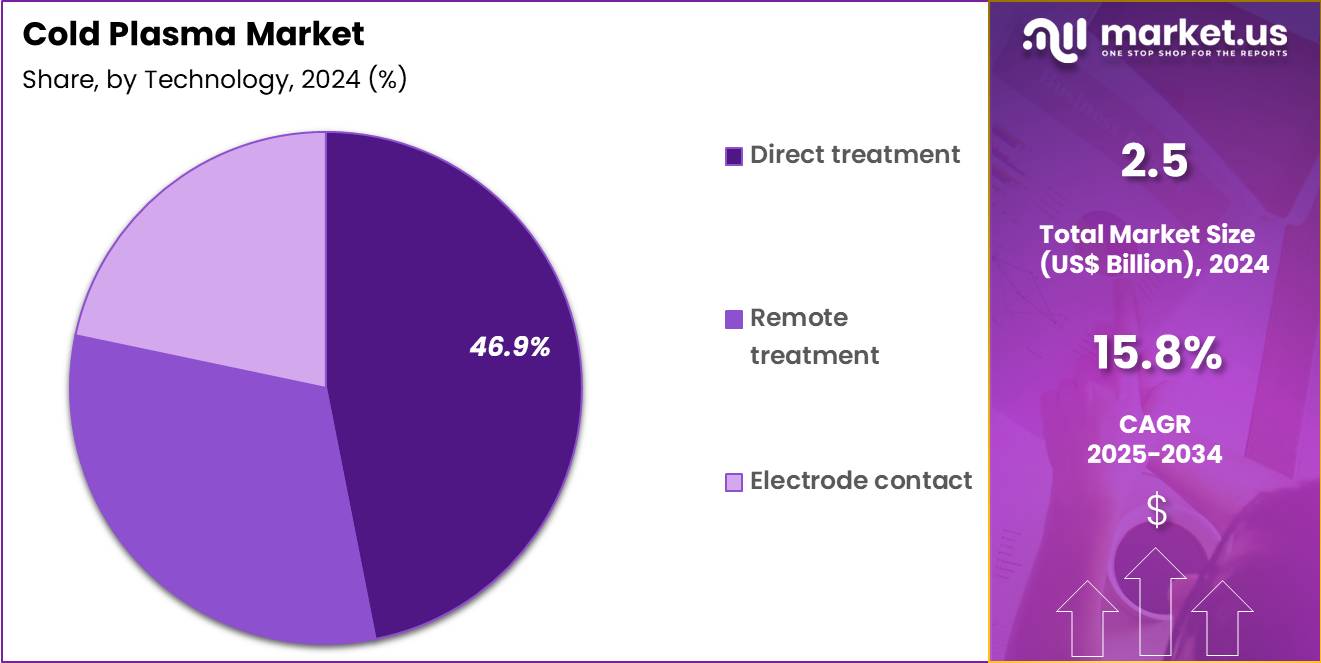

- Considering technology, the market is divided into direct treatment, remote treatment and electrode contact. Among these, direct treatment held a significant share of 46.9%.

- Furthermore, concerning the application segment, the market is segregated into wound healing, packaging decontamination, dentistry, cancer treatment, blood coagulation and others. The wound healing sector stands out as the dominant player, holding the largest revenue share of 41.8% in the market.

- The end-user segment is segregated into medical industry, textile industry, electrical & electronic industry and others, with the medical industry segment leading the market, holding a revenue share of 54.6%.

- North America led the market by securing a market share of 37.4% in 2024.

Product Type Analysis

Atmospheric pressure accounted for 63.7% of growth within the product type category and represents the most commercially viable configuration in the Cold Plasma market. Atmospheric systems operate without vacuum chambers, which improves ease of use in clinical and industrial environments. Manufacturers prefer atmospheric pressure devices due to lower infrastructure requirements. Real-time surface treatment supports continuous workflows in medical settings.

Reduced system complexity improves portability and deployment flexibility. Hospitals and clinics increasingly adopt atmospheric devices for bedside applications. Faster treatment cycles improve procedural efficiency. Compatibility with open-air environments supports wider adoption. Maintenance costs remain lower compared to low-pressure systems.

Atmospheric pressure plasma enables direct interaction with biological tissues. Safety profiles improve with controlled plasma generation. Scalability supports both small and large-scale implementations. Growing demand for point-of-care solutions strengthens adoption. Medical device developers integrate atmospheric plasma into compact platforms. Regulatory acceptance improves with standardized operation conditions.

Industrial users value minimal setup requirements. Innovation in plasma sources enhances stability and consistency. Training requirements remain manageable for clinical staff. Procurement decisions favor operational simplicity. The segment is projected to maintain dominance due to flexibility and deployment advantages.

