Global Cold Chain Market Based on Type(Warehouse, Transportation), Based on Temperature Type(Chilled, Frozen), Based on Packaging(Products, Materials), Based on Storage Equipment(On-grid, Off-grid, Transportation Equipment), Based on Application(Dairy & Frozen Desserts, Fish, Meat, & Seafood, Fruits & Vegetables, Bakery & Confectionery, Pharmaceuticals, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 11926

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Type Analysis

- Based on Temperature Type Analysis

- Based on Packaging Analysis

- Based on Storage Equipment Analysis

- Based on Application Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

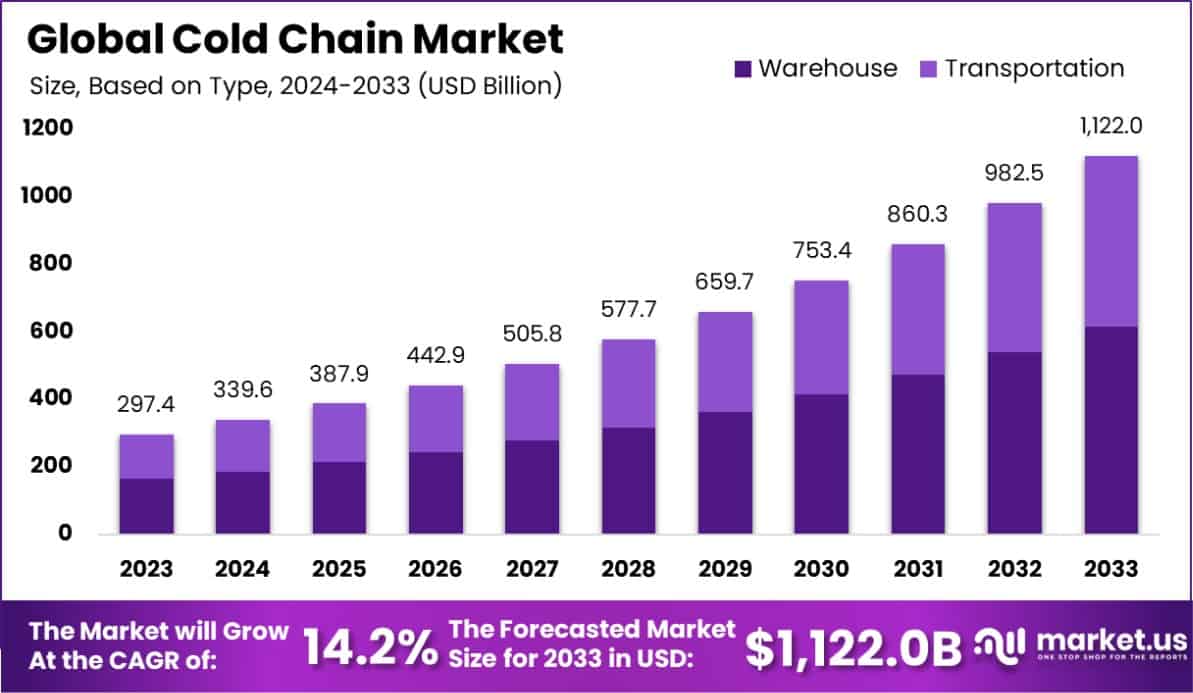

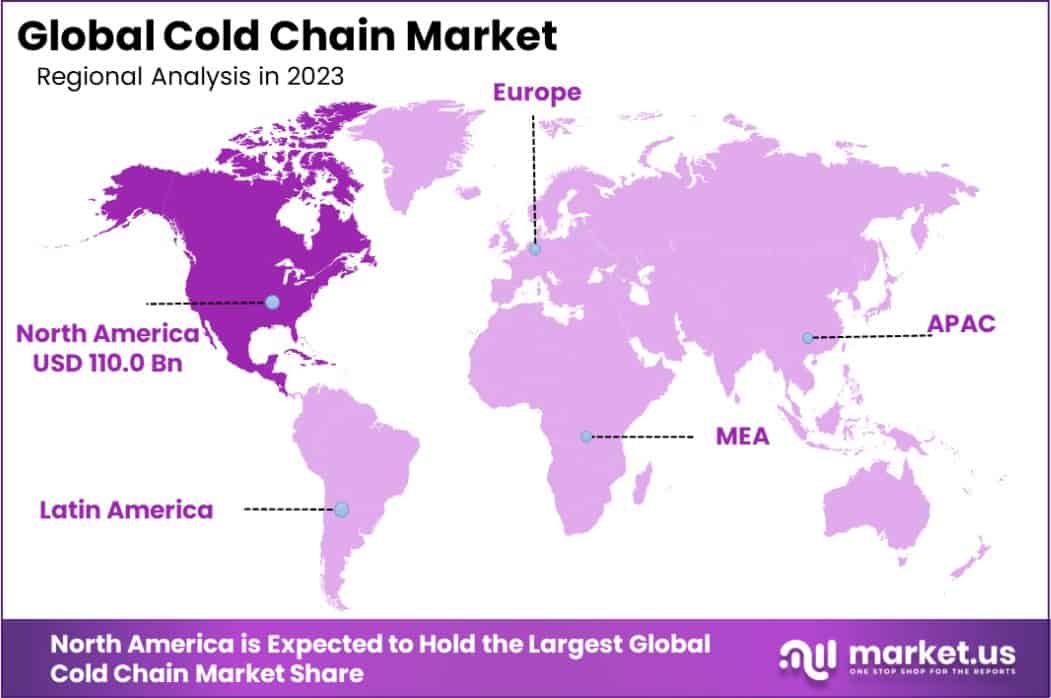

The Global Cold Chain Market size is expected to be worth around USD 1,122.0 Billion by 2033, from USD 297.4 Billion in 2023, growing at a CAGR of 14.2% during the forecast period from 2024 to 2033. North America dominated a 37% market share in 2023 and held USD 110.0 Billion in revenue from the Cold Chain Market.

Cold chain refers to a temperature-controlled supply chain network, essential for the storage, transportation, and distribution of perishable goods. This system maintains a consistent temperature from production to consumption, ensuring the quality and safety of food products, pharmaceuticals, and other temperature-sensitive items.

The cold chain market encompasses all components and services involved in the cold chain logistics of perishable products. It includes refrigerated storage facilities, transport vehicles, and logistics services that manage the procurement, storage, and distribution of commodities requiring temperature control, serving industries such as food and beverages, pharmaceuticals, and healthcare.