Technology Analysis

Direct treatment captured 46.9% of growth within the technology category and stands as the most utilized approach in the Cold Plasma market. Direct plasma exposure enables immediate interaction with target surfaces or tissues. Medical applications benefit from localized antimicrobial and regenerative effects. Clinicians prefer direct treatment for precision wound management. Controlled plasma dosage improves therapeutic outcomes.

Direct application supports faster biological response initiation. Equipment design allows accurate targeting of treatment areas. Hospitals integrate direct plasma treatment into routine care protocols. Reduced treatment duration improves patient throughput. Direct treatment enhances surface sterilization efficiency. Real-time feedback supports consistent application quality.

Technological advancements improve safety and controllability. Clinical studies support efficacy in tissue regeneration. Adoption increases with rising chronic wound prevalence. Training programs emphasize direct plasma techniques. Integration with handheld devices expands usage scenarios. Direct treatment aligns with minimally invasive care trends. Industrial users adopt direct plasma for surface modification tasks. Operational simplicity strengthens market penetration. The segment is anticipated to retain leadership due to precision and effectiveness.

Application Analysis

Wound healing accounted for 41.8% of growth within the application category and represents the primary medical driver of the Cold Plasma market. Rising incidence of chronic wounds increases demand for advanced therapies. Cold plasma supports antimicrobial action without thermal damage. Accelerated tissue regeneration improves healing outcomes. Clinicians increasingly adopt non-invasive wound care technologies. Plasma treatment reduces biofilm formation on wound surfaces.

Improved oxygenation enhances cellular response. Diabetic foot ulcers contribute significantly to demand growth. Hospitals seek alternatives to antibiotic-based wound management. Reduced infection rates improve patient recovery timelines. Outpatient wound care centers increase treatment volumes. Plasma therapy supports management of burn wounds and pressure ulcers.

Patient comfort improves due to painless application. Clinical protocols integrate plasma into advanced wound care regimens. Aging populations expand chronic wound prevalence. Healthcare systems emphasize cost-effective healing solutions.

Reduced hospital stay duration strengthens adoption. Clinical evidence supports plasma-assisted wound closure. Device innovation improves usability in wound care settings. Reimbursement interest increases with outcome improvements. The segment is expected to remain dominant due to unmet clinical needs and therapeutic efficacy.

End-User Analysis

Medical industry represented 54.6% of growth within the end-user category and dominates the Cold Plasma market. Healthcare applications drive the highest adoption of cold plasma technologies. Hospitals utilize plasma for wound care, sterilization, and tissue treatment. Rising focus on infection control strengthens demand. Cold plasma supports antimicrobial treatment without chemical residues. Medical device sterilization applications expand utilization.

Integration into surgical and outpatient settings improves workflow efficiency. Training infrastructure supports clinical adoption. Regulatory frameworks increasingly recognize plasma-based therapies. Research institutions drive innovation and validation. Hospitals invest in advanced wound management solutions. Plasma technology aligns with minimally invasive treatment trends. Chronic disease management increases medical plasma usage.

Device manufacturers target healthcare-specific plasma systems. Clinical outcomes reinforce continued investment. Patient safety considerations favor non-thermal plasma solutions. Medical practitioners value precision and control. Expansion of ambulatory care supports demand growth. Medical industry procurement budgets support technology upgrades. Collaboration between clinicians and manufacturers accelerates adoption. The segment is projected to retain dominance due to healthcare-driven demand and clinical validation.

Key Market Segments

By Product Type

- Atmospheric pressure

- Low-pressure

By Technology

- Direct Treatment

- Remote Treatment

- Electrode Contact

By Application

- Wound Healing

- Packaging Decontamination

- Dentistry

- Cancer Treatment

- Blood Coagulation

- Others

By End-user

- Medical Industry

- Textile Industry

- Electrical & Electronic Industry

- Others

Drivers

Rising prevalence of cardiovascular diseases is driving the market

The cardiovascular ultrasound market is driven by the rising prevalence of cardiovascular diseases, which necessitates non-invasive diagnostic tools for early detection and monitoring of conditions such as heart failure and coronary artery disease. Healthcare providers rely on ultrasound systems to assess cardiac structure and function, enabling timely intervention in high-risk populations.

Regulatory agencies emphasize screening programs that incorporate ultrasound to address the growing burden on healthcare systems. Pharmaceutical companies support ultrasound use in clinical trials for cardiovascular therapies, sustaining market demand. Clinical protocols integrate ultrasound for routine evaluations in primary care and specialty settings. Global health organizations track disease trends to inform policy on diagnostic equipment accessibility.

Academic research validates ultrasound efficacy in reducing mortality through accurate diagnosis. Patient care improves with portable ultrasound options for point-of-care assessments. Economic impacts from untreated diseases further justify investment in ultrasound technologies. The World Health Organization estimates that cardiovascular diseases caused 19.8 million deaths in 2022, representing 32% of all global deaths.

Restraints

High costs of advanced ultrasound systems are restraining the market

The cardiovascular ultrasound market is restrained by the high costs of advanced systems, which include premium pricing for features like 3D imaging and AI integration, limiting adoption in budget-constrained facilities. Manufacturers incur substantial R&D expenses for compliance with safety standards, passing these onto buyers. Regulatory requirements for validation add to financial burdens, deterring upgrades in smaller clinics.

Healthcare systems in developing regions struggle with funding for high-end equipment, reducing market penetration. Clinical practices may opt for basic models, compromising diagnostic accuracy. Global disparities in reimbursement exacerbate affordability issues for ultrasound technologies. Academic analyses highlight the impact on equity in cardiac care. Patient access is limited in areas with inadequate insurance coverage for diagnostic tools.

Economic models project slower growth without cost reduction strategies. From GE HealthCare’s 2024 annual report, the Ultrasound segment reported revenues of $5,131 million, reflecting modest 0.7% growth amid pricing pressures.

Opportunities

Advancements in AI-integrated ultrasound systems is creating growth opportunities

The cardiovascular ultrasound market offers growth opportunities through advancements in AI-integrated systems, which enhance diagnostic precision and workflow efficiency for conditions like valvular heart disease. Developers can innovate platforms with AI for automated measurements, expanding applications in point-of-care settings. Regulatory pathways for AI-enabled devices facilitate faster market entry, encouraging investment.

Healthcare providers gain tools for real-time analysis, improving outcomes in high-volume cardiology practices. Pharmaceutical partnerships focus on AI ultrasound for clinical trials in heart failure. Clinical research explores AI in telemedicine for remote cardiac assessments. Global adoption in emerging markets aligns with infrastructure development for digital health.

Academic collaborations refine AI algorithms to ensure accuracy in diverse populations. Patient therapies benefit from AI facilitating early detection with reduced operator dependency. From Philips’ 2024 annual report, the Ultrasound segment emphasized AI tools for cardiovascular diagnosis, contributing to 1% comparable growth.

Impact of Macroeconomic / Geopolitical Factors

Economic booms across continents infuse capital into innovative sterilization technologies, propelling the cold plasma market forward as industries prioritize efficient surface treatments in electronics and healthcare. Leaders exploit steady GDP increases to fund R&D in atmospheric plasma systems, targeting expanded applications amid rising global trade volumes. Still, volatile inflation rates globally push up energy and equipment expenses, forcing firms to absorb hits that slow penetration in developing economies.

Strained relations between major trading blocs interrupt rare gas supplies from conflict zones, challenging timely deployments for international projects. Innovators adapt by realigning partnerships toward secure trade corridors, which opens doors to collaborative advancements and cost-sharing initiatives.

Existing US tariffs, often at 10-25% on imported plasma generators from Asian powerhouses, burden overseas competitors with higher entry thresholds into American markets. U.S. players seize this advantage to invest heavily in native fabrication plants, which accelerates local tech evolution and job surges. Cutting-edge integrations with AI for precision control consistently empower the industry, fostering unbreakable growth paths and superior operational efficiencies worldwide.

Latest Trends

Integration of artificial intelligence in cardiovascular ultrasound is a recent trend

In 2024, the cardiovascular ultrasound market has demonstrated a prominent trend toward the integration of artificial intelligence, which automates image analysis and enhances diagnostic accuracy for conditions like echocardiography assessments. Manufacturers are focusing on AI algorithms to reduce exam times and improve workflow in busy cardiology departments.

Healthcare professionals are adopting AI-enabled systems for real-time guidance during scans, supporting precise measurements of cardiac function. Regulatory approvals highlight AI’s role in standardizing ultrasound interpretations across operators. Clinical trials are evaluating AI in detecting abnormalities like valve defects with higher sensitivity. Academic studies are exploring AI integration with wearable devices for continuous monitoring.

Global networks are advancing AI to ensure compatibility with diverse ultrasound platformzs. Patient therapies benefit from AI facilitating faster diagnosis and personalized treatment plans. Ethical protocols are ensuring data privacy in AI applications. From Siemens Healthineers’ 2024 annual report, the Ultrasound segment contributed to strong performance in Imaging and Ultrasound, with AI advancements in procedural guidance.

Regional Analysis

North America is leading the Cold Plasma Market

In 2024, North America held a 39.9% share of the global cold plasma market, stimulated by expanding applications in wound healing and oncology ablation, where non-thermal plasma technologies offer precise tissue treatment without thermal damage, appealing to surgeons in minimally invasive procedures. Healthcare providers amplified adoption for chronic ulcer management and sterilization in hospitals, driven by infection control mandates amid post-pandemic vigilance.