The growth of the cold chain market is primarily driven by the increasing global demand for perishable foods and the expansion of retail chains requiring robust logistics support. Additionally, the stringent regulations governing the transport and storage of pharmaceutical products bolster the development of more sophisticated cold-chain solutions.

Rising consumer awareness about the health benefits of fresh foods, along with the global increase in pharmaceutical sales, drives the demand for cold chain logistics. The need to prevent food spoilage and ensure the efficacy of health-sensitive products like vaccines also contributes significantly to this demand.

The integration of IoT and blockchain technology presents significant opportunities in the cold chain market, offering enhanced traceability and efficiency in logistics operations. This technological advancement enables better monitoring and management of the temperature conditions, thus opening new avenues for market expansion in both developed and emerging economies.

The cold chain market is strategically positioned at the nexus of several dynamic global needs, including food security, pharmaceutical distribution, and public health. As the demand for perishable goods and temperature-sensitive pharmaceuticals increases, the infrastructure and services required to maintain the integrity of these products through specialized logistics are becoming increasingly critical.

In 2023, UNICEF’s procurement of $105.9 million in cold chain equipment and services underscores the pivotal role of effective cold chain systems in supporting global health initiatives, particularly in vaccine distribution. This investment not only highlights the dependency of public health programs on robust cold chain solutions but also aligns with broader economic impacts.

Moreover, the food industry experiences over $750 billion in annual losses due to inadequate cold chain facilities, according to trade.gov. This staggering figure illustrates the urgent need for enhanced cold chain infrastructure to reduce spoilage and improve food safety across global supply chains.

Additionally, the bio-pharmaceutical sector, with approximately $260 billion in annual sales reliant on cold chain logistics, further emphasizes the critical economic stakes involved. Effective cold chain management ensures the efficacy and safety of biologics and other temperature-sensitive pharmaceuticals, aligning with broader market trends toward more personalized and condition-specific treatments.

These insights suggest a market ripe with opportunities for innovation and expansion. Companies and investors are well-advised to consider strategic investments in cold chain logistics technology and infrastructure to harness the potential growth in this sector. Enhanced efficiency in cold chain operations could lead to significant cost savings and improved outcomes across industries, marking this as a key area for future development and investment.

Key Takeaways

- The Global Cold Chain Market size is expected to be worth around USD 1,122.0 Billion by 2033, from USD 297.4 Billion in 2023, growing at a CAGR of 14.2% during the forecast period from 2024 to 2033.

- In 2023, Warehouse held a dominant market position in the Based on Type segment of Cold Chain Market, with a 55% share.

- In 2023, Chilled held a dominant market position in the Based on Temperature Type segment of the Cold Chain Market, with a 60% share.

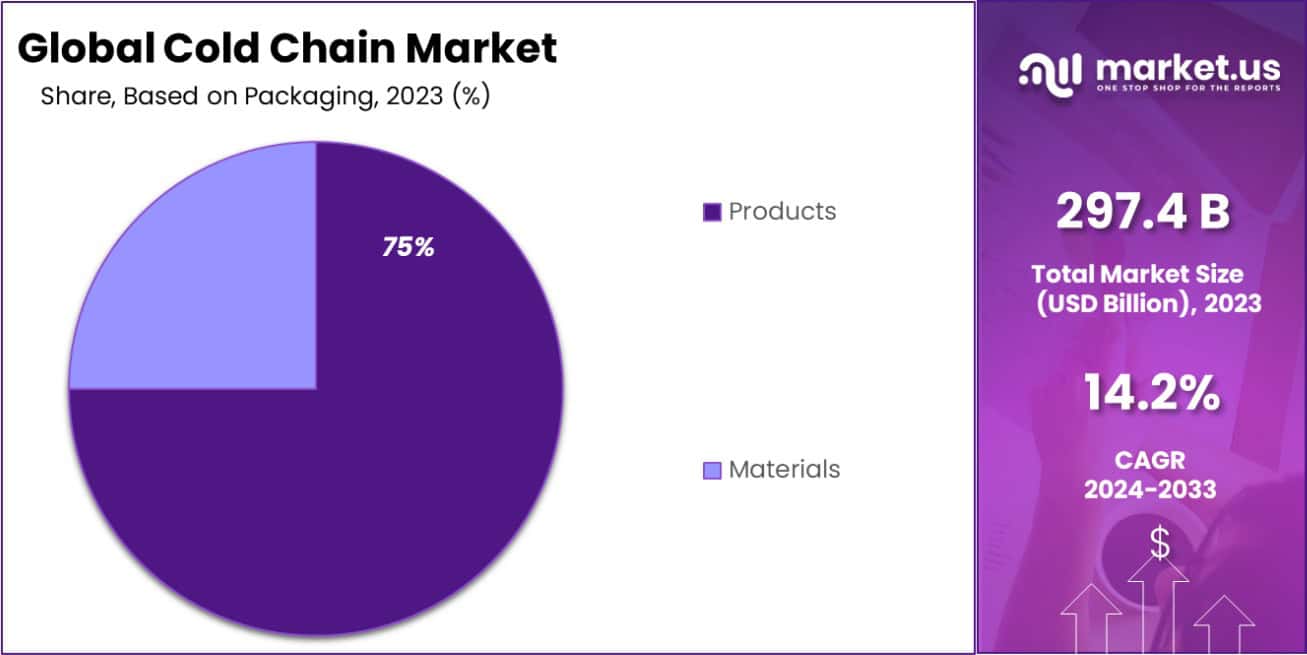

- In 2023, Products held a dominant market position in the Based on Packaging segment of the Cold Chain Market, with a 75% share.