Innovations in portable plasma devices enhanced usability for outpatient dermatology and dental applications, aligning with regulatory focus on safety for pediatric and geriatric cohorts. Rising incidences of diabetic foot complications heightened demands for plasma-assisted debridement, prompting integrated models in podiatry clinics. Biotech firms refined atmospheric pressure systems for antimicrobial efficacy, facilitating broader integration into telemedicine-supported follow-ups.

Collaborative trials validated plasma’s role in reducing biofilm in implant surgeries, bridging gaps in orthopedic care. Supply adaptations ensured high-purity gas sources compliant with biosafety protocols in high-volume facilities. In 2024, the FDA granted 510(k) clearance to the Canady Helios Cold Plasma Ablation System for soft tissue ablation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders envision notable escalation in cold plasma technologies across Asia Pacific during the forecast period, propelled by intensifying chronic wound care needs from diabetes epidemics and investments in indigenous medical device manufacturing. Clinicians deploy atmospheric systems in ulcer debridement protocols, optimizing outcomes for elderly patients in humid climates prone to bacterial resistance.

National authorities subsidize portable units for rural hospitals, equipping them to address infection surges amid monsoon vulnerabilities. Biotech innovators customize non-thermal variants with enhanced portability, suiting field applications for burn treatments in disaster-prone areas. Cross-national research groups evaluate antimicrobial efficacy through studies, fostering adoption for surgical sterilization in overpopulated operating theaters.

Pharmaceutical alliances adapt gas plasma generators through local production, ensuring affordability for dermatological therapies. Community programs train technicians on safe operation, extending coverage to peripheral facilities facing resource limitations. A 2024 update to a clinical trial in China evaluated cold atmospheric plasma combined with endovascular intervention for diabetic foot treatment.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cold Plasma market drive growth by advancing compact plasma-generation technologies that enable antimicrobial action, wound healing, and surface treatment across medical and industrial applications. Companies expand adoption by validating clinical efficacy and safety through trials that position plasma-based solutions as non-thermal, drug-free alternatives to conventional therapies.

Commercial strategies emphasize partnerships with hospitals, research institutes, and device manufacturers to integrate plasma platforms into existing treatment and production workflows. Innovation priorities focus on portable systems, precise dose control, and application-specific probes that widen use cases and improve user confidence.

Market expansion targets regions investing in advanced healthcare technologies and infection-control solutions. Neoplas Tools operates as a notable participant, leveraging its expertise in plasma physics, strong R&D orientation, and growing portfolio of medical plasma devices to support scalable commercialization and long-term market penetration.

Top Key Players

- Adtec Plasma Technology

- Tantec Group

- Plasmatreat GmbH

- Kiyohara & Co., Ltd.

- Enercon Industries Corporation

- Diener Electronic GmbH & Co. KG

- Henniker Plasma UK Ltd

- Advanced Plasma Solutions

- Nordson Corporation

- PVA TePla AG

Recent Developments

- In January 2025, Germany based Plasmatreat GmbH unveiled the PFW10LT Openair Plasma nozzle, a low temperature solution engineered for intensive surface activation on heat sensitive substrates. The technology enables effective modification of delicate materials while preserving structural integrity, supporting broader adoption of plasma treatment in precision manufacturing and medical material preparation.

- In January 2025, Plasmatreat GmbH introduced the PFW100 Openair Plasma nozzle, optimized for rapid processing of flat components over extended surface widths. The system is designed to support high throughput industrial environments by combining wide area coverage with consistent plasma performance, improving efficiency in continuous production lines.

- In December 2024, Relyon plasma GmbH entered into a cooperative agreement with Viromed Medical GmbH to accelerate development of medical applications using cold atmospheric pressure plasma. Relyon plasma contributes its plasma generation expertise, while Viromed Medical manages regulatory pathways and market access, enabling faster progression from research to approved clinical devices.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 Billion Forecast Revenue (2034) US$ 10.8 Billion CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Atmospheric Pressure and Low-Pressure), By Technology (Direct Treatment, Remote Treatment and Electrode Contact), By Application (Wound Healing, Packaging Decontamination, Dentistry, Cancer Treatment, Blood Coagulation and Others), By End-User (Medical Industry, Textile Industry, Electrical & Electronic Industry and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Adtec Plasma Technology, Tantec Group, Plasmatreat GmbH, Kiyohara & Co., Ltd., Enercon Industries Corporation, Diener Electronic GmbH & Co. KG, Henniker Plasma UK Ltd, Advanced Plasma Solutions, Nordson Corporation, PVA TePla AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adtec Plasma Technology

- Tantec Group

- Plasmatreat GmbH

- Kiyohara & Co., Ltd.

- Enercon Industries Corporation

- Diener Electronic GmbH & Co. KG

- Henniker Plasma UK Ltd

- Advanced Plasma Solutions

- Nordson Corporation

- PVA TePla AG