- In 2023, On-grid held a dominant market position in the Based on Storage Equipment segment of the Cold Chain Market, with a 60% share.

- In 2023, Fish, Meat, & Seafood held a dominant market position in the Based on Application segment of the Cold Chain Market, with a 25% share.

- North America dominated a 37% market share in 2023 and held USD 110.0 Billion in revenue from the Cold Chain Market.

Based on Type Analysis

In 2023, the Cold Chain Market was distinctly segmented into two primary types: Warehouse and Transportation. Warehouse held a dominant market position, capturing 55% of the market share.

This significant proportion underscores the critical role that warehousing plays in maintaining the integrity of temperature-sensitive products throughout the supply chain. The emphasis on warehouses is primarily due to their vital function in the stable storage and handling of perishable goods, pharmaceuticals, and other products requiring stringent temperature controls.

On the other hand, Smart Transportation, which encompasses the logistics of moving goods from production sites to warehouses and ultimately to the end consumer.

This segment is driven by the growing demand for efficient logistics solutions that can reliably maintain product temperatures during transit, reflecting a robust network of cold chain logistics.

Together, these segments illustrate the comprehensive structure of the Cold Chain Market, highlighting the essential interplay between warehousing and transportation to ensure the effective distribution of temperature-sensitive products across various industries.

The dominance of the Warehouse segment particularly reflects a heightened focus on investment in advanced storage technologies and infrastructure to meet the increasing demands of global supply chains.

Based on Temperature Type Analysis

In 2023, the Cold Chain Market was strategically divided based on temperature type into two main segments: Chilled and Frozen. Chilled held a dominant market position with a commanding 60% share, illustrating its pivotal role in the cold chain logistics landscape.

This segment primarily caters to the preservation and transportation of fresh produce, dairy products, and pharmaceuticals that require temperatures typically above freezing point but below room temperature.

The Chilled segment’s dominance is attributable to the increasing consumer preference for fresh and natural products, which has spurred significant investments in refrigerated warehousing solutions and sophisticated chilled logistics services. These advancements help in maintaining the quality and extending the shelf life of perishable goods.

Conversely, the Frozen segment, supports products that must be stored at sub-zero temperatures to preserve freshness and prevent spoilage. This includes a variety of food products, from meats and seafood to ready-to-cook meals.

Both segments are integral to the comprehensive functionality of the Cold Chain Market, but the larger share of Chilled underscores a shift towards more fresh and ready-to-eat food consumption patterns, influencing market dynamics and operational priorities within the industry.

Based on Packaging Analysis

In 2023, the Cold Chain Market was segmented based on packaging into two primary categories: Products and Materials. Products held a dominant market position, securing a substantial 75% share. This segment includes specialized packaging solutions such as insulated containers, refrigerated boxes, and temperature-controlled pallets, which are essential for the effective management of temperature-sensitive goods throughout the supply chain.

The dominance of the Products segment is largely driven by the increasing requirements for advanced packaging technologies that can maintain specific temperature ranges. These packaging solutions are critical in industries like pharmaceuticals, where the efficacy of drugs depends on consistent temperature conditions, and in the food sector, where freshness and safety are paramount.

Meanwhile, the Materials segment, involves the production and supply of raw materials used in the manufacture of cold-chain packaging products. This includes materials like polystyrene, polyurethane, and VIP (Vacuum Insulated Panels), which are integral to the thermal insulation properties of finished packaging products.

The predominance of the Products segment highlights the market’s shift towards more sophisticated and integrated packaging solutions, reflecting the growing complexities and regulatory demands of transporting temperature-sensitive products globally.

Based on Storage Equipment Analysis

In 2023, the Cold Chain Market’s Storage Equipment segment was categorized into On-grid, Off-grid, and Transportation Equipment. On-grid solutions emerged as the dominant category, securing a 60% market share. This segment primarily includes energy-connected refrigeration units essential for maintaining the required temperatures in a stable and controlled environment.

The high reliance on on-grid solutions can be attributed to their ability to provide continuous power supply, which is crucial for preventing temperature fluctuations that could compromise the quality and safety of perishable goods.

Off-grid solutions accounted for 25% of the market and include alternatives that operate independently of the traditional power grid, such as solar-powered refrigeration units. These are particularly valuable in remote areas where grid connectivity is unreliable or non-existent.

Transportation Equipment encompassing mobile refrigeration units used in trucks, ships, and containers that facilitate the movement of temperature-sensitive products across diverse geographic locations.

The substantial share held by the On-grid segment underscores its pivotal role in the cold chain infrastructure, reflecting ongoing investments in smart grid-connected systems to meet the stringent regulatory standards and consumer demands for product integrity in industries such as food, pharmaceuticals, and chemicals.

Based on Application Analysis

In 2023, the Cold Chain Market was analyzed based on application segments including Dairy & Frozen Desserts, Fish, Meat, & Seafood, Fruits & Vegetables, Bakery & Confectionery packaging, Pharmaceuticals, and Other Applications. Among these, Fish, Meat, & Seafood held a dominant market position, capturing a 25% share.

This segment’s predominance is attributed to the stringent requirements for maintaining precise temperature controls to ensure the safety and quality of perishable products during storage and transportation.

Dairy & Frozen Desserts and Fruits & Vegetables driven by the growing consumer demand for fresh and natural foods. Bakery & Confectionery and Pharmaceuticals segments followed, where temperature control is critical for ensuring product efficacy and safety. Other Applications, including a variety of temperature-sensitive products in different industries.

The significant share of Fish, Meat, & Seafood highlights the crucial need for robust cold chain solutions in the food industry, particularly for products that are highly perishable and require strict temperature management from point of origin to consumer to prevent spoilage and ensure compliance with food safety regulations.

Key Market Segments

Based on Type

- Warehouse

- Transportation

Based on Temperature Type

- Chilled

- Frozen

Based on Packaging

- Products

- Materials

Based on Storage Equipment

- On-grid

- Off-grid

- Transportation Equipment

Based on Application

- Dairy & Frozen Desserts

- Fish, Meat, & Seafood

- Fruits & Vegetables

- Bakery & Confectionery

- Pharmaceuticals

- Other Applications

Drivers

Key Drivers Boosting Cold Chain Market

The Cold Chain Market is experiencing substantial growth, primarily driven by the increasing global demand for perishable goods, such as food products and pharmaceuticals. As consumers worldwide seek fresh and quality food, along with the rising need for vaccines and biopharmaceuticals that require strict temperature control during storage and transportation, the cold chain industry has become essential.

Additionally, technological advancements in refrigeration and logistics have significantly enhanced the efficiency and reliability of cold chain solutions. Governments and regulatory bodies are also implementing stricter food safety and pharmaceutical handling regulations, further necessitating robust cold chain systems.

This convergence of consumer demand, technology, and regulation is shaping a promising future for the cold chain industry, ensuring the safe delivery of temperature-sensitive products across vast distances.

Restraint

Challenges Facing Cold Chain Expansion

The Cold Chain Market faces significant challenges that restrain its growth, primarily due to the high operational costs involved in maintaining temperature-controlled logistics. The installation and maintenance of advanced refrigeration systems are costly, and the energy expenses associated with these systems further escalate the operational overheads.

Additionally, the need for continuous power supply poses a challenge, particularly in regions with unstable electricity grids or those prone to frequent power outages. This reliability issue can lead to product spoilage, resulting in financial losses and reduced market trust.

Furthermore, the lack of infrastructure development in emerging markets limits the expansion of cold chain logistics, as effective transportation and storage facilities are crucial for maintaining product integrity. These factors collectively create barriers to the scalability and efficiency of the cold chain industry, impacting its global growth prospects.

Opportunities

Expanding Opportunities in Cold Chain

The Cold Chain Market is ripe with opportunities, particularly driven by the increasing consumer preference for fresh and quality products worldwide. The rise in online grocery sales has created a new avenue for cold chain providers to expand their services, accommodating the surge in demand for home deliveries of perishable goods.

Additionally, the global expansion of pharmaceutical sectors, especially with vaccines requiring strict temperature controls, presents a substantial opportunity for growth in the cold chain logistics sector. Emerging markets offer untapped potential as they develop better infrastructure and adopt more stringent regulations on food safety and drug distribution, providing a fertile ground for cold chain expansion.

Moreover, advancements in IoT and AI technologies are enhancing the efficiency and monitoring capabilities of cold chain systems, opening new possibilities for innovation and service improvement in this sector.

Challenges

Key Challenges in Cold Chain

The Cold Chain Market faces several hurdles that challenge its efficiency and growth. The foremost issue is the substantial initial and operational costs associated with setting up and maintaining temperature-controlled storage and transportation systems. These costs can be prohibitive, especially for smaller operators.

Additionally, the complex logistics involved in ensuring continuous temperature management across global supply chains present logistical challenges, increasing the risk of product spoilage and loss. Regulatory compliance also poses a significant challenge, as standards can vary greatly between different regions, requiring operators to navigate a complex web of rules to ensure compliance.

Moreover, in developing countries, the lack of robust infrastructure, such as consistent power supply and adequate road systems, further complicates the effective management of cold chains. These challenges demand innovative solutions and investments to enhance reliability and extend the reach of cold chain logistics.

Growth Factors

Driving Growth in Cold Chain

The Cold Chain Market is poised for significant growth, driven by several pivotal factors. Increasing global demand for fresh food products and the need for efficient pharmaceutical transport are key growth drivers.

As populations grow and urbanize, the demand for perishable items like fruits, vegetables, dairy products, and meats rises, requiring robust cold-chain solutions to maintain quality and safety.

Furthermore, the expansion of the pharmaceutical industry, particularly with the surge in vaccine production and distribution, underscores the need for reliable cold chain services. Technological advancements in refrigeration and tracking systems also contribute to market growth by enhancing the efficiency and reliability of cold chain logistics.

Additionally, governmental efforts to strengthen food safety and pharmaceutical handling regulations worldwide support the expansion of cold chain facilities and services, ensuring compliance and encouraging investment in this sector.

Emerging Trends

Emerging Trends in Cold Chain

Emerging trends in the Cold Chain Market are set to reshape the logistics landscape. One of the most significant trends is the integration of advanced technologies such as IoT, AI, and blockchain, which enhance tracking, efficiency, and transparency throughout the supply chain.

These technologies enable real-time monitoring and management of temperature and location, reducing the risk of spoilage and improving compliance with safety regulations. Additionally, the shift towards sustainable and eco-friendly practices is gaining traction, with more companies investing in green refrigeration technologies and energy-efficient vehicles to reduce carbon footprints.

Another growing trend is the customization of cold chain logistics to cater to niche markets such as gourmet foods, specialty pharmaceuticals, and personalized medicine, requiring specific temperature and handling conditions. These trends are driving innovation and opening new opportunities for growth in the cold chain industry.

Regional Analysis

The Cold Chain Market is experiencing diverse growth across different regions, with North America currently dominating the market, holding a 37% share and valued at USD 110.0 billion. This dominance is largely due to the region’s robust infrastructure, stringent regulatory standards, and high demand for perishable foods and pharmaceuticals.

In Europe, the market is driven by advanced technology adoption and increasing export of dairy and meat products, requiring effective cold chain solutions. Asia Pacific is witnessing rapid growth, spurred by rising consumer demand for fresh produce and the expansion of retail chains. The market in this region benefits from improving logistics infrastructure and government initiatives promoting food safety.

Meanwhile, the Middle East & Africa region is seeing gradual growth, with investments in infrastructure development and an increasing focus on reducing food wastage. Latin America’s market is growing, fueled by the rise in meat and seafood exports, which demand enhanced cold chain logistics to maintain product integrity and extend reach to global markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Cold Chain Market, key players like Agro Merchant Group, Nordic Logistics and Warehousing LLC, and AmeriCold Logistics LLC are strategically positioned to capitalize on the expanding demand for efficient and reliable cold storage and transportation solutions. Each of these companies brings unique strengths to the table, enhancing their competitiveness and market presence.

Agro Merchant Group has established a robust reputation for its comprehensive range of services tailored to the agricultural sector. Their specialized focus on perishable goods ensures tailored solutions that maintain quality and extend shelf life, essential for global food distribution networks. This focus is critical as the global demand for fresh produce continues to surge.

Nordic Logistics and Warehousing LLC differentiates itself with advanced technology integration in its operations. The company utilizes state-of-the-art refrigeration technology and real-time data monitoring systems, which not only enhance operational efficiency but also ensure compliance with stringent regulatory standards across different regions. This technological edge positions Nordic as a leader in innovation within the cold chain logistics sector.

AmeriCold Logistics LLC, one of the largest providers globally, capitalizes on its extensive network to offer scalable solutions that meet diverse client needs, from small producers to large multinational corporations.

AmeriCold’s strategic acquisitions and investments in automation have significantly expanded its service capabilities and geographical reach, allowing it to maintain and grow its market share.

As the Cold Chain Market continues to evolve, driven by global trends toward fresher food and more complex pharmaceutical logistics, these companies are well-equipped to lead and define the standards of service excellence in the industry. Their ongoing investments in technology and infrastructure are essential for maintaining competitiveness in this increasingly demanding market landscape.

Top Key Players in the Market

- Agro Merchant Group

- Nordic Logistics and Warehousing LLC

- AmeriCold Logistics LLC

- Burris Logistics Inc.

- Lineage Logistics Holdings LLC

- Kloosterboer Group B.V.

- Preferred Freezer Services LLC

- Cold Chain Technologies Inc.

- Cryopack Industries Inc.

- Creopack

- Cold Box Express Inc.

- Other Key Players

Recent Developments

- In July 2023, Lineage Logistics secured $500 million in funding to invest in new technologies and expand globally, aiming to increase its warehouse capacity by 15%.

- In May 2023, Kloosterboer Group launched a new eco-friendly refrigerated storage facility, increasing its storage capacity by 30,000 pallets.

- In March 2023, Burris Logistics Inc. expanded its operations by acquiring a regional competitor, enhancing its distribution capabilities by 20%.

Report Scope

Report Features Description Market Value (2023) USD 297.4 Billion Forecast Revenue (2033) USD 1,122.0 Billion CAGR (2024-2033) 14.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type(Warehouse, Transportation), Based on Temperature Type(Chilled, Frozen), Based on Packaging(Products, Materials), Based on Storage Equipment(On-grid, Off-grid, Transportation Equipment), Based on Application(Dairy & Frozen Desserts, Fish, Meat, & Seafood, Fruits & Vegetables, Bakery & Confectionery, Pharmaceuticals, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agro Merchant Group, Nordic Logistics and Warehousing LLC, AmeriCold Logistics LLC, Burris Logistics Inc., Lineage Logistics Holdings LLC, Kloosterboer Group B.V., Preferred Freezer Services LLC, Cold Chain Technologies Inc., Cryopack Industries Inc., Creopack, Cold Box Express Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agro Merchant Group

- Nordic Logistics and Warehousing LLC

- AmeriCold Logistics LLC

- Burris Logistics Inc.

- Lineage Logistics Holdings LLC

- Kloosterboer Group B.V.

- Preferred Freezer Services LLC

- Cold Chain Technologies Inc.

- Cryopack Industries Inc.

- Creopack

- Cold Box Express Inc.

- Other Key Players